2. The Stablecoin Landscape’s Fertile Business Ground

You’ll learn

- How giants like PayPal and JP Morgan use stablecoins to streamline operations, reduce costs, and power cross-border transactions.

- Why decentralized stablecoins are underrated, and how such currencies (i.e., USB and LUSD) stretch boundaries with unique financial and governance mechanisms.

- How hybrid stablecoin innovations (i.e., USDe and USDS) combine crypto and traditional assets to balance decentralization with stability.

- How and why stablecoins have found product-market fit while Central Bank Digital Currencies (CBDCs) struggle to gain adoption.

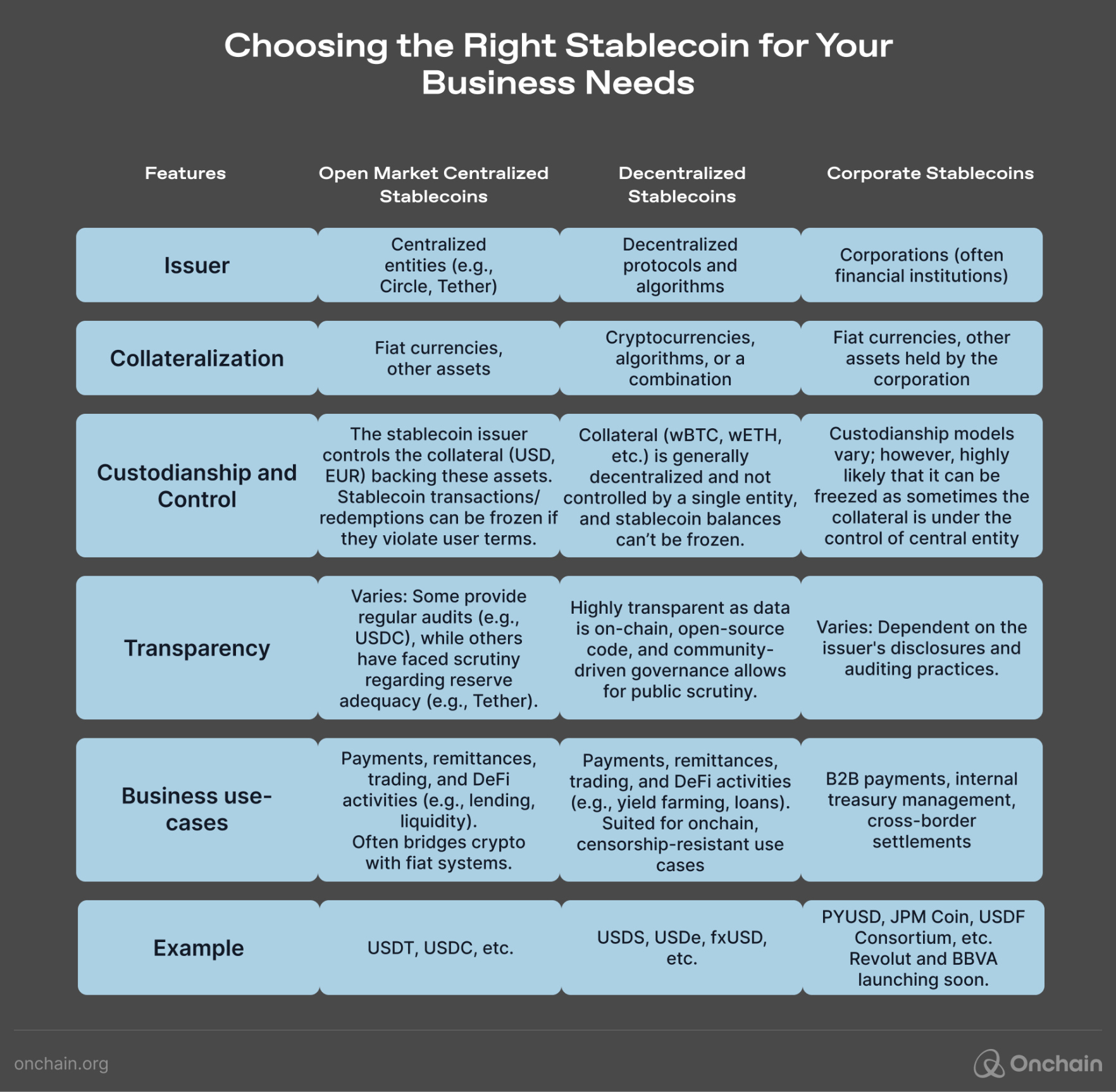

Whether you’re looking to create a new stablecoin protocol or incorporate stablecoins into your business model, understanding the different types and their unique characteristics can help you navigate this landscape strategically. Below, we break down the main categories of stablecoins to help you identify the right type for your goals.

2.1 Overview of stablecoin categories

There are multiple types of stablecoins in the market. This section provides a brief overview focused on these core categories:

1. Open market centralized stablecoins are accessible to everyone and operate on widely accessible networks, allowing them to be used across platforms without specific corporate limitations. Issued by centralized entities, they prioritize accessibility while varying in transparency and reserve management practices.

Examples:

- USDC (Circle) is known for its rigorous transparency standards. USDC’s reserves are fully disclosed and undergo monthly attestations by Deloitte, one of the big four accounting firms and one of the most prominent in the accounting industry. Its broad adoption in both DeFi and CeFi highlights its trusted status as a stable and reliable digital dollar.

- USDT (Tether) is widely adopted across global markets and is credited for its liquidity and accessibility. However, it has faced criticism over its reserve disclosures, leading to concerns about the consistency of its collateral audits.

2. Corporate stablecoins are issued by corporations for use within their specific business ecosystems. They may have permissioned access and are often tailored to fit the company’s products and services, limiting their use outside the corporate ecosystem.

Examples:

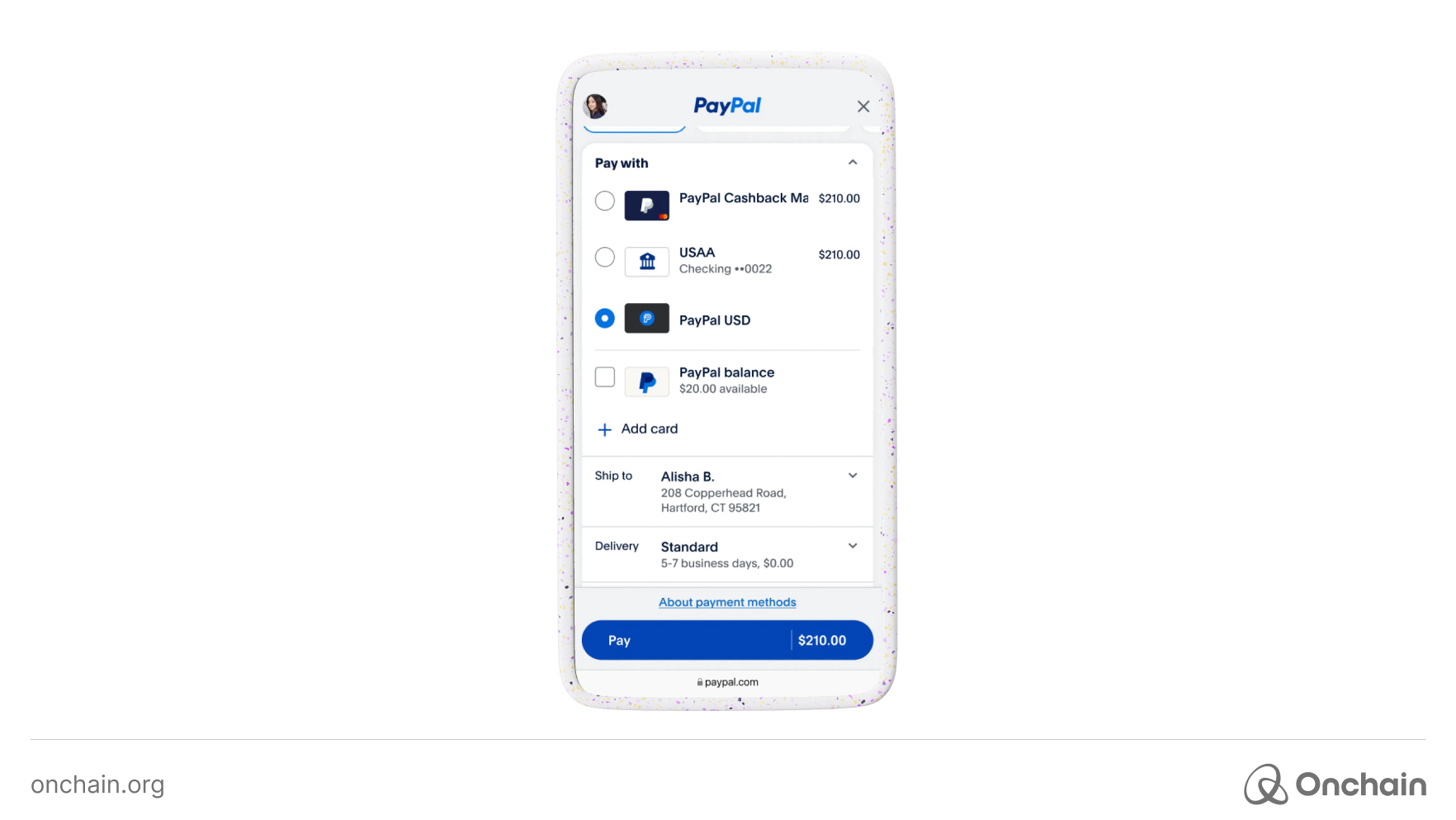

- PYUSD (PayPal) is created for use within PayPal’s payment services and is subject to its terms.

