1. The Trillion-Dollar Market You Can’t Afford to Ignore

You’ll Learn:

- Why and how stablecoins surged beyond crypto to handle trillions in annual transactions, and how they outpaced giants like Visa and Mastercard.

- How stablecoins generate revenue for businesses in traditional and decentralized finance and offer high-yield potential to corporate and institutional users.

- Why stablecoins are vital to DeFi as foundational assets by providing liquidity, stability, and services that traditional finance cannot match.

- And more

In the early days of cryptocurrency, stablecoins were a niche concept designed to stabilize a volatile market — no doubt a fundamental issue to solve for a supportive character in the play. The idea was simple: offer a digital asset that maintains a steady value relative to traditional currencies like the US dollar.

This was meant to help crypto traders avoid the wild price swings of tokens like Bitcoin, Litecoin, or Peercoin. The first stablecoin, bitUSD, was introduced in 2014, backed by Bitshares’ BTS token. Expectations were high, but the coin failed to maintain its peg and collapsed in 2018. Despite the initial flop, a concept was born, and a seed was planted in innovative minds. The new stabilizing asset class would soon become a vital digital economy pillar.

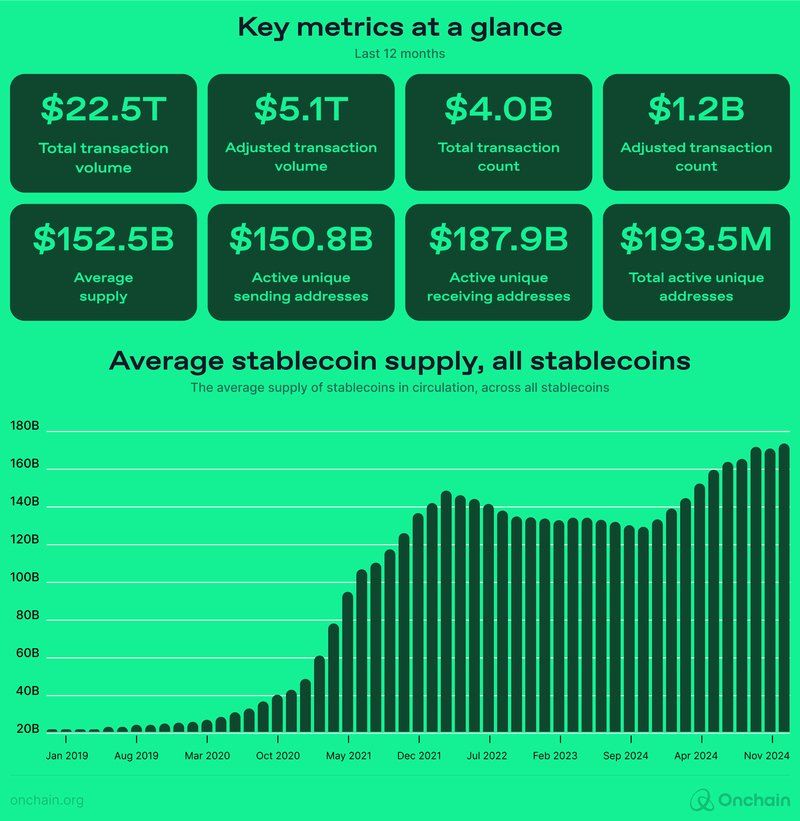

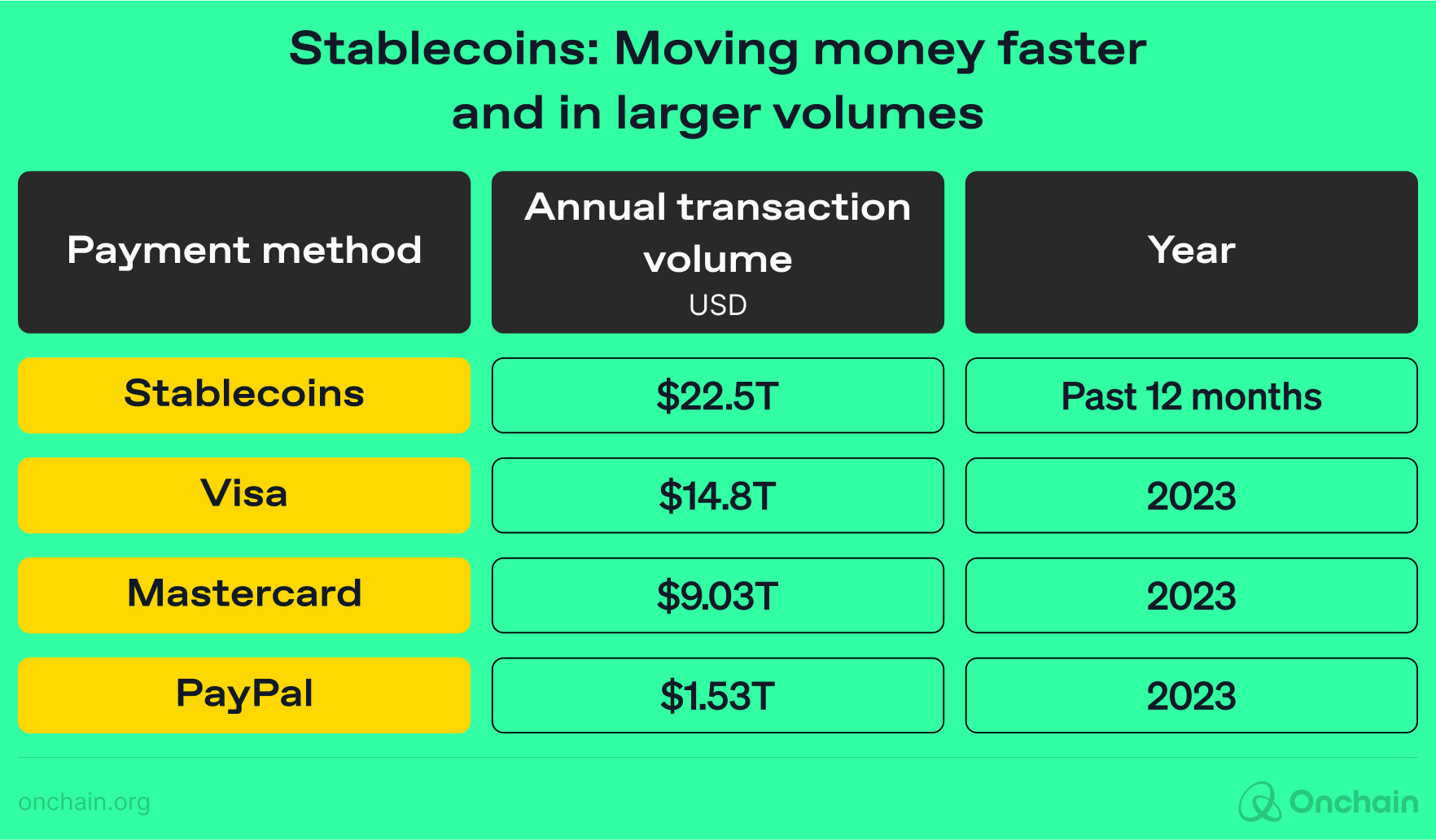

Only a decade later, stablecoin usage has evolved far beyond its original use case. Today, the new coin type plays a critical role in global finance. According to Visa, stablecoins have facilitated approximately $22.5 trillion in transactions in the last twelve months alone.

Almost $180 billion of stablecoins in circulation; 400x in the last 5 years

To put this into perspective:

- Visa reported a total transaction volume of $14.8 trillion (Visa annual report) in 2023.

- Mastercard processed $9.03 trillion (Ycharts, 2023) in total transaction volume over the same period.

- PayPal recorded $1.53 trillion (PayPal, 2024) in total transaction volume in 2023.

Note: The stablecoin transaction volume was sourced from Visa Onchain Analytics. Visa’s transaction volume was sourced from their 2023 annual report. Mastercard’s transaction volume is obtained from YCharts, 2023. PayPal’s transaction volume was sourced from Statista (2024).

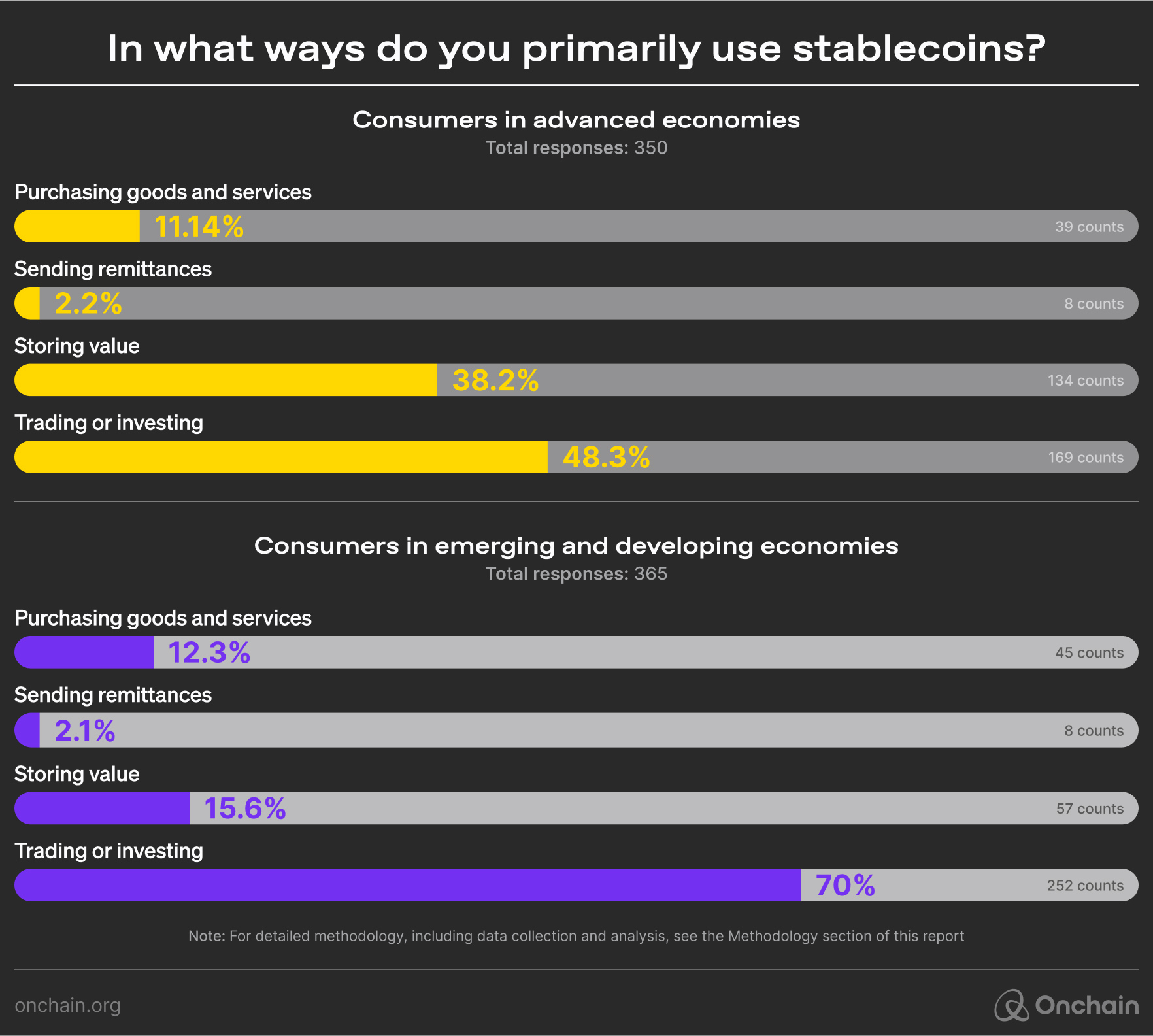

While these figures might suggest that stablecoins have already overtaken traditional financial giants, the reality is more nuanced. Visa and Mastercard process everyday consumer transactions — payments for goods and services — whereas stablecoin transactions, as of now, are primarily driven by the following:

- Crypto trading on centralized exchanges.

