The Trump Administration and New SEC Leadership: A Golden Era for Crypto

In this prediction:

- Why the Trump Administration’s pro-crypto stance is reshaping U.S. regulations and rejuvenating blockchain startups

- How Gary Gensler’s resignation and Paul Atkins’ new SEC leadership could spark a surge in DeFi, NFTs, and real-world asset tokenization

- Where founders can find the greatest growth opportunities as U.S.-based VCs return and ICOs regain traction

- The emerging trends — like AI and DePIN — that stand to flourish under a more favorable regulatory climate

- Actionable strategies for engaging U.S. markets, focusing on consumer tech, and building the next wave of crypto innovation

How technological innovation, onchain finance, and crypto investments are set to flourish in 2025

By 2025, the challenges that once stifled the growth of the blockchain industry — largely due to regulatory pressures – are anticipated to fade. A significant contributor to this turnaround is the resignation of Gary Gensler, the former SEC (Security & Exchange Commission) Chair, following the election of Donald J. Trump as President of the U.S. In Gensler’s place, pro-crypto advocate Paul Atkins, a former SEC Commissioner, will assume leadership and will become the new SEC Chair. Atkins is expected to collaborate closely with commissioners Hester Peirce and Mark Uyeda, both recognized for their strong crypto support. This change is ushering in global ramifications, benefiting not just U.S.-based entrepreneurs but founders and businesses worldwide.

As a European founder and President of a Swiss crypto foundation, I can personally attest to the immense legal and banking hurdles crypto companies face, particularly under Gensler’s tenure. Together with Senator Elizabeth Warren, Gensler spearheaded an anti-crypto agenda characterized by initiatives like “Operation Chokepoint 2.0” and building an “anti-crypto army.” This strategy involved restricting founders’ and investors’ access to banking services while filing numerous lawsuits against crypto companies.

Exodus from the U.S.

For many U.S.-based founders, the regulatory landscape left them with no choice but to relocate their operations to crypto-friendly jurisdictions like Switzerland, Singapore, or Dubai. However, given the U.S.’s pivotal role in the global economy, its policies impacted entrepreneurs far beyond its borders, causing me personally to move to Dubai like many others. I have experienced firsthand how U.S. regulatory uncertainties shaped decision-making. Measures like geo-blocking U.S. users or avoiding targeting U.S.-based individuals became commonplace to mitigate risks of potential lawsuits by the SEC. This pervasive fear not only increased operational costs but also stifled innovation.

