2. Token Launch Mechanics: What Works, What Doesn’t, and Why

You’ll learn:

- Why you need to launch a token and what the value proposition is.

- What a token launch lifestyle looks like and what to consider when planning.

- What problems and risks you need to manage, and what sectors to optimize for.

- Which token launch models exist today: how they work and perform.

- How ‘fair’ is a fair token launch? Is a token airdrop strategy sustainable? Do LBPs actually work?

Token launches are the driving force behind the Web3 economy, serving as a vital conduit between innovative projects and the communities that propel them forward. In recent years, the pace of these launches has accelerated exponentially, with a staggering average of 5,300 new tokens hitting the market daily as of 2024.

The following sections decode that evolution and provide founders with a map of today’s token launch models, including sector-specific needs and emerging strategies that actually work.

2.1 Defining the value proposition of tokens

The most impactful tokens today are not speculative chips that make a wallet shiny. They are:

🪙 Incentive systems that drive governance, staking, and contribution

🪙 Liquidity mechanisms replacing traditional capital markets

🪙 Product access tools or the product itself

🪙 Ecosystem glue that aligns builders, users, and investors

And that’s only to name a few.

The speculative era isn’t over — but serious builders are reframing the value of tokens.

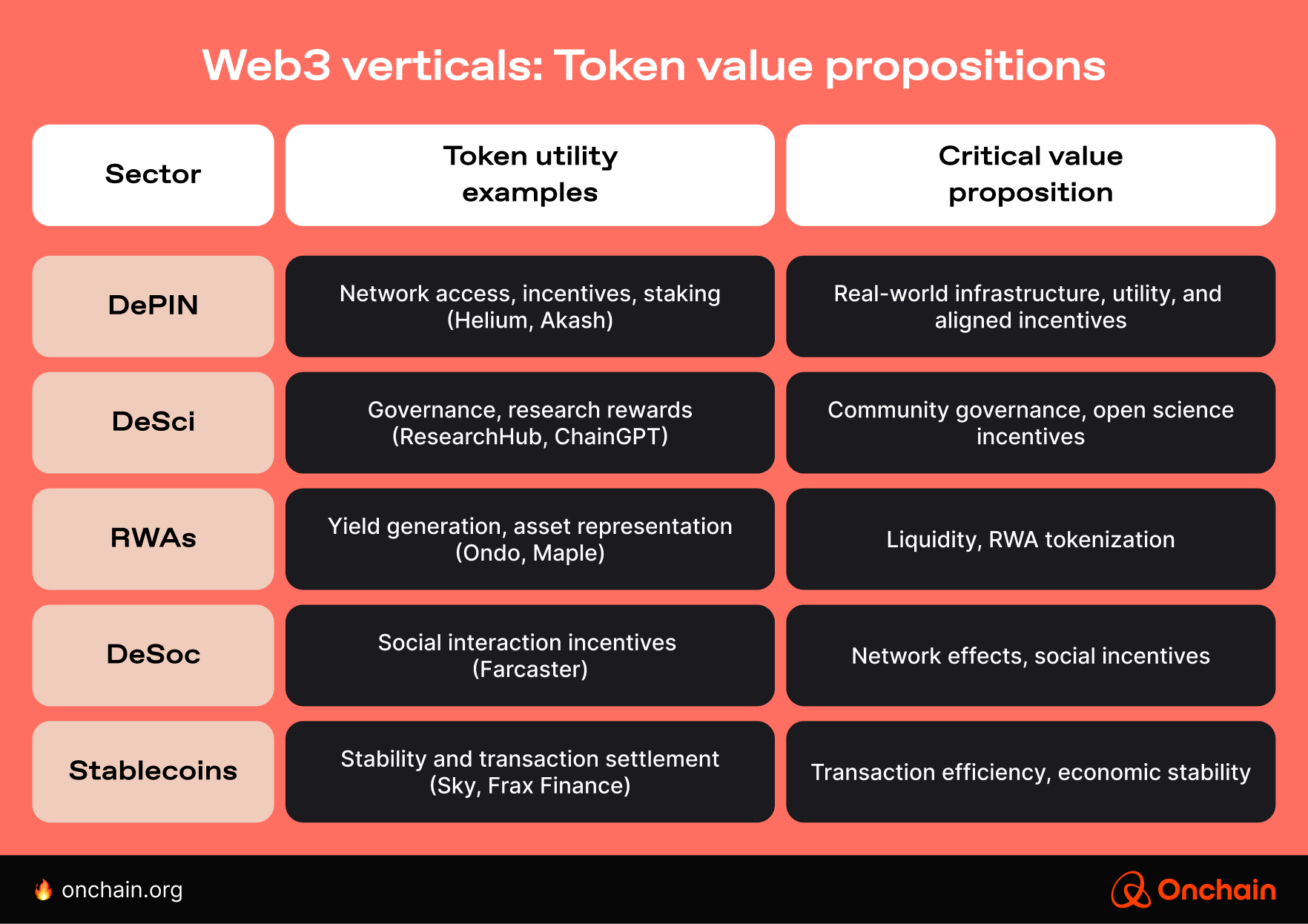

Web3 tokens now serve sector-specific functions that go far beyond price appreciation. To launch well, founders must match token utility to the needs of their vertical:

Insight: The most sustainable tokens are designed around usage, not speculation.

