3. Token Launch Case Studies: Data-Backed Lessons for Founders

You’ll learn:

- How projects structure their token launches, including ICOs, IEOs, mining-based distributions, and community-focused airdrops.

- Which strategies separate high-impact launches from underperformers.

- How teams deal with obstacles in distribution, liquidity, and governance.

- Strategic insights to inform future token launch playbooks.

Chapter 2 explored how token launches evolved from one-off fundraising events into multi-layered strategic operations. This chapter puts that framework into practice.

By examining launch case studies in diverse sectors like DePIN (Akash, Silencio), RWAs (Ondo), SocialFi (Kaito), and DeSci (ResearchHub), we uncover how various models perform in practice. As a founder, you gain insights on how to build momentum, earn trust, and avoid costly missteps.

3.1 DePIN platforms

Akash Network: High-inflation IEO meets ecosystem bootstrapping

Akash Network is a decentralized cloud computing marketplace enabling users to lease and monetize unused computing resources via blockchain incentives.

Token distribution model

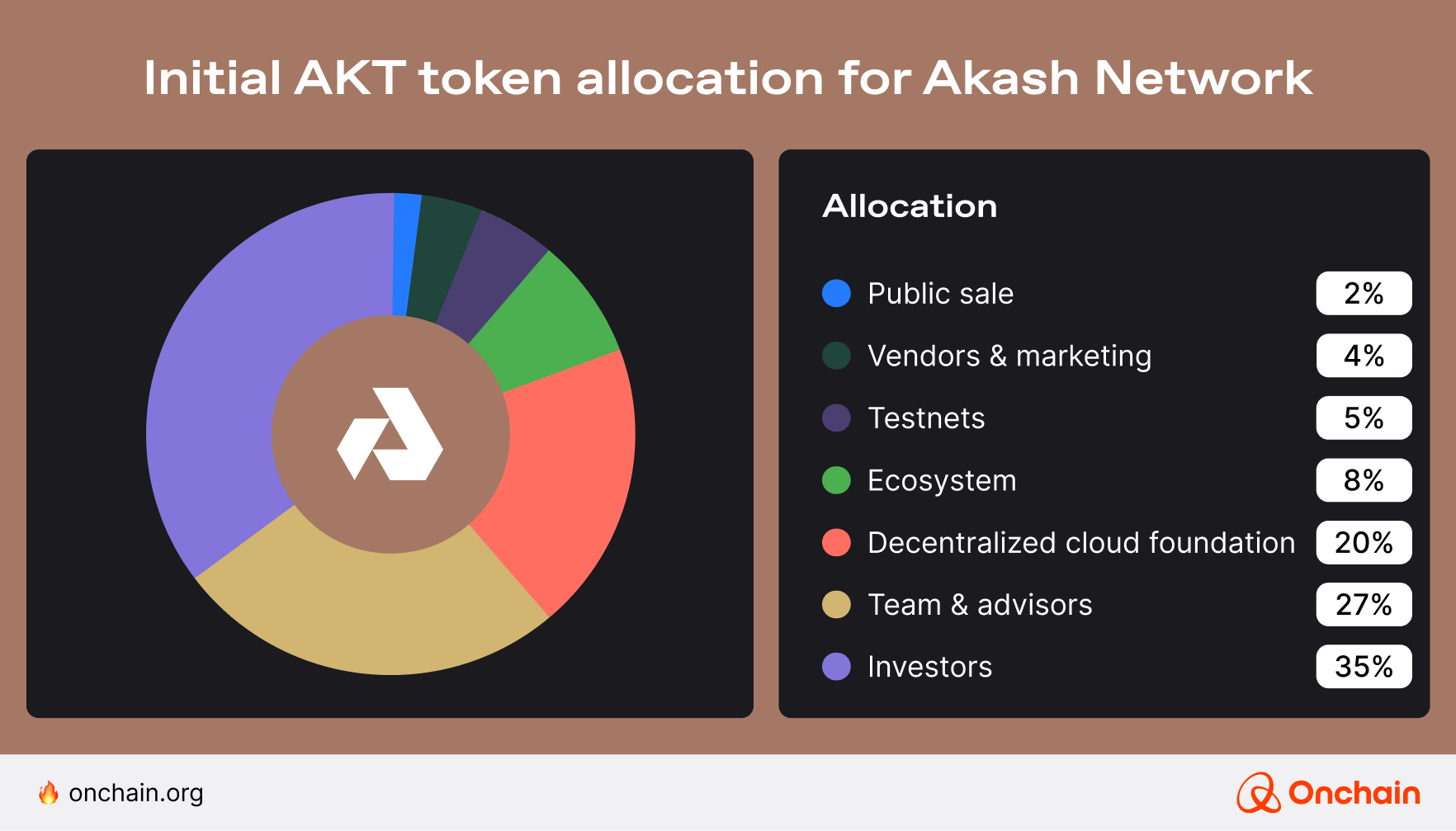

The Akash Network utilizes its native token, AKT, for functions such as governance, staking, and settlement. At launch in September 2020, AKT had a fixed genesis supply of 100,000,000 tokens. The project set a maximum supply cap of 388,539,008 AKT for the network.

Crucially, most of these allocations were locked and vested over time rather than released immediately.

AKT’s monetary policy was inflationary at launch: The majority of tokens (~75% of the max supply) were not released upfront but scheduled as future block rewards to incentivize network participation. This meant new AKT would be minted over time (up to the cap), with an initially high inflation rate (around 100% APR in the first year) to bootstrap the network’s security and usage. Over time, the inflation rate was designed to decrease (halving periodically), making the token’s issuance schedule deflationary in effect as the supply approached its cap.

Launch strategy

Akash’s launch strategy combined early private fundraising with a carefully managed public sale and exchange listing to distribute the token:

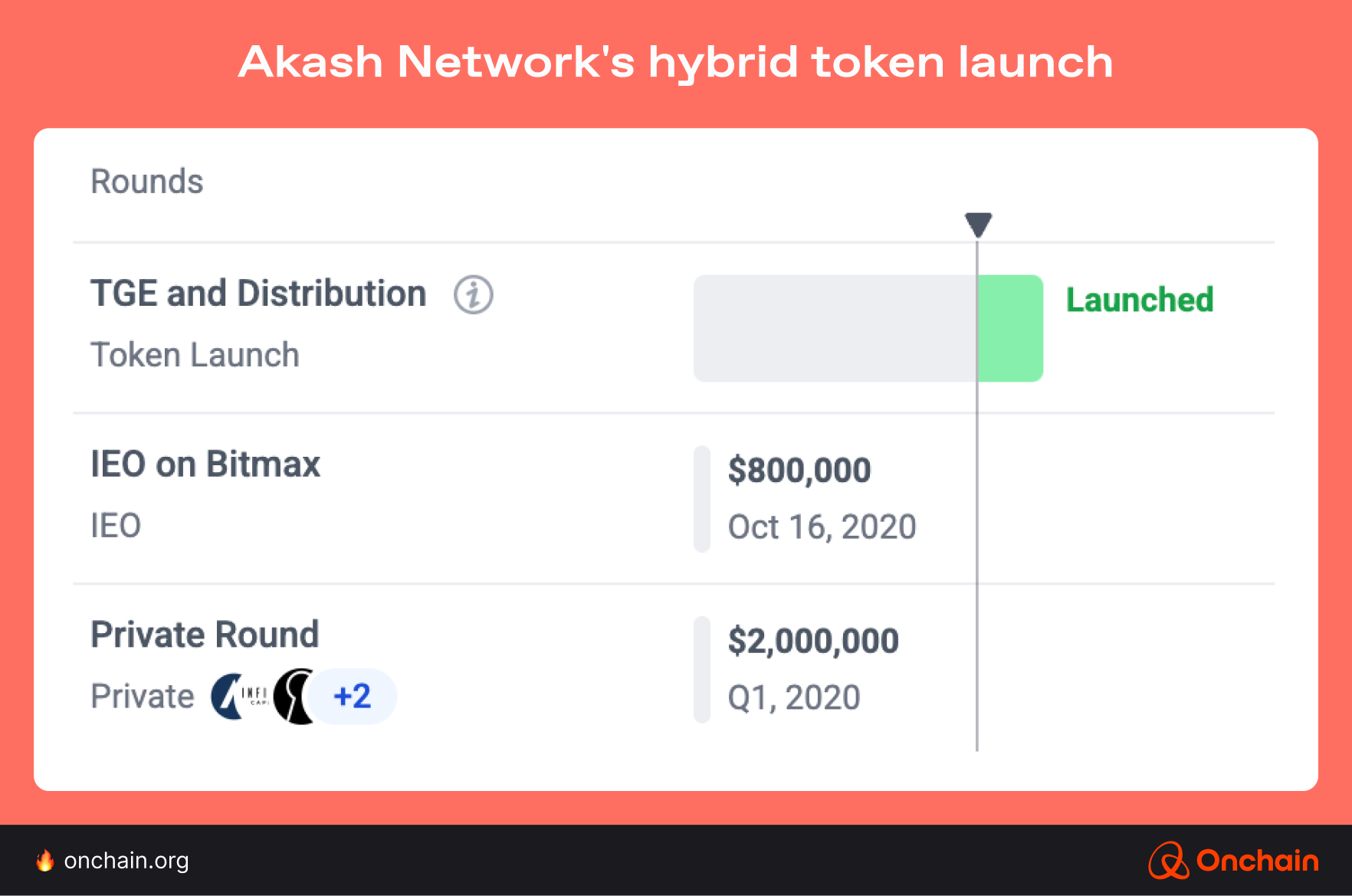

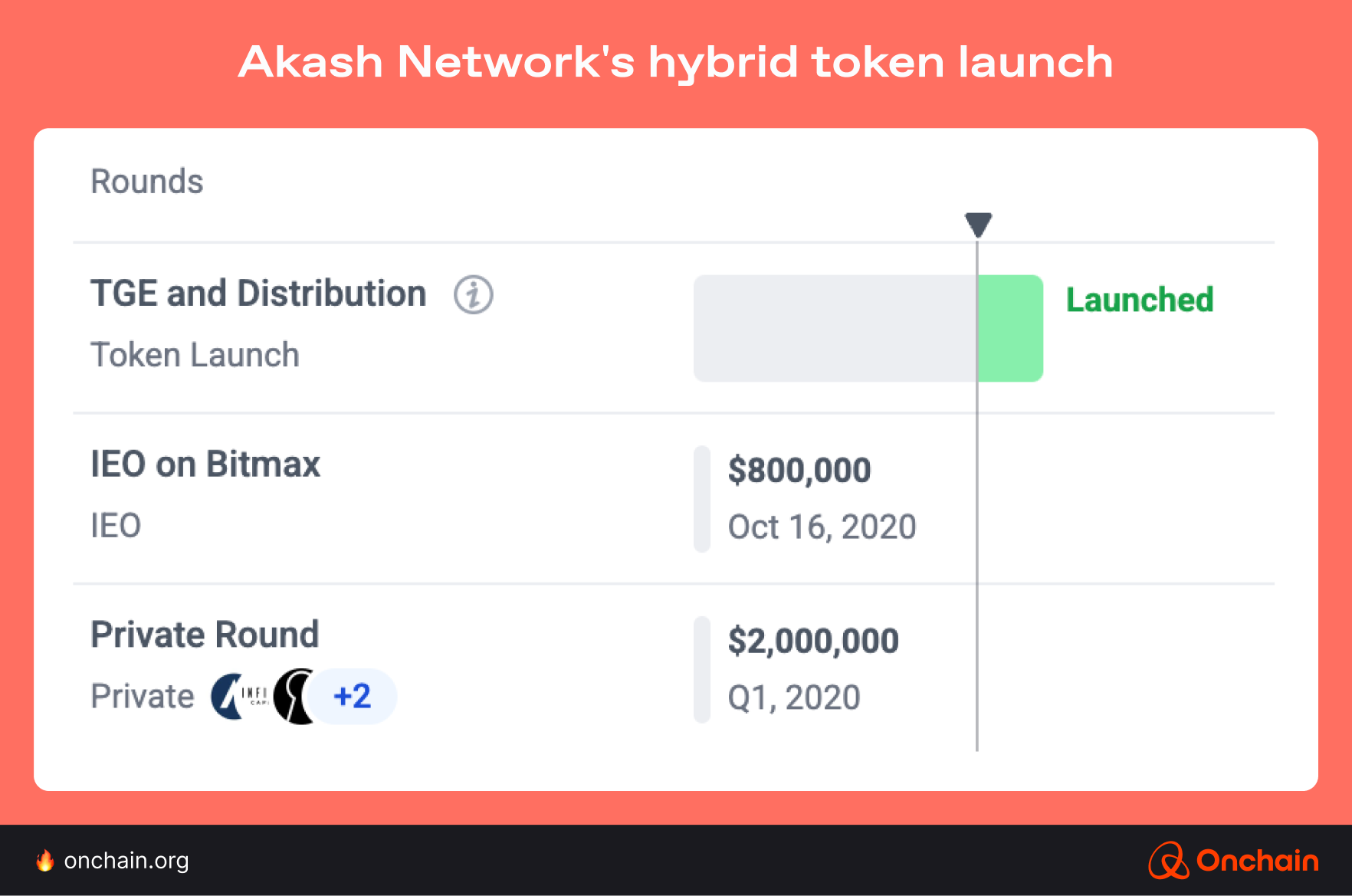

- Private sale (Mar 2020): Raised early capital from strategic investors.

- IEO on BitMax (Oct 2020): Sold 1.8 mil AKT for ~$800,000 in under an hour.

- Listing: Traded only on BitMax at launch, no initial DEX support.

➡️ AKT’s price quickly rose above $0.35, reaching ~$0.95. Additional listings (e.g., BitMart, Bittrex, Upbit) followed, expanding access and liquidity.

Community engagement

Leading up to the mainnet and token launch, the team implemented a range of marketing and communication strategies. They regularly published project updates and blogs to build anticipation. You may have come across the “The Unstoppable Update” series in October 2020.

The Akash team actively nurtured its community around the launch. Incentivized testnets and challenges helped onboard developers. In October 2020, just before mainnet 2, Akash opened a Phase 3 testnet with 1 million AKT in rewards for participants. This helped battle-test the network and also converted many early testers into evangelists.

To broaden its reach, Akash launched a Chinese community to serve Asia-based followers after the token release. Akash cultivated an engaged supporter base from day one through this global outreach, combined with prompt, transparent communication such as CEO Greg Osuri’s frequent X updates and community calls.

⁉️ Our evaluation

✅ What worked?

- Token economics were well-designed to align long-term incentives with limited initial float and clear emission schedules.

- The IEO strategy drove initial momentum, ensured immediate liquidity, and preserved scarcity.

- Early engagement programs (testnets, challenges) built loyalty and seeded a developer community.

⚠️ What could improve?

- Public allocation was limited (~1.8%), reducing broader community ownership at launch.

- Launching on a single exchange created friction for non-BitMax users and delayed broader liquidity.

- Another area of concern was the steep inflation rate at launch. While the high APR rewards successfully attracted stakers, some community members were worried about “farm and dump” behavior, potentially undermining long-term token value.

Silencio: One of the most oversubscribed IDOs to date via the Legion platform

Silencio is a DePIN project that rewards users for crowdsourcing noise pollution data to create environmental insights.

Silencio did more than launch a token; it started a movement. With 500,000 contributors and a record-breaking Legion sale, it proved that DePIN can be both equitable and explosive.

Token distribution model

Instead of holding a public ICO, Silencio rewarded contributors. Of the total 100 mil SLC supply, 7.5% was allocated to early app users through a “Beta Airdrop” based on noise data contributions. Additional gamified mechanisms, such as league rankings, raffles, and referrals, aligned token rewards with user participation and growth.

Launch strategy

Like Akash, Silencio avoided traditional token sales and instead used a unique technique to launch the token.

- Private rounds (2024): Raised ~$3.5 mil from backers like Moonrock and Borderless Capital.

- Community sale via Legion: Partnered with Legion for a merit-based IDO, prioritizing community alignment over capital raised.

- Oversubscribed launch: Accepted only ~$1.3 mil despite $112 mil+ in requests, reinforcing a fair and community-first approach.

As mentioned earlier, Silencio orchestrated a major community airdrop for its early app users. After the token generation event (TGE), they were given a 30-day window to claim their in-app tokens; any unclaimed tokens would revert to a community pool for future rewards. This mechanism ensured active users benefited the most, and no tokens were wasted.

Community engagement and sentiment

By launch, Silencio had over 500,000 contributors in 180+ countries. The mobile app enabled data submissions via smartphones, with a two-layer reward system: non-crypto points for basic activity and SLC tokens for high-quality, verified data. This approach filtered spam and ensured rewards went to genuine users.

Silencio actively engaged with its community through multiple channels, ensuring transparency and engagement during the launch process. Their X following grew from 8,000 to 112,000 in 2024, a 1,300% increase, as the team shared updates, milestones, and educational content about noise pollution and DePIN.

➡️ The launch was a huge success.

This isn’t just a milestone for Silencio; it’s a defining moment for the DePIN space.

- Thomas Messerer, CEO and co-founder, Silencio

⁉️ Our evaluation

✅ What worked?

- The community-first approach created immense grassroots momentum. At the time of the Legion sale, Silencio had tangible traction, which translated into investor appetite and nearly a 220x oversubscription of the tokens on offer. This is a rare feat in Web3, and it underscores the advantage of building a product before launching a token.

- The decision to raise only a fraction of that demand was a masterstroke in optics and strategy. It signaled to the community that Silencio valued their involvement over a huge treasury.

- With 51% of tokens allocated to the community and a gamified airdrop, Silencio fostered strong loyalty. Contributors got a real sense of ownership rather than being sidelined in favor of insiders.

- Silencio took a calculated risk using the then-unproven Legion platform, but it paid off by differentiating their launch.