- Decentralized finance (DeFi) activities.

- Liquidity provision within centralized and decentralized exchanges (DEXes).

These activities naturally generate higher volumes than typical consumer payments. Stablecoins function as liquidity tools within the crypto ecosystem, making their transaction volumes more comparable to financial market trading activities than day-to-day payments handled by Visa or PayPal.

Survey data from the Onchain Research team underscores that stablecoins are predominantly used for trading, investing, and storing value, with notable differences between consumers in advanced, emerging, and developing economies. In advanced economies, stablecoin usage is concentrated on trading and storing value, while in emerging and developing economies, trading dominates, complemented by a growing use case for remittances. These insights align with the IMF’s classification of advanced economies and emerging and developing economies (IMF, 2023). Our survey received 1,450 responses, and a full methodology is provided at the end of this report.

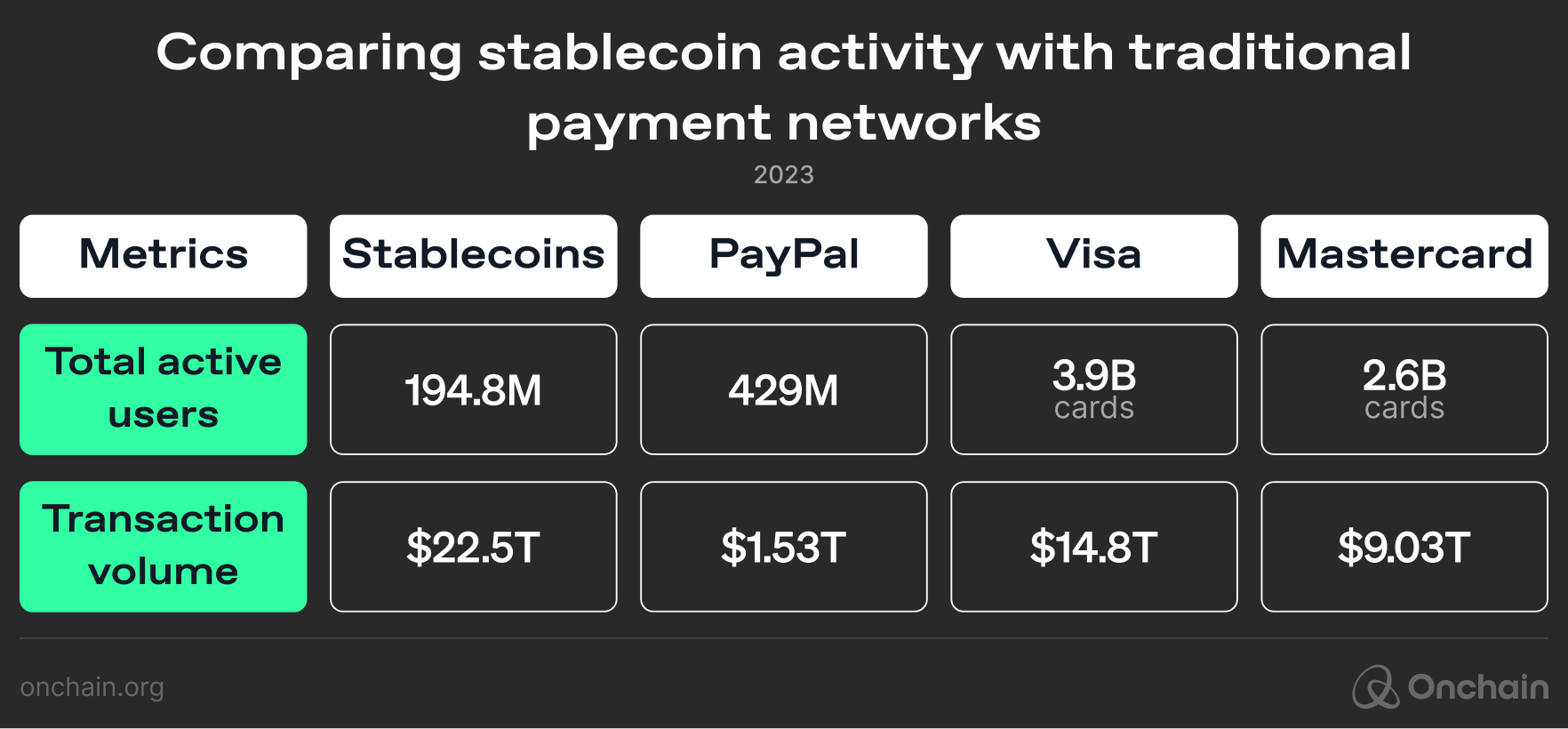

In terms of unique users, stablecoins are still far from rivaling traditional payment networks. According to data provided by Visa:

- The total active unique wallet addresses within the last 12 months (November 2023 to November 2024) reached nearly 195 million across all stablecoin transactions.

In stark contrast:

- Visa served over 3.9 billion cardholders worldwide in 2023.

- In the same timeframe, Mastercard maintained a user base of approximately 2.6 billion active cards.

- PayPal reported 429 million active accounts in 2023.

Nevertheless, stablecoins represent one of the few Web3 innovations that has found substantial product-market fit, particularly in emerging markets with high demand for stable digital assets.

Stablecoins have the potential to bridge the gap for the billions of unbanked and underbanked individuals worldwide. By leveraging blockchain technology, we can provide financial access where traditional systems have failed.

- Eneko Knorr, Co-Founder, and CEO, Stabolut

1.1 Stablecoin businesses: The cash cows of crypto

Despite a relatively modest user base compared to traditional financial giants, stablecoins have firmly established themselves as the “cash cows” of the crypto world. At the forefront of this profitability surge are two major players: Tether (USDT) and USD Coin (USDC).

USDT, the clear market leader, claims to have over 350 million active users globally (Tether, 2024), with a market capitalization of over $124 billion.

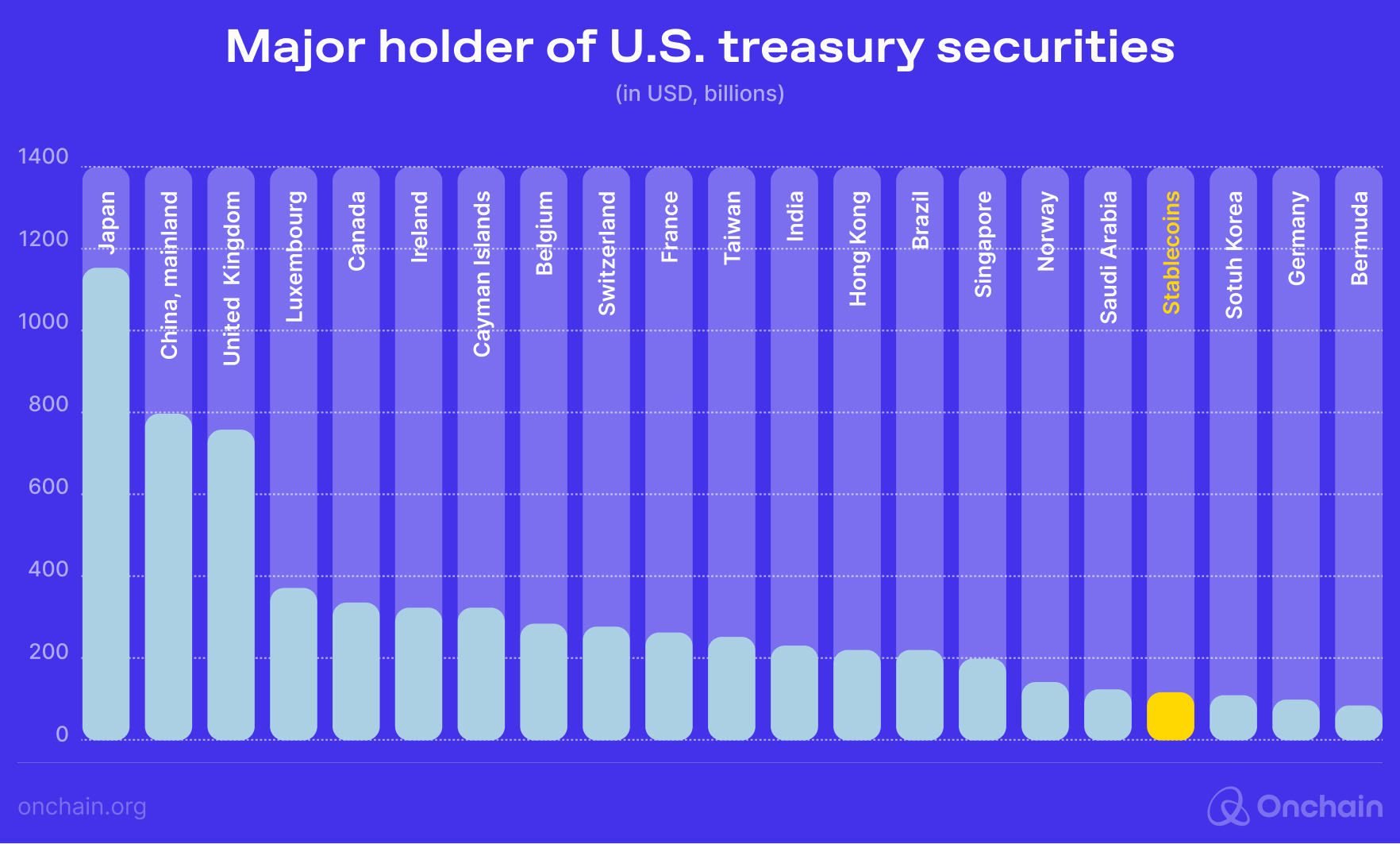

Its model is simple but powerful: a digital dollar backed by US dollars and yield-generating assets like US Treasury bills. This strategy ensures stability and generates substantial profits, with $98 billion in Treasury holdings surpassing countries like Germany and Australia.