A new dawn for crypto

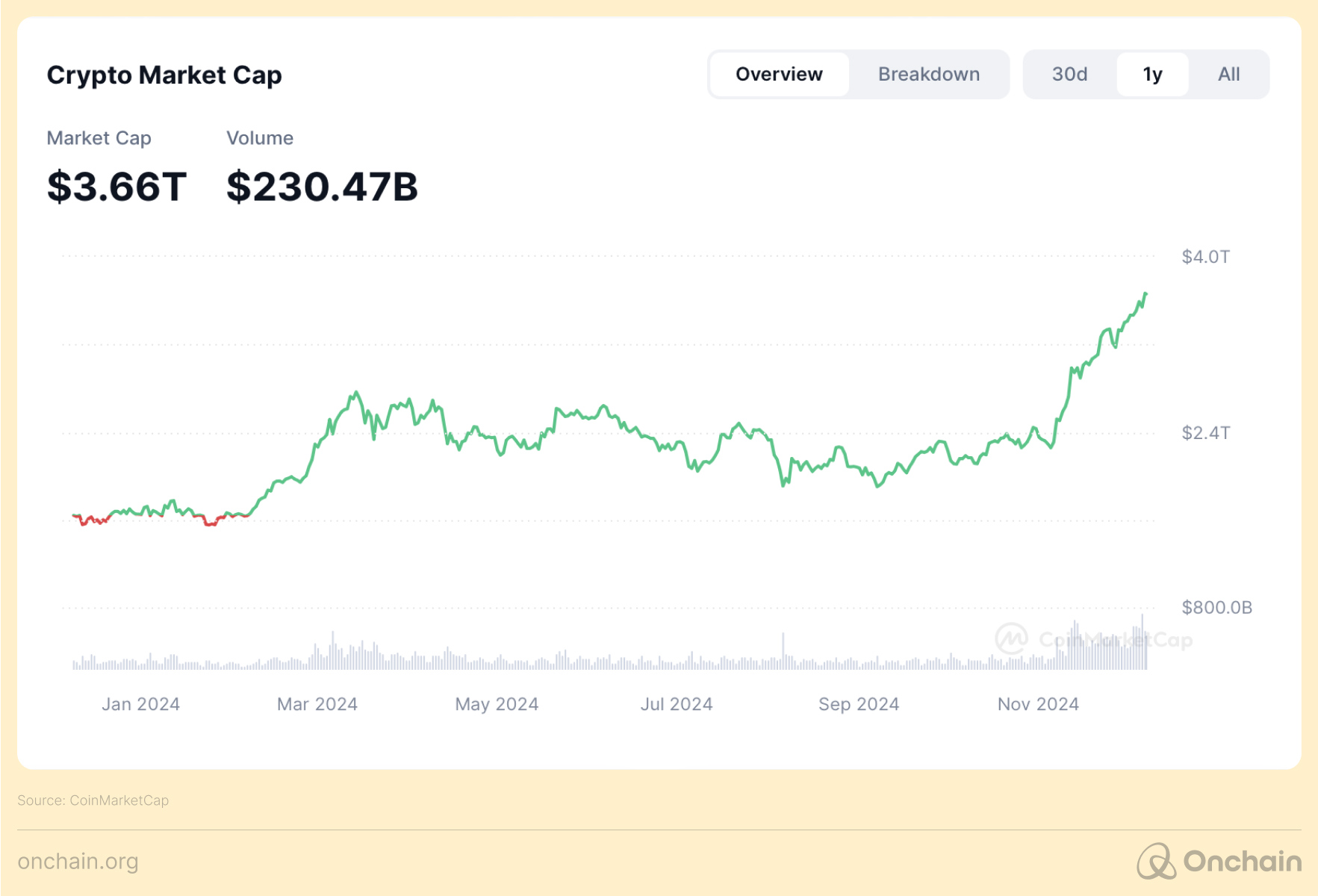

The political shift in the U.S. has marked a turning point. Entrepreneurs now feel a sense of optimism as the regulatory landscape begins to stabilize. This sentiment is reflected in the growth of the total cryptocurrency market cap, which has surged by over 50% — adding more than $1 trillion – since Trump’s election.

While market valuations are an early indicator, the true long-term impact lies in reduced regulatory risks and greater clarity, which enable founders to innovate without fear and investors to fund with larger size. This will have long-lasting, positive implications.

