3. How Businesses Generate Revenue With Stablecoins

You’ll Learn

- The secret to stablecoin profit — how market leaders (Tether and PayPal) generate consistent revenue through interest income, transaction fees, and ecosystem integrations.

- Which revenue models work — the mechanisms that turn stablecoins into reliable financial engines for businesses and protocols: stability fees, liquidation profits, and more.

- How leading companies (i.e., Stripe and innovative DAOs) remodel payments, treasury management, and operational efficiency.

- How to apply practical strategies for earning competitive yields on stablecoins using DeFi protocols, real-world asset platforms, and centralized accounts.

- Which steps you can take to harness stablecoins for business growth, market expansion, and financial sustainability in the evolving blockchain economy.

You now have a solid understanding of what makes stablecoins a meaningful asset in the business world and how they connect Web3 and the real world. We covered the reasons why stablecoins have achieved product-market fit, analyzed where their liquidity resides, and explored which blockchain networks are growing fastest. It’s time to shift focus.

Choosing the right blockchain to build on is essential for Web3 entrepreneurs, startups, and businesses. Sure, it’s critical to identify where stablecoin ecosystems thrive, but it’s equally important to understand how stablecoins generate revenue.

In this chapter, we’ll analyze how stablecoins create consistent cash flows and scalable financial opportunities. We dive into the revenue models of stablecoin protocols, so you’ll understand the disruptive mechanisms that make them a profitable business opportunity.

Read on as we explore the various stablecoin revenue models and discover how they unlock opportunities for entrepreneurs and businesses.

We’ll now show you why the stability of onchain earnings and profits’ stability matters. Our first stop is Tether, where earned interest on their USDT collateral enables the company to generate consistent cash flows. Later, we’ll break down revenue opportunities for utilizing and leveraging stablecoins (e.g., by using lending protocols).

It’s too late to become an early part of Tether and benefit from their record-breaking profit per employee ($30 million to $120 million, depending on the source). However, it’s still early in the stablecoin ecosystem development. In fact, this is still only the beginning.

You may be interested in building your own stablecoin project. Or simply want to implement stablecoins in your business operations. Wherever your passion leads you, the stablecoin sector is full of recurring revenue streams you can incorporate into your project, and we’ll break them down for you here.

3.1 The business models of stablecoin protocols

Tether (USDT)

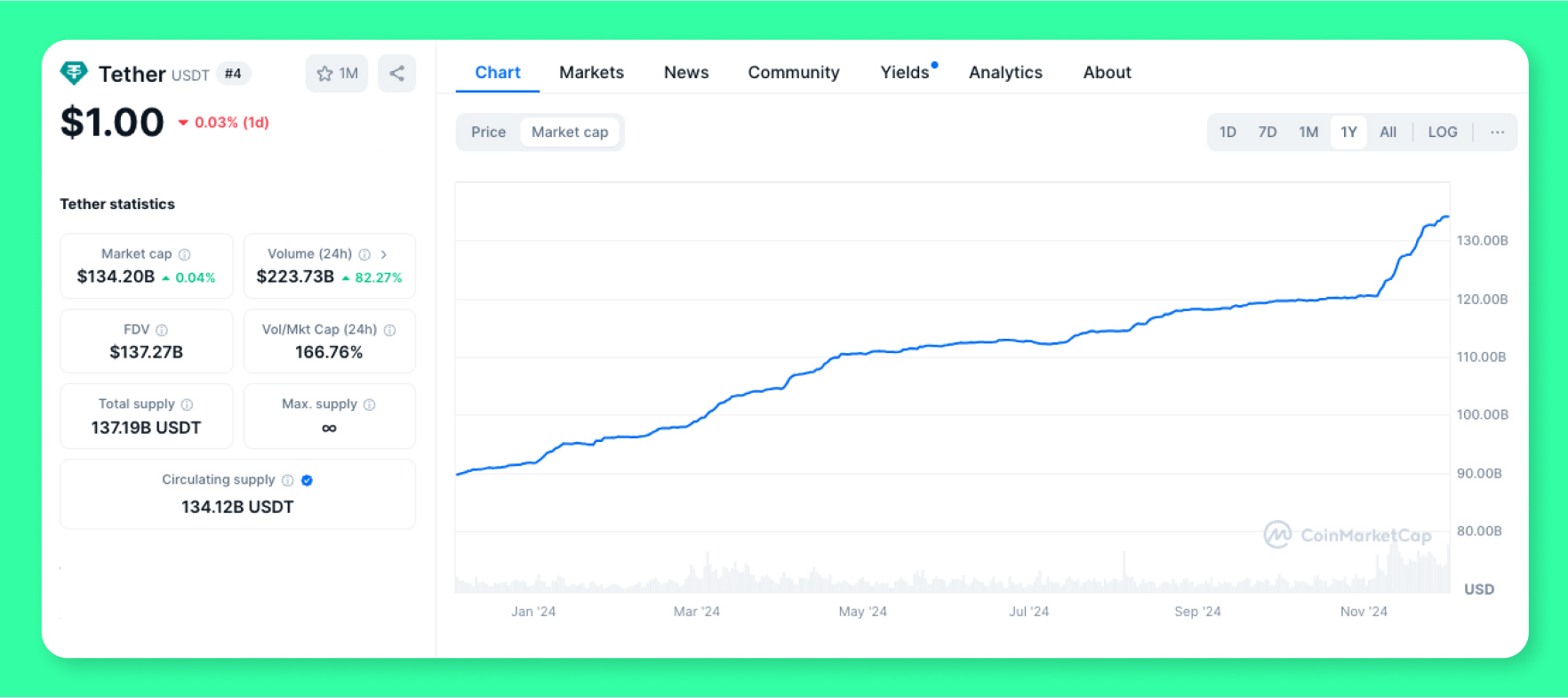

Tether (USDT) is a prime example of a highly centralized and profitable stablecoin company. Tether generates significant revenue through interest earned on its substantial collateral reserves. This capital fully backs their USD stablecoins at a 1:1 ratio.

With the largest stablecoin by market capitalization, Tether strategically invests its backing reserves in low-risk, interest-bearing assets and thereby ensures their revenue generation.

- U.S. Treasury bills (T-bills): 81% of Tether’s reserves are invested in short-term T-bills. These highly liquid government securities offer a reliable and steady revenue stream.

- Cash equivalents: Tether also allocates funds to other cash equivalents, such as money market funds (6.4%) and commercial paper (11.3%). This collateral diversification provides additional interest earnings while ensuring the necessary liquidity to meet USDT redemption requests.

The sheer magnitude of Tether’s reserves allows for high profitability even with modest returns. With a market cap exceeding $120 billion in October 2024, even a meager 2% annual percentage yield (APY) on reserves would generate over $2.4 billion in yearly revenue.

Transaction fees

Another significant revenue stream for Tether is fees for minting and redeeming USDT:

- Minting fees: When new USDT tokens are created (minted), Tether charges a 0.1% fee (with a $1,000 minimum) on the minting total. To mint USDT, new users must complete a $150 verification process. Approved accounts can then exchange USD for USDT. This fee structure is targeted toward institutional clients who want to mint larger sums of USDT. For example, a $1 million USDT mint would incur the baseline $1,000 fee, making smaller mintings more expensive on a USD-to-USDT basis.

- Redemption fees: Users who wish to redeem their USDT for USD are also subject to fees. These fees can vary but typically range from 0.1% to 3% of the redemption amount.

Profitability

Tether’s profitability is rooted in several key factors:

- Massive reserves: With over $125 billion in assets under management (AUM), Tether’s earned interest income is unparalleled in the stablecoin space.

- Stablecoin liquidity: USDT is the most liquid stablecoin in the market. This high liquidity maintains demand for the stablecoin and ensures a constant flow of minting/redemption fees.