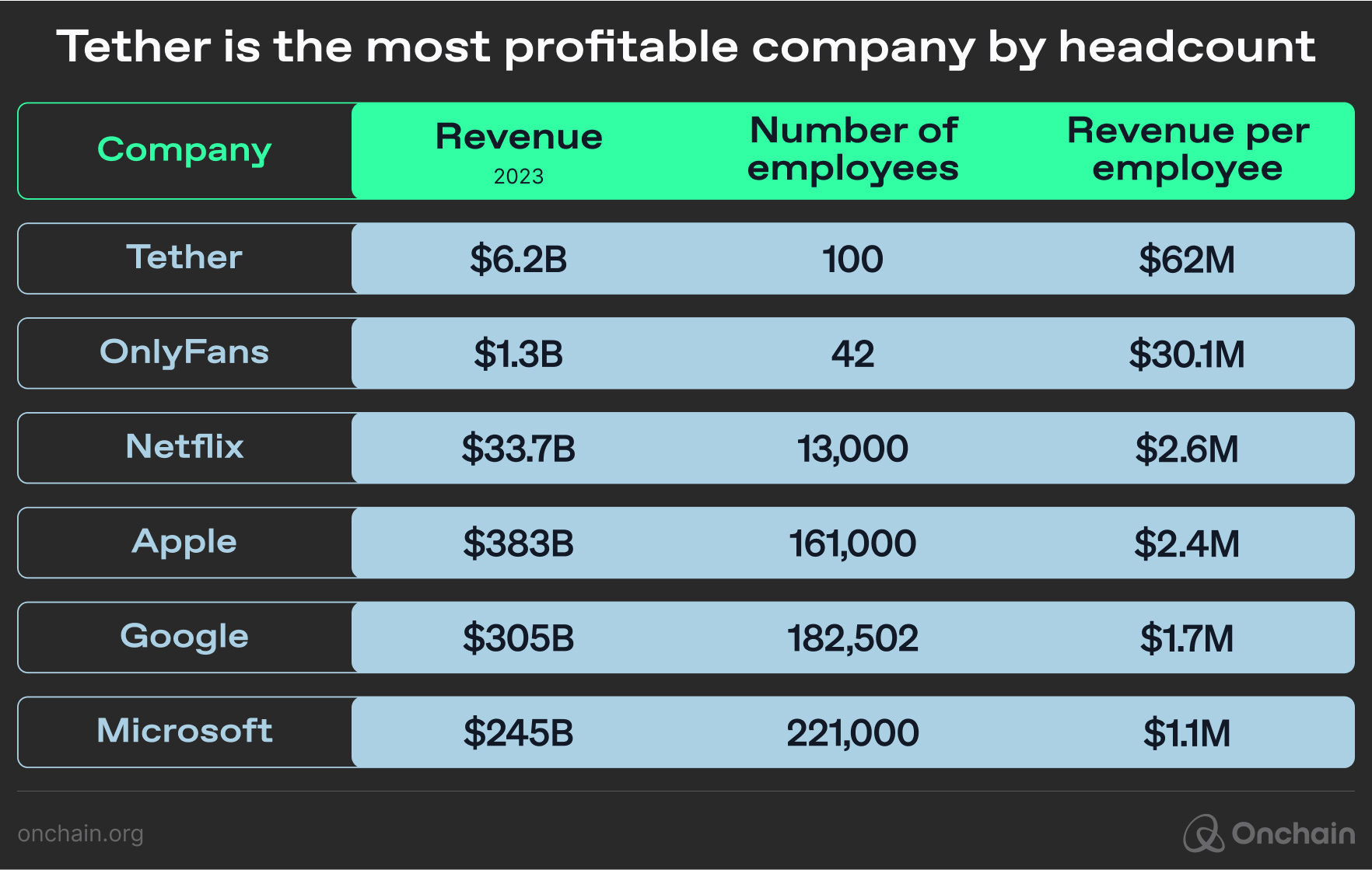

What’s even more remarkable is Tether’s operational efficiency. With a team of roughly 100 employees, Tether’s revenue per employee in 2023 stands at an impressive $62 million. For comparison, OnlyFans, known for its efficient revenue model, generates $30 million per employee, while major tech companies like Apple and Google report $2.4 million and $1.7 million per employee, respectively.

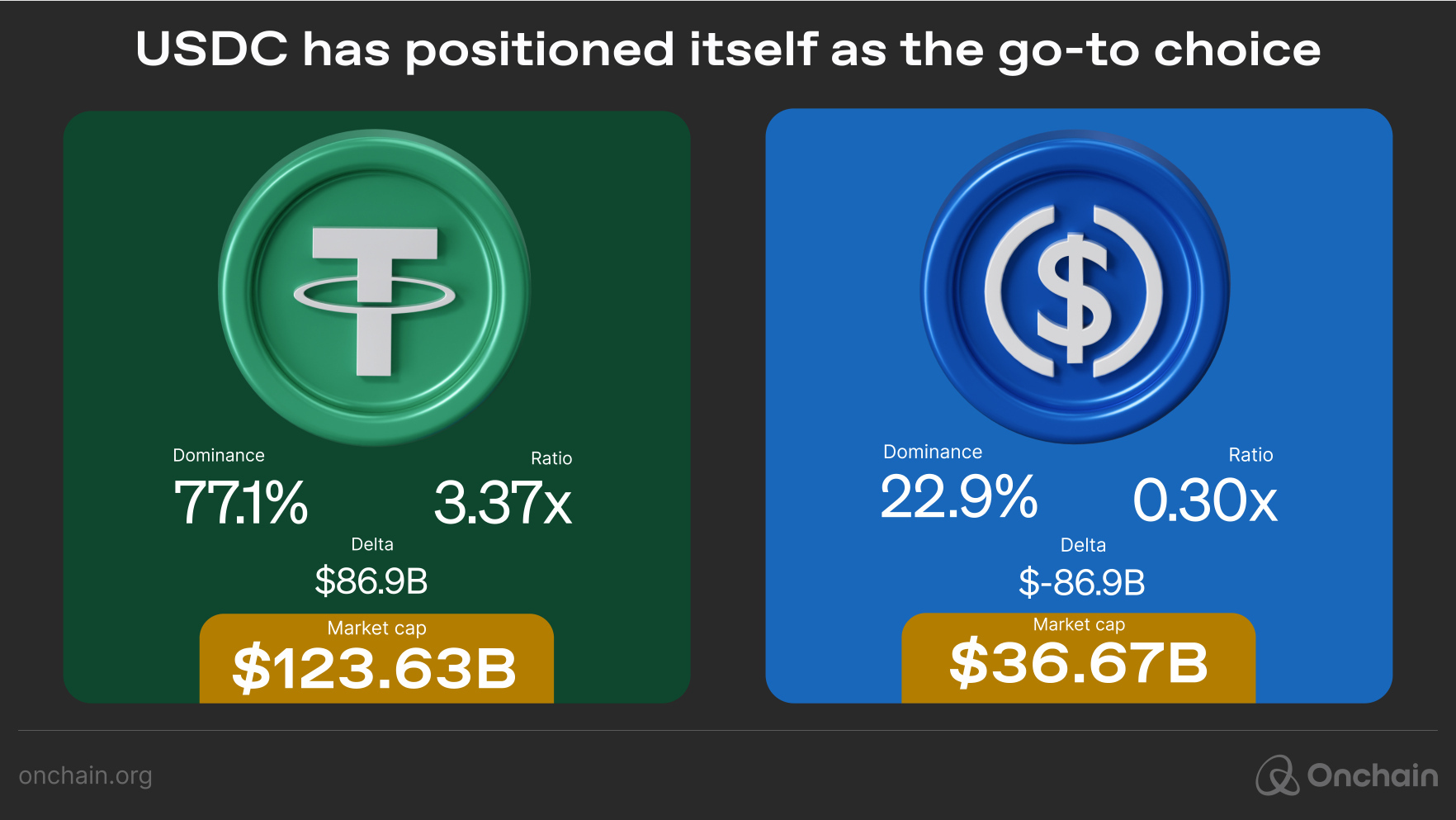

While Tether’s success stems from its ability to capture liquidity and interest income through a straightforward model, USDC has taken a slightly different approach.

Holding a 22.9% share of the stablecoin market, USDC has positioned itself as the go-to choice for businesses and institutions that require regulatory compliance, especially in regions like Europe, where financial regulations are becoming increasingly stringent.

Circle, the company behind USDC, generated approximately $1.5 billion in 2023. Although it trails behind Tether in market share, Circle’s compliance-first approach has cemented its role in the financial ecosystem for those navigating complex regulatory landscapes.

Circle is regulated at the state level in the US, which sets it apart from some of its competitors.

- Jeremy Allaire, Co-founder, Circle

Beyond Web3: How PayPal and Stripe are unlocking new revenue streams with stablecoins

