2025 = Make or Break Year for DePIN

Michał Moneta

Leader & Chief Operating Officer

In this prediction:

- Why 2025 is a decisive year for DePIN and how its fate could shape the next phase of Web3 growth.

- How real-world utility in AI, storage, and internet access can merge with crypto-fueled “degen hype” to gain traction.

- Where DePIN projects can stand up to industry giants like AWS or Google by adopting familiar subscription models and API-based revenue streams.

- What founders must do to overcome weak demand and inflationary tokenomics, especially as DePIN fights for attention among other Web3 narratives.

- Practical steps to align business development, marketing, and anti-inflationary tokenomics so DePIN can break out of the crypto bubble and prove its global potential.

The world needs DePIN. Not the Web3 world. The entire world.

- We need more computational resources to power AI algorithms.

- We need more storage to save this abundance of content and data we produce every single second.

- We need a ubiquitous and autonomous Internet to address the global asymmetry of information, which remains one of the most pressing challenges of the modern era.

Decentralized Physical Networks (DePINs) have the potential to address all the above through the power of blockchain technology.

Over the last few years, DePIN has been perceived as the long-awaited child of the Web3 family. Struggling to find obvious real-world use cases for its powerful tech, the fathers and mothers of blockchain tech finally had a way to break out of the bubble. No more Sisyphean research and building castles in the air when explaining to non-crypto folks why memecoins actually make sense. We have Helium, Geodnet, and Akash, and the job of finding the real-world applications of Web3 is done.

Or is it?

The challenges of DePIN

DePIN still struggles with two main challenges — both can be called market-oriented.

Challenge 1: Demand

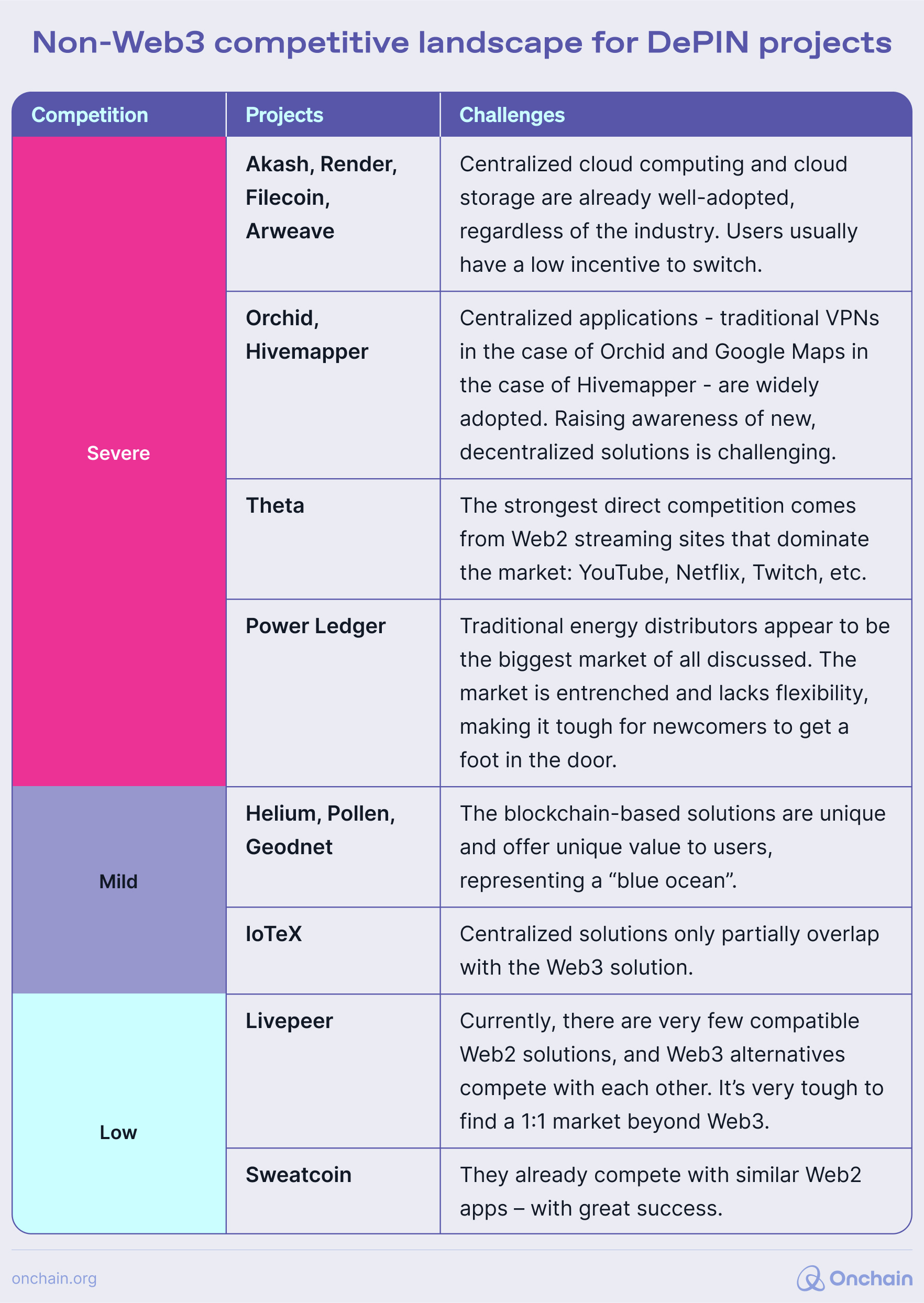

Decentralized Physical Infrastructure projects face great competition from outside of Web3.

Once they pass the boundaries of the crypto industry, they encounter Amazon AWS (in the case of Akash or Render), Google Maps (Natix, Hivemapper), or even institutional players, such as energy providers (Power Ledger, Glow).

NATIX: Pioneering DePIN for Mapping and Autonomous Driving in 2025

In 2025, NATIX Network will lead the charge in scaling DePIN (Decentralized Physical Infrastructure Networks) by transforming how data for autonomous driving and mapping is collected. With the launch of its VX360 device – NATIX empowers Tesla drivers to access, manage, and monetize their vehicle’s 360° camera data while contributing critical, real-world driving data for crypto and non-crypto rewards, and reshaping how autonomous vehicle systems are trained and validated.