- Market dominance: With the largest stablecoin by market cap, Tether benefits from USDT’s network effects and economies of scale.

- Diverse revenue streams: By combining interest income with transaction fees, Tether has created a robust and diversified revenue model.

- Low operational costs: Despite its massive AUM, Tether operates with a relatively small team and uses efficient blockchain technology. This keeps operational costs much lower than traditional financial (TradFi) institutions.

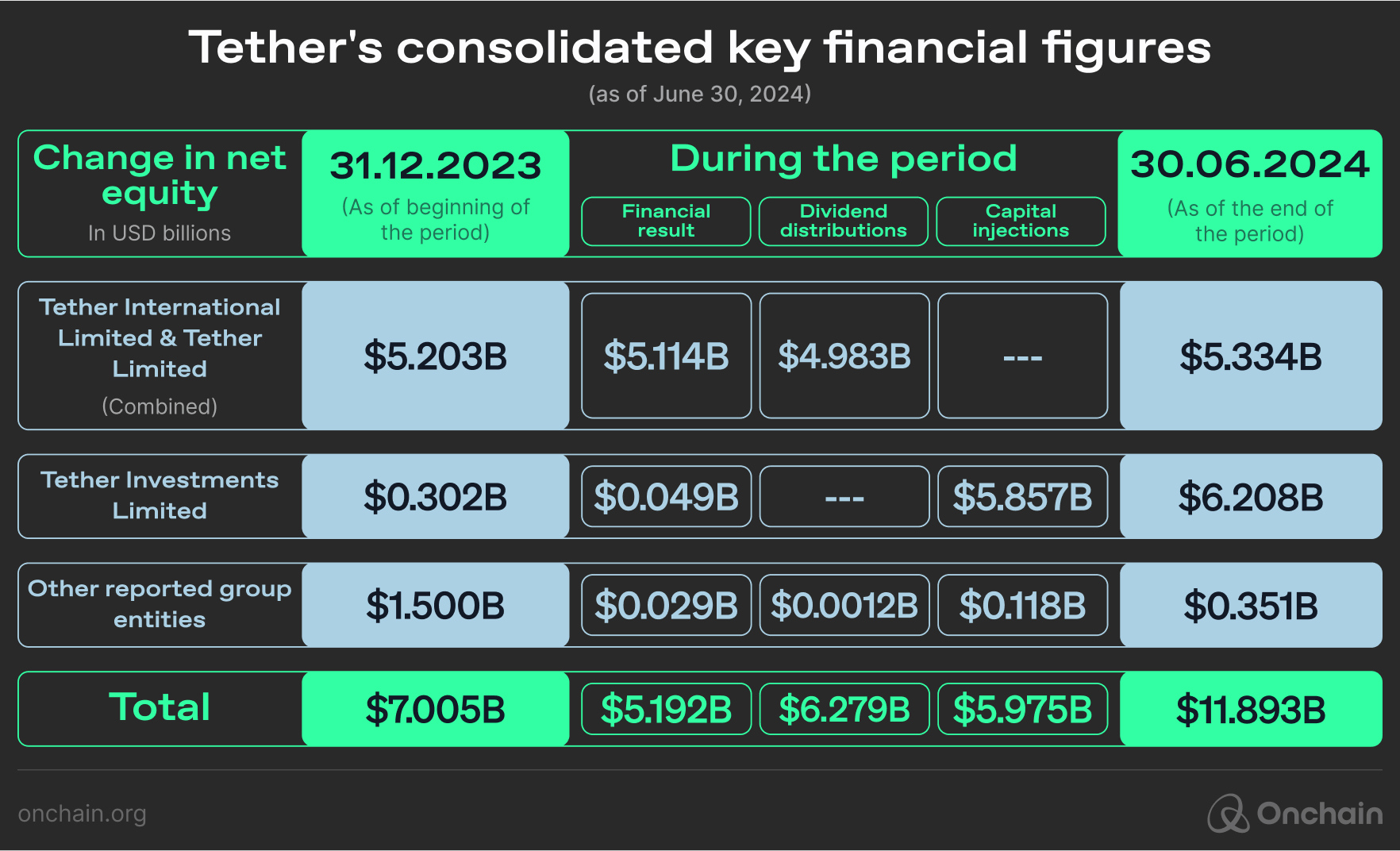

In the first half of 2024, Tether reported a $5.2 billion profit, largely driven by its T-bills earning a 4.72% yield. While the impact of declining interest rates on revenue remains uncertain, Tether generates an astounding ~$32 million per employee. Its reputation as one of the most profitable and well-run Web3 companies is certainly deserved.

Survey insights

Insight 2.3: Across both emerging and advanced economies, the dominant stablecoin is USD and Tether.

Despite the differences, Tether and USD Coin (USDC) dominate the stablecoin landscape in rising and established economies. Interestingly, Tether leads in both regions.

Among respondents:

- Businesses in advanced economies primarily use USDT.

- Businesses in emerging economies also identified Tether as their primary stablecoin.

This reflects the significant role Tether plays in enabling transactions globally, particularly as it maintains its lead in liquidity and adoption.

Despite the differences, Tether and USD Coin (USDC) dominate the stablecoin landscape in rising and established economies. Interestingly, Tether leads in both regions.

Among respondents:

- Businesses in advanced economies primarily use USDT.

- Businesses in emerging economies also identified Tether as their primary stablecoin.

This reflects the significant role Tether plays in enabling transactions globally, particularly as it maintains its lead in liquidity and adoption.

PayPal (PYUSD)