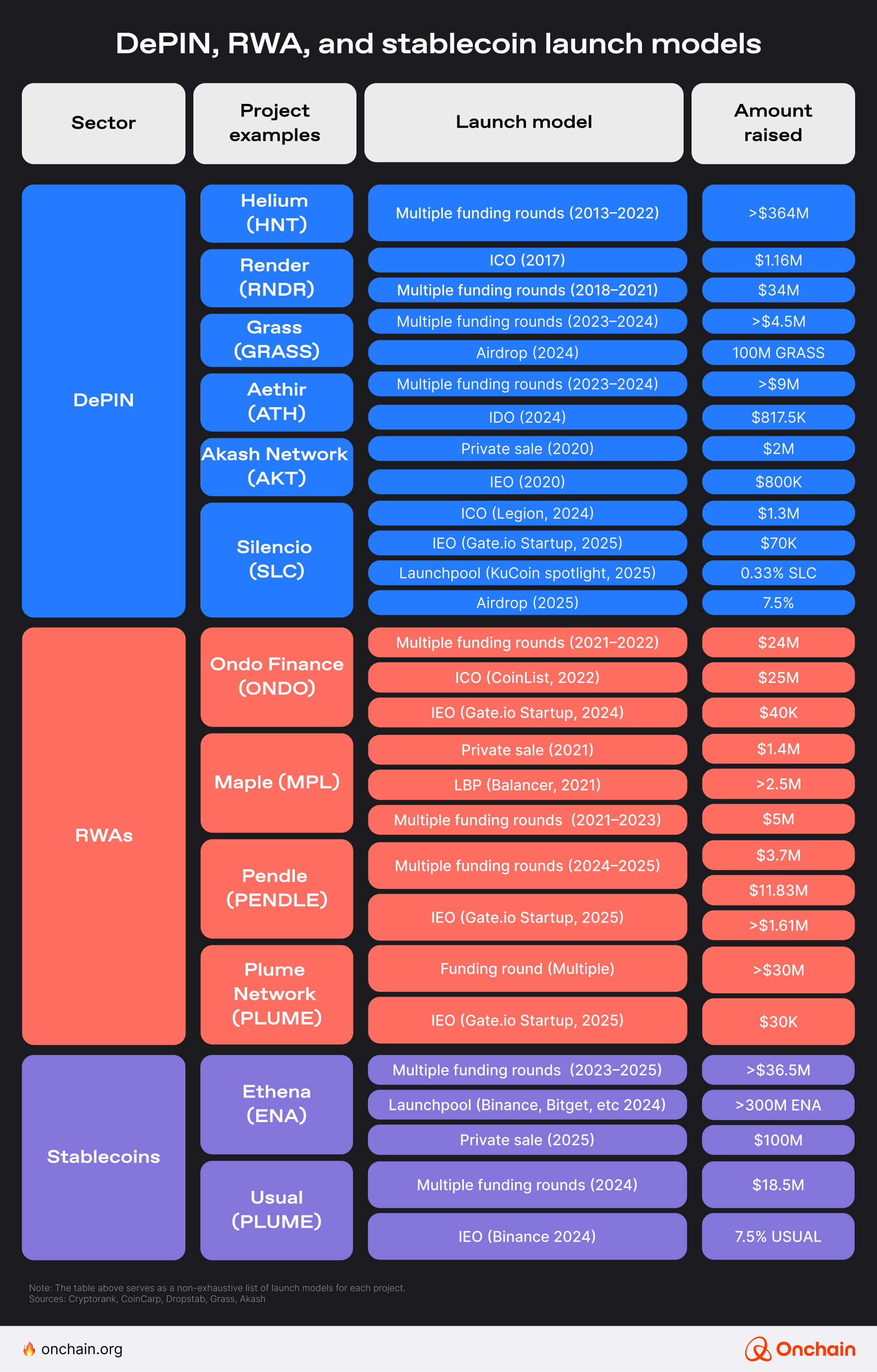

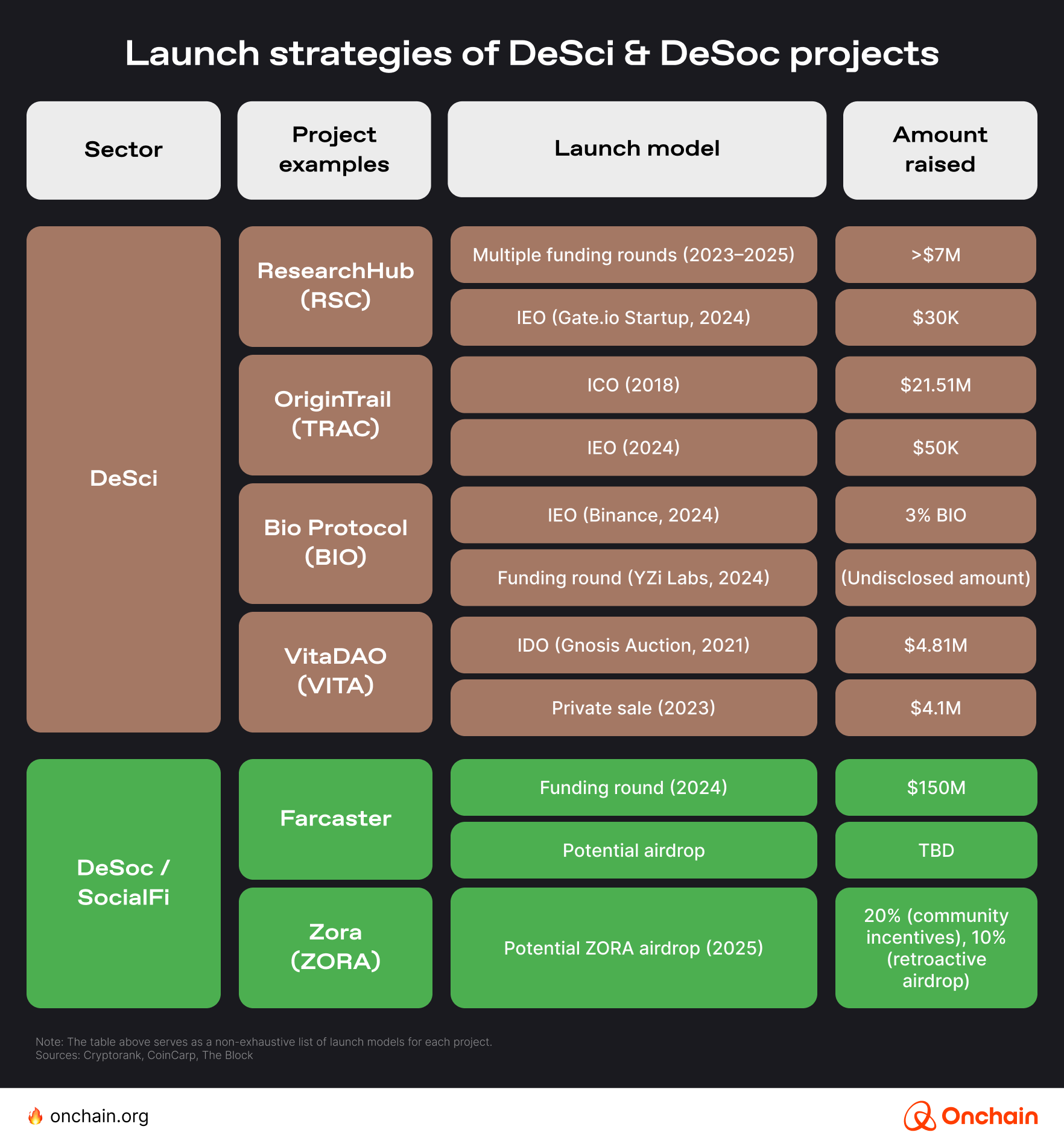

Diving deeper into each vertical, recent success stories have taken a hybrid approach when it comes to launching their tokens. For some, a combination of pre/private sales for early-stage fundraising and deployment of an IEO, IDO, or airdrop at a later stage for a broader reach seems to be the most effective approach.

While these findings are only based on a select number of projects, we can speculate that this staggered approach helps the project achieve multiple goals (e.g., offering more inclusive access, reducing volatility, attracting diverse investors, ensuring regulatory compliance, and fostering stronger community engagement) at different stages in the project’s lifecycle.

While Decentralized Physical Infrastructure Network (DePIN), real-world asset (RWA), and stablecoin projects often blend private sales with public offerings for infrastructure-led growth, decentralized science (DeSci) and decentralized social media (DeSoc) initiatives prioritize exchange listings and airdrop launches for broader reach.

There is no ‘one-size-fits-all’ solution to token launches. Token use cases often decide the best approach. How the token is allocated — whether as an incentive, for governance, utility, yield, or something else — can help inform the design of its economic model and, therefore, the most suitable distribution mechanism.

