2. Don’t Compete in Crowded Markets — Complement Instead

You’ll learn:

- Which RWA sectors are gaining traction, and why do projects scale while others stall.

- How the stablecoin scenario is replaying across treasuries, credit, and commodities.

- Where TradFi dominates and how founders can plug in by building wrappers, rails, and UX layers.

- Where demand is growing fastest, from DeFi integrations to emerging markets such as Nigeria, Brazil, and the UAE.

- What the next breakout primitives may look like and how to spot them early.

Stablecoins have set the benchmark for how crypto rails can support real-world utility at scale. But what about the rest of the real-world asset (RWA) landscape?

Across RWA categories — treasuries, private credit, commodities, real estate, and equities — the stablecoin scenario may be about to repeat itself. We see a rise in institutional interest, integrations with decentralized finance (DeFi), and growing momentum in emerging markets. But unlike stablecoins, this traction is nascent and uneven.

Outside the United States, regulators dabble. Hong Kong issued two rounds of tokenized green bonds, demonstrating that sovereign debt can ride on public ledgers. Nigeria and other frontier economies publicly explore tokenized government papers as a cheaper route to global capital. However, most regions still view tokenization as a means for representing fiat currencies (e.g., USD, EUR), rather than a gateway to broader asset classes. The question is what is being tokenized and where it is working.

That perception is changing.

In May 2024, the U.S. SEC hosted a roundtable titled “Tokenization: Moving Assets Onchain.” Wall Street firms and crypto-native builders showed up. For the first time, there was consensus: Tokenization can no longer be perceived as a new feature only. We’re looking at foundational infrastructure.

This is the moment where speculation turns into transformation. And nowhere is that clearer than in U.S. Treasuries.

Tokenized U.S. Treasuries: From experimentation to traction

Stablecoins demonstrated the global appetite for tokenized dollars. Tokenized U.S. Treasuries prove that the same appetite exists for onchain yield, with trust baked in.

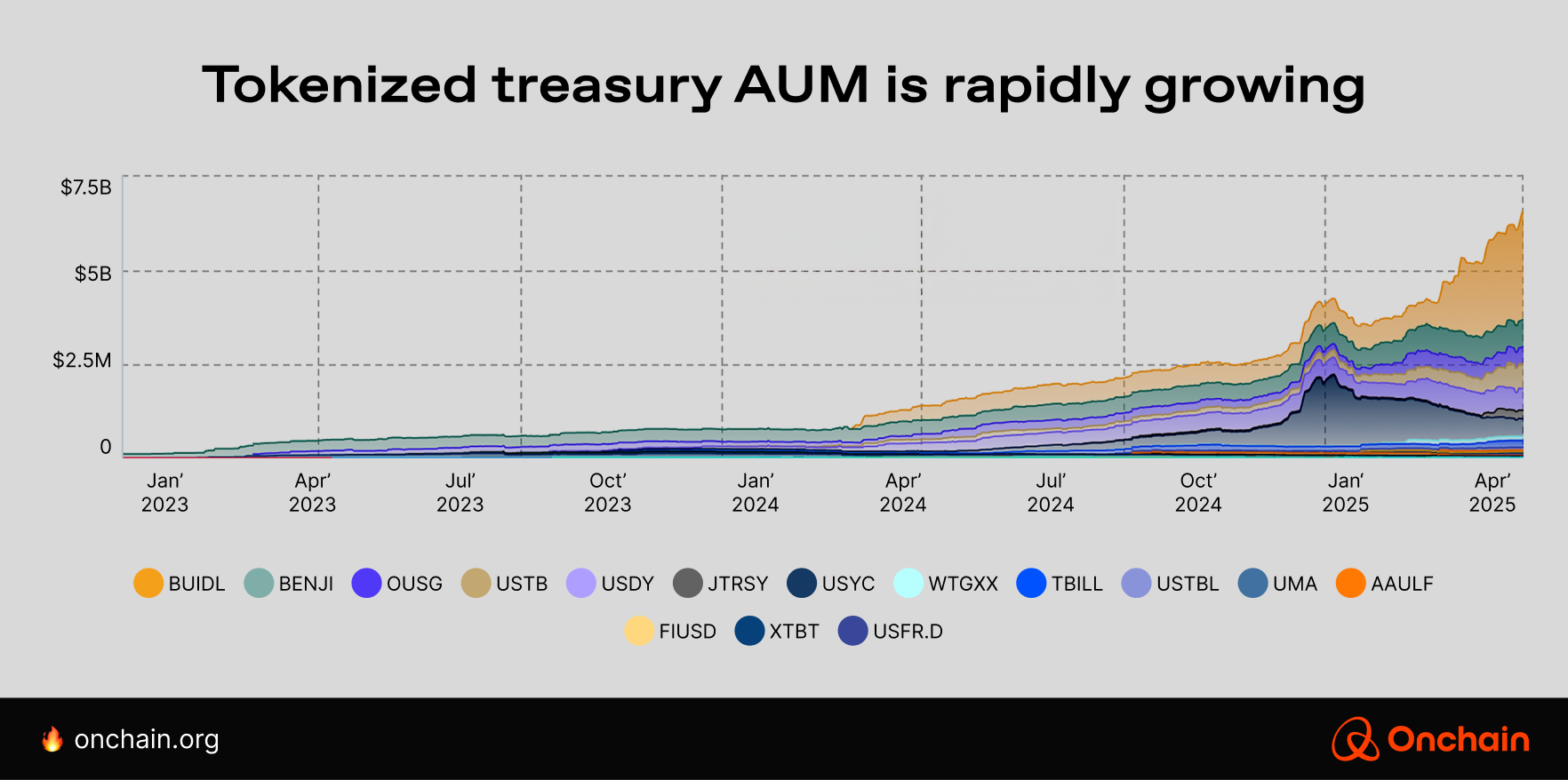

In one of the biggest success stories of 2025, tokenized treasuries surged past $7 bil in value. This wasn’t grassroots DeFi driving adoption; it was Wall Street.

