Crypto Prediction Markets Go Mainstream

Kade Garrett

Blockchain Writer

In this prediction:

- How prediction markets got to where they are today

- How Polymarket’s U.S. election forecasting was so accurate

- What makes Web3 and Web2 prediction markets different

- Whether there is potential for Institutional adoption of prediction markets

- How AI agents will financially arbitrage prediction markets

- Strategic business recommendations for utilizing prediction markets

Prediction markets are ancient. Better known as betting markets — they go back to at least 3,000 B.C. when the ancient Egyptians bet on sports, board games, and feats of skill. Political betting goes back to at least the 1500s.

Also referred to as futures markets or information markets, these markets aren’t just for savvy wagerers. They provide valuable information for your business decisions and real-time insights on various outcomes you won’t find anywhere else. There is no need to place your own monetary bets on a market.

The publicly available odds can be a statistical godsend for entrepreneurs, researchers, investors, and businesses. On the flip side, they are merely a predictive tool. Information market outcomes shouldn’t be blindly followed or trusted. You can use a hammer to hit a nail — or your thumb; I’ve done both.🙂 🔨

Polymarket and the U.S. election: a success story

The prediction markets for the 2024 U.S. election proved far more accurate — and much more responsive to news — than the polls that many are accustomed to. Polymarket is one of the largest prediction markets. It settles outcomes in the stablecoin USDC.

“The most accurate way to follow the [U.S.] election.” said Shayne Coplan, Polymarket founder, and it turns out he was right.

