“In order to have a decentralized database, you need to have security. In order to have security, you need to — you need to have incentives.”

– Vitalik Buterin

Token incentives and Web3 apps go hand in hand — and block to block. They support network security and encourage user onboarding.

Most Web3 incentives are of a financial nature. This has led to an entire field of study called tokenomics. Crypto rewards are a hotly debated topic that covers issues such as fairness, transparency, equity, ethics, profitability, and much more.

In and of themselves, there is nothing inherently good or bad about token incentives. And let’s be honest with ourselves: Aren’t we all motivated by financial rewards? 💰

If you’re an aspiring Web3 founder or currently running a blockchain startup, you need to have a thoughtful token incentive plan. And if you’re a crypto app user, Web3 researcher, or blockchain investor, you need to evaluate how these token incentive plans work. 😉

Get the tokenomics wrong, and a company can rise — and fall — quickly. Get the tokenomics right, and you can build engaged communities, reward positive behavior, and get stakeholders aligned on a common roadmap and vision.

Allow me to paraphrase and tweak Vitalik’s quote above, “In order to launch a crypto app successfully, you need to have good token incentives.”

Token incentives: then and now

Token incentives power the security of Bitcoin, Ethereum, Solana, and nearly every other public blockchain. You can earn crypto through mining, crypto staking, airdrops, app usage, and other distribution mechanisms.

The mining of bitcoin (BTC) is the earliest example of a crypto token incentive. Other blockchains incentivize by allowing you to earn tokens through staking your existing tokens. Popular blockchain staking options include ada (ADA), solana (SOL), and ether (ETH).

These are still viable token incentive structures. However, most mineable tokens require million-dollar capital investments to turn a profit. And to earn staking rewards, you already need tokens. This can be unaffordable, especially when many protocols have mandatory staking minimums.

Billions of people can’t afford the initial token investment or mining equipment needed to start earning. Still, they want to participate in the Web3 ecosystem and wouldn’t mind earning some tokenized rewards along the way. Can you blame them?

To attract users to your innovative crypto app, you want to create a token incentive system that is fair, transparent, and accessible. In 2025, most app projects distribute Web3 tokens to active app users. In other words, when users create, engage, market, and interact on the app, they earn crypto rewards.

How token incentives go wrong

A poorly thought-out token incentive plan can ensure that your project is so “trendy” that it’s out of style (aka bankrupt) before the next Web3 fashion show. Here are a few things both crypto app founders and users should consider:

Token volatility

Crypto tokens, especially from newer projects, can be quite volatile. It’s great when your tokens experience upside volatility. On the flip side, it’s frustrating when your app token rewards depreciate dramatically.📉

This can lead to users abandoning your app — especially if there aren’t other incentives binding them to your project.

