What is Real-World Asset tokenization?

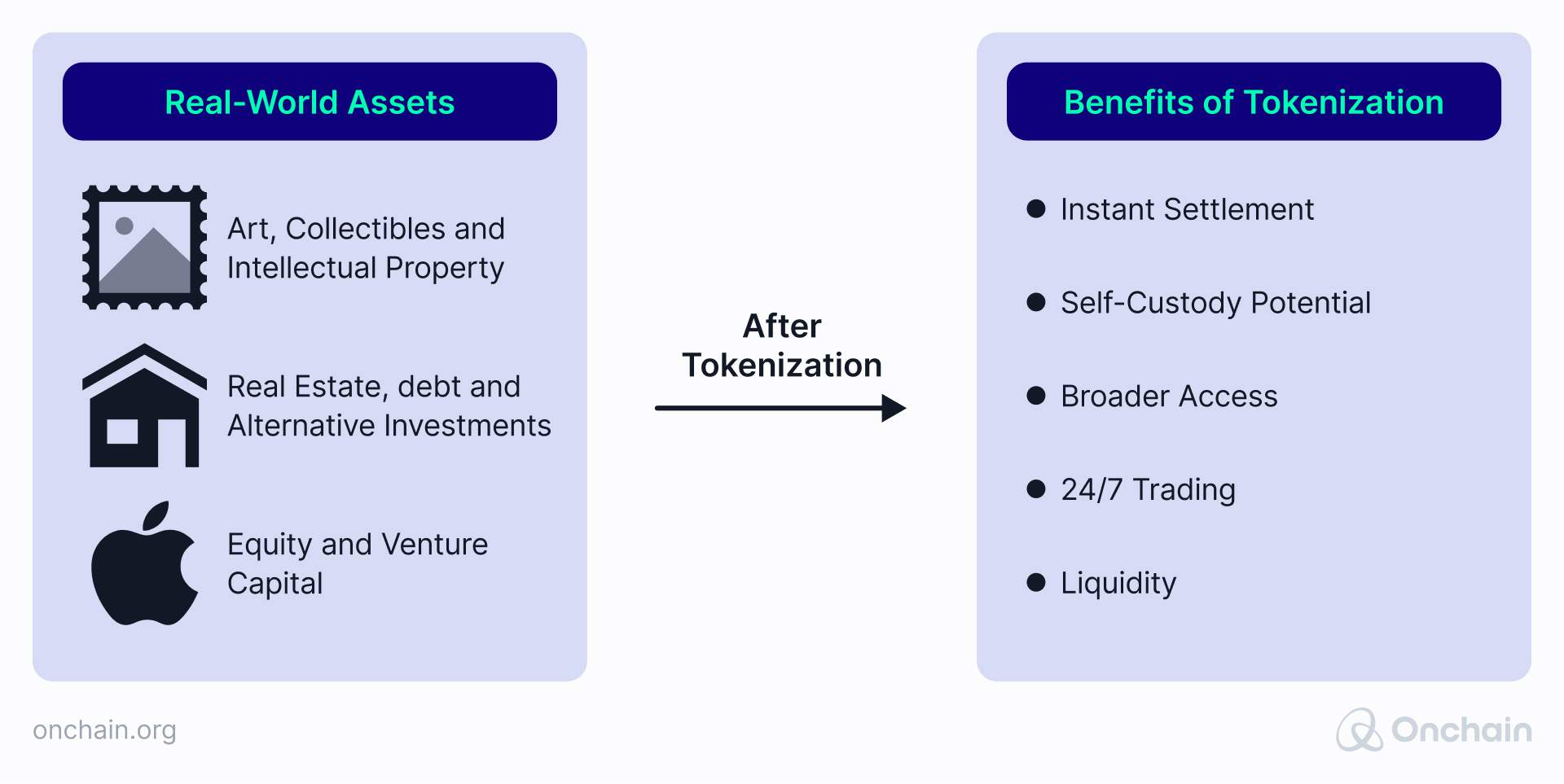

In a nutshell, tokenization consists of digitally securing assets through blockchain technology. This process transforms Real-World Assets into digital tokens. Almost any asset can be tokenized.

