NFTs in 2025: The Renaissance Many Don’t See Coming

Leon Waidmann

Head of Research

In this prediction:

- What are the critical drivers fueling the next wave of NFT adoption in 2025?

- How real-world asset tokenization is expanding NFT utility beyond collectibles.

- Why major brands are embracing NFTs to power loyalty programs and new experiences.

- The role of evolving U.S. regulations in unlocking the full potential of NFTs.

- Where creators and investors can find the biggest growth opportunities in the NFT renaissance.

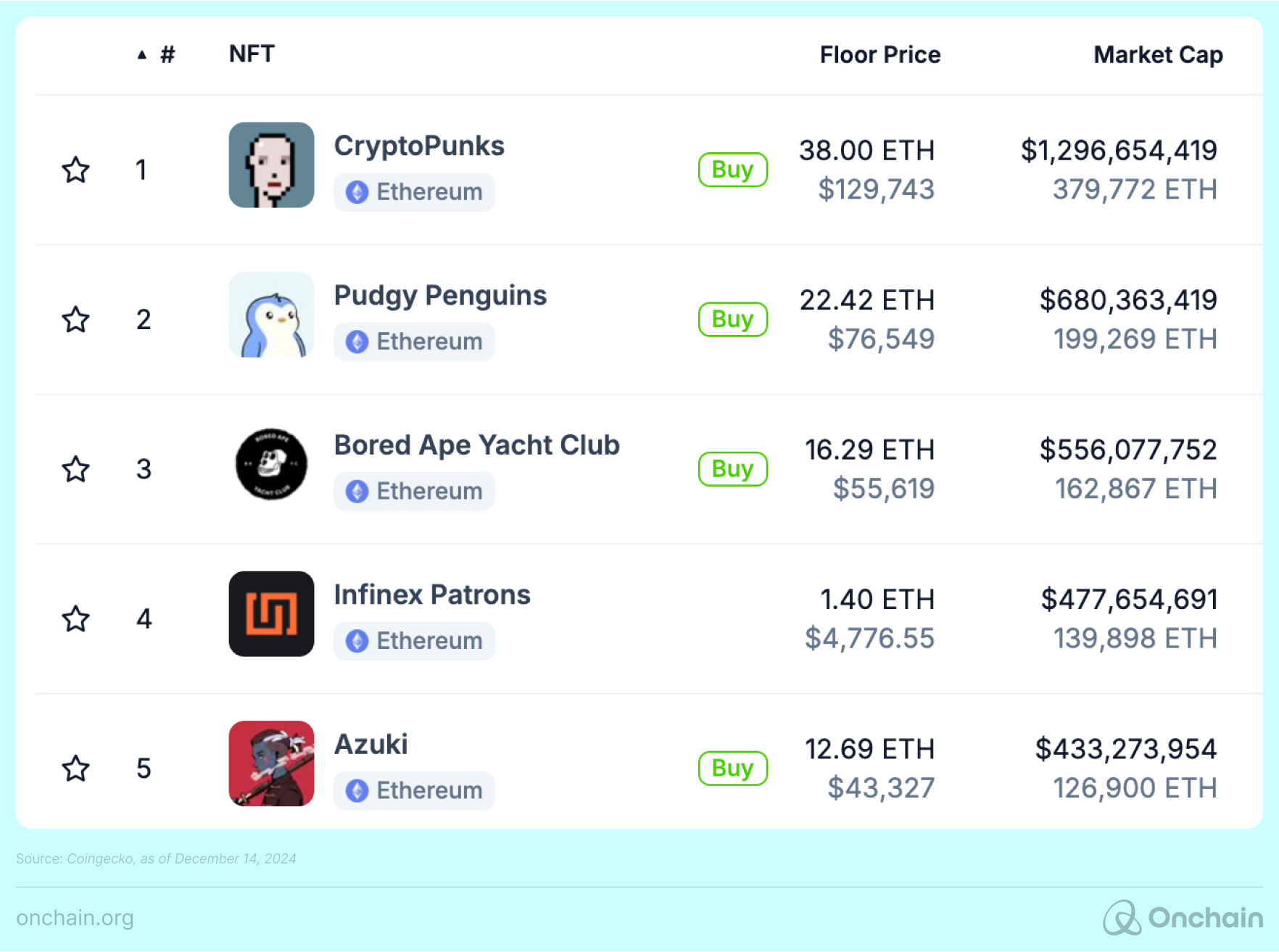

Just a few years after the dramatic highs and lows of the first NFT boom, the market is quietly preparing for another leap forward. Despite the sobering data — over 90% of NFT projects have “died,” and trading volumes remain a fraction of their 2021 peaks — resilient collections like CryptoPunks, Pudgy Penguins, Azuki, and Bored Apes are back in the spotlight.

What sparked this sudden resurgence? These projects not only survived the downturn, they built stronger communities, formed strategic partnerships, and doubled down on their core missions during the lean months. Much the same as Bitcoin, Ethereum, and Solana, which emerged more resilient after early market cycles, these NFT veterans have proven that weathering the storm can pay off handsomely.

As we enter what is effectively the second “real market cycle” for NFTs, the overall NFT ecosystem seems primed for a breakout year in 2025.

Why 2025 offers a fresh canvas for NFTs

1. Bullish market momentum

The broader crypto market is experiencing a resurgence. With Bitcoin leading the charge and altcoins following, liquidity is flowing back into speculative and experimental assets like NFTs. Blue-chip collections, which serve as bellwethers for the sector, are climbing rapidly. CryptoPunks, for instance, have become cultural icons and status symbols, with a collective value exceeding $1.4 billion.