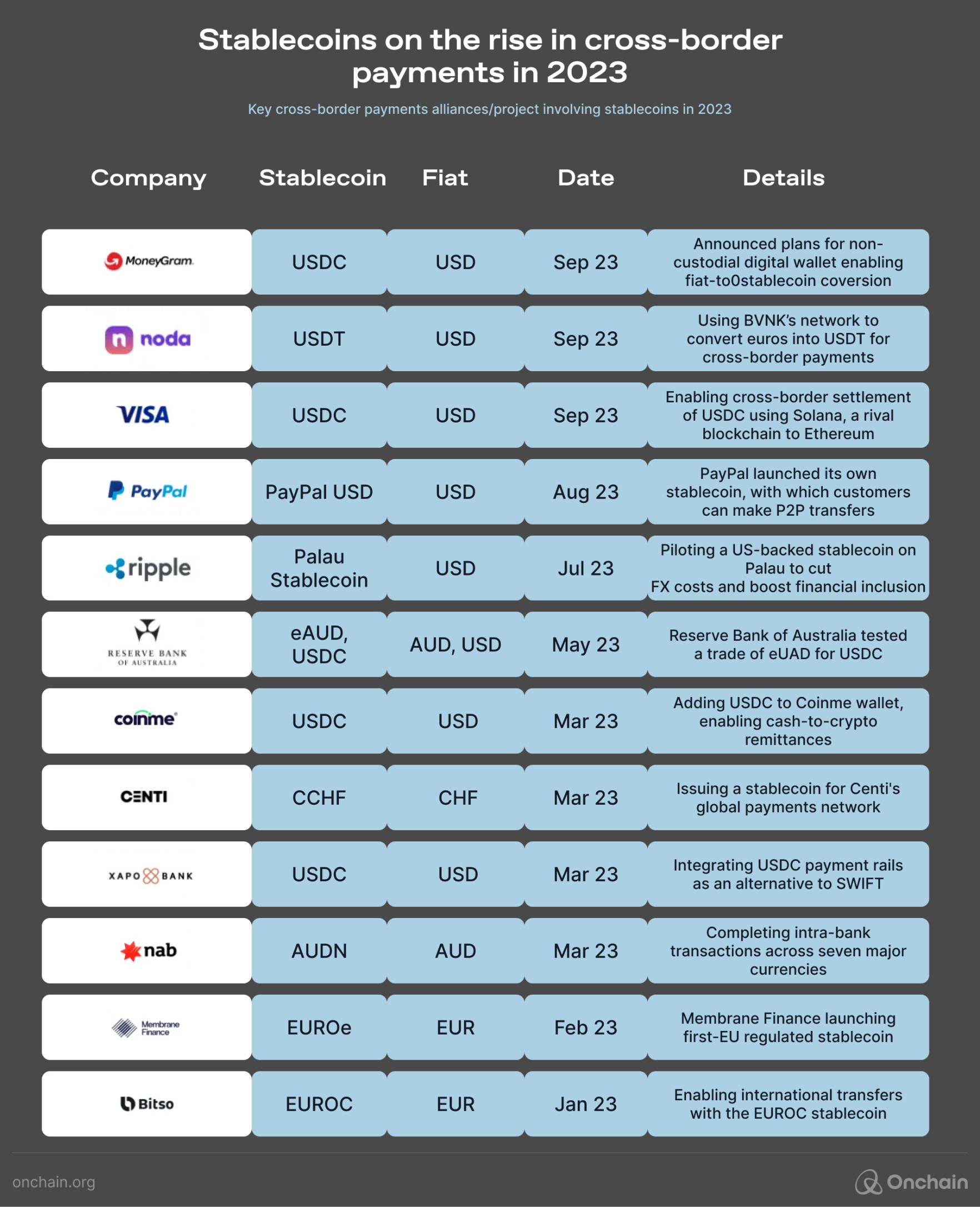

Stablecoins are beginning to make significant strides beyond the crypto world. Companies like Stripe and PayPal are leading the way, using stablecoins to open new revenue streams and financial efficiencies.

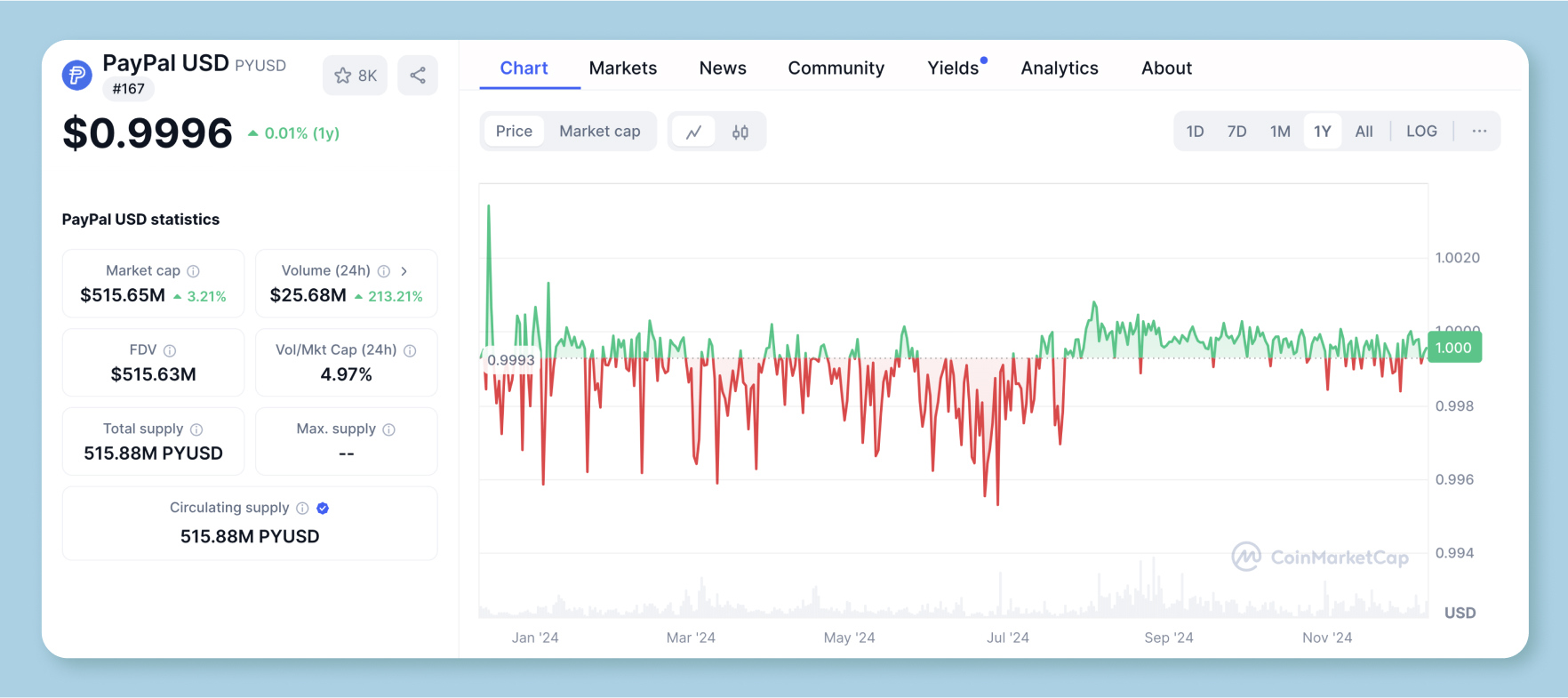

PayPal’s PYUSD: Integrating stablecoins into everyday transactions

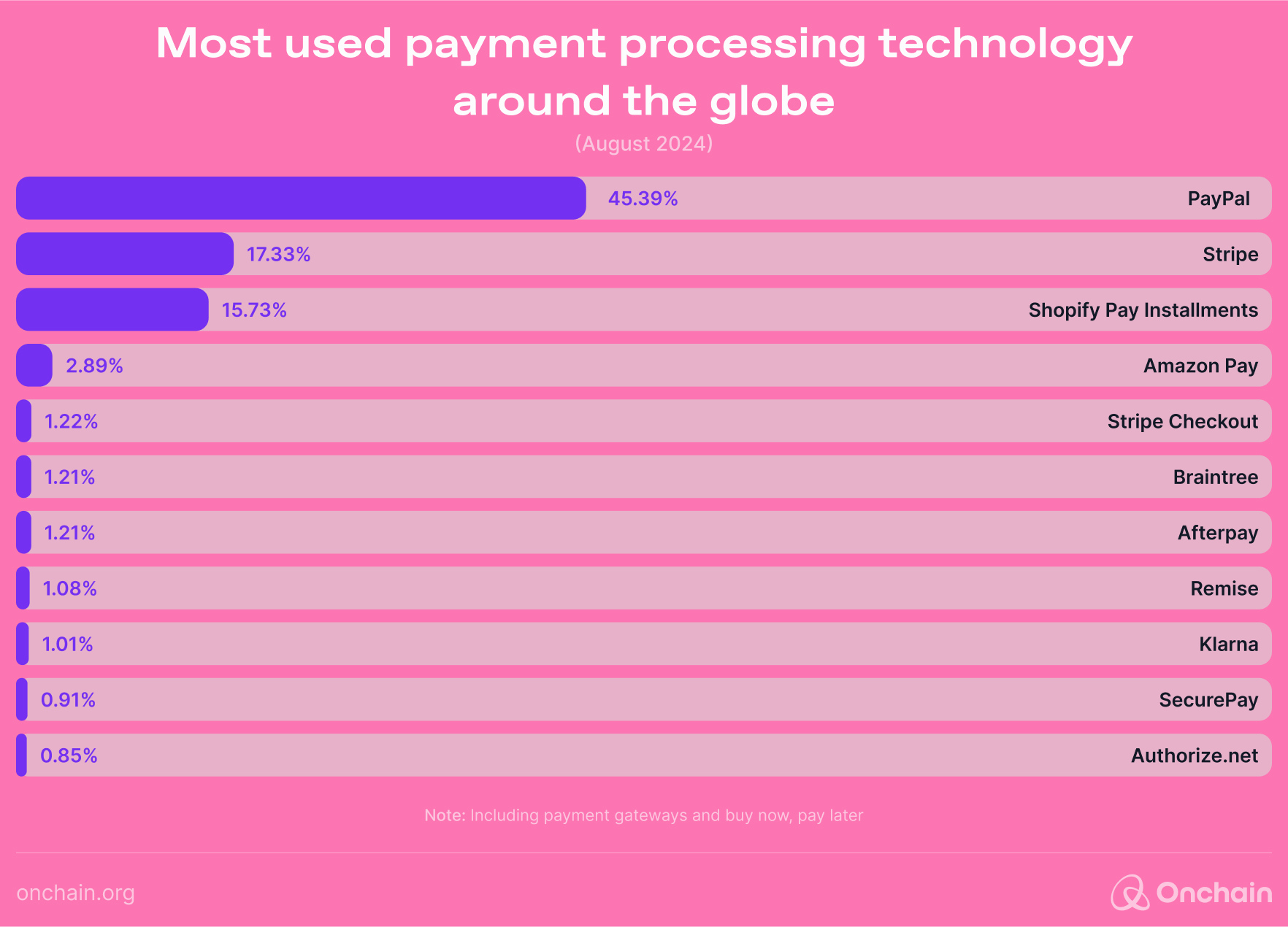

PayPal holds 45.39% of the global payment processing market, including payment gateways and buy now, pay later (BNPL) services, with Stripe following at 17.33%.

PayPal took a decisive step in August 2023 by launching PayPal USD (PYUSD), a US dollar-backed stablecoin. With over 430 million active accounts, PayPal’s introduction of PYUSD allows users to send, receive, and transfer funds across both the PayPal ecosystem and external Ethereum wallets, integrating stablecoins into everyday transactions for millions of people.

Stripe’s expansion into stablecoins

Meanwhile, Stripe has made significant advancements in the stablecoin space:

- USDC payment integration: Stripe incorporated USDC payments into its platform in 2022, allowing companies to accept USDC across Ethereum, Solana, and Polygon networks. This enables businesses to convert stablecoins into fiat seamlessly for global transactions.

Check out the Stripe USDC integration to see how it works:

- Acquisition of Bridge: In August 2024, Stripe made headlines with its $1.1 billion acquisition of Bridge, the largest crypto acquisition to date. This move fast-tracks Stripe’s role as a key player in stablecoin infrastructure, enabling faster, cheaper, and more secure transactions globally.

The recent advancements by PayPal and Stripe send a strong signal to stablecoin startups. Once overlooked due to limited early token liquidity, these companies now have a clearer path to major exits. This will likely spark increased funding and inspire a new generation of entrepreneurs to build around stablecoins.