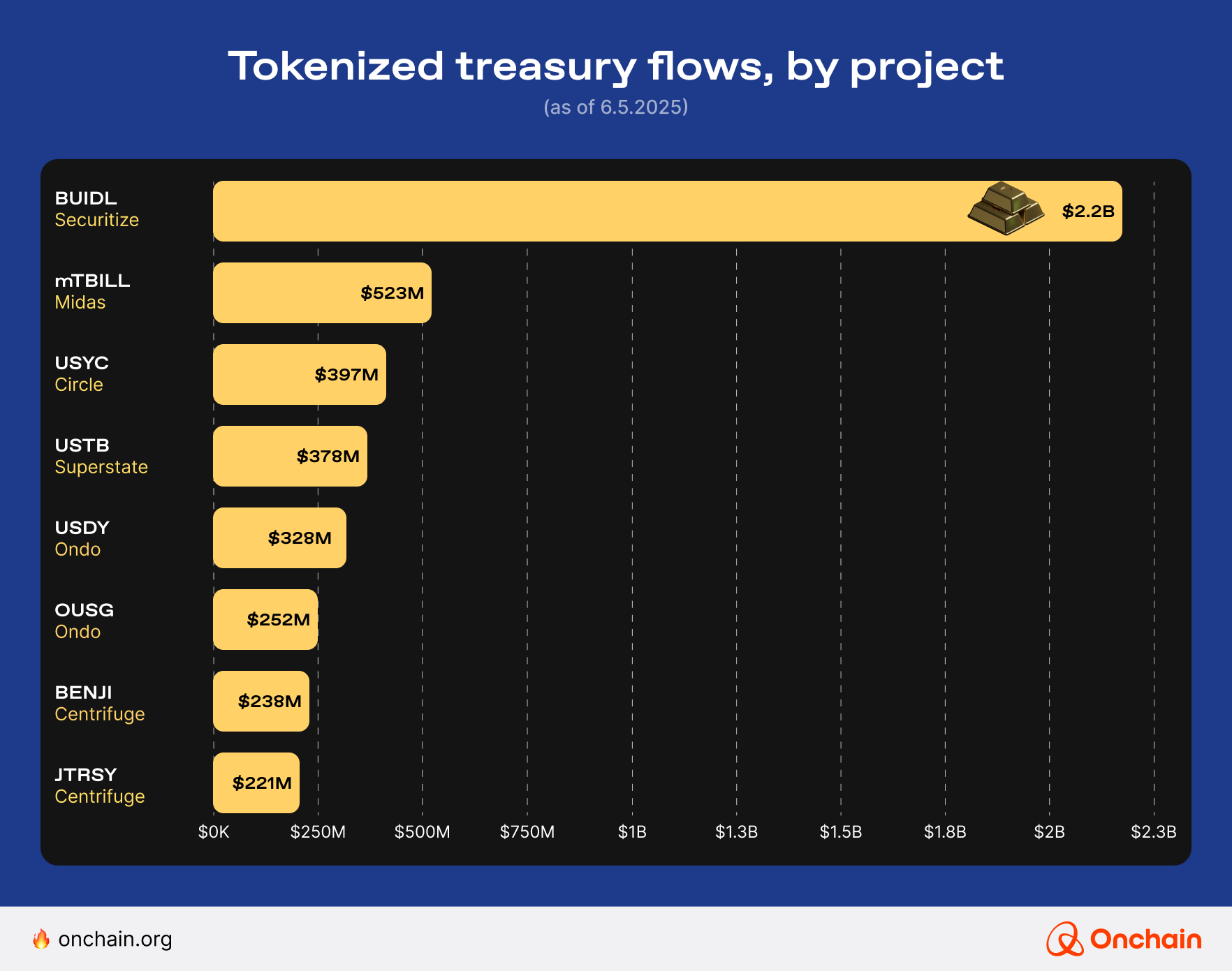

BlackRock’s BUIDL is the breakout success of 2025. Launched in late 2023 and powered by Securitize, the tokenized treasury fund reached $2.9 bil in assets under management (AUM) by May, capturing over 40% of the entire tokenized treasury market.

Why are tokenized treasuries booming?

🔶 High yield meets high trust.

With U.S. Treasury yields hitting 5 percent in 2024, investors from decentralized autonomous organizations (DAOs) to institutional funds wanted access. Onchain wrappers offered exactly that, without the slow, expensive TradFi plumbing.

It’s a very efficient technology, and we think it’s going to open up a lot of new investment opportunities. And, honestly, eventually, I think ETF and mutual funds are all going to be on blockchain.

- Jenny Johnson, CEO, Franklin Templeton

🔶 Composability with DeFi.

These aren’t isolated assets. BUIDL and BENJI integrate with DeFi platforms. MakerDAO added treasuries to its DAI collateral pool. DAOs park idle funds in yield-generating vaults.

BlackRock’s BUIDL is a prime example. It pairs the safety of U.S. government debt with the speed and composability of Ethereum scaling infrastructure. Cross-border settlement that used to take days now happens in minutes, at a fraction of the cost.

There hasn't been a short-term treasury tokenized product that provides USD yield onchain at scale until the launch of BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”).

- Securitize

By April 2025, BlackRock’s BUIDL fund had become the largest tokenized treasury product with a ~$2.6 bil market cap, accounting for roughly 41% of the sector.

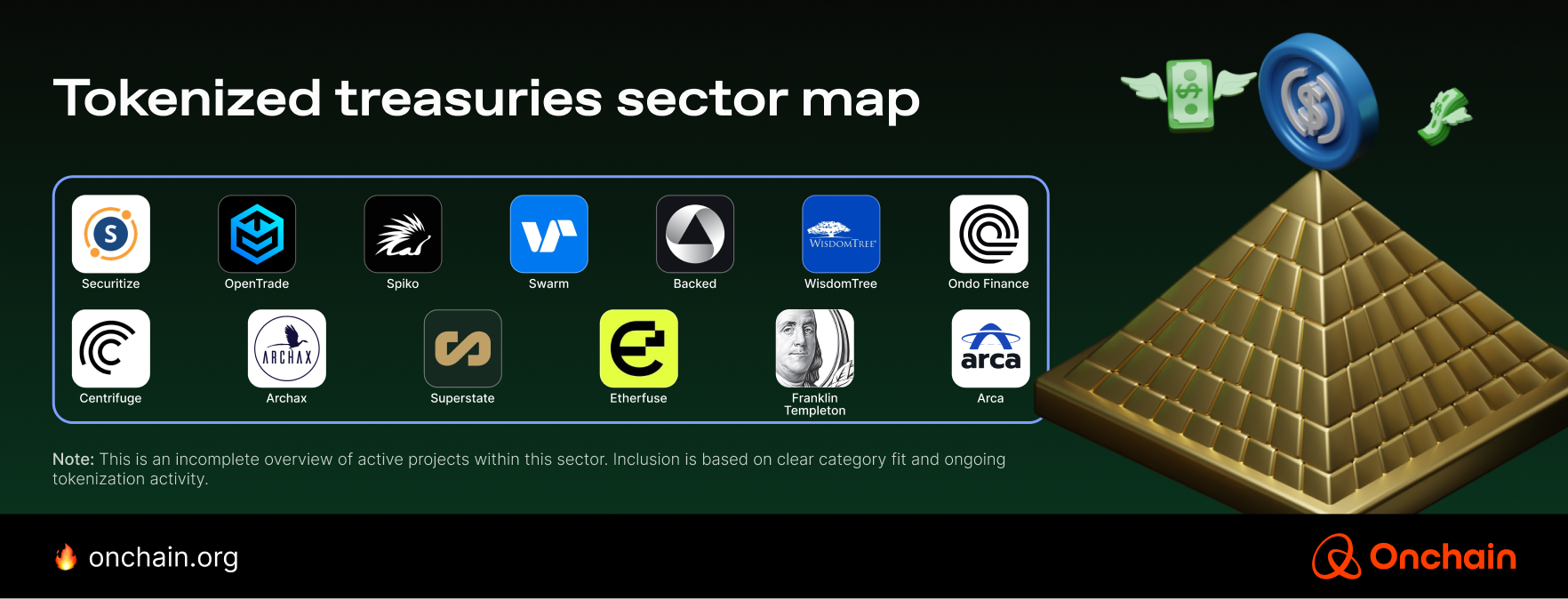

However, several other issuers are also actively building in this space.

Thus, this institutional involvement provides credibility and facilitates large-scale issuance, effectively bringing Wall Street to Ethereum.

But it’s happening elsewhere as well. Chains like Polygon, Solana, Stellar, Arbitrum, and even IOTA are also gaining traction, signaling a broader industry trend rather than a one-off experiment.

So what’s working, and what’s not?

Let’s break it down.

💡 These are the issuers that got the formula right — compliance, composability, and capital.

💡 Founder takeaway

You don’t need to tokenize treasuries. You need to wrap, distribute, or abstract away what already exists. Think APIs and UX, not asset management.