As better solutions for scenario generation that aim to train, test, and validate autonomous vehicles gain traction, the need for high-quality, real-world data will surge, driving demand for decentralized solutions like NATIX. The VX360 will bridge this gap by providing continuous, anonymized 360° footage at a scale previously unattainable. This data will not only accelerate autonomous driving advancements but also enhance applications in mapping, urban planning, logistics, and more.

By embracing DePIN principles, NATIX will continue to shift data ownership away from centralized corporations, empowering individuals to participate in and profit from the data economy. As the Web3 space evolves, NATIX’s model will demonstrate how token incentives can drive the expansion of real-world data networks, setting a standard for privacy, scalability, and data integrity across industries.

2025 will be the year DePIN goes mainstream—powered by pioneers like NATIX.

Sponsored content by NATIX

🌟 NATIX: Tesla Drivers at the Forefront of DePIN Innovation

🚗 Power Up with VX360

Tesla owners (2021+ models) can now monetize their vehicle’s 360° camera data with the NATIX VX360. Earn rewards while driving advancements in autonomous vehicles, mapping, and urban planning.

🔑 Why NATIX?

- Earn as You Drive: Crypto and non-crypto rewards for your data.

- Lead Innovation: Help train and validate autonomous systems with real-world data.

- Own Your Data: Empower yourself in the decentralized data economy.

📈 Prediction by NATIX:

By 2025, DePIN projects leveraging real-world incentives like VX360 will see a 2x adoption rate as demand for decentralized, high-quality data accelerates.

🌍 Be Part of the Movement: Learn More

Acurast is another interesting example of how DePIN can tap into everyday hardware for large-scale impact. Focusing on smartphones as a source of secure computational power, Acurast shows how ubiquitous devices can be mobilized to support Web3 infrastructure.

Smartphones remain vastly underutilized relative to their advanced capabilities. These cutting-edge, highly secure, and power-efficient devices have the potential to revolutionize how computational power is delivered. Through Acurast’s decentralized network, everyday devices are harnessed to power hyper-personalized AI agents that prioritize security, confidentiality, and performance."

- Alessandro De Carli, Co-Founder, Acurast

This approach underscores how DePIN solutions can unlock billions of devices worldwide, bridging the gap between high-powered AI demands and the everyday technology people already own. As more projects follow suit, harnessing underappreciated resources could rapidly expand DePIN’s real-world utility, further solidifying the case for Web3 adoption beyond crypto-focused circles.

We explored this topic in detail in our “DePIN Brings Real-World Business Opportunities for Web3” report:

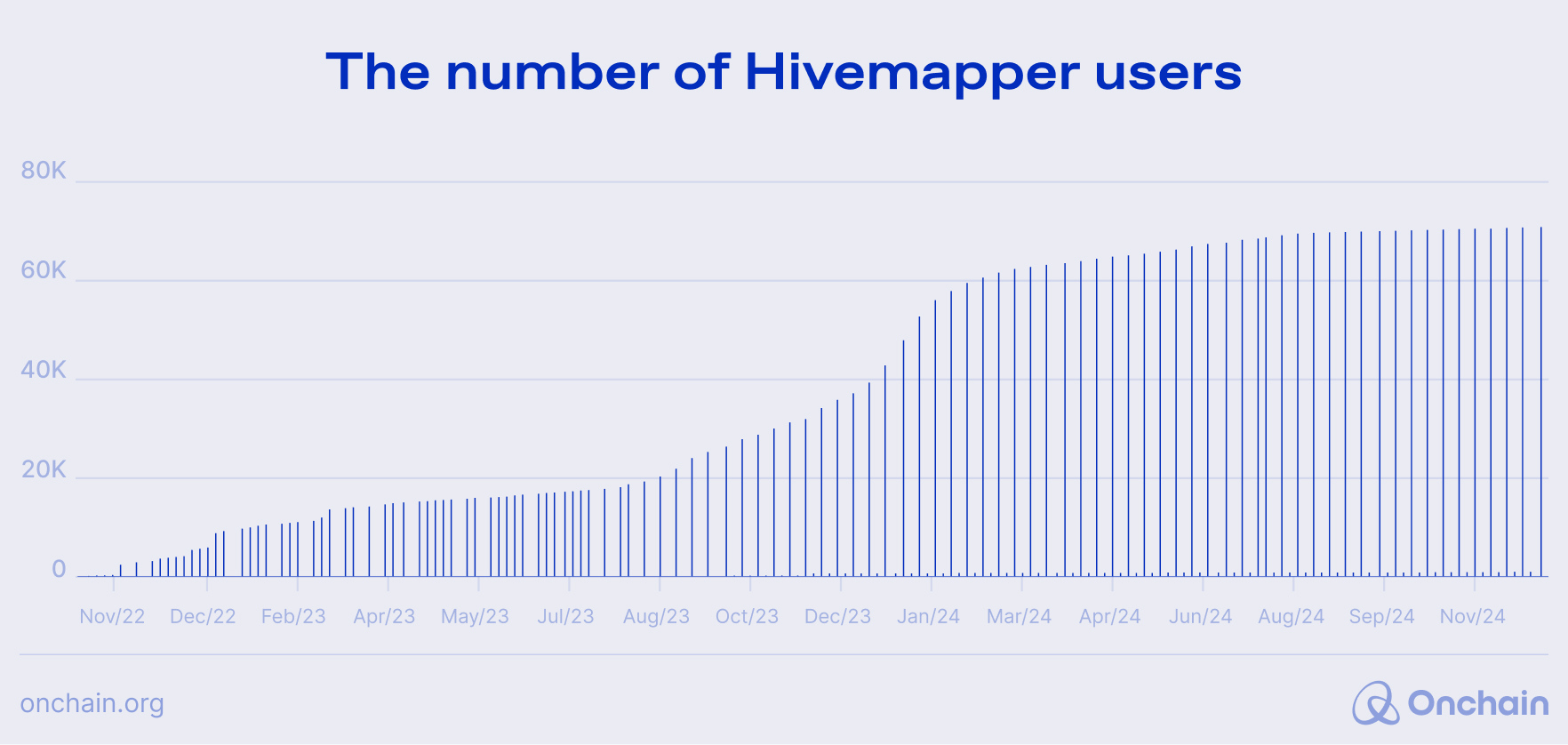

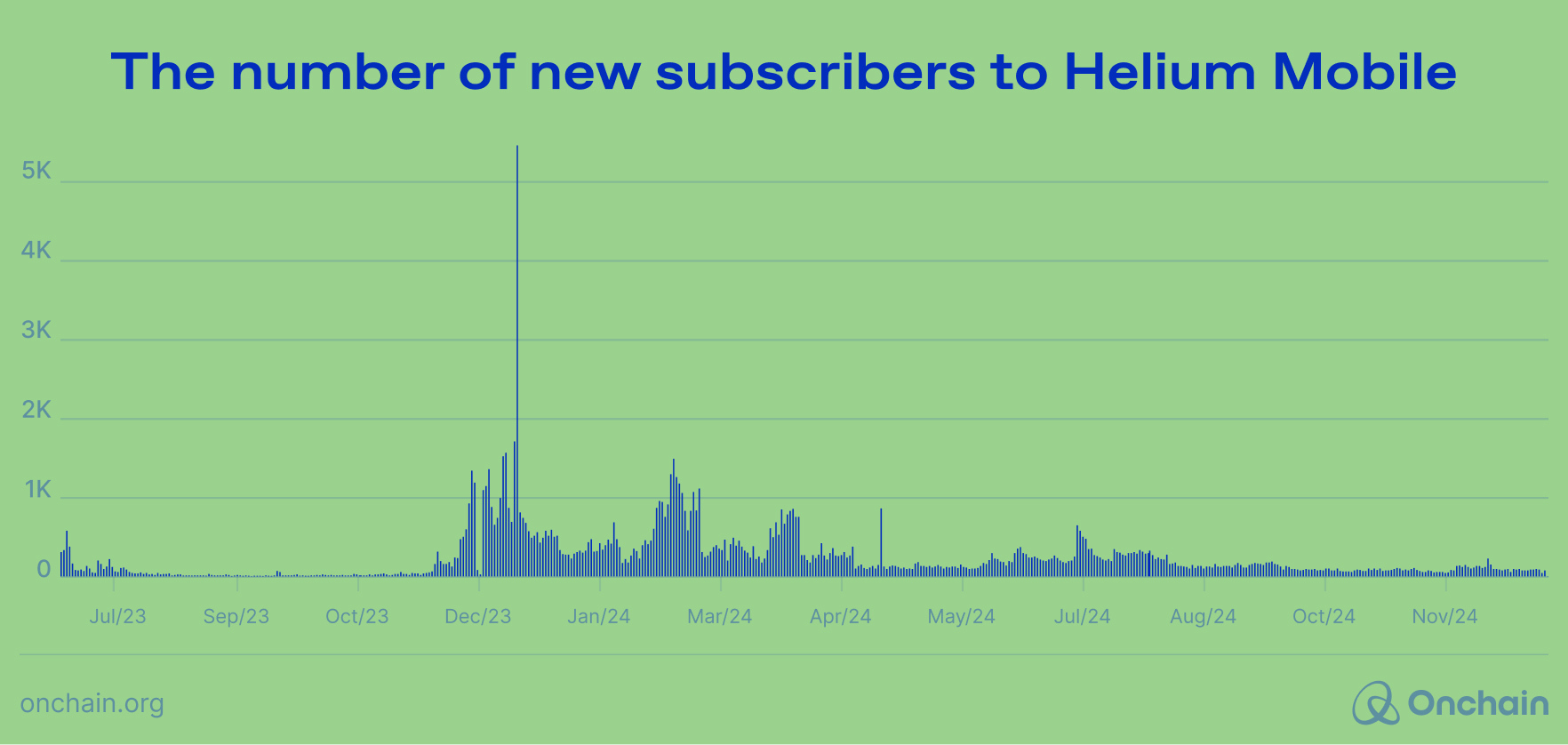

As a consequence, the demand for DePIN services remains mediocre. You can see it from the graphs below, which show the growth of three top DePIN projects.

1. Decentralized computing network Akash – active leases (customers who use and manage resources on the network):

2. Decentralized mapping network Hivemapper – maps users.

3. Decentralized wireless network Helium Mobile – subscribers.

These struggles are present inside the Web3 world as well. We looked at the crypto industry where DePIN services are needed and made an interesting discovery about real-world-oriented narratives. We’re talking about DePIN, DeSci, orand RWA vs. pure digital use cases, like memecoins or GameFi. It seems the industry is able to focus on only one “serious” niche of Web3 at a time.