- Leon Waidmann, Head of Research, Onchain

1.2 Why stablecoins matter for businesses, customers, and the Web3 ecosystem

Today, we can’t imagine the Web3 world without stablecoins. They:

- Are the base of more than 95% of trading pairs on exchanges.

- Participate in the majority of liquidity pools.

- Hedge against usual crypto market volatility.

- Play the role of an onchain store of value.

- Facilitate the cross-chain interoperability.

- Serve as the foundation for the entire world of DeFi.

However, they wouldn’t have reached a market cap of nearly $180 billion (if we consider the entire stablecoin category) were they limited to Web3 only. Stablecoins belong to a small niche of blockchain use cases that go beyond the crypto world.

Our survey — targeting tech-savvy Small and Midsize Enterprises (SMEs) and startups already interested in Web3 technologies (as detailed in the methodology) — revealed some interesting insights into how stablecoins are being adopted and utilized globally. While these findings are significant, it’s essential to understand that the focus of our survey might lead to higher reported adoption rates due to potential sampling bias.

Survey insights

Adoption gaps between advanced and emerging economies

- In emerging economies, 48% of businesses have already implemented stablecoin usage or are in the proof-of-concept (POC) stage, with another 40% exploring possibilities for future adoption.

- In contrast, only 18% of businesses in advanced economies have implemented stablecoins, with 32% remaining in the exploratory phase.

This disparity highlights key differences:

- Emerging and developing economies see stablecoins as a solution to currency volatility. They also provide access to global financial systems where traditional infrastructure is lacking.

- Advanced economies, on the other hand, exhibit hesitancy due to regulatory uncertainty, with concerns around compliance (reported by 24% of respondents) and integration challenges (15%).

Dominant use cases

Interestingly, our survey revealed that across both advanced and emerging economies:

- 37% of respondents cited the dominant use case for stablecoins as a hedge against market volatility.

- Yield generation through DeFi ranked second, with 26% of businesses actively utilizing stablecoins.

- Surprisingly, cross-border transactions, often viewed as a key driver of stablecoin adoption, ranked last, with only 11% of respondents identifying it as their primary use case. This highlights the evolving utility of stablecoins as businesses and consumers increasingly look beyond remittances to other financial opportunities.

Businesses that are leveraging stablecoins

Grab, Southeast Asia’s biggest car-sharing and food delivery company, integrated USDC into its app to enhance the customer experience and introduce new features.

Meanwhile, AE Coin, a Dirham-pegged stablecoin recently approved by the UAE government, is taking its first steps to transform payments within the United Arab Emirates. Regulated by the UAE Central Bank, AE Coin aims to support e-commerce, mobile wallets, and financial institutions, offering businesses and consumers a stable, blockchain-based currency for everyday transactions and DeFi activities.

BBVA, one of the largest banks in the world, incorporated USDC to speed up their institutional clients’ trading operations.

PayPal went one step further and launched its own stablecoin to “revolutionize commerce again by providing a fast, easy, and inexpensive payment method for the next evolution of the digital economy.”

It’s too early to predict the exact direction of the stablecoin revolution in commerce, apps, and financial institutions. However, it’s clear that thanks to USDT, USDC, and tailored coins, blockchain technology has finally found its way into the business mainstream.

Stablecoins already enable companies to:

- Enhance transaction efficiency (faster settlement and lower costs compared to traditional money transfers).

- Integrate cross-border payments and remittances easily.

- Get immediate exposure to the US dollar market.

- Diversify their investment portfolio.

- Set up tailored payment rails, e.g., for a specific group of customers.

- Improve the transparency of their financial operations.

Moreover, it’s not only “the big guys” who benefit from growing stablecoin adoption. USDC, USDS, and PYUSD increasingly appeal to individuals who see a separate set of utilities.

Survey insights

We’re far from replacing cash or card payments in local grocery stores with “fast, efficient, and immutable stablecoin transactions.” However, according to the recent report by Castle Island Ventures, “Stablecoins: The Emerging Market Story” (which specifically focused on emerging markets), individual customers see USDT and its equivalents as an excellent way to:

Obviously, the more “emerging” the economy, the higher the utility for individuals.

While USDC and EURC are reshaping traditional financial services in developed markets, their most potent potential lies in expanding access for the 1.4 billion unbanked individuals globally. By enabling send, spend, save, and store functionalities in regions dominated by mobile technology, USDC and EURC unlock financial opportunities for those historically excluded.

- Sanja Kon, VP of Partnerships & Business Development, Europe Circle

However, if the institutions above continue with their current stablecoin adoption rate, we may see the emergence of a mutually beneficial market also in developed countries where:

- Businesses integrate stablecoins to improve operational efficiency and

- Simultaneously offer them to customers.

- The customers, in turn, benefit from fast and cross-border transactions, which results in

- Increased revenue for companies, completing the cycle.

As stablecoins expand their use beyond the crypto world, they’re challenging the traditional money transfer systems that have long dominated international payments.

The question now is: Can stablecoins also reshape cross-border transactions with their promise of lower fees, faster speeds, and global accessibility?