- JPM Coin (J.P. Morgan) is restricted to J.P. Morgan’s institutional clients for settlement and internal corporate use.

3. Decentralized stablecoins are primarily crypto-backed and governed by decentralized autonomous organizations (DAOs). No stablecoin can be fully decentralized due to factors like infrastructure reliance, oracle dependencies, or governance centralization. However, the following examples are among the most decentralized options as of November 2024:

Examples:

- LUSD (Liquity Protocol) is backed by ETH with decentralized governance and is available for permissionless use.

- fxUSD (f(x) Protocol) is a USD-pegged stablecoin from Aladdin DAO, which is fully backed by Ethereum liquid staking derivatives and managed via a two-token model that enables leverage of up to 10x on ETH.

- USB (Stabolut) is a crypto-backed, dollar-pegged stablecoin designed to operate without reliance on traditional banking systems. USB employs a delta-neutral hedging strategy to maintain its peg to the US dollar, offering decentralization, financial resilience, and privacy-enhancing features.

For some reason, only 0.1% of the $180 billion stablecoin market is decentralized. The rest is exposed to real-world assets or centralized stablecoins.

- Cyrille Briere - Contributor at f(x) Protocol

4. Hybrid stablecoins use a combination of collateral mechanisms (e.g., a mix of crypto assets and traditional reserves) to balance stability and scalability. They aim to leverage the benefits of decentralization while maintaining robust stability.

Examples:

- Ethena’s USDe is backed by a combination of liquid-staked Ethereum (stETH) and Bitcoin (BTC). Ethena employs a delta-neutral strategy, using short positions on derivatives exchanges to offset price fluctuations in the backing assets, thereby maintaining the stability of USDe.

- USDS (Sky, formerly MakerDAO) is supported by a diversified portfolio that includes both cryptocurrency assets and real-world assets (RWAs), such as U.S. Treasuries. This combination aims to provide a stable value by leveraging the liquidity of crypto assets and the reliability of traditional financial instruments.

In Chapter 3, we’ll delve into how individuals, businesses, and Decentralized Autonomous Organizations (DAOs) can use USDS to generate a conservative yield on their stablecoin holdings.

5. Commodity-backed stablecoins are pegged to real-world commodities like gold or oil, and their values are linked to the price of their underlying physical assets. This category provides exposure to commodity values in a stable digital form.

Examples:

- Pax Gold (PAXG) is pegged to the gold price. Each token represents one fine troy ounce of gold held in secure vaults.

- Tether Gold (XAUt) is backed by physical gold, providing digital ownership of a real-world commodity.

2.2 Corporate stablecoins: Doing business around the world

In this section, we’ll take a closer look at some of the dominant corporate stablecoins with a positive track record, making them important from a business case perspective:

1. PayPal’s PYUSD

- Recently launched, PYUSD aims to simplify cross-border payments for businesses and reduce transaction fees. It’s designed for easy integration into PayPal’s ecosystem, making it a trusted option for enterprises engaging in global transactions.

- According to Bloomberg, “PayPal paid an invoice to Ernst & Young LLP on September 23, 2024, using PYUSD relying on an SAP SE platform to complete the transaction.”

Survey insights

While businesses in advanced economies and emerging economies have been cautious about adopting stablecoins, our survey highlights that 90% of vendors globally are ready to accept them:

In advanced economies, 67% of vendors reported some degree of readiness to accept stablecoins.

In emerging economies (as defined by the IMF), this readiness rises to 92%, showing strong support for stablecoins.

This indicates that businesses hesitant to adopt stablecoins are operating within an ecosystem already primed for stablecoin-based transactions.

- How is this relevant for business? Corporate stablecoins like PayPal’s PYUSD are gaining traction due to their ability to streamline cross-border payments and reduce transaction fees. Designed for seamless integration into PayPal’s ecosystem, PYUSD offers businesses a trusted and cost-effective solution for global transactions.

- Real-world use case: On September 23, 2024, PayPal used PYUSD to pay Ernst & Young LLP via an SAP SE platform, demonstrating its potential for B2B payments and ERP integration.

- Integrating stablecoins into ERP systems, as shown by SAP, provides a familiar and reliable framework for businesses. This reduces barriers to adoption, making stablecoins like PYUSD an attractive option for enterprises that seek efficiency and cost savings in international transactions.

2. JP Morgan’s JPM Coin

- JPM Coin is used by large institutions for secure, real-time settlements. Its strong presence in institutional finance makes it a key player for businesses in need of a reliable solution for cross-border payments, especially in the B2B space.

- How is this relevant for business? Imagine a large company needs to move money between different countries. JPM Coin allows them to do this instantly, 24/7, regardless of time zones or bank holidays. This significantly speeds up operations and improves cash flow.

- JPM Coin isn’t just about speed; it is also about smart transactions. Think of it like setting rules for your payments. In other words, payment is automatically triggered when a certain pre-defined condition is met. For example, when a shipment arrives at the destination, a product is delivered, or a contract is signed. This automation saves time and reduces errors.

- Such advantages are not merely theoretical. In June 2023, the German multinational conglomerate Siemens AG became the first company to use JPM Coin for euro-denominated payments. This marked a significant expansion of JPM Coin’s capabilities beyond US dollar transactions.

- JP Morgan recently revealed that Ant International, an affiliate of China’s Alipay, has processed billions of dollars in transactions using JPM Coin. This showcases the real-world impact and scalability of the stablecoin.

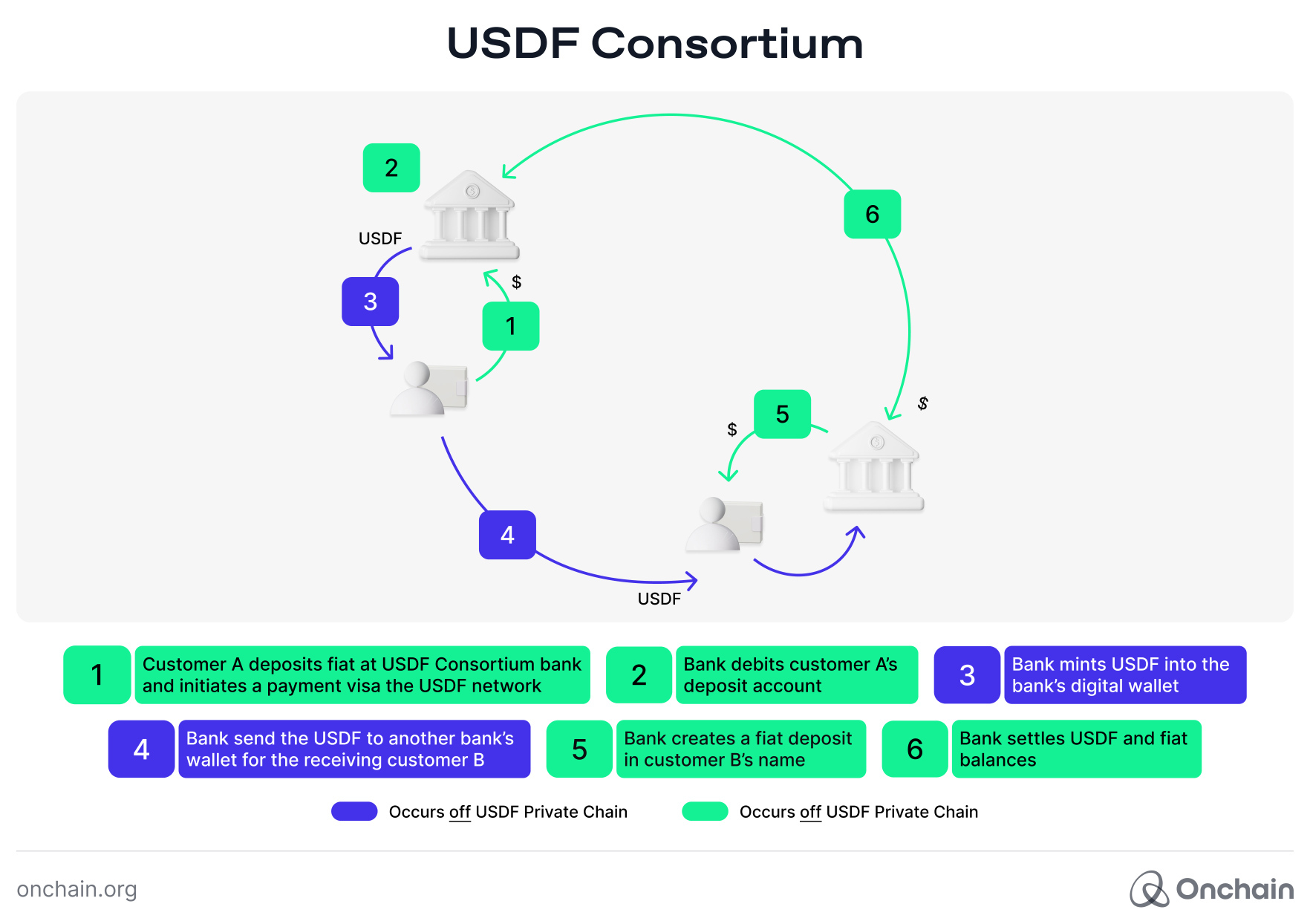

3. USDF Consortium

- USDF is a bank-led initiative focused on providing a stablecoin that integrates with existing financial systems. It aims to offer businesses an efficient way to settle payments across different banks, blending the best of traditional finance and stablecoins.