➡️ Legion tapped into a huge pool of retail interest that might not have been reachable via a traditional VC or exchange launch.

➡️ Since Legion allocated tokens based on reputation and support, those who got into the sale were likely strong believers in the project’s mission.

⚠️ What could improve?

- A primary risk in Silencio’s tokenomics is over-inflation, where too many tokens enter circulation without sufficient demand to support them. It’s critical to introduce clearly defined deflationary or burn mechanisms.

- Another challenge lies in sustaining network usage and revenue to support the token economy. Silencio’s value proposition hinges on turning noise data into a profitable business (selling data to cities, businesses, researchers, etc.).

- If those revenue streams grow slower than expected, the generous community rewards (which are effectively an inflationary pressure for the first five years) could outpace organic demand for the token.

- The team’s plan to reinvest 75% of revenue into the ecosystem is great for alignment, but it assumes there will be substantial revenue. Silencio should design reward structures for sustainability rather than rapid short-term growth.

3.2 RWA platforms

Ondo Finance: A token launch in slow motion

Ondo is a DeFi platform that bridges traditional finance (TradFi) and crypto through tokenized real-world asset (RWA) investments.

Ondo played the long game by building real-world traction for tokenized treasuries before even thinking about launching ONDO. When it finally did, it was methodical, DAO-approved, and deeply liquid.

Token distribution model

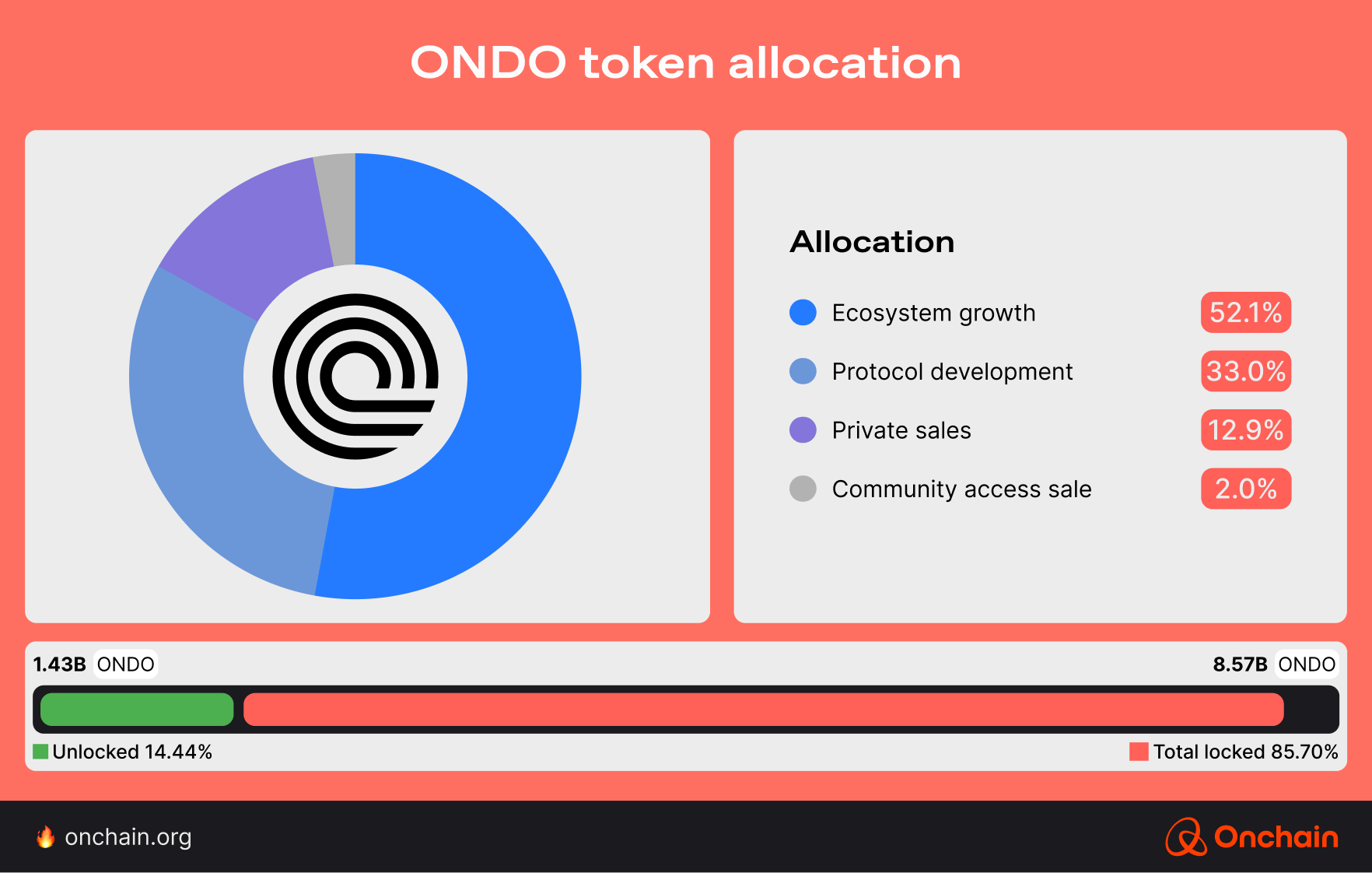

ONDO has a fixed supply of 10 bil tokens and no planned inflation. At launch, only ~14% was in circulation. The rest remained subject to long-term vesting schedules, including:

- Ecosystem growth tokens: 24% unlocked at launch, remainder vesting over five years.

- Private/investor allocations: Similar multi-year cliffs and vesting schedules.

The Ondo DAO voted in January 2024 to lift the global lock on the tokens, more than a year after its May 2022 launch. This intentional delay was to prevent speculative trading before Ondo’s RWA products had traction.

Launch strategy

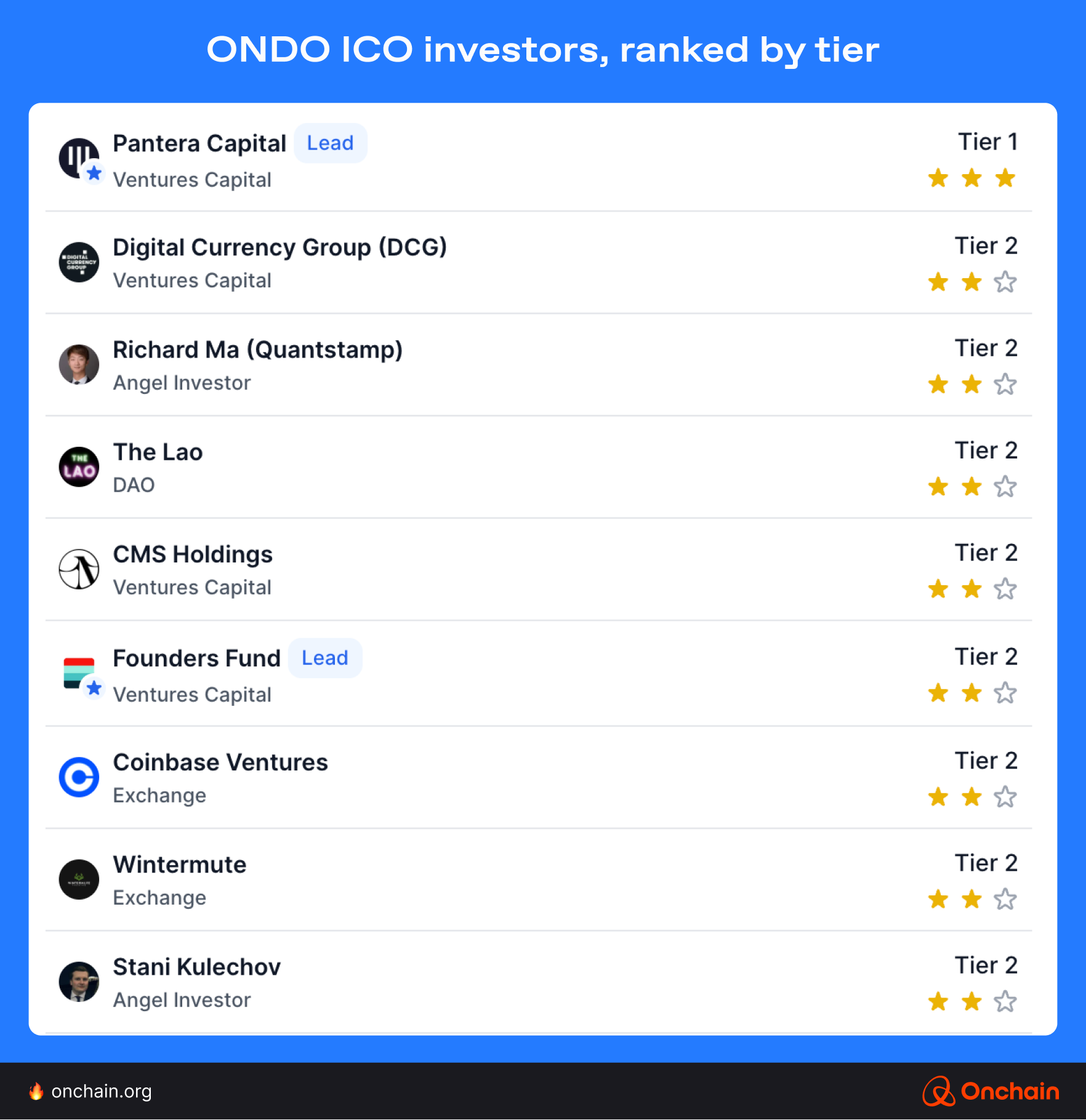

Ondo Finance took a measured, somewhat unorthodox path in launching the ONDO token. Instead of an immediate exchange listing or fair launch, Ondo conducted an ICO on CoinList in May 2022.

