4. Adoption-Drivers, Emerging Markets, and Your Chance to Expand

You’ll learn

- Why inflation, currency volatility, and lack of financial infrastructure create fertile ground for stablecoin innovation.

- Where stablecoins reshape financial systems in the world and which opportunities exist for entrepreneurs and businesses to lead change.

- Which stablecoin-powered solutions are best suited for these markets, and why they have the potential to thrive.

- How to use these insights to better design, build, and implement stablecoin businesses that address local needs and unlock untapped opportunities.

Emerging and developing economies are leading global stablecoin adoption due to their ability to bypass TradFi barriers. Stablecoin transfers are providing faster, cheaper, and more reliable payments to both domestic and international markets.

Stablecoin adoption is particularly prevalent in countries with high inflation. For example, Argentinian inflation surged past 100% in 2023. Its citizens abandoned the Peso (ARS) and turned to stablecoins like USDC and USDT to protect against the erosion of their purchasing power.

There is a huge need for stablecoins in countries where the currency is losing value. People need stablecoins to protect their capital and, in some cases, to ensure privacy.

- Cyrille Briere, Contributor at f(x) Protocol

Many African countries also face high inflation rates. Watch this video to discover how PYUSD and Yellow Card are providing financial alternatives.

Individuals in volatile economies are turning to stablecoins to navigate economic uncertainty.

Survey Insights

According to our survey data, stablecoin adoption in emerging markets is significantly higher than in advanced economies, with 45% of consumers from emerging markets using stablecoins, compared to only 17% in developed regions.

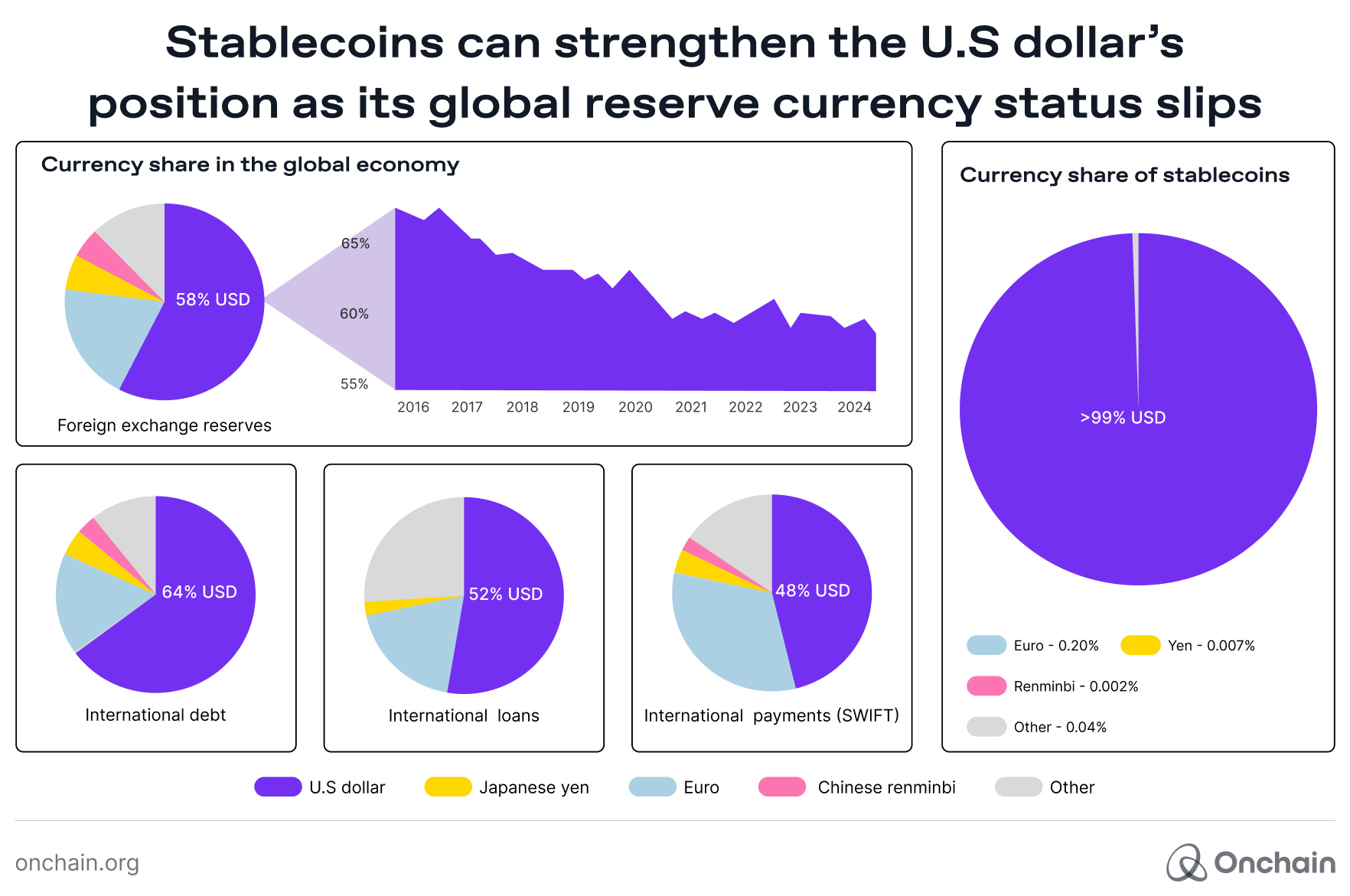

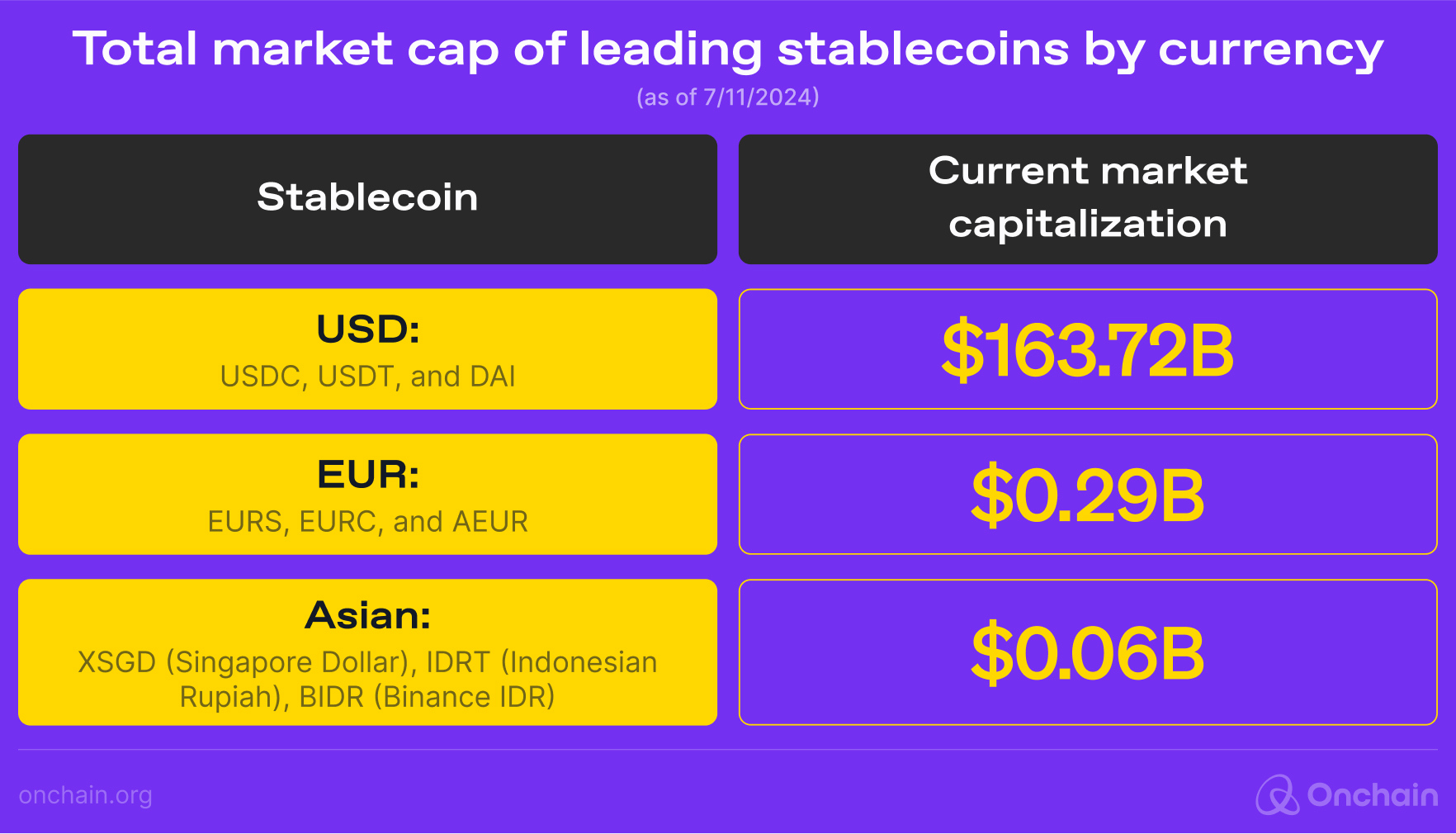

Nearly all stablecoins are pegged to the US dollar, which accounts for over 99% of the market. The euro (EUR) is the second most common currency used for stablecoin denominations, representing approximately 0.20% of the market. A small portion of the remaining stablecoins are pegged to gold and other fiat currencies.

But why are USD stablecoins so dominant? The answers won’t surprise you, but upcoming trends may not be what you expect.