Airdrop tokenomics

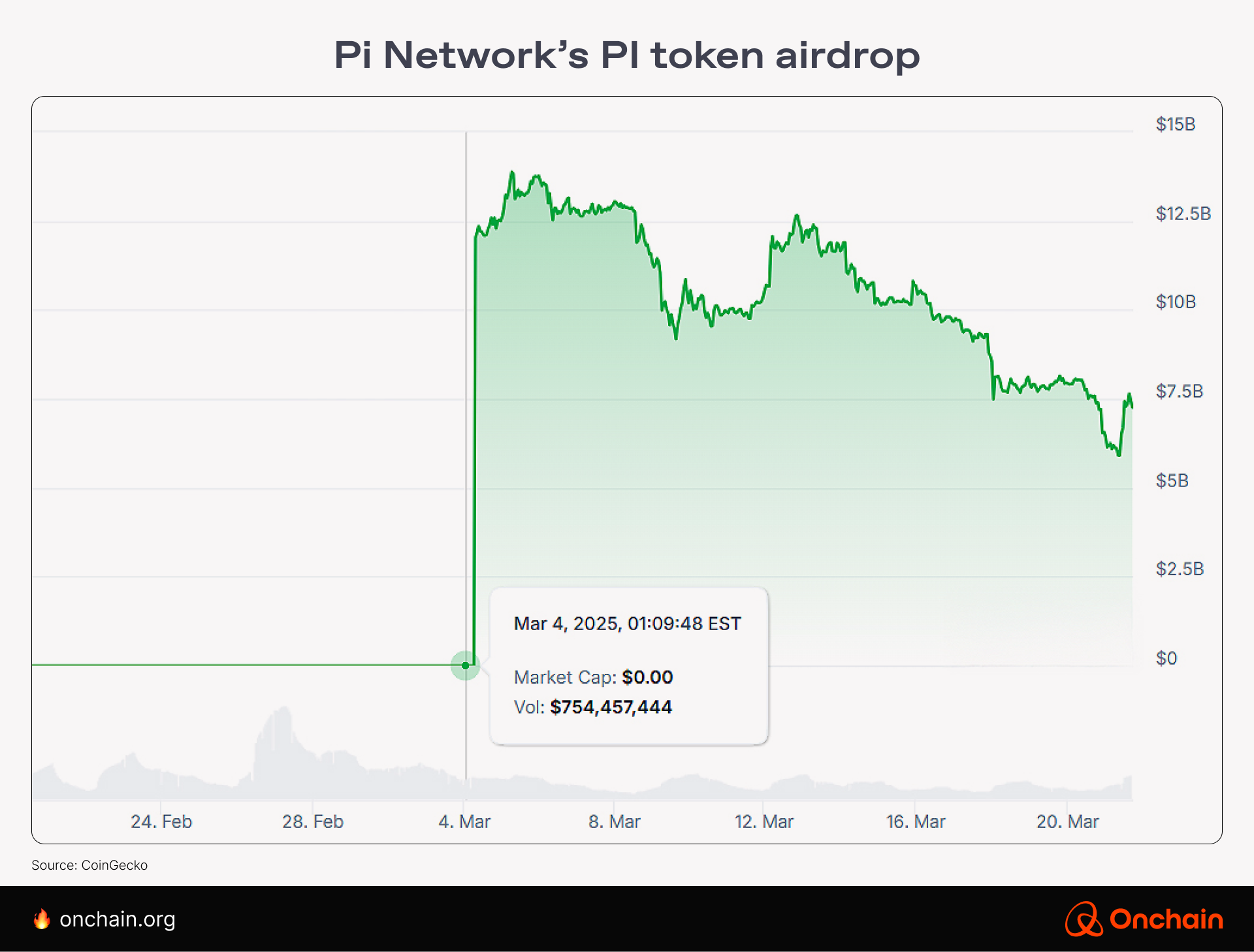

An airdrop of tokens is often distributed to early users or contributors to a platform. For years, the most valuable was Uniswap’s 2020 UNI airdrop at around $6.43 bil. In February 2025, Pi Network smashed the previous UNI record.

Still, airdrops can create tokenomic havoc that, while exciting, may not be ideal for long-term growth. Speaking of volatility, look at the market cap chart of Pi Network.

Pi Network went from a market cap of $0 to over $12.5 bil in one day. The numbers surged to $13.8 bil by the next day, then dropped to under $6 bil in less than a month.

With volatile billion-dollar swings, it’s too early to know Pi Network’s onchain future. Still, many projects’ tokens collapse post-airdrop due to unaligned incentives and user abandonment.

When an app token’s price is in freefall, the company behind it feels the pain. Because these tokens are often used to bootstrap early funding needs, these drawdowns can lead to budget cuts, layoffs, or bankruptcy.

Yield and activity farming

Other founders have driven huge user numbers in the short term by giving out more lucrative crypto rewards than the competition. Such incentives are triggered by a Web3 app signup, app activity, referrals, contributing to the community, and other metrics.

But is this sustainable? Usually not. When the rewards diminish, users flee to the next “highest token rewards” offer.

The don’ts of tokenomics

Combined with token volatility, unsustainably high Web3 token yields often lead to unmaintainable tokenomics, frustrated users, and controversy. Examples of projects with airdrop issues include Starknet, Hamster Kombat, and many others.

