Beyond DeFi and enterprise: the rise of consumer-focused blockchains

For years, the blockchain narrative has revolved around decentralized finance (DeFi) and enterprise applications. However, today’s widely used Web3 applications remain largely speculative. And while these applications have showcased blockchain’s technical capabilities, they have yet to translate into mass-market adoption and address real-world issues for everyday users.

Good news is that the tides are now shifting.

Web3 is stepping out of its “infrastructure phase” and is now moving towards the application layer — budding ecosystems composed of consumer apps that abstract away complexity and deliver meaningful, tangible benefits. A new wave of blockchains has emerged as a result of this transformation: Enter consumer-focused blockchains, networks designed for real-world applications that prioritize seamless user experiences, developer accessibility, and mainstream adoption.

Broadly referred to as consumer-focused blockchains (in some occasions, application-specific chains or appchains) or simply consumer chains, these blockchains can all refer to networks that are designed for specific use cases and optimized for everyday consumer use, in the form of blockchain-based applications and services.

Let’s highlight ‘everyday consumer use’ here: these chains have to be reliable and capable enough to handle high transaction volumes and provide a frictionless user experience to make them ideal for frequent use. Since consumer chains prioritize low-cost, high-speed transactions and user-friendly design, they work in contrast with monolithic blockchains such as Bitcoin or Ethereum’s base layer, which face scalability limitations and high fees.

The term ‘consumer chains’ itself is expansive, encompassing any blockchain that is optimized for mass-market apps and designed to be as seamless as traditional internet experiences. Because the term is broad, they can come in different forms:

- Ethereum Layer 2s like Base and Abstract, which reduce fees and improve accessibility while maintaining Ethereum’s security.

- High-performance Layer 1s like Sui, Berachain, and Solana, which are built for scalability and high-volume transactions.

- App-specific blockchains (appchains) that are tailored to particular use cases, such as gaming or social media, ensuring optimal performance for their respective applications.

Consumer chains are purpose-built to power consumer apps related to payments, loyalty and reward programs, gaming, social networks, and shopping, among others. Unlike traditional blockchains which require users to navigate complex wallets, gas fees, and security trade-offs, consumer chains also focus on making on-chain interactions as smooth as everyday internet use.

