From cloud computing to cloud storage — and from VPNs to sensor networks — DePINs are changing the ownership and monetization models for networks typically owned by governments or large corporations. How is that possible?🤨

Decentralized Physical Infrastructure Networks (DePINs) merge blockchain technology with the physical networks we all use to communicate, work, travel, enjoy, and traverse the physical and digital worlds. That sounds like a pretty big market, and — spoiler alert — it is.

The DePIN sector has an estimated total value of $2.8 tril, with a projected increase to $3.5 tril by 2028. If you’re running a startup or aspire to be a Web3 founder, this is a market you should be paying attention to.

DePIN is where the onchain and offchain worlds meet. Is combining the tech of blockchain with offchain networks and services a great business combination? Or does using blockchain technology just add unnecessary complexity that doesn’t outweigh its business benefits?

To answer that, you need to know the cons, the pros, and what’s in between. Let’s get started.🏃

What is DePIN, exactly?

On the technical side, DePINs utilize blockchain technology, combined with tangible hardware, to provide services. Blockchains can be used for activity monitoring, sending or receiving crypto payments, and connecting and communicating with the physical infrastructure required to support a decentralized network.

On the business side, this blockchain infrastructure facilitates payments to network providers and sales to network users. Both provider and user usage are tracked to ensure that adequate and honest services are given and received.

There are numerous ways of promoting honest behavior on DePINs, including token incentives, financial penalties, and other monitoring and enforcement actions. Carrots and sticks, if you will. 🥕🏒

DePIN apps: what you need to know

DePIN users must connect with a PC or mobile application, also known as an app. By definition, these are decentralized applications (dApp) because they interact with a blockchain. But what you call them doesn’t really matter — Web3 apps, crypto apps, dApps, and so on — it’s the technology that counts.

DePIN apps should look and feel just like regular apps. If the app seems super “crypto native,” it’s not a good sign. The most promising crypto consumer apps hide the crypto tech behind a sleek user interface (UI) — making them easy to use.

Also known as chain abstraction, this design feature “abstracts away” the blockchain tech so it runs in the background. That way, your users can engage with the app without Web3 distractions.

DePIN projects in the real world

Despite the recent hype, DePIN isn’t a new phenomenon. DePIN projects like Filecoin and Helium are over ten years old, having been founded in 2014 and 2013, respectively. These projects remain active and have demonstrated long-term business potential and resilience.

Helium and Filecoin are wireless and storage networks, respectively. They are half of the DePIN “Big Four” use cases — along with computing and sensor networks. Filecoin combines the InterPlanetary File System (IPFS) with blockchain technology to enable peer-to-peer file sharing and storage.

Like most DePIN offerings, users can be either consumers or providers on this DePIN. Those who provide storage for others get paid in Filecoin’s FIL token. Consumers pay with FIL tokens to use Filecoin as their cloud storage provider. You could think of Filecoin as a Web3 version of Google Cloud Storage or an onchain version of Dropbox.

Akash is a popular computing network. Silencio, Dimo, and Natix Network are notable sensor networks. These examples belong to the second half of the “Big Four”. You can also find DePIN-enabled VPNs, energy projects, content delivery systems, and more.

Here are a few more DePIN projects we like.

Silencio is a noise-measurement app. Providers use their phones to measure sound levels and get compensated in tokens. Grass is a bandwidth app that users can run on their PCs. They can earn points by sharing their unused internet bandwidth, which may be redeemable for tokens. Dimo is a smart DePIN that lets motorists monetize their driving data to earn tokens.

Onchain’s very own Michal Moneta conducted on-the-ground tests of all three of these DePINs. You can find his in-depth feedback, analysis, and insights into them in Chapter 3 of our crypto apps report.

The role of DePIN in emerging markets

DePINs can — and do — compete with existing centralized networks. That being said, their best business use cases may be in developing and emerging markets where there’s less, or no centralized competition.