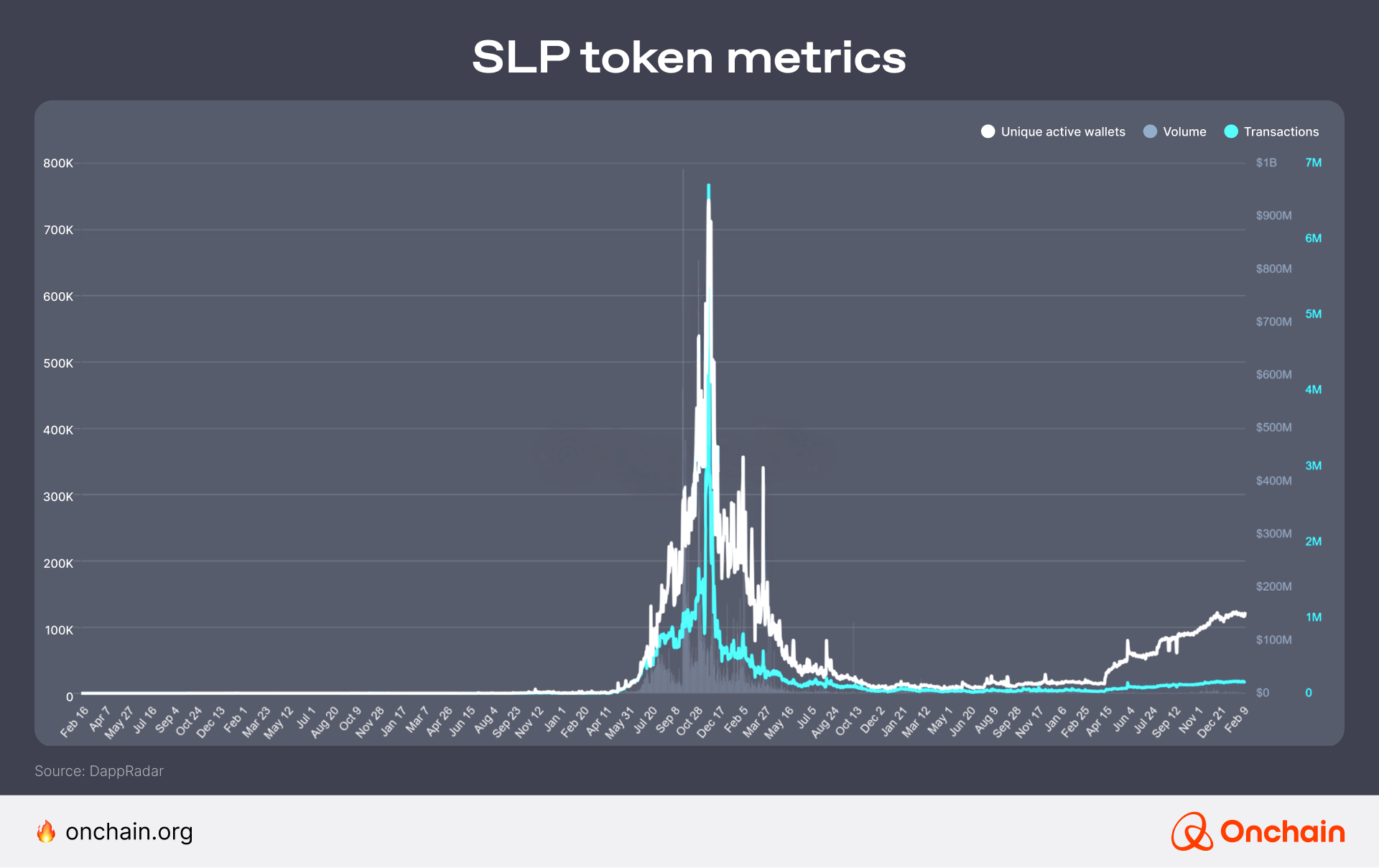

Simple Love Potion (SLP) was distributed for in-game play on Axie Infinity and was not airdropped to users. Still, look at the market cap chart for SLP.

This rocket-up-and-then-freefall price action is far too common for airdrops, metaverse tokens, and other in-app currencies. While this sort of chart pattern is the norm for memecoins, it is also surprisingly common with more legitimate, honest, and ambitious projects — like Axie Infinity.