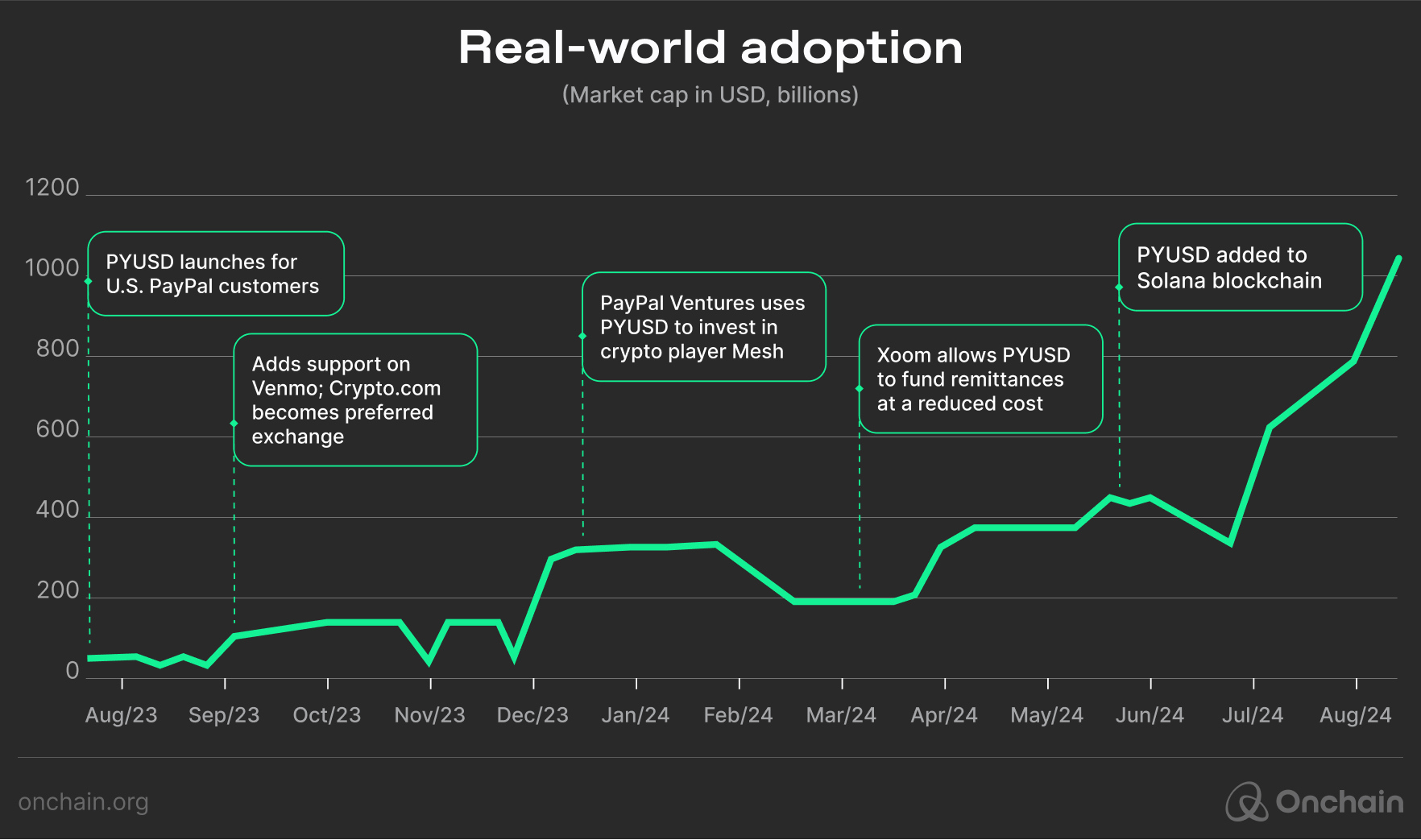

In August 2023, PayPal debuted its own in-house stablecoin, PayPal USD (PYUSD). Its entry into the stablecoin sector marked a significant moment for both the financial technology (FinTech) industry and the crypto ecosystem. By October 2024, PYUSD had shown remarkable growth and adoption, positioning PayPal as a formidable player in the stablecoin space.

Market performance and growth:

PYUSD has experienced explosive growth since its launch:

- Market capitalization: Surpassed $1 billion in August 2024, followed by a drop to $647 million (as of October 22, 2023).

- Year-over-year growth: Approximately 339% growth from launch to August 2024.

- Recent growth: 45% month-on-month increase between July and August 2024.

- Market position: As of October 2024, PYUSD ranks as the 6th-largest stablecoin with a $647 million market cap.

Key drivers of PYUSD growth

1. Multi-chain presence:

- PYUSD initially launched on Ethereum.

- PYUSD expanded to Solana in May 2024, leading to significant growth.

- 60% of PYUSD circulation is on Solana.

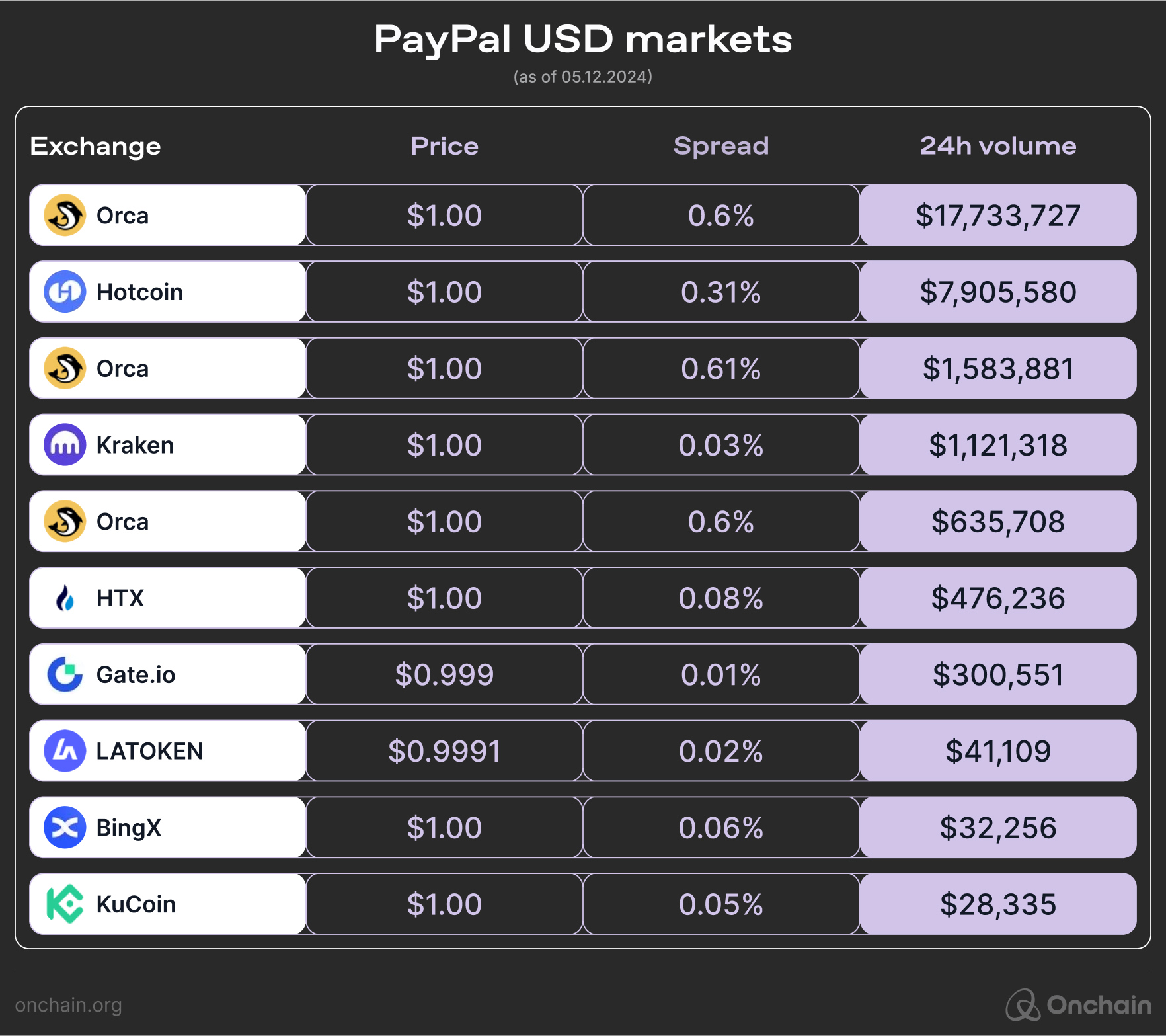

2. Exchange listings:

- PYUSD was added to major cryptocurrency exchanges just months after its launch.

Popular trades include swaps with USDC and USDT.

Integration with PayPal services:

- In March 2024, Xoom (PayPal’s remittance service) enabled PYUSD for cross-border transfers.

- This removed the fee margin for PYUSD-funded transactions, reducing remittance costs by 25%.

3. Incentive programs:

- Platforms like Kamino, Drift, and Marginfi offer enhanced rewards for Solana-based PYUSD deposits.

- Anchorage Digital announced stablecoin rewards for institutions depositing PYUSD.

I believe these incentives are designed to be short-lived rather than lasting, with the primary aim of increasing PYUSD circulation and motivating users, particularly newcomers, to engage actively in the Solana ecosystem.

- Ambreen Khral, Market Researcher, Onchain

While it’s premature to comment on PayPal’s specific business model, we will likely see them adopt revenue streams implemented on other stablecoin platforms.

1. Interest income:

- PayPal likely earns interest on the collateral reserves backing PYUSD.

- With over $700 million in circulation, even modest interest rates could generate significant revenue.

2. Transaction fees:

- While blockchain transaction fees go to network validators, PayPal may charge fees for minting/redeeming PYUSD.

- PayPal could integrate PYUSD with its existing services for additional free revenue opportunities.

3. Foreign exchange (FX) fees:

- PYUSD could become a growing source of FX fee revenue if recipients choose to receive other tokens. This conversion also creates arbitrage revenue opportunities (Innopay, 2023).