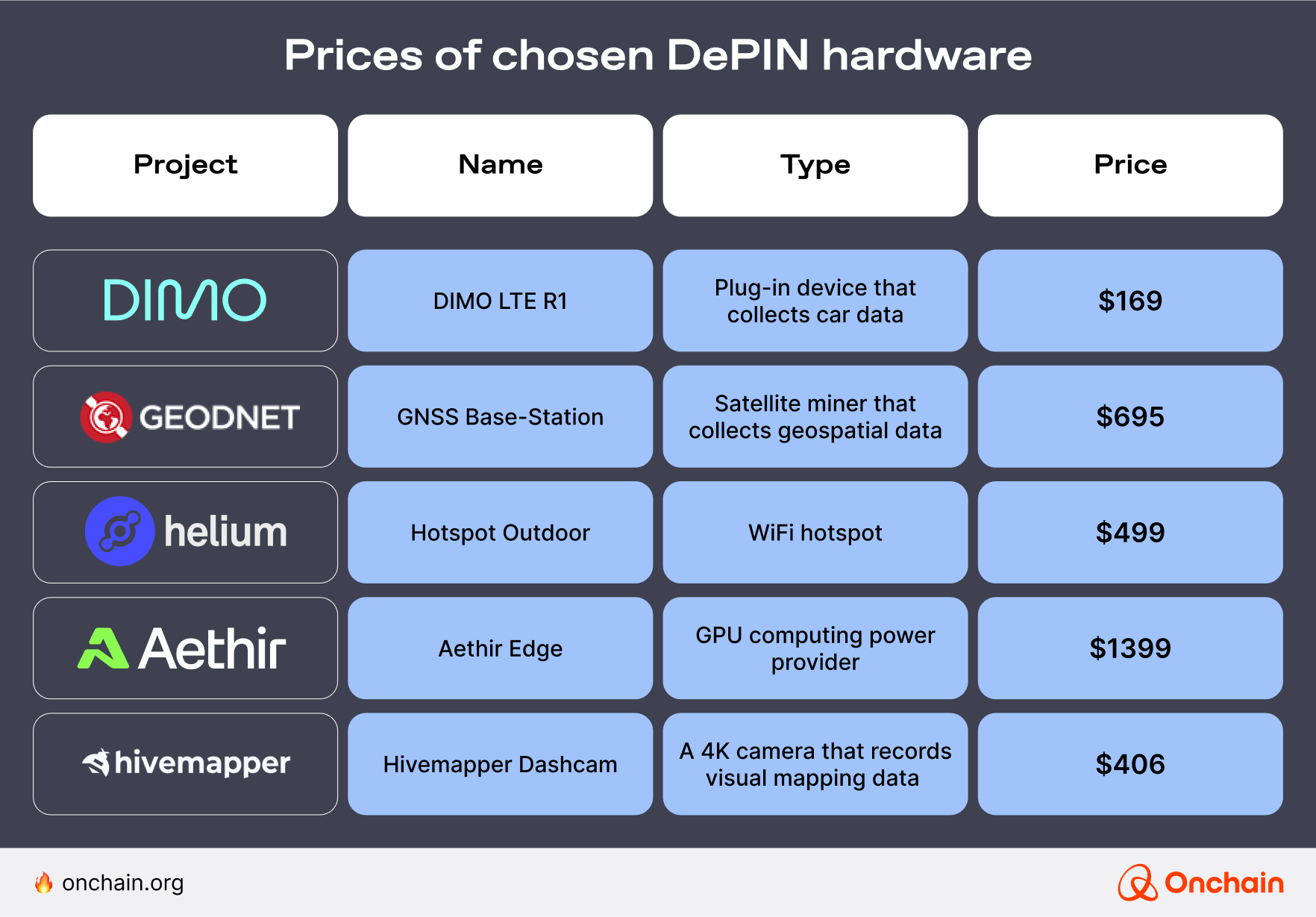

In these markets, user demand tends to be high. But that is only half of the equation. These DePIN networks spread their utility and coverage by incentivizing network providers to join and participate. However, to start providing services, they often need to purchase hardware with significant upfront costs.

This prevents those who can’t afford the hardware from participating on the provider side of the network. So, paradoxically, the best network coverage is often in places that need it the least.