2. Regulatory shifts in the US will enable experimentation:

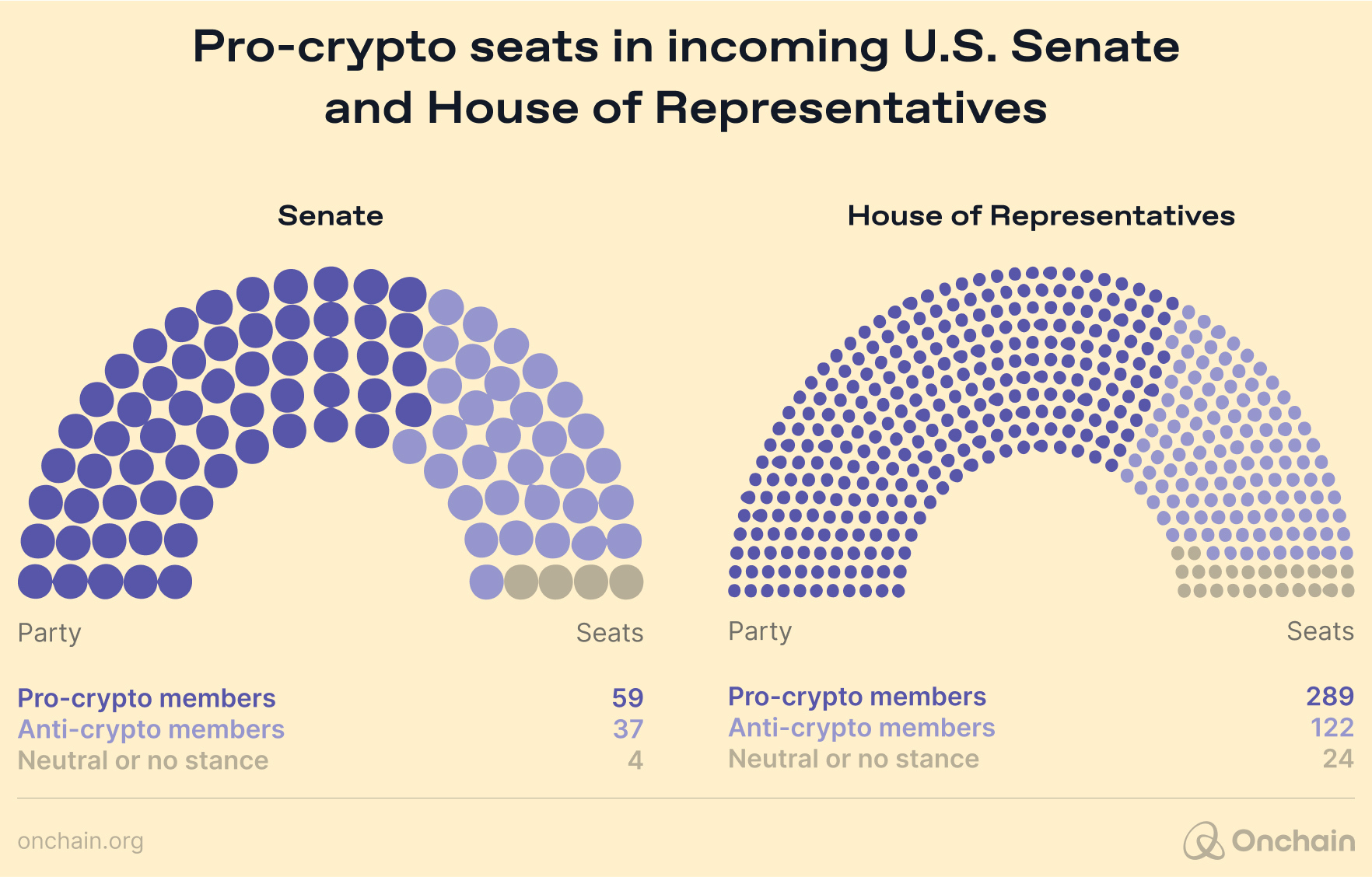

The regulatory clouds over Web3 are starting to clear. With Gary Gensler stepping down as SEC chair and pro-crypto leadership taking shape under President-elect Donald Trump, there’s newfound optimism in the blockchain space. Clearer guidance on NFT classifications is opening doors for projects that were previously hesitant to innovate. Founders are now looking forward to a future where they can once again experiment with NFT models like token-gated communities and dynamic NFTs without fear of ambiguous legal repercussions.

Prediction 1: Under clearer U.S. regulations, NFT projects will experiment with dynamic, token-gated models, offering exclusive events, merchandise, and VIP platforms to holder-only communities

3. Real-world utility and big-brand moves:

NFTs are no longer just the domain of degen traders. Major brands are actively integrating NFTs into their strategies.

-

Pudgy Penguins’ real-world expansion: Pudgy Penguins may not be a major brand itself, but it has strategically partnered with retail giants like Walmart and Target to distribute its Pudgy Toys. These toys come with integrated NFTs via QR codes. They connect physical products with digital experiences in Pudgy World, an interactive blockchain-powered platform. This innovative blend of physical and digital assets showcases how NFTs can enter mainstream retail and bring blockchain technology to everyday consumers.