- JPM Coin was launched when the regulatory environment in the United States was a little more relaxed. However, other US-based banks faced a more challenging time.

- The USDF Consortium has made significant adaptations to address regulatory concerns, including a transition from a public to a private blockchain network.

- How is this relevant for business? Robert Morgan himself explains:

I believe that tokenized deposits are the single most important opportunity for banks to innovate, compete, and maintain the critical role that they play for their customers and communities around the country.

- Robert Morgan, CEO of USDF

Other notable developments:

- Revolut has made a name for itself by offering crypto services. At the time of writing this report (Nov 2024), Revolut plans to issue its own stablecoin to provide customers with enhanced financial services, including faster cross-border payments and access to DeFi.

Revolut’s planned stablecoin launch isn’t its first venture into the crypto world. In May 2023, the company launched Revolut X, a dedicated crypto exchange platform. It offers users a specialized space to buy, sell, and trade cryptocurrencies.

Later, in August 2023, Revolut introduced virtual crypto payment cards. These allow users to spend their cryptocurrency holdings with merchants that accept Visa or Mastercard, further bridging the gap between crypto and everyday transactions.

According to a spokesperson from Revolut, “The firm wants to expand its crypto offering, taking a compliance-first approach to become a safe harbor for the entire crypto community.”

- How is this relevant for business? Revolut’s stablecoin could become an efficient tool for businesses interested in lower-cost payment options and easier access to DeFi investment opportunities.

While the exact details of Revolut’s stablecoin are still under wraps, we anticipate the following:

- The stablecoin will likely be integrated into the Revolut app. Users will be able to access and manage it easily alongside their other financial products.

- Given Revolut’s emphasis on compliance, we expect the stablecoin to be issued by a regulated entity and adhere to the relevant regulations.

- BBVA and Visa: BBVA, a multinational Spanish bank, is exploring a Euro-pegged stablecoin and a collaboration with Visa in an interesting move to enable faster settlements and cross-border transactions. This development aims to bring stablecoins into the traditional banking space, with Visa integrating USDC for payment settlement.

- How is this relevant for business? These corporate stablecoins are reshaping how businesses handle global payments, and could potentially eliminate the friction between traditional payment systems like SWIFT.

BBVA is one of the first banks to utilize Visa Tokenized Asset Platform (VTAP), a new platform designed to help financial institutions create and manage digital tokens linked to traditional assets like fiat currencies.

Essentially, VTAP allows banks to issue their own stablecoins and integrate them with blockchain networks. BBVA is using VTAP to develop its own stablecoin on the public Ethereum blockchain. This stablecoin aims to facilitate digital settlements and transactions.

The organization plans to launch a pilot program with select customers in Europe in 2025, focusing on real-world applications of their stablecoin.

The following table breaks down the key differences between the three main categories of stablecoins — centralized, decentralized, and corporate. Based on your business needs, this can help you make informed decisions about your business requirements and risk tolerance.

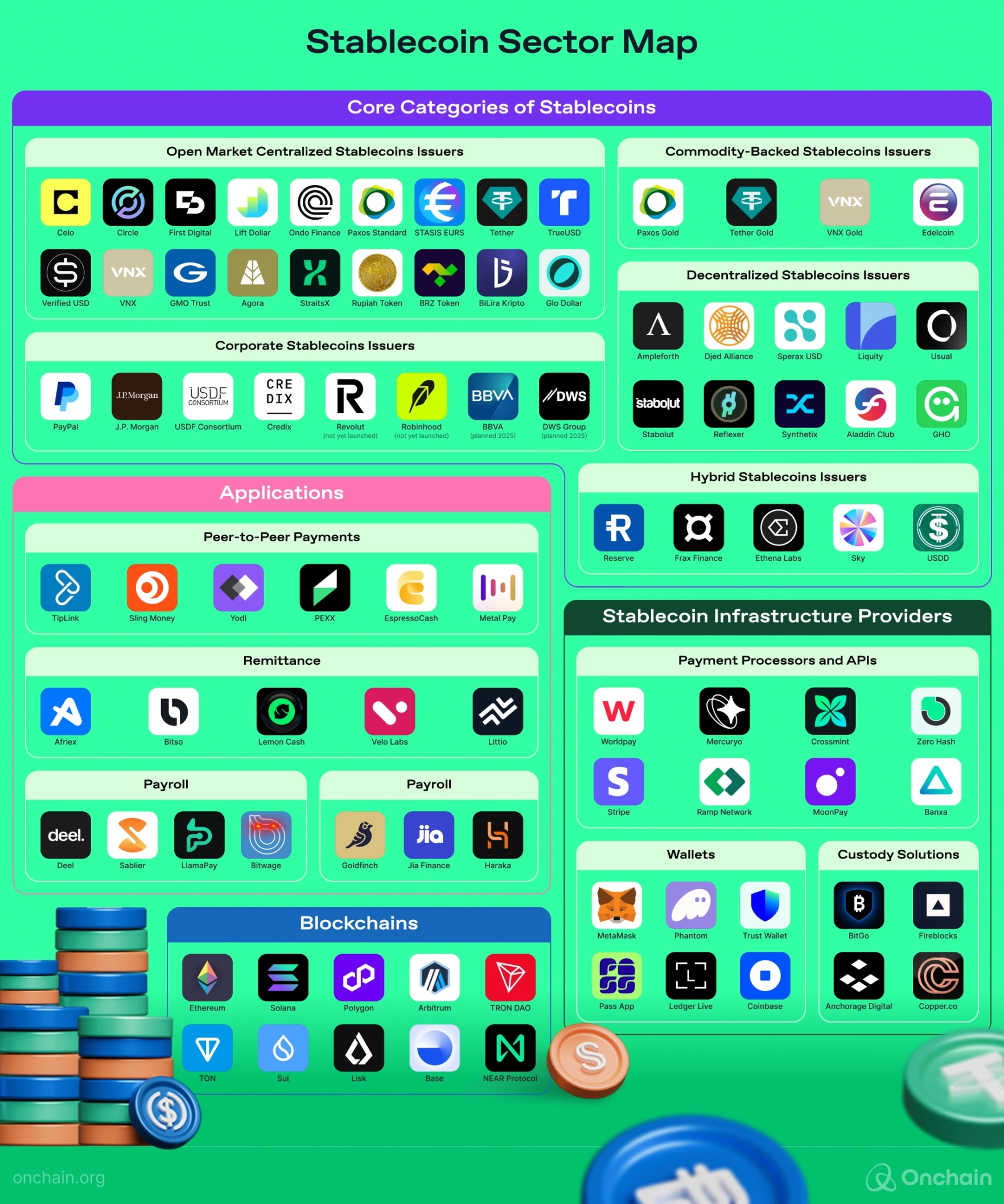

To gain a clearer understanding of the stablecoin ecosystem, we analyzed over 100 stablecoin-related projects spanning various models, applications, and supporting infrastructures. The Stablecoin Sector Map below visualizes these findings, illustrating the breadth of offerings across centralized, decentralized, corporate, hybrid, and commodity-backed categories. By mapping out the key issuers, applications, blockchains, and infrastructure providers, we identified how different types of stablecoins power diverse use cases — from peer-to-peer payments and remittances to decentralized finance and institutional settlements.

It is important to note that while the Sector Map highlights the most relevant projects within the ecosystem, it does not include every project, making it an inherently incomplete representation. However, it provides a good overview of the overall scale and reach of the stablecoin industry and its relevance for the broader Web3 ecosystem.

2.3 How stablecoins found a product-market fit while CBDCs haven’t (yet?)

By now you understand that stablecoins have carved out a unique role within the digital economy. But what happens when governments attempt to create their own digital currencies with similar goals in mind?