4.1 USD-pegged stablecoins run the show

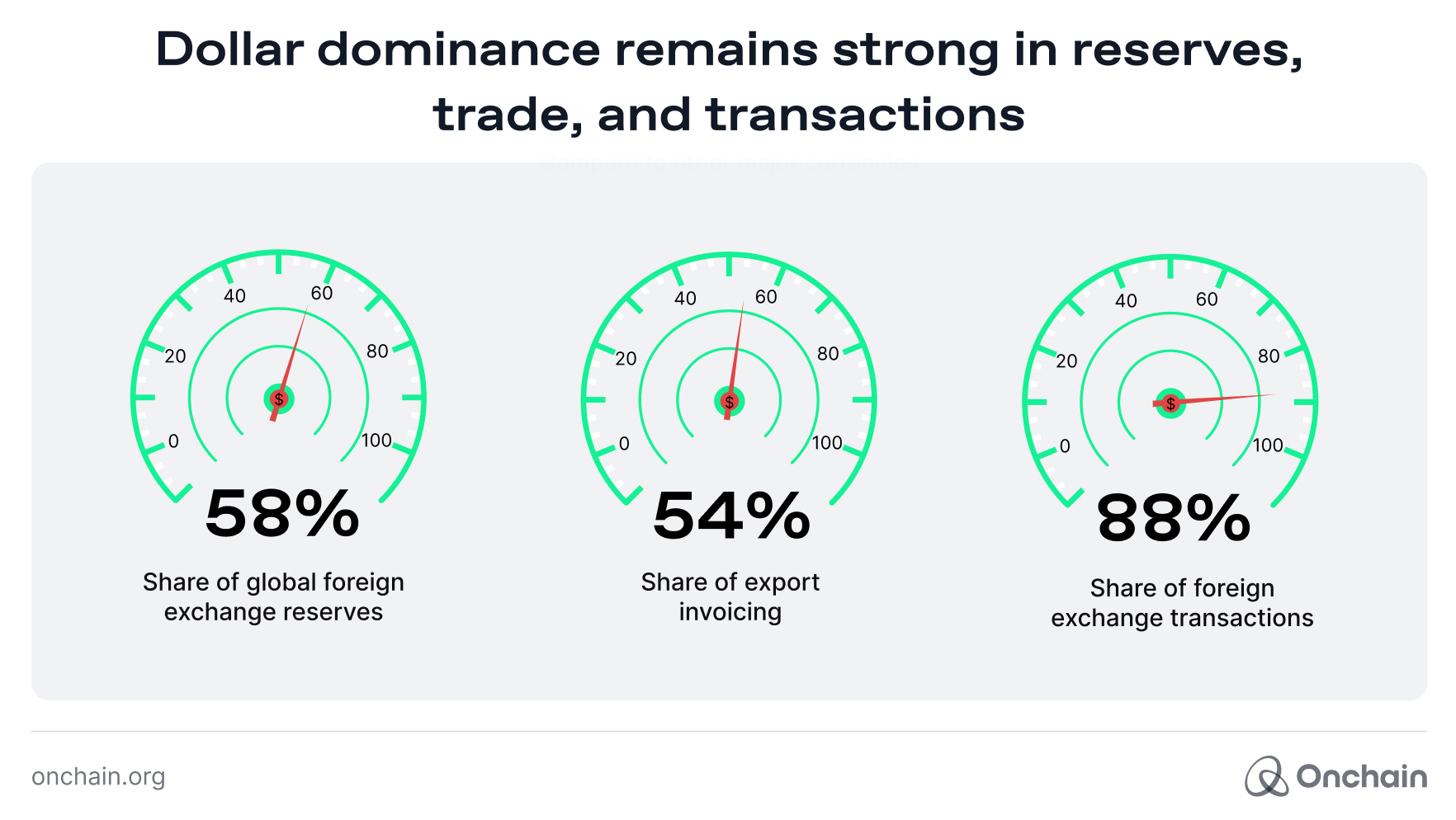

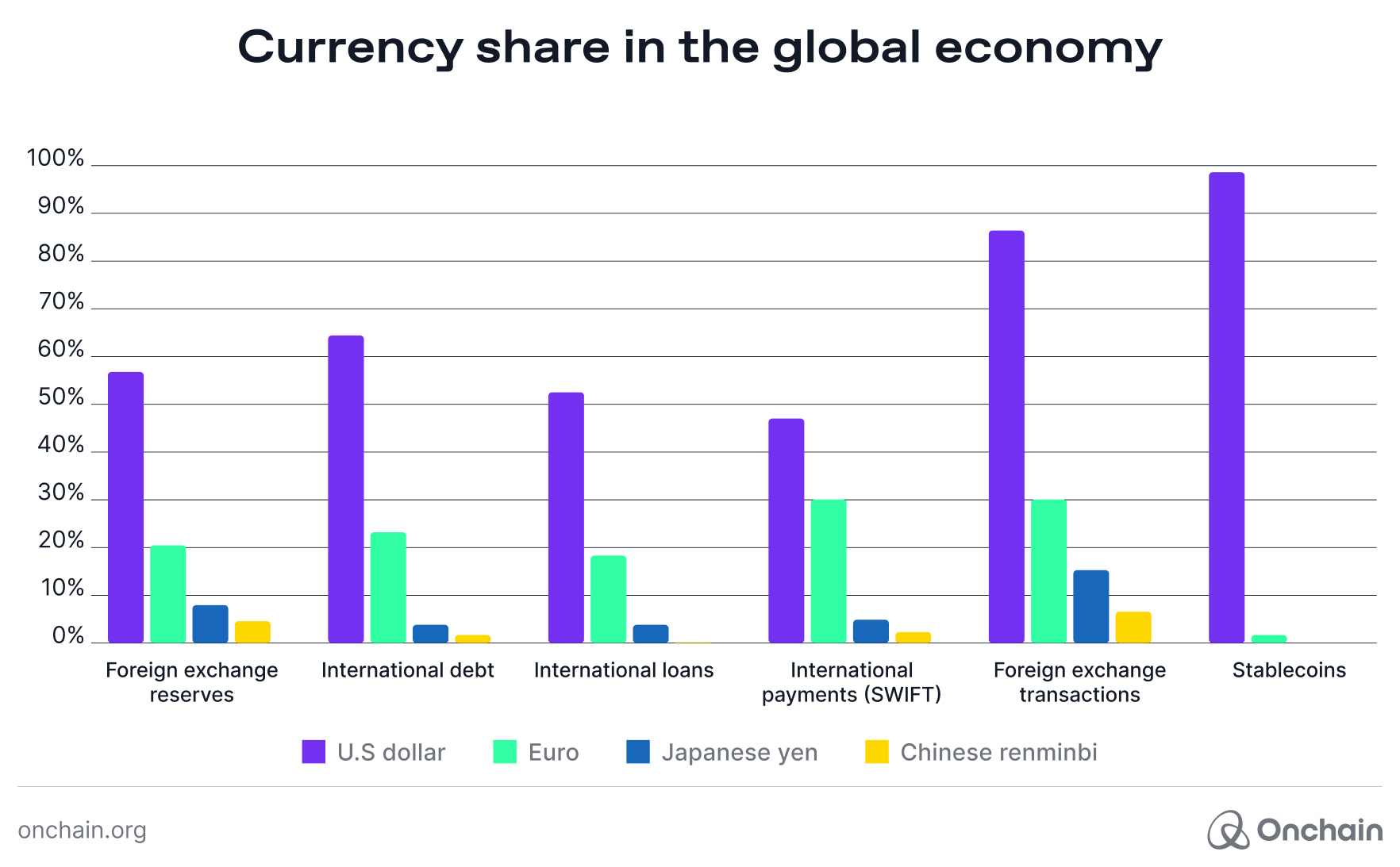

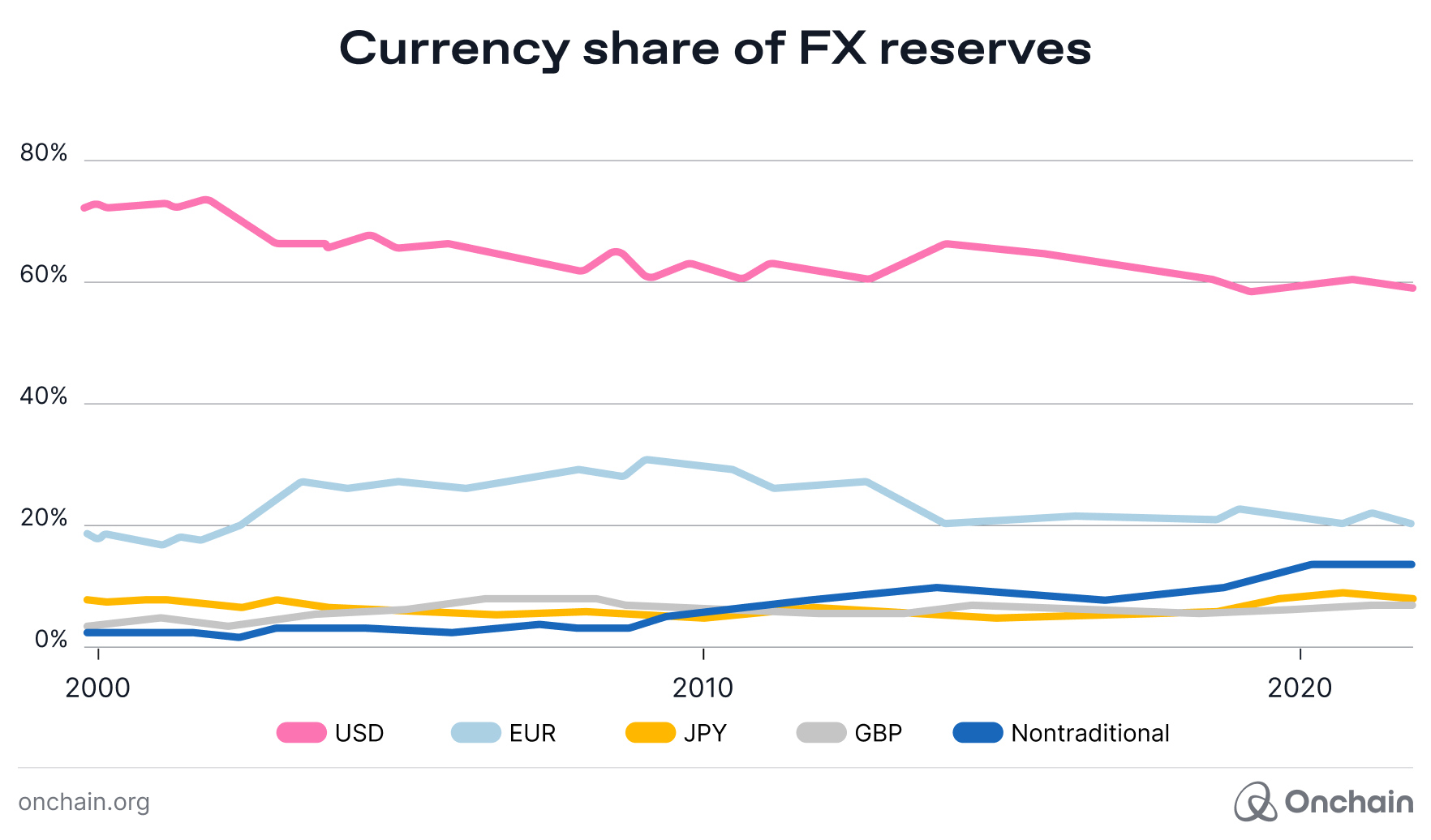

USD is the world’s leading reserve currency. Held by central banks and global institutions, USD holdings account for 58% of foreign reserve holdings, dwarfing the EUR’s 20% share. This disparity underlines USD’s continued prominence and dominance in the international monetary system.

According to CoinGecko, as of November 5, 2024, the top two stablecoins — USDT and USDC — represent over 90% of the stablecoin market cap. This dominance is particularly evident in emerging markets, where 47% of stablecoin users prefer USD stablecoins.

The role of USD stablecoins in emerging markets

USD-pegged stablecoins have become a critical lifeline in emerging markets. Factors like USD scarcity and local currency depreciation drive stablecoin demand. These highlight the growing demand for relatively stable and low-inflation currency alternatives:

- Cross-border payments: In many emerging markets, stablecoins provide more affordable and efficient cross-border payments. In the Philippines, the GCash platform integrated PayPal’s PYUSD, enabling users to send and receive low-cost remittances. Stablecoin-based solutions are particularly beneficial for freelancers and families reliant on remittances for financial support.

- Limited TradFi access: Many individuals in emerging markets need access to conventional banking and financial services. For the unbanked, stablecoins provide a gateway to financial tools like lending, borrowing, and investing. For instance, M-Pesa in Kenya has integrated USD-pegged stablecoins, extending access to previously unavailable services.