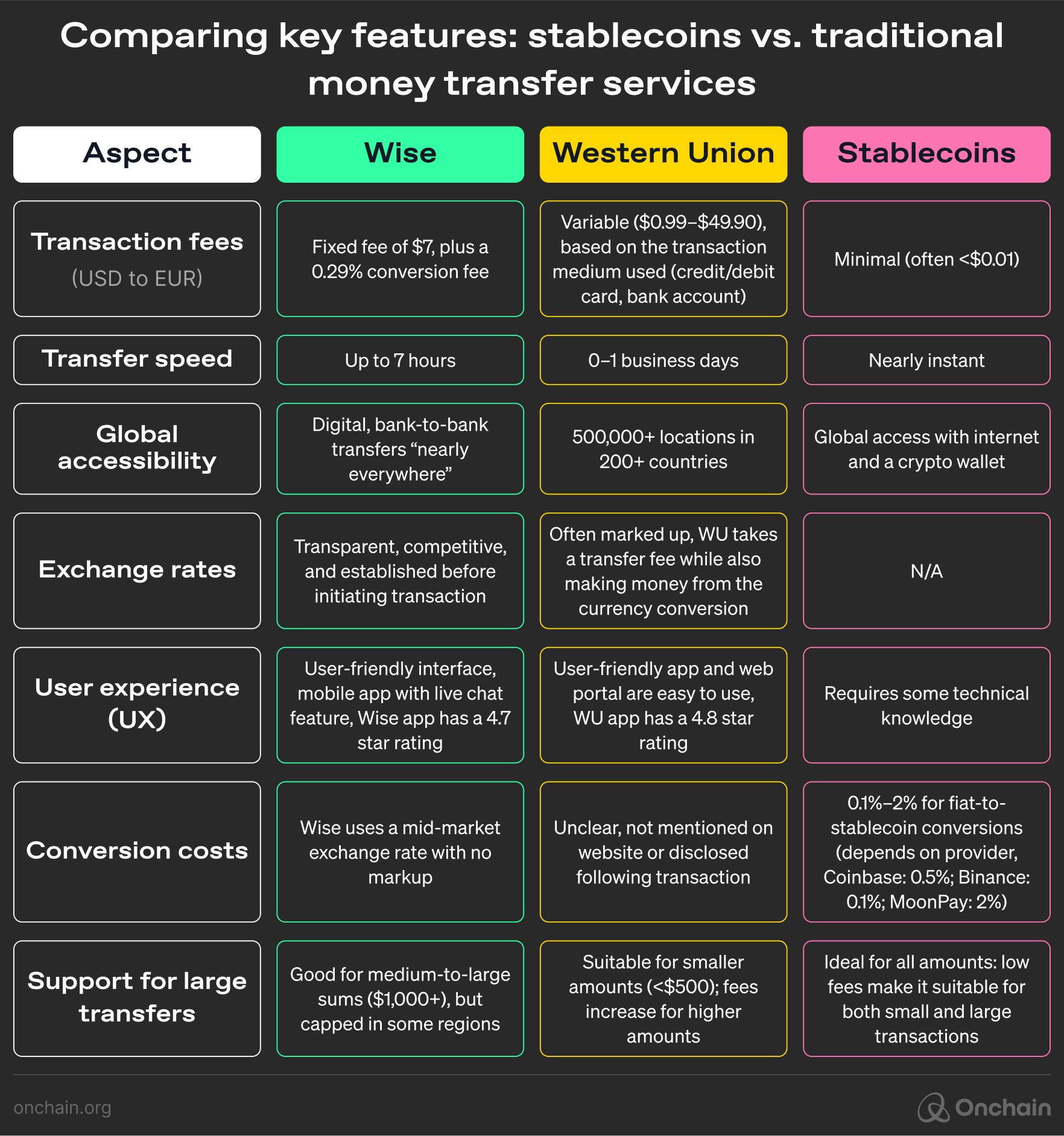

1.3 Traditional services vs. stablecoins

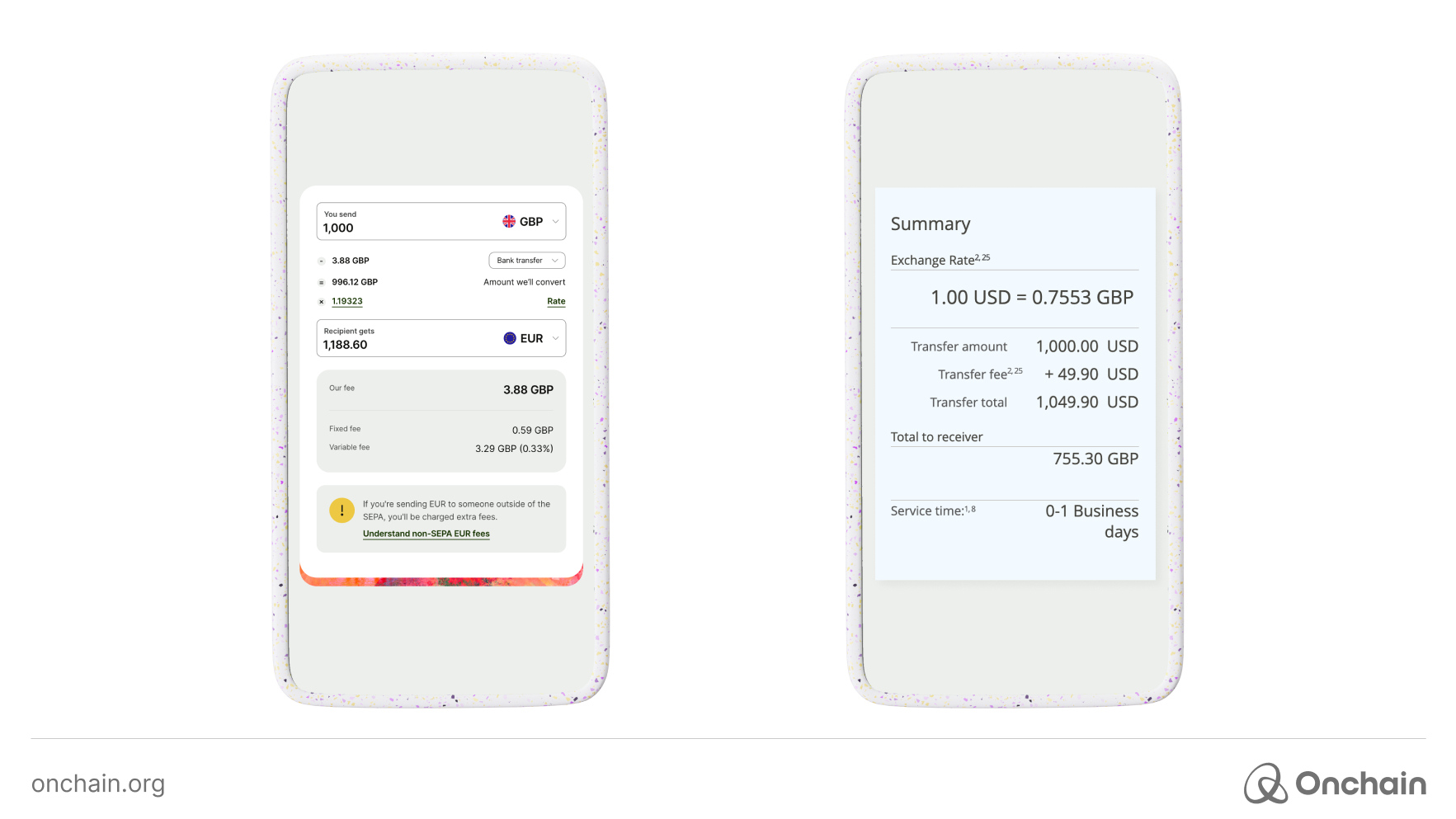

For decades, services like Western Union and, more recently, platforms like Wise and Revolut have dominated the international transfer market. However, stablecoins are changing the way we approach international transfers, with far-reaching impact. Let’s explore how these different approaches stack up against each other in meeting the evolving needs of global consumers and businesses.

As you can see from the above table, stablecoins offer a significant advantage in cost-related aspects such as transaction fees and other incurring fees. Transaction speed is the fastest, and accessibility is guaranteed anywhere there is an internet connection.

By bypassing intermediaries, stablecoins eliminate delays, hidden costs, and currency conversion markups. For businesses, this translates into faster cash flow and reduced operating expenses, while individuals — particularly in emerging markets — gain access to affordable and reliable financial tools.

The only point where traditional methods still outperform stablecoins is in user experience.

1.4 Getting started with stablecoins

Set up a digital wallet

A digital wallet is your gateway to the blockchain, which includes holding and transferring stablecoins. Some of the most popular options are:

- A browser extension wallet popular for Ethereum and EVM-compatible chains.

- Ideal for interacting with decentralized applications (dApps) and DeFi protocols.

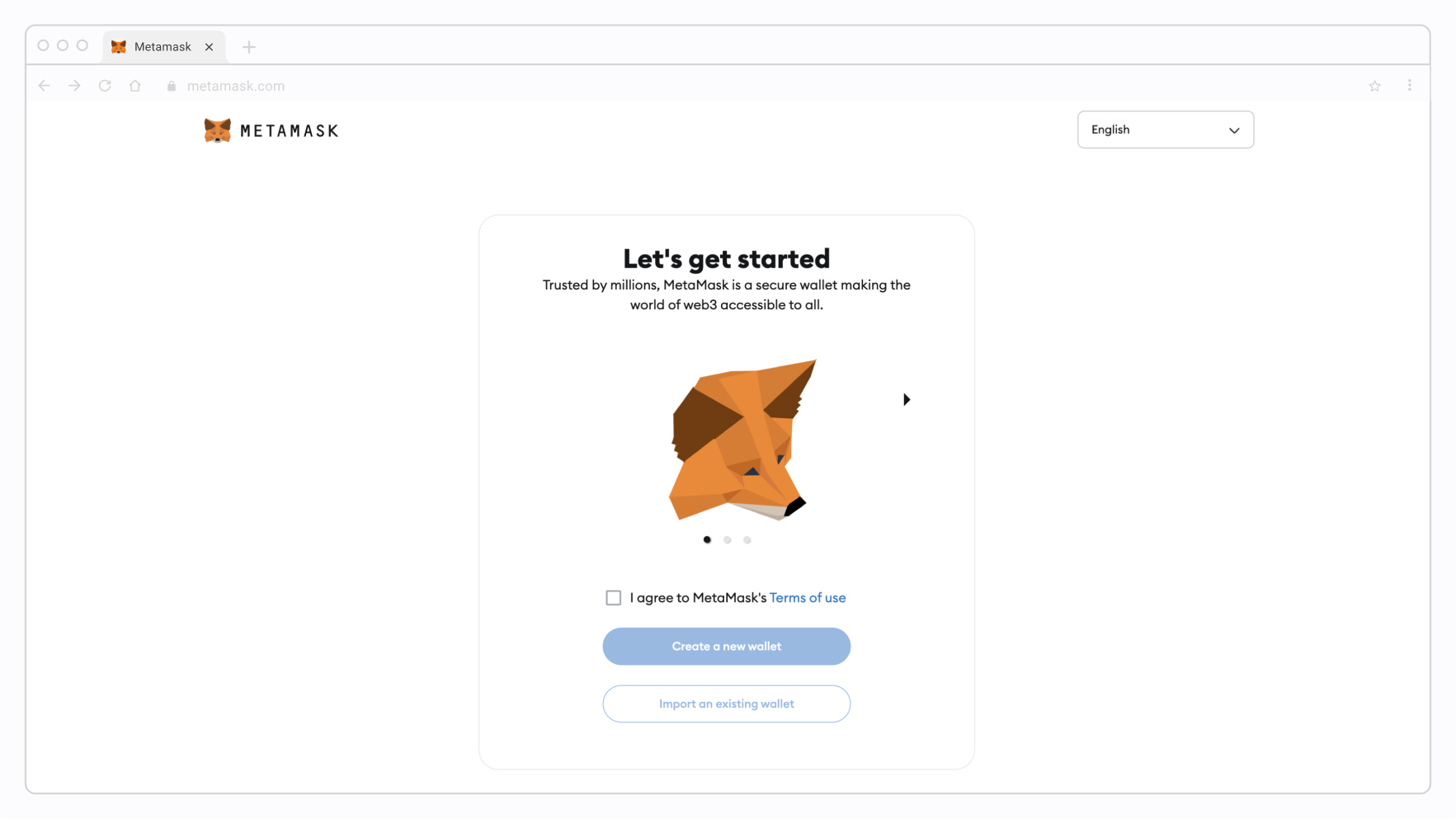

2. Once you’ve got it installed, you’ll see a “Get Started” button — go ahead and click to kick things off. On the next screen, click “Create a Wallet” to set up your very own Ethereum wallet.

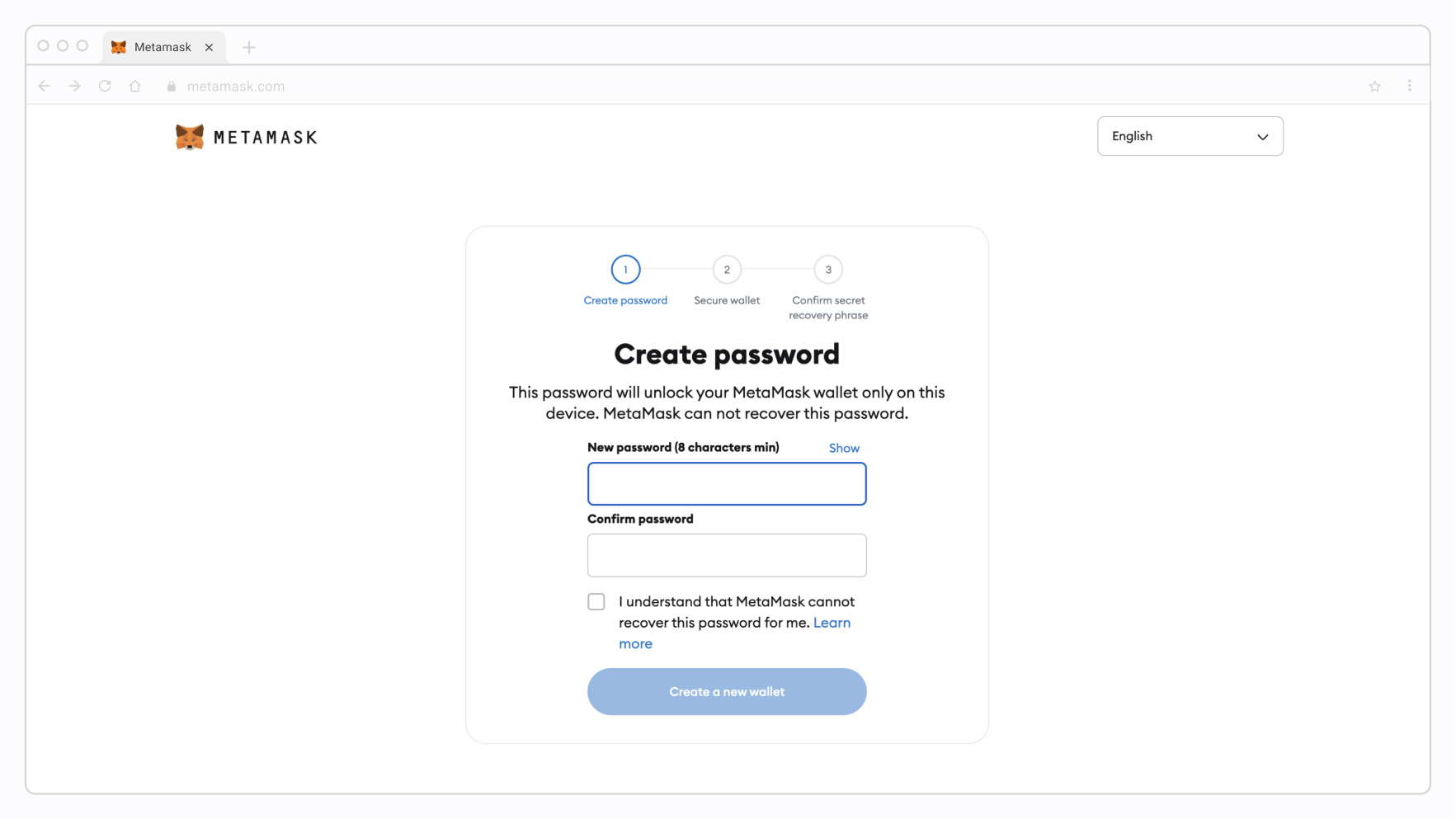

3. Now comes the important part: Choosing a password. Make it something strong you’ll remember, then type it again to confirm. Easy enough, right?