2.2 Planning for token-led growth

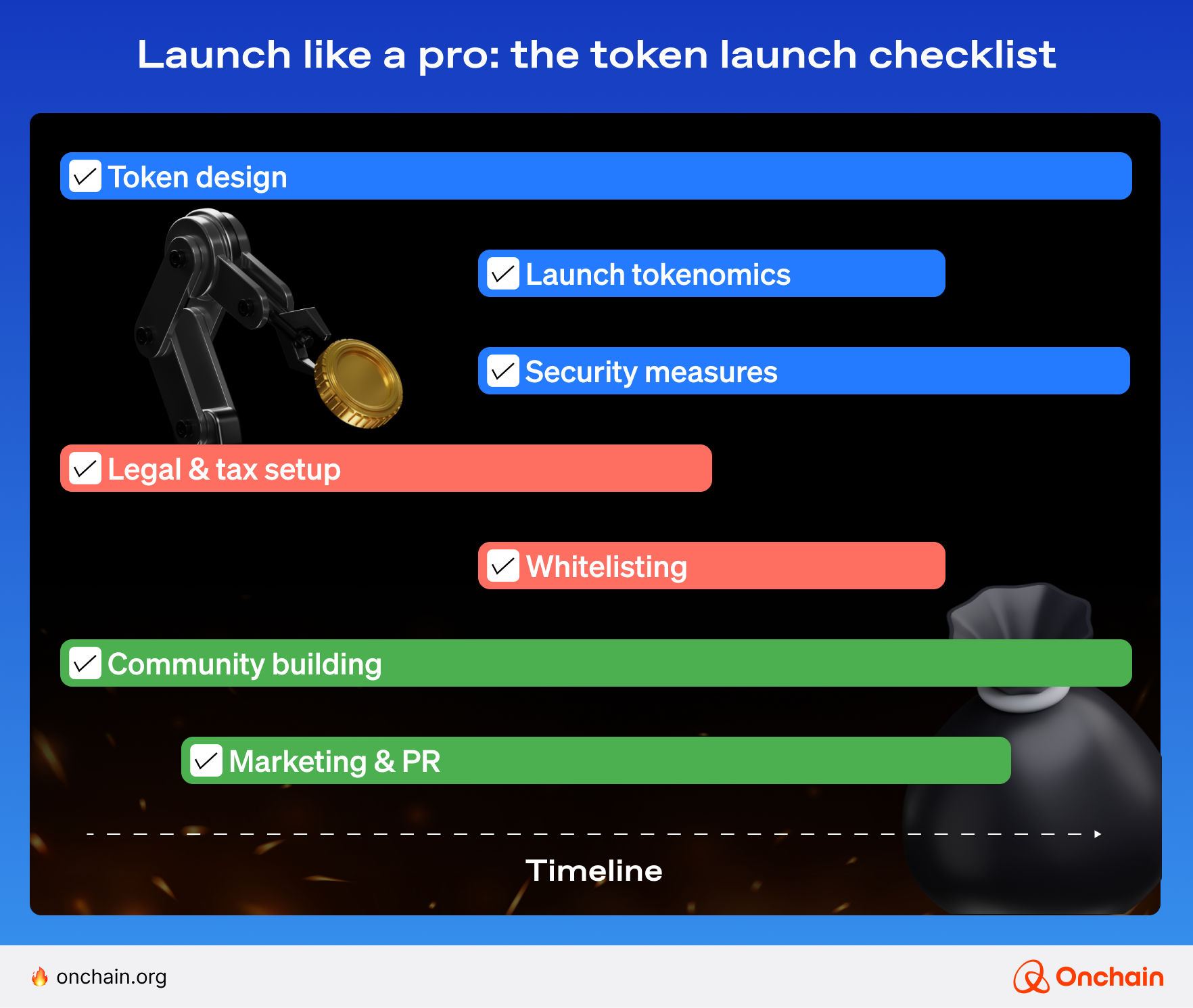

A token’s launch strategy is critical. A poorly executed launch can hurt a project in the long run. It’s essential for Web3 builders to align their launch strategy with key objectives for each stage of their project’s lifecycle. As a baseline, here’s a sample framework to guide founders and business leaders.

A successful token launch demands a phased, strategic approach, prioritizing early-stage community building and token design as a dynamic, ongoing process. Founders can address other critical elements (tokenomics, security, etc.) later in the project lifecycle, though they remain equally important for long-term success.

Legal and regulatory planning should align with the project’s growth stage, covering entity structuring (e.g., Swiss Foundation) and compliance (KYC/AML, data protection). Meanwhile, pre-launch marketing is essential in generating visibility and investor interest before the token goes live.

To visualize all these, we mapped out these key components below, which form a non-exhaustive yet streamlined approach.

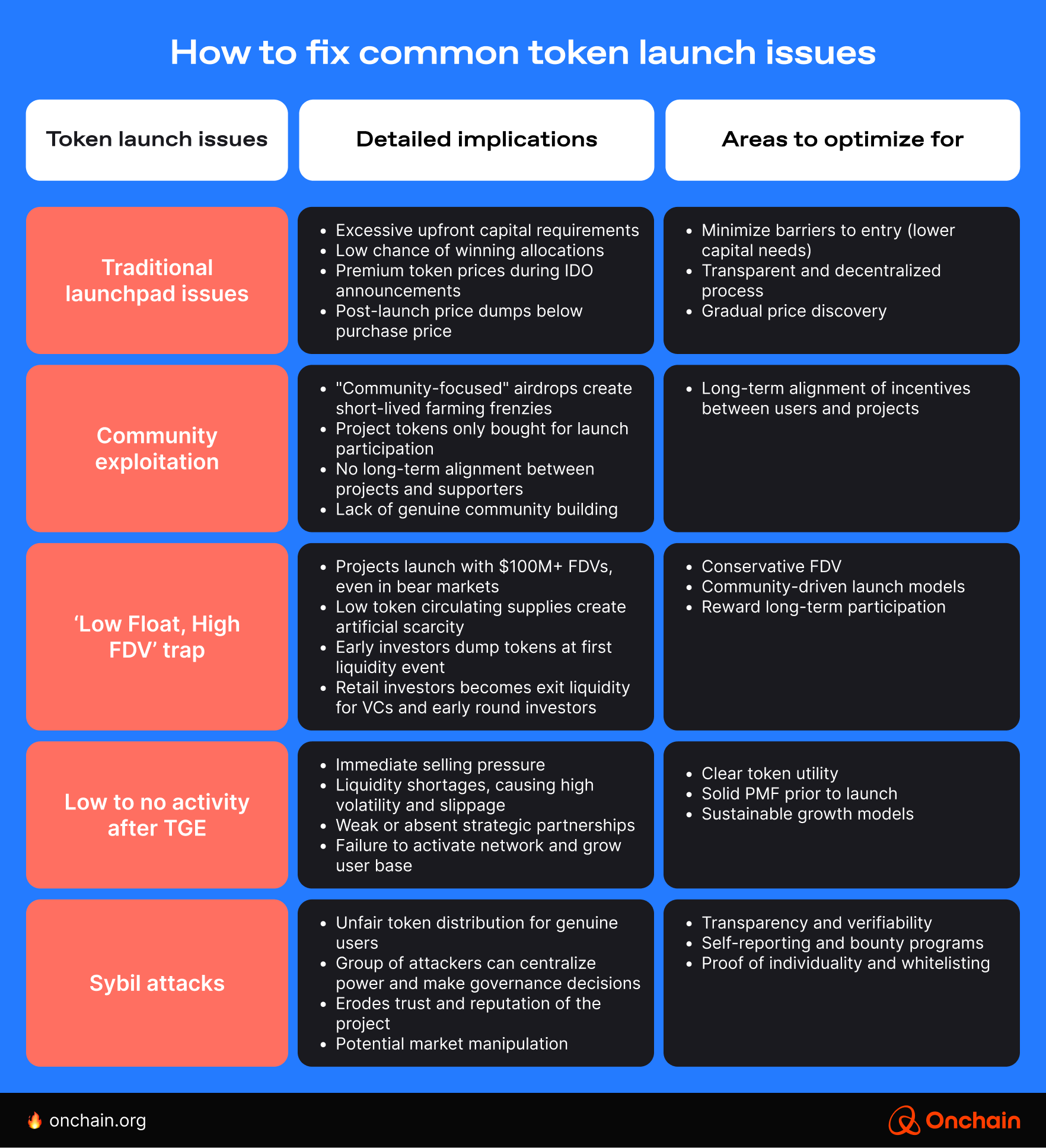

Understanding the risks inherent in your project and what you should optimize for as a project owner will help inform the right strategy for your launch.

In the following sections, we explore existing token distribution models in detail and sample an optimal token distribution strategy.

2.3 Token distribution models in Web3

In this section, we looked closely at the token launch ecosystem and how it’s evolving.

First, let’s check out the broader landscape. The following sector map lists the current token launch platforms, sorted by select key categories.