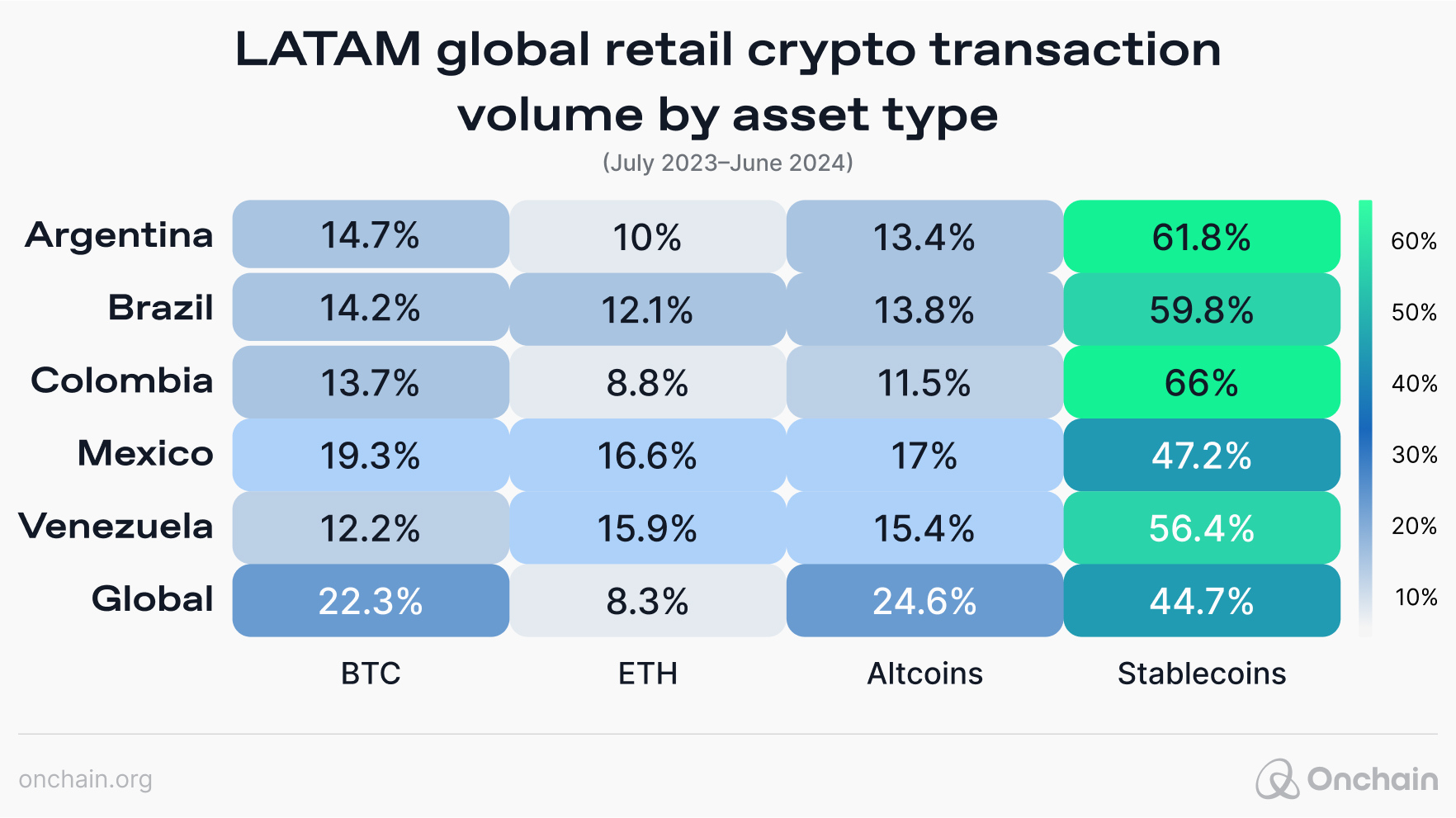

- Inflation hedge: High inflation rates in countries like Argentina make local currencies unsuitable for preserving wealth. Argentinians have increasingly turned to stablecoins to preserve the purchasing power of their savings. Argentina leads the Latin American (LATAM) region for retail stablecoin transactions, far exceeding the global average. This trend reflects the role of USD-pegged stablecoins as a lifeline in inflation-plagued economies.

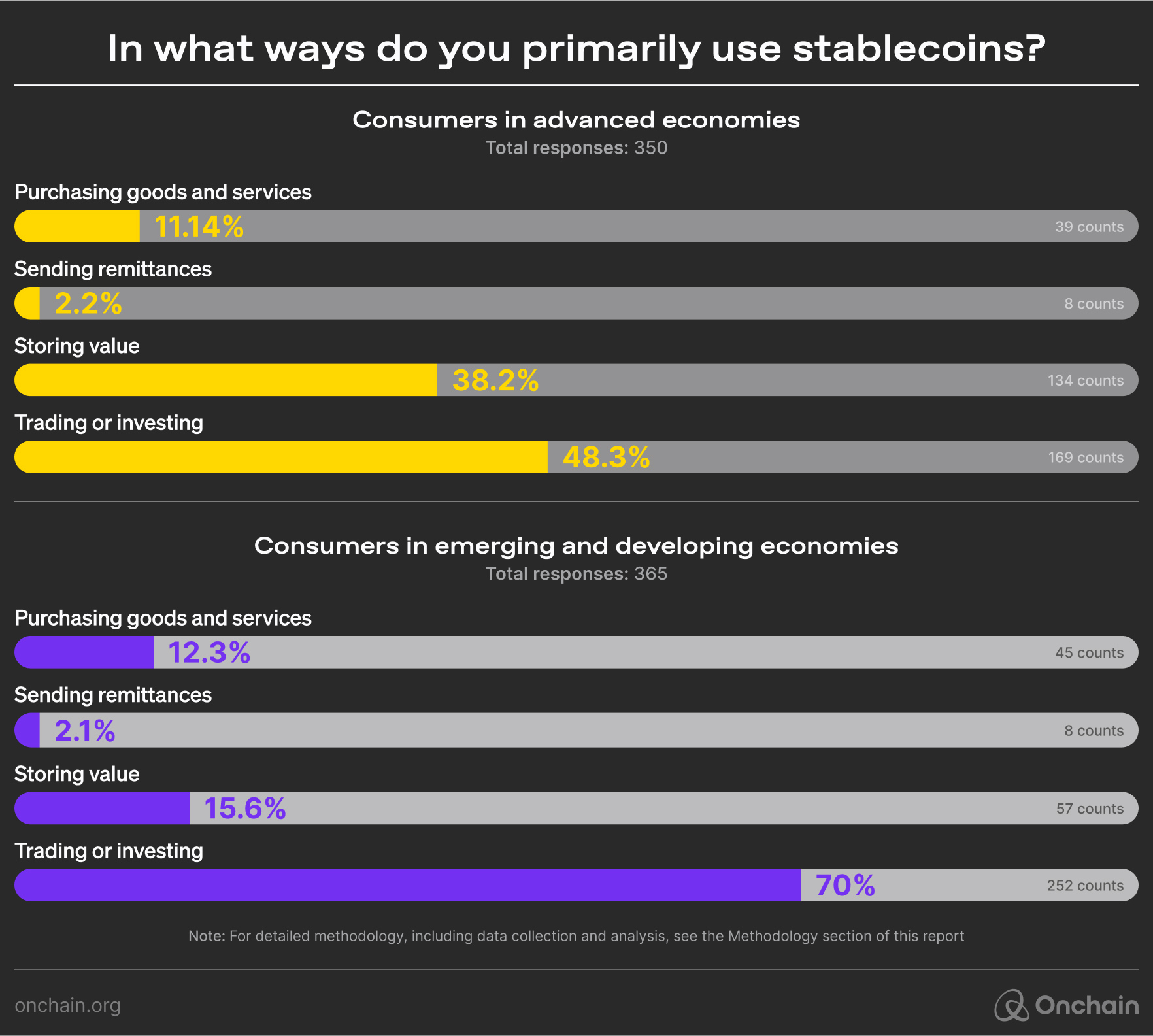

Our survey confirms that stablecoins are currently utilized primarily for trading, investing, and storing value. This holds true across both emerging and advanced economies. Responses also reveal that remittances represent an area with significant growth potential.

Survey Insights

Across both emerging and advanced economies, stablecoin is utilized for trading, investing or storing value. Remittance continue to be an area with significant growth potentials across all markets.

The ability to bypass traditional payment systems and reduce transfer fees has made stablecoins an increasingly popular choice for cross-border payments. Stablecoin-enabled remittance platforms are transforming emerging economies.

GCash’s PYUSD integration demonstrates how platforms can enhance payment accessibility and affordability. Growing stablecoin adoption highlights the market demand for better global remittance offerings.

USD stablecoins rule the emerging market landscape. However, the overwhelming market share of USD-backed stablecoins raises important questions about the future of the stablecoin ecosystem.

Can other state-backed currencies make their mark on this landscape, or will the U.S. greenback continue to reign supreme?

4.2 Challenges and opportunities for non-USD stablecoins

USD dominance as a global means of payment is overwhelming and, as we’ve seen, even more striking in the stablecoins sector.

Why do other stablecoins struggle to break the greenbacks’ Web3 dominance? Or even keep up?