Additionally, Pudgy Penguins has announced its $PENGU token airdrop, which is set for release on the Solana blockchain. The introduction of $PENGU aligns with a broader trend of NFT projects that integrate native tokens to enhance user participation and ecosystem utility. Should more projects embrace token airdrops in 2025, this strategy could further bridge communities and bolster long-term ecosystem loyalty.

- Forbes Web3: Media companies experiment with NFT-based memberships, premium content, and interactive storytelling. They create unique reader experiences and drive direct engagement with their audience by tokenizing certain articles, reports, or virtual events.

- Sony’s NFT integration in gaming: Sony’s recent patents hint at the intent to redefine digital ownership in gaming. The company filed patents focused on interoperable NFTs, allowing gamers to transfer in-game assets across multiple platforms. This innovation aims to redefine how digital ownership works in gaming and demonstrates how a global brand can utilize blockchain technology to create new value propositions for consumers.

- Onchain utility NFTs: Complementing these moves, Onchain’s Founding Membership NFTs offer token-gated access to exclusive research, tools, and the Web3 Insights Marketplace. Offering benefits like future token airdrops, discounted event access, and interactive content opportunities, Onchain’s NFTs showcase how utility-driven assets can unlock real-world value for members.

Prediction 2: Traditional companies will partner with established NFT pioneers to co-develop new products, from branded digital avatars to licensed in-game assets, blending corporate reach with Web3 innovation.