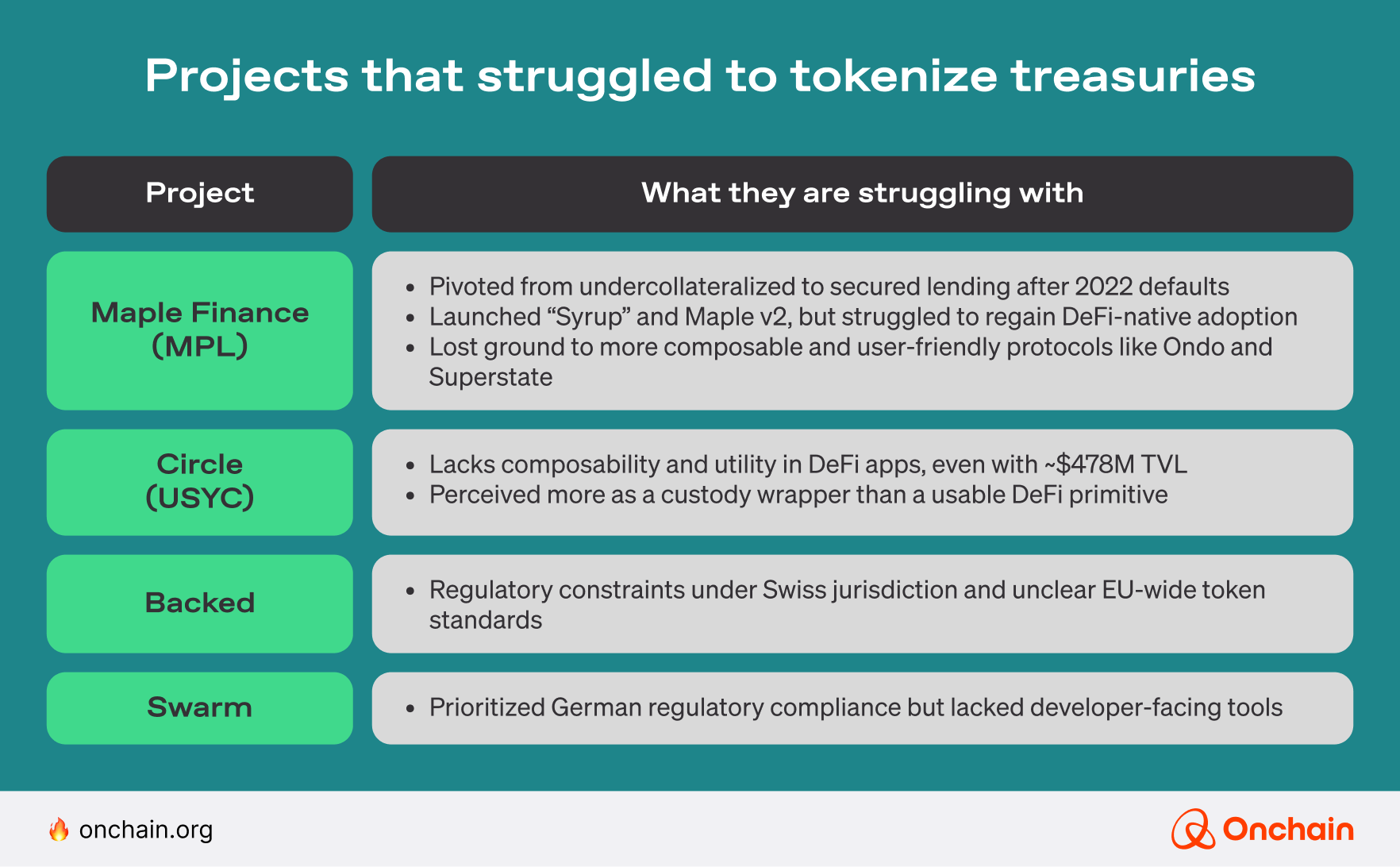

💡 Founder takeaway

Regulatory clarity is necessary, but it’s not sufficient. Without usability, you won’t gain traction in a composable world.

What about adoption in emerging markets?

The excitement around tokenized treasuries isn’t limited to Wall Street. The year 2025 has witnessed significant advancements in the adoption of tokenized U.S. Treasuries, driven by both institutional initiatives and emerging market participation.

In 2025, tokenized treasuries have already experienced broad adoption on two key fronts: TradFi giants from Wall Street and institutional players from emerging markets.

- Wall Street giants such as Goldman Sachs are significantly expanding tokenization initiatives. The leading global investment bank is set to launch three major tokenization projects in 2025, including its first tokenized U.S. investment fund and a euro-denominated digital bond.

- Institutions in emerging markets are also making substantial strides. For instance, Realize (Abu Dhabi) launched a tokenized T-bill fund, tradable on IOTA and Ethereum, targeting $200 mil AUM under a license from the Abu Dhabi Global Market (ADGM). This marks the first-ever regulated tokenized fund domiciled in Abu Dhabi.

- Governments and Fintechs in emerging regions are equally active. Hong Kong successfully issued tokenized green bonds in July 2023, and Nigeria is actively experimenting with government bond tokenization, showcasing the broader global shift towards sovereign debt tokenization.

💡 Founder takeaway

There’s whitespace in localization. Help governments, local banks, and Fintechs issue, distribute, or access tokenized sovereign debt in their own region.

How does DeFi react?

Protocols are adapting, but the stack remains messy.

- MakerDAO added T-bills to DAI collateral in 2023. That move now earns the DAO a strong risk-free yield in 2025.

- Lending protocols are integrating tokenized treasuries as collateral.

- Stablecoin projects are exploring real yield-backed models.

But there are still pain points:

Despite growth, tokenized treasuries face structural hurdles.

🔒 Access restrictions (accredited/KYC only)

🧱 Liquidity fragmentation (many chains, few bridges)

💰 High entry minimums for non-U.S. users

💡 Founder takeaway

Opportunity for founders:

Instead of trying to compete with BlackRock, build what they won’t: the UX, rails, and access layers that make tokenized treasuries usable for the rest of the world.

The rails exist. Now they need interfaces, abstractions, and distribution. That’s where the next wave of products and services centered on tokenized treasuries will emerge.

Want to build in this space?

Our upcoming exclusive Onchain Report for members breaks down how to design wrappers, yield flows, and composable infrastructure around these primitives, with real examples and plug-and-play frameworks.

Get ready to go from watching the market…to shaping it.

Tokenized commodities: When tangible assets go onchain

If stablecoins gave us digital cash, and tokenized treasuries gave us digital yield, what’s next?

The answer is hard assets: gold, silver, uranium, and carbon.

In addition to being stored in vaults or traded on legacy exchanges, in 2025, these assets are composable, borderless, and live onchain. Investors are paying attention.