Challenge 1: The USD is seen as an inflation hedge

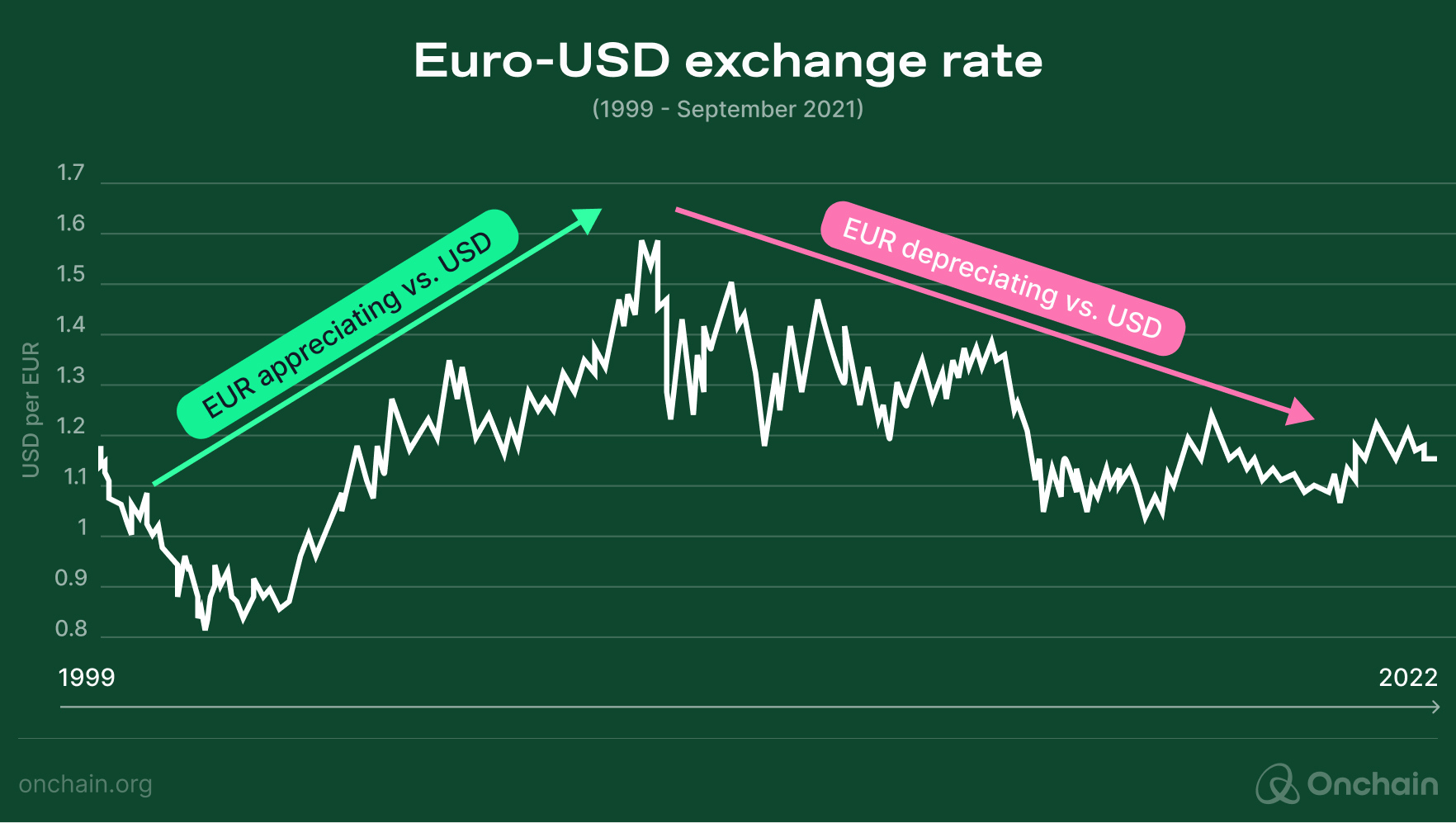

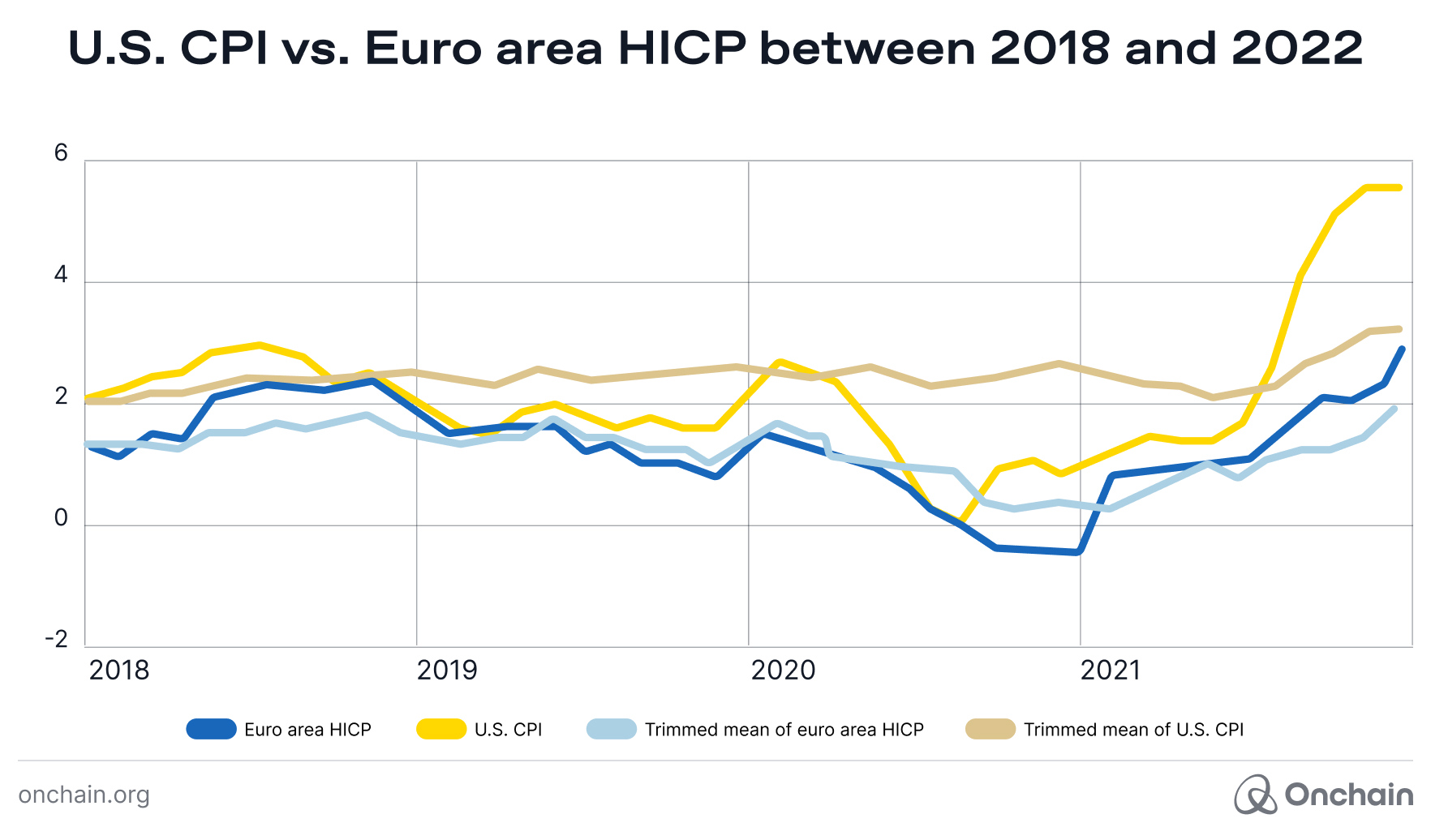

When discussing stablecoin use cases, “serving as an inflation hedge” is often mentioned. The same use applies to regular USD, which is in high demand in high-inflation countries. In addition, the USD is more globally accepted than the EUR and has recently shown a higher relative value than its European counterpart.

When we mix the USD’s anti-inflationary image with cryptocurrencies like BTC’s anti-inflationary image, we get a potent combination that is very difficult to overcome.

Challenge 2: Liquidity concerns

One of the biggest challenges for non-USD stablecoins is achieving sufficient liquidity for large transactions. Building confidence in these assets requires strategic partnerships and incentives for market makers.

- Erwan Mismaque, Head of Partnerships at Lisk

What makes one asset safer, more stable, and easier to use?

No, it’s not “the central bank standing behind it.” It’s the liquidity of an asset that is absolutely critical to its utility and perceived value.

USD-pegged stablecoins benefit from the first-mover advantage, which enables them to generate network effect advantages over non-USD varieties. Currently, trading stablecoins that are not pegged to the USD may simply pose unnecessary liquidity risks for large transaction amounts.

The logistical difference is inconsequential if you want to send a friend 10,000 EUR stablecoins (lucky them!) instead of 10,000 USD stablecoins. But imagine a €1 billion EURO-pegged stablecoin order placed on a DEX! There simply isn’t the market liquidity to fill the order. This issue causes people to stick to established stablecoins pegged to USD.

Challenge 3: The need to be international

For emerging economies, the USD gives access to international services. The Euro (EUR), Singaporean dollar (SGD), and British pound (GBP) aren’t adequate substitutes. This aspect is specifically important for economies and countries struggling to acquire USD.

For many, USD stablecoins function as a good USD substitute. The blockchain technology underneath USDT or USDC becomes secondary.

Considering all the hurdles mentioned above, it’s unreasonable to expect USD stablecoin dominance to change significantly in the near term. However, there are signs of at least a slightly more diverse stablecoin market to come:

Opportunity 1: The USD is far from perfect

Popularity doesn’t necessarily mean the best, cheapest, or highest quality. This holds true when evaluating car models, books, local restaurants, or, in this case, a global currency.

The USD has several issues that put a limitation to its dominant global position:

1. Inflation and declining purchasing power. The USD is not immune to inflation, as some believe. It just inflates at a much lower rate than the hyperinflationary currencies that make the headlines. However, comparing exchange rates, the Euro (EUR), Swiss franc (CHF), and other strong currencies stack up well.

2. High national debt. As of 2024, the U.S. national debt has exceeded $36 trillion (you can see the debt increase before your eyes using this debt clock), nearly 125% of GDP. It makes the U.S. debt-to-GDP ratio one of the highest among developed countries, raising concerns about the sustainability of U.S. fiscal policy.

3. High dependence on foreign investment. The United States relies heavily on foreign investment to finance its aforementioned debt. By 2023, external countries held around 30% of their national debt, with Japan ($1.1 trillion) and China ($870 billion) being the largest holders. This dependency can create geopolitical vulnerabilities — especially in the times of deglobalization (outlined below).

Opportunity 2: Growing number of success stories

Stablecoin issuers have already recognized the drawbacks of the USD and the need to diversify their stablecoin offerings. The most prominent newcomers are backed by the Euro (EUR) and the Rupiah (IDR).

Regions like Indonesia are embracing local stablecoins, as they offer a more accessible way to transact within local economies while reducing dependence on the USD.

- Erwan Mismaque, Head of Partnerships at Lisk

Indonesia’s IDR is the third most popular fiat-pegged stablecoin. IDR stablecoins like the IDRT and BIDR have already achieved market caps higher than established currencies like the CHF or GBP. The Onchain Foundation’s Lisk is also planning to release an IDR-backed stablecoin.

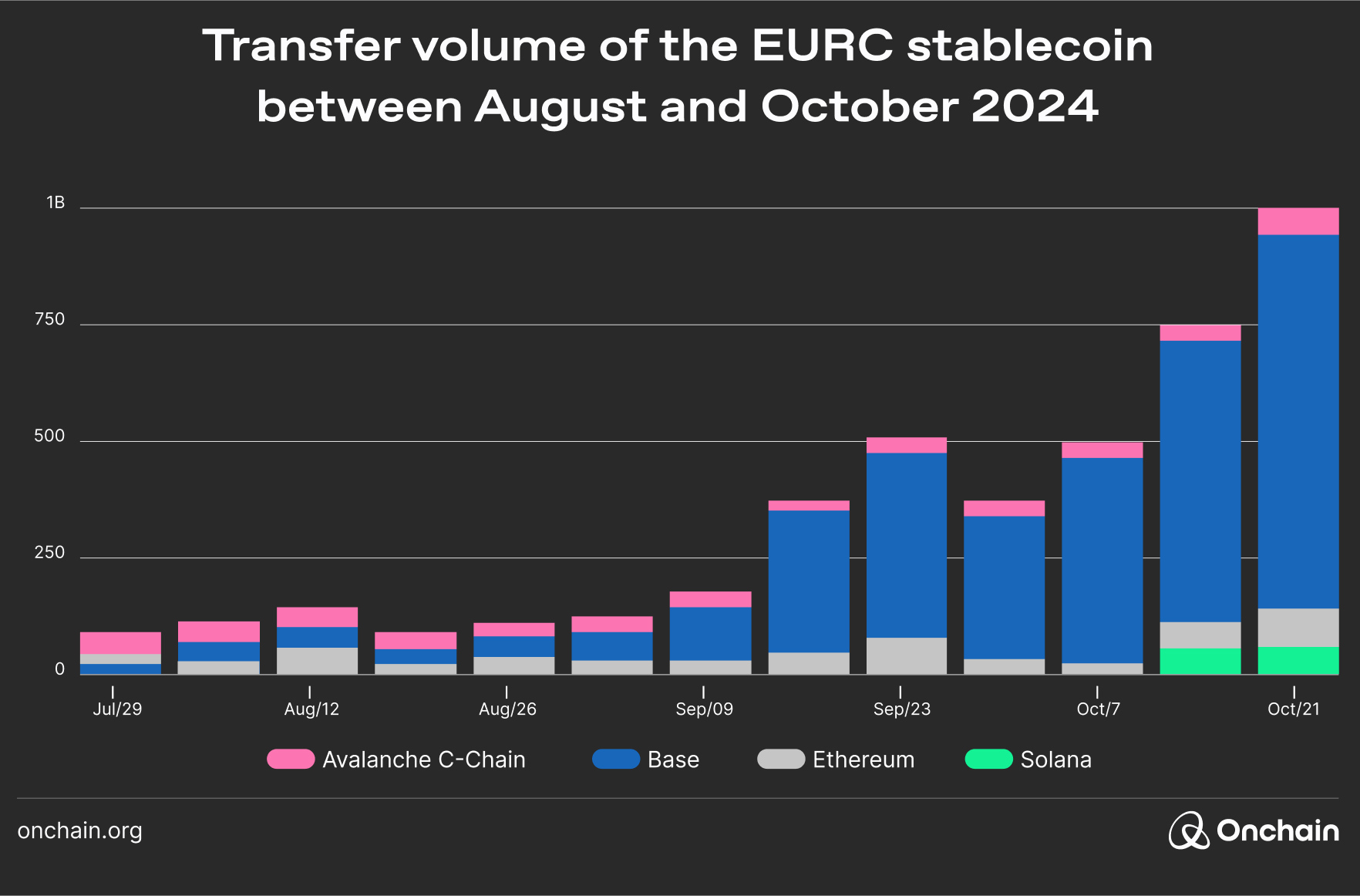

Besides various IDR-backed projects, Circle’s EUR-backed stablecoin (EURC) looks like another stablecoin gaining adoption. EURC gained significant traction during 2024.

