When DeFi dApps Meet AI the Future is Ultra Smart

Ananya Shrivastava

Research Analyst

In this prediction:

- Why AI-powered dApps could reshape DeFi by simplifying user experiences, automating complex trading, and expanding access to sophisticated financial tools.

- Which real-world platforms (spoiler: Numerai, DIN, Lightchain AI) are leading the way, illustrating how AI can boost liquidity and lower technical barriers.

- How decentralized governance and auditing solutions will address security concerns, ensuring AI-driven protocols remain transparent and trustworthy.

- Where savvy entrepreneurs can capitalize on tokenized AI services, cross-chain infrastructures, and user-focused innovation to capture untapped DeFi demand.

- Actionable strategies for founders looking to integrate AI into DeFi, including agile development, robust data pipelines, and collaborative partnerships across the ecosystem.

Will AI reshape the decentralized finance (DeFi) world?

We all have come across DeFi Apps (decentralized finance) that lean on smart contracts to automate financial interactions. Now, a new concept is unfolding: AI-driven dApps, or “smart apps.” We’re looking at a fusion of blockchain’s decentralized nature and trustless backbone with AI’s predictive analytics, personalized tools, and automation.

This convergence will lead to unprecedented efficiencies. Read on to learn about already existing projects and which processes they improve. Get inspiration for additional implementation areas where smart apps can—and will —make a difference in 2025 and beyond.