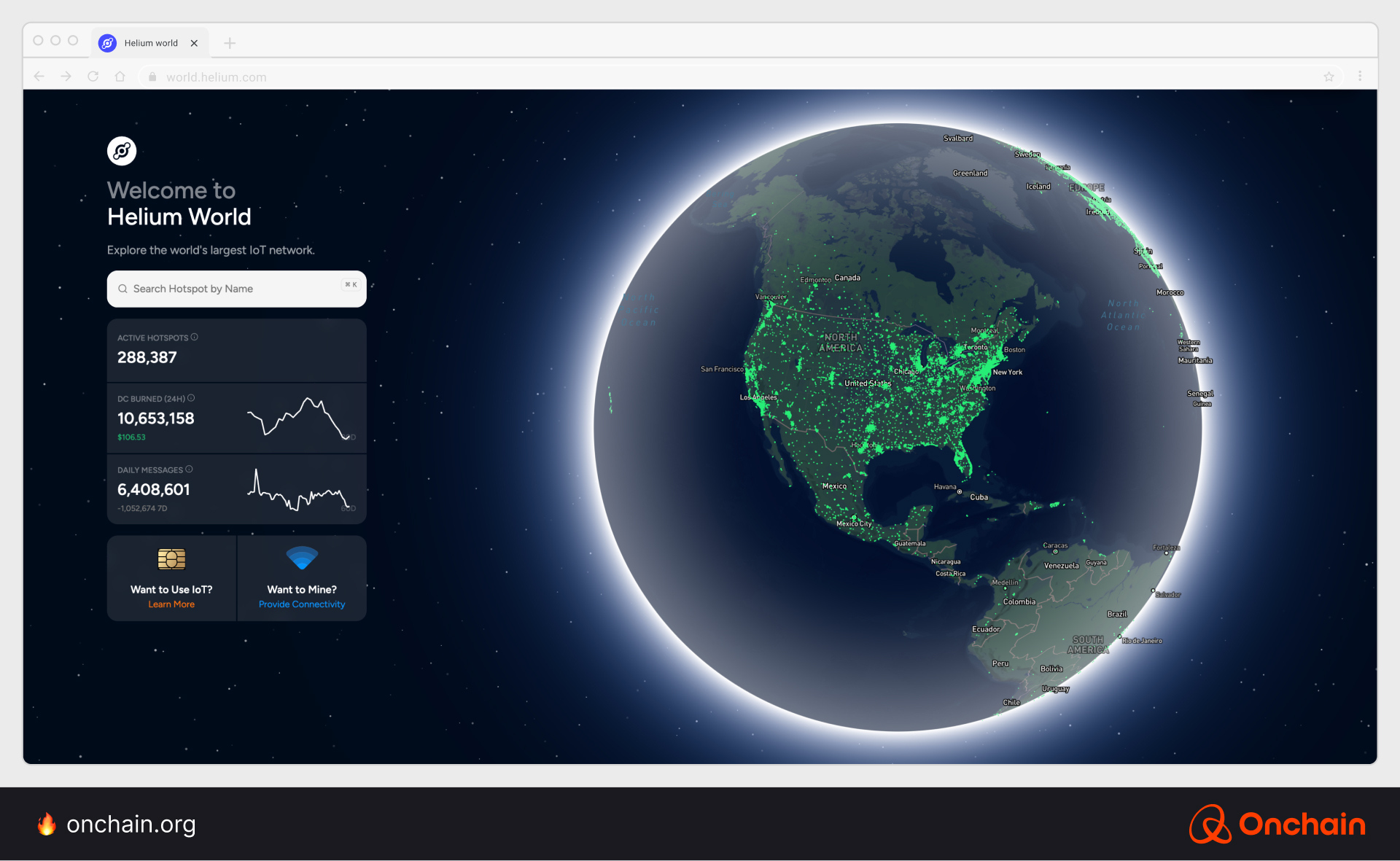

Take Helium, which requires hardware to provide IoT or 5G mobile coverage.

Helium’s IoT coverage is still lacking in North America, but it is pretty dense in populated areas.