Long-term success for EURC could pave the way for other EUR-backed stablecoins — especially since Circle fully complies with Europe’s cumbersome MiCA regulations. To meet MiCA requirements, the company provided evidence that EURC’s collateral is stored in European financial institutions.

With greater regulatory clarity in Europe, we are focused on forging vital connections between the digital financial system and the real economy. Rather than competing with central banks and traditional financial institutions, these regulations allow today’s stablecoins to complement existing payment options. MiCA is a pivotal step for advancing the mainstream adoption and acceptance of stablecoins in the EU, ensuring consumer protection, institutional adoption, and their meaningful contribution to the European financial system.

- Patrick Hansen, Senior Director, EU Strategy & Policy at Circle

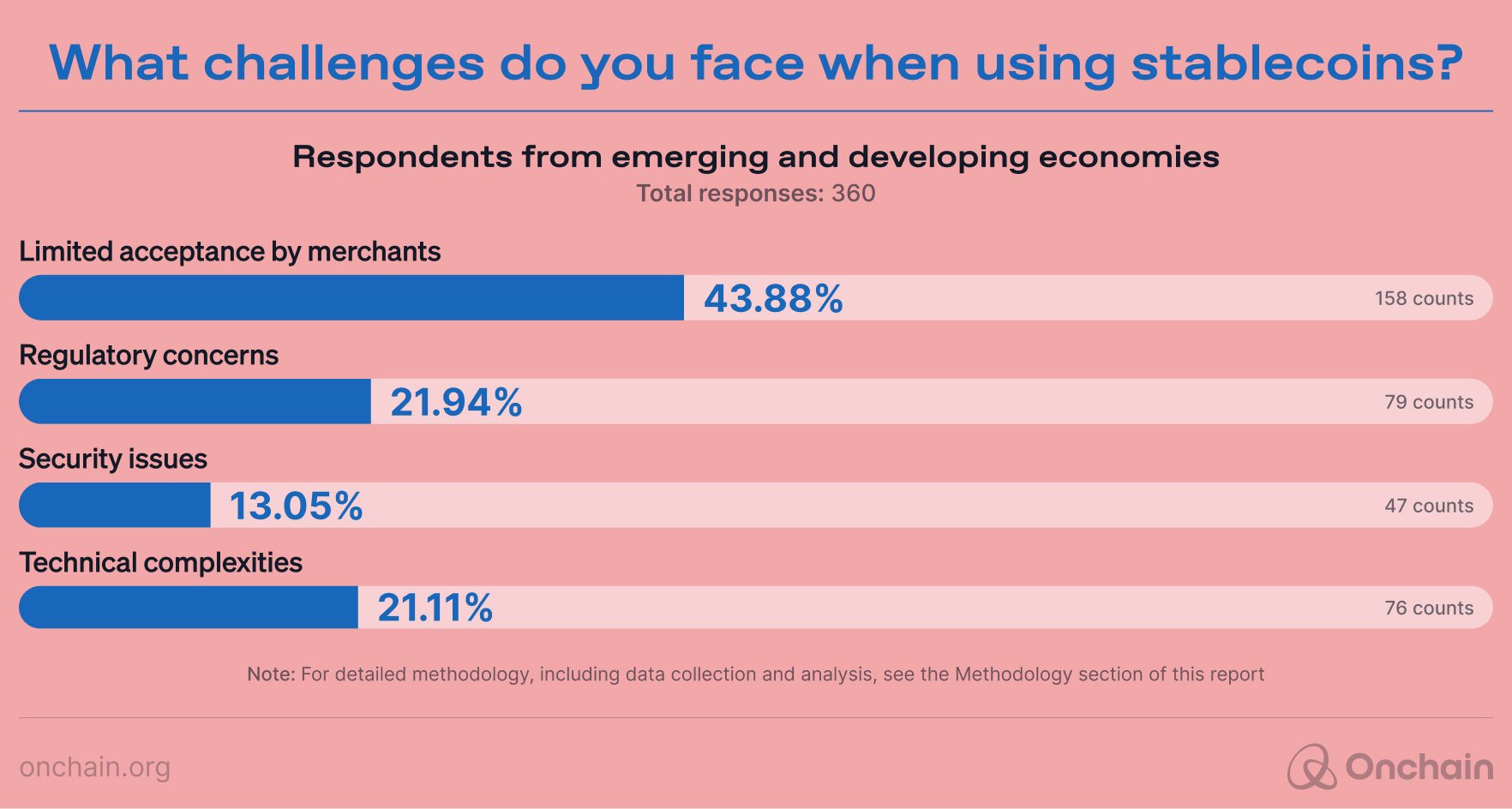

If this trend continues, it may also contribute to the higher utility of stablecoins. As consumer research suggests, merchants’ limited acceptance of USDC/USDT presents the biggest challenge. It’s not surprising. Paying with USD or USD stablecoins is not feasible in places where only the local currency is accepted — i.e., 99% of places outside the United States.

The rise of stablecoins pegged to the local currency should encourage merchants to simply accept them. It may still be cumbersome, but customer interest (especially in emerging economies) might drive merchant adoption in the same way that FinTech payment options have been implemented.

Opportunity 3: Deglobalization is coming

At the time of writing (November 2024), we’ve just witnessed Donald Trump’s win and the upcoming change of power in the U.S. Congress. Without getting too partisan, this political realignment will likely contribute to shifts in global trade.

If accurate, the relative value of the USD would make for a good value storage. At the same time, it may lower the accessibility of the USD for people using different currencies. The potential increase in isolation for the U.S. economy will decrease USD demand.

This would make fiat alternatives and their associated stablecoins more appealing. Key regional blocks and alliances, such as the Eurozone, BRICS, or Asian countries, might be particularly affected.

Looking at the chart below, you can see the high-globalization period of 1990–2008 resulted in the highest spike in international trade. Whenever the world was isolated (Cold War, WW2), global trade growth was significantly more “stable.”

Deglobalization can also increase costs, as domestic production may be more expensive than outsourcing to cheaper labor markets. Higher production costs spur inflation, which the U.S. Federal Reserve may address by raising interest rates. All these factors generate opportunities for USD stablecoins alternatives.

Opportunity 4: Why does it have to be different from the real world?

Lastly, the stablecoin market doesn’t have to differ that much from traditional currency market dynamics. Although the USD is still the de facto reserve currency, its dominance is being challenged by the EUR, JPY, and other big players. In addition, there is growing international interest in currencies the IMF defines as “nontraditional reserve currencies” like the Australian dollar (AUD), Canadian dollar (CAD), Chinese renminbi (CNY), South Korean (KRW), and the Singaporean dollar (SGD).

The aforementioned currencies have established histories, clear use cases, and massive daily trading volumes. Stablecoins are a Web3 use case that will adapt to real-world trends and global trade patterns. Still, any shift away from the USD won’t be immediately reflected in stablecoin adoption rates.

Expect to see stablecoins pegged to local currencies that will serve merchants and customers in intra-country commerce — and potentially increasingly as an alternative to USD stablecoins for cross-border transactions. The “trust into local currencies” human element must also be factored into your currency calculus:

4.3. Stablecoin business opportunities in emerging and developing economies

Selling a stablecoin in Europe or the U.S. is like selling a bucket of ice to an Eskimo. Why focus on 700–800 million people when there are 5 billion people living in high-inflation countries and over 3 billion unbanked individuals worldwide?

- Paolo Ardoino, CTO, Tether

Ardoino’s statement underscores the untapped potential of stablecoins in emerging and developing economies (as defined by the IMF). Economic conditions in developing countries create a powerful demand for accessible, stable, and cost-effective financial tools.

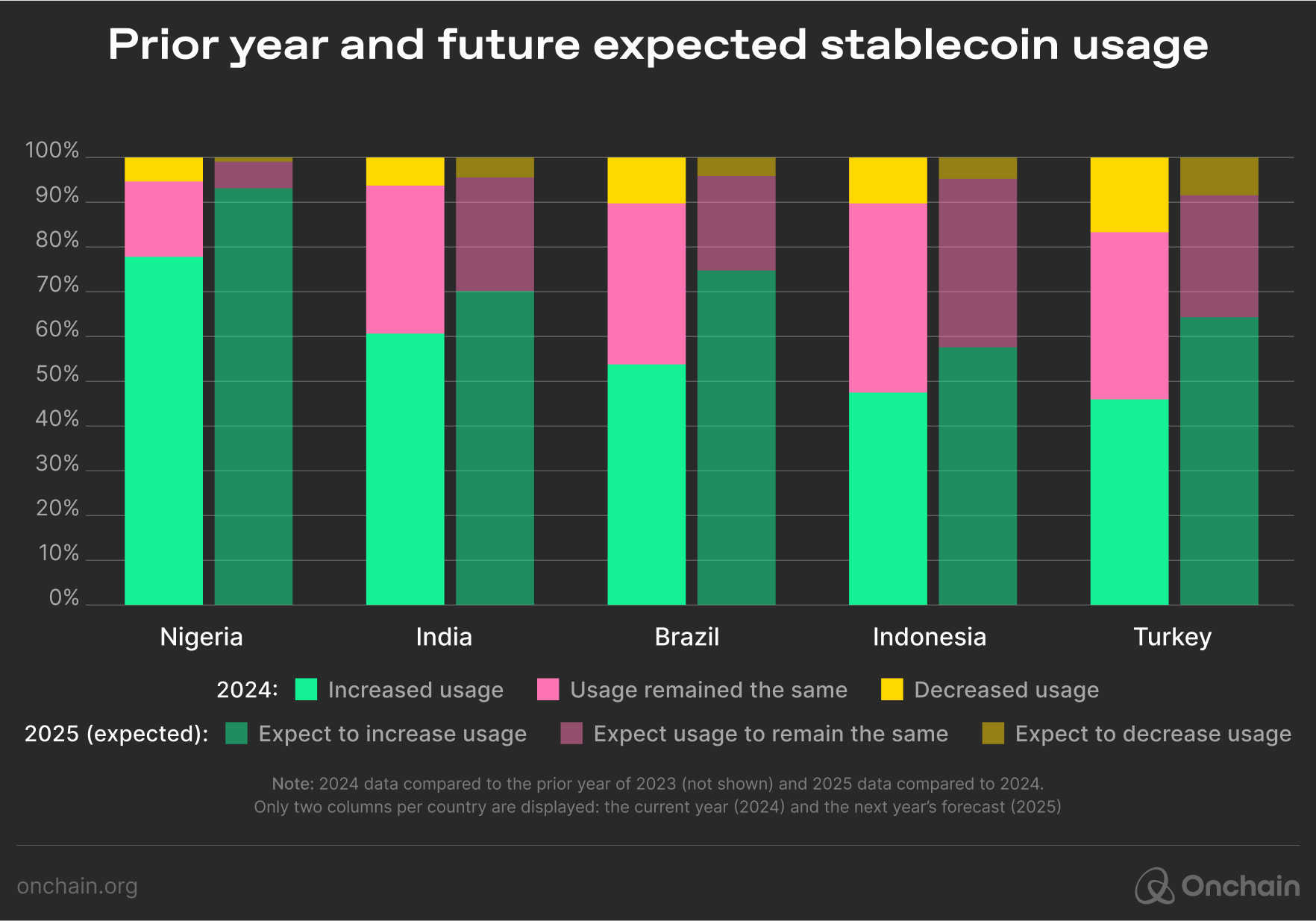

According to our survey, stablecoin adoption rates in emerging economies are significantly higher. 45% of consumers from emerging economies use stablecoins, compared to only 17% in advanced economies.