Our Onchain research team analyzed and measured the potential impact of RWAs on real-world scenarios in our research report Real-World Assets for Real-World Purposes.

Tokenized RWAs show substantial potential to improve the economic situation in emerging markets and bring about a shift in the way some asset classes are managed.

It’s not the only area where tokenization is making waves. As an example, this approach is also being applied in private credit, where loans and other credit assets are digitally secured, creating new investment opportunities and broader market access.

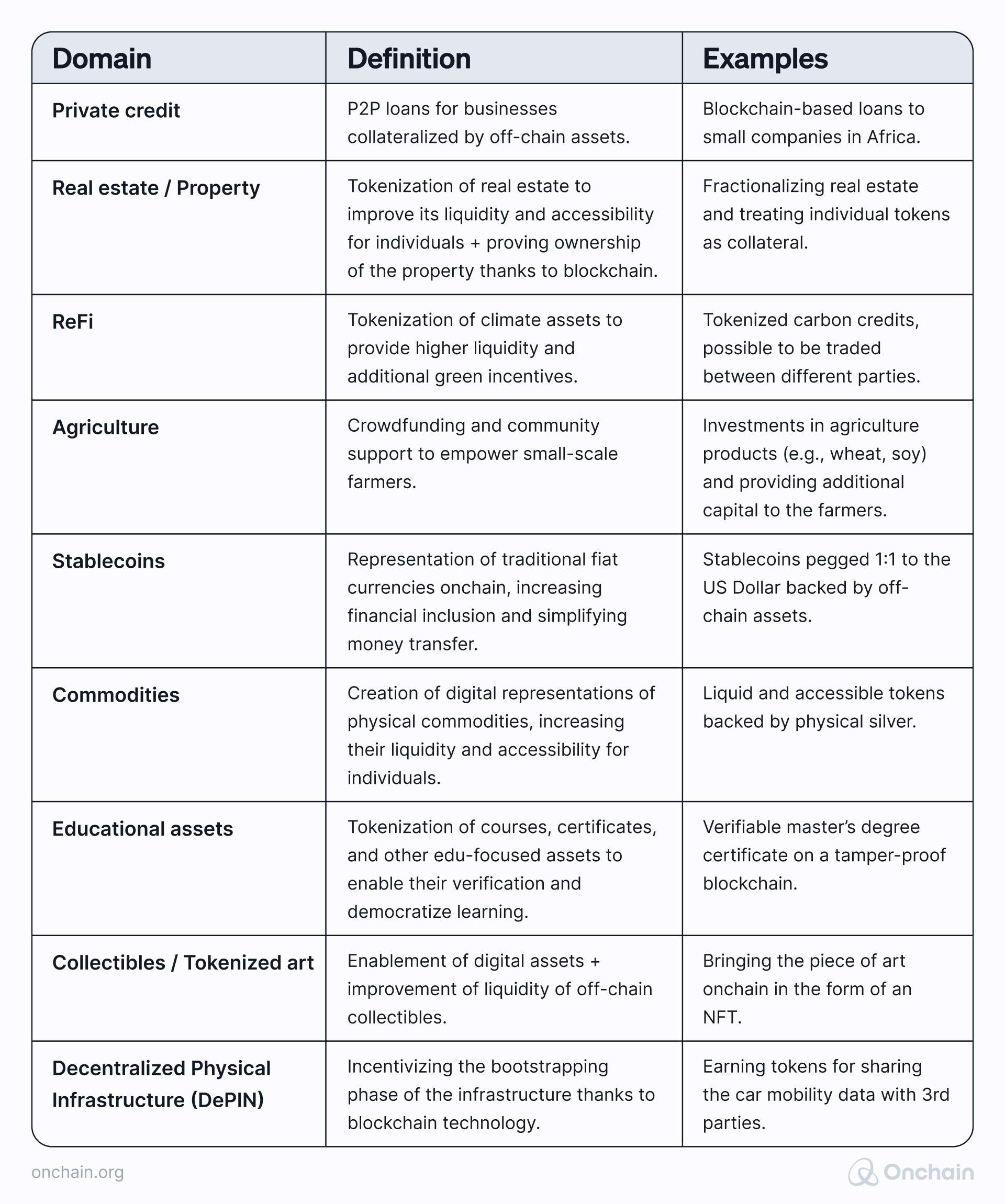

Let’s take a look at some of the RWA asset tokenization types:

In addition, they also cover diverse financial instruments, such as equity, bonds, or funds.