4. Ecosystem growth:

- PYUSD’s integration into PayPal’s vast user base could drive the adoption of other PayPal services.

Sky Protocol (USDS)

USDS is the newly introduced stablecoin of the Sky ecosystem (formerly known as MakerDAO), complementing the popular DAI token. Launched on September 18, 2024, USDS represents a significant evolution in the decentralized finance (DeFi) space. As of October 2024, USDS’ market cap surpassed $1.25 billion.

Key drivers of growth

- Collateral options expanded to include real-world assets (RWAs).

- Integration of tokenized T-bills and corporate bonds.

2. Cross-chain presence:

- Initially available on Ethereum, it expanded to Layer 2 (L2) solutions like Optimism, Arbitrum, and Solana.

3. DeFi integration:

- Remains a cornerstone of major DeFi protocols across multiple blockchains.

4. Institutional adoption:

- Increased adoption for cross-border settlements among crypto-native businesses.

- USDC has seen significant adoption for cross-border settlements, particularly among crypto-native businesses. For instance, Crypto.com, a major cryptocurrency platform, has integrated USDC into its payment ecosystem, enabling more efficient settlement processes.

Our goal with USDS has been to push the boundaries of what blockchain technology can achieve while making those benefits accessible to everyday people. While cutting-edge technology is fascinating, it only matters if it leads to real-world impact. We want to ensure that regular users can enjoy these advantages, which is why we've designed USDS to offer a savings rate managed by the Sky ecosystem that taps into both DeFi and traditional finance opportunities.

- Rune Christensen, Co-Founder, Sky Protocol

Business model and revenue streams

1. Stability fees:

- Users pay fees (~1.5%/year) when they generate USDS against their collateral.

- In 2024, stability fees generated over $259 million in revenue.

2. Liquidation fees:

- Fees are collected from the liquidation of undercollateralized positions.

- Liquidation fees contributed approximately $193 million to protocol revenue in 2024, whereas USDS lost $10 million.

3. Yield from RWA collateral:

- Interest earned on tokenized RWA collateral.

- Estimated to generate $75 million at 4.5% APY by the end of 2024.

3.2 Comparing different business models of stablecoin protocols

To effectively analyze and compare various stablecoin business models, we’ve developed a comprehensive framework that examines key operational aspects, revenue mechanisms, and stability strategies.

Dubbed the Stablecoin Business Model Analysis Matrix (SBMAM), this framework provides a comprehensive overview of different protocols’ approaches to maintaining a stable USD peg while generating recurring revenue.

Analysis and insights

1. Revenue model evolution

Tether generates income from interest on its $125+ billion reserves. However, this income is tied to fluctuating interest rates. PYUSD earns reserve interest and utilizes PayPal’s payment ecosystem. Sky Protocol relies on DeFi-native revenue streams, such as stability and liquidation fees, providing resilience across market cycles.

2. Collateral strategies and transparency

Tether’s focus on T-bills has improved transparency and boosted confidence, though this revenue is affected by U.S. monetary policy. PYUSD enjoys PayPal’s reputation but lacks reserve transparency. Sky Protocol’s innovative multi-collateral model, including RWAs, enhances stability but adds complexity.

If you want to learn more about this topic, check out the Onchain “Real-World Assets for Real-World Purposes“.

3. Stability mechanism sophistication

Tether and PYUSD rely on in-house mechanisms for quick responses but face risks from centralized failure points. In contrast, Sky Protocol’s algorithmic system offers decentralized resilience but is vulnerable to extreme market stress. For example, during the March 2020 crash, MakerDAO (rebranded to Sky Protocol in 2024) faced mass liquidations and network congestion. The DAO ended up losing $4.5 million in DAI before stabilizing with centralized USDC collateral. These trade-offs emphasize the delicate balance between stability, adaptability, and risk in different models.

4. Market positioning and growth

Tether maintains market dominance in crypto trading due to its deep liquidity. PYUSD integrates with PayPal’s vast user base, bridging TradFi and DeFi. Sky Protocol’s focus on cross-chain capabilities positions it for strong DeFi growth.

3.3 Implementing stablecoins in business operations

The true strength of blockchain isn't about solving global issues like hunger. It's about revolutionizing how we transfer value – making it faster and more transparent.

- Dr. Ananya Shrivastava, Research Analyst, Onchain

If you want to offer customers a crypto payment option, this section is for you! The following study explores how businesses can leverage Stripe’s payment solution to enhance their operations, manage payments, and reach new markets. The leading global payment platform, Stripe, has integrated the stablecoin USDC.

With transaction speeds increasing and costs coming down, we’re seeing crypto finally making sense as a means of exchange.

- John Collison, Co-founder, Stripe

Stripe’s Pay with Crypto feature lets businesses accept stablecoin payments that settle as fiat balances. Businesses can easily integrate crypto payments into their existing checkout flow (Checkout and Elements) or through the Payment Intents API. Business customers are directed to a secure page to connect their wallet and pay. With Stripe’s Link, businesses can offer returning customers a streamlined checkout process.

Adding crypto as a payment option to the checkout page:

Businesses can accept USDC payments on the Ethereum, Solana, and Polygon networks. These payments are automatically converted into USD, eliminating the need for businesses to hold or exchange stablecoins. Stripe charges a 1.5% fee per transaction.

To streamline the onboarding process, the platform offers an API for various programming languages, allowing developers to easily integrate USDC payments. These APIs enable businesses to:

- Create payment intents: Generate payment intents for USDC transactions, defining the amount, currency, and other parameters.

- Manage webhooks: Receive real-time notifications about the status of USDC payments, enabling automated system actions and updates.

- Access payment history: Retrieve detailed records of past USDC transactions for reconciliation and reporting purposes.

For more details on this feature, check this Stripe documentation page.

Businesses that utilize this solution can:

- Expand their customer base: Accepting USDC allows businesses to cater to the growing crypto user demographic, potentially increasing revenue substantially.

- Reduce transaction fees: Compared to traditional payment methods, USDC transactions are significantly cheaper, saving businesses money.

- Speed up global settlement: Cryptocurrency transactions are typically processed faster than traditional payment methods, reducing wait times for both customers and businesses.

- Enhance security and transparency: Stablecoin transactions leverage the security and transparency of blockchain technology, reducing the risk of fraud and unauthorized access.

- Give access to DeFi opportunities: Businesses can potentially earn interest on their USDC holdings by utilizing DeFi protocols.

Even though “Pay with Crypto” is designed for a global rollout, payment acceptance capabilities are currently limited to a small number of U.S. businesses.

Clear regulatory frameworks are crucial to fully realizing the potential of stablecoin payments. Regulatory clarity will foster growth and encourage widespread adoption. This is evident in regions like Europe, where the MiCA framework has paved the way for stablecoin adoption. While major TradFi institutions are eager to explore tokenized assets, most await regulatory certainty before fully exploring and embracing this technology.

With clear regulations, companies can now confidently use stablecoins as a payment innovation and monetary tool, knowing exactly how to account for them in financial statements and manage associated risks. These are significant advancements that make Europe a very promising growth market for us.

- Jeremy Allaire, Co-founder, Circle

3.4 Earning yields with stablecoins

We’ve covered how Tether generates revenue. But you want to know how regular businesses and individuals can earn stablecoin yields. What options are available, and how do they compare? You’re about to find out.

Businesses and individuals alike can generate passive income from their stablecoin holdings. Be aware, though, that navigating the various options and their associated tradeoffs can be daunting. This section explores key strategies for earning yields on stablecoins. We spotlight lending protocols, RWA platforms, and interest-bearing accounts offered by crypto exchanges.

