Let’s say you’ve just raised a round in the stablecoin USDC. Your dev is in Poland, your designer is in Argentina, and your ops team is in Bangalore. The product is shipping, the community is vibing, but then comes the boring part: payments. Suddenly, you’re stuck converting crypto to fiat, jumping between exchanges, getting wrecked by fees, and waiting days for settlements to land.

Sounds familiar?

It’s the classic friction point in crypto. You can raise in tokens, reward contributors in tokens, but try buying a Software as a Service (SaaS) subscription or grabbing lunch! Good luck.

Cryptocurrency cards are here to change that. With these Visa- and Mastercard-powered cards, you can spend your crypto instantly, just like cash.

Our research found that cryptocurrency payments are the most widely used and rapidly growing sector among real-world Web3 consumer apps. Survey results based on responses from 1,000+ users across various Web3 demographics strongly reinforce this trend.

- 35.02% reported being most excited about “crypto real-world payments” among emerging Web3 trends. For more details check out our “Crypto Apps for Consumers Are Here to Stay” report.

In this article, we’ll break down what crypto cards are, how they work, and what makes them more than just a shiny fintech gadget.

Spoiler: they’re quietly becoming a power tool for global startups, decentralized autonomous organizations (DAOs), and digital nomads alike.

What are crypto cards, anyway?

Think of cryptocurrency cards as your traditional debit or credit card with a Web3 engine under the hood. Instead of pulling funds from a fiat bank account, they pull from your crypto wallet. You swipe, tap, or pay online, and the backend converts your tokens (ETH, USDC, SOL, etc.) into fiat in real time.

The goal? Let users spend crypto like they spend cash: no complicated off-ramps, no middlemen. Just seamless, instant usability.

How do crypto cards work?

Cryptocurrency cards come in various forms. The table below helps you understand how they differ in features and how they work.

While custodial cards dominate the current landscape due to regulatory and banking integrations, new models are emerging that prioritize self-custody and onchain interoperability.

Top crypto cards in 2025

Here are some of the leading crypto cards available today:

- Crypto.com Visa card: Offers up to 8% cashback in CRO tokens, with additional perks like Spotify and Netflix rebates. Available globally with tiered benefits based on staked CRO amount.

- Coinbase card: Allows crypto spending of multiple currencies directly from your Coinbase account. Earn up to 4% back in crypto rewards. Available in the U.S.

- Bybit card: Offers up to 10% cashback with zero transaction fees. Designed for users seeking a secure and rewarding crypto debit card experience.

- Nexo card: Combines credit and debit functionalities, offering up to 2% cashback and up to 14% interest on crypto holdings. Available in multiple regions.

- WireX card: Offers up to 8% cashback in WXT tokens and integrates seamlessly with DeFi wallets. Available in the UK, EEA, and APAC regions.

- Gnosis Pay card: One of the first non-custodial crypto cards. Built with privacy and decentralization in mind, it allows real-time spending from a self-custody wallet while staying compliant with fiat settlement. Currently in early access rollout across Europe.

Before choosing the right crypto card for your needs, it’s essential to consider several key factors beyond just rewards and cash back. Here’s a quick visual guide to help you compare wisely:

From wallet to checkout: How crypto cards power instant spending

For founders building crypto-native products, understanding how a crypto card transaction flows is key to optimizing UX, compliance, and onchain-offchain integration.

The diagram below breaks down the lifecycle of a crypto card swipe—from a customer presenting the card to a merchant, to real-time crypto-to-fiat conversion, to final authorization.

Every time a user taps their card, this system springs into action—verifying balances, converting tokens, and authorizing payments within seconds.

This is the behind-the-scenes engine that makes cryptocurrency cards feel magical, bridging the gap between blockchain wallets and the traditional card networks your users already trust.

Now that we’ve unpacked the mechanics behind how crypto cards work, let’s zoom out and compare the bigger picture. Beyond the backend plumbing, what truly matters to users, especially crypto-native founders and teams, is how these cards perform in the real world: Are they more rewarding? More cost-efficient? Easier to use?

Crypto cards vs. traditional spending cards

This section dives into a head-to-head comparison of crypto cards and their traditional counterparts, focusing on three pillars that matter most: reward systems, usability, and crypto card fees vs,. traditional card fees.

As you’ll see, cryptocurrency cards aren’t just about spending tokens, rather they’re reshaping financial incentives, reducing friction, and unlocking new ways to engage with money and community.