4. Here’s where you need to pay close attention. MetaMask will show you a 12-word backup phrase. Grab a pen and paper and write those words down exactly as they appear. Make sure it’s in the same order. This is your key to recovering your wallet if anything ever happens to your computer. Keep it somewhere safe and private. Seriously, anyone who gets their hands on this phrase can access your funds, so guard it with your life.

5. Click “Next” when you’re ready. MetaMask will ask you to prove that you wrote the 12-word key down by entering it into the text box. You’re almost there!

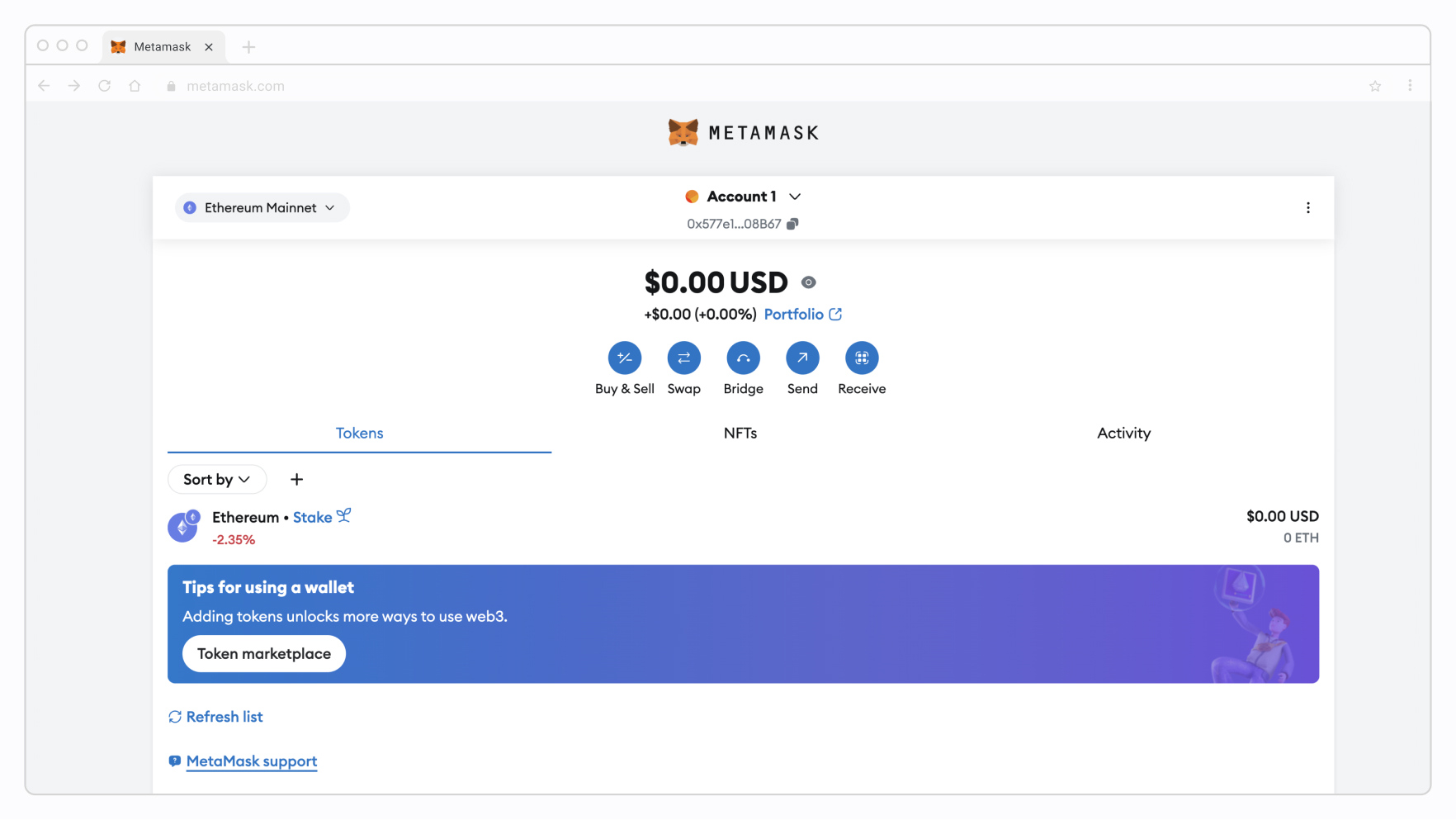

6. You’ll now see your shiny new MetaMask wallet. The “Assets” tab shows what funds you have. “Activity” lets you check your transaction history. That’s it — you’re all set to dive into the world of Ethereum and Web3. Happy exploring!

If MetaMask isn’t for you, there are several other wallet options that are just as easy to open.

- A user-friendly wallet with easy integration into the Coinbase exchange.

- Supports multiple blockchains and offers a smooth onboarding experience.

- Setup: Download the app from your device’s app store, create an account, and secure your recovery phrase.

- Designed for the Solana ecosystem, offering fast transactions and low fees.

- Great for users interested in Solana-based dApps and NFTs.

- Setup: Visit the Phantom.app, install the browser extension or mobile app, create a new wallet, and safely store your seed phrase.

- Safely storing a wallet’s seed phrase is of utmost importance. Phantom recently had an update bug that required the seed phrase to restore wallet access.

-

A next-generation Web3 smart wallet designed to simplify access to the decentralized web while prioritizing safety and usability.

-

Supports: Multiple blockchains, personalized Web3 discovery, and gas fee payment using any token in your wallet.

-

Security: Features passkey protection and multi-factor recovery, ensuring your assets remain secure even if your device is compromised.

-

Backed by The Onchain Foundation, Pass App is your gateway to Web3 — download now on the App Store and Google Play to start your journey!

Sponsored by Pass App

Find your passion, onchain

How to Get Started:

Download the app, set up your account, and start exploring personalized We3 opportunities.

What Makes Pass App Unique:

Pass App allows you to discover curated onchain projects tailored to your interests, enjoy seamless multichain support with gas fee abstraction, and earn exclusive rewards through the Pass Perks Program.

Unlock the future of Web3 with Pass App today!

Purchasing stablecoins

Once you have a wallet, you can acquire stablecoins through various methods:

1. Cryptocurrency exchanges:

- Platforms like Coinbase, Binance, or Kraken offer stablecoin purchases.

- Process: Create an account, complete KYC verification (typically with a state ID or passport), deposit funds, and buy stablecoins like USDC, USDT, or DAI.

2. Direct purchase from providers:

- Some stablecoins can be bought directly from issuers or payment platforms.

- Example: PayPal’s PYUSD can be purchased directly through the PayPal app.

3. Other notable stablecoin on-off ramp options for customers and businesses

- Stripe USDC integration (primarily for businesses):

This feature enables businesses to accept USDC payments, seamlessly integrating stablecoins into traditional payment systems. With Stripe, users can pay for goods and services with USDC where Stripe is supported.

-

PayPal PYUSD (customers and businesses):

PayPal users can now purchase, transfer, and use PayPal USD (PYUSD) in several ways:-

Transfer PYUSD between PayPal and external compatible wallets.

-

Send person-to-person payments using PYUSD.

-

Fund purchases by selecting PYUSD at checkout.

-

Convert supported cryptocurrencies to and from PYUSD.

-

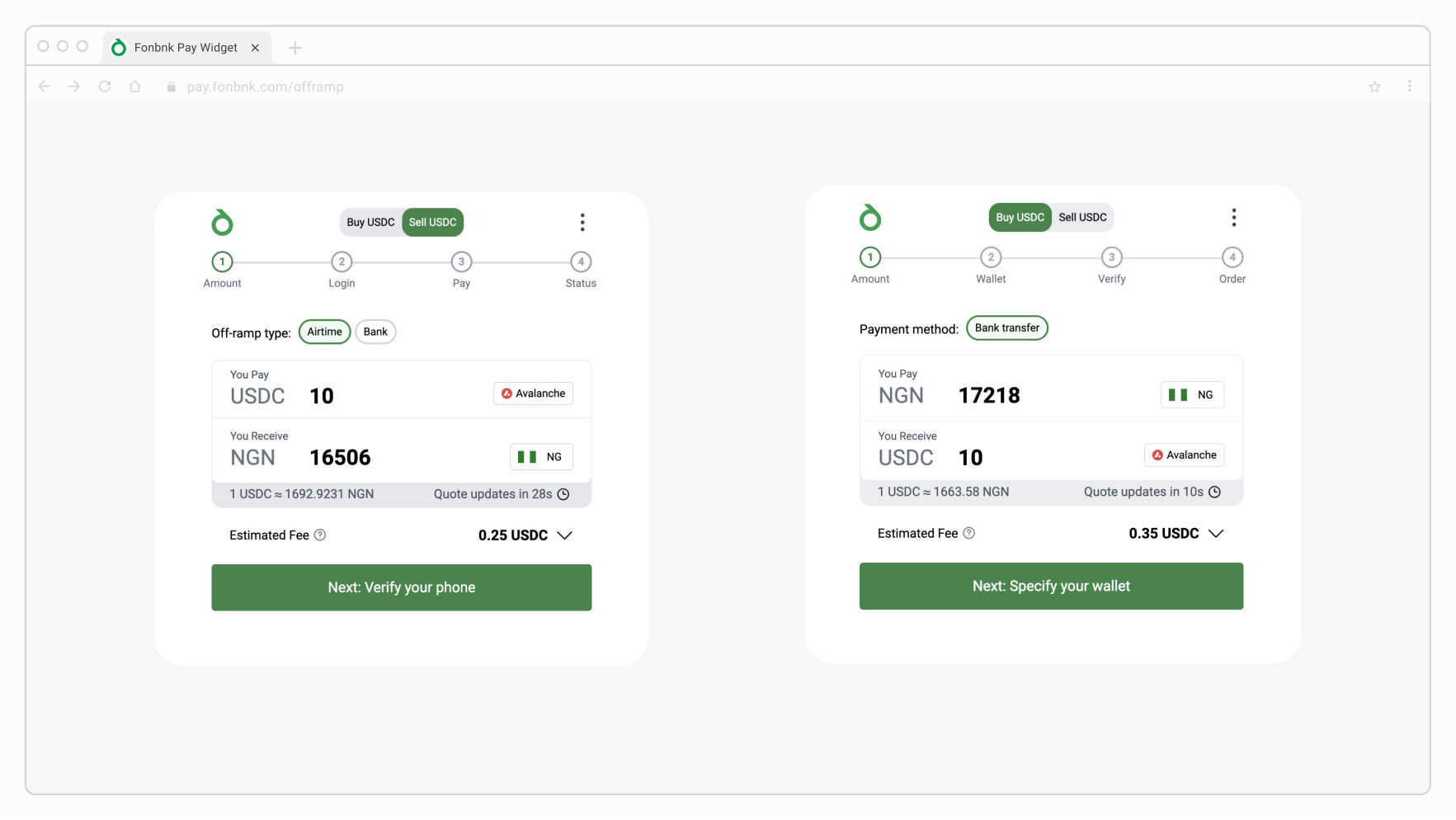

4. Bridging emerging markets to Web3

In regions like sub-Saharan Africa, where traditional on/off-ramp options like PayPal and Stripe may be limited, innovative solutions are emerging to bridge users to Web3 and stablecoins. Platforms such as Kotani Pay, BitPesa, and Fonbnk are creating new access points by enabling conversions of local assets, like mobile money, airtime, or bank transfers into stablecoins such as USDC and USDT. These tools address a key need in underserved areas, where telecom infrastructure and mobile services are more accessible than traditional banking.

