Finance

Covers blockchain’s impact on financial systems, including banking, payments, and investment models.

The Rise of Crypto-Backed Stablecoins: the Stabolut Story

Are crypto-backed stablecoins rewriting the rules of DeFi? This article dives into one of the most prominent coins, Staboluts’ USB, and uncovers the mechanics of its business model, highlighting its potential to foster financial inclusion and drive the next wave of stablecoin innovation.

Stablecoins in Crypto Crime: A Solution in Disguise?

While blockchain and stablecoins promise a more secure and inclusive financial system, critics paint them as tools for criminals. As stablecoins in crypto crime make headlines, a deeper look reveals an unexpected truth.

Stablecoin Adoption in Rising Markets: A Digital Bridge for Emerging Economies

Stablecoins provide a unique opportunity for entrepreneurs on the hunt for financial and market diversification. They solve several problems, including inflation, payment security, and transaction rates, while holding reliable value. Read on to learn about stablecoin adoption in rising markets and how you might get involved.

What Is a Stablecoin?

A portmanteau of “stable” and “coin,” these assets bring steadiness to the wild world of crypto. They maintain a 1:1 peg with an RWA. But what is the point of a stablecoin? They are more than a blockchain-based payment alternative; they are redefining how the globe conducts business.

Stablecoins: The Most Lucrative Business Onchain

Do stablecoins truly open remarkable conditions to enable business onchain? The answer is yes! But where lies their massive potential? And what differentiates them from other blockchain ventures? We went out to get answers and came back with this report, including practical insights for entrepreneurs. Follow us through the landscape as we explore the business opportunities. Get data to support decisions related to stablecoin integration or protocol building.

Institutional Adoption of Stablecoins: A New Era of Business Transactions?

Stablecoins are changing how institutions handle money and do business. Major players like JPMorgan and PayPal are using them for faster payments, better treasury operations, and access to decentralized finance. This article explores the rise of stablecoins, their benefits, and real-world use cases. Discover why they're ushering in a new era of finance.

How to Get Started With Stablecoins and Use Them in the Real World & Web3 World

Stablecoins are transforming global finance, facilitating $22.5 trillion in transactions last year and surpassing traditional payment networks. With lower fees, instant transfers, and inflation protection, they're transforming business operations and financial inclusion.

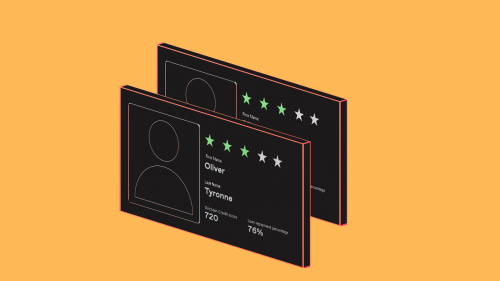

Onchain Credit Scores Will Bring Trillions of Dollars to DeFi

Without collateral, how does crypto lending work? Learn how crypto lending platforms are using onchain credit scores and other blockchain tools to increase liquidity and capital efficiency in the growing DeFi ecosystem. Crypto-collateralized loans are no longer the only option on the block (chain).

A One-Month Retrospective on the Ethereum ETFs

Joining Bitcoin, Ethereum’s currency can now be purchased as a U.S. spot ETF. We cover the Ethereum ETF options, break down their first month performance metrics, and compare these numbers with the Bitcoin ETFs that preceded them. Learn about the pros and cons of crypto ETFs — and if they are the right investment solution for you.