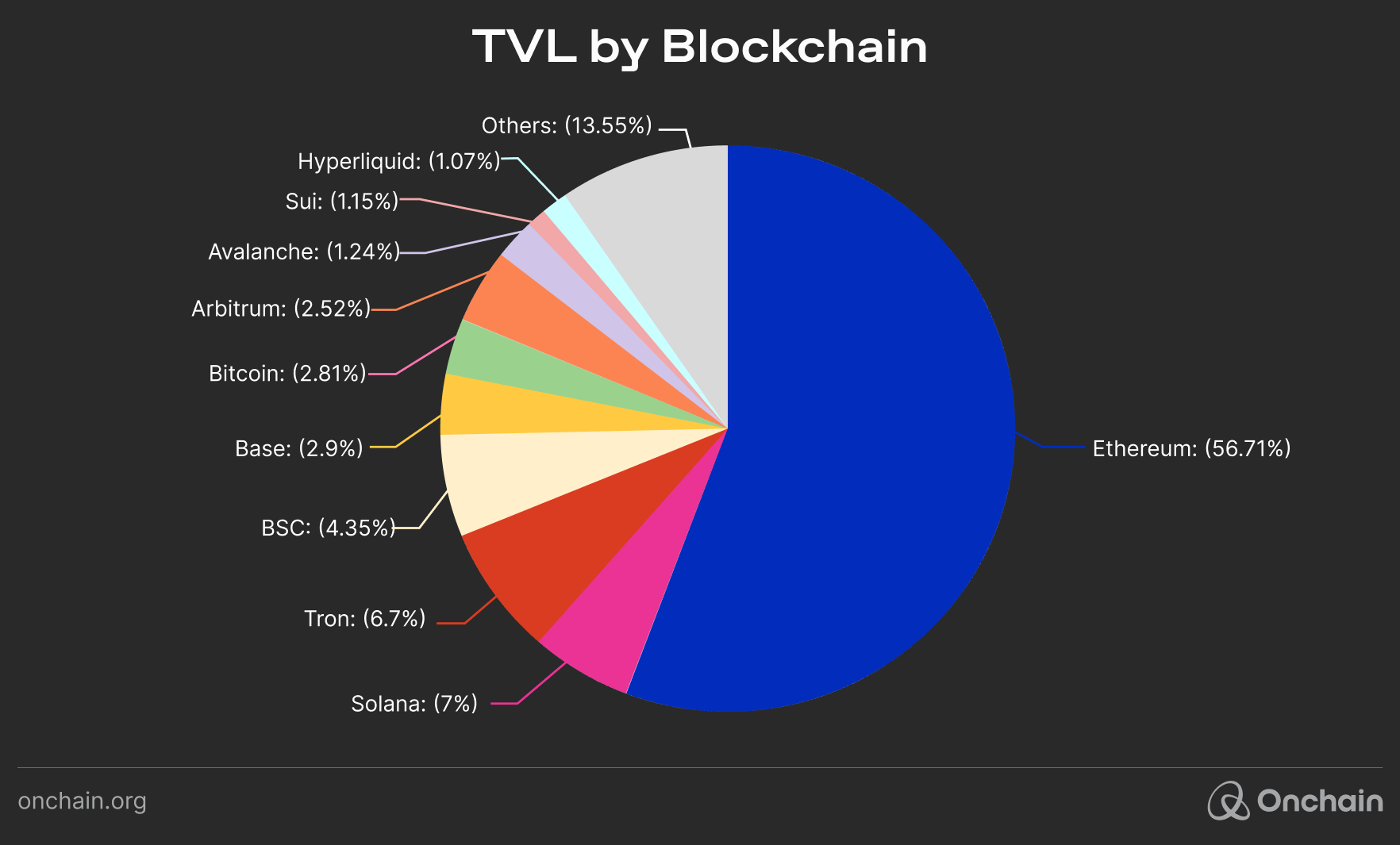

The market for AI-integrated DeFi applications is experiencing significant traction. Ethereum remains the leader in DeFi activity, boasting a Total Value Locked (TVL) of over $71B as of December 2, 2024, with AI-enhanced platforms like Numerai contributing niche, high-value use cases. Numerai is essentially a crowdsourced hedge fund that leverages the power of thousands of data scientists to predict the finance market, which is a radical departure from traditional finance. It provides a platform for entrepreneurs to tap into a global network of talented data scientists. This can be invaluable for building AI-powered DeFi investments and prediction markets.

AI is already changing decentralized finance applications by enabling smart automation, risk analysis, and user personalization in dApps. After more than a year of gaming dominance, the “Other” category has emerged at the top (as of Dec 2, 2024), which is driven by innovative AI-powered dApps such as DIN and Alaya AI.

DIN is building a decentralized, AI-native data pre-processing platform specifically designed for Web3. Think of it as a specialized kitchen where raw data is “cooked” and transformed into a format that AI models can readily consume. By providing the infrastructure for more efficient data processing and analysis, DIN unlocks new levels of opportunities in DeFi. For example, DIN can help Automated Market Makers (AMMs) adjust asset prices in response to real-time market conditions and liquidity fluctuations. This ensures efficient price discovery and reduces the risk of impermanent loss for liquidity providers.

Key trends and predictions for integration of AI in DeFi

So, let’s delve into the exciting trends shaping this landscape!

Enhanced predictive analytics and automated trading

AI enables real-time data analysis, predictive insights, and autonomous trading strategies for users to stay ahead in volatile markets.

Benefits for Entrepreneurs:

- Enhanced decision-making: Platforms like Alaya AI allow entrepreneurs to leverage crowdsourced AI models to build effective hedge fund strategies, reducing reliance on traditional analysts.

- Streamlined operations: Fetch.ai’s CoLearn allows startups to pool and train data models collaboratively, simplifying resource-sharing for optimized performance.

- Risk management: platforms like Endor Labs, GitLab, etc, use predictive analytics to evaluate social and behavioral data, helping businesses anticipate market shifts and minimize risks.

Opportunities in 2025:

- Predictive analytics in the blockchain is projected to grow significantly, driven by the demand for enhanced financial tools in the DeFi ecosystem.

- Cross-chain data sharing is fostering greater collaboration for AI-powered trading tools, increasing adoption.

- Platforms are exploring tokenized AI trading strategies as a means of creating decentralized hedge funds and opening up innovative investment opportunities.

Personalized user experiences

AI-driven personalization tailors financial products and services to individual users, improving engagement and satisfaction.

Examples:

- SingularityDAO: Offers personalized portfolio rebalancing and dynamic yield farming strategies.

- Zerion: Uses AI to suggest customized DeFi investment strategies by analyzing on-chain and off-chain activity.

- Ledger’s CLAW: AI-powered bot that simplifies complex DeFi lending and borrowing setups for new users.

Prediction 1: 2025 will see AI-powered personalization become a standard feature in DeFi, with platforms offering tailored financial strategies to 80% of active users.