Transforming Real-World Assets into digital opportunities

In the emerging markets, the tokenization of Real-World Assets in the agriculture and Regenerative Finance sectors is making significant headway. Both have the potential to reduce poverty. They achieve this by stimulating more small business activity and fostering an environment for entrepreneurship and trade. This actively contributes to lifting communities out of poverty.

Tokenizing agriculture and renewable energies stabilizes the value of these assets. So they can be traded without using any unstable or hyper-inflated currencies. This can be crucial in emerging markets where agriculture is essential for survival and can unlock new revenue streams and reduce costs.

Emerging markets and regions with high inflation and limited financial inclusion offer extensive RWA tokenization opportunities.

Furthermore, the European Carbon Offset Tokenization Association (ECOTA) is making great strides in promoting token-based decarbonization projects globally. Our interview with Abdullah Yildiz, the Executive Director of ECOTA, also highlights this.

How does tokenizing RWAs with blockchain work?

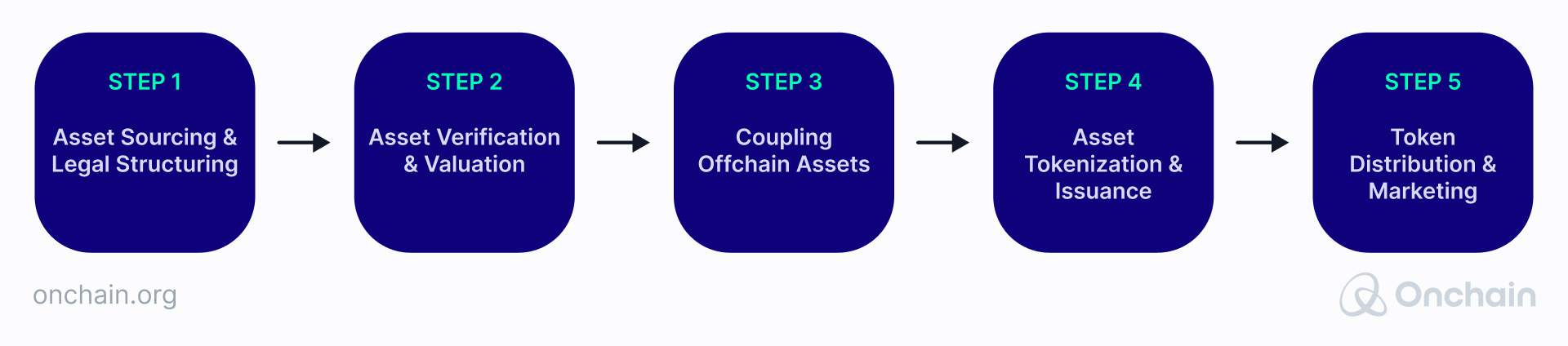

The Real-World Asset tokenization process involves the following steps:

- Asset sourcing and legal: After you’ve selected the asset to be tokenized, the legal requirements must be clarified. You must comply with and adhere to all regional regulations.

- Verification and valuation: Evaluate and determine the asset’s market value. Then perform the necessary due diligence to verify the legitimacy and ownership.

- Coupling offchain assets: Choose and deploy a decentralized oracle to link the offchain asset data to the smart contracts.

- Tokenization and issuance: Choose the appropriate token standard and develop the smart contract. Then, you can start minting tokens.

- Distribution and marketing: Finally, determine the distribution method for your tokens. This could be via private sales or airdrops.

Once you’ve tokenized an asset, it allows for fractional ownership and improved liquidity utilizing blockchain’s secure and transparent features.