How to craft a token incentive plan

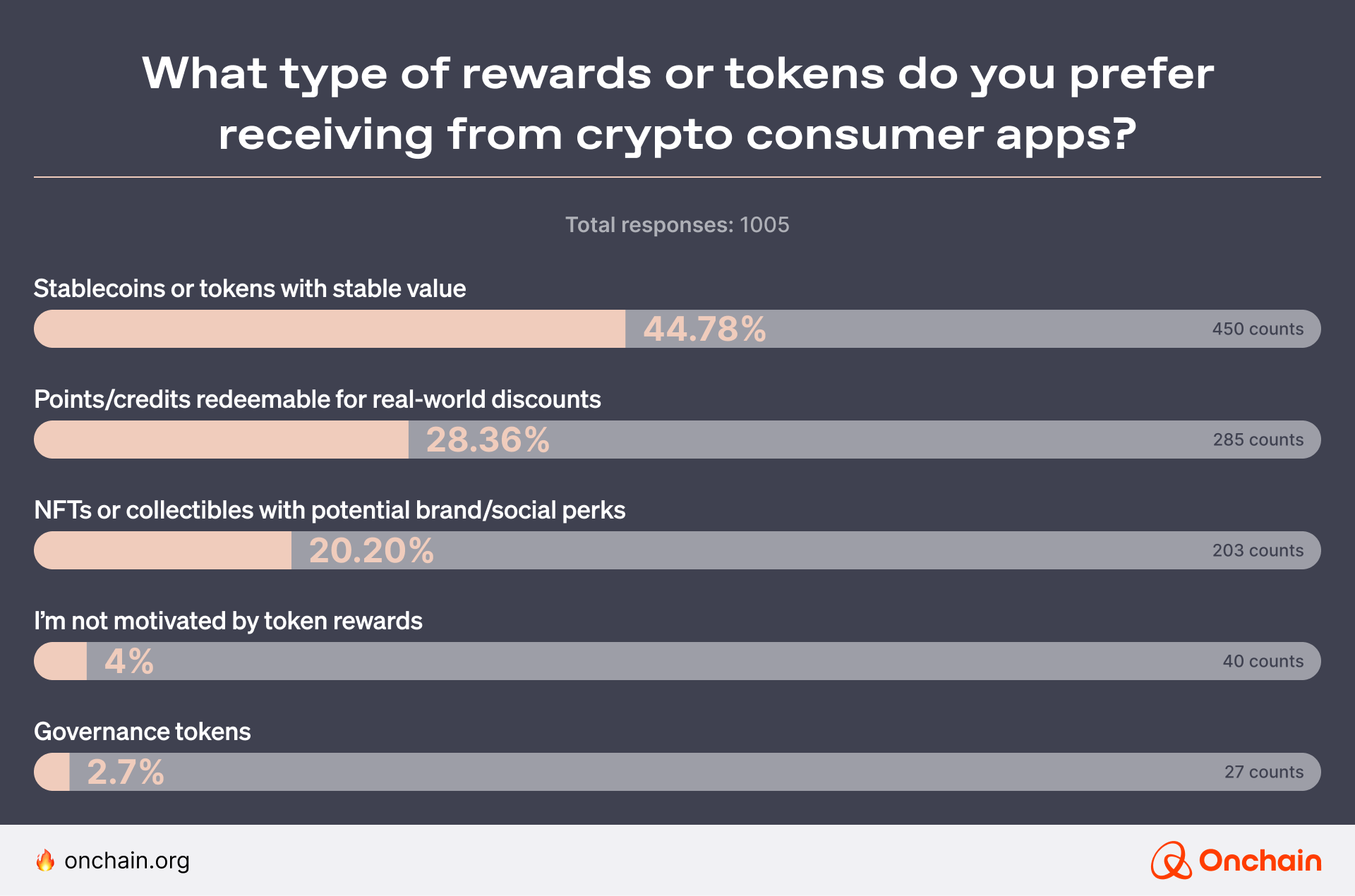

Now that you know the token incentive plan “don’ts,” let’s cover some of the “dos.” We have some real data on crypto consumer app token incentives. In a 1,000+ person Onchain survey, stable rewards were the most popular option.

These rewards can be in the form of third-party stablecoins or a proprietary app token that also leverages similar principles. For example, with the Web3 loyalty app Blackbird, you get tokenized FLY rewards. FLY is pegged to USD at a stable rate, and you don’t need to worry about price volatility.

Other good-to-have characteristics of a token incentives scheme include transparent token allocations, clear vesting schedules, and an explanation of how the token has value.

But aren’t there other reasons for using crypto consumer apps?