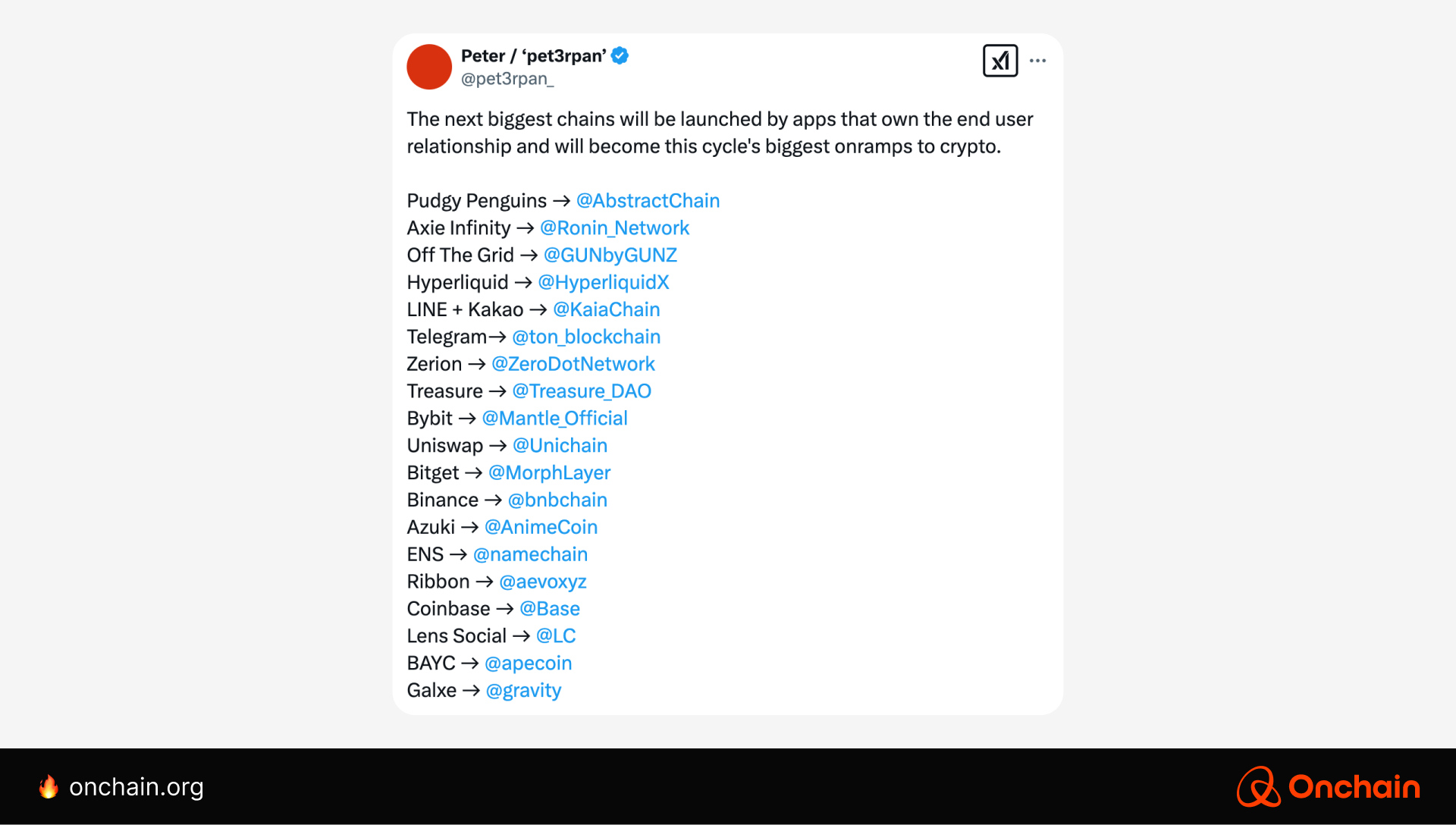

With this shift, a new opportunity emerges: consumer chains could become the biggest onramps for crypto adoption, bridging the gap between blockchain technology and mass-market users. But how do they work, and what sets them apart?

The million-dollar blockchain adoption question

Despite its disruptive potential, blockchain has struggled to break into the mainstream. But why? Today, there are a few key challenges that have slowed down adoption:

Make it easier to use

Let’s start with the user experience. The average person does not want to be burdened with the complexities of managing wallets, gas fees, or the blockchain on which a dApp is built, all of which create significant barriers for non-technical users.

However, this is starting to change: In the year 2025, a16z predicts a formal shift in how crypto companies will approach development and are expected to begin with the end-user experience in mind instead of letting the infrastructure determine the UX.

Make it easier to build on

Developers can face similar challenges, and we often hear how building consumer-friendly apps can be challenging and resource-intensive. They often face fragmented or complex tooling, lack of native integrations, and limited support for user-friendly features.

Make it scalable and seamless across networks

Yes, the infrastructure for building on blockchain exists. But is it truly ready for mass adoption? For many blockchains, the answer is still no.

The reality is that most blockchains just aren’t built for mass-market use. Take Bitcoin and Ethereum’s base layer: While they are the most established networks, they struggle with speed and cost. Bitcoin processes a mere ~7 transactions per second (TPS), and Ethereum’s base layer manages only ~15-30 TPS. That’s nowhere near enough to handle the demands of real-world applications like payments, gaming, or social platforms where users expect instant, frictionless transactions.

For blockchain to go mainstream, we need networks that can handle hundreds or even thousands of TPS without sky-high fees. That’s exactly why super scalable networks like Solana, Base, Lisk, and Ethereum Layer 2s (L2s) exist: These chains offer high-speed, low-cost solutions that make building consumer-friendly apps actually practical.

But speed alone isn’t the only hurdle — blockchains still don’t talk to each other well. Most networks remain isolated, limiting the potential for truly interconnected applications. Until blockchain ecosystems can seamlessly communicate, allowing users to move assets and data freely across different platforms, mass adoption will remain a distant goal.

Consumer-focused blockchains: A new paradigm

Imagine a world where, as a user, you no longer have to bother about the underlying chain behind your favorite Web3 applications.

Let’s flip this and take the perspective of builders instead: Imagine a world where the needs of the users come first, where both user and developer experiences are the North Star where everything else is built around.