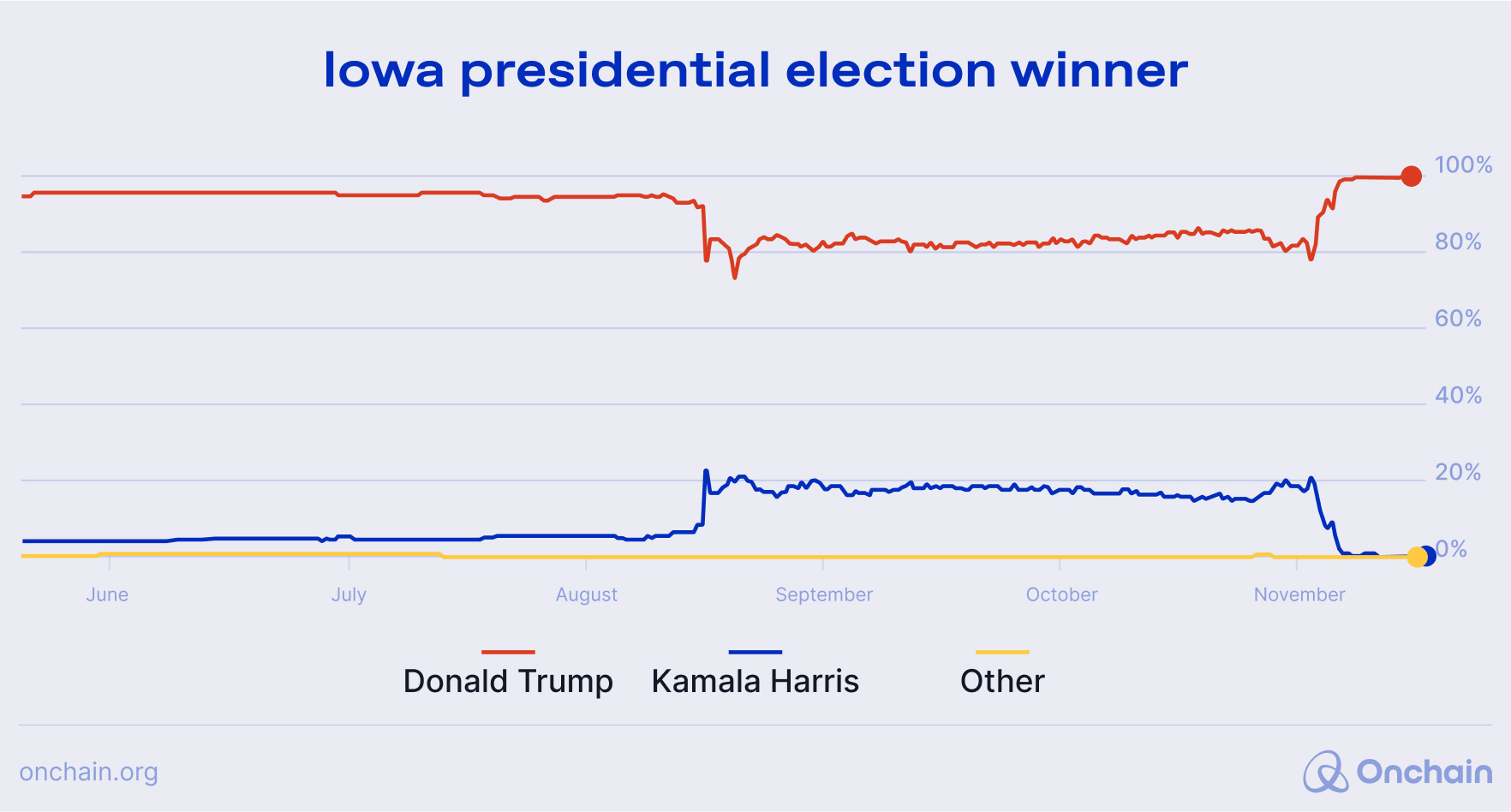

In my Polymarket article from August 2024, I pointed out that “odds in Iowa are flipped at 93:7 — favoring Trump.” Yet famous pollster Ann Selzer showed Harris up by 3 points in Iowa in her November 2nd poll. Trump ended up winning by 13 points, equating to a gigantic 16-point disparity.

This is a huge blunder by election polling standards. So grave Trump took legal action for election interference. This leaves two likely options:

- The poll was done in good faith. It was just incredibly inaccurate.

- The poll was purposely biased and intended to affect voter turnout and sentiment — and potentially the election outcome itself.

If the poll was intended to influence voters in favor of Harris, Trump’s legal team could use Polymarket as evidence. You can see that Harris was polling around 5% and got a temporary bump to 25% the day the Selzer poll was released:

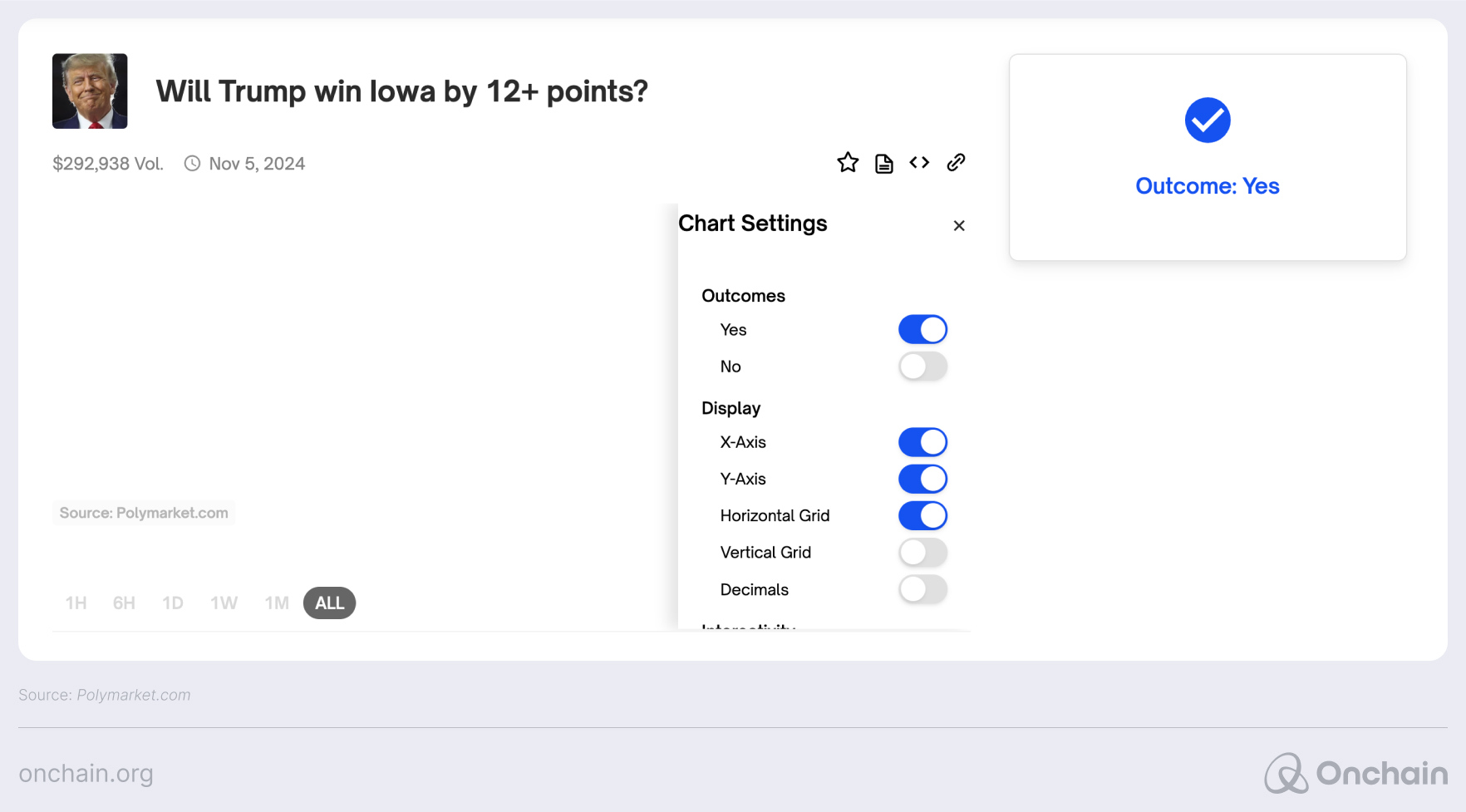

There was even a market for the Iowa margin of victory with nearly $300,000 wagered:

Polymarket’s odds turned out much more accurate than the polls across the whole U.S. electoral map of Congressional and Senate races. In addition to superior accuracy, these markets can change odds in real time — something not possible with polls.

If you want the most recent breaking news, you check X — not the legacy media. In much the same way, I predict that everyone will check Polymarket for the latest election odds going forward. People may not even bother with CNN, MSNBC, the New York Times, and the rest of the legacy media.

If the election outcome matters to your business, an accurate forecast allows you to prepare and adjust to likely outcomes. For the crypto industry, a Trump victory was hailed as a positive that will lead to regulatory relief. For other industries, a Trump victory may necessitate the need to modify plans. Worried about potential tariffs? A prescient prediction market could allow a company to forego actions that cost millions of dollars.

While the U.S. political markets were the largest and most dynamic, you can find global election markets for a variety of countries. Here are some betting markets for Germany’s upcoming vote:

Will Polymarket’s track record in election outcome accuracy continue? I predict it will — but don’t take my word for it. Look at the odds above on Polymarket, compare them with the polls, and wait for the results. You won’t have to wait long. The German elections will be held on February 23rd, 2025.

Prediction 1: Election-based prediction markets will become widely accepted as the best forecaster of election outcomes. Polling data will recede to a supplementary prediction tool.