Case Study:

SingularityDAO integrates AI to offer dynamic portfolio management and personalized investment advice, enhancing user retention and profitability.

Recently, the organization joined forces with Cogito Finance and SelfKey. This merger will create Singularity Finance, an EVM-compatible Layer-2 blockchain that focuses on tokenizing the AI economy.

Tools like SingularityDAO are already leading the way with dynamic portfolio management. By analyzing on-chain and off-chain behavior, AI models will curate hyper-personalized lending, staking, and yield-farming products. This will simplify DeFi adoption for non-technical users and enable mainstream audiences to access sophisticated financial tools with ease.

Benefits for Entrepreneurs:

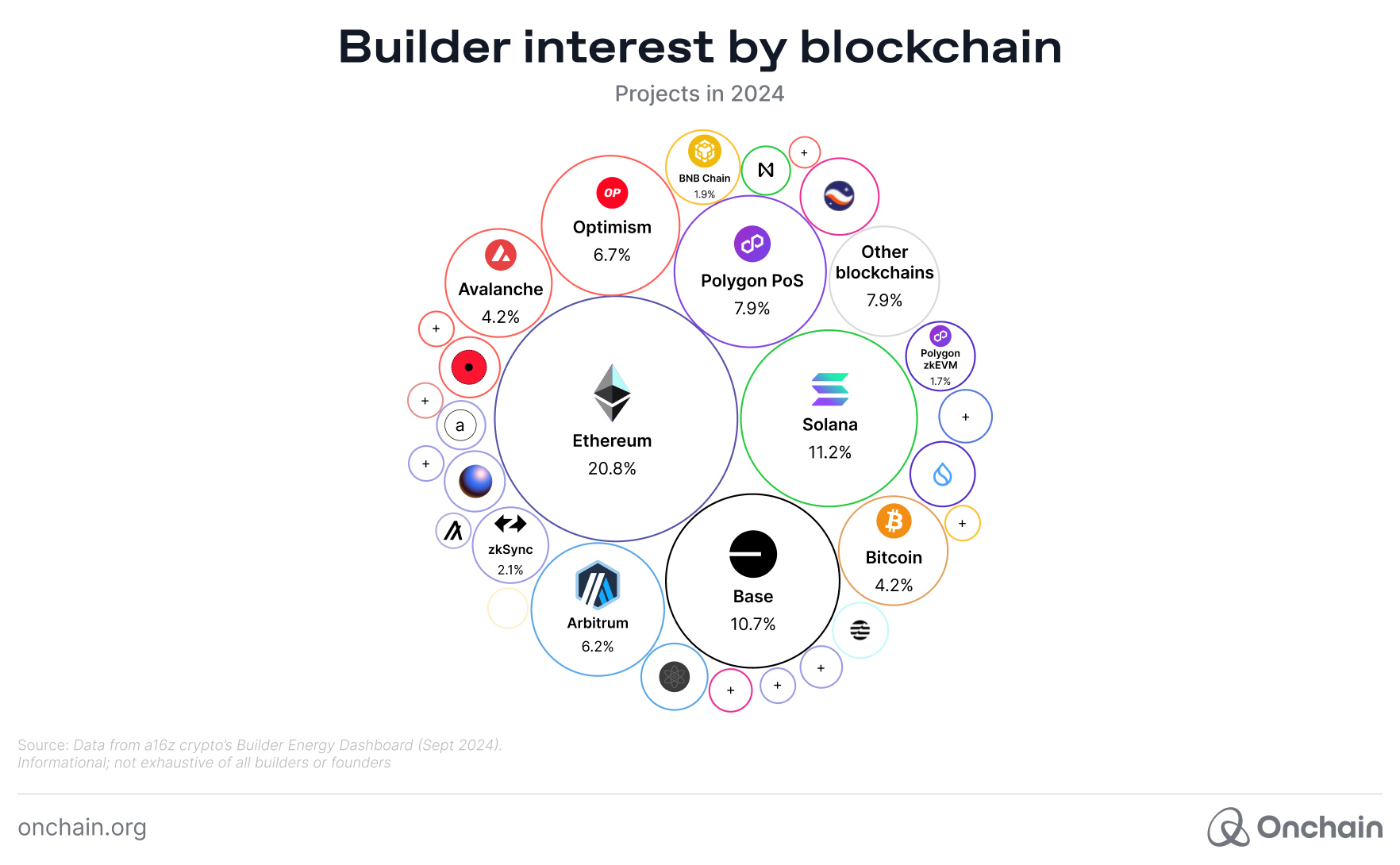

- Scalability for AI-driven applications: With over 70% of blockchain developers building on EVM-compatible solutions, the adoption of Layer 2 frameworks like Singularity Finance aligns with developer preferences, ensuring faster ecosystem growth.