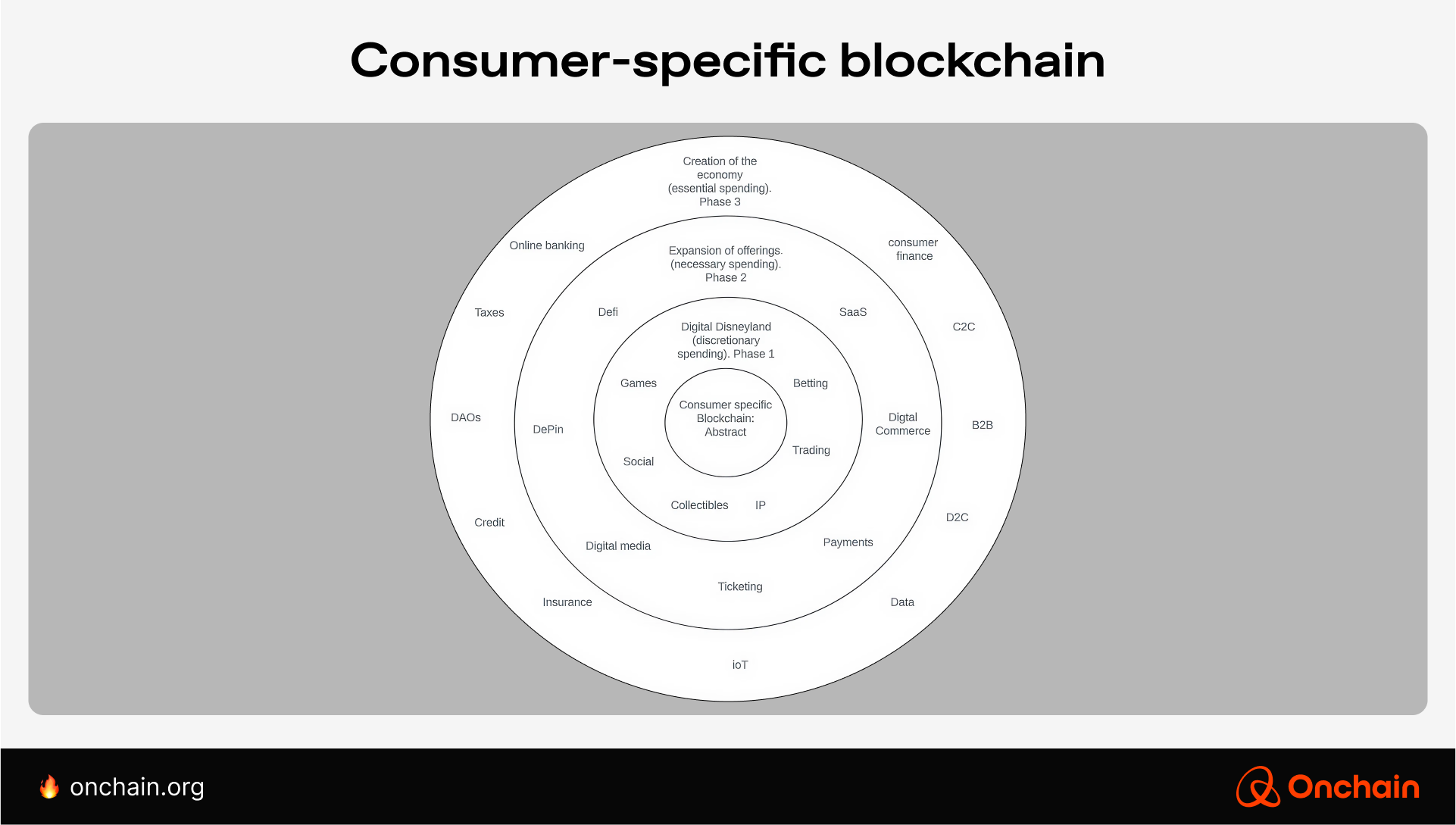

This is the vision that consumer chains are working on, fundamentally rethinking the design and architecture of blockchain technology to prioritize the needs of end users and developers, all while tackling the adoption challenges we talked about earlier. Abstract opines that these chains can work similarly to the way cities work, “and like all cities, demand for them is driven by the attractions and activities they offer,” as visualized below.

These chains share several key features and characteristics which help achieve this vision:

- Enhanced scalability and performance: Consumer chains use techniques like sharding, parallel execution, and optimized consensus to handle high transaction volumes, reduce latency, and improve efficiency.

- Account abstraction: Many consumer chains implement or support account abstraction, which allows smart contracts to manage accounts, simplifying user interactions with dApps by removing the need to manage private keys or worry about gas and making it similar to Web2 experiences.

- Improved developer tooling: Consumer-focused blockchains often provide comprehensive SDKs, framework, libraries, and documentation to simplify the development process and empower creators to build engaging applications.

- Focus on specific use cases: Some consumer-focused blockchains are tailored for specific industries or applications, allowing for optimized performance and functionality.