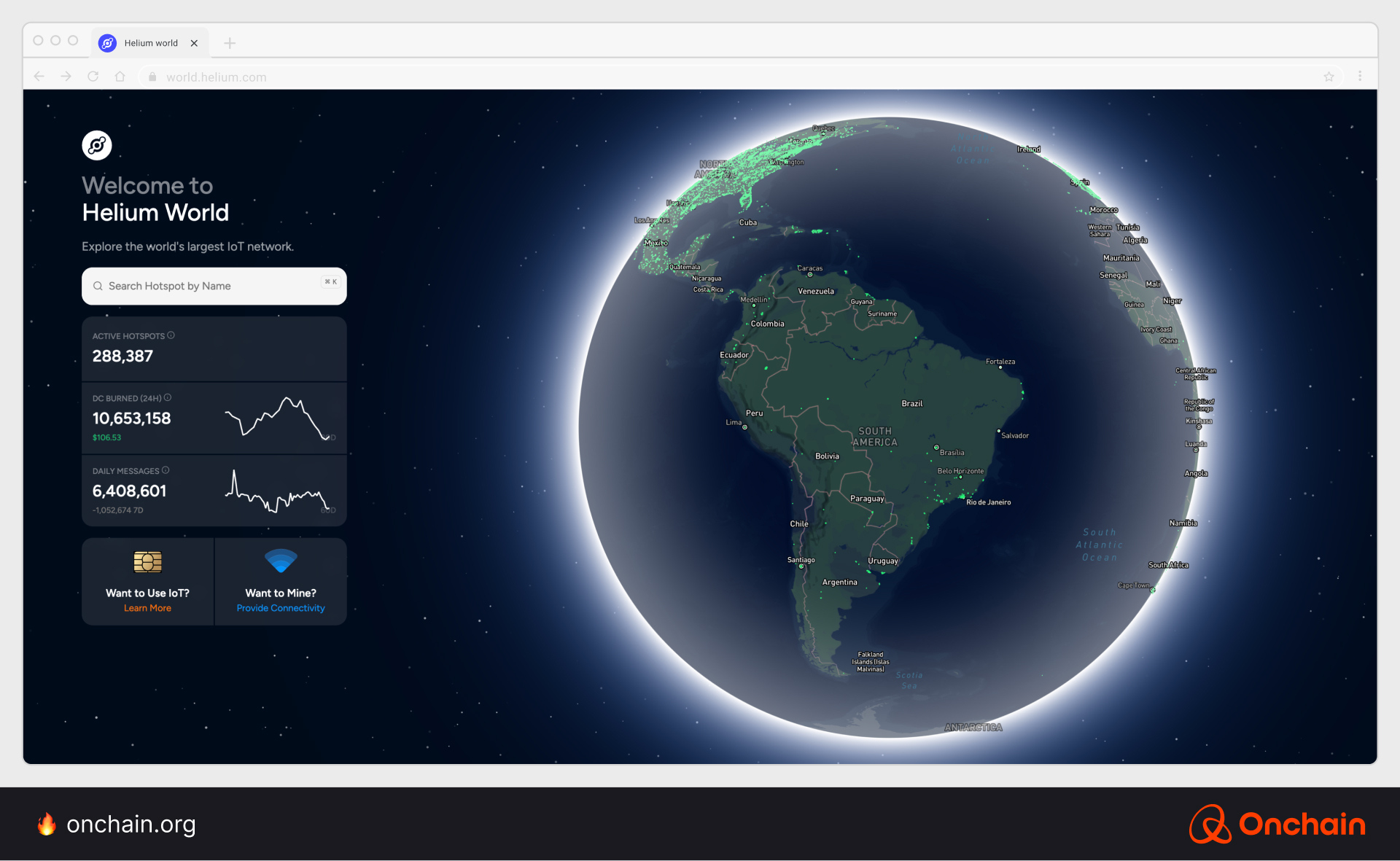

When you drop down south of the equator, coverage is much more sparse.