Understanding stablecoin yield options

Passive income-earning options on stablecoins typically fall into three categories:

1. Lending protocols: Platforms like Aave, Compound, and Sky Protocol allow users to lend their stablecoins to liquidity pools and earn variable interest rates based on market dynamics. These decentralized systems provide flexibility and high liquidity but come with fluctuating rates. Smart contract vulnerabilities within these platforms are another potential risk.

2. RWA protocols: Platforms like Maple Finance and Centrifuge connect stablecoin holders with real-world borrowers. These protocols allow lenders to diversify their earnings by financing real-world operations, such as lending to FinTech startups. Maple Finance lets stablecoin lenders earn returns in the 5–10% range, making it a compelling option for those seeking steady returns.

The key is to provide products that people onchain want to allocate stablecoins into. At Maple Finance, we focus on offering highly liquid yield opportunities that are both safe and rewarding. By bringing corporate loans onchain, we’ve started with crypto institutions and aim to branch out to other sectors over time.

- Martin de Rijke, Head of Growth, Maple Finance

3. Interest-bearing accounts: Centralized platforms like Coinbase, Binance, and PayPal offer fixed interest on stablecoin deposits, resembling traditional savings accounts. These services are user-friendly and cater to crypto newcomers. However, they often provide lower returns compared to decentralized options and come with counterparty risk.

Beyond these traditional strategies, a new category of DeFi-native stablecoins has emerged that automatically generates yields for holders. Known as yield-bearing stablecoins, they simplify the earning process by automatically embedding returns in their design — innovative on the one hand, bearing unique risks on the other. The risks include stablecoin collateral volatility, reliance on specific market strategies, and other tradeoffs associated with higher yields.

- USB by Stabolut: This crypto-backed stablecoin uses delta-neutral hedging strategies to generate yield for users. USB offers a USD alternative that doesn’t need the traditional banking system. The risks for USB include market dependencies on its derivatives and potential vulnerabilities in the hedging strategy. Nevertheless, it’s an appealing option due to its privacy-enhancing bankless operation, combined with its yield-generating potential.

At Stabolut, we’ve designed USB to not only maintain a stable dollar peg but also generate yields through delta-neutral hedging strategies. This approach ensures resilience and independence from traditional banking systems, offering users a unique combination of stability, yield, and privacy.

- Eneko Knorr, Co-Founder and CEO, Stabolut

- USDB: Built on Ethereum L2 Blast, USDB generates collateral yield through rewards from staked ETH (sETH). The tradeoffs include derivative risks and potential shortcomings in the hedging strategy. Still, based on its bank-free operation and yield generation, USDB is a promising contender.

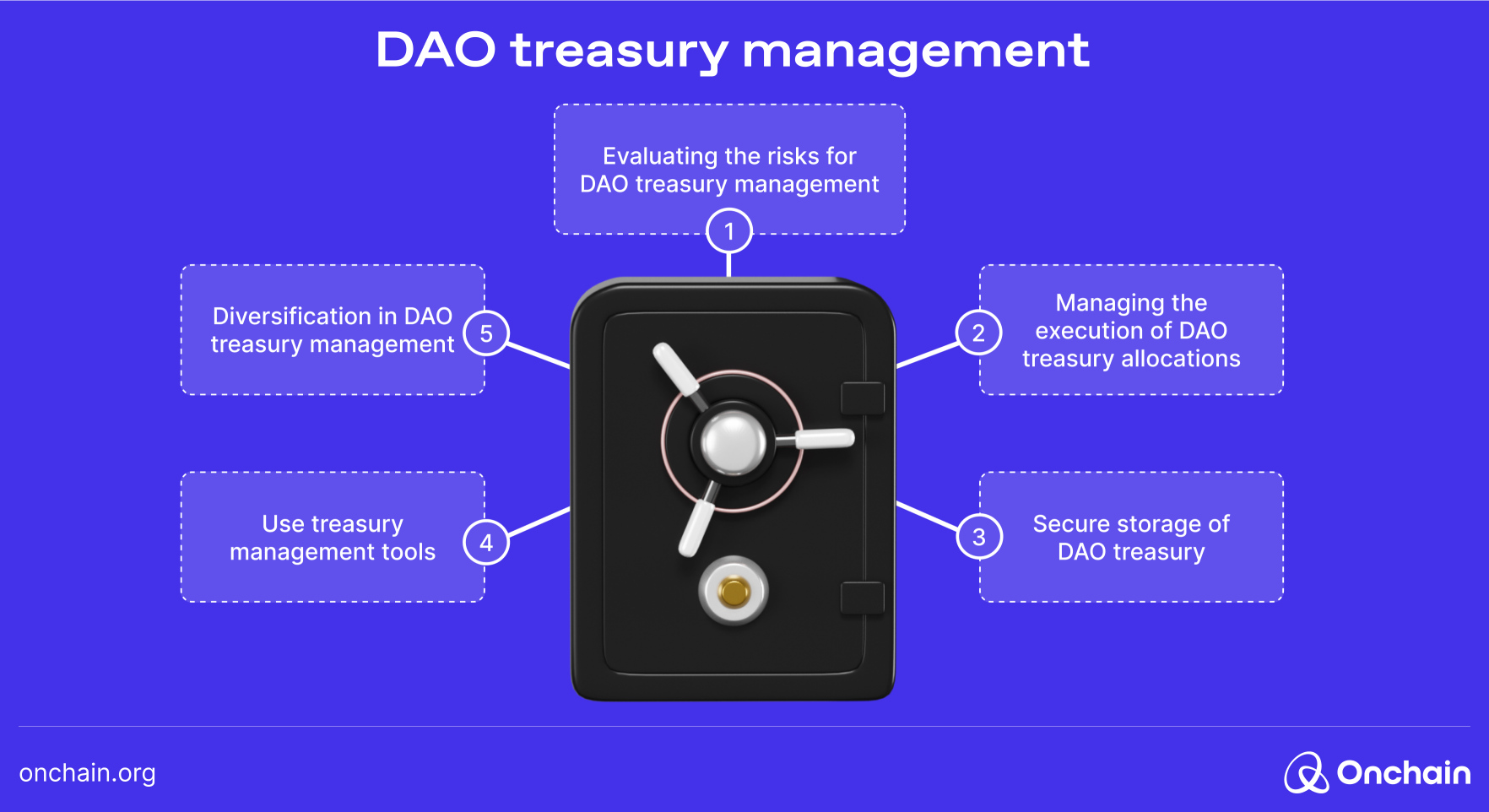

How DAOs use stablecoins to generate yield

To truly understand stablecoin yield strategies, you also need to look at the practices of decentralized autonomous organizations (DAOs). These blockchain-based organizations use stablecoins to support their operations, ensure financial stability, and earn yield on their treasuries.

DAOs like Uniswap and fxProtocol hold stablecoins to cover operational costs, pay salaries, and fund everyday expenses. This ensures their treasuries are not negatively affected by crypto price volatility. This is great during bull markets. However, a DAO that holds ETH or its native token as a treasury asset can be caught off guard when the crypto market turns bearish.

Some DAOs allocate stablecoin reserves to fund grants, promote ecosystem development, or support DAO-related projects.

As a company or a DAO, you need stablecoins for your treasury because you can't hold all your assets in volatile cryptocurrencies.

- Cyrille Briere, Contributor at fxProtocol

How about we run you through a practical yield-generating opportunity you can implement?