2.3.1 Navigating token sales models: ICOs, IEOs, and IDOs

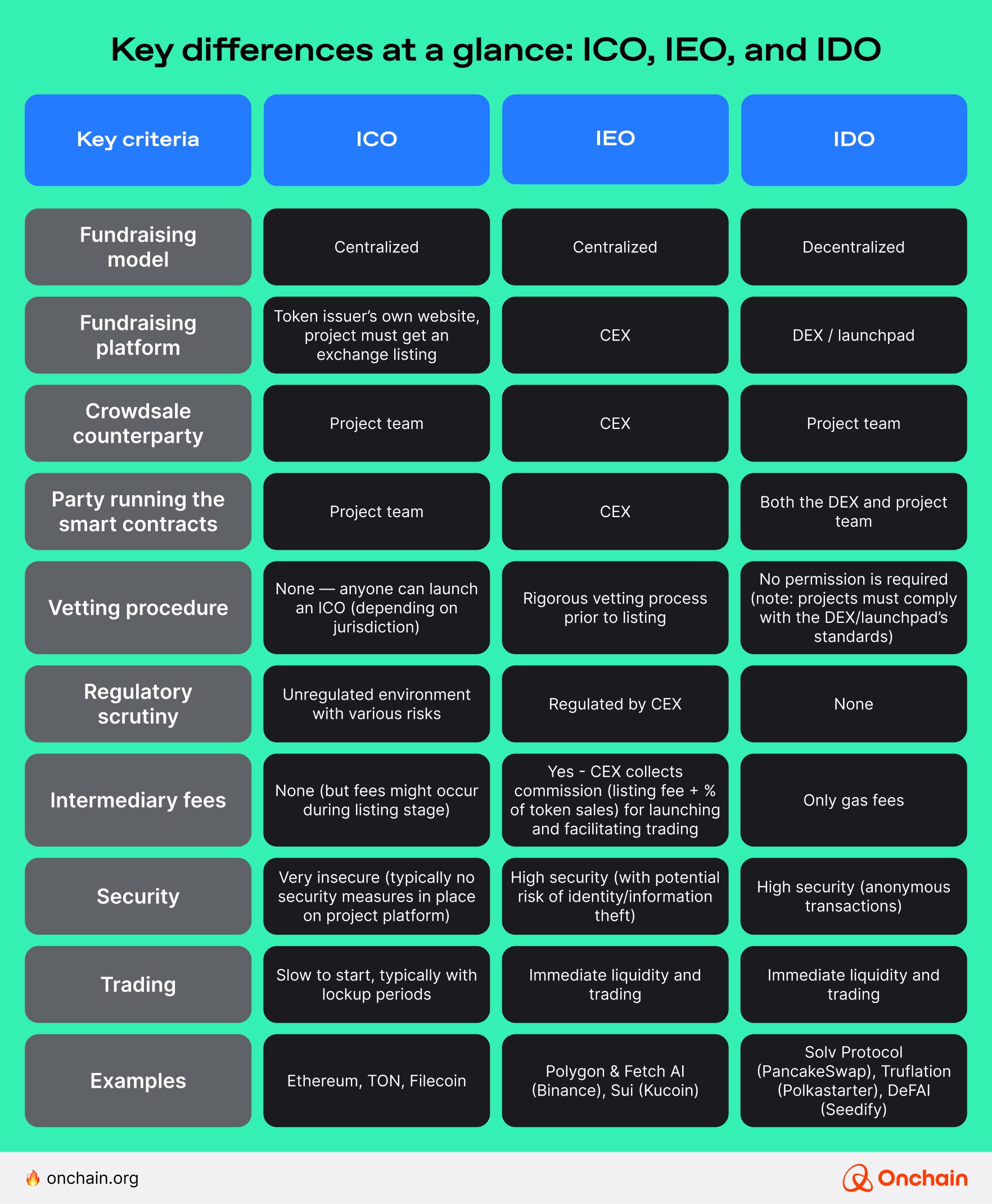

The first chapter covered the evolution of token launch models. Now, we dive into the landscape of ICOs, IEOs, and IDOs — models that span both private and public sales, often blending the two in practice.

For founders evaluating which model fits their project best, the breakdown below further details the contrasting strengths of each model. For more information, read our full guide here.

2.3.2 Community comes first: fair token launches

Fair token launches put a project’s community front and center — no insiders, no backroom deals, no pre-sale discounts.

They represent Web3’s founding ethos: equal opportunity over equal outcome.

While projects could easily take the IDO route, many new crypto projects are also leaning into fair launches to attract interest from small investors and avoid a reliance on seed capital from private investors. Bitcoin (BTC) is considered one of the pioneers adhering to the principles of this model, while other projects such as Yearn Finance (YFI) and BadgerDAO (BADGER) launched with this model as early as 2020.

What makes a launch “fair”?

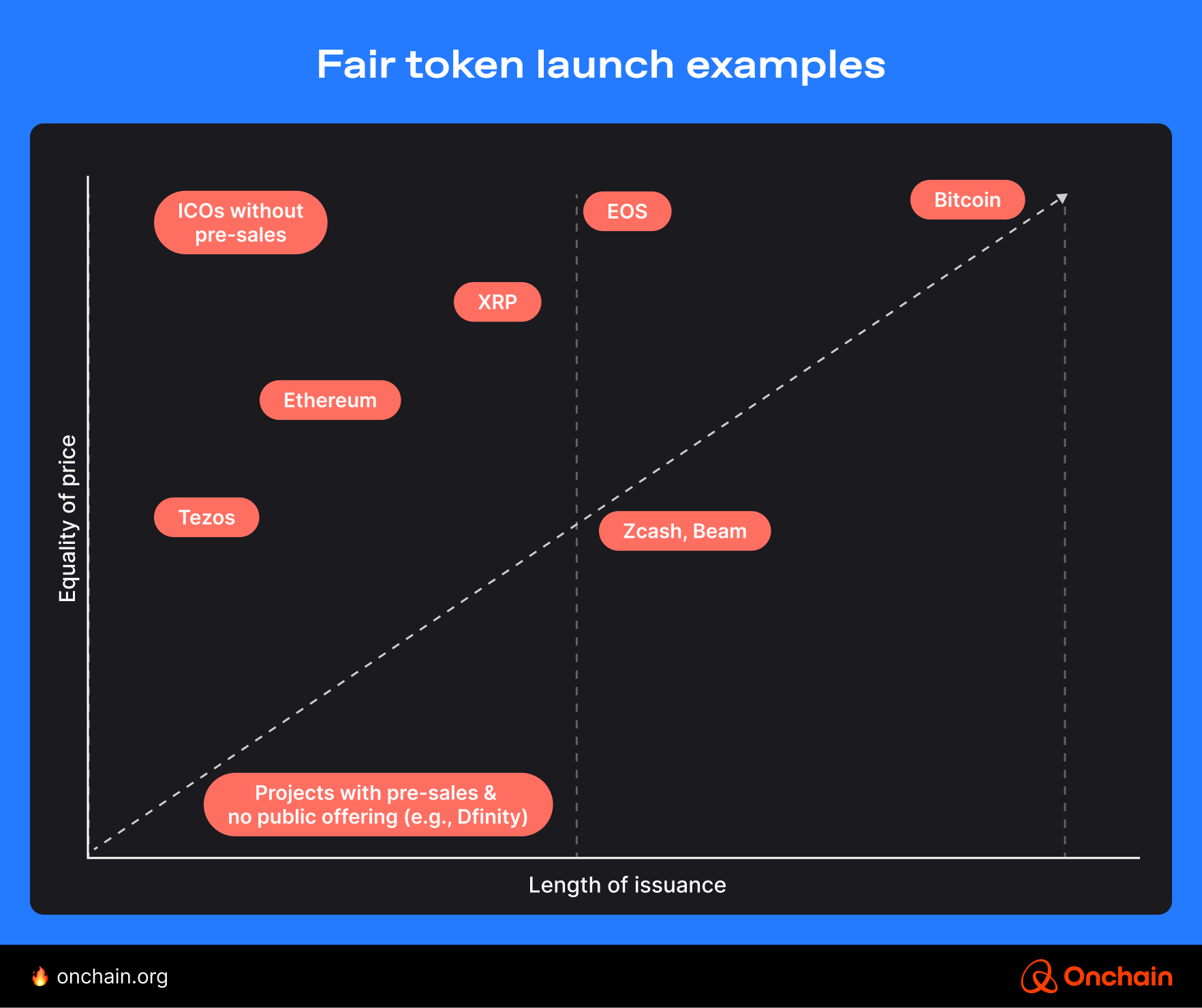

According to a paper by economist and lawyer Wulf Kaal, there are two notable attributes underlying fair token launches:

- 🟦 “Fairness to the public/community by offering equal opportunities for token distribution – including, depending on the preferences for purity of the fair launch design of founders, and the permissible carve-outs.