High inflation and currency volatility make conducting business difficult. These issues contribute to the high adoption of USD-pegged stablecoins in emerging economies.

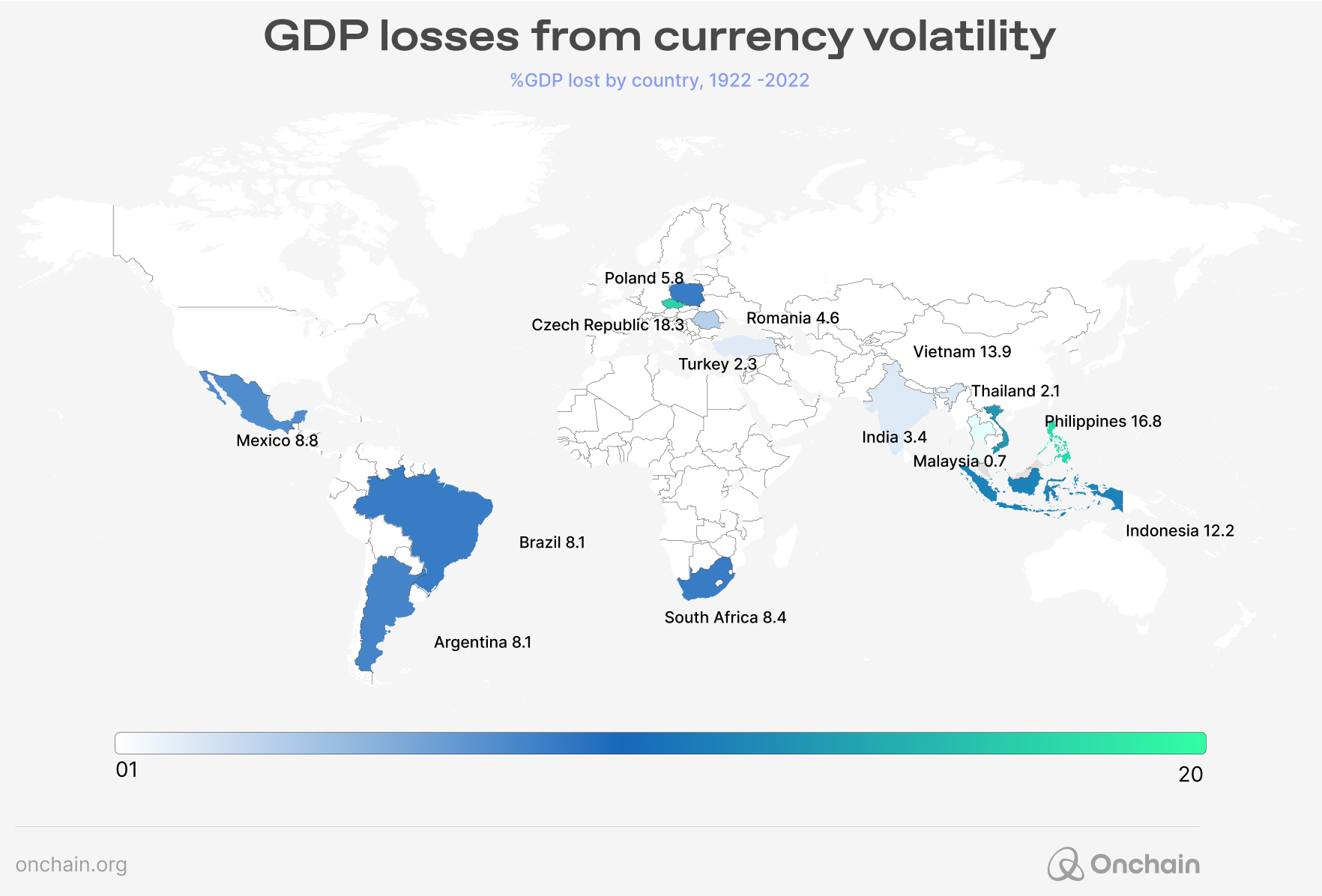

Total cumulative and aggregate GDP losses due to long-term currency volatility are estimated at $1.2 trillion — equating to 9.4% of global GDP. Since 1992, GDP losses from currency volatility have been particularly significant in countries such as Indonesia ($184 billion) and Brazil ($172 billion).

Emerging markets with high inflation rates and currency volatility are witnessing a surge in USD stablecoin usage, as these assets offer a more stable store of value.

The regions below exemplify how stablecoins meet critical financial needs in economies where conventional banking systems and fiat currencies fall short.

Turkey: Strong demand and mainstream stablecoin usage

Turkey’s adoption of stablecoins is among the highest. Stablecoin purchases account for 3.7% of the country’s GDP and a staggering $63.1 billion in cross-border payments in 2024.

Following the 2023 election, Turkey relaxed its FX controls, making USD stablecoins more accessible. The fact that stablecoin demand remains robust indicates that they have moved from a niche to a mainstream financial product.

Argentina: Hyperinflation and the role of USD-pegged stablecoins

Argentina’s currency has historically been volatile. The devaluation of the Argentinian Peso (ARS), by over 50% in late 2023 led to a temporary fiscal surplus. Despite President Milei’s economic reforms, inflation continued to surpass 250% when normalized to global rates. The need for stable assets boosts the necessity for USD-pegged stablecoins.

Amidst restricted access to the USD, Argentinians face high premiums when buying stablecoins. Milei’s reforms have attempted to stabilize the currency. Nevertheless, the demand for stablecoins continues to be high in Argentina.

Brazil: Steady growth in stablecoin adoption

Brazil’s inflation issues are less severe than those in Argentina or Turkey. Still, the country has seen notable adoption of stablecoins, driven by a need for cross-border payment solutions. Brazil’s cross-border stablecoin payment outflows in 2024 reached $12 billion. Stablecoin purchases reached 0.20% of GDP, highlighting a growing interest in more stable and reliable forms of money.

The adoption of stablecoins in Brazil is driven by the need for cost-effective and efficient international transfers. Stablecoins provide a dual benefit: a safeguard against currency uncertainty and enhanced financial transaction efficiency.

Nigeria: High USDT volumes despite FX restrictions

Frequent currency devaluations and restrictive FX policies have accelerated stablecoin adoption in Nigeria. USDT has gained dominance due to its low transaction fees and compatibility with regional financial networks. They offer a better payment option than the hyperinflationary Naira (NGN). Blockchain-based remittances lower transaction fees from the conventional 8–10% to only 1–2%. This could save Nigerians over $1 billion per annum.

USD-pegged stablecoin adoption flywheel in emerging and developing economies

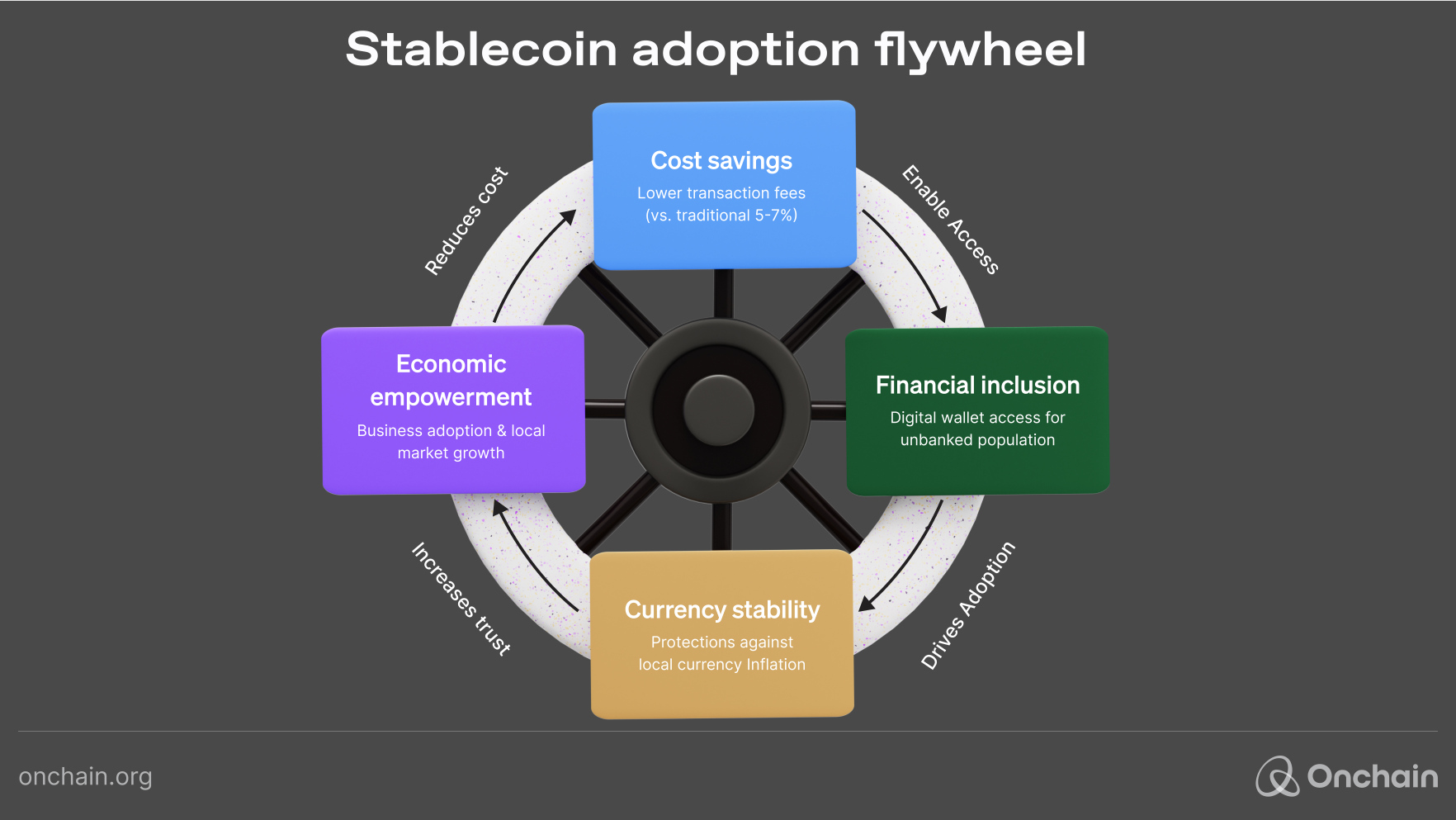

To understand the self-sustaining impact of USD-pegged stablecoins, we can visualize a flywheel effect:

- Cost savings and accessibility: Lower transaction fees make stablecoin remittances more affordable, encouraging higher adoption.

- Financial inclusion: Stablecoins are an entry point to financial services for unbanked populations, especially through mobile wallets.

- Currency stability: In inflation-prone regions, USD stablecoins act as a more stable store of value, driving further demand.