Real-world case studies of consumer chains

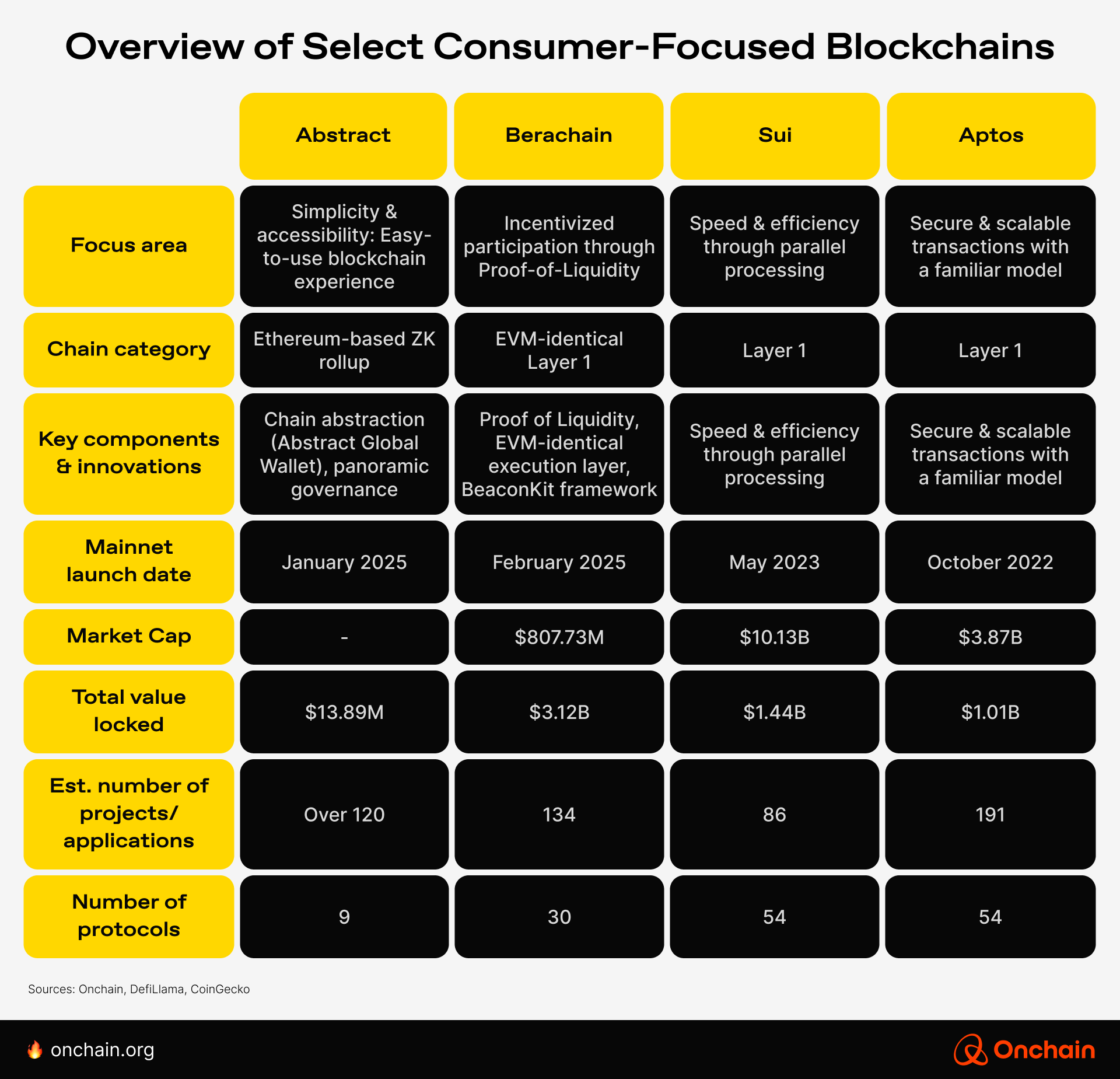

To better understand these chains and how they work, we mapped out an overview of a few key consumer chain projects in the space today.

Each of these blockchains aims to enhance the consumer experience, but they take different approaches to achieving that goal. Let’s dive deeper into how they work and their real-world applications.

Abstract Chain: Blockchain minus the complexity

Imagine using a blockchain app without even realizing it’s on a blockchain. That’s what Abstract is building. As a ZK rollup on Ethereum, it removes all the usual crypto pain points — no network switching, no gas fees, no complicated wallets.

What makes Abstract special?

✅ Login like Web2: It allows the use an email or social account instead of managing private keys.

✅ Gas? What gas?: It allows apps to sponsor and cover fees, so users never have to think about them.

✅ Works across chains: With LayerZero integration, Abstract dApps will enable interaction across over 90 blockchains, making Web3 a more unified experience.