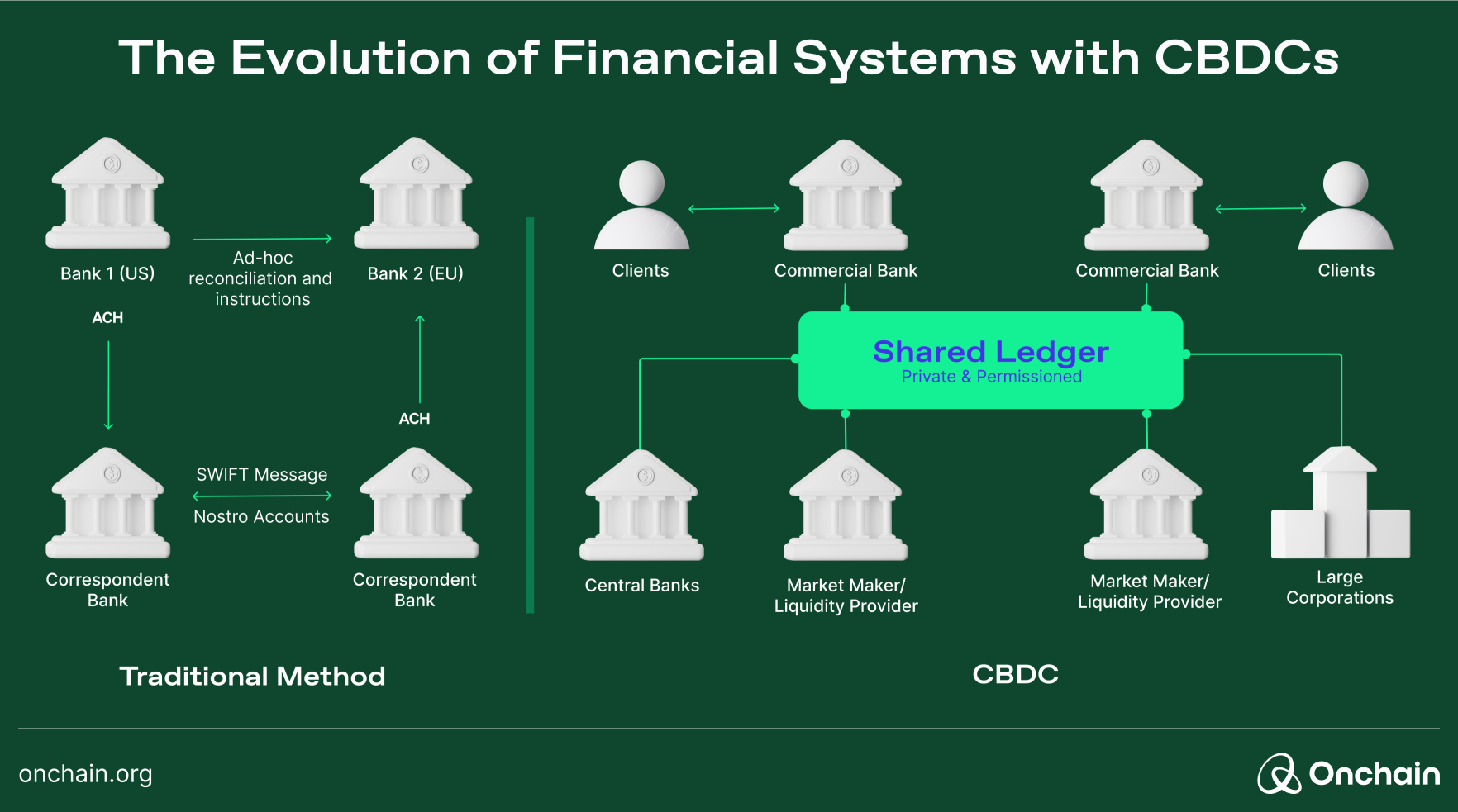

This is where Central Bank Digital Currencies (CBDCs) come into play. Unlike stablecoins, CBDCs are digital versions of national currencies issued directly by central banks. They aim to offer a state-backed digital alternative to cash, promoting financial inclusion and modernization of payment systems.

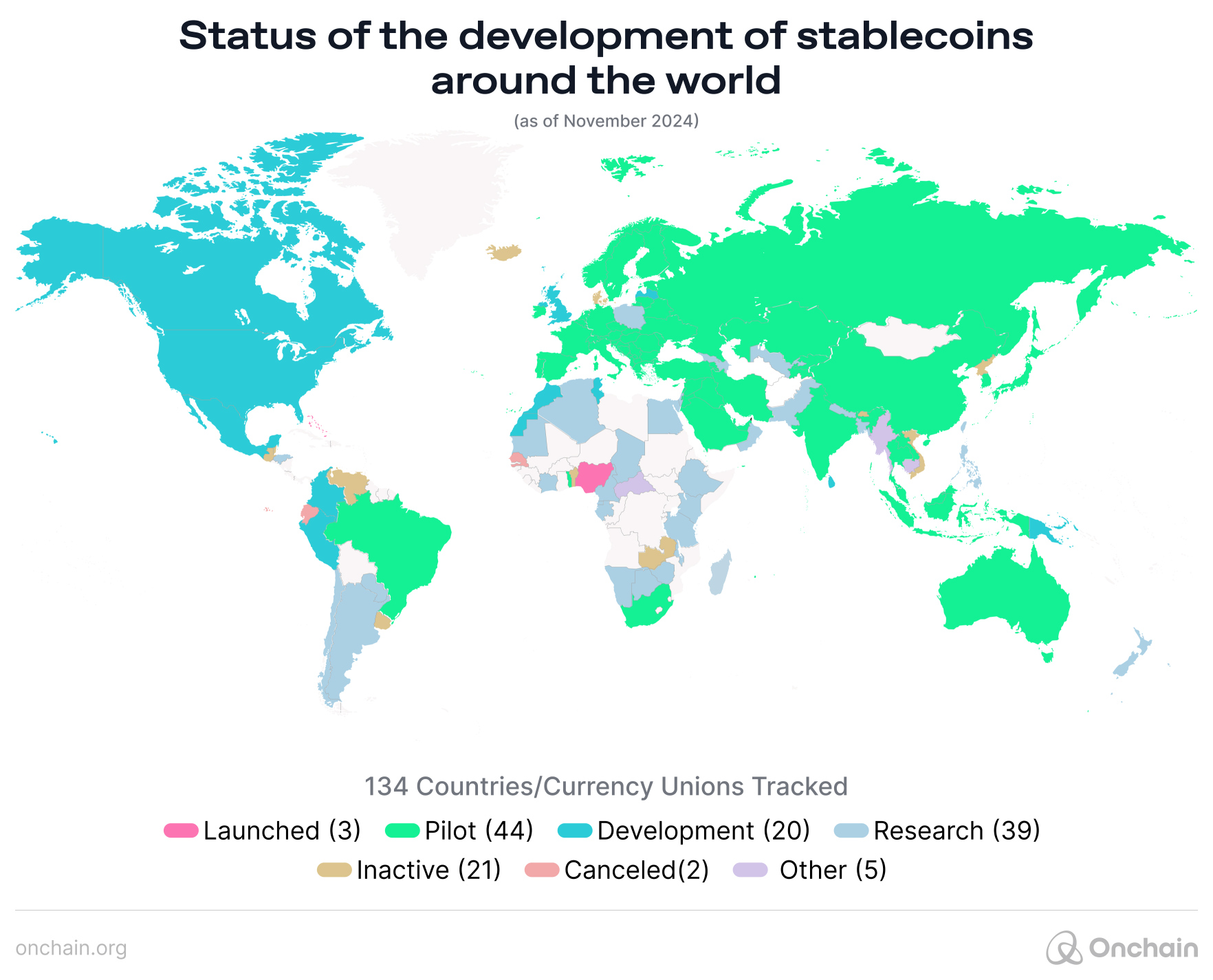

Over 130 countries, representing about 98% of the global GDP, are actively researching or developing CBDCs.

However, while stablecoins have rapidly gained traction across DeFi and international payment utilities, CBDCs have yet to find the same product-market fit.