Gold leads the pack — but it’s just the beginning

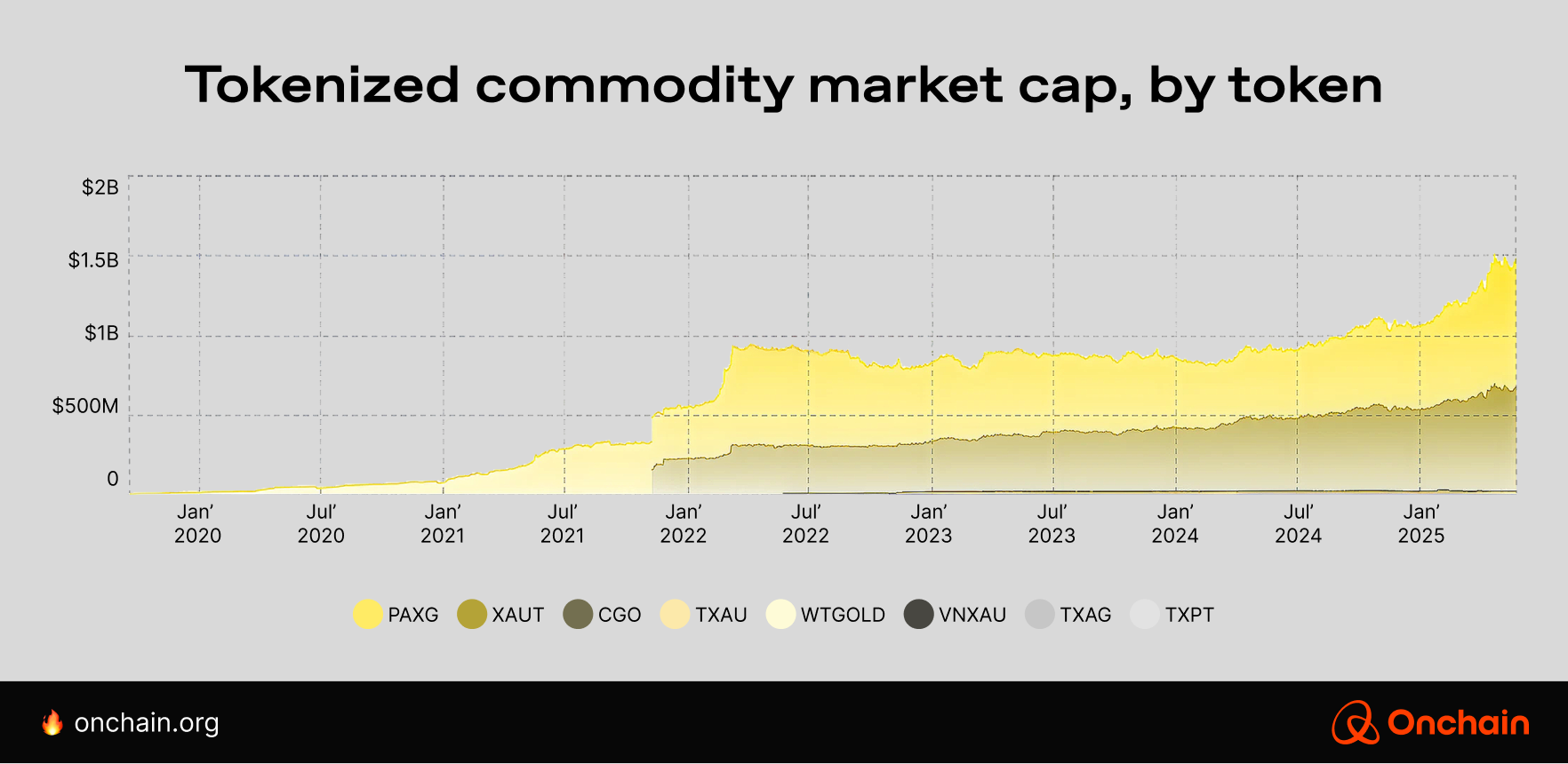

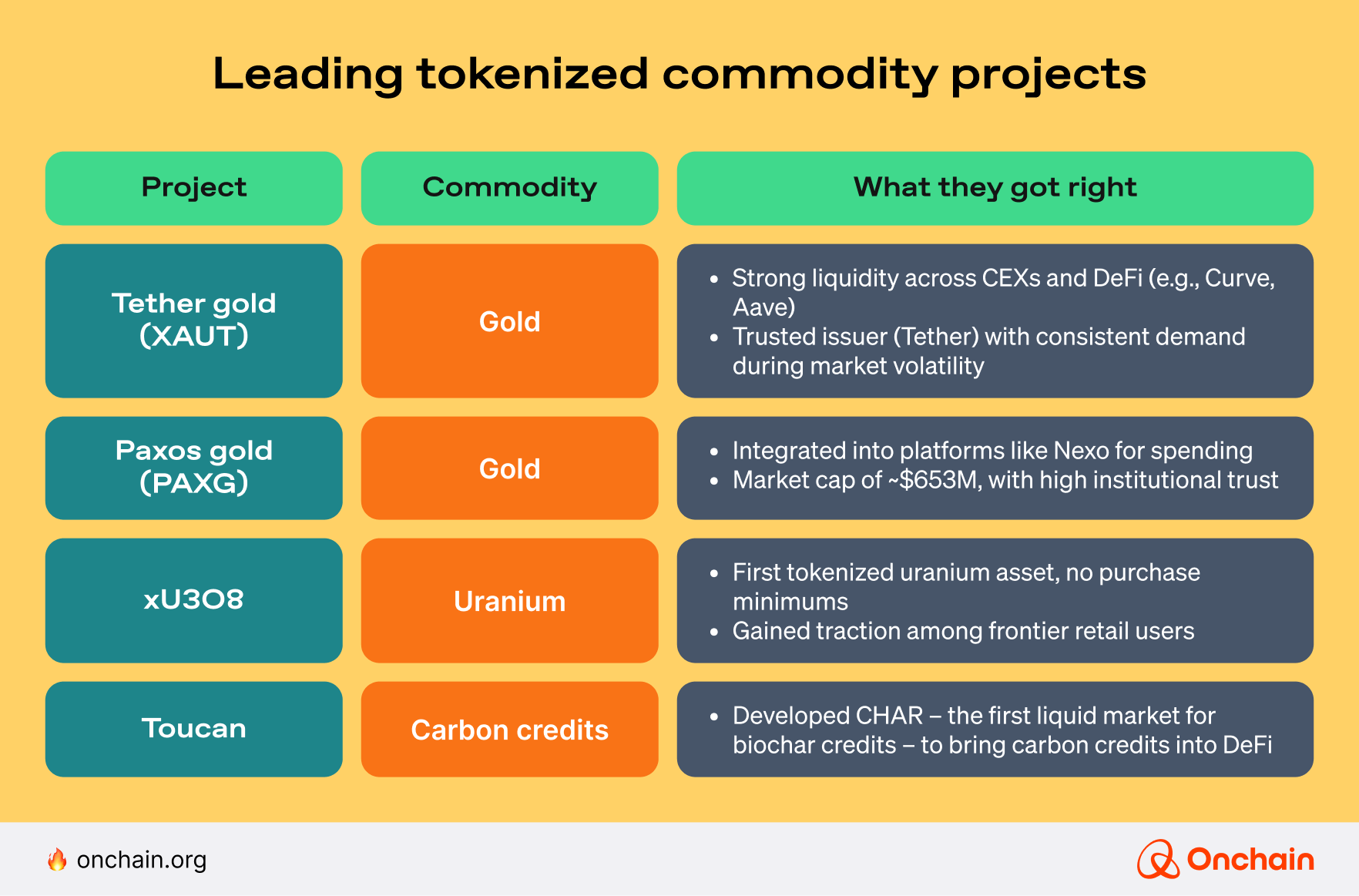

In March 2025, the combined market capitalization of gold-backed stablecoins hit a record $1.5 bil. Tether’s XAUT and Paxos’ PAXG are the clear leaders, with XAUT at about a $654 mil and PAXG at a $804 mil market cap, respectively, as of that time. Trading volumes for these tokens spiked to multi-year highs, topping $1.6 bil in monthly volume.

The catalyst: The price of physical gold rallied to all-time peaks (surpassing $3,000/oz in some markets), and crypto investors sought refuge in digital gold during crypto market turbulence. In effect, tokenized gold provided a familiar safe haven, but on blockchain rails.