Ondo raised roughly $25 mil from tens of thousands of retail participants. This gave Ondo a broad global base of token holders; those buyers effectively became long-term stakeholders due to the enforced lockups.

No major centralized exchange (CEX) listing was done at the TGE. In fact, ONDO did not trade at all for over a year after its sale. The global transfer restriction meant that even vested tokens couldn’t move until the community agreed. This delay was quite unusual; most projects seek immediate post-sale liquidity on DEXs or CEXs.

Ondo’s team justified the lockup as a way to prevent premature speculation and ensure the token launch coincided with a more mature product and market. Essentially, they wanted Ondo’s RWA products (like OUSG, Flux) to gain traction first, so the token’s release would attract investors based on fundamentals rather than just hype.

Unlike native crypto projects, RWA tokens need structured approaches that satisfy both traditional finance compliance and blockchain transparency requirements.

- Marko Vidrih, Co-Founder, RWA.io

This decision closely aligns with users’ motivations. According to our survey, 24.34% of participants cite “real-world utility” as the top reason they would hold a token long-term.

In regard to market engagement, this approach appears to have paid off. Immediate trading volume was substantial. Ondo reported daily volumes of hundreds of millions of dollars, and the price held up relatively well despite the influx of supply. In fact, the market cap grew to the $1–$2 bil range within weeks of launch, reflecting strong demand based on the RWA narrative.

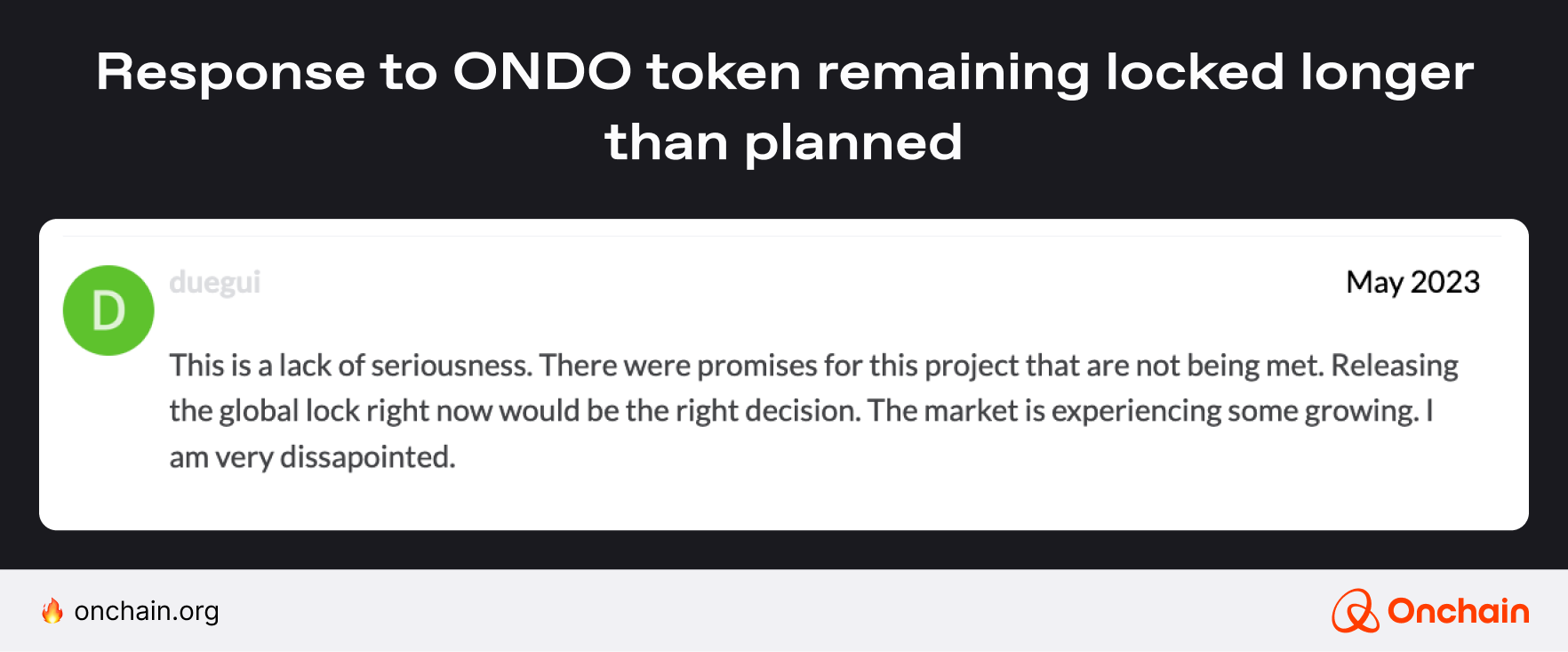

However, this carefully engineered launch was not without controversy.

Community engagement and sentiment

Early community response to Ondo’s token strategy was mixed and, at times, contentious. Tensions grew as the token remained locked longer than originally expected.

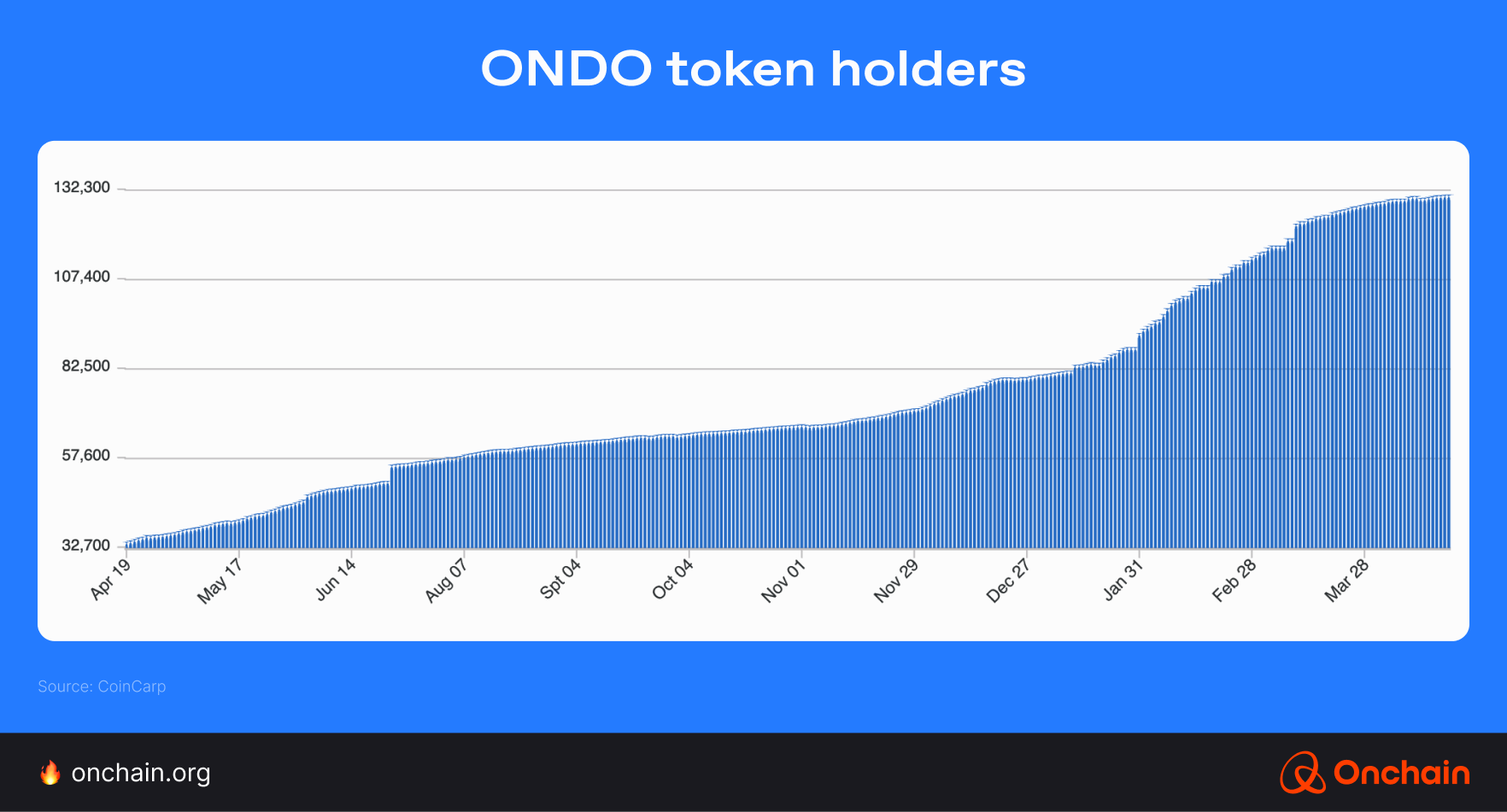

After the token’s strong price performance, this changed. Over 18,000 addresses claimed ONDO at launch, making it one of Ethereum’s largest DAOs by holder count. Still, governance remains centralized: Team and investor allocations, though locked, represent the majority of voting power.