Built by Igloo Inc., Abstract shares the same parent firm as the creators of NFT collection Pudgy Penguins, making it one of the most anticipated project debuts in the space. Despite controversies surrounding its recent mainnet launch, Abstract continues to gain traction, hitting the 1 million Abstract wallet milestone a month since launch.

Berachain: Where engagement pays off

While Abstract makes blockchain easier to use for consumers, prioritizing seamless access, Berachain makes blockchain more rewarding for consumers, prioritizing incentives for engagement.

Berachain flips the script by turning users into stakeholders. Instead of staking tokens, users stake liquidity through its Proof-of-Liquidity (PoL) model, allowing them to earn rewards while keeping the ecosystem strong and robust. PoL puts into effect an additional layer of incentive alignment, which dictates the behaviors of users, dApps, and validators.

Why Berachain stands out:

✅ Get rewarded for participating: Providing liquidity earns you governance power and staking rewards.

✅ EVM-compatible: Seamlessly connects with Ethereum dApps.

✅ Built for DeFi, gaming, and NFTs: Low fees and high speed make it perfect for consumer apps.

In many ways Berachain still lags behind other major networks like Solana, but that doesn’t stop hype from building around the newly launched chain: It’s been less than a month since launch, and it has already become one of the fastest growing blockchains, with TVL surging to $3.26 billion and surpassing more established players like Arbitrum and Base at the time of writing this article.

Sui and Aptos: high speed, scalable, and consumer-ready

While Abstract focuses on usability and Berachain on engagement, Sui and Aptos are all about raw performance, focusing on speed, scalability, and security instead. Both built from the ground up, they create a seamless, user-friendly blockchain experience that feels as intuitive as traditional web applications. These are what make them among the most consumer-centric blockchains out there today.

✅ Sui — Parallel processing = No waiting: Transactions happen simultaneously, making apps fast, smooth, and cheap, making it ideal for gaming, finance, and real-time interactions.

✅ Aptos — Ultra-secure, ultra-scalable: Processes thousands of transactions per second while keeping security top-notch, perfect for large-scale applications like social apps and e-commerce.

✅ Both leverage the Move programming language: A developer-friendly way to build efficient, secure smart contracts.

Why consumer-focused blockchains matter, and what’s at stake

The opportunity ahead

Web3 is shifting from speculation to real adoption, and consumer-focused chains are leading the way. These networks make blockchain faster, more accessible, and frictionless, unlocking new opportunities for every type of participant in the space.

- For founders and builders, they offer the chance to create Web3’s first truly mainstream apps, from loyalty programs and gaming to decentralized social platforms. The companies that get it right now will be the Coinbases and Stripes of Web3.

- For businesses, there’s no need to build a blockchain from scratch. These chains provide plug-and-play solutions that make it easy to launch digital assets, rewards, and commerce initiatives without alienating mainstream users.

- For developers, they offer a low-cost, high-speed playground for innovation. Grants, hackathons, and built-in funding make it easier to build mass-market dApps.

- For investors, the shift from hype to utility means bigger markets and better business models. Consumer chains could be Web3’s next billion-dollar investment category.

With these opportunities in mind, how can founders and business leaders choose the right strategy? There are several key areas they can focus on to win in the space:

🚀 Build for the long game: The next generation of blockchain apps must deliver real value beyond financial speculation.

🧩 Make Web3 feel like Web2: Users shouldn’t even know they’re on blockchain. Whether through methods like account abstraction, gasless transactions, and oh-so-smooth onboarding, abstracting away complexity should be a top priority.

🔗 Interoperability as a growth strategy: Founders should design with cross-chain functionality in mind from day one (e.g., LayerZero, Cosmos IBC, or native bridges).

💡 Forget hype and tokenomics – focus on real use cases: Tokenomics and short-term incentives alone won’t sustain a product. Founders should ask: What do these apps do better than Web2?

The blockchain industry has long speculated about the “killer app” that will onboard the next billion users. Consumer chains prove it’s not about a single app — it’s about making the entire Web3 experience effortless.

For businesses and investors, this isn’t just another trend, it’s the next Schelling point for the industry. Those who pay attention to consumer-focused blockchains today will be the ones leading the charge toward a future where Web3 isn’t just an option — it’s the standard.

What’s next from here?

Onchain’s research team conducted deep analysis into existing L1s and L2s to build a case for (or against) their footing as business amplifiers. Some aren’t ready, while others will change the way you think about the Web3 world. We also share strategic and practical applications of our exclusive findings, all tailored to industry founders and builders in the Web3 space. Start reading the report by moving forward in this Track.