Loyalty schemes

Traditional cards offer rewards like airline miles or cashback. Crypto cards, on the other hand, provide:

- Token-based rewards: Users earn cashback in cryptocurrencies like BTC, ETH, or platform-specific tokens.

- NFT perks: Some cards include NFT-based rewards, granting access to exclusive communities or benefits.

These innovative reward systems align with the interests of crypto-savvy users and offer more than just monetary incentives.

Fees

While traditional cards may have annual fees, foreign transaction fees, and interest charges, crypto cards often feature:

- Lower foreign transaction fees, especially when settled in stablecoins.

- Transparent conversion rates: Real-time crypto-to-fiat conversion rates at the point of sale.

- Minimal hidden charges: Many crypto cards aim for fee transparency, though it’s essential to review each card’s fee structure.

Usability

Crypto cards offer:

- Global acceptance: Use your crypto card anywhere Visa or Mastercard is accepted.

- Digital wallet integration: Compatible with Apple Pay, Google Pay, and other digital wallets.

- Multi-currency support: Spend various cryptocurrencies without manual conversion.

These features make crypto cards practical for everyday use, bridging the gap between digital assets and traditional finance.

So far, we’ve seen how cryptocurrency cards stack up against traditional cards. But this is more than a consumer product upgrade, it’s a powerful infrastructure shift that quietly releases real-world value for crypto-native companies.

The benefits of crypto cards for businesses

For startups, DAOs, and globally distributed teams, crypto cards go beyond being a cool payment method—they’re operational tools.

Below we break down three key reasons why founders should be paying attention:

1. Operational efficiency for startups

Startups working in crypto often hold treasury in USDC or ETH, but need to pay for tools, events, ads, or software in fiat. Crypto cards allow you to:

- Spend from your treasury without off-ramping.

- Pay for services instantly from AWS to team dinners.

- Avoid delays, manual transfers, and excessive fees.

Imagine your team needs to book conference flights, pay for freelancers, or buy hardware — all in fiat. With a crypto card these become seamless transactions.

2. Payroll and contributor payments for DAOs

DAOs reward contributors in tokens, but spending usually requires:

- Selling on an exchange,

- Converting to fiat, and

- Withdrawing to a bank account.

A crypto card compresses all that into a single swipe.

- Pay contributors directly in stablecoins.

- They can spend immediately without off-ramping.

- Set monthly allowances or automated top-ups.

This builds a truly global, bankless workforce.

3. Global team support

Remote teams are usually scattered across borders with wildly different banking access. Cryptocurrency cards eliminate the related barriers:

- Pay contributors in crypto → they spend it via a card.

- No need to deal with wire transfers, IBANs, or SWIFT codes.

- Instant payments and minimal foreign exchange (FX) risk, especially with stablecoins.

Your teams in Lagos, Manila, Berlin, or Buenos Aires can all get paid on time and use their card locally.

So far we’ve talked about the mechanics, the benefits, and why businesses should care but what does this look like on the ground?