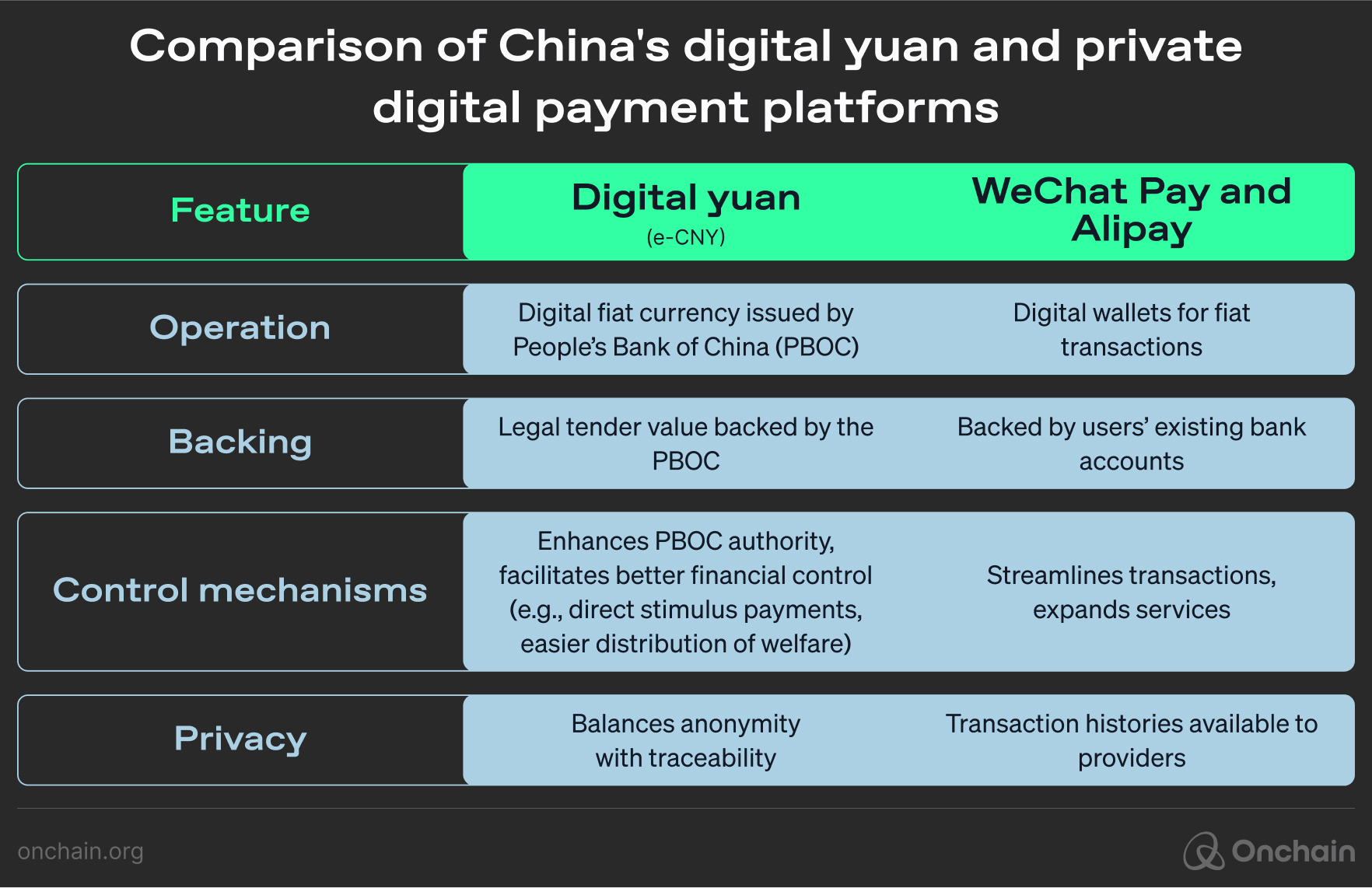

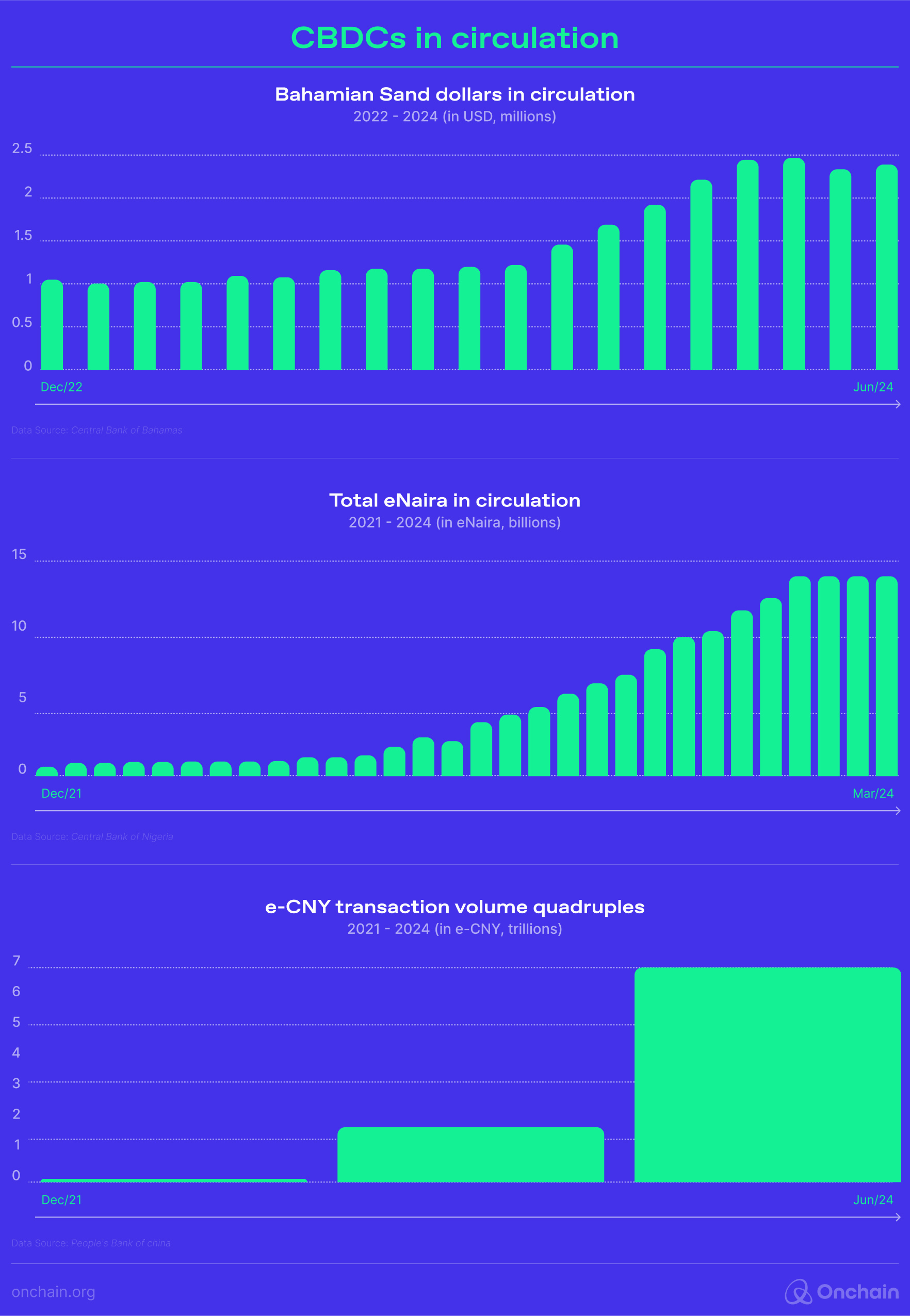

For example, China’s digital yuan (e-CNY) is the largest and most advanced CBDC pilot, with over 7 trillion e-CNY ($986 billion) transacted as of 2024 (Atlantic Council, 2024).

Yet, in the everyday lives of Chinese consumers, the e-CNY is still overshadowed by established digital payment giants like WeChat Pay and Alipay, which already offer seamless transactions in China’s digital economy.