- Monetization opportunities: Entrepreneurs creating AI tools (e.g., chatbots, prediction models) can tokenize these assets and earn from decentralized marketplaces.

- Access to AI compute resources: The tokenization of AI services aligns with the Web3 shift toward decentralized ownership. This is projected to drive significant demand, particularly as AI computing becomes a scarce yet essential resource.

Opportunities in 2025:

- The market for AI agent tokens has increased in recent months. It reached a total of $8 B market cap in December 2024. Entrepreneurs can create AI computing marketplaces or tokenized AI models to offer scalable infrastructure and meet the growing demand for AI-powered DeFi tools.

- On December 13, 2024, IQ AI introduced an Agent Tokenization Platform (ATP) that simplifies DeFi and empowers users to build and manage intelligent, autonomous agents. Users can tokenize these agents to create networks of co-owners that support development and share in success. It is set to launch in Q1 2025.

- Entrepreneurs can create cross-chain personalized solutions, tapping into the liquidity of Ethereum, Binance Smart Chain, and Polygon.

- For example, Stargate Finance is a fully composable cross-chain liquidity transfer protocol that enables users and developers to move assets seamlessly across multiple blockchains. Entrepreneurs can develop DeFi applications that utilize Stargate to identify the most profitable yield farming opportunities across different chains (e.g., Ethereum, BSC, Polygon) and automatically transfer user funds for maximum returns.

- Building adaptive lending, staking, or yield farming protocols that respond to user activity and changing market conditions.

- AI tools like SingularityDAO, Zerion, and Ledger’s CLAW simplify complex DeFi products, allowing non-technical users to access sophisticated financial tools with ease. Startups can build user-friendly AI-driven platforms that cater to the needs of underbanked populations and Web2 users transitioning to Web3. These tools will lower the learning curve and enable greater adoption of DeFi across global markets.

Credit scoring and risk assessment

AI evaluates creditworthiness by analyzing user transaction history, onchain data, and other risk indicators, enabling more inclusive lending.

Benefits for entrepreneurs:

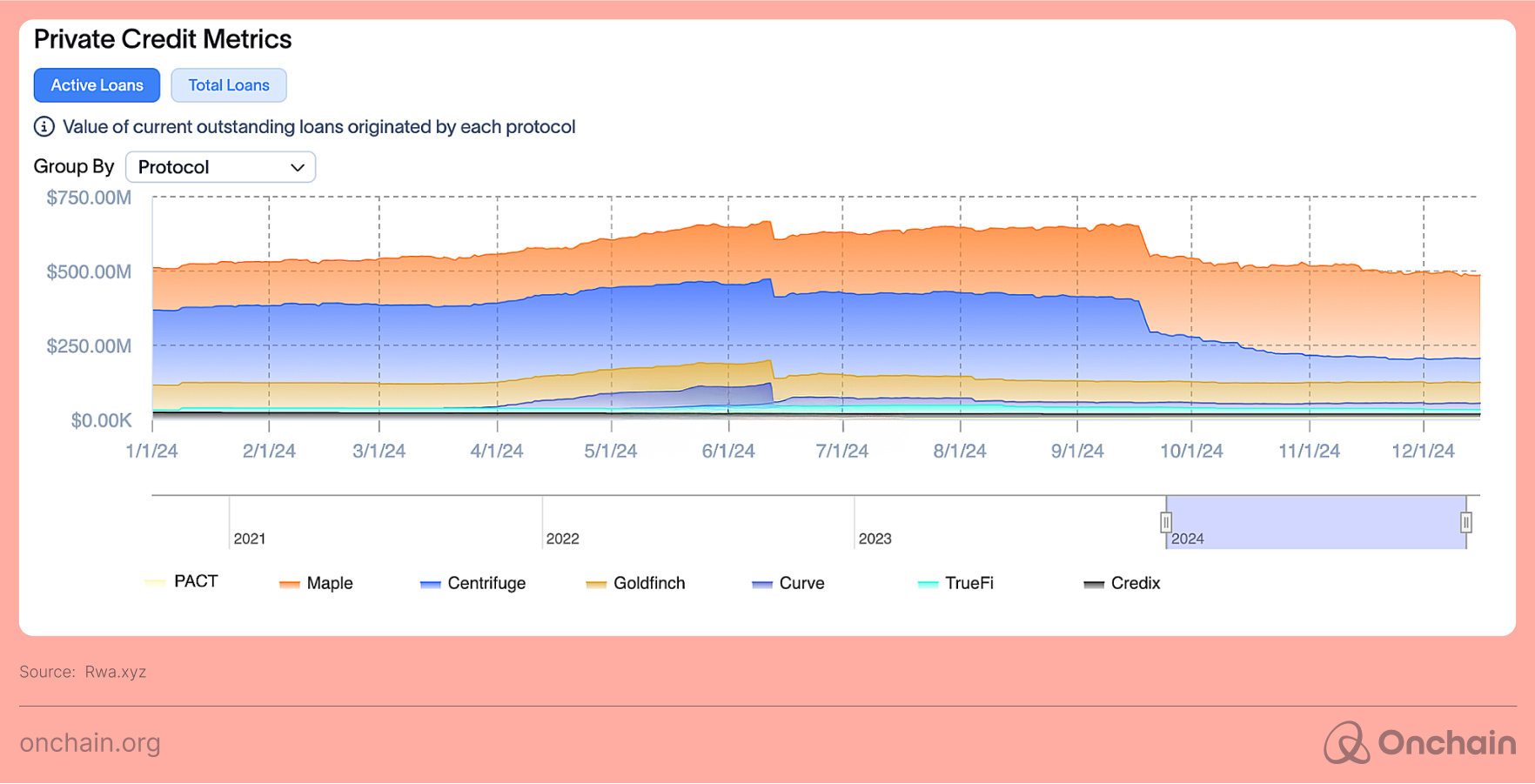

- Streamlined lending decisions: Platforms like Credix and Maple Finance empower startups to extend credit to underserved markets using AI-driven risk models. This reduces reliance on traditional credit bureaus and facilitates faster, more inclusive lending decisions.

- Lower costs and increased efficiency: By automating credit scoring and risk evaluation, startups can significantly reduce operational costs associated with manual underwriting processes. For example, Lendvest integrates Chainlink CCIP, which is backed by the Risk Management Network. This is a separate, independent network that continually monitors and verifies cross-chain operations for suspicious activity to support a cross-chain credit score system.

- Personalized loan offerings: AI enables entrepreneurs to create personalized loan products based on detailed risk profiles, enhancing user engagement and satisfaction.

Opportunities in 2025:

- Increasing reliance on onchain behavioral data is driving innovation in AI-powered credit scoring, particularly as more DeFi users engage in lending protocols like Aave and Compound.

- DeFi platforms that offer credit solutions are gaining traction in regions like Africa and Southeast Asia, where over 70% of the population remains underbanked. This represents significant untapped market potential for entrepreneurs.

- Real-world asset (RWA) lending is becoming a cornerstone of the DeFi ecosystem, with protocols like Maple Finance reporting a 2x increase in active loans in 2024. AI-enhanced risk models will be key to scaling this trend further.

Other biggest movers

However, the DeFi space is buzzing with platforms striving for better user experiences, scalability, and security. Lightchain AI is taking an even bolder step. The application weaves intelligence directly into its core.

Lightchain AI tackles the shortcomings of current systems and unlocks new potential through AI. In doing so, it is in a position to spearhead the next generation of DeFi innovation. With its mainnet launch already in sight in late 2024, the platform is generating significant excitement as a potential disruptor in the industry that is a must to watch in 2025.

Prediction 2: AI-native platforms like Lightchain AI will set new benchmarks for scalability and efficiency in DeFi, driving a wave of “AI-first” blockchain protocols in 2025.