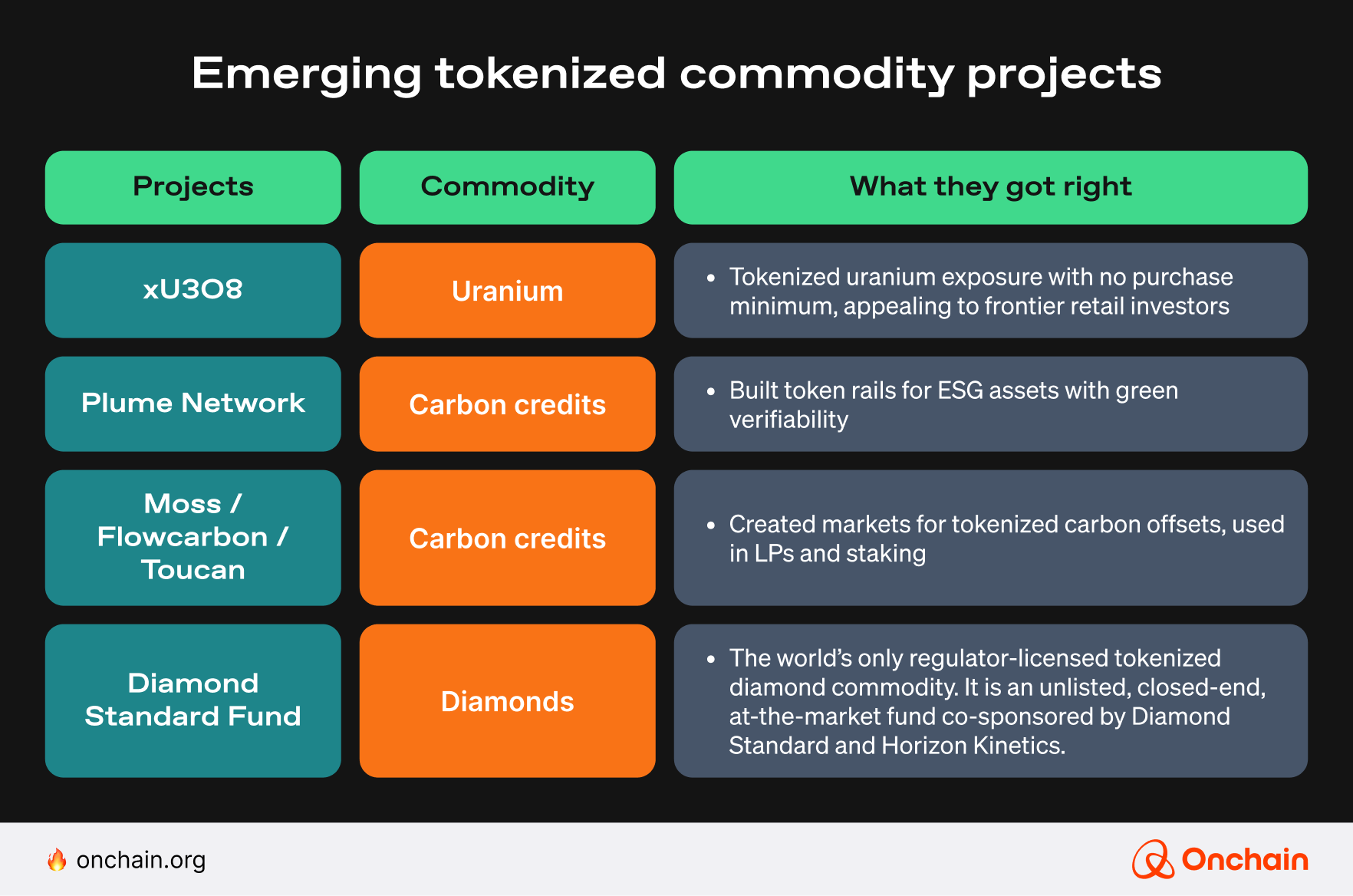

Beyond gold: The rise of alt-commodities

Here’s where founders get creative:

These projects are transforming tokenized assets into programmable financial instruments, which are utilized in lending, yield strategies, payment flows, and tokenized ETFs.

Why is it working now?

✅ Macroeconomic tailwinds: As inflation and rate volatility persist in 2025, investors worldwide are turning to hard assets for protection, and tokenized commodities offer both accessibility and portability.

✅ Cultural familiarity: In emerging markets, people already trust commodities like gold more than fiat currencies, and now they can hold it digitally, without the need for vaults or borders.

✅ Composability with DeFi: Gold tokens like PAXG and XAUT are accepted as collateral in Fringe Finance, tradable on DEXs, and used in structured yield products. Other tokens, such as uranium or carbon credits, are entering DeFi through liquidity pools and staking protocols.

✅ App integration: Fintechs like Nexo are beginning to integrate commodity tokens into crypto cards, allowing users to spend gold-backed tokens (such as PAXG) by instantly converting them to fiat at checkout. This unlocks real-world utility, not just hodling.

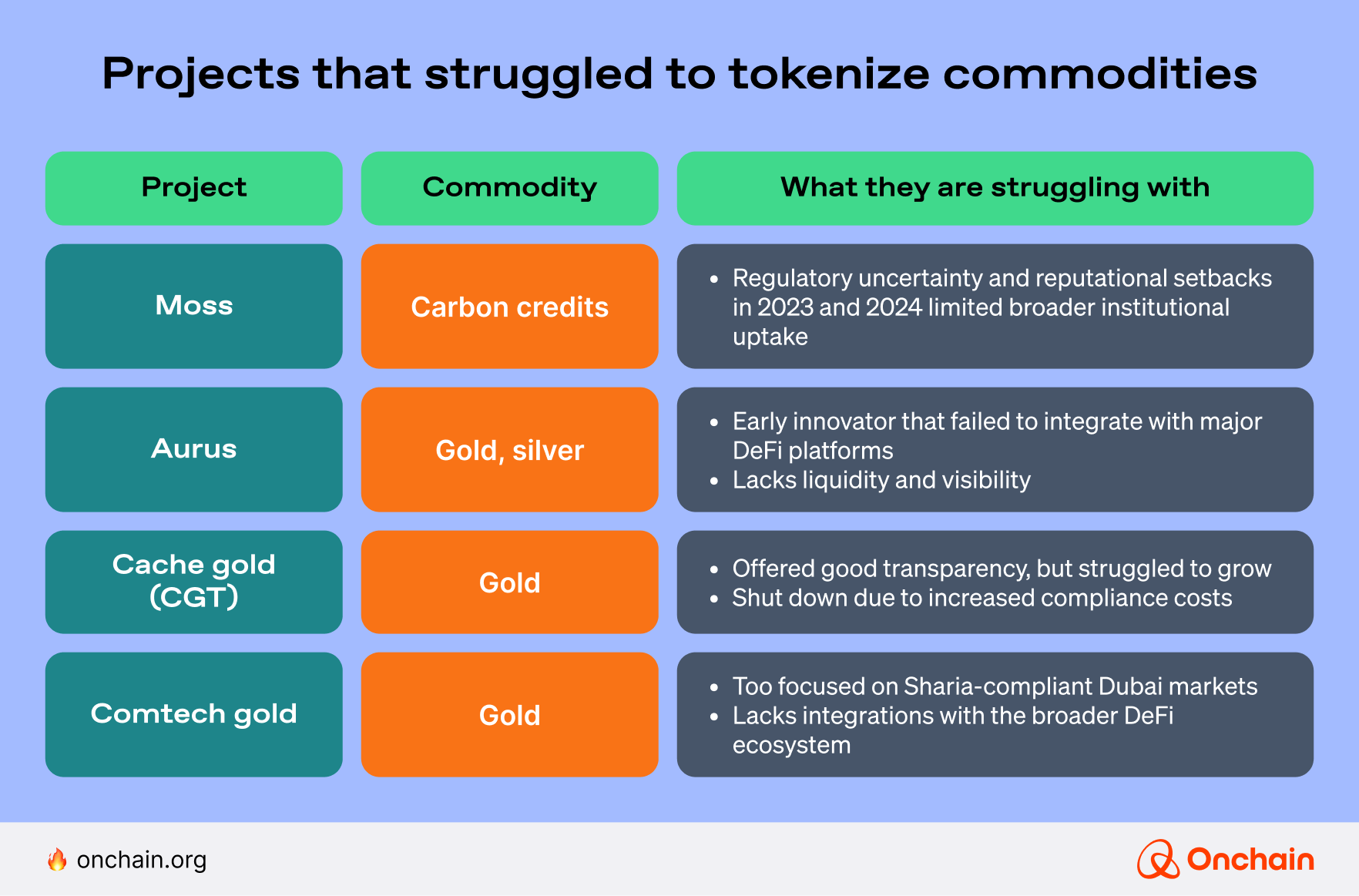

Performance snapshot (2024-25): What worked and what didn’t?