Revitalizing technological innovation

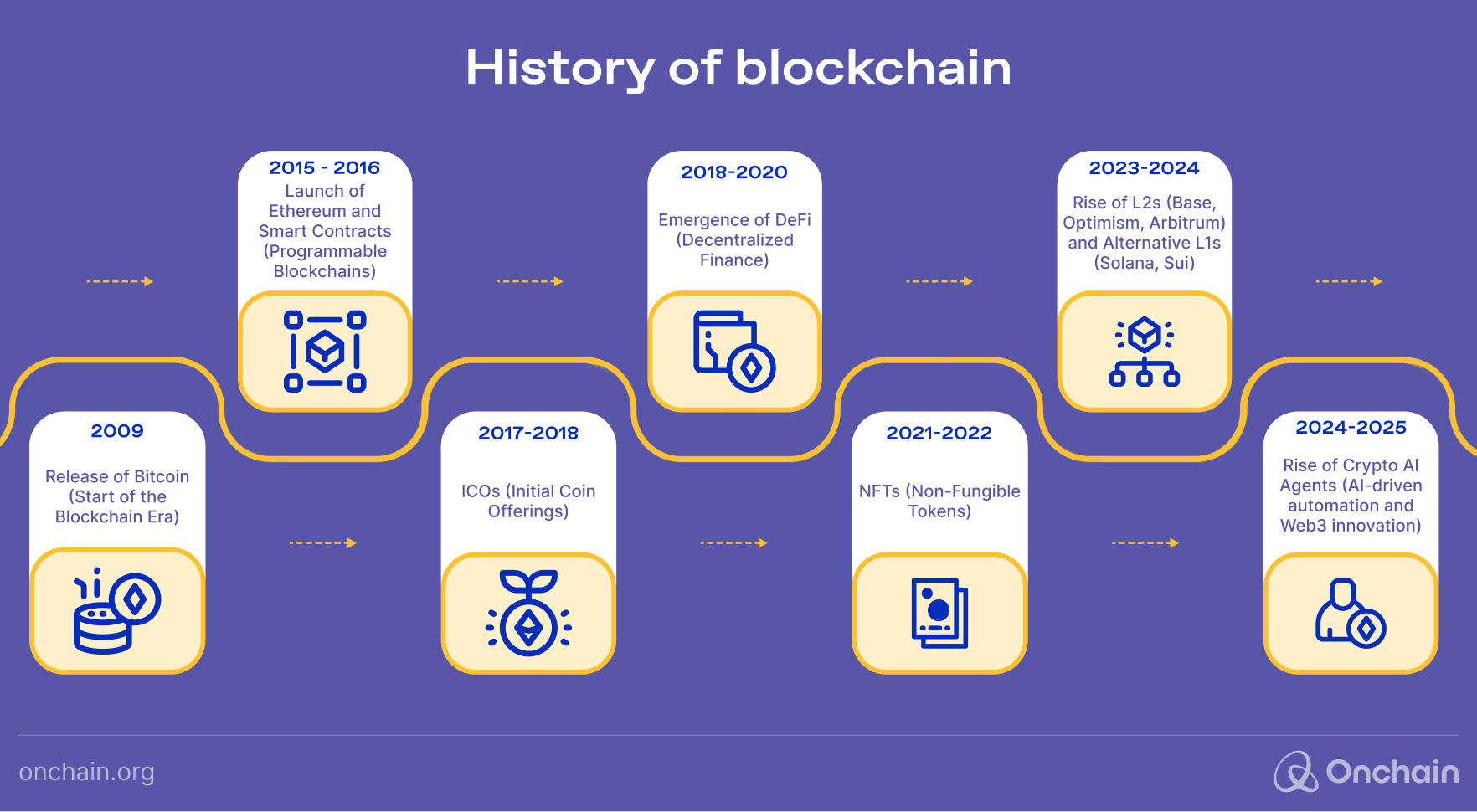

The blockchain industry has historically progressed through waves of innovation.

- 2015 – 2016 – programmable blockchains and smart contracts

- 2017 – 2018 – ICOs (Initial Coin Offerings)

- 2018 – 2020 – DeFi (Decentralized Finance)

- 2021 – 2022 – NFTs (Non-Fungible Tokens)

Each milestone was marked by groundbreaking technological advancements.

In the past years, however, innovation in use cases appeared to stagnate and was largely focused on infrastructure. Entrepreneurs and investors concentrated almost entirely on developing new L1 and L2 blockchains, sparking a widespread public demand for consumer-focused crypto applications.

Recently, memecoins – essentially a rehash of ICOs and DeFi principles – dominated the space, offering little technological substance. This phenomenon stemmed from founders’ reluctance to innovate in a legally ambiguous environment, favoring projects with minimal regulatory risk.

With a more favorable regulatory climate, the industry is poised to explore new frontiers. ICOs, DeFi, and NFTs can now be repurposed as foundational technologies to address emerging trends such as decentralized physical infrastructure networks (DePIN) and artificial intelligence (AI). Privacy-focused solutions may also experience a small resurgence, especially following the recent appeal of rulings against Tornado Cash.

Founders will have all the means to pioneer groundbreaking innovations that have yet to be conceived, creating entirely new blockchain industry sectors.