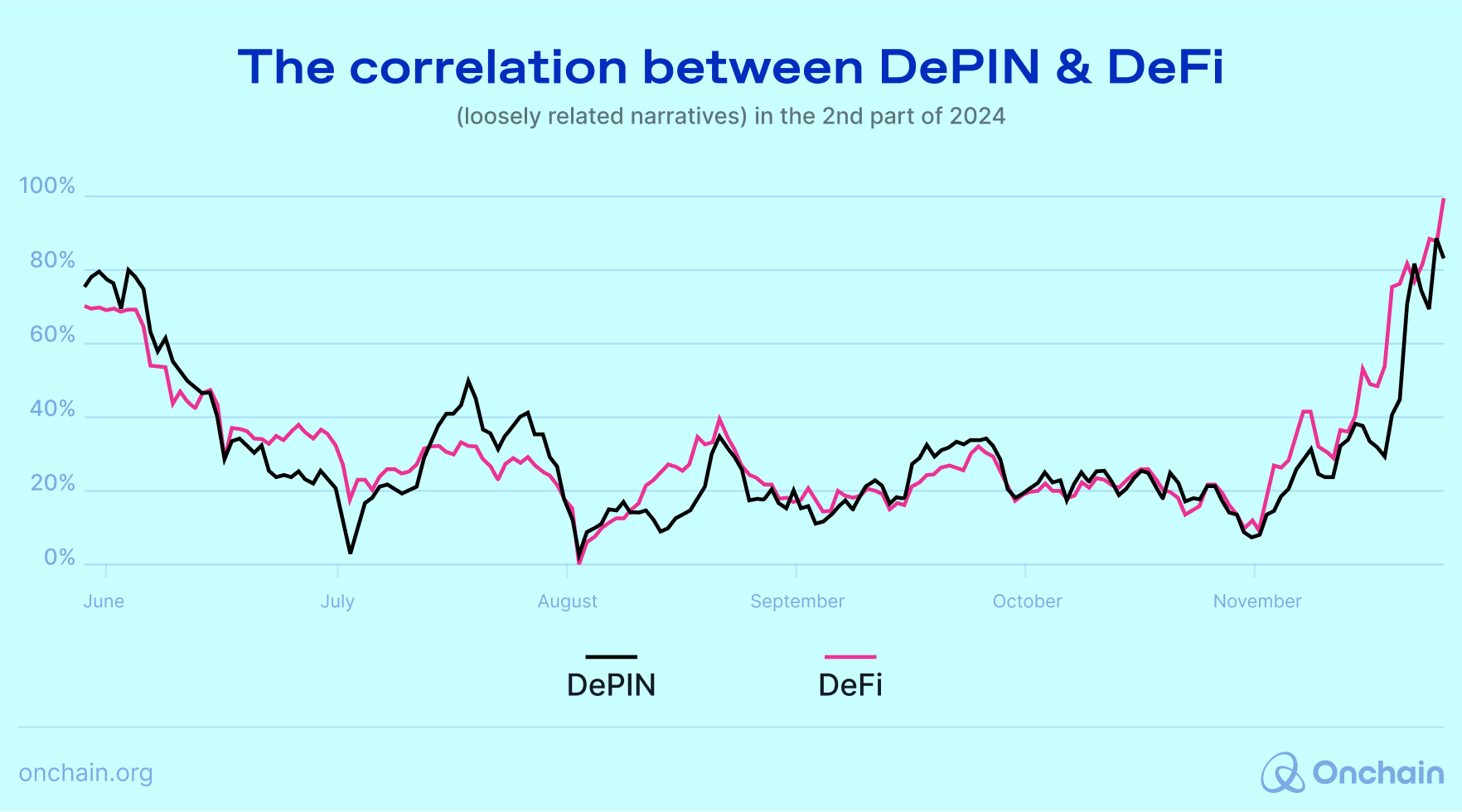

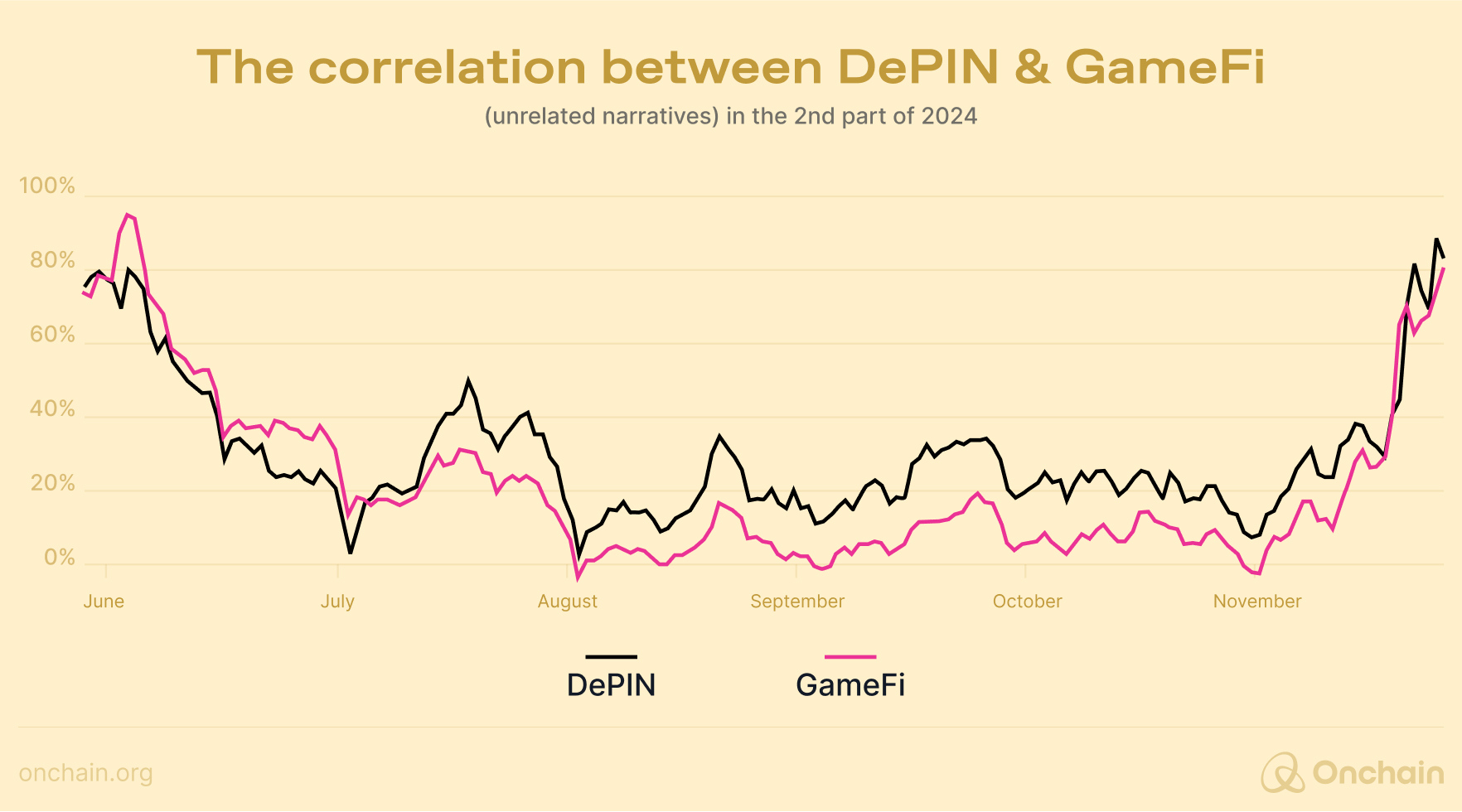

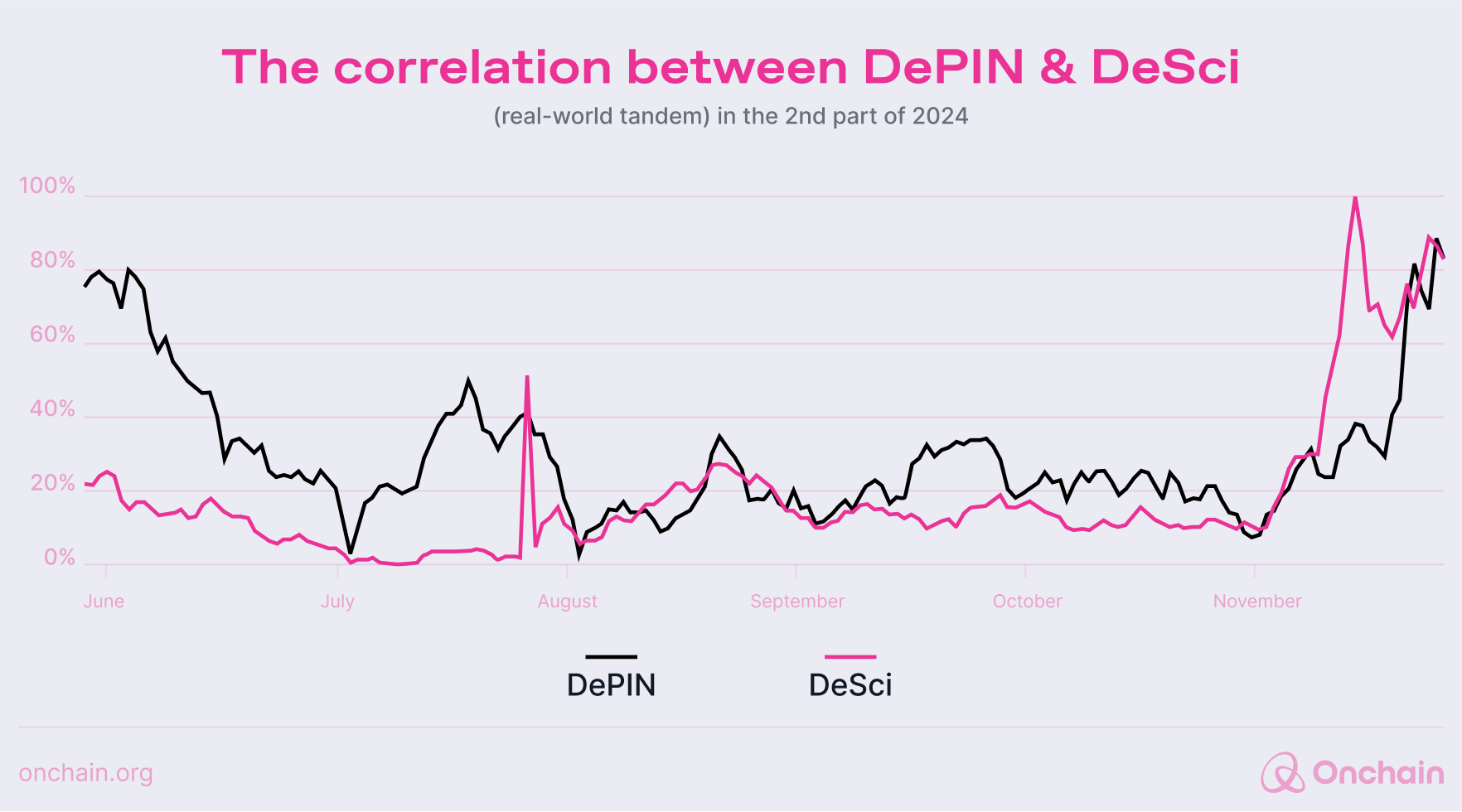

What are we saying? To see it in detail, please check the below charts based on the brilliant “Narrative Index” by @cryptokoryo_research. They show the price performance of each narrative we analyzed in direct comparisons:

- DePIN vs. DeFi – two loosely related narratives regarding their real-world impact. DeFi is way more crypto-focused than DePIN.

- DePIN vs. GameFi – two unrelated narratives regarding their real-world impact. GameFi is almost completely crypto-focused at the moment.

- DePIN vs. DeSci – two related narratives regarding their real-world impact. Both DeSci and DePIN focus on use cases beyond the crypto world.

As you can see, the correlation between the price index of DePIN and DeFi is very strong. In other words, these two narratives don’t compete for the same mindshare and simply follow the market trends.

The correlation between the interest in DePIN and GameFi is very strong. As in the case of DeFi, these two niches don’t compete for the same capital.

The correlation between DePIN and DeSci is weaker than in the case of the previous two comparisons. And, as you can see, there are at least a few periods when one of the categories rises at the expense of another.

It’s a hypothesis, but there is a strong probability that Web3 investors focus on only one real-world-oriented narrative at the time, leaving DePIN, DeSci, or RWA to compete for their mindshare. It poses a challenge for DePIN as it has to face not only out-of-Web3 but also in-Web3 competition.

Prediction 1: DePIN will likely fight for a place in the Web3 mindshare with other, more real-world-oriented narratives.