- Economic empowerment: Businesses that accept stablecoins for payments attract a broader customer base, reinforcing the stablecoin’s local utility.

Stablecoins are a payment method and a stabilizing force within the local economy.

We are looking at an actual flywheel because each cycle reinforces the next.

- More users → more adoption by businesses → more utility → more users.

- More stability → more trust → more adoption → more stability.

- More financial inclusion → more economic activity → more demand for financial services → more inclusion.

However, it’s worth noting these potential friction points:

- Regulatory uncertainty exists in many markets.

- There is a need for reliable internet/mobile infrastructure.

- Initial education and onboarding challenges exist.

- Lack of conversion points between stablecoins and local currencies.

What kind of stablecoin businesses should you build in emerging economies?

The stablecoin adoption flywheel generates several promising business avenues for Web3 companies. As adoption expands, more opportunities open up for financial inclusion, economic empowerment, and innovative digital services. Local demand for stable and accessible financial solutions further drives the need for such solutions.

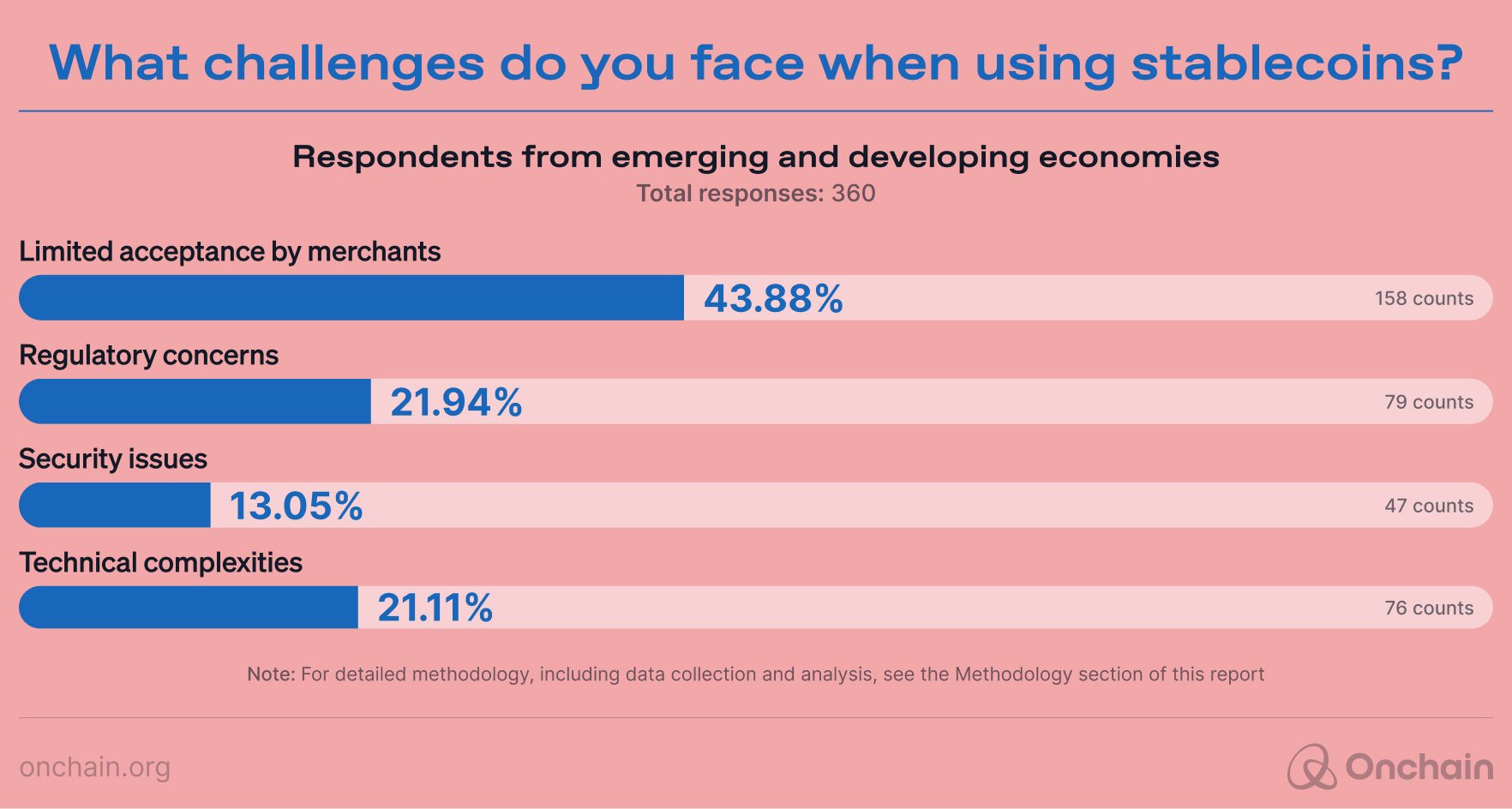

Our survey results support the assessment of both the opportunities and challenges in developing economies. For example, limited merchant acceptance continues to be a significant barrier. 43% of respondents in emerging economies identified it as their primary challenge. However, these obstacles also point to opportunities for innovation and infrastructure development.

Key business opportunities for Web3 companies in emerging and developing economies

1. Local currency-pegged stablecoins

Opportunity: Develop stablecoins pegged to local currencies, providing an alternative currency option for everyday transactions, savings, and access to financial services.

Why it’s promising:

- Currency familiarity: Users are more comfortable transacting in their local currency.

- Regulatory acceptance: Governments may favor stablecoins tied to their own currency, fostering adoption.

- Reduced exchange risks: Eliminates the need for currency conversion, reducing currency volatility issues.

Examples:

- StraitsX Singapore Dollar (XSGD) – Enables seamless stablecoin payments in SGD.

- StraitsX Indonesian Rupiah (XIDR) – Supports financial inclusion in Indonesia.

- BiLira (TRYB) – Pegged to the Turkish Lira (TRY).

- BRZ Token (BRZ) – Tied to the Brazilian Real (BRL) that supports cross-border payments.

2. Remittance and cross-border payment platforms

Opportunity: Build stablecoin platforms to provide low-cost, fast, secure remittance services.

Why it’s promising:

- High remittance fees: Traditional remittance services charge high fees and have slow settlement times.

- Financial inclusion: Stablecoins offer unbanked populations affordable access to financial services.

- Cost savings: Stablecoin remittances reduce fees significantly, serving migrant workers and low-income populations.

Examples:

- Afriex – Offers fee-free stablecoin transfers to African countries.

- Canza Finance – Provides seamless, low-cost cross-border payments in Africa.

- Bitso – Facilitates fast and affordable cross-border payments across LATAM.

- Littio – Provides stablecoin-based remittance services for LATAM.

- Yellow Card – Offering accessible stablecoin swaps integrated with Africa’s mobile money infrastructure.

3. Merchant payment gateways and point-of-sale (POS) systems

Opportunity: Create stablecoin-compatible payment gateways and POS systems for merchants to accept stablecoins.

Why it’s promising:

- Cash dominance: Many emerging markets still rely heavily on cash, which poses risks and inefficiencies.

- Digital transformation: Increasing smartphone penetration enables digital payment adoption.

- Currency volatility mitigation: USD stablecoins protect merchants from local currency depreciation.

Examples:

- Celo (cUSD) – Provides mobile-first payment solutions for emerging markets.

- Metal Pay – Supports stablecoin payments for merchants.

- Kuna Pay – Assisting Eastern and Central European merchants with crypto bank accounts and invoice systems.

4. DeFi microfinance and lending platforms

Opportunity: Build platforms that offer microloans and savings products denominated in stablecoins for individuals and small businesses.

Why it’s promising:

- Limited access to credit: Traditional banks often exclude individuals and small businesses.

- High interest rates: Decentralized platforms provide more competitive returns.

- Trust and transparency: Blockchain transparency reduces fraud and increases trust.

Examples:

- Goldfinch – Provides stablecoin loans to businesses in emerging markets.

- Jia Finance – Enables revenue-based financing for small businesses.

- Haraka – Offers blockchain-based microloans in Africa.

5. Savings and investment platforms

Opportunity: Design platforms that help users save and invest in stablecoins, protecting them against inflation while offering competitive yields.

Why it’s promising:

- Inflation hedge: USD stablecoins safeguard users’ wealth in high-inflation economies.

- Interest earnings: Decentralized platforms often provide higher yields than traditional banks.

Examples:

- Valora – Allows Celo stablecoins to be used on its mobile app for savings and transactions.

- Sperax USD (USDs) – Offers sustainable yields on stablecoin savings.

6. Payroll solutions

Opportunity: Implement payroll systems that pay employees and contractors in stablecoins for instant, borderless payments.

Why it’s promising:

- Global workforce trends: Remote work has created a demand for faster and cheaper international payments.

- Payment delays and fees: Traditional payroll systems are slow and costly for global teams.

Examples:

- Deel – Offers crypto payment options, including stablecoins, for international payroll.

- Sablier – Supports real-time stablecoin payment streaming.

7. Tokenization of RWAs

Opportunity: Use stablecoins to enable fractional ownership and investment in real estate and other RWAs.

Why it’s promising:

- Investment accessibility: Allows users to gain investment exposure in high-value assets.

- Liquidity: Makes traditionally illiquid assets tradeable and accessible.

Examples:

- RealT – Allows investors to earn rental income by tokenizing real estate.

- VNX Gold – Facilitates the tokenization of precious metals.

8. Financial literacy and education platforms

Opportunity: Develop platforms to educate users about blockchain technology, stablecoins, and financial management.

Why it’s promising:

- Knowledge gap: Education increases adoption and builds trust.

- User empowerment: Financial literacy helps users reach better financial decisions.

Examples:

- Binance Academy – Offers free educational resources on blockchain and crypto.

- Coinbase Learn – Provides beginner-friendly resources on crypto and stablecoins.

- Onchain – Features a comprehensive Blockchain and Web3 Glossary and in-depth research reports that educate users and businesses on the evolving blockchain landscape.

4.4 Which emerging and developing economies are the most promising for stablecoin business?

From offering a hedge against hyperinflation in Latin America to enabling cross-border remittances in Sub-Saharan Africa, stablecoins are proving their value as a transformative financial tool. Key findings from our report reveal that USD-pegged stablecoins dominate these markets, addressing challenges like currency volatility and limited access to traditional banking. Furthermore, innovative use cases such as tokenized microfinance, merchant payment gateways, and decentralized lending platforms are opening new revenue streams for entrepreneurs while empowering communities.

This section explores the most promising regions for stablecoin adoption — Sub-Saharan Africa, Southeast Asia, Latin America, and Eastern Europe — highlighting unique opportunities, localized challenges, and actionable insights for entrepreneurs and businesses looking to make an impact.

Sub-Saharan Africa

Key markets: Nigeria and Kenya

Why it’s promising: Sub-Saharan Africa has some of the lowest levels of financial inclusion globally, with only 49% of the population having access to a bank account. However, the region has shown a strong appetite for mobile-based financial solutions, exemplified by the success of platforms like M-Pesa. This makes it an ideal testing ground for stablecoin-driven solutions.

Nigeria:

- Challenges: Nigeria faces persistent inflation, with the Naira (NGN) consistently depreciating against major currencies. This economic instability drives residents to seek stable, dollar-denominated alternatives.

- Opportunities: Stablecoins can address the needs of Nigeria’s $17 billion remittance (2021) market by providing cheaper, faster, and more secure alternatives to traditional services like Western Union. Platforms like Yellow Card have already demonstrated how stablecoin-powered remittance solutions are gaining traction, saving users substantial fees and delays.

- Potential use cases:

- Cross-border payments and remittance platforms.