Prediction 1: Technological consumer innovation will re-emerge as the focal point, with AI and DePIN leading the charge, alongside entirely new sectors being conceived.

Onchain finance: Realizing crypto’s original vision

Since its inception, the crypto industry has pursued the ambitious goal of transitioning traditional finance (TradFi) onto blockchain (DeFi). Over the past decade, significant progress was made in developing infrastructure to support this vision, from token issuance and stablecoins to decentralized exchanges, lending platforms, and oracles with improved user experiences and lower transaction costs. The groundwork was laid to bridge the gap between TradFi and DeFi.

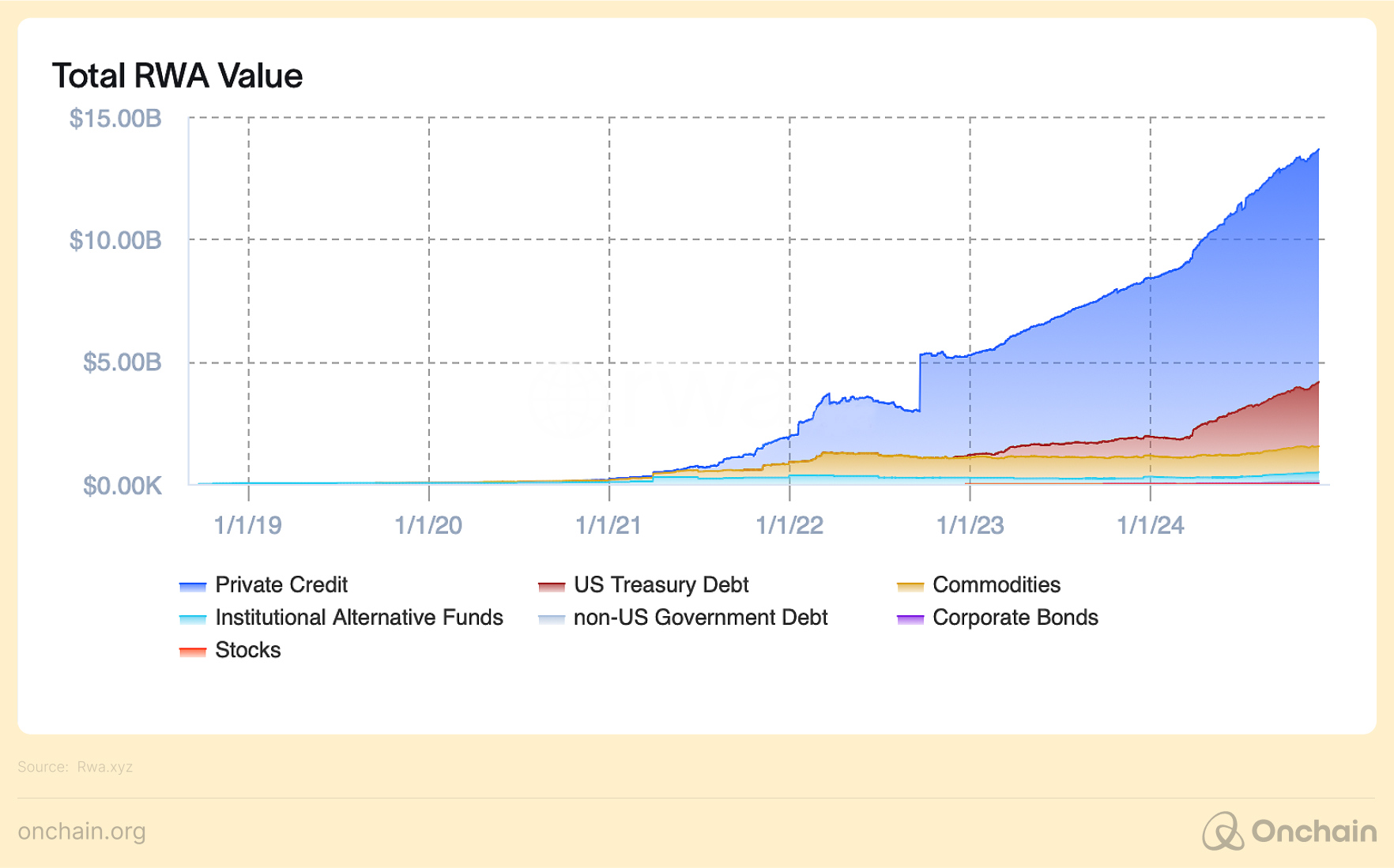

Institutional players are taking notice. Former President Trump has announced the launch of a DeFi platform, World Liberty Financial (though the platform itself is far from perfect). BlackRock, a global investment giant, is heavily investing in real-world asset (RWA) tokenization through its BUIDL fund. Banks are also teaming up with blockchain projects like Chainlink to bring offchain data onchain — for example, the interbank messaging network SWIFT is experimenting with Chainlink to connect traditional finance systems to multiple blockchain networks securely. Additionally, stablecoins, which have achieved significant market penetration, exemplify crypto’s real-world applicability, with companies like Tether and Circle emerging as industry leaders.

For founders and businesses, the opportunity to bring traditional finance onchain is immense. The current onchain RWA market stands at $13 billion and is expected to grow 50-fold by 2030. By replicating existing financial systems onchain, entrepreneurs can capture significant market share and drive the industry forward. A better regulatory environment will lay the foundation for crypto and real-world assets to disrupt finance.

Prediction 2: Real-world assets, particularly stablecoins, will continue to be a fast-growing sector within crypto. The finance industry will begin to be onchain.