Strategic recommendations for implementing AI in DeFi

Integrating AI into DeFi presents unique hurdles that require balancing decentralization with the structured needs of AI technologies.

- Operational complexity and siloed structures: Traditional financial institutions and emerging DeFi platforms both grapple with operational inefficiencies that hinder the rapid deployment of AI-powered solutions.

- Challenges:

- Legacy AI operational models restrict agility and speed.

- Functional silos limit collaboration between AI engineers, blockchain developers, and product managers.

- Strategies for change:

- Implement cross-functional teams to bridge technical and strategic objectives.

- Embrace agile methodologies to adapt to the rapidly evolving DeFi market. For example, Fetch.ai, an autonomous agent-based platform, manages off-chain AI computations to reduce transaction costs.

- Challenges:

- Integration and monitoring: AI models need to seamlessly integrate into decentralized infrastructures while being constantly monitored to ensure accuracy and relevance.

- Challenges:

- Maintaining transparency in AI decisions without compromising competitive algorithms.

- Continuous model validation to adapt to changing user behaviors and market trends.

- Strategies for successful integration:

- Deploy AI models using modular architectures for easier updates.

- Implement decentralized auditing systems to validate AI predictions and outcomes.

- Challenges:

- Security and trust concerns: AI’s reliance on data introduces vulnerabilities that pose risks to DeFi platforms, such as biased models or manipulation of AI outputs. These issues can erode user trust and compromise the integrity of decentralized systems.

- Challenges:

- AI-driven oracles could be manipulated to feed incorrect price data into DeFi platforms, leading to massive financial losses.

- Algorithmic lending protocols might amplify systemic risks if biases or inaccuracies are embedded into AI credit models.

- Solutions:

- Conduct rigorous testing and validation of AI models before deployment.

- Integrate decentralized governance to oversee and audit AI decisions.

- Use interoperable solutions like Chainlink’s oracles and decentralized data lakes for seamless cross-chain data aggregation.

- Challenges:

Prediction 3: By 2025, decentralized governance and auditing tools will become crucial to ensuring trust and transparency in AI-powered systems. Platforms will adopt distributed AI validation and transparent oversight frameworks to counter security risks.

To address AI security risks, platforms will integrate decentralized AI validation models and transparent auditing frameworks. Tools like Chainlink’s decentralized oracles will play a pivotal role in mitigating manipulation risks, while modular AI solutions will allow for constant upgrades and oversight.