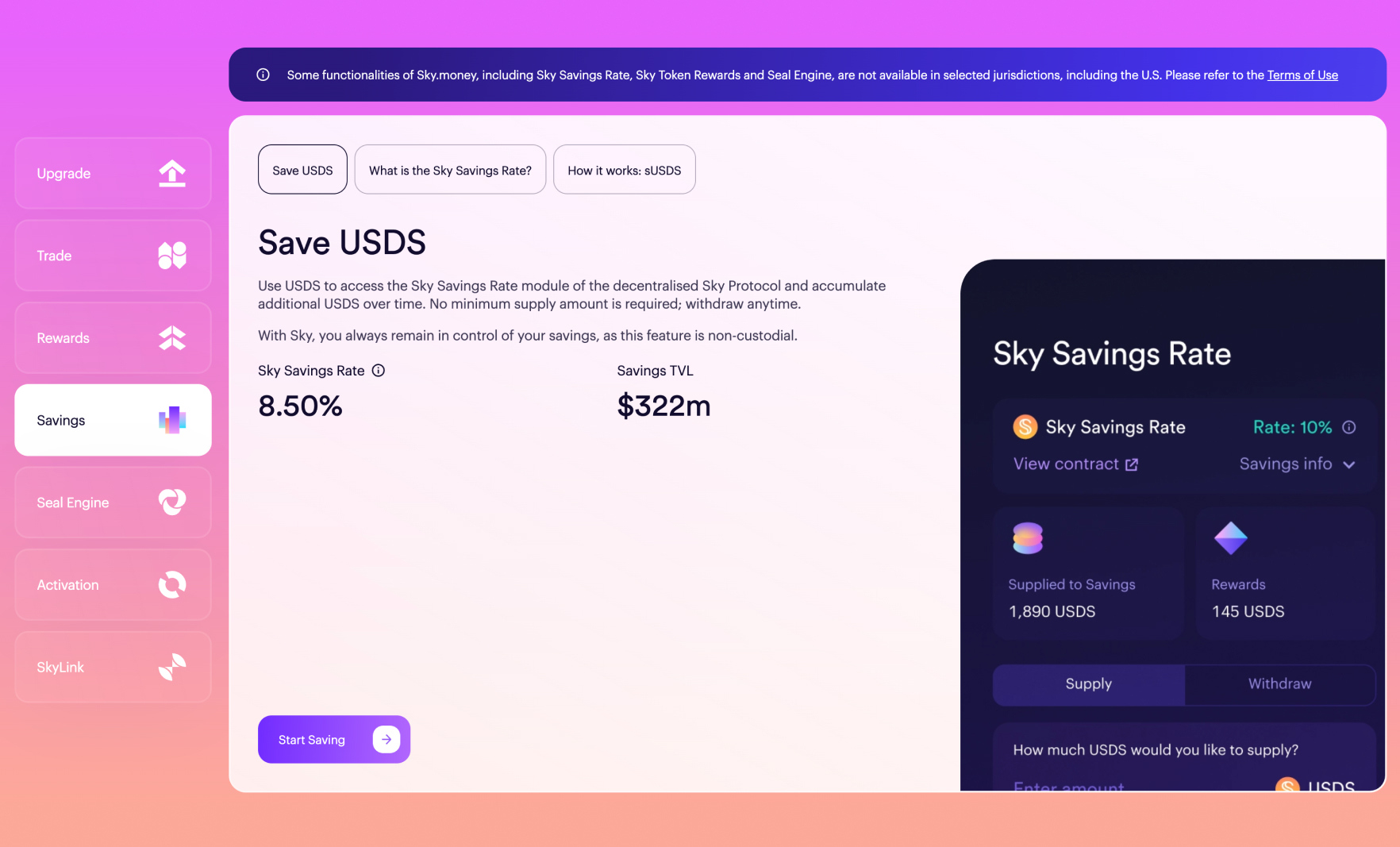

How to earn a yield on stablecoins with Sky Protocol (formerly MakerDAO)

Sky Protocol is a good example of how these yield strategies work in practice. In the DeFi world, Sky Protocol offers a unique way to earn passive income through its Sky Savings Rate (SSR). This feature allows users to deposit USDS stablecoins and earn a competitive 6.50% APY.

See how it’s done:

Step 1: Acquire USDS

First, you need to get some USDS, which is Sky Protocol’s native stablecoin. Here’s how you do it:

- Buy on exchanges: You can purchase USDS on a centralized exchange (CEX) or decentralized exchange (DEX). Just pick the exchange, buy some USDS, and transfer it to your personal wallet. USDS is available on exchanges like Kraken, Raydium, Orca, and Uniswap.

- Convert DAI to USDS: If you already have DAI, you can easily convert it to USDS at a 1:1 ratio using the Sky.money platform.

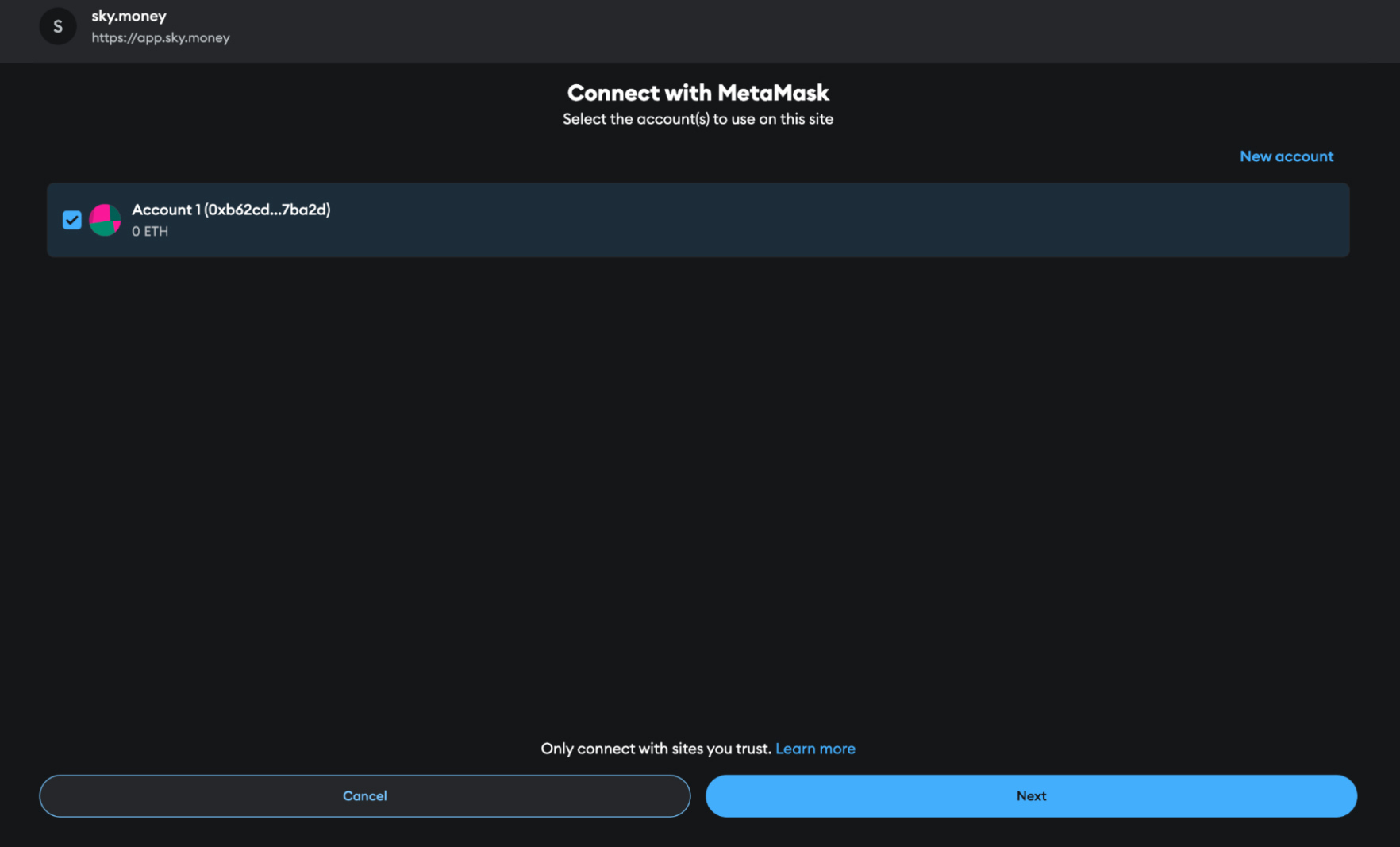

Step 2: Connect your wallet

Once you have USDS in your wallet, it’s time to visit Sky.money:

- Go to Sky.money.