These developments demonstrate that 2024 has been a transformative year for NFTs. Traditional companies like Sony, and Forbes, among others, have already joined forces with blockchain pioneers to create real-world use cases. The trend is representative of how NFTs move beyond speculative trading to become integral tools for loyalty, interoperability, and immersive experiences across gaming and consumer products.

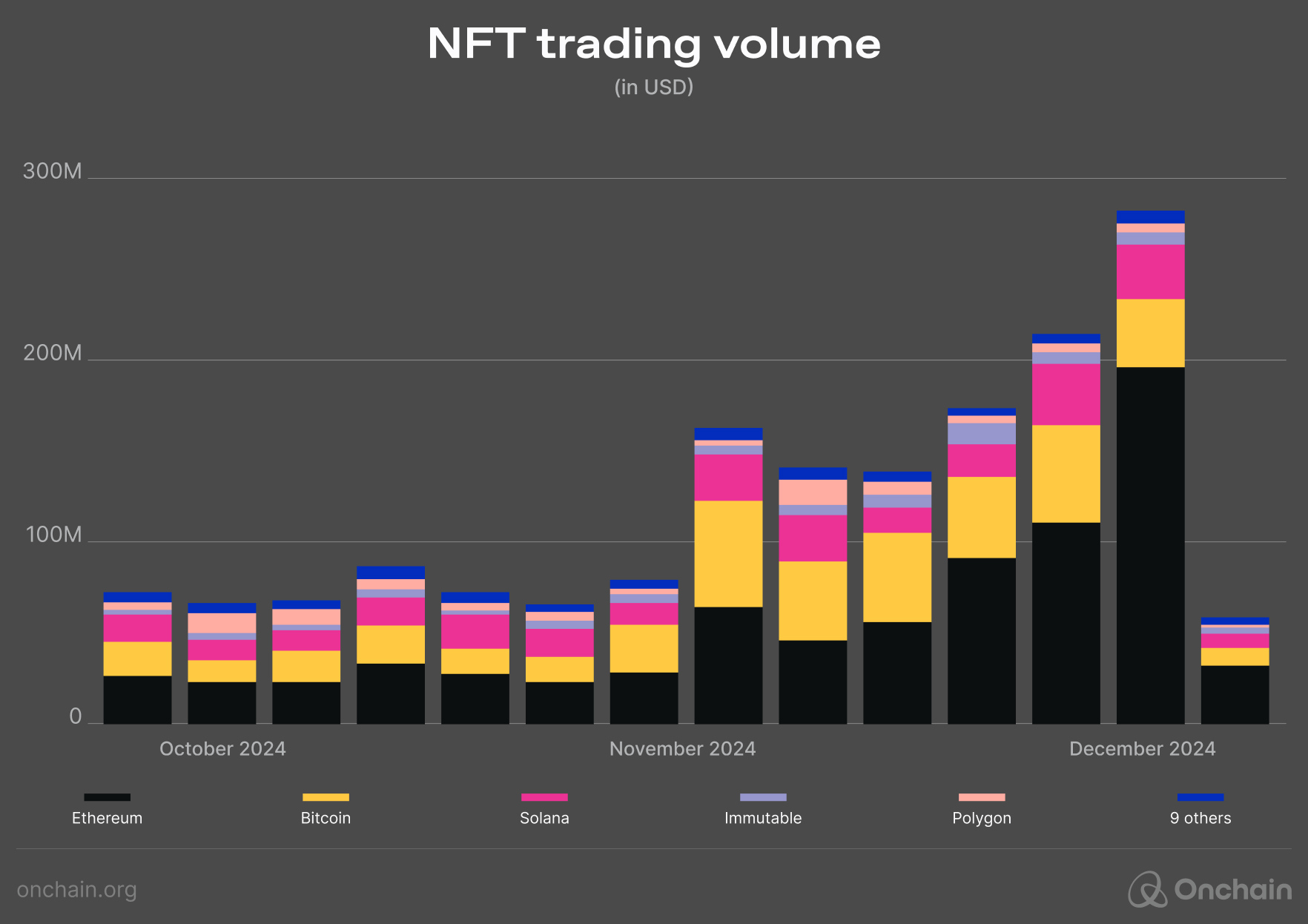

Current volumes show we’re still early

NFT trading volumes have shown a modest but steady recovery throughout late 2024. In October, weekly volumes averaged between $50 million and $70 million, rising to peaks above $175 million per week by December. This resurgence, though encouraging, remains modest compared to the multi-billion-dollar months of the first NFT frenzy in 2021 and early 2022.