Helium is just one example of unevenly distributed DePIN coverage. To make the infrastructure side more accessible, more and more DePINs allow users to become providers via their phones, cars, computers, and other devices they already have. Still, this varies based on the type of network and its technical requirements.

Even more interestingly, some DePINs offer users the option to monetize on their smartphones or purchase specialized hardware for potentially better returns. Here are a couple of interesting examples worth looking into.

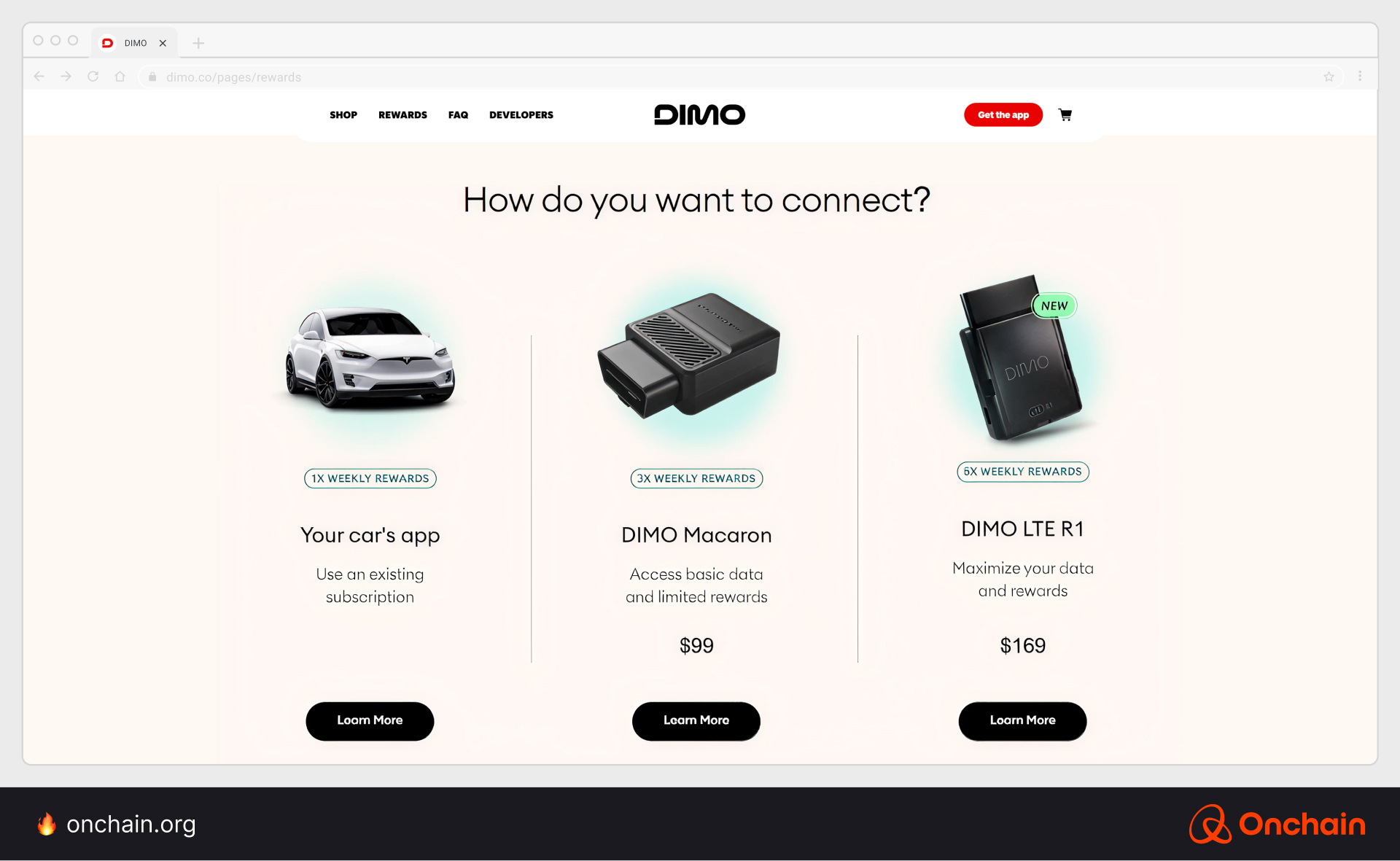

Dimo’s DePIN options

To be a provider on Dimo, only two things are needed: a car and a smartphone. This has no upfront costs. On the downside, a phone doesn’t collect as much data as Dimo’s hardware options. As a result, the phone-only option has the lowest reward potential.

