You may think Regenerative Finance is somewhat offbeat for blockchain entrepreneurs and enthusiasts. If so, you’ll be interested in what the Onchain Research Report on Real-World Assets (RWA) for Real-World Purposes reveals about it.

ReFi has the potential to transform how we use money and finance as tools to support life on our planet.

In this article you’ll learn everything you need to know before embarking on a Regenerative Finance project.

What are the benefits, how do DeFi and Web3 fit into Regenerative Finance, why does it matter, and what are the potential pitfalls?

What is Regenerative Finance?

In short, Regenerative Finance tackles environmental, social, and economic challenges through inventive investment strategies. And this leads to fostering regeneration and resilience.

In turn, it takes into account its impact on a broad spectrum of ecological aspects.

Blockchain ReFi can be thought of as a valuation of natural assets on the blockchain.

And how does Regenerative Finance work in the blockchain and Web3 world? – It leverages Decentralized Finance (DeFi) and blockchain to counteract the impacts of industrialization and systemic financial imbalances.

Regenerative Finance projects – use cases

At present, there are numerous ReFi projects underway globally. Most of them are currently in the test and pilot phase. Here are few examples:

- The Climate Trust is a US non-profit organization. It invests in emission reduction projects using carbon credit. By using blockchain it ensures transparent tracking can be implemented. They also verify authenticity in initiatives like reforestation and renewable energy.

- Moss is located in Brazil, with a mission to actively promote the preservation of the Amazon rainforest. This is achieved through the tokenization of targeted carbon credits, coupled with the inventive utilization of Moss non-fungible tokens (NFTs) and Web3.

- Triodos Bank is another example. They are a European financial institution that deploys Regenerative Finance through impactful investments in renewable energy, sustainable regenerative agriculture, and social enterprises. This achieves financial returns while promoting positive environmental and social outcomes.

These companies all deploy the key Regenerative Finance principles. They champion ethics and societal well-being. Furthermore, they deploy the Web3 and sustainability megatrends that fuse together, to create the Regenerative Finance model.

Regenerative Finance and blockchain – Toucan as a successful use case example

Toucan has a passion for preserving the planet. Their vision is to bridge the gaps between Web3 and the carbon markets. So the voluntary carbon market (VCM) will serve as the foundation for a regenerative economy.

Voluntary carbon markets enable carbon emitters to compensate for their emissions. This is done by acquiring carbon credits. These credits are generated by projects that aim to mitigate or reduce greenhouse gas levels in the atmosphere.

VCM demand has grown rapidly since 2018 in response to the Paris Climate Agreement.

In 2021, the Voluntary Carbon Market’s value rose to over $1bn for the first time and is expected to exceed $100bn by 2030.

Toucan.Earth

Post-launch, Toucan’s infrastructure rapidly scaled to support $4 billion in carbon credit trading volume. Today, we represent 85% of all digital carbon credits.

Integrating a unified global carbon market onto the blockchain will create opportunities to incorporate Regenerative Finance principles. And will lead to growth and regeneration. Their strategy introduces a unified global carbon market onto the blockchain.

Their impressive list of achievements so far:

- Bridged 25 million carbon credits (4% of the current market supply) from the Verra carbon registry to the blockchain.

- Reinvested 75% of the fees generated from their carbon credit tokenization bridge into offsetting additional credits. The results have increased carbon reduction with their protocol usage.

- Established two tokenized carbon pools – The base carbon tonne (BCT) and nature carbon tonne (NCT).

- Supported over 120 web3 builder teams incorporating tokenized carbon, including emissions offsetting and gaming infrastructure.

Regenerative Finance, Web3 and the financial imbalance

So, what makes projects like Toucan so revolutionary and valuable? Traditional financial markets are built on value extraction and people exploitation.

These empower the few while relying on the labor of many. Resources and wealth end up in a small number of places and individuals. Sustainability is not a consideration.

ReFi applies regenerative economics theory in the real world. This enables long-term value generation for all to be achieved and the conservation and restoration of natural resources. The aim is to create a self-regenerating, sustainable system without relying on scarcity or exploitation.

The role of blockchain in Regenerative Finance

Not all ReFi projects are based on this alternative technology. However, blockchain and Tokenization of RWAs add simplicity and data security to the concept because wealth distribution is one of the intrinsic values of DeFi (Decentralized Finance).