Challenge 2: Inflationary tokenomics

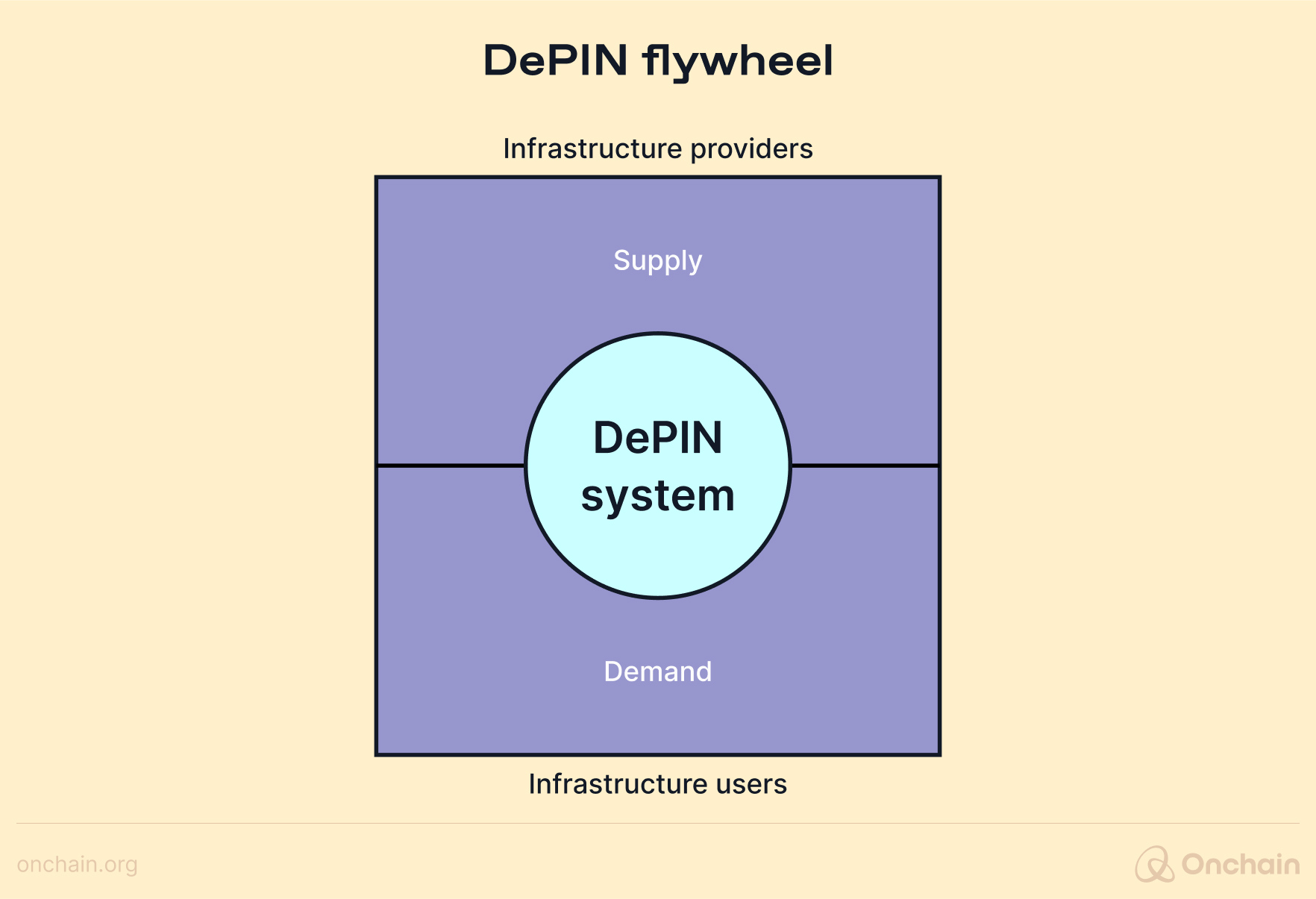

The struggles on the demand side automatically generate problems for the supply part of the DePIN flywheel.

The quality of an offering depends on the number of contributions to the network. e.g., the amount of computing power, the number of map images, the volume of geospatial data, etc. Therefore, all participants must be encouraged to make them. Token rewards serve as the strongest and most obvious incentive. However, as the competition for users intensifies, they automatically lead to inflation.

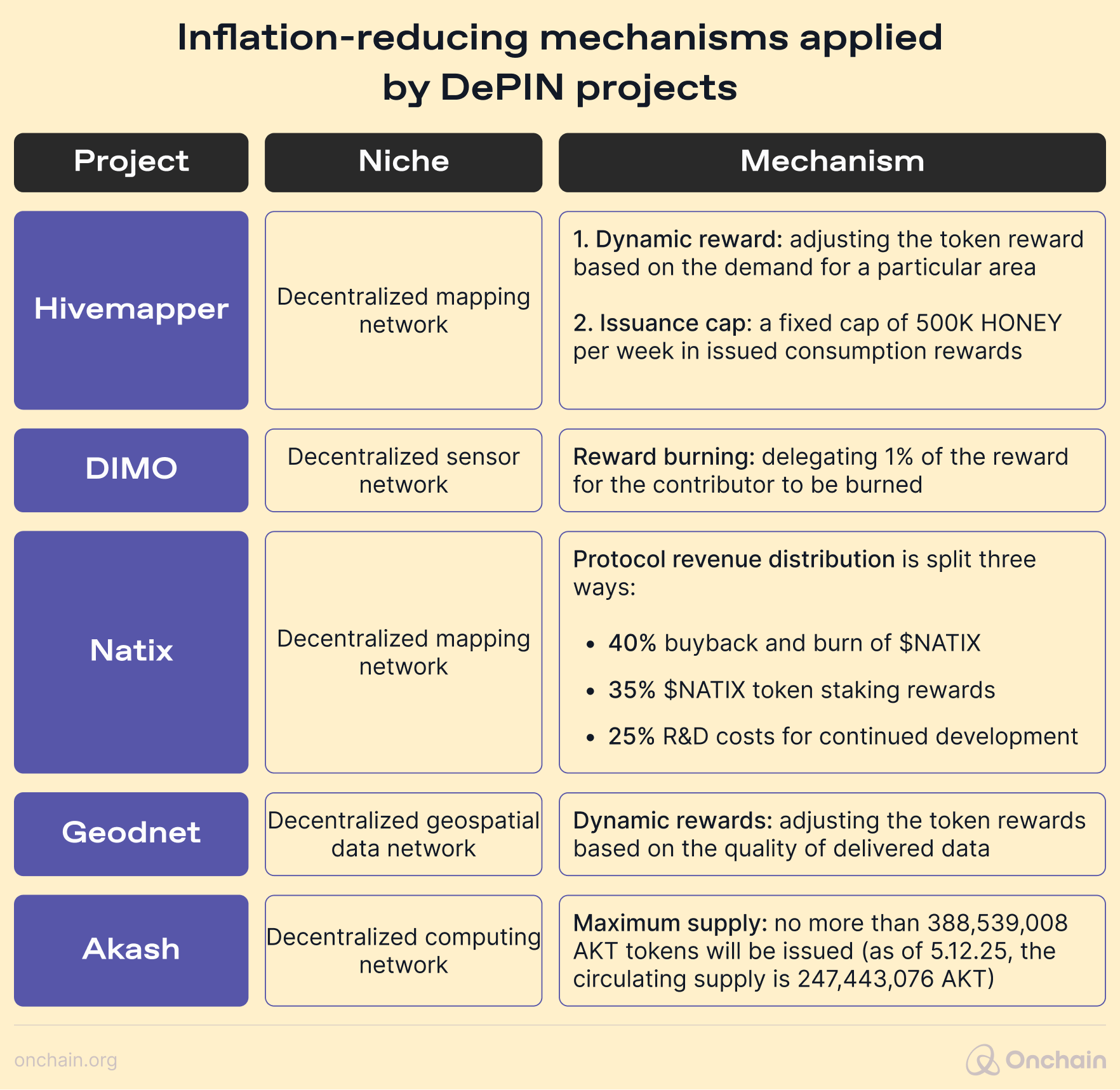

Fortunately, there are clever workarounds that address this issue. The following table showcases a few of them. Their efficiency still needs to be evaluated in 2025.

Prediction 2: Highly inflationary tokenomics will lead to the slow death of a few popular DePIN projects already in 2025.

Why do DePIN companies need to focus on these challenges now? And why should you, as an entrepreneur or a Web3 person operating in a different sector, care?

At Onchain, we like to say that DePIN serves as a unique subcategory of Web3 that is capable of expanding beyond this space and moving large non-Web3 audiences towards decentralization. The reason: This user group may start by interacting with DePIN projects but then move to other Web3 solutions.