The return of U.S.-based investment and founders

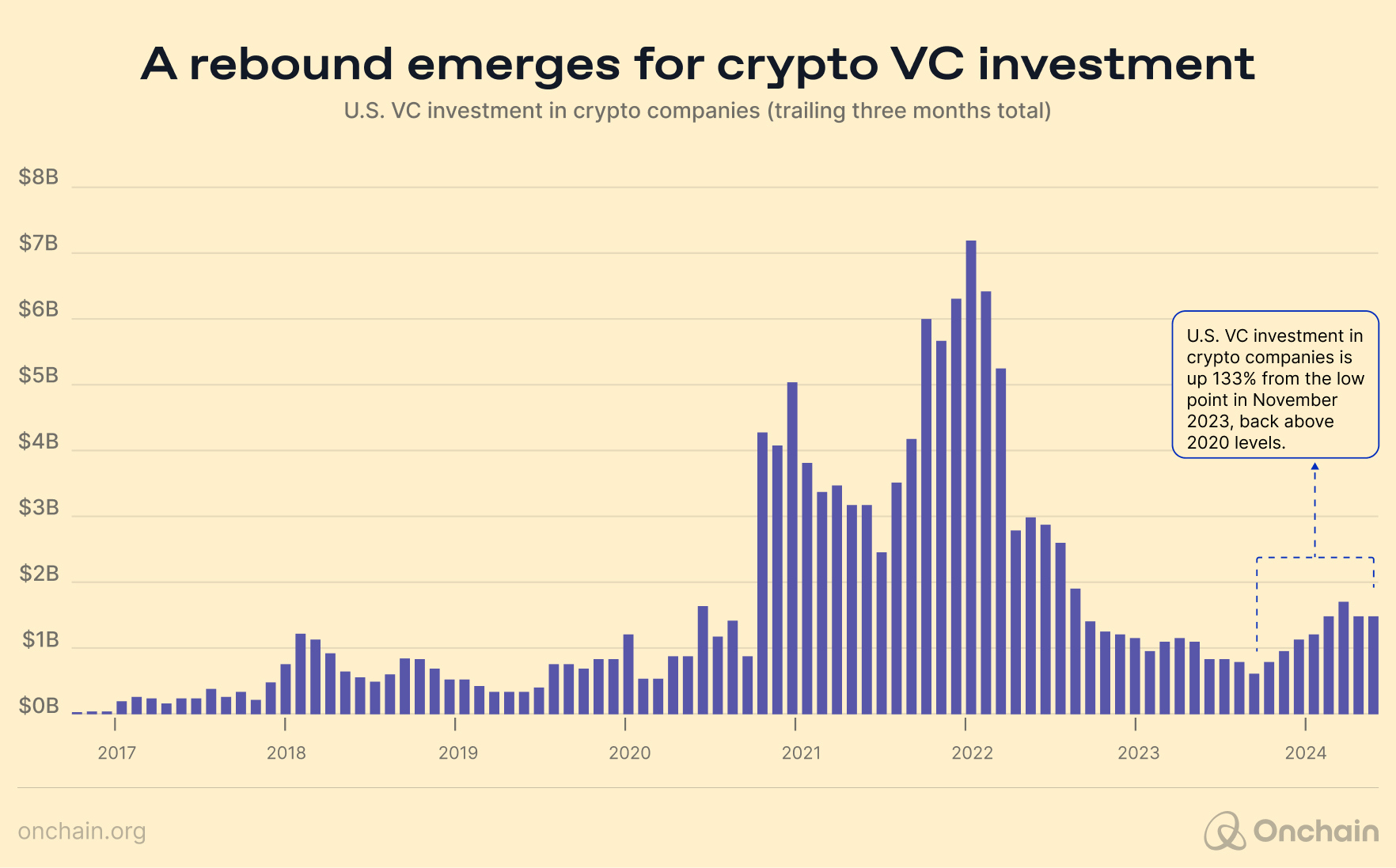

As regulatory certainty improves, venture capital investment in blockchain technology is expected to rise, particularly from U.S.-based VCs that already dominate the sector. This shift will likely encourage founders and their operations to return to the U.S., drawn by greater funding opportunities and an unparalleled entrepreneurial network. Cities like New York and Miami, which have established themselves as crypto hubs in recent years, will grow the strongest; however, I anticipate California will regain relevance due to its concentration of VCs and top-tier talent.

Despite the increasing influence of VCs, there is growing criticism of their control over token distributions. This backlash could lead to a revival of ICOs, offering fairer and more transparent token launches. Platforms like Echo and Legion are well-positioned to facilitate this resurgence. For founders, ICOs are a great growth vehicle as building in public with their community is a great way to ignite a project with retail investors being the first adopters of their products. Additionally, it offers a much fairer token distribution mechanism, allowing everyone to participate without any questionable backdoor deals.

Prediction 3: Founders will return to the U.S., with California re-emerging as a hub. Investment in the industry will grow, and ICOs will experience a revival.

Strategic recommendations

For businesses and entrepreneurs, the time is ripe to capitalize on the evolving regulatory and technological landscape:

- Double down on consumer technology: Focus on emerging trends like AI and DePIN while exploring new, groundbreaking innovations.

- Seize opportunities in RWAs: Bring traditional financial primitives onchain to capture a share of the growing RWA market.

- Engage with U.S. markets: Even if incorporation in the U.S. is premature, targeting the U.S. as a market is essential, given its size and opportunities.

Conclusion

The political and regulatory changes under the Trump administration, coupled with the appointment of a crypto-friendly SEC Chair, signal a new era for the blockchain industry. Founders can now innovate without fear, businesses can operate with greater clarity, and investors can expect robust growth. The U.S. is reclaiming its position as a global leader in crypto, poised to drive the next wave of technological and financial innovation. This is a pivotal moment for the industry — one that promises to shape the future of blockchain for years to come.

Thoughts of Onchain research team

We share Max’s optimism that the new SEC leadership and pro-crypto mood could usher in a “golden era” for U.S. blockchain projects. This shift might give founders room to breathe — reviving ICOs, fueling RWA tokenization, and igniting fresh innovation in AI, DePIN, and more.

However, we’re cautious about relying too heavily on one jurisdiction; global markets remain complex, and political climates can change rapidly. The real opportunity lies in executing these new freedoms responsibly — balancing regulatory gains with the decentralized ethos of crypto so that entrepreneurs worldwide can innovate without losing sight of Web3’s core values.