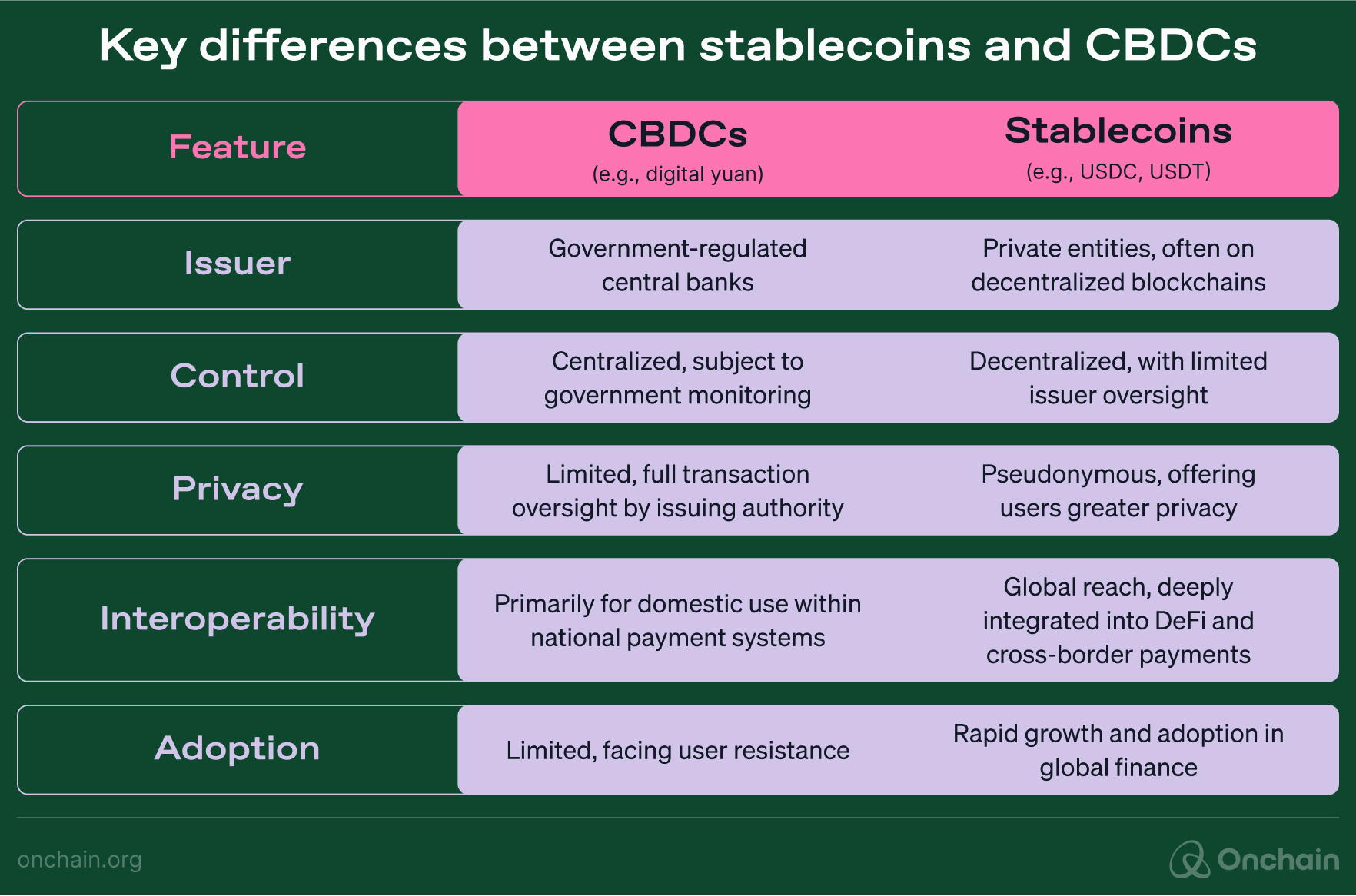

To understand why CBDCs struggle to gain traction, we need to compare them to their primary competitors: private digital payment platforms. Unlike stablecoins, which fill global financial gaps and serve decentralized finance use cases, CBDCs are designed to modernize domestic payment systems.

Private platforms dominate this space with seamless, user-friendly services that are already deeply integrated into daily life. The following comparison table highlights CBDCs’ challenges in achieving product-market fit, even in a controlled environment like China, where the government could theoretically mandate their use.

This pattern of limited success isn’t unique to China. Nigeria’s eNaira, another prominent CBDC, faces similar challenges. Citizens still prefer cash and existing mobile money options.

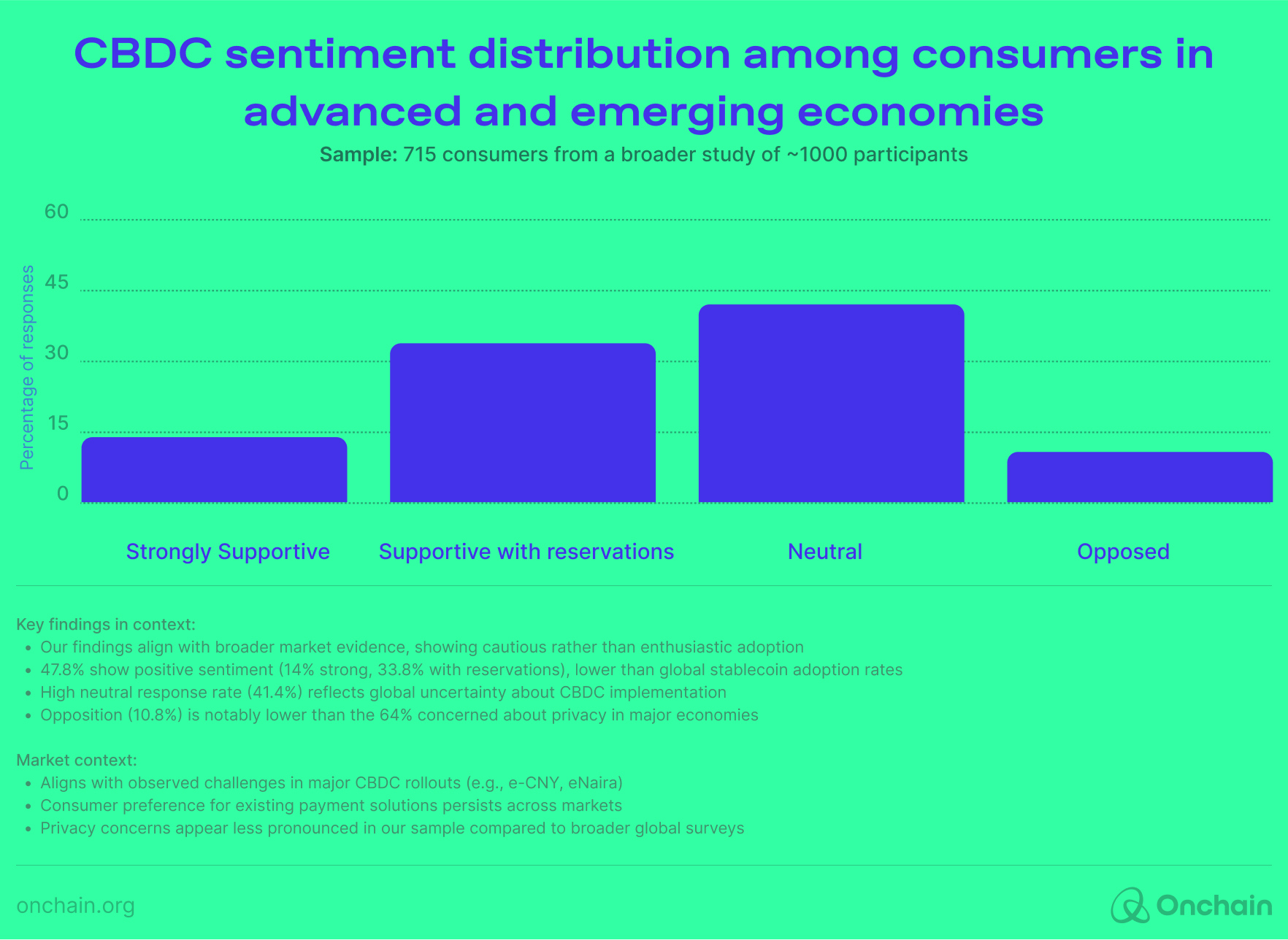

Our global survey of 715 consumers across emerging and advanced economies reflects this cautious sentiment. While outright opposition to CBDCs is relatively low at 10.8%, the response pattern suggests a measured rather than enthusiastic approach to adoption.

The largest group of respondents (41.4%) remain neutral, indicating significant uncertainty about CBDC implementation and benefits. Among those expressing support, the majority (33.8%) do so with reservation, while only 14% are strongly supportive.

This distribution aligns with observed CBDC rollout experiences globally. Consumers are not opposed to CBDCs but are not convinced of their distinct advantages over existing payment solutions.

The public’s hesitation points to a core issue: CBDCs, while secure and regulated, do not offer the distinct advantages that stablecoins bring, namely decentralized control, privacy, and global accessibility.

That’s a strong statement, and it deserves a closer look. The following is a side-by-side comparison.

2.4 Why liquidity matters — build where you’re treated best

For Web3 entrepreneurs, startups, and founders, choosing the right financial environment for growth is key.

Understanding where stablecoin liquidity resides and how it flows is critical to building scalable, cost-efficient projects that can thrive in the ecosystem.

This section provides a detailed overview of the stablecoin liquidity landscape in November 2024, mapping out the most liquid blockchain networks and what that means for you as a Web3 entrepreneur.