Token incentives aren’t everything

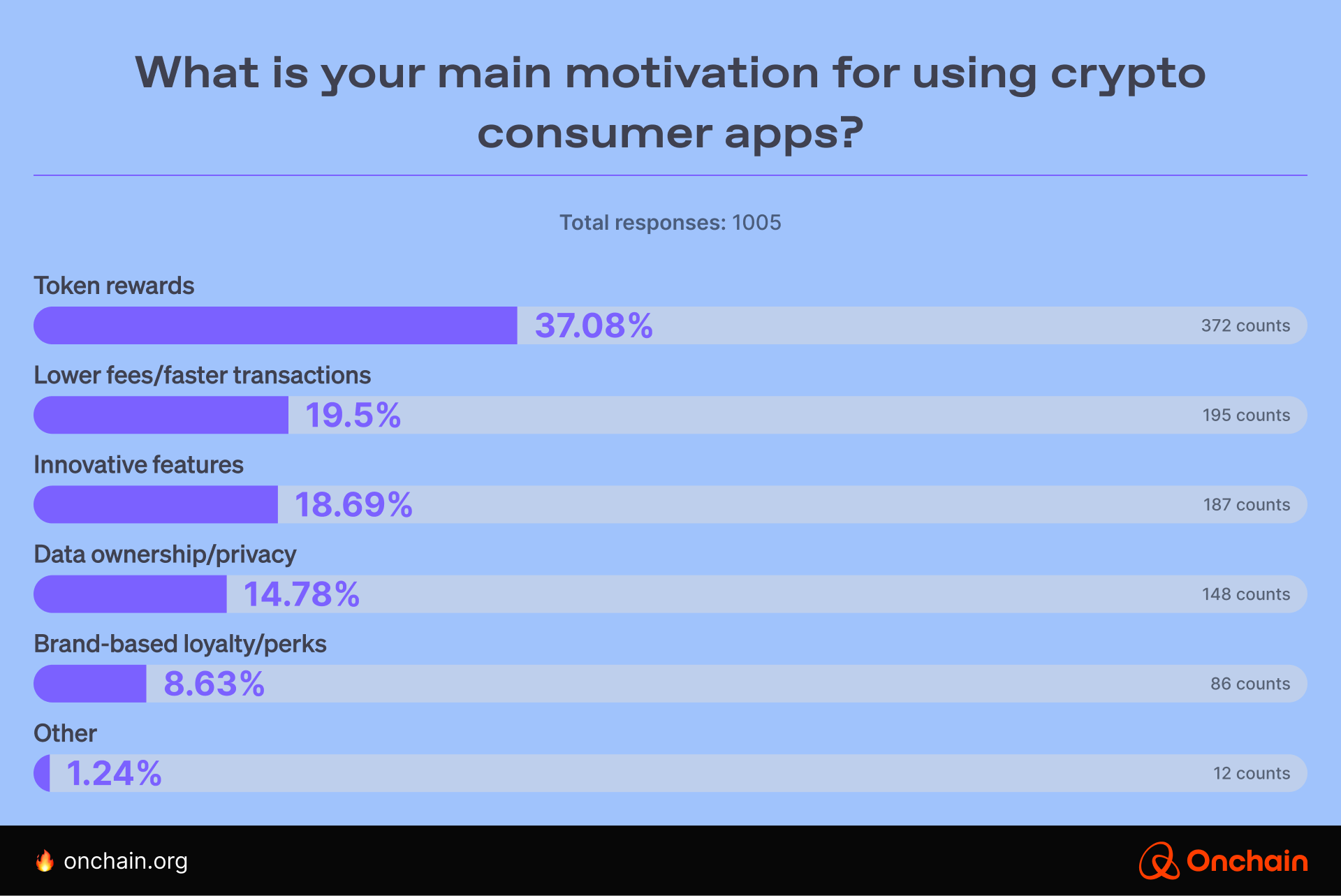

After an airdrop, what is the incentive for users? If not tokens, it has to be something else. Crypto app motivations exist outside the financial realm. But what are they?

You don’t have to guess; We conducted a comprehensive survey on user motivations and have answers.

If you want to compete with other Web3 apps and their Web2 cousins, focusing on Web3 token rewards isn’t enough. You need to create apps that are innovative, respect user privacy, and compete on cost. Crypto app categories that are making Web3 waves include DePIN, crypto credit cards, DeSoc, and much more.

Outside of these survey results, there are other motivations that drive both founders and crypto app users. These include:

- A strong desire to “Make a difference.”

- Being on the cutting edge of tech

- More financial freedom and so on

Add it all together, and you have a complex combination of complementary and competing motivations for crypto app users. Getting this incentive recipe right can mean the difference between an innovative app with long-term potential and an app that disappears overnight.

Token incentives done right

For Layer 1 blockchains like Bitcoin and Ethereum, tried-and-true tokenomic models are well established. However, token incentive structures still vary greatly for crypto apps built on top of these protocols. This nascent space uncertainty on token rewards provides opportunities for the ambitious to create their own onchain apps.