Issues with prediction markets

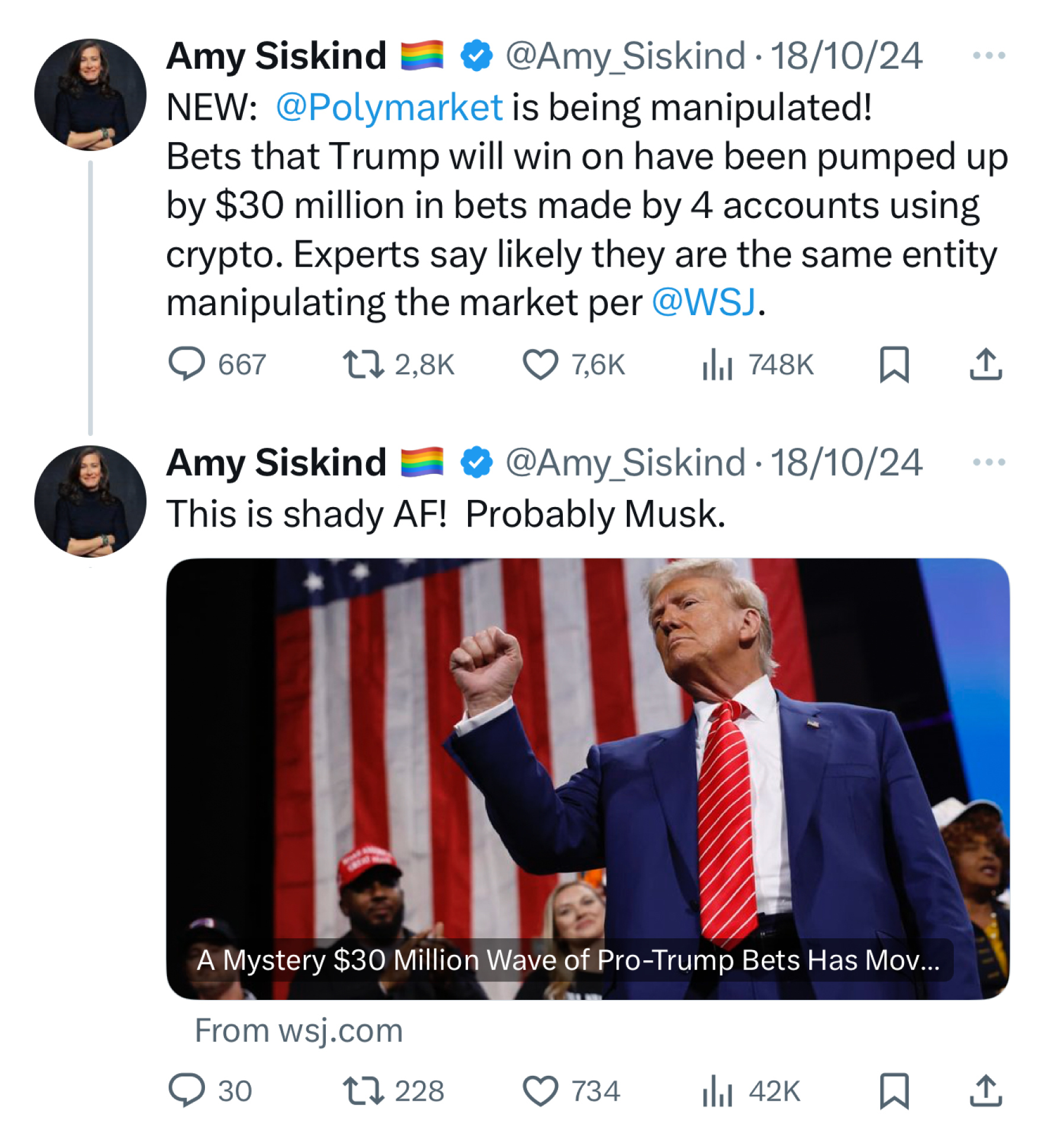

Critics would tell you that these betting markets aren’t more accurate. They simply adapt more quickly to new information and adjust the odds accordingly. But is that a bad thing? Others say that prediction markets can alter elections and be manipulated by whales. Yet, other experts would say this assertion lacks evidence.

While these markets ostensibly benefit from the “wisdom of the crowd,” they are also vulnerable to the human herding mentality that can lead groups to behave irrationally. Do you remember the NFT craze? How about ICO mania? There is no shortage of irrational or risky behavior — especially in the Web3 world.

