The trillion-dollar lending market presents a huge opportunity for disruption through decentralized finance (DeFi) alternatives. This DeFi paradigm shift in lending is coming to fruition through un- and under-collateralized loan options that can compete with — or beat — traditional finance (TradFi) options.

This innovative sea change in DeFi lending is being facilitated through onchain credit scores and innovative blockchain tools that assess a lender’s creditworthiness. DeFi provides loan alternatives to those offered by banks, credit unions, and other traditional finance (TradFi) lenders.

Many in the crypto ecosystem prefer onchain loans over legacy borrowing options. Learn how they work so you can weigh the pros and cons yourself.

How does crypto lending work (typically)

Crypto loans are fast, uncomplicated, and have a very straightforward approval process. Deposit crypto as collateral and borrow against it, no questions asked or KYC/AML required.

These loans are typically overcollateralized with large-cap cryptos like BTC or ETH — or through stablecoins like USDT, USDC, or DAI. However, as DeFi lending evolves, options like private credit tokenization are emerging, allowing for more flexible, collateral-free lending opportunities.”

This allows you to access the liquidity of your crypto portfolio without having to sell it and possibly benefit from the token’s price appreciation during the loan period. There are a number of both centralized and decentralized platforms that serve this thriving market, including:

- Aave

- Balancer

- Compound

- Nexo

- Salt

- Yearn

While the crypto-collateralized lending sector is an important part of DeFi, it lacks uncollateralized lending options and other structures found in the TradFi world. TradFi options tend to use your financial reputation — aka your credit score — to determine your loanworthiness.

The potential benefits of crypto loans over traditional loans include fast approvals, competitive borrowing/lending rates, and complete flexibility on how your loan capital is spent. You can use the money for personal or business use. The only limitations are your imagination — and your loan amount.

Banks tend to be less accommodating — to say the least. You may be required to undergo a home inspection to get a loan from a bank, with restrictions placed on how you can spend the loan. DeFi loans typically skip these hoop-jumping steps and let you put your loan capital to work based on your needs and preferences, not a bank’s.

DeFi thought leaders have long discussed the need for uncomplicated loans that don’t require locking up crypto capital. Now, they’ve taken action to provide loans that rely on reputation and incentives in lieu of collateral obligations.

Why onchain credit scores are needed

Onchain credit scores were a missing piece in the un/under-collateralized crypto lending ecosystem. Without collateral, lenders must have ways to assess the likelihood of loan repayment. Lender preferences would probably include a creditworthiness score and loan repayment history.

In addition, there need to be consequences for skipping out on an under-collateralized loan in bad faith. With a typical TradFi mortgage, not making your house payments results in the loss of your down payment — and having the lending institution repossess your house.

Without consequential crypto loan repercussions, the dishonest side of human character is tempted to borrow capital — and never pay it back to the gullible/unfortunate crypto lender. Onchain credit scores are a key tool in the DeFi lending toolbox.