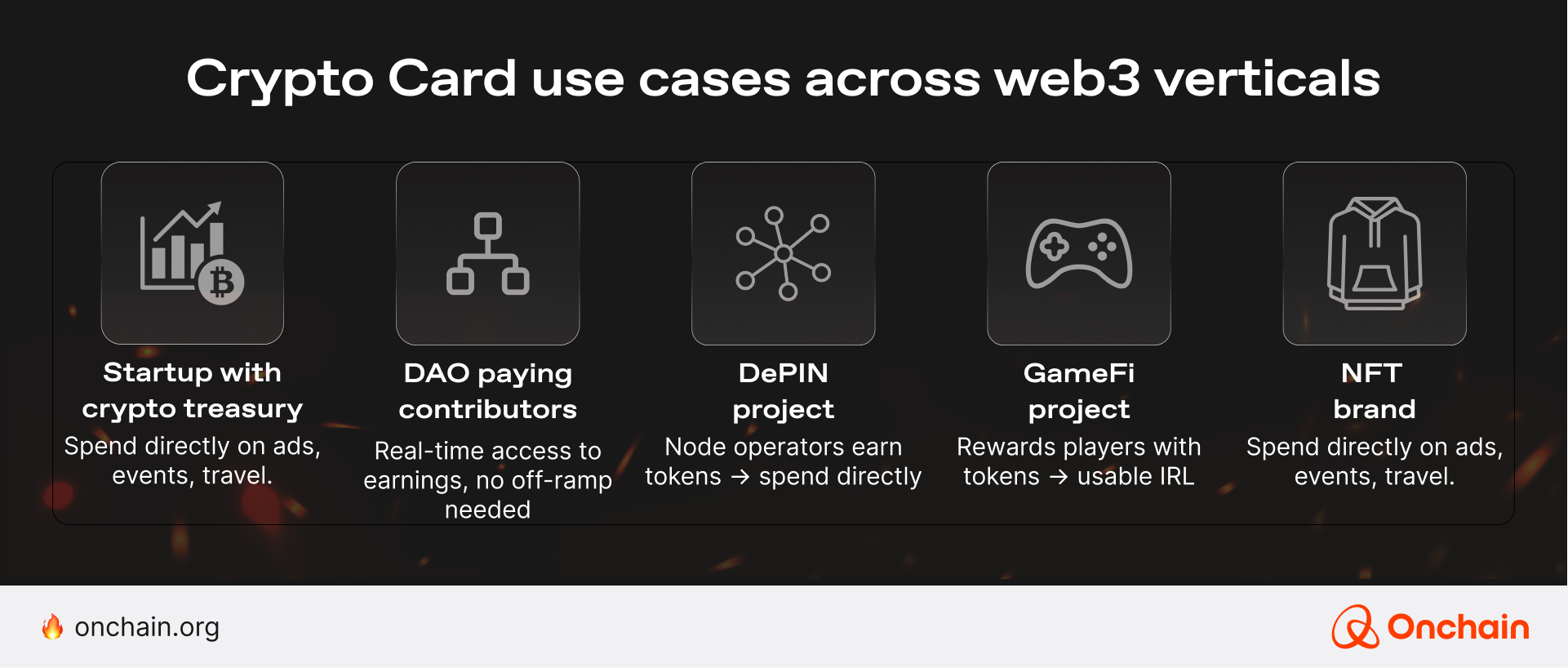

Below you find five concrete use cases where crypto cards simplify operations, drive user engagement, and make tokens usable in the real world.

⚠️ Things to know before you swipe: Challenges founders must consider

Crypto cards unlock powerful functionality but before you rush into integration, it’s worth considering a few guardrails. Here are three key watchouts that every Web3 founder or ops lead should have on their radar:

1. Regulatory roulette

Crypto regulations vary per jurisdiction and they change faster than Layer 2 gas fees. What’s compliant in one country might be restricted in another.

Tip: Work with partners who offer regional support and have solid compliance track records (think: KYC/AML out of the box).

2. Volatility vibes

Your USDC might be stable, but not all tokens are created equal. Sudden market swings can eat into contributor earnings or treasury value mid-swipe.

Tip: Favor stablecoins for day-to-day payments and set card limits if you’re using volatile tokens.

3. Security isn’t optional

Cards are only as good as the rails they run on. Poor key management, phishing attacks, or insecure APIs can turn a crypto spending solution into a security liability.

Tip: Choose platforms with hardware-level encryption, fraud monitoring, and built-in wallet security.

The bottom line: Do your due diligence, start with controlled rollouts, and scale smart.

The future of crypto cards: Smart, programmable, and ecosystem-aware

Crypto cards started as a simple bridge between digital assets and fiat payments—but their true potential is just beginning to unfold. As blockchain infrastructure matures and user expectations evolve, crypto cards are poised to become programmable financial tools woven into the very fabric of Web3 ecosystems.

According to one survey, 86% of current crypto holders are eager to try crypto credit cards, and 29% of non-crypto users say they would consider one if it simplified their experience. That’s not just traction—that’s a signal.

What’s next? We expect programmable, autonomous spending tied directly to how Web3 organizations operate. Imagine a world where:

- AI agents review DAO proposals and pre-approve contributor expenses based on onchain voting.

- Smart treasuries auto-disburse allowances to contributor cards based on verified contributions or role-based budgets.

- Interconnected ecosystems reward cardholders with cashback in native tokens—customized by dApps and DAOs themselves.

This is where crypto cards outgrow their bridge function. They establish a core infrastructure for programmable money, transparent governance, and frictionless coordination across borders and networks.

But what if you could back your stablecoins with gold? Click the arrow below to dig a little deeper with gold backed stablecoins that anchor your holdings (for businesses and investors).