In addition, Web3 prediction markets — especially nascent ones — may be vulnerable to hackers that can find smart contract vulnerabilities. Lastly, all betting markets can be abused by those with gambling addictions.

The Web3 prediction market ecosystem expands in 2025

Just as there are numerous crypto payment options, there are many crypto prediction markets. One of the original success stories was Augur, which launched on Ethereum. While it provided the initial Web3 roadmap, it has taken a back seat to other projects that provide lower transaction costs and a better user experience (UX).

Decentralized prediction markets offer enhanced privacy, wider global access, and more markets than their centralized alternatives like PredictIt and Kalshi. The institutional crowd may prefer these centralized markets for legal or compliance reasons.

Prediction 2: The prediction market ecosystem will diverge and consolidate into two main categories: Web2 prediction markets and Web3 prediction markets.

Due to the enhanced liquidity and the advantages mentioned above, I predict much of the market wagering activity to remain on decentralized alternatives. With Polymarket’s monthly volume exceeding $2 bil. for October and November 2024, they are currently in a market-dominant position. While some of this volume was driven by markets linked to the U.S. election, Polymarket’s December trading volume was still in excess of $1.9 bil.

Other promising Web3 prediction markets include Gnosis and Drift Protocol:

Prediction 3: For election-focused markets, the Web3 prediction market ecosystem will continue to maintain market dominance and gain market share from Web2 alternatives. The Web3 prediction market ecosystem will coalesce around 2–3 primary options that control 95%+ market share of Web3 information markets.

To be clear, I’m saying that Web3 markets will dominate the election-related betting markets specifically. I’m not expecting Web3 options to dominate the gigantic sports betting or exchange-based futures markets — at least not anytime soon.

For untapped prediction markets — from politics to science to pop culture — Web3 markets are ideally suited to flourish. This is due to the fact that they are open and allow anyone to set and speculate on markets — no need to get approval from a third party.

Web3 prediction markets will witness institutional adoption

Making accurate predictions is a huge business. Prediction market-based forecasts on event probabilities can serve as auxiliary data points to take pre-event actions or precautions. For various industries and businesses information markets focused on science, elections, and business.

These markets provide valuable information for commodity prices, crypto regulations, international trade, exchange rates, and numerous other outcomes. When combined with other insights and research, they will be considered a valid data source in an organization’s predictive tool kit.

Having proprietary information can be of great value to a company. That is why in-house research and private reports can provide a competitive advantage that leads to higher profit margins. That being said, the ability to maintain predictive information dominance will recede as the wisdom of the crowd gets dispersed through these markets.

“Information is power. But like all power, there are those who want to keep it for themselves.”

- Aaron Swartz, software developer, internet activist, entrepreneur

While likely considered a novelty by many a C-suite executive in 2024, prediction markets will become a ubiquitous tool for individuals and companies alike. First came the printing press. Then, the internet. Now, prediction markets are taking the dissemination of information to another level.

Do you think businesses in the United States and abroad weren’t monitoring Polymarket’s “Politics” tab? Of course, they were.

At a bare minimum, businesses monitor prediction markets that affect their industry for actionable insights. Beyond this, I see businesses taking a proactive approach to engaging in this burgeoning and exciting sector of the blockchain ecosystem.

Prediction 4: Prediction markets will see notable institutional adoption as a monitoring tool. Other institutions will create information markets to crowdsource predictions or wager in markets where they have a competitive advantage.

As the ecosystem develops, I predict that you will see markets in specific industries or niche topics. Traditional futures markets provide commodities and other asset prices, but prediction markets will fill in the gaps for markets that aren’t – or can’t be — served by Wall Street. You can’t log into your brokerage account and wager on who the next U.S. Federal Chair will be, but you can on Polymarket.

AI agents enter the prediction market arena

One of the hottest AI topics is the emergence of AI agents — and their suitability for interacting with the blockchain. AI agents can autonomously execute complex tasks and goals. Examples include building Web3 apps, launching tokens, and interacting with humans online.