These relatively low numbers help us understand that we’re still at the onset of this NFT renaissance. It remains uncertain whether the record heights of 2021 and 2022 can ever be reached again.

Prediction 3: Weekly NFT trading volumes will continue to rise, averaging $200–300 million by mid-2025, yet remain significantly below the multi-billion-dollar peaks of 2021.

Strategic recommendations:

Where to focus your efforts with NFTs in 2025

We’re still early in this new chapter, but not too early to build and innovate. If you’ve been considering diving back into NFTs or launching new ventures, now might be the perfect time to position yourself at the forefront of a market that can be expected to grow in 2025 and beyond. We’re transitioning from a hype-driven frenzy to a steady build-out of value-driven ecosystems, regulatory frameworks, and more tangible use cases. Together, these shifts present an environment ripe with opportunities – slowly but steadily.

1. Utility-driven memberships and loyalty programs

As of late 2024, brands increasingly integrate Non-Fungible Tokens into their membership and loyalty programs. Let’s look at some top brands and how they integrated NFTs:

Examples:

- Hugo Boss’s tokenized loyalty program: In May 2024, Hugo Boss launched “HUGO BOSS XP,” an omnichannel member experience centered around their customer app. This program blends traditional loyalty features with blockchain-supported elements. This allows members to collect and redeem NFTs through purchases and interactions across channels. Initial results from the UK launch indicated double-digit growth in key metrics, including new member registrations and app downloads. The numbers suggest a positive reception among consumers.

- Louis Vuitton’s VIA NFT project: In June 2023, Louis Vuitton introduced the “VIA Treasure Trunk” NFT collection, with each NFT priced at approximately $41,000 (€39,000). These NFTs are designed as digital counterparts to physical luxury trunks. They were limited to a few hundred units and offered exclusive access to future products and experiences. The high price point and exclusivity are aimed at reinforcing brand prestige and customer loyalty.

- Starbucks Odyssey: Starbucks launched its blockchain-based loyalty program, Starbucks Odyssey, in December 2022 — at a time when mainstream utility NFTs were still in their infancy. It allowed members to earn and purchase “digital stamps” (NFTs) that unlocked unique coffee experiences. Starbucks later released a small paid NFT collection, the “Siren Collection,” which sold out in under 20 minutes, but by mid-2024, the Odyssey program was discontinued. Industry observers note that while the idea was innovative, it may have arrived too soon before either the market or the technology had matured enough to sustain engagement. Nonetheless, it remains an instructive case for brands now exploring NFT-based loyalty in today’s more conducive climate.

Opportunities:

- Turnkey NFT platforms for brands: User-friendly, end-to-end solutions that enable everyday businesses to issue, redeem, and manage NFT-based rewards without requiring in-house crypto expertise.

- Enhanced brand-consumer relationships: Direct-to-consumer models that reward loyalty and offer perks, insider content, and event invitations. The goal is to create a sense of belonging and long-term value.

- Data-backed personalization: Ecosystems where participation metrics, such as event attendance, content consumption, and repeat interactions, translate into personalized tokenized rewards. This incentivizes deeper engagement and creates a flywheel of brand affinity.

2. Cultural NFTs on emerging networks

Beyond Ethereum’s established dominance, emerging ecosystems like Base, Ton, Solana, Aptos, and Sui are gaining traction. Cultural NFTs are thriving within these communities and reflect a growing demand for “digital Rolexes” that confer status, tribal identity, and brand affiliation. Successful Solana-based collections like Mad Lads have already illustrated how prestige and vibrant culture can develop on chains outside the Ethereum ecosystem. So, 2025 seems destined to see some “blue chip” NFT collections emerging.