- 🟥 Very limited opportunities for the founders, developers, or other insiders to access token distribution prior to the public.”

For those championing this concept, a foundational principle is established where a fair launch presents “equal opportunity — not equal outcome — to acquire a coin over a long period of time at a relatively equal price.” Expanding upon this and the two themes above, founders and project owners can look to the following indicators to ensure fairness and prioritize community during their launch.

- Length of issuance:

A longer issuance schedule gives market participants ample time to thoroughly evaluate the project and its pricing before making decisions. - Relative price equality:

No insider group or person can purchase the token at a significant discount. - Number of wallets:

Fairness can be assessed by the number of wallets holding the token and the engagement of those wallet owners. - Fairness to the public:

Fairness to the public means fairness to people who are not involved in the project, above all else. No early investors are permitted with a pre-allocation of project tokens or with a pre-mining program.

Our research found that equitable rewards to the project community (and beyond) should be the top priority for both token launch initiators and participants — and the principles of the fair token launch model highlight this need.

What founders need to know

According to our survey, a high concentration of tokens among insiders is considered one of the biggest project red flags. Reinforcing this, high initial token allocations to founders, on top of poor community communication are among the top issues for participants when evaluating token launches.

Memecoin launchpads as fair launch platforms

In 2024, Pump.fun, Sunpump, and Four.meme supported fair launches using bonding curves, instant token creation, and no pre-sales.

What worked?

- Anyone could launch or participate.

- Real-time pricing meant no early advantage.

- Tokens were traded immediately with transparent mechanics.

But here’s the catch:

- Core teams typically retained just 5–15% of supply.

- That meant limited capital for operations and incentives.

- Large holders could still game the system post-launch.

Bottom line: Fair doesn’t mean frictionless. Design for fairness, but don’t ignore durability.

Key takeaways for founders

If you’re considering a fair launch:

✅ Use transparent price discovery mechanisms (e.g., bonding curves, auctions).

✅ Avoid pre-mines, insider rounds, or backroom vesting schedules.

✅ Anchor launch mechanics to community trust, not hype.

✅ Combine fair launches with tools that verify identity, contribution, or reputation.

Fairness isn’t just moral — it’s strategic. It builds the kind of stakeholder alignment money can’t buy.

2.3.3 Reinventing airdrops

One of Web3’s most popular token launch strategies, an airdrop distributes tokens to early users, often to boost marketing or grow a community. This strategy took off during 2020’s DeFi Summer, and for good reason: Who doesn’t love ‘free’ crypto?

In fact, in our survey, airdrops are considered one of the most appealing distribution methods, alongside NFT-driven launches.

Yet, investor psychology is very much at play here: Because the tokens are obtained with such a low barrier, airdrops create very little sense of ownership, with the holder not having enough ‘skin in the game.’ Over time, the thrill of earning without any risks becomes too good to be true.

Can airdrops create sustainable token growth?