This concentration of voting power remains an issue in the short term, with team and investor tokens vesting. They will collectively control the majority of ONDO when it vests. Some observers worry this could lead to governance centralization, where a small group can steer the DAO.

⁉️ Our evaluation

✅ What worked?

- Launching amid an RWA boom helped Ondo gain attention as one of the top RWA projects. Indeed, positive sentiment, such as news of the first U.S. Bitcoin ETF approval, buoyed the token’s debut, which started under $0.10 and climbed to ~$0.27 within weeks.

- ONDO tokenomics were designed to support long-term growth. Total supply is capped at 10 bil with no inflation, and only 14% was in circulation at launch. This controlled float mitigated immediate sell pressure and helped stabilize early trading.

⚠️ What could improve?

- Insufficient early liquidity led to volatile price discovery and caused price fluctuations. It also caused investors to act more cautiously during the initial trading period.

- Low initial float (14%), driven by heavy team and early investor allocations, boosted early ONDO prices but will be followed by large token unlocks.

This reveals a shift in RWA token design from DeFi-era liquidity-first models like Centrifuge and Maple to compliance-conscious, adoption-aligned strategies like Ondo. Future RWA protocols are more likely to follow Ondo’s model, earning attention through traction, not speculation.

3.3 SocialFi platforms

Kaito’s airdrop-fueled rise (and dip)

Kaito is an AI-powered Web3 search engine and analytics platform that incentivizes user-generated content and curation through token rewards.

The social finance (SocialFi) project exploded onto the scene with an AI narrative, an airdrop on Base, and a same-day Binance listing — instantly becoming one of the sector’s most promising newcomers. The launch was widely praised across the ecosystem for its marketing precision, high visibility, and rapid onboarding success.

Token distribution model

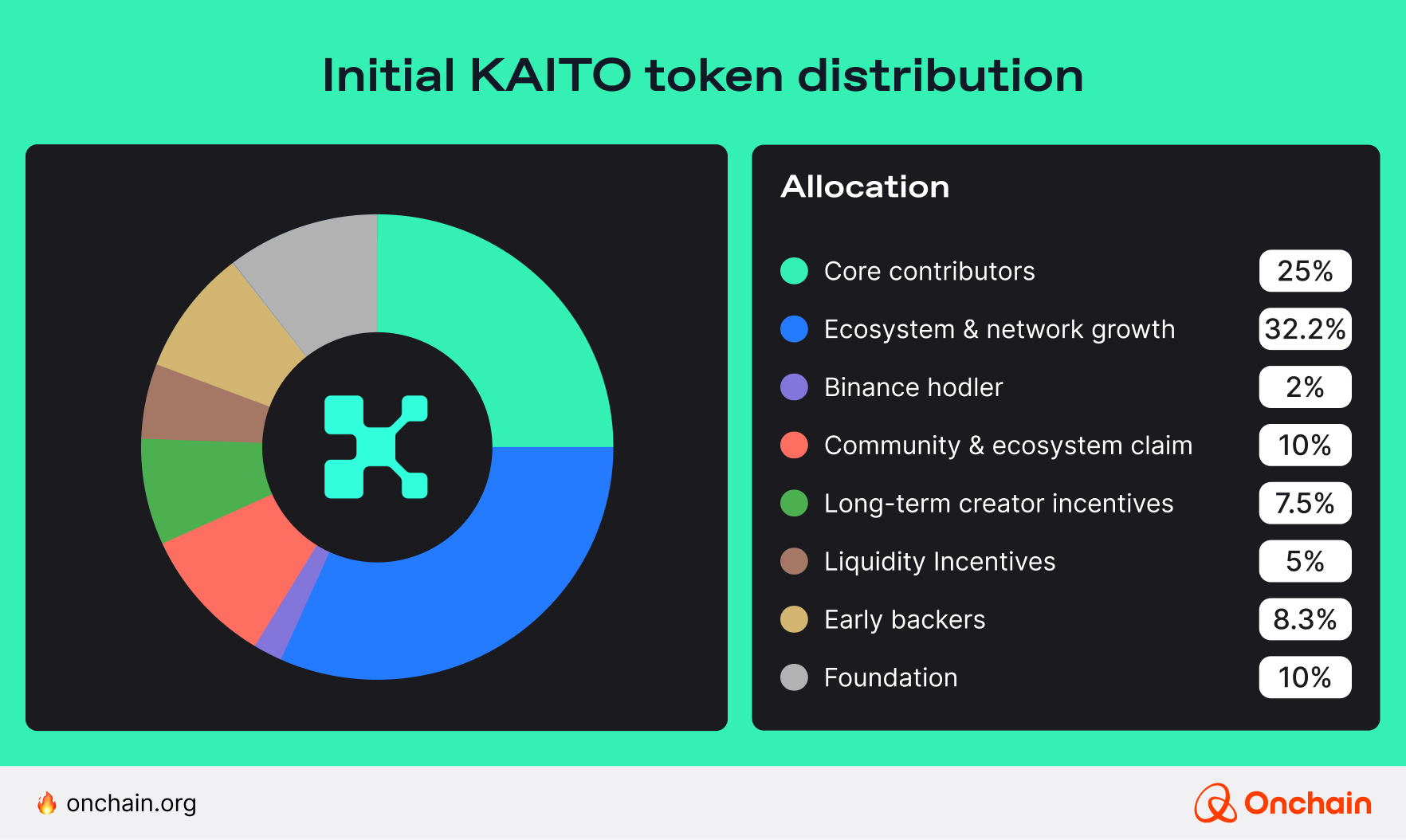

Kaito aims to change the attention economy by integrating AI with decentralized finance (DeFi) principles. At its core, Kaito seeks to tokenize user attention by rewarding quality content creation and engagement through its native KAITO token.

It has a fixed total supply of 1 bil tokens. The initial allocation prioritizes community growth, with 56.67% of tokens reserved for community and ecosystem initiatives.

Most insider tokens are subject to post-launch vesting schedules that reportedly lock KAITO for ~6 months. The token unlocks are implemented gradually over ~3.5 years to prevent an immediate supply dump.

Launch strategy

Kaito launched KAITO on February 20, 2025, via a community airdrop on Base (Ethereum L2), paired with immediate listings on top CEXs like Binance, OKX, and Upbit. Binance also included Kaito in its HODLer Airdrop Program, distributing 2% of the supply to BNB holders and boosting early visibility.

This dual strategy of a decentralized airdrop and broad CEX support ensured strong initial liquidity. By launch, 241 mil tokens were in circulation. The pre-market pricing implied a $1.5–$1.7 bil FDV. The token market cap peaked at $2.88 bil ($2.9 bil FDV) within days.