Dimo also offers two different hardware options, giving potential providers three choices in total. Dimo gives them options so they can join as network providers on their terms, not Dimo’s. This should help grow adoption as different providers in various regions choose the option that best suits their needs.

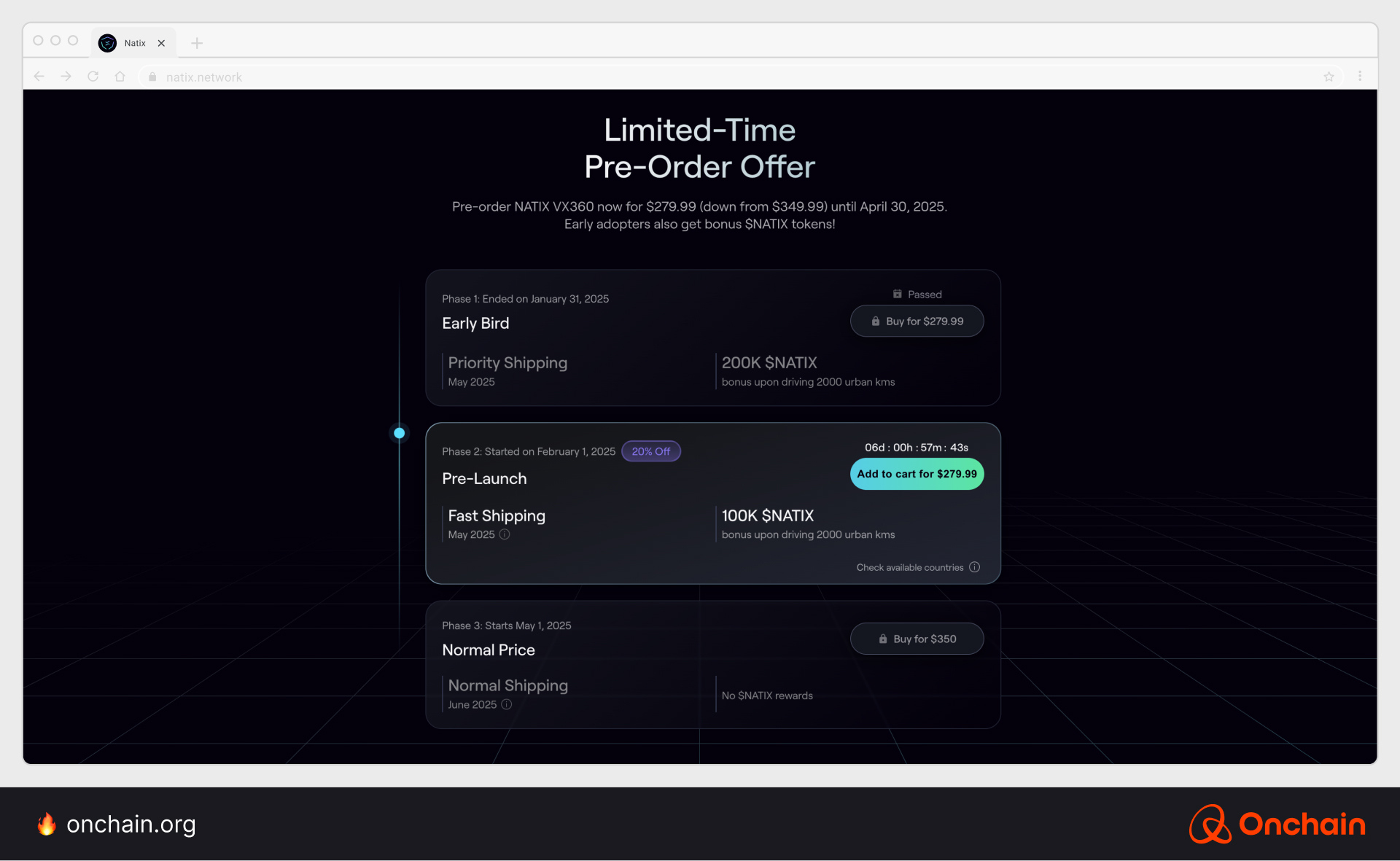

Natix Network’s DePIN provider options

Natix Network operates in a similar way, but involves the open onchain road. While Dimo monetizes data, Natix Network maps the world through integrated camera footage. With option one, Natix providers simply need to install the app and place their smartphone on the dashboard while they drive.

It’s an accessible and easy way to join and try Natix out as a provider. And if providers don’t like it, they can simply leave — without being stuck with $100–$400+ of useless hardware.

There’s also a Natix hardware option that allows providers to boost their rewards. At the time of writing, this hardware only works with certain Tesla models with integrated front-, side-, and rear-facing cameras.

This choice allows them to provide Natix with better data. In return, they get higher rewards. Natix also incentivizes early adopters by providing price discounts and NATIX token bonuses.

DePIN: decisions, decisions, decision

Every decision you make in life comes with tradeoffs. When it comes to DePIN, there are a couple of key questions to ask yourself when trying to onboard network providers.

- Do you want to offer a no-strings-attached provider option?

- Or, would it be better to give providers a hardware alternative? This could be a “win-win” that gives you better data while providers achieve better long-term returns.

If you’re building an app, providing both options could be a business decision that really pays off. By removing the onboarding friction with an app-only provider option, you’re likely to get more participants. Beyond that, it’s also a “get their foot in the door” business strategy.

For example, if someone already has a Tesla, they can just download the app and start earning Natix’s NATIX tokens. Once they try it out, they may do some back-of-the-envelope math and decide they want the hardware to boost their rewards. Not a bad upsell, huh?💰

DePIN tokenomics and rewards considerations

Many DePIN projects use native tokens as both a funding source and a reward mechanism. Filecoin (FIL), Natix Network (NATIX), Helium (HNT), Dimo (DIMO), and many others use their own tokens.

While this is a very straightforward way to distribute rewards with lower upfront costs, as an entrepreneur, you need to consider the long-term effects on both users and the token’s price. Take Helium’s HNT token, for example. At one point, it traded above $50 per token. In April 2025, it trades for less than $3.