What are the benefits of RWA tokenization and who needs it?

The benefits of RWA tokenization include:

- enhanced liquidity

- improved accessibility

- heightened transparency

- increased transaction efficiency

- cheaper and faster settlement times

Who needs to tokenize?

The answer to this is simple. Anyone who wants to open up and explore this groundbreaking new arena can take advantage of RWA tokenization.

From the business owners’ and entrepreneurs’ perspectives, tokenization can lead to overall cost savings. It has the potential to boost profits and enhance the efficiency of capital utilization.

Such opportunities to capitalize on this exist in many Real-World Assets that can be tokenized. The private credit and agriculture areas are good examples. Companies such as Centrifuge and Afen have benefitted significantly.

Centrifuge empowers users to bring real-world assets into the realm of DeFi. Converting a myriad of real-world financial products into digital assets opens up opportunities to enhance liquidity and maximize the profit potential.

Agriculture is vital for many African economies, and Afen’s primary focus is tokenizing agriculture-related RWAs. This has proven to enhance productivity, streamline supply chains, and empower local farmers, ensuring improved food security and increased income.

From the investors’ standpoint, they can participate in a wide array of assets, such as real estate or art, through fractional ownership. It is a win-win situation for all.

Our RWA report found that the Real-World Asset tokenization market is increasing and is projected to reach $15.6 Trillion by 2030.

Real-World Asset use case examples – tokenization of RWAs in different industries

Societe General of France issued its first tokenized RWA in the form of a digital green bond. This security token is registered on the Ethereum blockchain. This green bond is exclusively used to finance or refinance eligible green activities. It has gained enormous traction and is compatible with its sustainable and positive impact bond framework.

Another real-world use case example is RealT. The company makes property buying and selling easier by tokenizing assets on the blockchain and cutting out the intermediaries. This provides opportunities to enhance real estate liquidity and opens the door for a broader, more diverse group of investors to the market. Once qualified, potential investors can acquire fractionalized ownership in real estate.

RealT has indicated that its most recent property evaluations from the beginning of 2024 show a 23.46% year-over-year performance increase.

Another innovative Real-World Asset example is Tutellus, which offers a tokenized educational platform. Their strategy involves breaking down courses, certifications, and learning materials into individual elements represented by tokens. This makes higher education more accessible by reducing entry barriers and allowing micro-purchases.

Furthermore, tokenizing educational certificates minimizes the risk of forgery and provides transparency.

These real-world purpose use case examples, from green bonds to real-estate assets, are just the tip of the iceberg. Many more are emerging.

What are the challenges of blockchain RWA tokenization?

These consist mainly of regulatory issues and a lack of standardized processes.

- There is a need for multiple platforms to handle tokenized assets across various jurisdictions due to regulatory ambiguity.

- Interoperability problems may be an issue. At present, most institutions depend on private blockchains that generally do not engage with other blockchain platforms.

- Asset valuation and pricing of tokenized assets is challenging. Valuing illiquid or unique assets, such as art or intellectual property, poses such a quandary.

- Security concerns, scalability, and the credibility of tokenized assets must be overcome.

- Finally, in emerging markets, there is a lack of access for both investors and project initiation.

In summary, these challenges are by no means insurmountable. But it is important to be aware of them.

Future growth from the rising trend of RWA tokenization in business

RWA tokenization is more than just a passing trend. It represents a paradigm shift in the approach to investments.

It offers transparency, transactional efficiency, and risk management capabilities. It can also render previously illiquid asset classes tradable.

This new era of investment is wide open, inviting all who wish to partake in this groundbreaking financial journey.

RWA tokenization democratizes opportunities and increases accessibility. So this promotes financial inclusivity.

Real-World Asset tokenization has the potential to reshape the financial landscape, democratize wealth, reduce poverty, and advance financial inclusion.

Now that you have a basic understanding of real-world assets, we’re going to take you deeper by examining the most popular segments of the sector. In the next article, you’ll learn about one of the quickly-growing RWA niches. Regenerative finance (ReFi) tokenizes real environmental assets and activities with the goal of curbing climate change. Let’s have a look.