These projects gained momentum, scaled adoption, and integrated with DeFi or real-world financial systems.

These projects faced barriers such as a lack of liquidity, unclear market positioning, or reputational issues.

💡 Founder takeaway

Successful commodity tokenization isn’t about launching new assets — it’s about creating value by integrating existing commodity-backed tokens into widely-used products and services.

For example, Nexo integrated Paxos gold (PAXG) directly into its lending and savings platform. Users can borrow, earn interest, and utilize PAXG without the complexity of minting new gold tokens, thereby significantly enhancing user adoption.

Despite its potential, this vertical faces steep hurdles.

➡️ Regulatory treatment is unclear. Depending on jurisdiction and structure, a token representing a commodity might be considered a digital commodity or a security.

➡️ Market fragmentation is another issue. A gold token from issuer A isn’t always interchangeable with one from issuer B, and it harms liquidity.

Today's onchain carbon ecosystem is fragmented and excludes the largest demand centers for the voluntary carbon market (VCM): industry and commodities.

- Dana Gibber, Chief Executive Officer, Flowcarbon

➡️ Additionally, commodities often involve numerous middlemen (inspectors, shippers, insurers); tokenization can streamline these processes, but it also has to integrate with real-world operations, which is challenging.

💡 Founder insight

Action items:

Rather than launching yet another commodity-backed token, focus on building essential infrastructure around successful tokens. Practical approaches include:

- Create DeFi platforms that accept commodity tokens (e.g., gold, carbon credits, uranium) as collateral.

- Wrap existing tokens into yield-bearing products or diversified index baskets.

- Integrate commodity tokens into user-facing products such as crypto debit cards, wallets, and DeFi savings tools.

- Provide essential tooling such as oracles, compliance infrastructure, and cross chain bridges to vault operators.

The opportunity hides in the tooling, not the tokens. Whoever abstracts away the friction will win the capital flow.

Private credit: Quietly powering the onchain economy

When crypto headlines are ablaze with non-fungible tokens (NFTs), memecoins, and restaking derivatives, private credit may seem like the most mundane corner of Web3. But founders know better.

What if the next billion-dollar Web3 opportunity isn’t another airdrop but underwriting a cross-border trade loan?

Welcome to onchain private credit, where Fintech infrastructure meets DeFi, and borrowers actually repay.

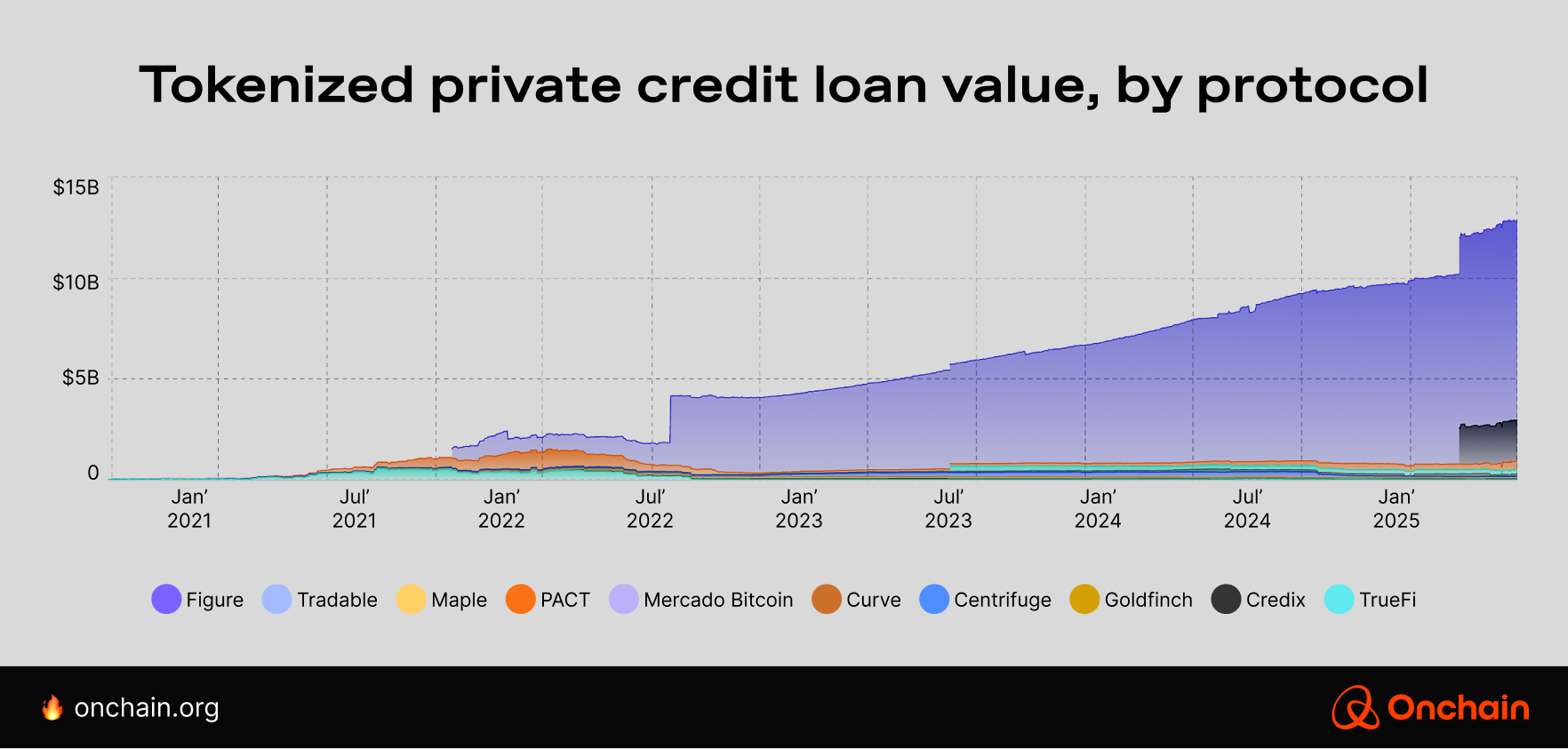

A $12 bil proof of progress

In TradFi, private credit, including non-bank lending such as SME loans, real estate debt, or invoice financing, is a $1–$2 tril market.

In Web3, the total is now $12 bil in tokenized active loans, up 56% YoY as of March 2025.

📈 That’s faster growth than tokenized treasuries, real estate, or commodities.

Even more interesting is that a growing share of these loans are undercollateralized.