While still in the early stages, there are already several projects creating AI agents specifically for prediction markets, including Olas and Polytrader AI. They leverage AI to get probabilities, look for discrepancies in available prediction markets, and then wager in markets that seem mispriced — all done automatically.

Prediction 5: Thousands of autonomous AI agents will widely engage in prediction markets to arbitrage future probabilities and increase the accuracy of these markets. The prediction market AI agent economy will generate $100 mil.+ in 2025.

Strategic recommendations

For businesses and entrepreneurs, prediction markets can be utilized as a valuable and cost-free tool that provides value:

- Monitor relevant prediction markets for actionable information: Leverage the publicly available information on these markets. Incorporate this knowledge into a comprehensive predictive analytics framework.

- Create your own prediction markets: Need insights on an industry or your competitors? Create your own prediction markets to gain insights into public (or industry) sentiment and wisdom.

- Monetize your business’ knowledge differential: Does your company’s predictive analytics division have a great track record? Do you have proprietary knowledge and private information that would give you a competitive advantage in specific betting markets? Monetize this knowledge by placing strategic and risk-mitigated wagers on event outcomes to earn revenue.

Note: Please consult your financial and legal counsel for legality in your region. Polymarket, for example, is banned in some jurisdictions.

I should state the obvious here: Probabilities are just probabilities — but you probably already know that. A 97:3 market probability will still be wrong 3% of the time — provided it’s priced correctly. That being said, blindly looking into the future or flat-out guessing aren’t viable substitutes in the business sector.

Businesses can use these markets as a hedging tool. This could be to forecast the price of commodities or crypto or, to speculate on how real-world events could affect exports and global supply chains. Your considerations will vary based on the industry.

In addition, these prediction markets could be used to gauge market sentiment, forecast competitor moves, estimate market demand for your product(s), and a whole lot more. As a nascent industry that has been widely unexplored — particularly for businesses and entrepreneurs — prediction markets are bound to explode in activity in the latter half of the 2020s.

That’s a wager I would place a bet on — if Americans were legally allowed to.

Prediction markets will set a new forecasting standard

As a probability marketplace of future events, prediction markets serve as an irreplaceable knowledge base that adjusts in real time. As a passive viewer, you can benefit from these publicly available markets without spending a penny — or making anyone poorer in the process.

“...a piece of knowledge, unlike a piece of physical property, can be shared by large groups of people without making anybody poorer.”

- Aaron Swartz, software developer, internet activist, entrepreneur

On the other hand, concerns about “market manipulation” include the prediction-based variety. Will AI agents manipulate certain markets negatively? Will people misinterpret these markets with dire financial or legal consequences? Could the “crypto pump and dump” strategy be implemented into these outcome markets for ill-gotten financial gain?

All technologies come with unforeseen consequences and downsides. Prediction markets are no different. They are certainly not a panacea. Like other future predictions — from polls to weather forecasts — you should remind yourself that they are often wrong.

Soon, the number of prediction markets on a platform will number in the hundreds, if not thousands. Savvy individuals, perceptive businesses, and AI agents will engage in predictive wagering to earn profit — and benefit the rest of humanity in the process.

I could be completely wrong, but that is my prediction. What’s yours?

Thoughts of the Onchain research team

While the rise of crypto prediction markets seems promising, we caution against mistaking hype for sustainable adoption. Polymarket’s success illustrates the real-time power of crowd-sourced forecasts, yet security risks, potential whale manipulation, and jurisdictional clampdowns remain genuine threats. AI-driven arbitrage could supercharge accuracy and volume, but may also introduce algorithmic bias and “flash crashes.”

We still believe these markets can become a valuable decision-making tool, provided they evolve with robust safeguards and transparent governance. Ultimately, the next few years will show whether prediction markets mature into a cornerstone of Web3 intelligence or revert to yet another short-lived crypto narrative.