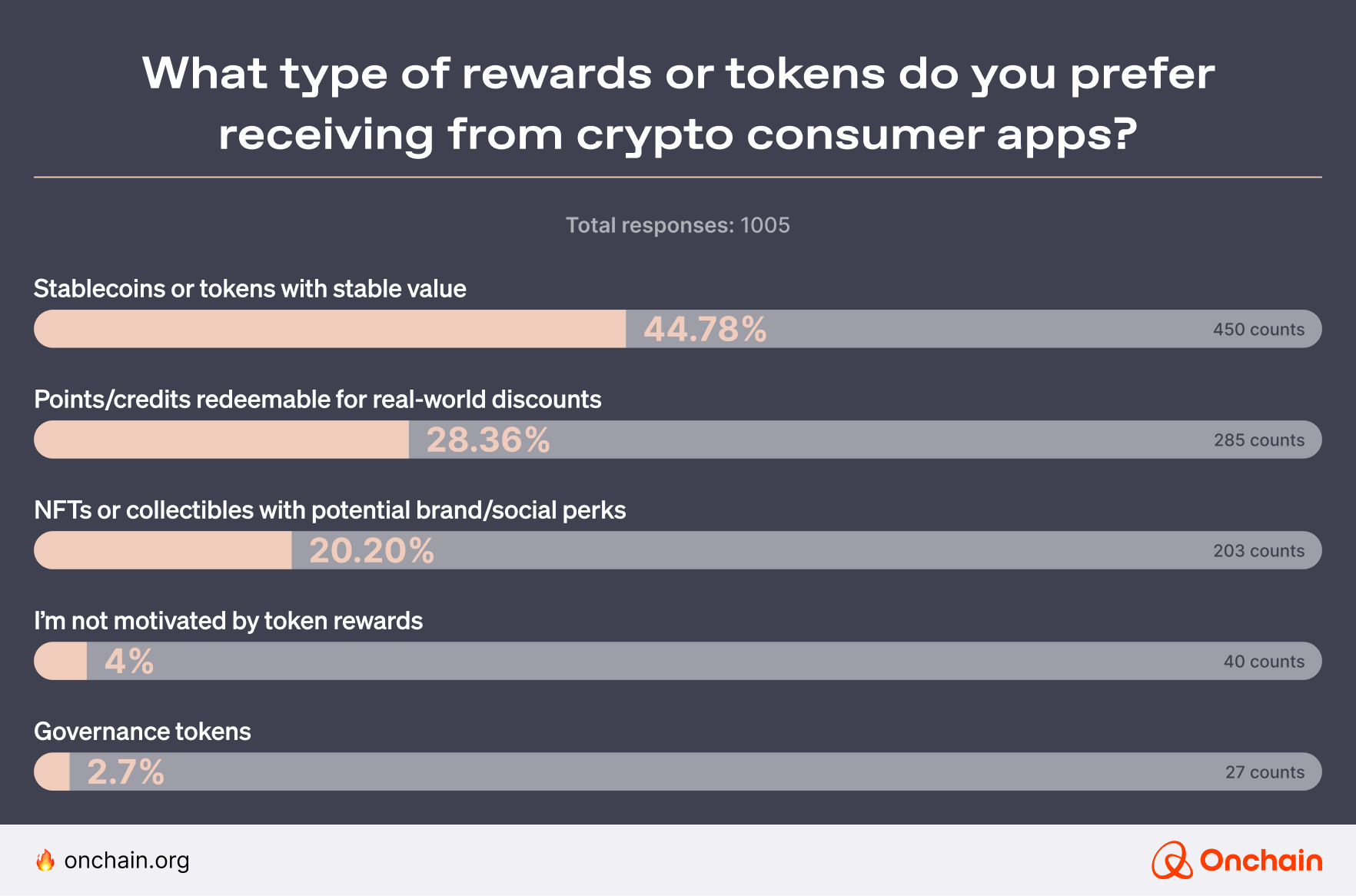

We don’t need to spell it out for you. You understand that DePIN providers love it when their tokens go up in value. On the flip side of the blockchain, providers hate it when their token rewards plummet. For this reason, we recommend you consider integrating stable token rewards into your DePIN ecosystem.

These could be stablecoins (USDC, USDT, USDS) or a custom token that is also monetarily stable. Blackbird is a good example of this tokenomic strategy. It provides stable FLY token rewards that are pegged to the U.S. dollar.

Although it’s not a DePIN project, Blackbird provides a tokenomic blueprint for incentives and rewards that are in high demand. Onchain conducted a survey that found that most users want predictable app rewards.

The future of DePIN and real-world Web3 adoption

Blockchain is here. AI is here. DePIN is here. None of them will go anywhere anytime soon. By taking the best from both onchain and offchain worlds, DePINs provide value to users, providers, and the entrepreneurial community that creates them.

As blockchain technology, hardware, phones, computers, cars, and other DePIN components continue to evolve, we expect to see more and more people become users and providers.

I’ll admit it, I’ve only dabbled in DePIN as a provider. That being said, I find myself drawn into the opportunities. I’m currently looking to purchase another vehicle — and a few Tesla models have caught my eye.

I can’t say I would buy a Tesla simply to earn higher DePIN token rewards. However, I also can’t say these rewards wouldn’t sway me if I were on the fence and deciding between two competing models.

Especially if I can double up my driving rewards by earning both DIMO and NATIX rewards simultaneously.😀

If you found this helpful and want to dive deeper, you’re in luck. The next article in this Track offers a lens into DePIN projects that are bringing everyday infrastructure onchain, as well as the roles Bitcoin and Ethereum play in DePIN development. Click the arrow below to move forward.