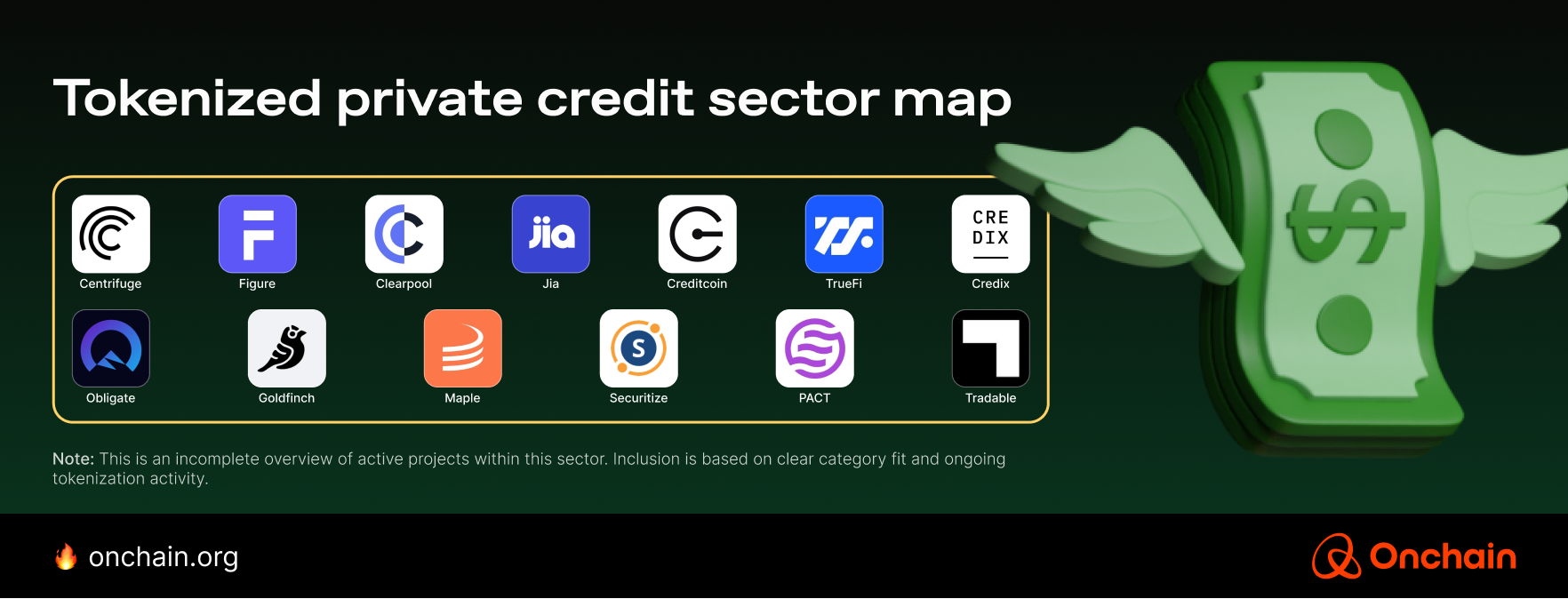

Platforms like Goldfinch, Centrifuge, and Credix enable real-world borrowers — from Latin American (LATAM) Fintechs to African logistics firms — to access working capital without requiring 100% crypto collateral. That’s a significant shift. It means trust is being moved onchain via novel mechanisms, such as borrower vetting, legal recourse, and onchain credit scoring.

🧠 Curious how undercollateralized lending works in crypto? Read our deep dive on onchain credit scores and the platforms rewriting the rules of trust in DeFi.

Where did this growth come from?

- $9.6 bil came from Fintechs like Figure that tokenize everything from home equity lines of credit (HELOCs) to mortgage-backed loans.

- The rest? DeFi-native lending protocols, such as Goldfinch, Centrifuge, Maple Finance, TrueFi, and Obligate, have invested hundreds of millions in real-world businesses.

These numbers suggest that tokenized private credit is finding product-market fit (PMF) as a means to connect global capital with borrowers through blockchain.

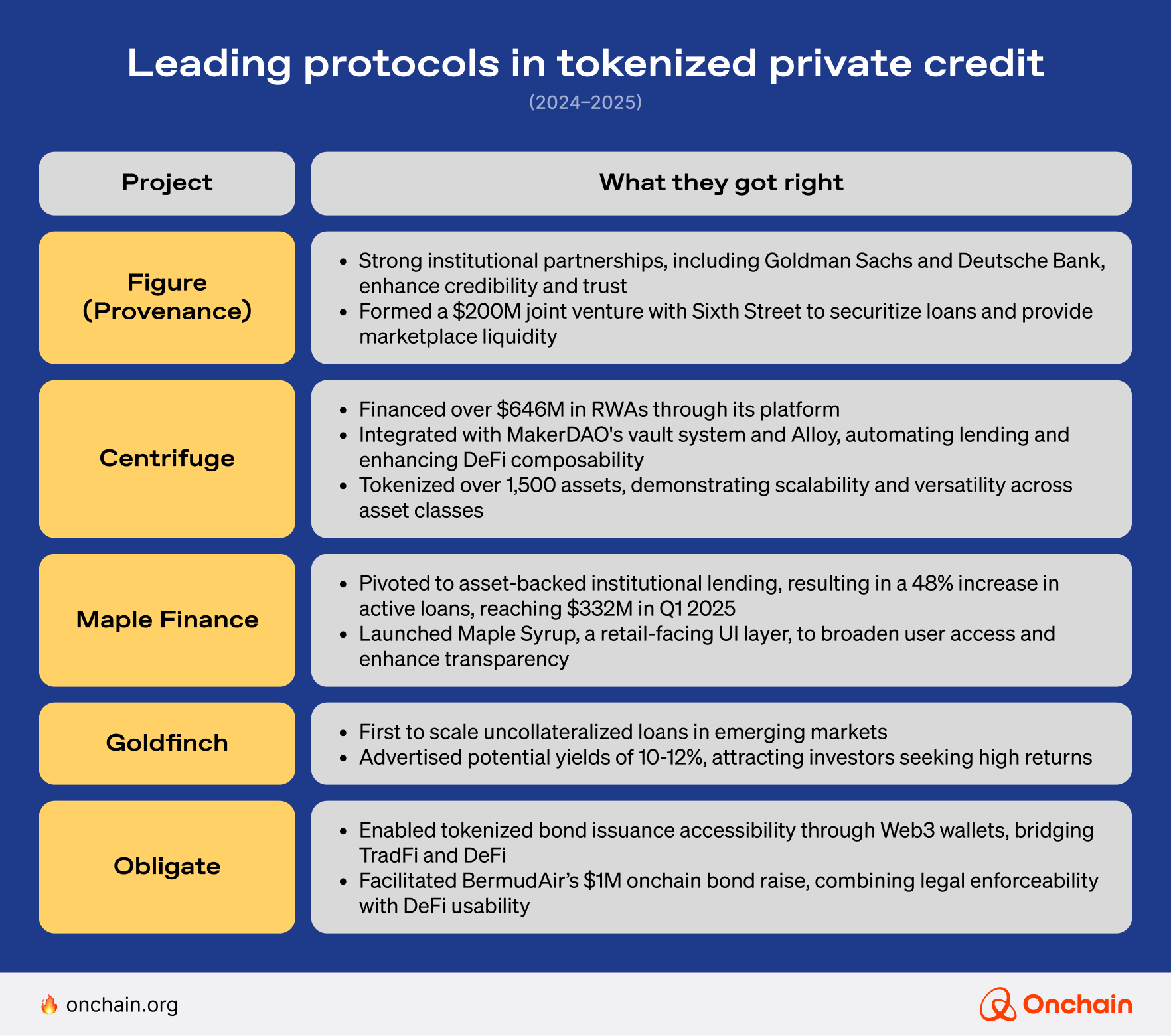

These projects survived the crypto winter and also iterated, specialized, and matured. Each represents a unique entry point for founders: from UX wrappers to scoring engines to regional expansion.