- Click on “Connect Wallet.”

- Choose your Ethereum-compatible wallet (like MetaMask) and approve the connection.

Step 3: Deposit your USDS into the ‘Sky Savings Rate’

Now comes the exciting part!

- Navigate to the “Earn” or “Savings” section on Sky.money.

- Enter the amount of USDS you want to deposit.

- Approve the transaction in your wallet to give the protocol access.

- Confirm the deposit.

And just like that, your stablecoins are working for you — earning yield! But wait, before you jump to implement that, you need to know more.

One of the standout features of USDS is the Sky Savings Rate, which allows users to earn returns on their holdings. This feature is designed to be user-friendly, enabling individuals to access high-yield opportunities conveniently through a decentralized stablecoin. By combining the stability of traditional currencies with innovative DeFi mechanisms, we aim to provide a product that meets the needs of both consumers and businesses.

- Rune Christensen, Co-Founder, Sky Protocol

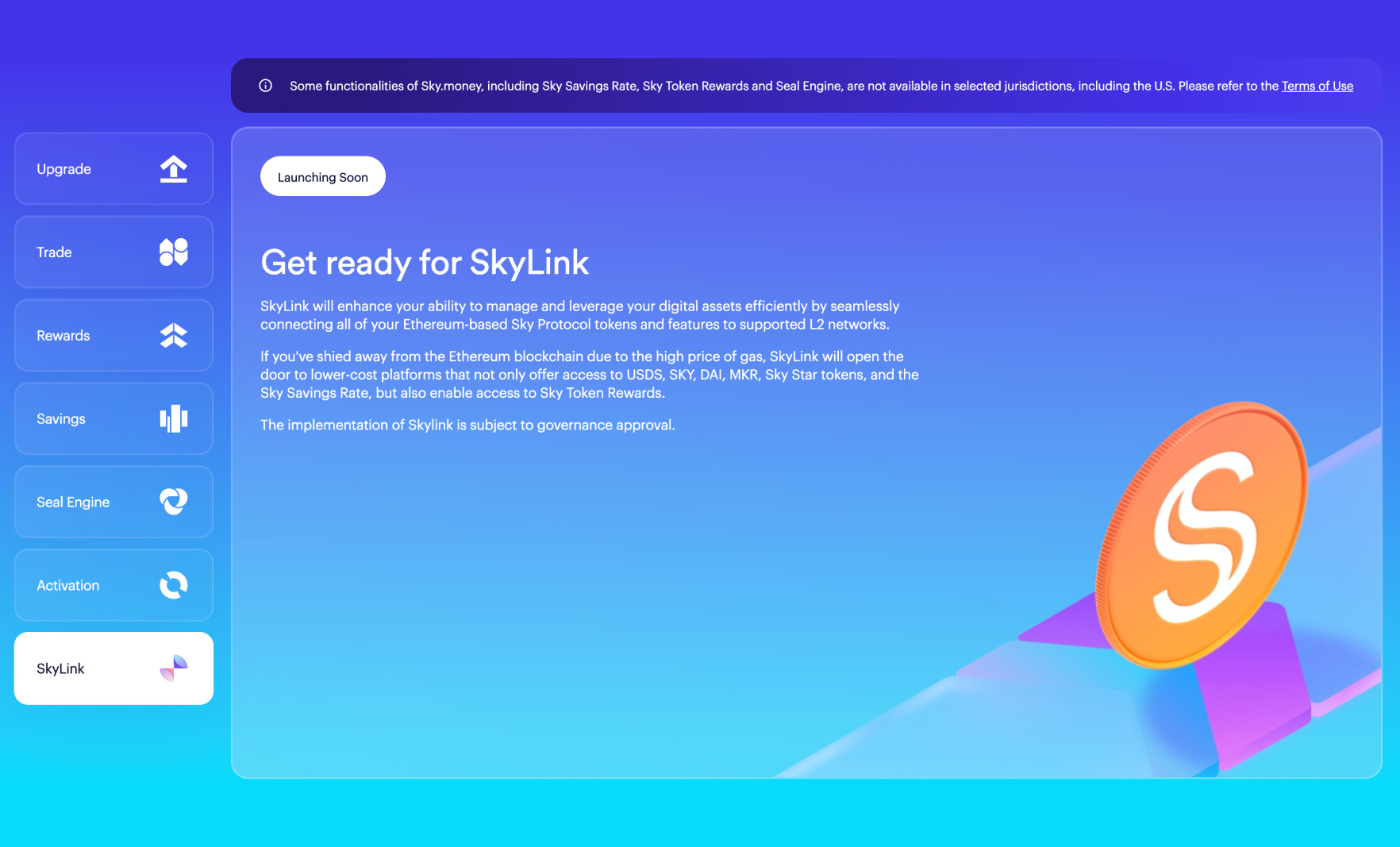

Pending a successful governance approval, Sky Protocol plans to launch SkyLink, which allows users to leverage their digital assets on other Layer 2 networks.

Step 4: Monitor your earnings

Once your USDS is deposited, it will start accruing interest at around 6.25%. You can keep an eye on your balance on the Sky.money dashboard and watch your earnings accrue in real time.

Here are a few things to consider:

Sustainability/variability of yield

The 6.50% APY offered by the SSR seems attractive, especially in low-interest environments. However, we must question the long-term sustainability of these rates. How does Sky Protocol generate these returns? Are they relying on unsustainable token emissions or risky lending practices? The DeFi landscape is littered with protocols that promise high yields. Some simply lower their APY; others crash and burn.

Transparency issues

While Sky Protocol claims to be transparent, the actual underpinnings backing their yield generation remain somewhat opaque. For a DeFi protocol handling user funds, this lack of clarity raises concerns. How can users truly assess the risks if they don’t fully understand how their returns are being generated?

Regulatory gray area

Depending on the jurisdiction, Sky Protocol operates in a legal gray area. This ambiguity poses significant risks to users. What happens if regulators decide to crack down on Sky Protocol, similar DeFi platforms, or their users?

Centralization concerns

Sky Protocol’s governance structure raises eyebrows. While certainly decentralized at the protocol level, the concentration of decision-making power in the hands of a few large token holders is concerning. This could lead to governance decisions that benefit the few at the expense of the many.

Security track record

Audits are a positive first step, but they do not guarantee security. Sky Protocol’s relatively short track record in the volatile DeFi space is cause for caution. How will it fare during a major market downturn or a sophisticated attack?

Ecosystem dependencies

Sky Protocol doesn’t exist in isolation. Its reliance on other protocols and oracles introduces additional points of failure. A problem in a connected protocol could have cascading effects, potentially jeopardizing user funds.