Its data storage structure reduces risk of fraud and foul play in regenerative projects and Impact Investments. RWAs allow the connection to the real world and add a layer of stability for value.

Who needs Regenerative Finance and why does it matter?

The more projects engage in moving away from the depletion of resources, the higher the benefit to everyone.

ReFi provides incentives for financing, offering rewards to those fostering positive outcomes.

The following areas and sectors are just some of the diverse arenas that can benefit from deploying Regenerative Finance:

- Agriculture and Farming

- Real Estate

- Renewable energy

- Insurance

- Climate finance

- Impact investment

- Circular economy

- Small enterprises

Regenerative Finance can open the door for you to build more sustainable and ecological businesses. Read on to find out how.

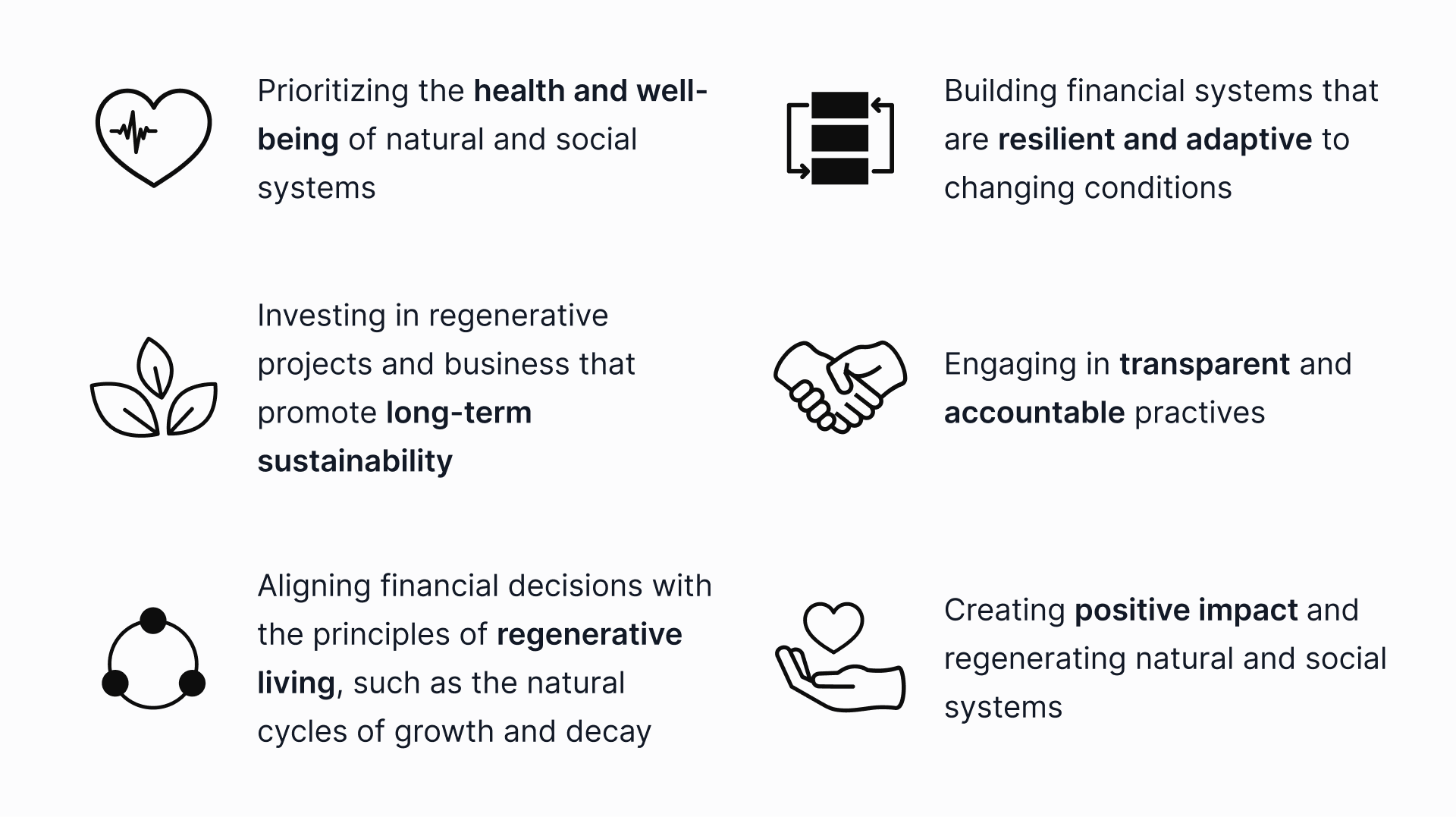

The key traits of Regenerative Finance

Aditya Raj, Expert in Blockchain and AI listed the key principles in his article “Unleashing the Power of Regenerative Finance”:

- Health and well-being

- Long term sustainability

- Regenerative living

- Resilient and adaptive

- Transparent and accountable

- Positive impact

Many cryptocurrency, regenerative finance, and blockchain projects are working on technology that follows the above principles.

The goal of Regenerative Finance is to shift away from the “extractive economy.” In other words, the current system – where finite resources are extracted, and only the privileged few reap the profits.

Regenerative Finance and Real-World Assets – what’s the connection?

The rise of Real World Assets signifies a crucial step in merging traditional finance with decentralized technologies. Tokenizing RWAs blurs the lines between physical and digital assets. And this will result in unlocking new financial possibilities.

Tokenization allows for fractional ownership. This makes investments that were once limited to a select few more accessible and democratized.

ReFi already plays a role in climate-related projects (as you’ve seen with Toucan). By tokenization of carbon credits, the concept is directly applied as a means to reduce carbon emission. Abdullah Yildiz, Executive Director of the European Carbon Offset Tokenization Association explains this in an interview with us “Tokenizing the Path to Net Zero”.

It is predicted that global demand for carbon credit will increase 15-fold by 2030 and 100-fold by 2050.

What should you consider before starting a Regenerative Finance project?

In Regenerative Finance challenges arise in both technological aspects and biodiversity methodologies. These methodologies are often intricate and ecosystem-specific, posing potential complications.

Tokenization and blockchain offer many benefits. But they may introduce unnecessary complexity instead of enhancing credibility. Blockchain is not a universal fix; even if suitable for a project, it can’t address underlying flaws. If a project fails to meet goals, transparency alone won’t result in success.

Communicating potential risks in Regenerative Finance as an investment scheme is crucial for both investors and project developers.

Building trust and educating stakeholders is essential for successful adoption. This is key as Regenerative Finance technologies are still very new, and trust issues have to be addressed.

Advantages and challenges of Regenerative Finance projects

Scaling ReFi requires a mindset shift towards a regenerative economy. This is a challenge that can be addressed with support from politicians and regulators. Here is a brief overview of the advantages and challenges:

Advantages:

- Promotes sustainability: ReFi backs projects and initiatives that adhere to sustainable and ecological practices.

- Fosters Global Positive impact: ReFi investments contribute to the regeneration of ecosystems, communities, and the global economy. They align with ESG principles.

- Ensures Transparency: ReFi projects or initiatives built on blockchain technology result in transparent and secure transactions.

- Prioritizes Social Responsibility: ReFi investors and/or participants prioritize and advance the economic development of society.

Challenges:

- Early investment Challenges: As the ReFi sector is still in its infancy, there are limited direct opportunities available through traditional markets. There’s still a lack of awareness and understanding of the concept and its benefits.

- Market Volatility: The potential for market volatility in this innovative new sector may lead to increased risk for both investors and entrepreneurs

- Lack of Regulation and Standards: No current regulatory framework for ReFi, and no universally accepted standards yet – This is a typical challenge for project initiation and attracting investors in innovative ideas.

- Insufficient Metrics: Insufficient date heightens the risk factor, and may enhance ‘greenwashing’ – the misrepresentation of green principles which is an ongoing challenge in the global adoption of ESG practices.

Regenerative Finance – embracing a sustainable future

Regenerative Finance is supporting the efforts to create a sustainable economy, propelling interest, investment, and innovation.

Web3 is accelerating financial innovation. And with regenerative finance the anticipated regulations and social factors favor its growth. This will be supported by business leaders, policymakers, academics, and citizens seeking alternatives.

So adoption will surge. And a new generation prioritizing environmental and community well-being enters the workforce. Early adopters have the advantage of shaping the system’s future, and greater diversity among them enhances its resilience.

The prediction is that Regenerative Finance will gain momentum as a tipping point is reached, and public awareness increases.

To get a broader picture of the potential of regenerative finance, read our research report, Real World Assets for Real World Purposes.