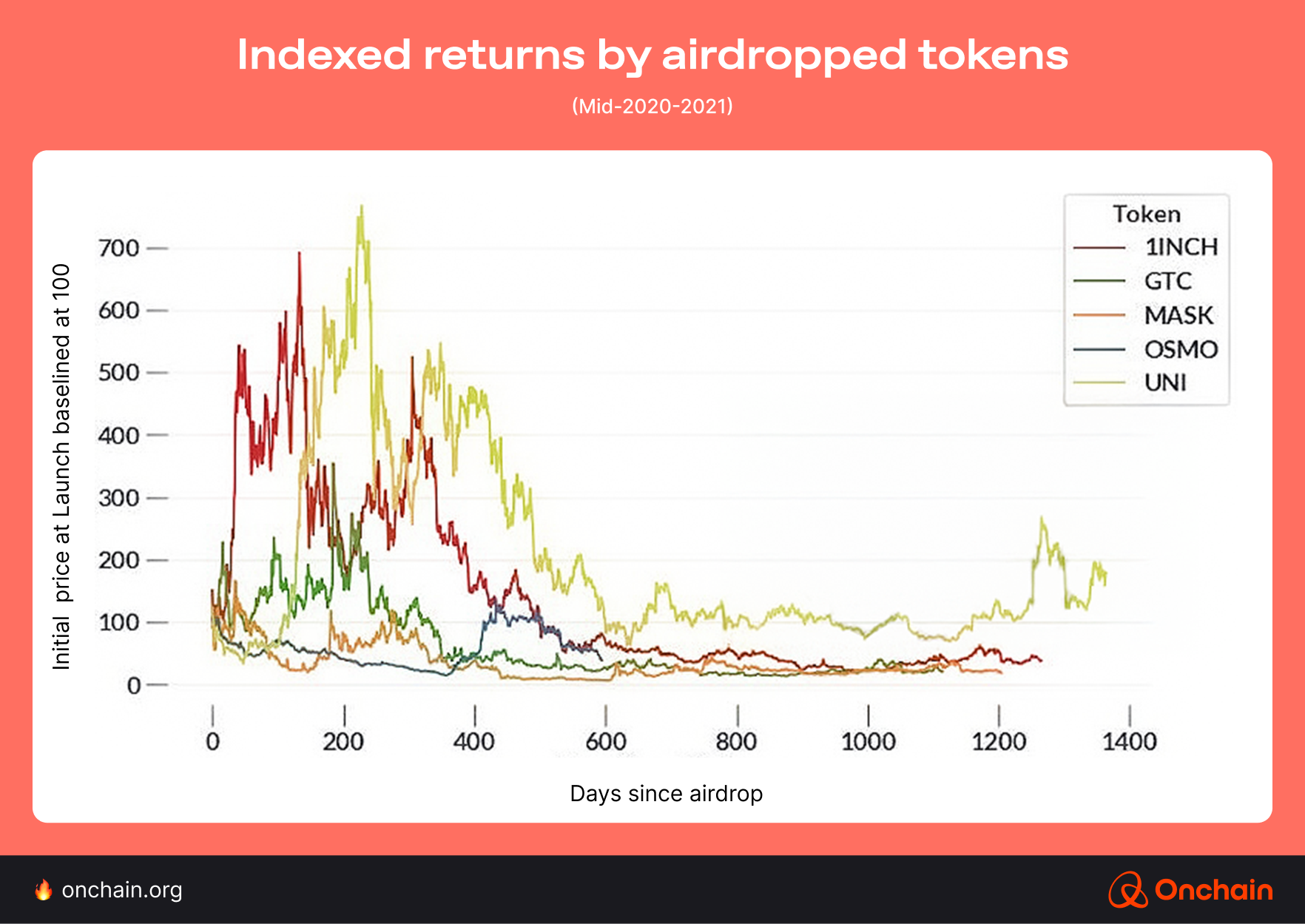

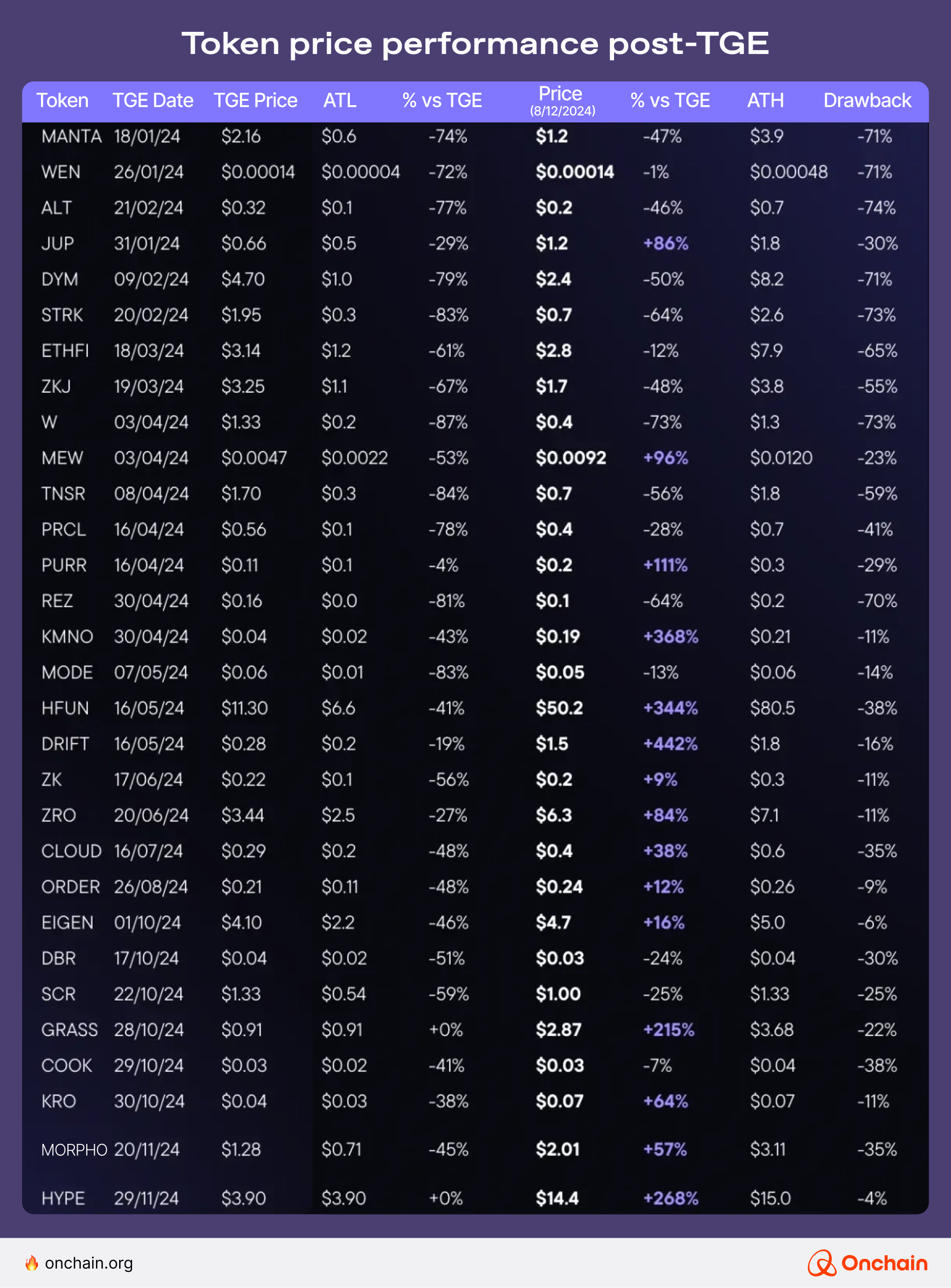

Airdrops are used by protocols to distribute tokens to the community and prevent a low float, rewarding early users for desired behaviors that help grow the protocol. While they offer short-term windfalls, most airdropped tokens lose their long-term value. Based on Coin Metrics’ data, only about a third maintain their value post-airdrop (as of the first day of trading). Additionally, airdropped tokens result in a median loss of -61% for token holders based on the same dataset.

This goes to show that, while airdrops can spark early participation, most of them rarely lead to long-term value (with those launched between 2020 and 2021 as heavy outliers, shown below).

Airdrop token performance from 2024, too, suggests that these tokens may provide a short-term bump in activity/usage. However, post-airdrop metrics show significant variability across the board, with substantial losses more heavily impacted by dilution, underscoring the need for a long-term plan.

Whether airdropped tokens can create real and sustainable growth is yet to be determined — something Web3 founders and project owners need to carefully consider when planning for long-term network growth.

Airdrops: What they’re still good for

✅ Distributing supply without regulatory baggage.

✅ Rewarding early users retroactively.

✅ Creating visibility around a protocol.

✅ Bootstrapping liquidity (when paired with usage).

Airdrops: What often goes wrong

🚨No long-term incentive: Users dump and disappear.

🚨Sybil attacks: Bots farm rewards, draining supply.

🚨Low utility: Tokens have no purpose beyond speculation.

🚨Dilution risk: Circulating supply spikes while demand flatlines.

If you’re planning an airdrop in 2025, ensure it’s earned, useful, and strategic.

Key insight: Airdrops aren’t dead — but they need discipline. In 2025, the best ones aren’t giveaways — they’re earned incentives that strengthen your ecosystem.

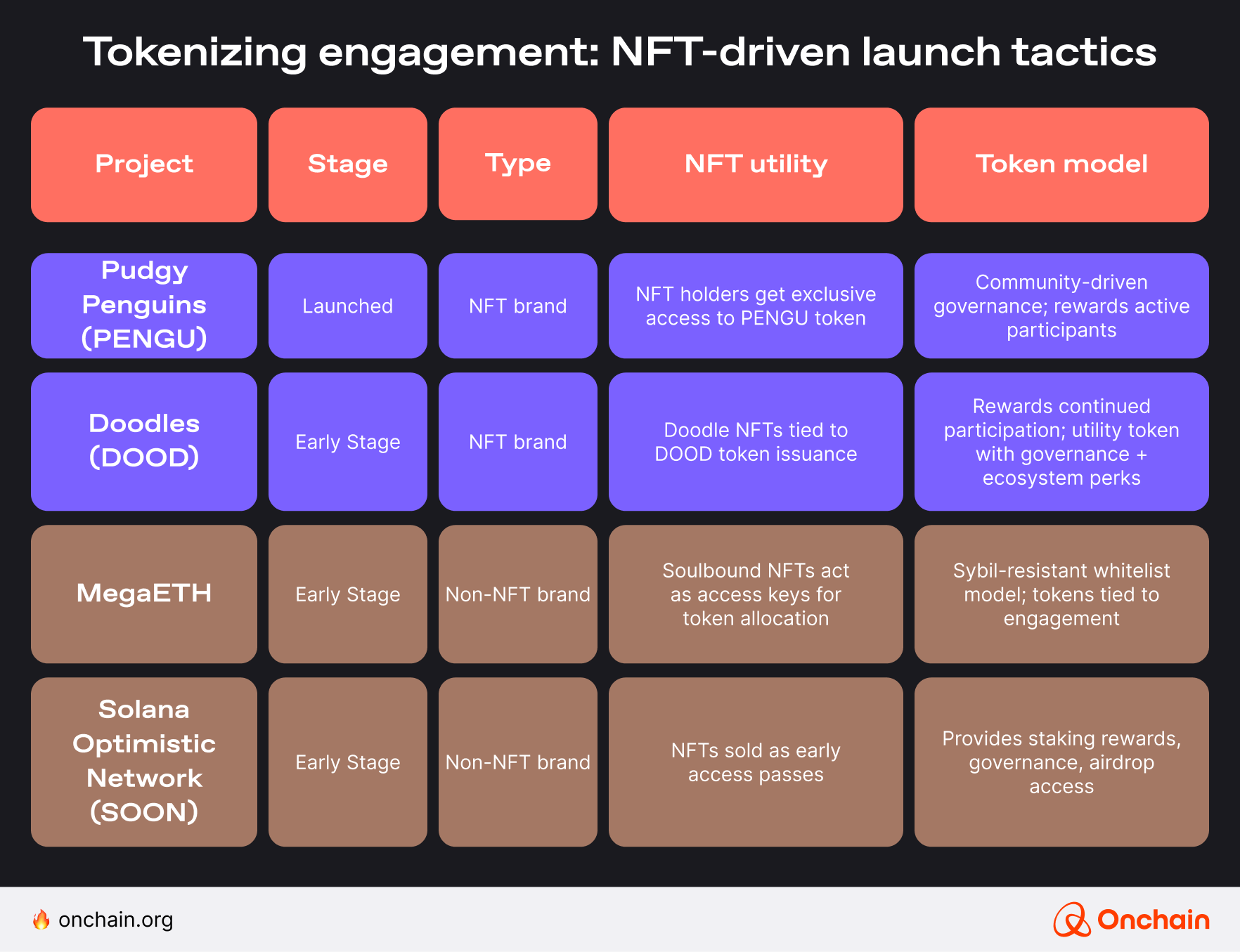

2.3.4 Is the cartoon era over? The rise of NFT-driven launches

The NFT-driven launch model is a rising token distribution trend. This model positions NFTs in a project’s launch as utility or governance tokens. Rather than being mere digital cartoon collectibles, they now function as growth drivers for Web3 projects.