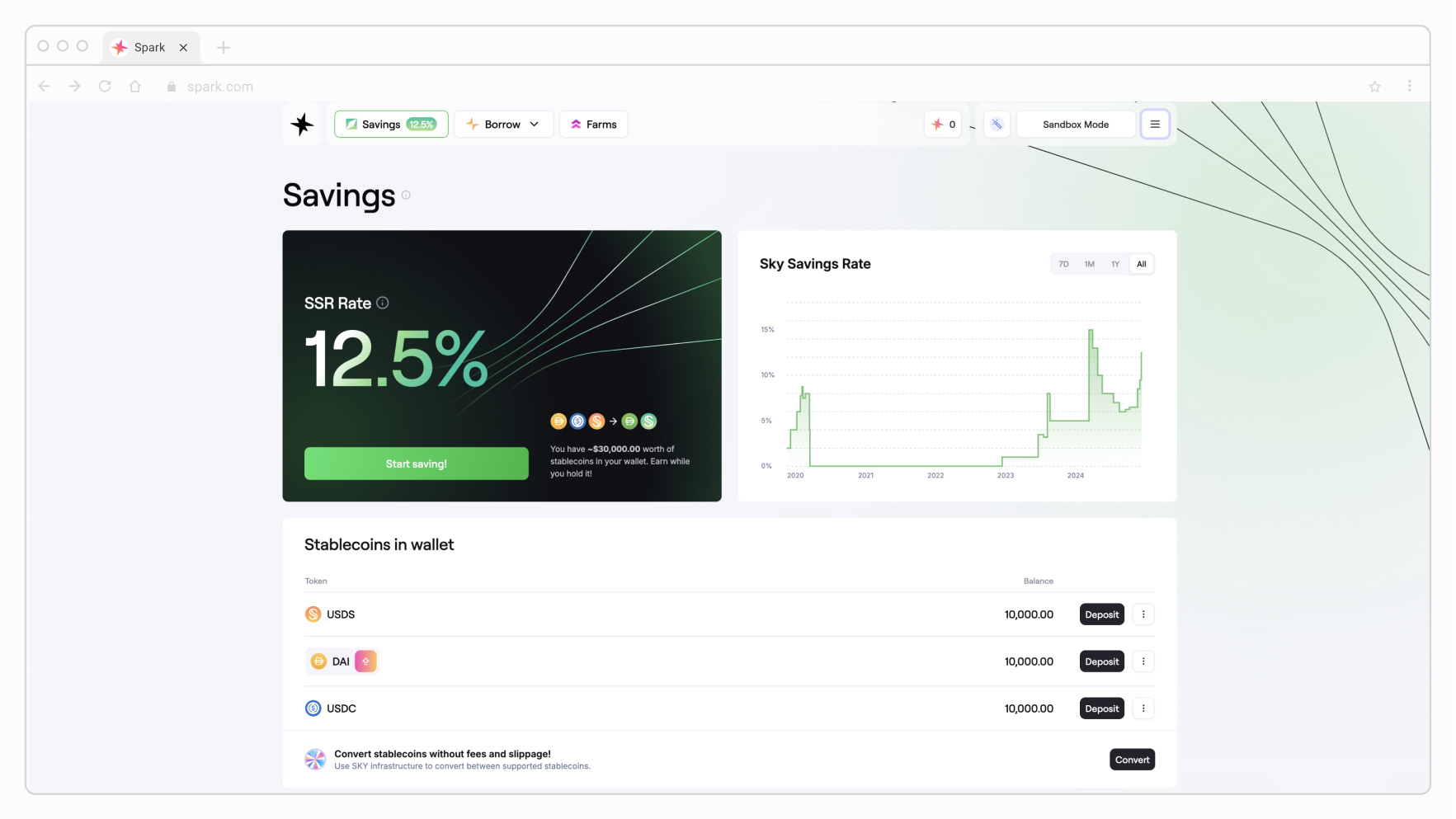

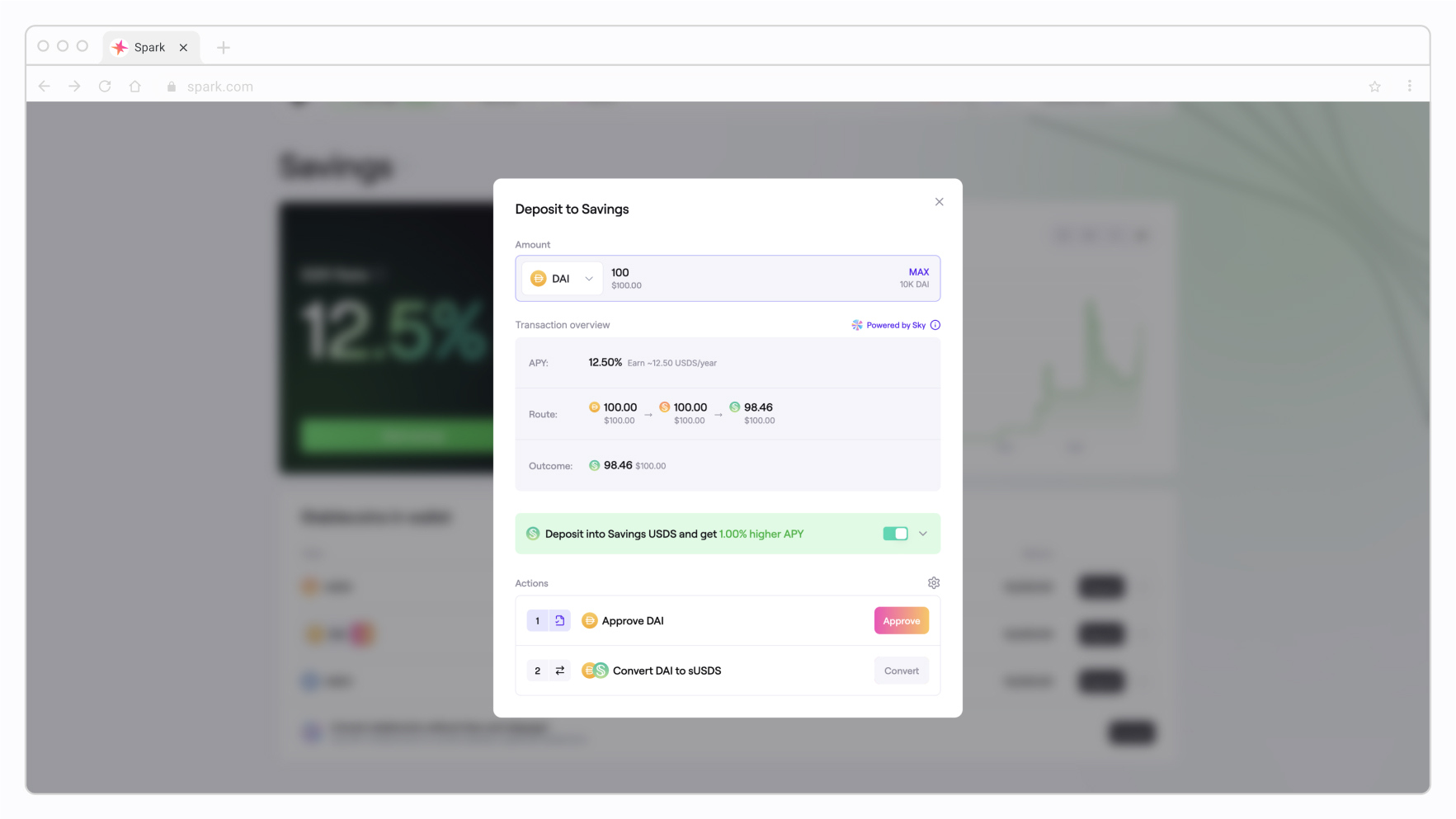

Other options – similar concerns

If you’re feeling adventurous and want to maximize your returns even more, consider checking out Spark Protocol. It allows you to lend or borrow with your USDS for potentially higher yields.

1. Visit Spark.fi and connect your wallet.

2. You can choose to deposit USDS to earn extra yield or borrow against it for additional liquidity.

Just remember that using Spark also comes with its own risks and tradeoffs. These include interest rate volatility and collateral liquidation, so make sure you’re comfortable with the pros and cons of DeFi yield generation.

You now have a ton of information to help you make decisions for your business purpose. It may be tough to decide where to focus your attention. So, let’s add some market information to the mix. The next chapter explores where adoption is highest and why. You’ll get an idea of what market conditions drive adoption, how the economies there are changing, and how to use this to your advantage.