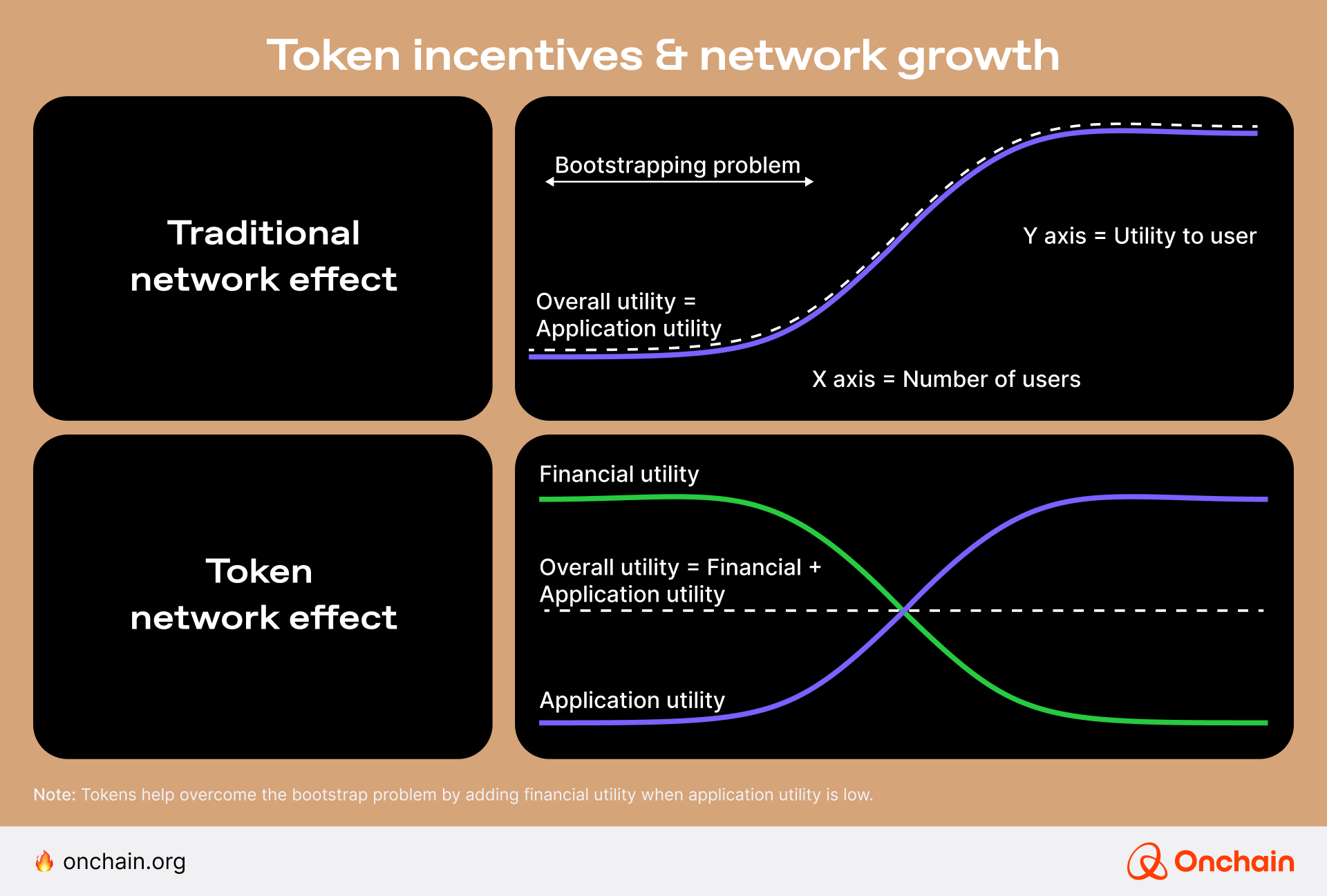

Let’s make another thing clear: Frontloading token incentives isn’t necessarily a bad thing. But when the financial rewards wane, you need to replace them with something else of real value. For crypto apps, this means apps that become highly useful and provide real utility.