Today, NFTs remain a popular choice for project owners and investors alike due to the incentives and utility they provide to holders.

NFT-driven launches combine the popularity of NFTs with the wide utility of tokens, thus fostering community engagement while minimizing common issues:

✅ Unlike traditional airdrops that are more prone to manipulation (e.g., airdrop farming or Sybil attacks), the NFT-driven launch model is more resilient against such exploits.

✅ Projects can restrict transfers to ensure that only committed users benefit.

✅ By tying token access to active participation (such as holding an NFT for governance or staking), these models prioritize long-term value creation and genuine user engagement.

NFT-based projects can launch by building a loyal fan base around collectibles, while non-NFT projects can create utility within their ecosystems by using NFTs as access keys to tokens. A few recent projects have adopted such models with varied implementations.

These NFT-driven tactics demonstrate how tokens can transform passive holders into engaged stakeholders, further demonstrating that sustainable launches require more than speculation: They demand utility-aligned incentives that reward genuine participation.

Check this out: The Onchain Founding Membership NFT is a practical example of how NFTs can power early-stage token launches. These NFTs provide holders with defined access, benefits, and participation rights, demonstrating how NFTs can serve as both a funding mechanism and a utility layer for new projects.

Key insights

Despite NFT-driven launches being in their infancy, there are important lessons in the model:

- Use NFTs as token access keys: Instead of traditional airdrops, distribute governance/utility tokens only to NFT holders. This builds a committed community.

- Integrate layered utility: Use NFTs for governance, staking, and exclusive privileges to deepen user involvement.

- Optimize distribution mechanisms: Explore soulbound NFTs to combat Sybil attacks. Or, consider gated sales where only active contributors receive tokens.

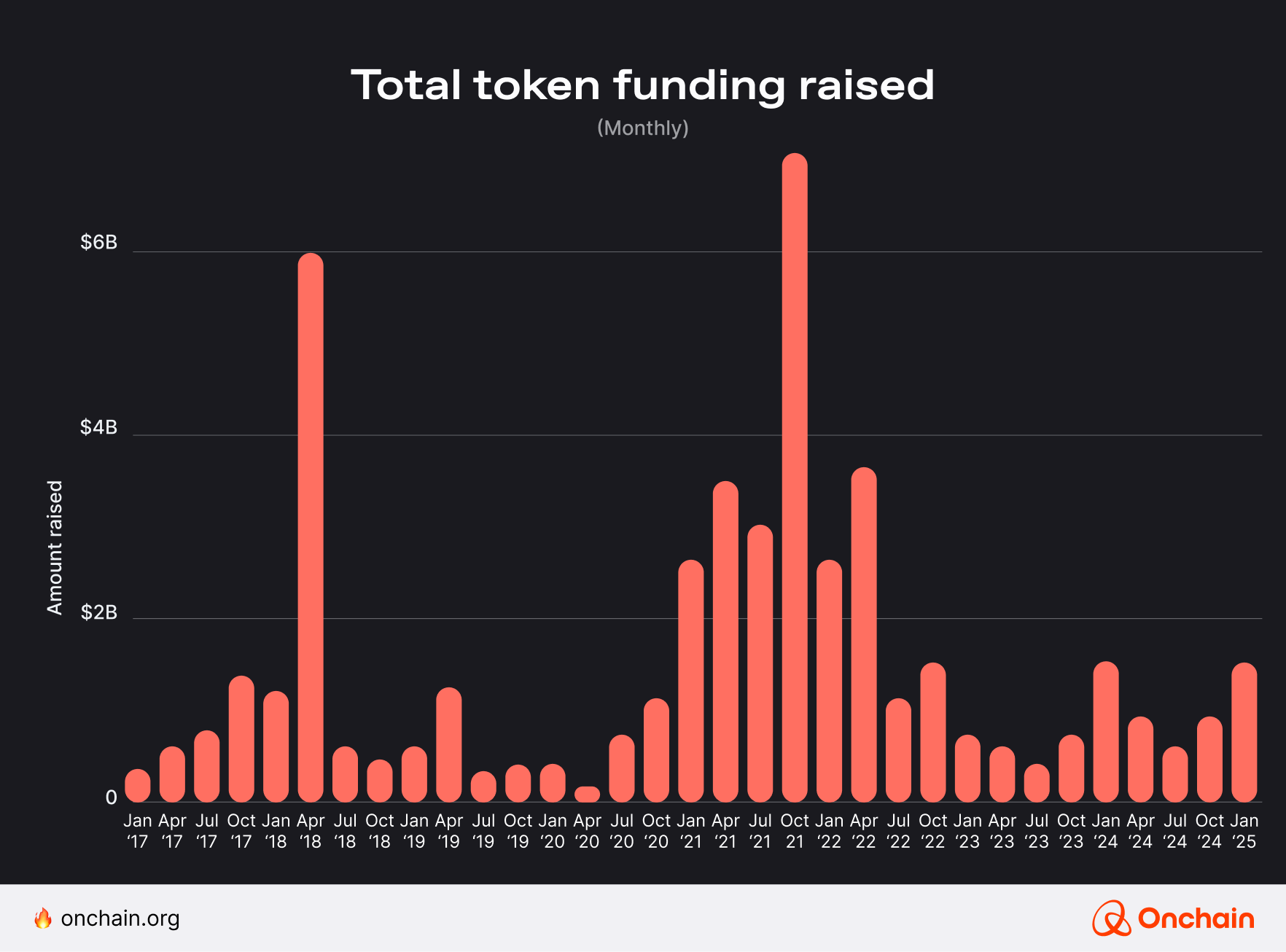

2.4 ‘ICO 2.0’: A new generation of token launch models

The Q2 2025 momentum in crypto fundraising has picked up substantially, matching Q4 2021 rates. Such a bull market signals a resurgence of interest and activity in Web3. However, the landscape has changed. Gone are the days of unregulated ICOs that favored early speculators and allowed for market manipulation.

Today, token distribution trends have shifted from mindless airdrops to intentional, community-driven models that prioritize real value over inflated numbers. The rise of “ICO 2.0” platforms marks the next stage of evolution, focusing on decentralized, fairer, and more transparent token launches.

Unlike traditional ICOs, which often favored early speculators, platforms like Legion and Echo.xyz emphasize equitable token allocation, community engagement, regulatory compliance, and a long-term commitment to drive growth.

In this section, we explore how they mark a new era in token launches, aligning with broader Web3 strategies.

Reinventing the ICO wheel

Echo and Legion are resurrecting ICOs while fixing most of their flaws. They do so by:

✅Emphasis on equitable distribution: No concentrated VC holdings means increased accountability and trust, along with reduced structural risks (Echo).

✅ Attracting genuine communities: Members are investing alongside VCs — aligning VC motivations and incentives with individual members (Echo). Merit-based structuring encourages active participation in investments, turning investors into long-term users of the project (Legion).