Conclusion: The future is smart

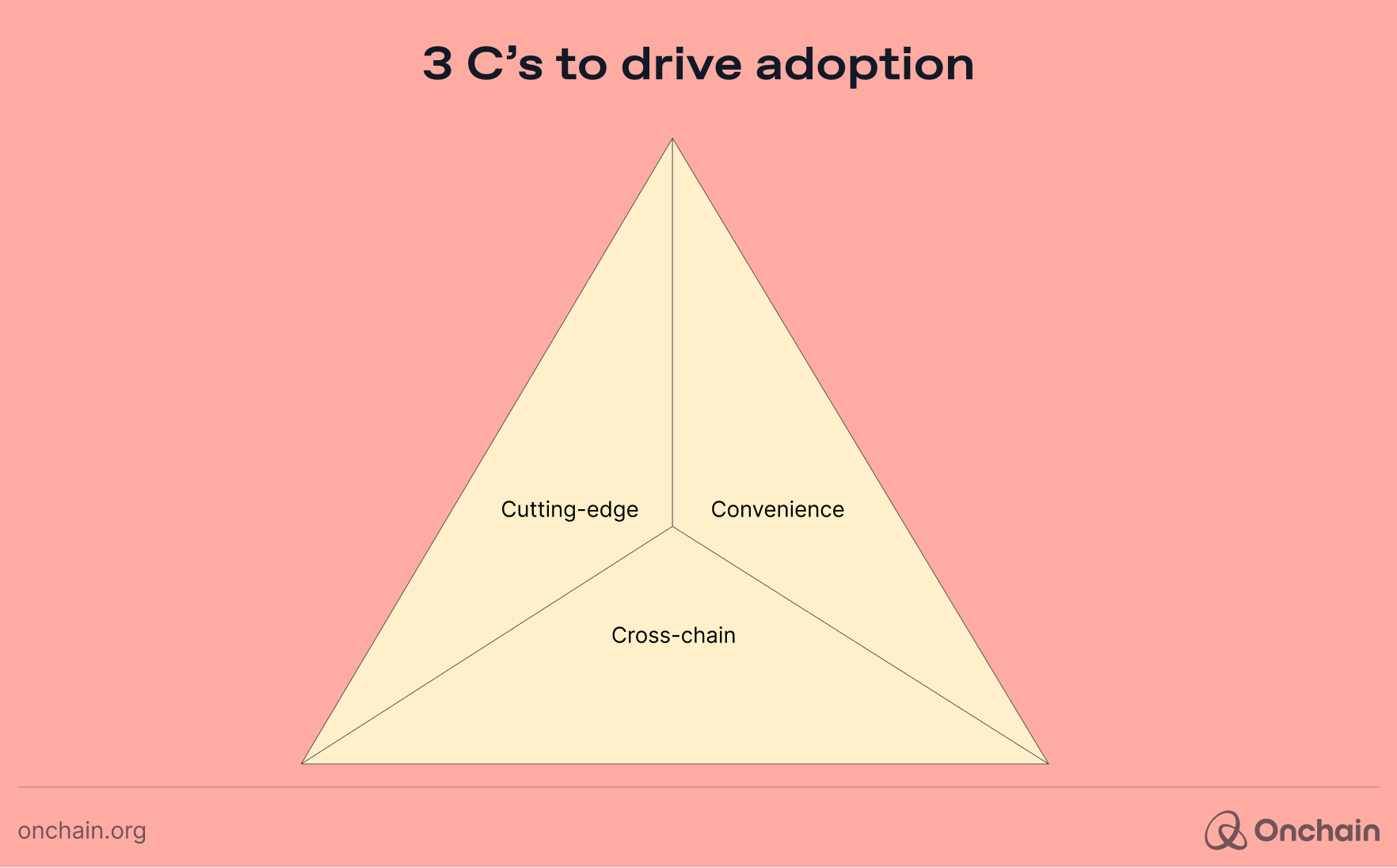

Despite the challenges posed by the integration of AI in DeFi, Web3 builders have persisted, and their resilience is set to pay off in 2025. This influx of users will be due to what we call the “3 Cs” of Web3 adoption:

- Cutting-edge: Innovations like Lightchain AI and Singularity Finance are set to become trailblazers, propelling the DeFi industry forward. As these projects experiment with new models and redefine use cases by integrating AI-powered features, we can expect a wave of exciting developments that redefine what’s possible in decentralized finance.

- Convenience: AI-driven personalized user experiences will make DeFi platforms more accessible to mainstream users. Enhanced interfaces, tailored financial advice, and adaptive solutions will lower barriers to entry, attracting millions of new users to the ecosystem.

- Cross-chain: These groundbreaking innovations in convenience won’t truly take off unless they become cross-chain compatible. Imagine a world where your DeFi wallet seamlessly travels with you across different applications, just like your physical wallet does in the real world.

Thoughts of the Onchain team

In the summer of 2024, we explored the synergy between AI and blockchain in our AI and Blockchain Disruption: Unveiling Perfect Synergy Use Cases report, and we’re thrilled to see that vision coming to life. We truly believe AI has the power to crack open DeFi for the broader masses and give everyday users a streamlined, almost intuitive way to lend, stake, or yield-farm.

Projects like SingularityDAO, IQ AI, or AI wallets like Pass App show that “smart” can actually mean simpler for many, reducing the cognitive overload typically associated with onchain complexity.

Of course, real-world impact hinges on more than neat integrations. We still face hefty infrastructure demands. AI training can be resource-intensive, and bridging DeFi with big-data analytics raises serious questions about security and potential misuse.

Yet, if founders tackle these pain points head-on, bolstering each step with transparent governance, thorough risk assessments, and user-centric design, AI-driven DeFi could very well become the rocket fuel that pushes Web3 to mainstream acceptance in 2025. After all, marrying blockchain’s trustless core with AI’s adaptive intelligence is precisely the sort of game-changer that might transform complex protocols into everyday financial tools.