Examples:

- Solana’s NFT market growth: Solana has experienced a substantial increase in NFT sales, with its all-time sales volume nearing $6 billion by October 2024. In that month alone, Solana-based NFTs recorded a 30-day sales volume of $67 million, accounting for 19% of the overall NFT market volume.

- Mad Lads collection on Solana: The Mad Lads NFT collection launched in April 2023 and has become one of Solana’s most prominent projects. By February 2024, it ranked among the top four NFT collections, with a floor price exceeding 200 SOL (approximately $14,630 at that time) and a total volume of approximately 3 million SOL. As of December 16, 2024, the floor price for Mad Lads stands around $14,000.

Prediction 4: Solana, Base, Sui, Ton, and other rapidly growing blockchain ecosystems will mint their own “bluechip” collections, proving that prestige and cultural relevance can thrive beyond Ethereum’s established dominance.

Opportunities:

- Early involvement in new ecosystems still shapes their cultural signatures.

- Launching high-quality, iconic NFT projects that resonate with rapidly expanding user bases.

- Tapping into markets where community identity and aesthetic values drive ongoing demand.

3. Interoperable gaming ecosystems

Gaming provides a natural home for NFTs. With Sony filing patents for interoperable assets, the potential is huge. Analysts project blockchain gaming revenues will surpass $10 billion by 2027, fueled by true digital ownership and cross-platform compatibility. Early experiments, like Off The Grid, show that gamers are willing to invest in portable, tradable in-game items. Infrastructure that enables developers to integrate NFTs seamlessly into existing titles or create marketplaces for cross-game asset transfers could become indispensable. This would forge persistent digital economies that stand the test of time.

4. Compliance and infrastructure solutions

As the U.S. and other global markets adopt clearer pro-crypto regulatory stances, established brands and institutional investors are more likely to join the fray. This influx raises the bar on compliance, fraud prevention, and auditability. Services that integrate KYC/AML protocols offer secure custody solutions or streamline reporting, which can become mission-critical to corporate NFT strategies. Entrepreneurs who focus on compliance, data integrity, and infrastructure will foster trust and open the floodgates for larger players to safely embrace NFTs.

The path ahead: Building the NFT future together

While speculation and hype cycles may still reemerge and distort market fundamentals, there’s also a strong undercurrent pushing NFTs toward more grounded applications. Real-world asset tokenization, loyalty-driven memberships, AI-driven adaptability, and cultural ecosystems that thrive on emerging chains promise to move NFTs beyond their reputation as collectibles du jour.

Still, this potential renaissance isn’t guaranteed. Regulatory clarity, long considered just around the corner, may take longer than anticipated. This would lead to uncertainty and discourage traditional brands and investors from going all-in. Likewise, there’s always the danger of another surge in speculation, which would overshadow steady progress. If influencers and short-term traders regain control of the narrative, we might see price spikes grab headlines instead of meaningful innovation. This could again prevent NFTs from achieving their broader, more sustainable goals.

In 2025, NFTs stand at a crossroads. The question is not whether opportunities exist but whether the market can navigate the regulatory, cultural, and economic challenges that lie ahead. If builders, investors, and users push through the noise and embrace real utility, authenticity, and trust, NFTs could finally shed their boom-and-bust image and become a lasting force.

Thoughts of the Onchain research team

We’re also watching NFTs with cautious optimism. True, Pudgy Penguins landing in Walmart might signal that mainstream retail is warming to tokenized collectibles, while blue chip projects like CryptoPunks remain cultural icons. However, bridging beyond the top-tier communities remains an uphill climb. Most NFT successes hinge on hype, not broad-based utility.

Still, brand partnerships with companies like Target and Sony, along with evolving regulations, could lay the groundwork for a more tangible NFT ecosystem. The real question is whether founders can craft long-lasting, user-friendly applications, like robust loyalty programs or interoperable gaming assets, so NFTs don’t just survive another cycle but thrive in a sustainable and genuinely useful way.