✅ Fundraising, fully onchain: Strongly aligned with Web3 principles of decentralized distribution and asset ownership through smart contracts (Echo, Legion).

✅ Balancing innovation and regulation: While offering novel mechanisms and fundraising structures, both platforms aim to balance the democratic and decentralized spirit of early ICOs with the requirements of a highly regulated environment (Echo, Legion).

Project initiators see the value being created by these platforms, as per the survey findings below.

Democratizing private investment in Web3

Emerging platforms like Echo are reimagining how early-stage funding works. Instead of limiting ICO access to elite investors, Echo enables anyone to join investment deals created by vetted ‘lead investors’ — experienced individuals or groups who initiate project funding onchain. These lead investors can form groups where members co-invest under the same terms, creating decentralized, transparent investment collectives.

To balance accessibility with accountability, Echo reviews all lead investors and applies jurisdiction-based regulations to individual contributors. This structure maintains investor protections while keeping the collaborative spirit of the platform intact.

Rooted in merit, where skills matter

Legion, by contrast, shifts focus away from capital and toward contributions. Token allocation is weighted via active involvement in the project rather than just financial backing. This merit-driven system helps align token distribution with genuine project engagement.

At the heart of Legion is the Legion Score, an onchain reputation system inspired by the EigenTrust model. It evaluates a user’s activity, endorsements, and engagement across chains to quantify their value to the community. This encourages deeper participation and disincentivizes speculation.

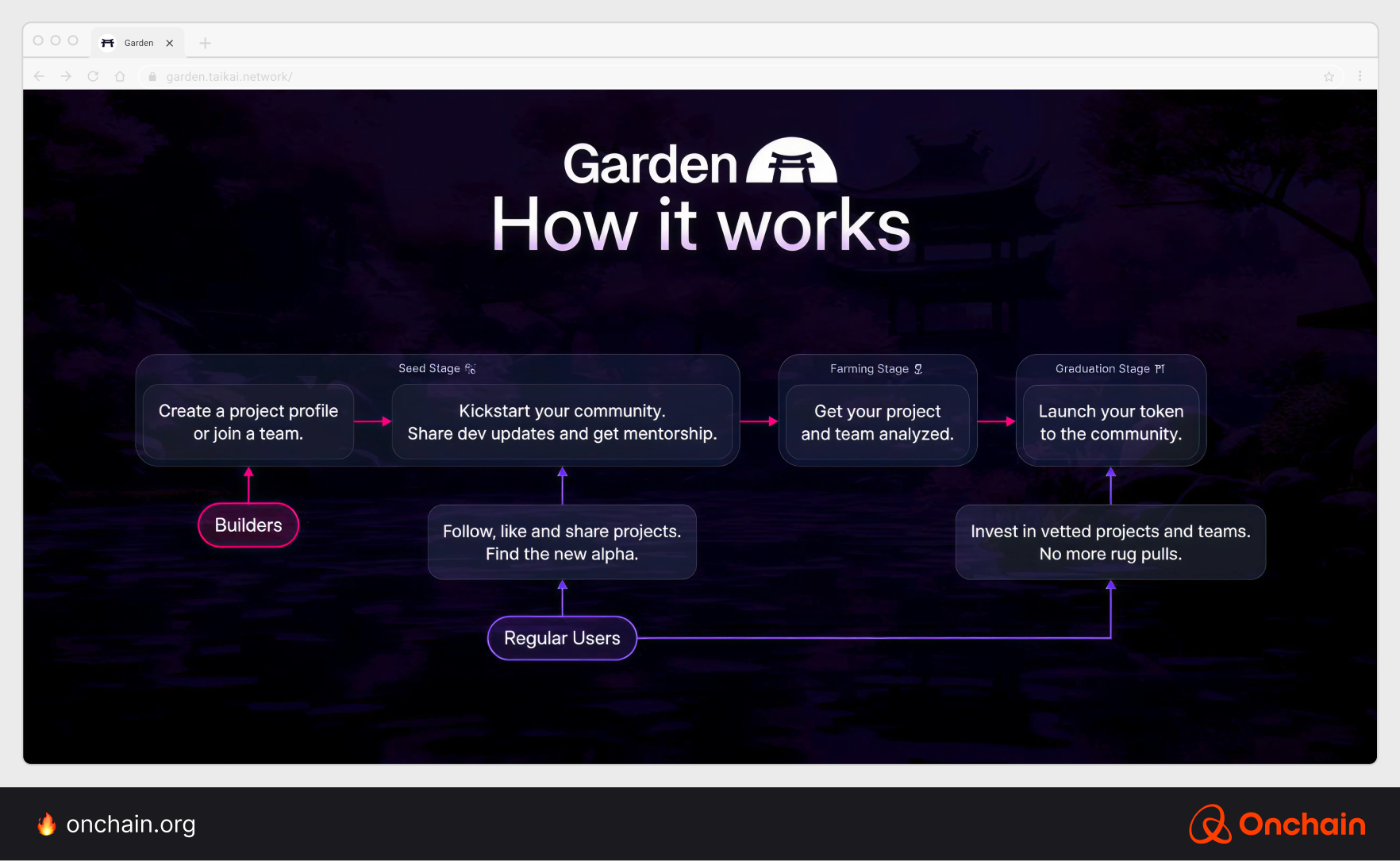

TAIKAI Garden is another notable platform building on the foundation laid by the likes of Legion and Echo. Where these earlier players introduced merit-based rewards and onchain VC models, Garden pushes the paradigm further: It eliminates reliance on speculative incentives and centralized gatekeepers, streamlining the entire journey from prototype to public token launch in a single environment.

Its cornerstone is the Token Factory — a fully audited token generation and distribution tool. With Token Factory, teams can design tokenomics, set allocations, choose between fixed-price, linear, or auction-based sales — and launch directly on Uniswap v4 with pre-built liquidity and price stabilization. No external funding or whitelists are needed: just a direct, permissionless path to launch.

Unlike Echo’s investor-led governance or Legion’s gamified contribution layers, Garden’s “Graduation Stage” empowers any project that meets objective milestones to launch safely, transparently, and with full control over its distribution.

In a landscape where token launches are being redefined, Garden’s model shows what a credible, decentralized alternative looks like: secure, founder-controlled, and aligned with the community from day one.

Why these new-generation platforms matter

Since late 2024, platforms like Echo and Legion have gained momentum, with several projects hitting fundraising goals in hours. Their success reflects a growing interest in more equitable, community-aligned fundraising models, ones that prioritize real contribution and impact over hype.

Projects using Echo to launch are making big waves in fundraising, including

- MegaETH $10 mil, raised in less than three minutes:

- Ethena $300,000

- Initia, $2.5 mil, in less than two hours

- Fogo, $8 mil in less than two hours

Meanwhile, Legion’s real-world impact is demonstrated through projects such as:

- Almanak, $1 mil

- Enclave, $1 mil

- Silencio, $1.3 mil secured out of $112 mil worth of allocation requests

All of these were funded in the six months since Legion’s launch.

Adapt or perish: creating a healthy competitive landscape

While community-first fundraising platforms like Legion and Echo have been generally receiving positive attention, their emergence is also creating some friction and getting pushback from Web3 VCs. This democratization is giving control back to individual investors, which may feel threatening to VCs. As a result, these ICO 2.0 platforms are creating pressure for lower-quality investment funds — or those that don’t provide value — to adapt and up their game when it comes to value creation.

What’s next for ICO 2.0 platforms?

The future looks positive for these next-gen decentralized platforms. However, before we move on to our strategic recommendations regarding these platforms, located in Chapter 5, we’ll go deeper into the landscape and put the spotlight on recent token launches.

In the following chapter, you will discover the successes and struggles of several token launches. You’ll also get an idea of how the Echo.xyz and Legion platforms work in action through analyzing projects like Silencio.