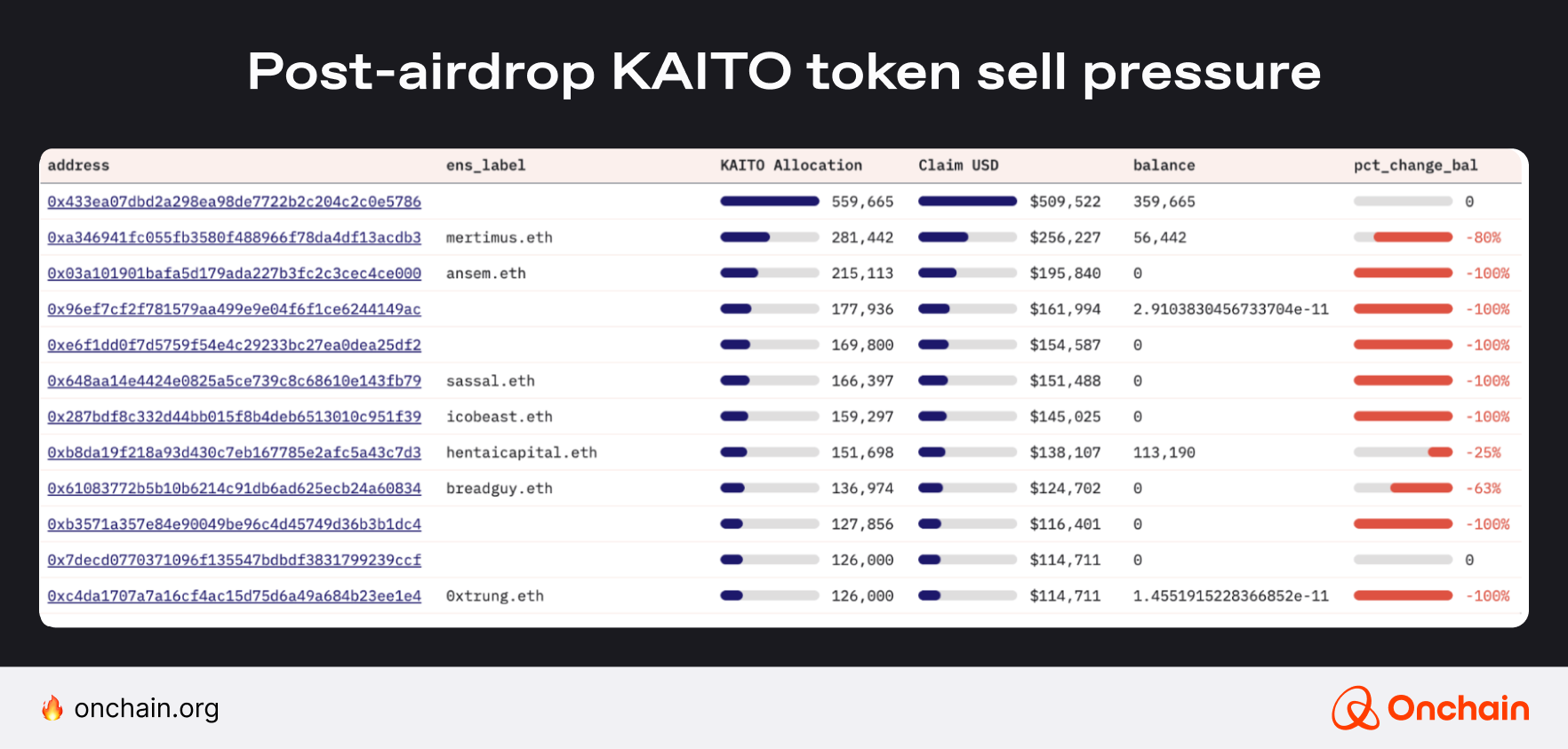

Despite initial sales by some KAITO recipients — including 10 of the top 12 airdrop wallets — KAITO’s price held around $0.90 to $1, showing resilience until broader market volatility (e.g., the tariffs crash) took effect.

Community engagement and sentiment

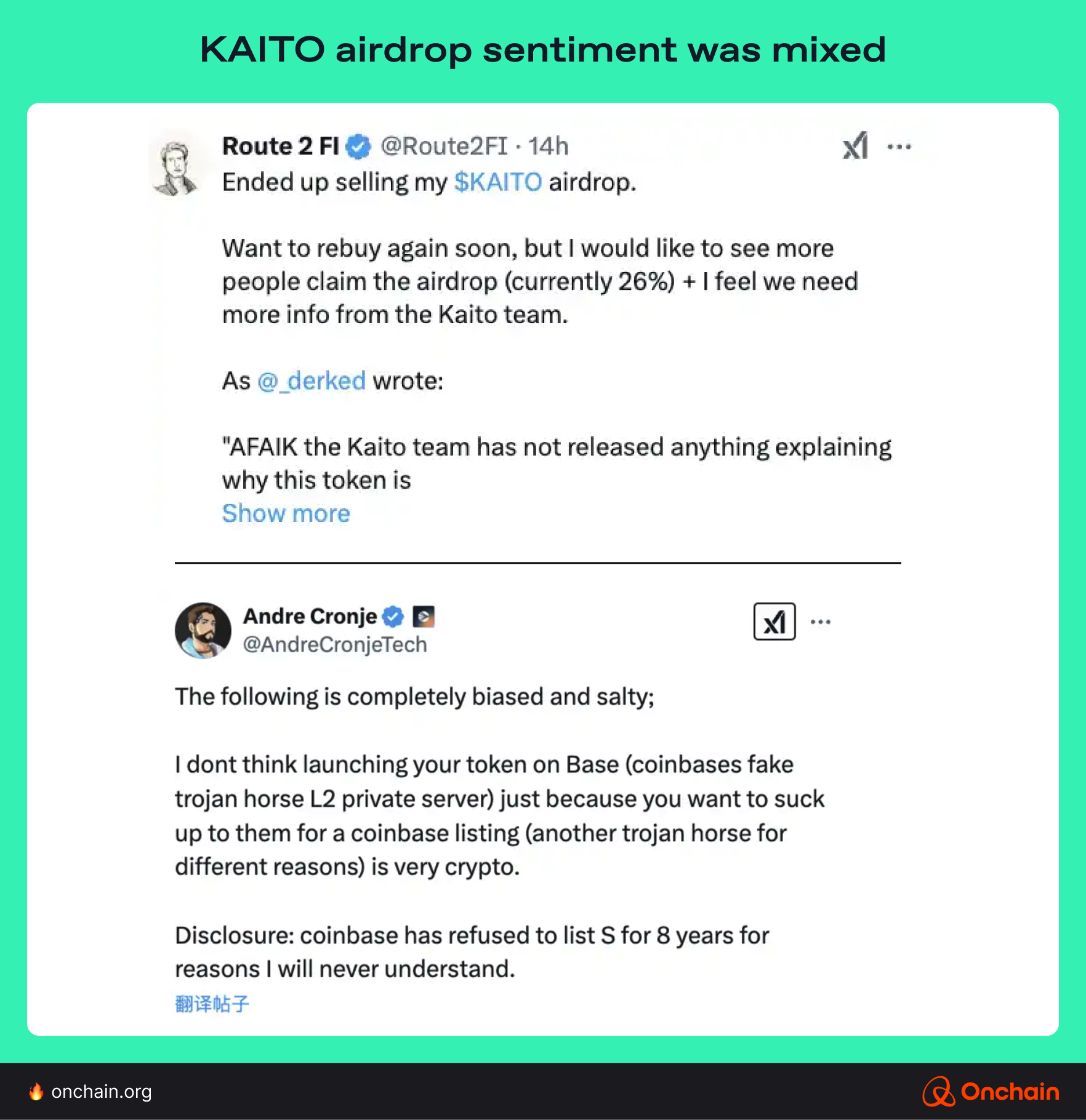

Sentiment around Kaito’s airdrop was mixed and evolved over time. Some early observers voiced concerns around fairness and Sybil resistance. Others who followed the launch closely saw it as one of the most well-executed airdrops in history. The rollout was widely praised for its visibility, clean execution, and strong onboarding performance, especially in the first few post-launch weeks. Multiple community discussions and X Spaces highlighted positive experiences and a sense of transparency during the process.

That said, as initial excitement faded, attention shifted to questions around long-term engagement. Despite the strong launch, at the time of writing this report, KAITO is down more than 70% from its all-time high (ATH) price. This suggests that the token’s utility and ecosystem stickiness were a bigger challenge than the airdrop distribution. Macro factors, such as tariff-related volatility, likely played a role. However, they also accelerated underlying issues around user retention and sustained participation.

The bottom line: Initially, Kaito’s airdrop generated massive visibility, strong user onboarding, and widespread engagement. However, the price drop of KAITO raises concerns about long-term retention and token utility.

⁉️ Our evaluation

✅ What worked?

- The airdrop and exchange listings created momentum and credibility, with early price stability reinforcing confidence.

- The project’s AI positioning and fast-paced marketing narrative helped cement it as a frontrunner in the SocialFi space at launch.

⚠️ What could improve?

- While initial critiques focused on fairness and Sybil resistance, the deeper issue appears to be ecosystem stickiness: Many users didn’t stay engaged once the hype cooled down.

- External factors like macro volatility (e.g., tariff-related selloffs) likely accelerated KAITO’s price decline, but the fragility was already visible in the lack of sustained token use cases.

Kaito’s case underscores a broader truth for SocialFi and AI-native platforms: Strong marketing and a successful airdrop can drive early momentum, but lasting traction requires more than visibility. Projects must build mechanisms that convert initial attention into long-term engagement, with clear token utility and retention loops baked in from the start. Otherwise, early excitement risks fading into short-lived speculation.

3.4 DeSci platforms

ResearchHub: No ICO, no dump, just tokens for real contributors — Web3 done right?

ResearchHub is a decentralized science (DeSci) platform designed to accelerate scientific collaboration by incentivizing researchers through token rewards.

The team behind the hub chose sustainability over speculation. But can it bridge crypto-native mechanics with academic adoption? We dig into the project that’s tokenizing peer review, one paper at a time.