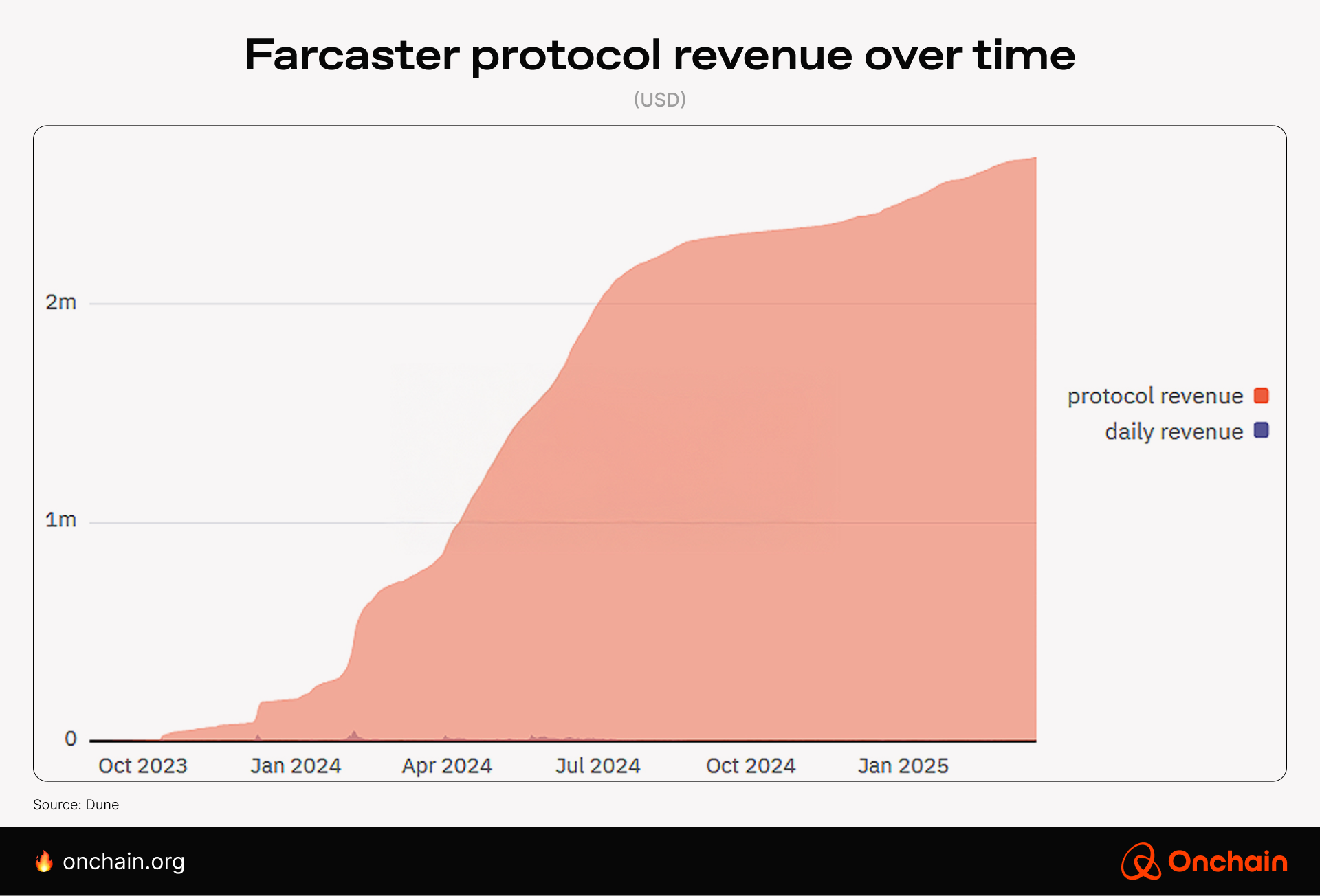

For example, Farcaster is a DeSoc app that gained popularity with the launch of its Frames feature in 2024. One user earned over $12,000 on the platform. It’s a nice payday, but most of these earnings were from an airdrop and aren’t sustainable.

To sustain growth, non-economic user incentives will also need to be provided. While Farcaster’s revenue is charting nicely 📈, it will need to continue growing much higher to compete with major social networks.