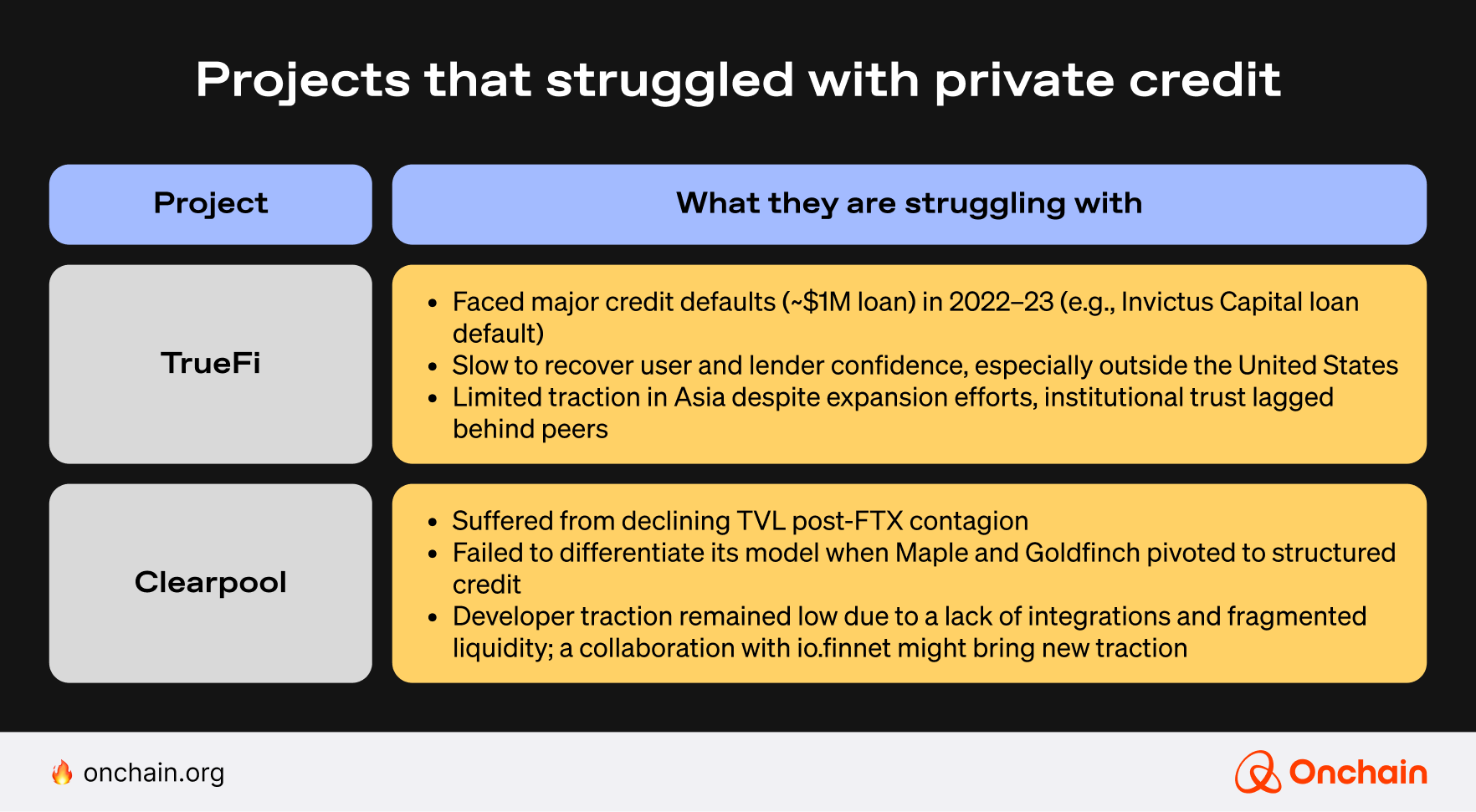

⚠️ In contrast, the laggards faced challenges due to market volatility, defaults, and difficulties in differentiating their offerings.

Institutional trust in blockchain credit builds on measurable success. Platforms such as Maple and Figure have moved beyond speculative DeFi narratives. Instead, they deliver programmable credit solutions that are integrated seamlessly with enforceable, real-world legal frameworks.

Onchain private credit is a quiet success because it solves a real-world problem: connecting global capital with businesses that need it. It proves that DeFi doesn't have to be entirely trustless; rather, it's about building more effective, transparent rails for trust to operate on.

- Marko Vidrih, Co-Founder, RWA.io

By demonstrating reliability, compliance, and tangible benefits, these platforms make blockchain-based lending increasingly attractive to TradFi institutions, as the following examples show:

- Apollo Global, a $500 bil AUM firm, began onboarding private credit portfolios via Provenance.

- JPMorgan issued tokenized money market shares and collateral instruments onchain.

- Maple scaled from 4 to 28 institutional borrowers in 12 months. Over 800 lenders are actively deploying capital through the protocol, up from just 250 a year ago.

This institutional embrace is also evident in the total numbers: By late 2024, overall tokenized private credit had grown ~44% year-to-date, largely thanks to these major players.

Isn’t DeFi supposed to remove intermediaries? Why are we adding credit underwriters again?

It’s a valid question. However, the risk is real.

DeFi originally emerged with the promise to reduce the need for trust in centralized entities, such as banks, payment processors, and custodians, by replacing them with transparent, immutable, and permissionless infrastructure. In certain areas, like fully collateralized lending or automated market-making, this vision holds true. Smart contracts alone can manage risk effectively because collateral and market pricing mechanisms are entirely onchain.

However, some financial activities, particularly under-collateralized or unsecured lending, rely fundamentally on evaluating subjective factors such as creditworthiness, future cash flows, or even the borrower’s reputation. Blockchain data alone can’t reliably capture these, yet.

It’s one reason DeFi protocols, which aim to support more complex forms of lending, increasingly integrate centralized trust mechanisms. They rely on offchain underwriters, KYC processes, and specialized risk-verification entities to bridge the gap between purely algorithmic risk management and the real world.

💡 In other words, DeFi was never about removing trust entirely. Instead, it seeks to eliminate unnecessary reliance on centralized institutions wherever possible. Founders should acknowledge the role centralized mechanisms play, where purely decentralized frameworks still fall short.

Apparently, this approach is spreading. Projects like Goldfinch use “trust through community,” a system in which their backers vouch for uncollateralized borrowers.

Another example is Obligate (formerly FQX), a platform for onchain bond issuance that interfaces with DeFi users, allowing them to directly invest in these bonds through their Web3 wallets.

Obligate stands out due to its tech stack, but even more so because of its compliance-first approach, combined with Web3-native UX. Issuers could raise capital through standardized digital bonds, while investors, both institutional and crypto-native, could subscribe to those bonds directly using their wallets. A standout example came in late 2024. BermudAir, a commercial airline based in Bermuda, issued a $1 mil bond via Obligate on Polygon, where crypto investors (via a partner like XBTO) could fund the bond and earn interest. Such deals connect DeFi liquidity with traditional debt markets in a regulated and compliant way.

Here’s where new sub-niches emerge and founders should pay attention.

Originally, onchain private credit addressed funds and Fintechs. Lately, founders have ventured into niche categories with real-world demand.

🎓 EduFi is here: Pencil Finance has launched the world’s first student lending on the Layer 3 EDU chain, where yield is tied to real repayments.

🏦 Onchain bonds take off: Bitcoin Suisse issued a tokenized bond on Obligate, which is compliant, overcollateralized, and settled in USDC.

📊 Retail credit vaults: Platforms like Credix make private credit investable by DAOs, while Maple’s Syrup frontend offers retail-friendly access to secured institutional lending.

These are only the new sub-niches within private credit. Much larger tokenization frontiers are taking shape. See Chapter 3 for the full zoom-out.

Where challenges remain

Let’s keep it real. This category is growing, but it’s not smooth sailing:

- Credit inherently carries default risk, and a few high-profile defaults in 2022–2023 (e.g., on TrueFi and Maple) highlighted how challenging underwriting can be when lenders are far removed from borrowers.

- Assessing a borrower’s creditworthiness (an SME in Africa, for instance) is hard to automate or decentralize. Protocols have had to introduce offchain underwriters or verifiers, reintroducing intermediaries.

- Additionally, regulatory classification is a complex process. Are these loans considered securities?

💡 Founder takeaway

Opportunity for founders:

Building the next Figure might be a far-off goal, but you could just as effectively:

- Underwrite niche loan pools (e.g., EduFi, SME lending).

- Build credit scoring oracles for underserved markets.

- Create data and dashboard layers for bond flows.

This is infrastructure, and infrastructure scales.

Stablecoins, treasuries, commodities, and credit are the core four of tokenization today. They’re all real and have growing traction.

However, these foundational asset classes are no longer unexplored. Institutional players have firmly arrived, the infrastructure has matured, and barriers to entry are rising steadily. So next, we focus on where founders can still uncover strategic advantages and new, untapped opportunities.