Token distribution model

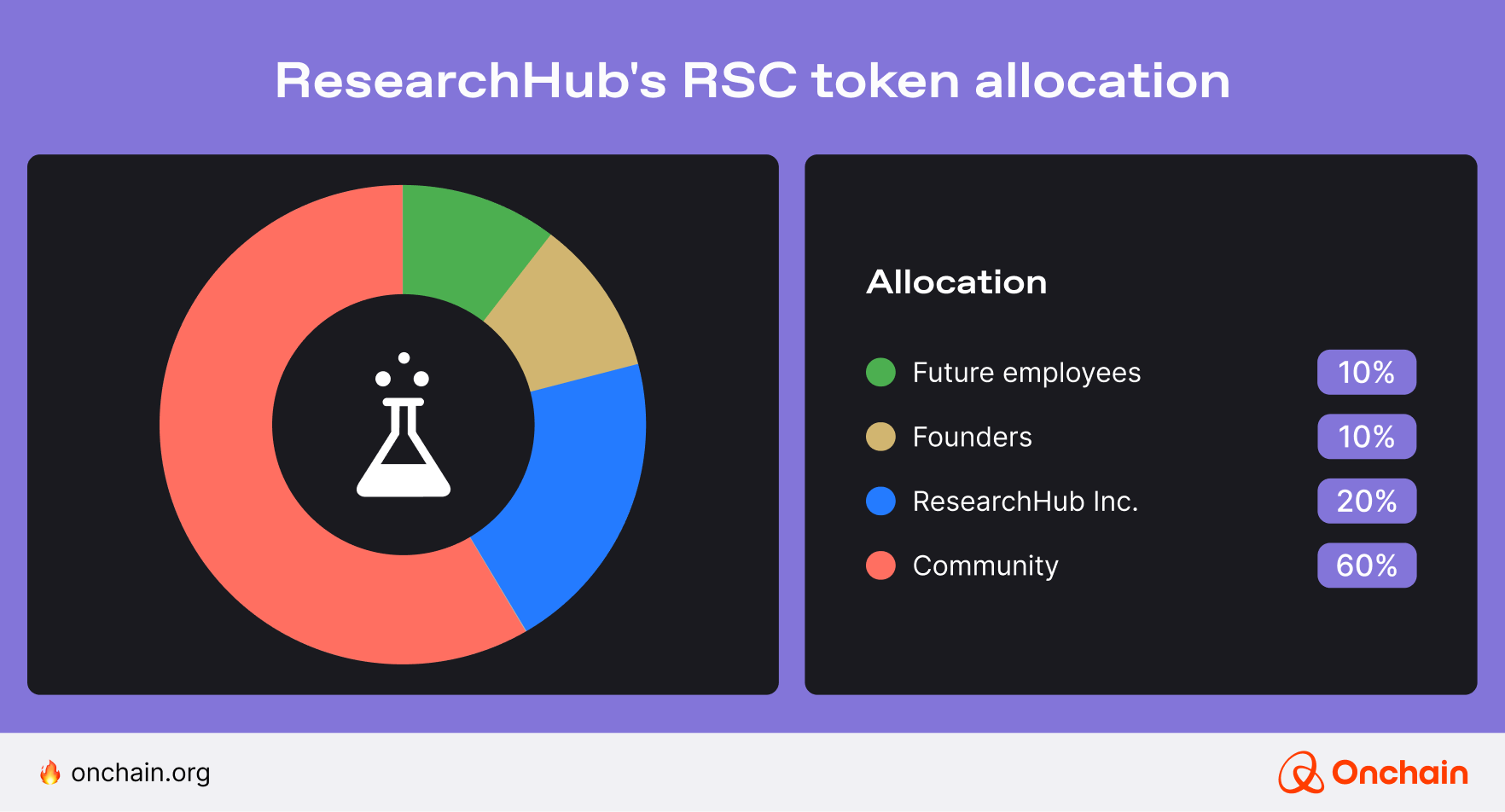

The initial allocation was weighted toward community incentives (60%), and the remaining 40% was split between the project’s treasury (20%), the founding team (10%), and future employees (10%).

Community-allocated tokens are released gradually over 12 years, with a yearly emission cap of 5% (or approximately 50 million RSC). This supports project sustainability and prevents RSC oversupply issues.

In fact, at the TGE on August 1, 2020, only a small fraction of tokens entered circulation: ~7.5 mil RSC, roughly 0.75% of the supply. The slow release schedule aims to align incentives with long-term platform growth.

Launch strategy

ResearchHub took a unique community-centric approach rather than a traditional ICO or token sale. Its launch unfolded in several strategic steps:

➡️ Step 1: earn-to-own (mid-2020)

ResearchHub launched an earn-to-own model that rewards RSC tokens to contributors for activities like upvoting. Weekly distributions of 1 mil RSC helped bootstrap content and onboard scientific contributors before any public listing.

➡️ Step 2: gradual tapering of rewards (2020–2022)

To avoid RSC oversupply, reward emissions were halved periodically. This shifted incentives from short-term growth to sustainable, organic engagement.

➡️ Step 3: TGE (Nov 2022)

RSC officially launched with a limited 7.5 mil circulating supply. Instead of a public sale, ResearchHub privately raised ~$5 mil from backers like OSS Capital and Sora Ventures to align long-term incentives and avoid speculative hype.

Community engagement and sentiment

From the outset, ResearchHub’s team prioritized building an active community of researchers and enthusiasts around the platform.

The communication strategy was transparent and developer-oriented: Co-founder Patrick Joyce and others regularly published updates on Medium and the ResearchHub forum to explain the project’s mission and tokenomics.

Adoption efforts have also included high-profile community-driven initiatives, such as research bounties to analyze widely discussed scientific claims, attracting both media attention and new researchers.

However, platform traction has remained relatively niche. A 2023 Blockworks report highlighted that one of the top-performing users earned 8,000 RSC (worth over $1,000 at peak) for a single analysis. This is impressive on an individual level, but also a reminder that participation and engagement are concentrated in a small cohort.

The bottom line: ResearchHub’s launch exemplified several best practices for a DeSci token project. ResearchHub’s early phase involved some practical challenges.

⁉️ Our evaluation

✅ What worked?

- First, tying token distribution directly to platform contributions proved highly effective. The weekly RSC compensation program and per-upvote rewards successfully bootstrapped content creation and user growth.

- The gradual token release and long vesting schedule prevented early insiders from controlling too much of the initial and total supply. This allows new contributors to earn meaningful RSC each year. It also ensured a gentle RSC introduction to the trading market. There was no massive RSC unlock and subsequent dump that crashed the token price.

- The straightforward communication of the project’s purpose to accelerate science provided utility and moral appeal, which helped sustain user engagement beyond the profit motive.

⚠️ What could improve?

- Nature noted a practical issue: Scientists who earned RSC might find it cumbersome to convert tokens to fiat money because it initially involved DEXs like Uniswap; decentralized crypto-to-fiat exchanges are unfamiliar territory for most academics.

- Governance also proved challenging. While many users held RSC, actual voting participation was low. This is a common issue in DAO-like systems and highlights the need for better community decision-making processes.

You have a good understanding of the various launch strategies we analyzed. You learned about specific approaches and how they worked in specific cases. It’s time to answer a more pertinent question: How well did they perform, and what are the common success factors?

The token isn’t the finish line. Rather, it’s the starting signal. What really matters is how aligned it is with your product, your community, and your long-term vision.

- Ananya Shrivastava, Research Scientist, Onchain

In a nutshell, smart token design, fair distribution, strong early momentum, and a clear link between the token and the product’s real-world use appear to bring positive results.

Let’s dig in to get clarity on that. We applied a 1-to-5 scoring system to rank each project across five key areas, with 5 representing the strongest performance.

- Strategic design: Was the tokenomic model thoughtfully structured? Inflation, vesting, token caps.

- Community fairness: How fair and inclusive was the distribution? Airdrop access, merit-based, etc.

- Launch momentum: Did the token launch drive strong early participation and liquidity?

- Utility & ecosystem fit: Was the token launch aligned with a usable product or protocol value?

- Post-launch stability: Did the token retain users and avoid steep dumps or controversies?

Cross-sector lessons for onchain founders

This structure allows us to pinpoint recurring patterns, strategies that worked, red flags to avoid, and the tactical lessons every Web3 founder should keep in mind before pressing the launch button.

We identified several success patterns and cross-referenced them with the findings of our survey.

✅ Patterns of success

- Continuous adoption through real-world utility

Projects that linked tokens to tangible real-world value earned ongoing user interest beyond any initial speculative hype. Clearly demonstrating practical benefits early on can create genuine demand and long-term token utility. Notable examples include Akash’s decentralized cloud computing and Silencio’s environmental data network.

- Trust through transparency

Transparently communicating allocation and distribution methods fosters trust and engagement. Community-oriented launches with clear incentives, such as carefully structured airdrops or fair-launch platforms, consistently saw better long-term engagement. Notable examples include Silencio via Legion’s merit-based platform and ResearchHub’s community-driven reward system.

- Volatility prevention through controlled emissions

Gradual vesting (e.g., ResearchHub) avoided selloffs and gave contributors time to engage.

- Early community activation

Teams that invested in developer programs, education, and direct communication (e.g., Silencio, ResearchHub) built strong user bases from the start.