Andre Cronje’s onchain credit score solution

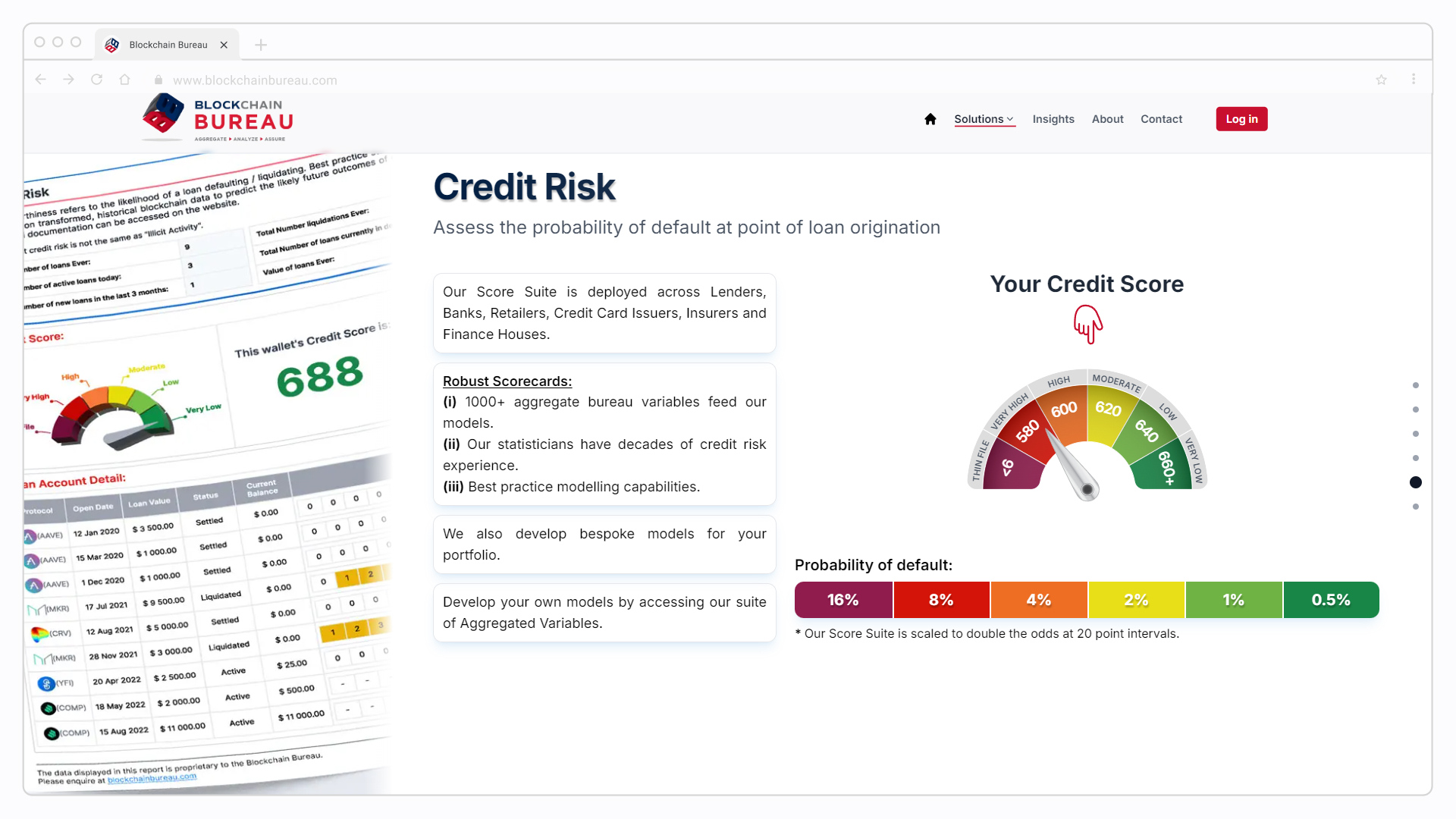

Known for popular projects such as Yearn, Keep3r Network, and Sonic (formerly Fantom), Andre Cronje took a historical analysis approach to developing an onchain credit scoring system. His solution — Providence — analyzed more than 60bil transactions and 15mil loans across over 1bil wallets.

Source: Blockchain Bureau

Providence is an onchain scoring system that preserves the core crypto ethos (privacy, self-sovereignty, and more) by tying the credit score to a wallet address — not a person. Providence is a data-rich vetting tool that works across 20 blockchain protocols.

This data-driven approach allows Providence users to get a credit score in a fully anonymous way that doesn’t require any KYC or personal information (name, age, nationality, and so on). This unlocks capital in the DeFi loan market by making uncollateralized loan assessments competitive with TradFi alternatives.

Source: Blockchain Bureau

In addition, these loans are far better than TradFi options for borrowers who value or need anonymity. If you live in an authoritarian region, you can use crypto transactions, a crypto VPN, and onchain credit scores to circumvent authoritarian restrictions on online activity and financial transactions.

Source: Blockchain Bureau

Onchain credit scoring tools

Andre Cronje’s Providence is one of many onchain credit scoring tools that provide borrowers and lenders with crypto loan options that were not previously widely available. While some value complete privacy, others take a pseudonymous approach or tie a wallet address to an offchain identity (such as a company or individual).

Here are a few more Web3 credit scoring tools you should know about:

Credora

Like Providence, Credora is an onchain credit scoring system that you can use to calculate the risk-adjusted returns for DeFi credit markets. It is designed to improve liquidity, transparency, and loan efficiency in primary and secondary onchain debt markets. Lenders can link onchain scores with offchain agreements to give them real-world legal recourse when loans go unpaid.

zkCredit

The zkCredit tool from zkMe verifies onchain credit scores using zero-knowledge proofs (ZK proofs). It enables the privacy-preserving transfer of a FICO credit score to the onchain world, providing opportunities for real-world asset (RWA) tokenization and DeFi interactions. According to zkCredit, borrowers can get fairer credit access while lenders reduce risk and increase capital allocation efficiency.

SoFiLend

Crypto personalities with good Web3 reputations can risk their onchain reputation to receive a crypto loan. SoFiLend assesses your creditworthiness by looking at your online and onchain social profiles (X, Lens, ENS, and more) and using them as reputational collateral. In addition to damaging their online reputation, those who don’t repay their loans will have their funds on Lens and ENS locked in escrow until loan repayment is finalized.

Other Web3 credit scoring options

This is just a small sampling of the Web3 credit scoring tools on offer. While unpaid loans damage your onchain reputation, you can also improve your onchain credit score/limit through successive loan repayments. This is particularly compelling for those in the developing world who simply don’t have access to traditional credit lines.

Can crypto lending take on TradFi lending?

Combing onchain credit scores and lending markets makes sense. Credit markets allow markets to grow, improve business capital efficiency, and are the foundation of the modern global economy.

Onchain sleuths can tell you that DeFi lending is measured in billions of dollars — while TradFi journalists opine that the consumer credit market in the U.S. alone exceeds $17 trillion. DeFi lending seems primed for substantial growth. Yet, outside of U.S. treasuries, onchain credit market activity is fairly subdued.

Lenders and borrowers want predictable rules for all DeFi market participants. This is one potential reason some are surprised by the lack of substantial growth in onchain borrowing and lending. Proponents predict that onchain credit scores will ameliorate lenders’ risks and concerns while providing a better experience for loan recipients.

However, to attract lending and borrowing at the institutional level, credit-based lending needs to be incorporated into the composable DeFi stack. While repayment considerations were a prior pain point, onchain credit scores and related solutions are leading efforts to bring more of the global capital market onchain.

With growing openness to un/under-collateralized lending, DeFi is creating a paradigmatic shift from the old TradFi ways. To become a fully parallel alternative to TradFi, DeFi must offer a wider range of alternatives to lending, borrowing, and capital market liquidity.

With onchain credit scores, it is likely that crypto lending platforms will take a growing percentage of debt markets for the unbanked, underbanked, and overbanked.

To stay up to date on the latest onchain news, follow Onchain on X, LinkedIn, and Farcaster.