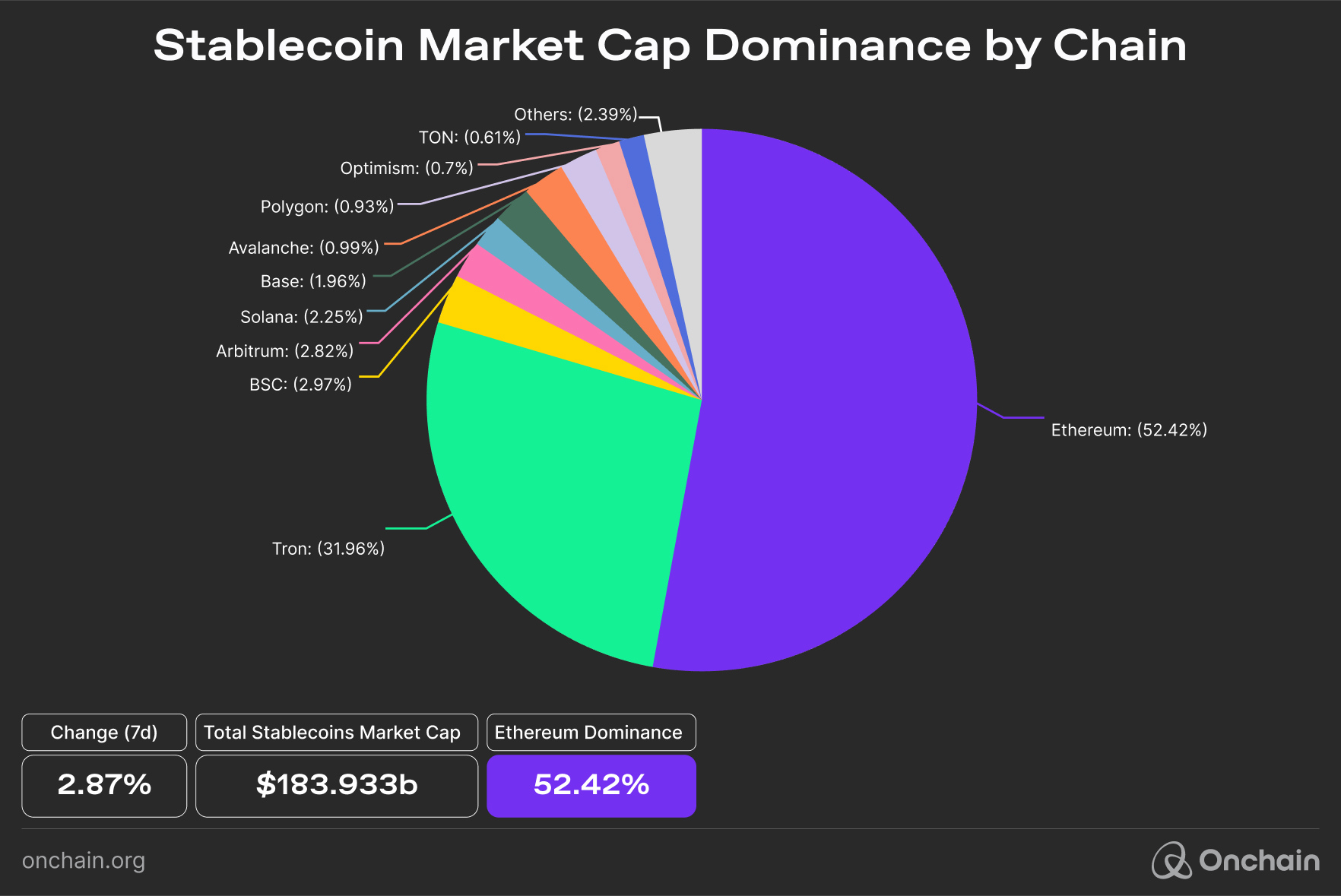

1. Ethereum: The dominant liquidity hub

Ethereum maintains the largest stablecoin ecosystem, holding 52.42% of the total liquidity, primarily through USDT and USDC. Ethereum’s vast DeFi infrastructure, encompassing protocols like Aave, Compound, and Uniswap, is central to its dominance in stablecoin transactions.