-

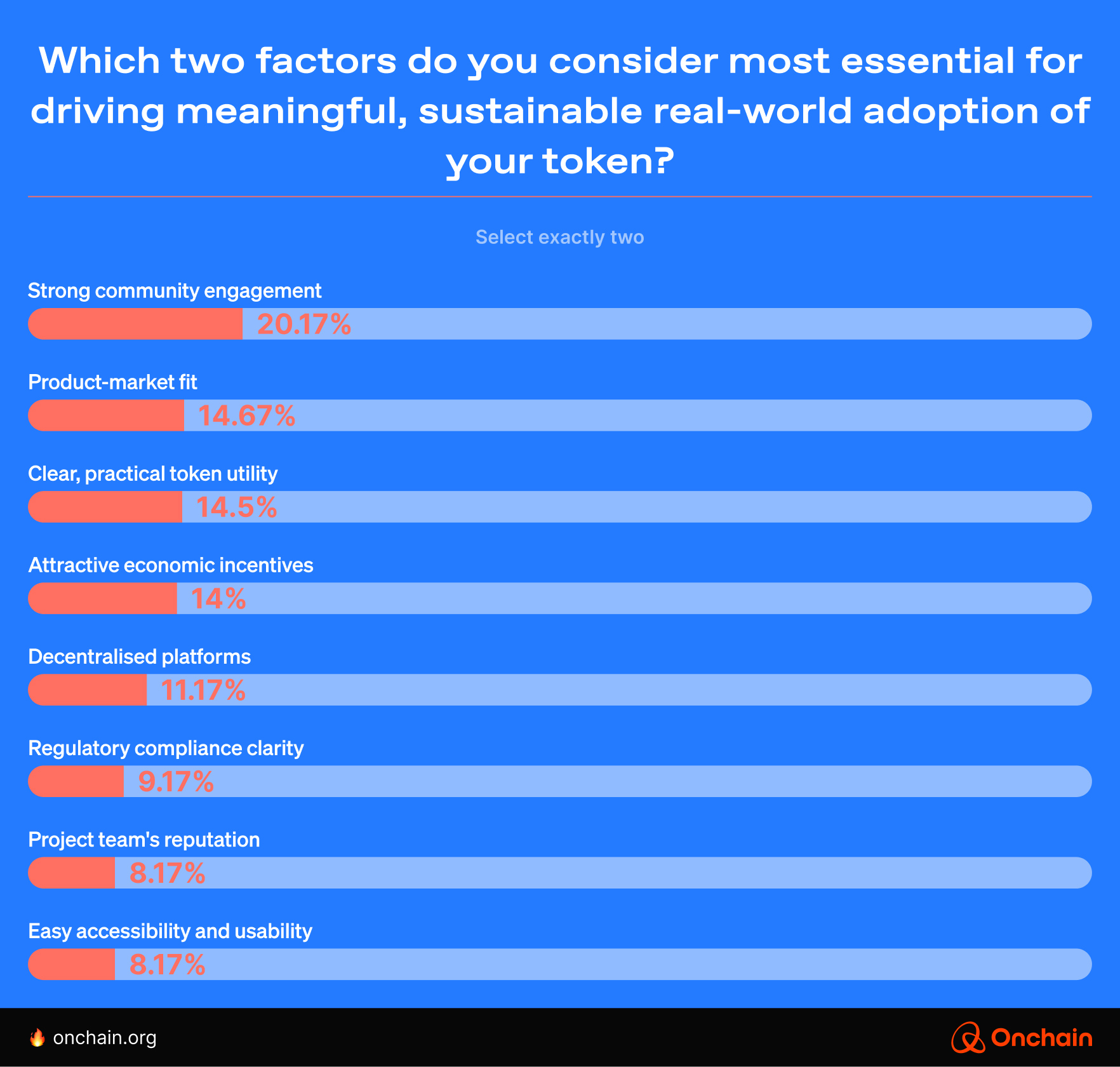

Survey data confirms these findings: 58.33% of launch initiators named community engagement as the most critical success factor, while participants prioritized real-world utility and trust-building mechanisms.

- Timely liquidity and listings

Projects that launched with clear CEX and/or DEX support (e.g., Akash) saw smoother price discovery and better stability.

- Effective liquidity and strategic exchange listings

Successful projects strategically managed their initial liquidity and exchange listings to ensure smooth token price discovery and stability. Akash benefited substantially from timely listings on reputable exchanges.

-

Survey data revealed that project owners view community engagement (20.17%) and a strong product-market fit (14.67%) as the top drivers of long-term token adoption.

⚠️ Common pitfalls to avoid

- Aggressive inflation models

Projects like Akash and Kaito struggled with early token dumping due to excessive emissions and limited utility.

- Weak token-product alignment

If the token isn’t core to the user experience (UX), interest fades after the airdrop, as seen in the early Kaito and Ondo phases.

- Lack of transparency or insider overreach

Hidden insider allocations eroded credibility and caused long-term backlash (e.g., Ondo Finance’s huge insider token unlock).

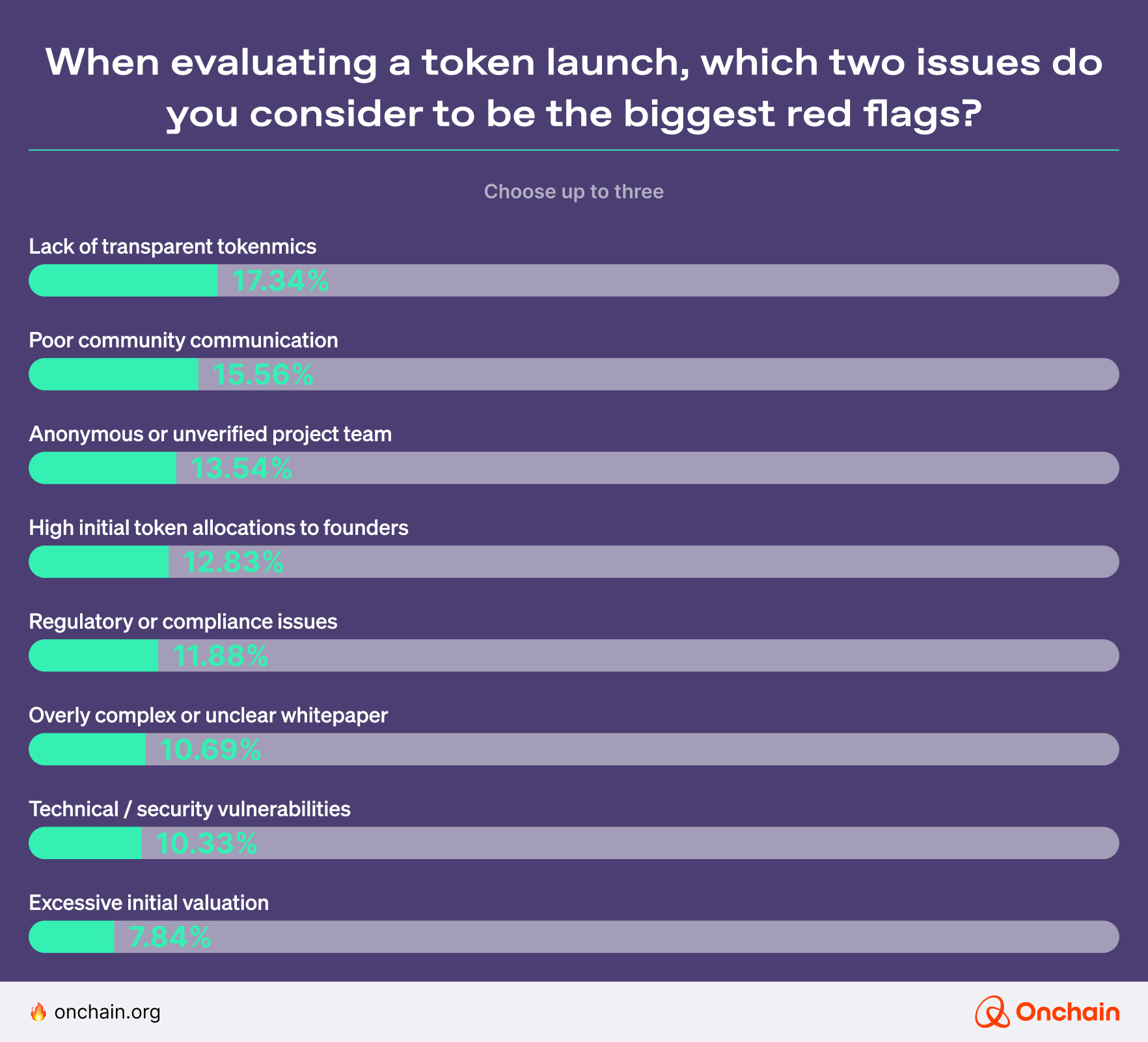

These patterns align with our survey results.

Key insight: The token isn’t the finish line. It’s the starting signal.

Let’s see what you have learned from the successes and failures. The most effective launches:

- Prioritize real contributors over passive speculators.

- Balance growth with supply discipline.

- Treat tokens as an evolving ecosystem component, not a one-off launch event.

These are critical points to consider for your token launch. However, they are not the only ones that determine the future of your project. In the coming chapter, we direct your attention to a completely different aspect: regulatory frameworks across jurisdictions.

They can force you in directions you haven’t prepared for. The fourth chapter provides you with the regulatory clarity you need to build with confidence. We cover, compare, and contrast the most Web3-friendly regions for founders and startups.