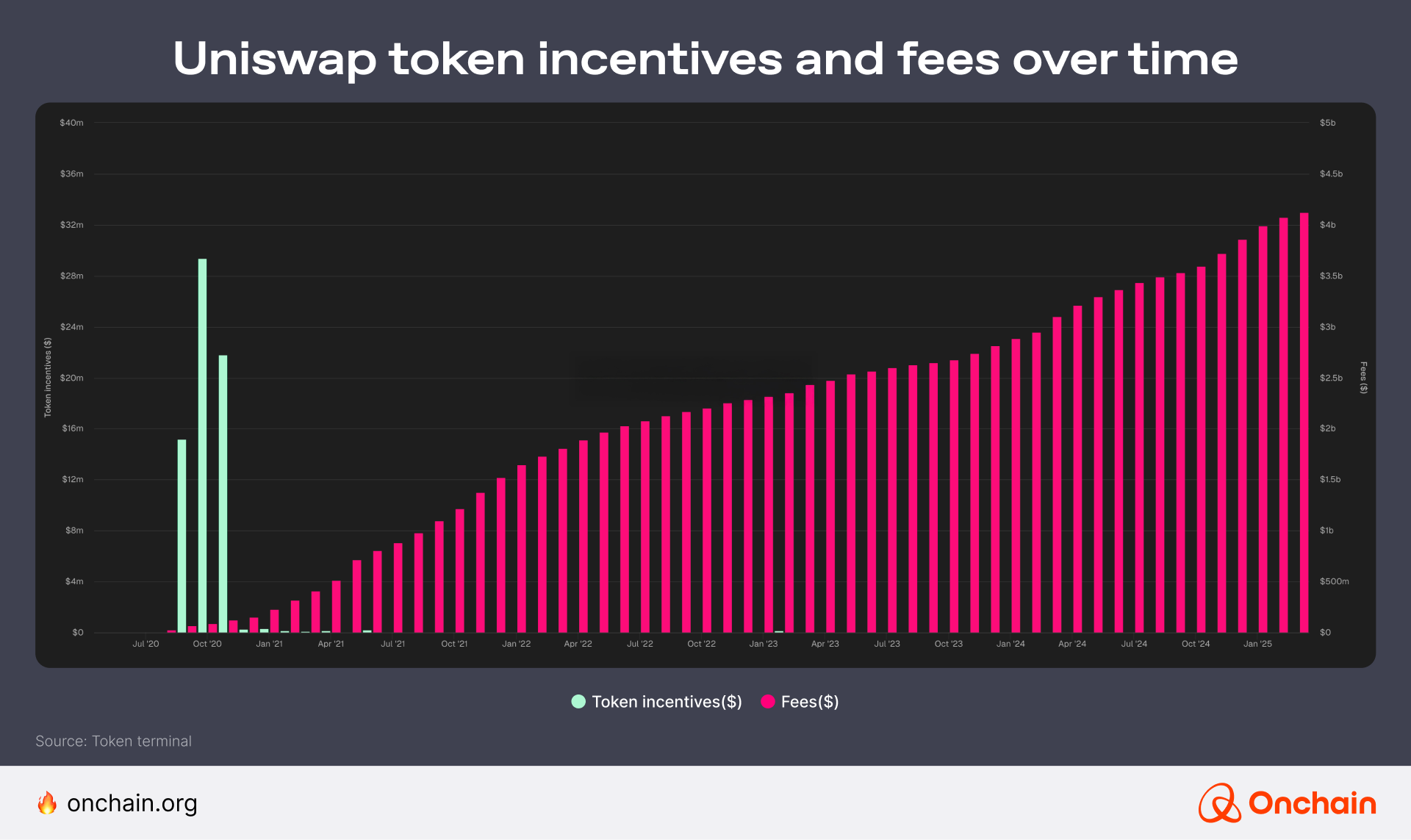

Airdrops can and do go wrong. Pivoting back to Uniswap, how did the UNI airdrop pan out for them? I’d say it worked out well.

Doesn’t it look like the “Token network effect” chart above? Uniswap managed to navigate its monster airdrop to become a trusted DeFi project. It now generates billions of dollars in fees every month.

Uniswap provides a trusted and useful service for crypto traders and investors. Crypto apps need to have usefulness as their guiding north star. Crypto loyalty apps need to work as well, or better, than alternatives. The same thing goes for DePIN apps, Web3 games, and crypto payment apps.

Are you ready to build a crypto app?

By themselves, token incentives simply aren’t enough for apps that want to stand the onchain test of time. To gain mass adoption, your app needs to be useful and easy to use. AI and chain abstraction make great crypto apps feel like regular apps, so users no longer experience anxious onboarding.

“People respond to incentives. The rest is commentary.”

-Steven Landsburg, Economist

Incentives motivate people. What are your motivations for building (or using) crypto apps? Share this article and tag us. We want to hear from you. I’ll go first. In no particular order, my motivations for getting into crypto were these:

- I was fascinated with the tech of Bitcoin.

- I thought it would make the world a better place.

- I wanted to make some extra money. Hey, I’m being honest. 🤑

Without the non-financial motivations, I probably would have left the crypto space many blocks ago. With the lack of mainstream interest during the early years, flat/volatile token price dynamics, friends/family making fun of me, and all the FUD related to hacks, criminality, protocol infighting, and more — it would have been easy to walk away.🚶

Crypto OGs have been through the Web3 ringer. Those who are 10-year+ crypto veterans are true believers. But to launch a successful crypto app, you need to target everyone with a smartphone. You can’t just attract battle-hardened crypto natives. 🥷

Not only do you need a solid marketing strategy and business plan to last in the long term, you need to be aligned with current token regulations. Progress in the Track to learn how to handle them.