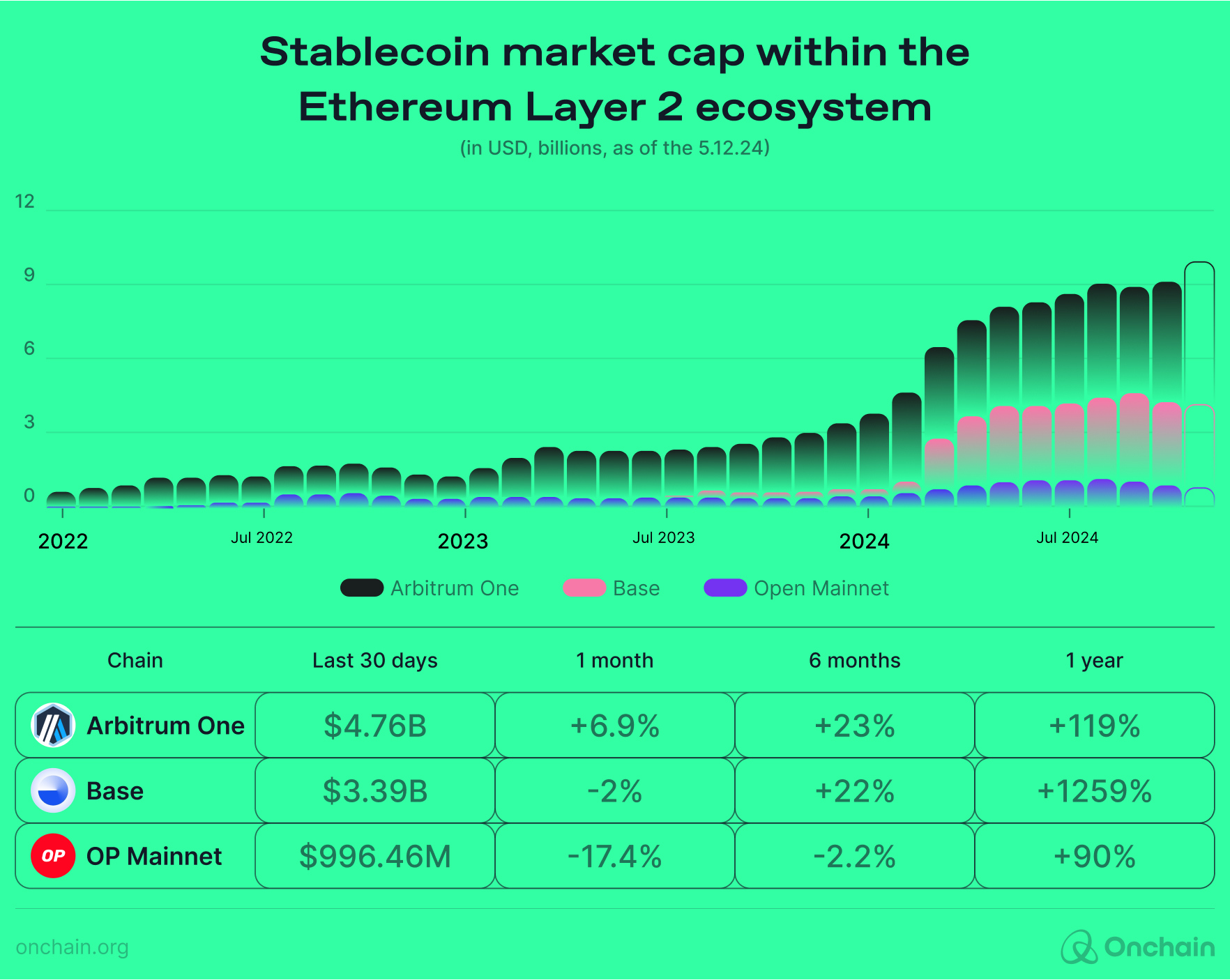

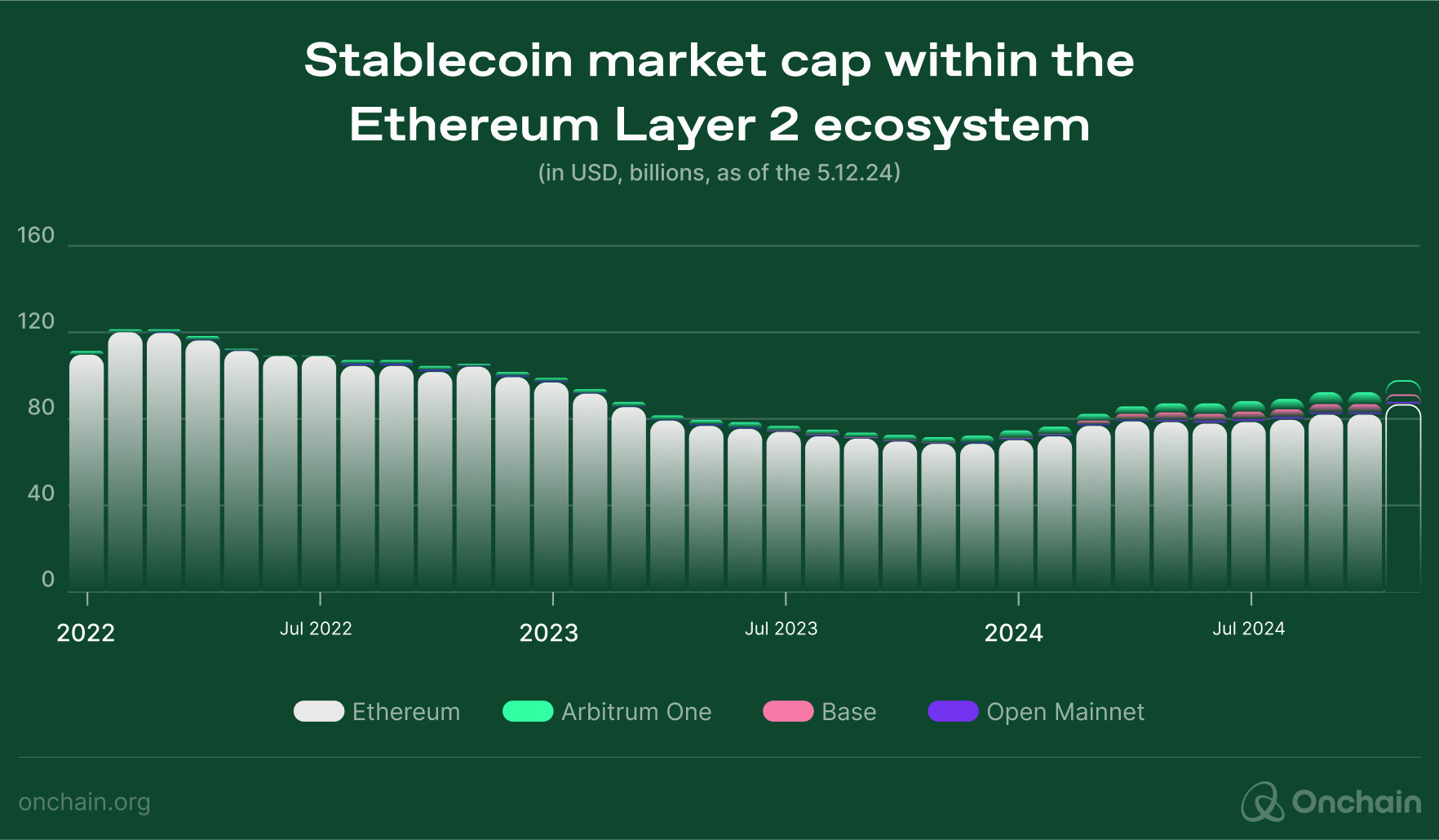

However, Layer 2 (L2) solutions like Arbitrum and Base are gaining momentum. These chains offer relief to Ethereum’s gas fee challenges. In October 2024, Arbitrum recorded over 3.2 million active addresses, and Base boasted an impressive 23.1 million. Both networks have experienced explosive growth this year: Arbitrum’s stablecoin market cap increased by 119% year-over-year, reaching $4.76 billion. Base surged by an astounding 1259% to $3.39 billion.

Key Takeaway:

- Ethereum is still the best platform for deep DeFi liquidity, but startups should look to Arbitrum and Base for scalable, low-fee solutions that tap into Ethereum’s liquidity without the high transaction costs.

- Despite their rapid growth, these L2 networks are still relatively small compared to the Ethereum Mainnet, indicating substantial room for expansion.

2. Tron: Leading in payments and remittances

Tron is home to 31.96% of the total stablecoin liquidity as of November 2024, mainly driven by USDT. Tron’s key advantage is its ability to facilitate cross-border payments and remittances, particularly in regions like Latin America and Southeast Asia, where low fees and high-speed transactions are essential.

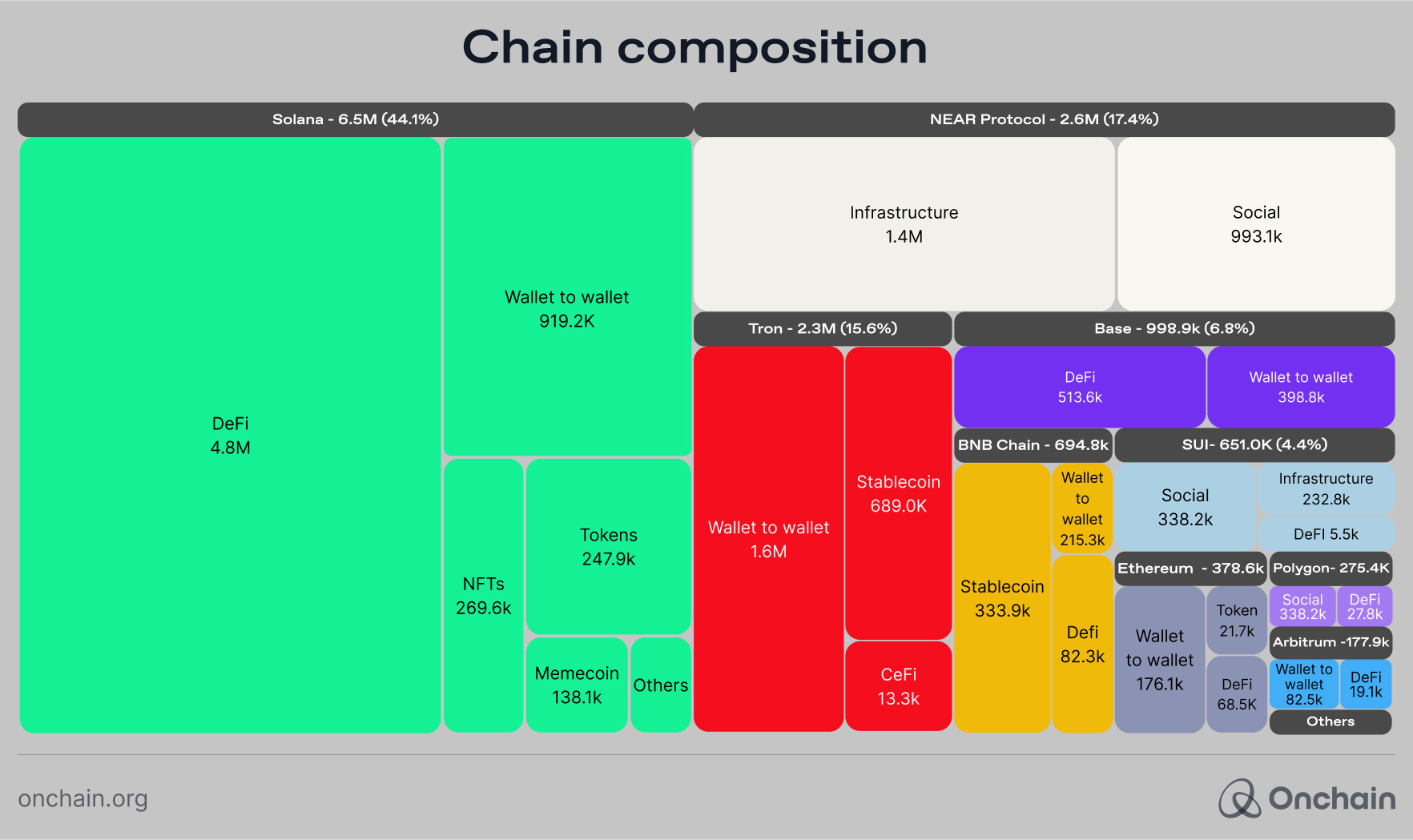

With around 2.3 million monthly active addresses, Tron is optimized for high-frequency transactions. Therefore, it’s an ideal platform for payment-heavy applications. USDT dominates the Tron network’s usage, with 689k active stablecoin addresses.

- Key takeaway: Tron provides the most efficient and cost-effective platform for businesses focused on global payments and remittances, particularly for scaling operations in emerging and developing economies.

3. Solana: Optimized for speed and scalability

Solana remains one of the fastest-growing ecosystems for stablecoin liquidity, holding 2.07% of the market. As of October 2024, Solana boasts 5.4 million monthly active addresses, accounting for 44.1% of blockchain activity. Its infrastructure supports high-frequency trading and NFT marketplaces, and it is powered by USDC as the primary stablecoin in its ecosystem.

Solana’s ability to process 65,000 transactions per second makes it a top choice for businesses that require low latency and fast transaction throughput, whether in DeFi or the growing NFT sector.

- A key takeaway for entrepreneurs: Solana is the platform of choice for businesses looking for fast, scalable infrastructure, particularly for high-frequency markets and NFT applications. Its high speed and low fees make it attractive for startups requiring rapid transaction settlement.

4. Other notable rising stablecoin chains

Several other blockchains are gaining momentum in the stablecoin ecosystem, presenting intriguing opportunities for entrepreneurs and businesses to explore.

Blockchain active addresses: A snapshot of user engagement

Note: Active addresses are a valuable metric for illustrating user engagement observed over a longer timeframe, however, they provide only a partial view of blockchain activity. This metric does not differentiate between unique users, automated transactions, or spam, which can inflate the numbers. For this analysis, active addresses serve as a broad indicator to highlight trends and adoption across different ecosystems.

- TON blockchain: With its focus on wallet-to-wallet transactions and cross-border payments, TON has seen significant growth, especially for remittance services. TON’s liquidity footprint is expanding. Its architecture favors low-fee, fast transaction models similar to Tron.

- Sui: Sui has garnered attention through its growing base in Decentralized Social Media (DeSoc) applications and DeFi. It currently has over 651K active addresses, split between 338.2K in social applications, 232.8K in infrastructure-related projects, and over 5K in DeFi.

- NEAR Protocol: NEAR continues to focus on infrastructure-heavy applications, and counts 2.6 million monthly active addresses. Infrastructure applications like oracles and account abstraction are driving most of its usage. NEAR’s modular architecture attracts projects that need scalability and interoperability across blockchains, increasing its significance for business-to-business applications.

- Base: Base, a Layer 2 solution on Ethereum, has 998.9K active addresses, with 513.6K in DeFi activity and 398.8K in wallet-to-wallet transactions. Due to its cost-efficiency and combined with Ethereum’s security, It’s a preferred option for developers who strive to scale.

Now that you are aware of the potential, the uniqueness, and the advantage of stablecoins, you are ready to see what you can get out of it and how. The following paragraphs not only analyze exiting business models but also evaluate which works best in which businesses. Even better, we have some practical tips for you. You’ll learn how to apply practical strategies for earning yields and growing your business with the help of stablecoins.