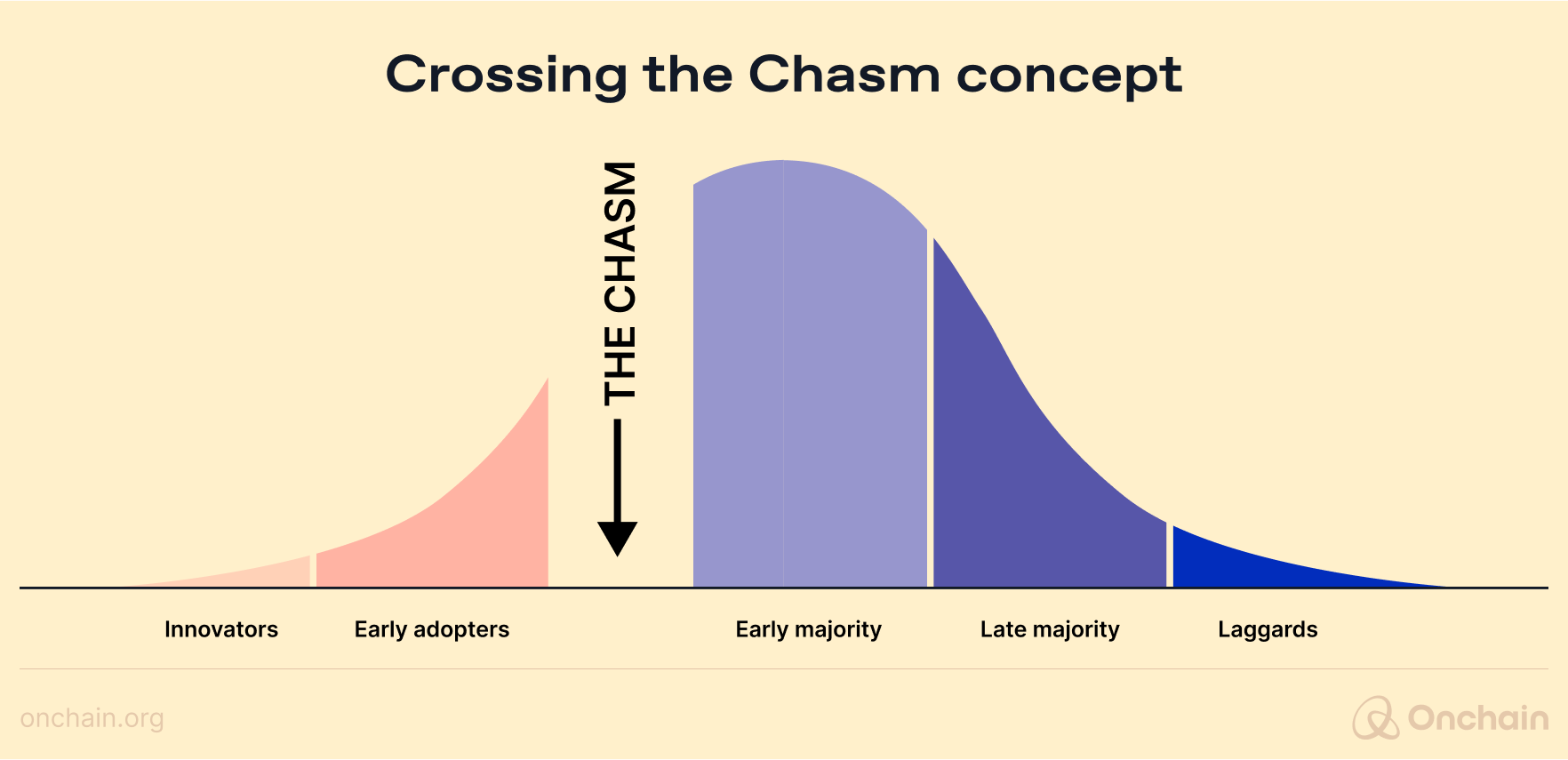

In other words, DePINs have the real potential to “cross the chasm” on behalf of the entire crypto world. If you’re not familiar with this concept, let me provide you with a few notes from the DePIN report we produced this year:

In his book “Crossing the Chasm,” George A. Moore identified an adoption gap that high-tech products must cross on their way to the mass market. Web3 products are no different.

Your first users are the innovators — tech geeks who love to test and develop new solutions. Next, you’ll attract early adopters — visionary companies that want to discover a breakthrough product. The chasm opens in the latter part of this adoption cycle, as you can see in the chart below.

The challenge is to reach the early majority of pragmatic companies that prefer to use already evaluated solutions. To reach this mainstream market and become the Google or Salesforce of the 2020s, your company must first establish its position in niche customer groups: innovators and early adopters who are driven by curiosity and require little convincing.

But wait, before attempting to reach the far side of the chasm; you must encourage these groups to openly mention, engage with, and even advocate for your project to attract more pragmatic customers. In the case of DePIN, it’s all about generating enough hype within Web3’s early adopters to bring the attention of non-Web3 customers (the early majority).

Here’s a question you should now ask: Will it be easier to cross the infamous chasm in the following years than in 2025? Due to the cyclical nature of crypto, it’s very unlikely. The time to generate hype around the early adopters is now, and considering the immensely positive climate around Web3, it may never be better.