- Merchant payment solutions for SMEs dealing with currency volatility.

Kenya:

- Challenges: Limited access to credit in rural areas and dependence on cash transactions hinder financial progress. While mobile money platforms have laid the groundwork, there’s significant potential for blockchain to further these efforts.

- Opportunities: Entrepreneurs can leverage stablecoins to create tokenized agricultural finance platforms. For instance, blockchain crowdfunding models could allow farmers to raise capital for crops or livestock with revenue-sharing mechanisms to benefit stakeholders.

- Potential use cases:

- Micro-lending platforms using stablecoins.

- Decentralized crowdfunding for agricultural investments.

Kenya offers a conducive environment for operations due to its lack of stringent regulations, while Nigeria, despite its large market potential, poses significant risks due to unclear regulations and economic factors.

- Jessica Gaubert, Co-Founder / COO, Haraka

Remember that Kenya’s lack of regulatory oversight is a challenge. A poorly defined regulatory framework can lead to uncertainty for investors and entrepreneurs. This creates a potentially fertile ground for fraud, corruption, inconsistent policy enforcement, and other legal risks.

A notable example of this regulatory enforcement is Worldcoin, a crypto project co-founded by OpenAI CEO Sam Altman. In August 2023, Kenyan authorities suspended Worldcoin’s operations over the collection of biometric data from its users, citing security and privacy concerns.

Southeast Asia

Key market: Indonesia

Why it’s promising: Southeast Asia’s rapidly digitizing economies and significant unbanked populations make it fertile ground for stablecoin adoption. More than 180 million people in Indonesia lack access to traditional banking services, underscoring the need for innovative financial solutions.

Indonesia:

- Challenges: Despite rapid digitalization, gaps in financial literacy and limited access to credit continue to plague large segments of the population.

- Opportunities: IDR-pegged stablecoins, such as StraitsX (XIDR), can provide localized solutions for everyday transactions, savings, and cross-border remittances. Collaborating with government-backed blockchain initiatives could further accelerate adoption.

- Potential use cases:

- Localized stablecoin-powered wallets for small businesses.

- Integration of stablecoins into existing e-commerce platforms to streamline payments and settlements.

Latin America (LATAM)

Key markets: Argentina and Brazil

Why it’s promising: Latin America faces some of the world’s highest inflation rates alongside a growing remittance market. This combination makes stablecoins indispensable as a store of value and a tool for financial inclusion.

Argentina:

- Challenges: Argentina’s Peso (ARS) has faced hyperinflation exceeding 100%, forcing residents to seek alternative ways to preserve their wealth. Regulatory restrictions on dollar access further compound the problem.

- Opportunities: Stablecoins like USDT and USDC offer a lifeline by acting as a hedge against inflation. Platforms such as Bitso are enabling low-cost remittances and payment processing, particularly for tech-savvy users.

- Potential use cases:

- Stablecoin-powered payment systems for freelancers and exporters.

- Retail platforms for small loans denominated in stablecoins.

Brazil:

- Challenges: While Brazil has shown economic stability compared to neighboring countries, cross-border payment inefficiencies persist, hindering trade and remittances.

- Opportunities: Brazil’s central bank’s real-time payment system (Pix) provides a blueprint for integrating stablecoins into digital payments. The growing adoption of stablecoin-based payroll systems could also benefit Brazil’s export-driven industries.

- Potential use cases:

- Cross-border trade facilitation using stablecoins.

- Payroll platforms catering to Brazil’s growing gig economy.

Central and Eastern Europe

Key markets: Ukraine and Poland

(Note: We use the term “Central and Eastern Europe” here to collectively reference Ukraine and Poland, acknowledging that this classification is not perfectly precise.)

Why it’s promising: This region exhibits relatively high digital adoption and financial inclusion. Yet, geopolitical instability and currency volatility differentiate it from other emerging markets. Ukraine’s conflict-driven financial instability and Poland’s stable but trade-constrained environment showcase how stablecoins can fill unique economic niches — even within neighboring countries.

Ukraine:

- Challenges: The ongoing conflict has destabilized traditional financial systems, leading to restricted access to local currencies and high transaction costs.

- Opportunities: Stablecoins like USDT have gained significant traction as a medium of exchange and a store of value. Platforms like Kuna empower freelancers and small businesses by offering seamless crypto-enabled cross-border payments.

- Potential use cases:

- Crypto-powered invoicing and mass payouts for remote workers.

- Crowdfunding solutions for humanitarian and infrastructure projects.

Poland:

- Challenges: Though economically stable, cross-border trade inefficiencies remain a growth bottleneck.

- Opportunities: Stablecoins can streamline payments for Poland’s growing base of remote workers and export-oriented SMEs, reducing costs and increasing speed.

- Potential use cases:

- Cross-border payment systems for SMEs.

- Stablecoin-powered payroll systems for remote employees.

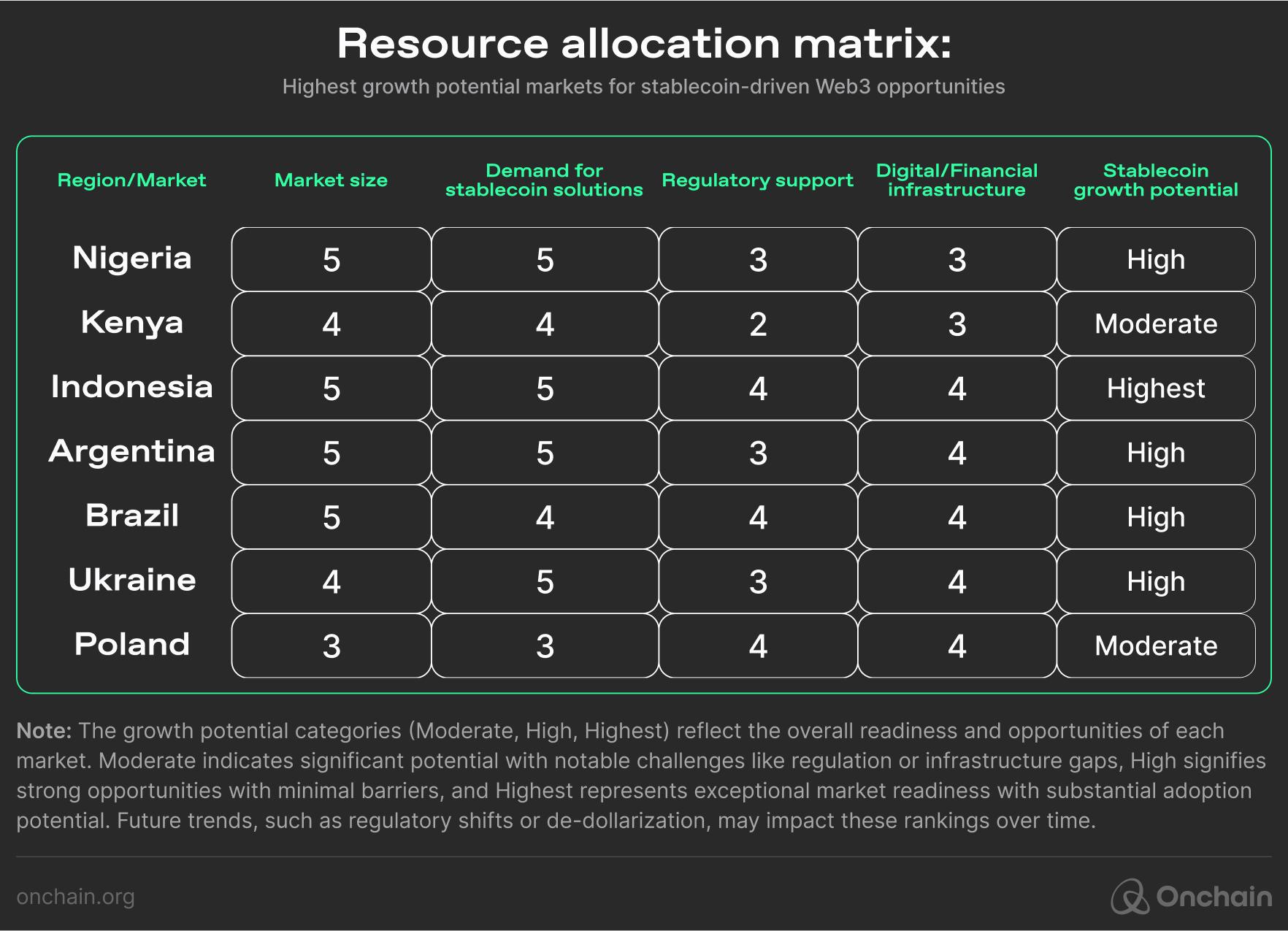

Below, you can see a resource allocation matrix that indicates the highest growth potential markets for stablecoin-driven Web3 business opportunities. The matrix evaluates markets based on four critical factors — market size, demand for stablecoin solutions, regulatory support, and digital/financial infrastructure to identify their potential for stablecoin-driven Web3 business opportunities. Each criterion is scored from 1 to 5, where 5 indicates the highest potential, and 1 indicates the lowest.

The overall scores from these criteria were combined, and markets were categorized into qualitative tiers: Low, moderate, high, and highest growth potential. These rankings provide actionable insights into where stablecoin adoption is most likely to thrive. This assessment builds on key findings from our report.

Note: The growth potential categories (Moderate, High, Highest) reflect each market’s overall readiness and opportunities. Moderate indicates significant potential with notable challenges like regulation or infrastructure gaps, High signifies strong opportunities with minimal barriers, and Highest represents exceptional market readiness with substantial adoption potential. Future trends, such as regulatory shifts or de-dollarization, may impact these rankings over time.

Key takeaways

- Indonesia ranks as the market with the highest growth potential, thanks to its large unbanked population, strong demand for stablecoins, government-backed blockchain initiatives, and expanding digital infrastructure.

- Nigeria demonstrates high potential driven by its significant remittance market and the strong adoption of USD-pegged stablecoins, though regulatory clarity remains challenging.

- Argentina and Ukraine show high potential due to pressing economic challenges, including hyperinflation and conflict-driven disruptions. However, regulatory navigation is essential for sustained growth in these regions.

- Brazil offers a stable and scalable environment for SMEs and remittance solutions, supported by its robust digital payment infrastructure.

- Kenya has moderate potential, benefiting from its well-established mobile finance ecosystem, though it requires more decisive regulatory clarity to sustain long-term growth.

- Poland, while stable, provides opportunities for SME-focused stablecoin solutions, particularly in cross-border transactions and export-driven industries.

Emerging and developing economies are fertile ground for stablecoin innovation. Whether sparked by isolated factors like hyperinflation in parts of Latin America and Africa or a combination of challenges — regulatory uncertainty, cross-border payment inefficiencies, conflict-driven instability in places like Ukraine, or trade friction in relatively stable markets like Poland — these conditions make stablecoins indispensable financial lifelines. Far from a mere convenience, stablecoins offer genuine resilience where traditional banking and stable currencies fall short. For entrepreneurs, understanding these local complexities and how they intersect is key to delivering scalable, life-improving solutions.

Strategic priorities for entrepreneurs and businesses:

- Develop localized stablecoin solutions that address specific regional challenges.

- Collaborate with governments and regulators to build trust and foster compliance.

- Leverage mobile penetration and digital literacy to drive adoption at scale.

Those are some solid facts and fuel for you to work with. You’ve gained insights into the workings of the most successful stablecoins and understand what makes the market tick. You have received regional financial and market data impacting the stablecoin business. And you received specific recommendations for your next steps. What’s left is to wrap it all up so you have the main points at a glance.