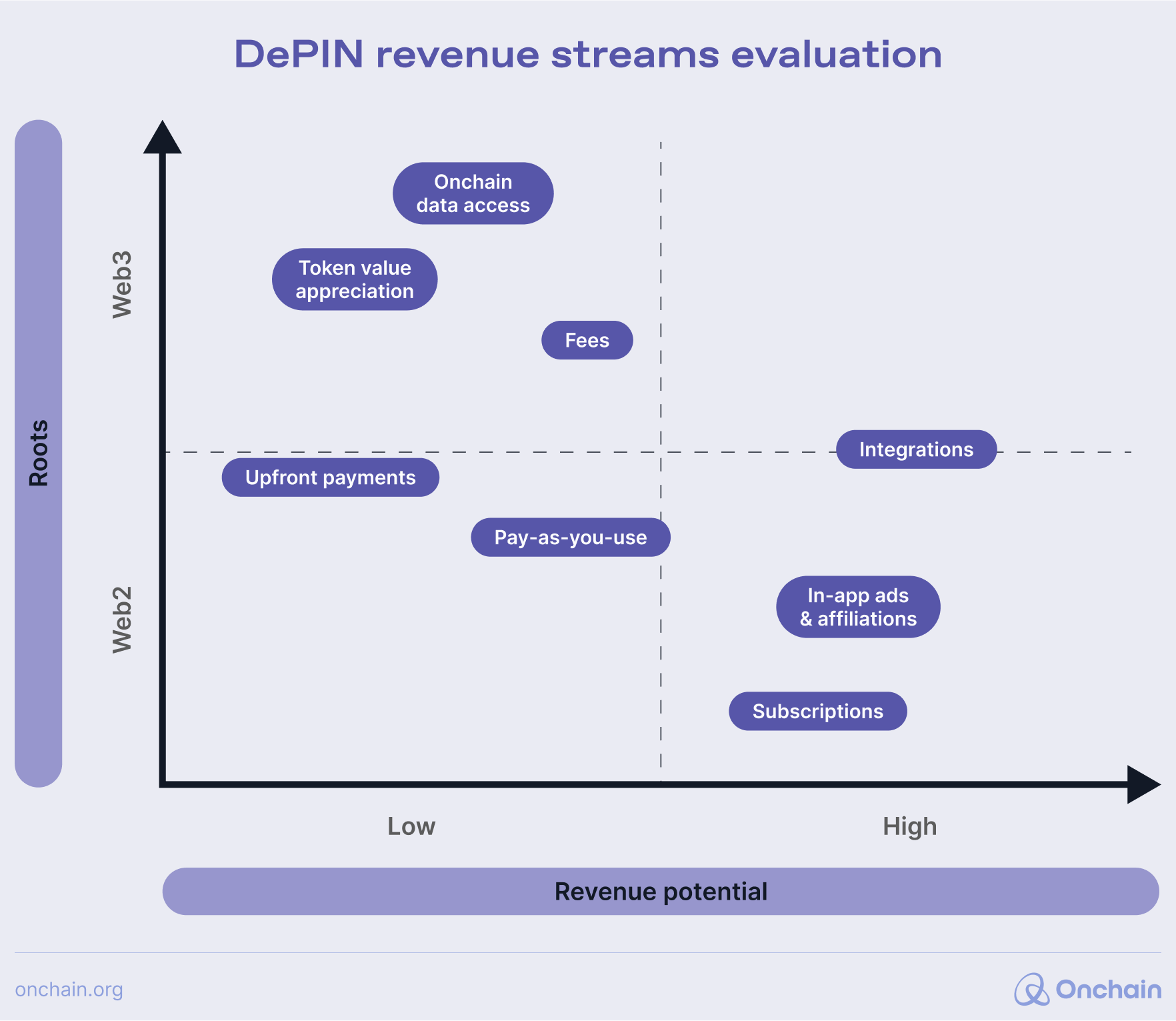

I maintain that no other Web3 niche—stablecoins aside, it’s more of a unified product—has an equally high potential to make the jump. In addition to its real-world utility, DePIN concepts are way easier to grasp for businesses and entrepreneurs from outside the crypto world. I attribute this to its potentially non-Web3ish business models and revenue streams. Here are some examples:

- API access/onchain data selling (e.g., Hivemapper, Livepeer, Natix)

- Upfront payment/hardware selling (e.g., DIMO, Helium)

- Subscription model (e.g., Helium Mobile, Orchid, Sweatcoin)

- Enterprise / governmental integrations (e.g., Power Ledger)

- In-app advertising/brand affiliations (e.g., Sweatcoin)

Prediction 3: Projects that package DePIN services into familiar business models, like subscriptions, API access, or enterprise contracts, will lead to adoption as they lower barriers for non-Web3 businesses.

Having said that, in order to push all this valuable information over the edges of Web3, DePIN needs to be at the forefront of the entire 2025 bull market hype. Ironically, crypto-related issues are not the most pressing ones to address. As outlined above, the tokenomics struggles are being taken care of, and other issues like cumbersome integrations are being gradually fixed as the space matures.

The most pressing matter for all projects in the sector now is adding marketing and business substance. DePIN projects need to cross the chasm hand in hand with the crypto community. Business development teams must provide and pitch solutions, with development relations squads onboarding more technical geeks to launch them. For you as an entrepreneur, it’s critical to take these aspects into account when structuring your business. It’s no minor issue, and our research has shown time and again that they are frequently overlooked.

My bets on DePIN remain optimistic, though. In the years after 2025, I expect this niche to become more professionalized and, at some point, simply disconnected from the Web3 space. However, before the gauntlet is thrown down to the big players such as AWS or Azure, the loyal and abundant early adopters need to be in place. For me, this is not merely a prediction but a true wish for the coming 12 months.

Prediction 4: 2025 will see DePIN projects evolve their GTM strategies, with marketing teams taking the lead in building relationships with both crypto-native and traditional industry audiences.

Strategic recommendations

The coming months may be deciding the future of DePIN in general. Entrepreneurs involved in this niche should definitely:

- Engage with and get the Web3 community onboard. Before crossing the chasm and throwing down the gauntlet to non-Web3 giants, DePIN as a sector needs to establish dominance in the Web3 space. To achieve that, the ordinary DePIN supply and demand balance needs attention, and DePIN companies need to think more like marketers. This means focusing on generating degen hype around their projects. Make this a top goal for 2025 and collaborate.

- Ramp up the business development game. In the background, it’s worth establishing pure B2B relationships that will help DePINs address common challenges on the demand side of their business.

- Be clever regarding the supply side. And, on the technical side of things, DePIN projects should revamp their tokenomics and apply more anti-inflationary mechanisms — the way that Natix, Hivemapper, or Geodnet have done.

Thoughts of the Onchain research team

From our vantage point at Onchain, we see DePIN as more than just a buzzword — it’s a real chance to show the world that Web3 can solve everyday problems. We agree with Michal that 2025 is make-or-break: without tackling weak demand, tokenomics inflation, and tough competition from players like AWS, DePIN might stall out. Still, we’re feeling bullish.

DePIN’s unique mix of real-world utility and crypto-driven innovation could be the catalyst that finally “crosses the chasm” and draws a wider audience to Web3. We’re eager to see founders adopt more approachable business models, rally the Web3 faithful, and prove to non-crypto enterprises that decentralized infrastructure isn’t just hype — it’s transformative. We’ll keep sharing insights and resources to help entrepreneurs refine their strategies, lock in sustainable tokenomics, and bring the best of DePIN to life in 2025.