Fonbnk, for instance, a project integrated into the Ethereum Layer 2 Lisk, allows users to convert mobile airtime and mobile money into stablecoins, reducing cross-border transaction costs by up to 80% and opening new possibilities for savings, payments, and investment.

Fonbank is creating a bridge to Web3 by providing on and off-ramps for mobile-first, cash-based economies in sub-Saharan Africa. We're converting mobile payment value into stablecoins, which unlocks access to leading Layer 1 and Layer 2 protocols, addressing significant market gaps in cross-border transactions and enabling investment, savings, and merchant payments.

- Christian Duffus, Co-Founder, Fonbnk

The Fonbnk platform offers a multitude of consumer-focused functionalities, such as:

- Converting prepaid mobile airtime minutes into stablecoins like USDC, USDT, or cUSD.

- Exchanging mobile money (e.g., M-PESA) for cryptocurrency.

- Using bank transfers to purchase stablecoins.

- Selling stablecoins to receive local currency through mobile money or bank transfers.

- Accessing decentralized finance (DeFi) services using converted funds.

5. Decentralized exchanges:

- Platforms like Uniswap or SushiSwap allow swapping other cryptocurrencies for stablecoins.

- These services require some crypto knowledge and usually involve higher fees.

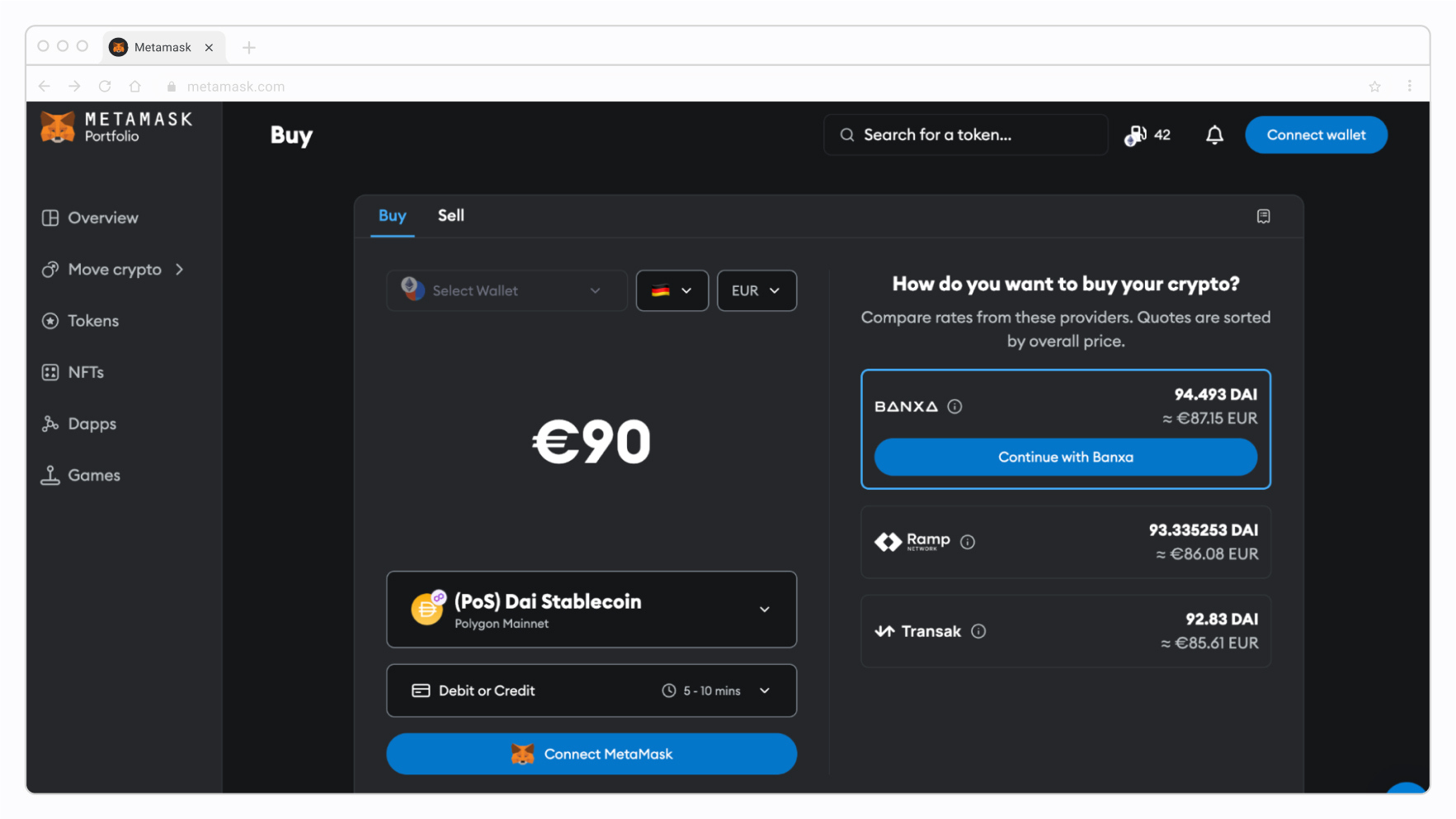

6. Buy stablecoins directly from the wallet you just set up with MetaMask — choose how you want to pay:

But how do you actually use stablecoins?

1.5 Using stablecoins in the real world and Web3

Take a look at some common stablecoin use cases:

Real-world use cases

- Cross-border remittances

In countries like Nigeria, stablecoins have become a popular option for remittances. For example, Nigerians working abroad use USDT to send money back home, bypassing traditional remittance services.

- Merchant payments

Businesses increasingly accept stablecoin payments, improving efficiency and providing a new global payment option.

- Inflation hedge

In Argentina, where inflation reached over 100% in 2022, citizens turned to stablecoins like USDT to preserve their savings. Local exchanges reported significant increases in stablecoin trading volumes as people sought to protect their wealth from the rapid devaluation of the Peso.

- Freelancer & payroll payments

Companies like Request Finance have facilitated crypto payroll solutions using stablecoins. They’ve processed nearly $300 million in total crypto payments, with 60% of these payments made in dollar-denominated stablecoins.

By enabling seamless cross-border payments, stablecoins allow companies to pay international employees and freelancers quickly, cost-effectively, and directly “onchain,” avoiding traditional banking delays and high fees. At Onchain, we embrace this approach by offering employees the option to be paid in stablecoins and leveraging platforms like Request Finance. This not only simplifies the payroll but also reflects our ethos of bringing people onchain — demonstrating real-world use cases that exemplify the advantages of blockchain technology.

Web3 use cases

Stablecoins have become the foundational layer that supports all the innovative developments we see in DeFi today. They play a crucial role in facilitating mainstream crypto adoption, especially in developing countries and regions suffering from hyperinflation.

- Rune Christensen, Co-Founder, Sky Protocol

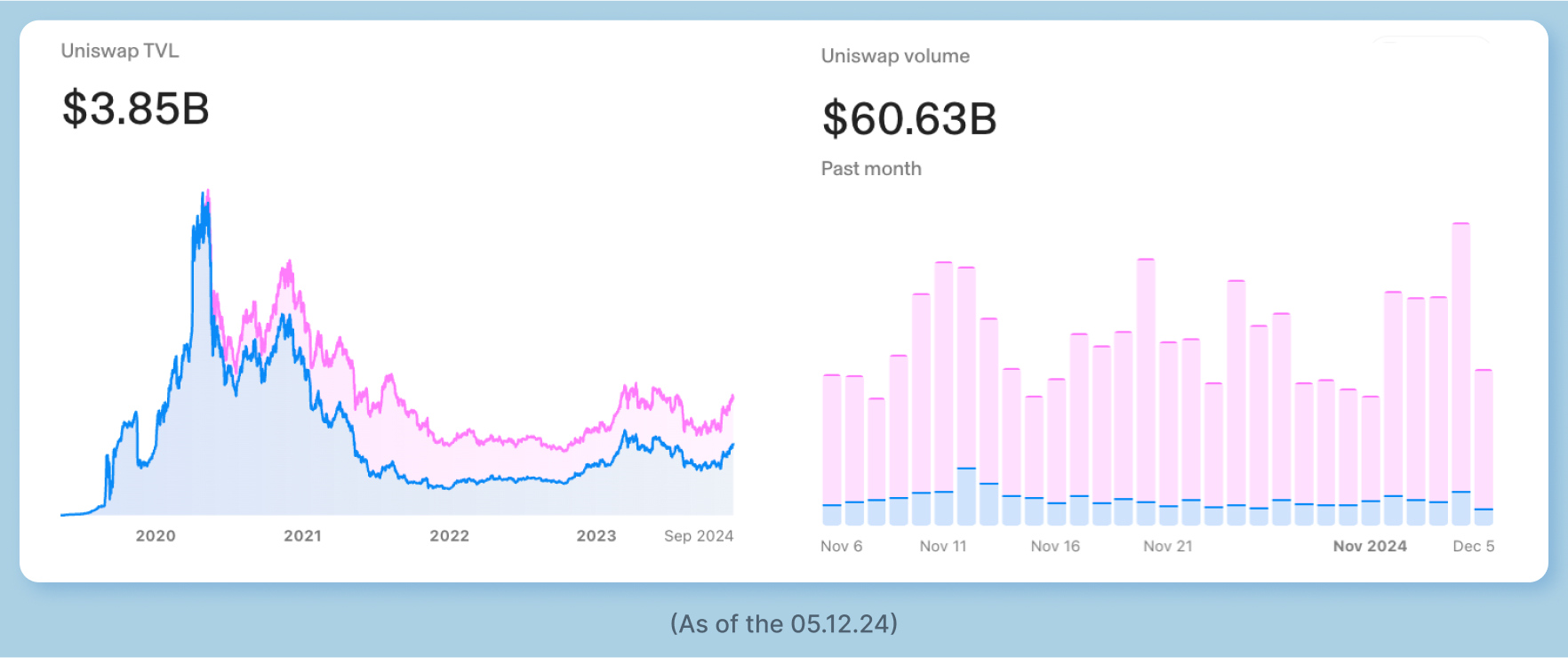

1. Decentralized finance: Users can participate in lending, borrowing, and earning interest on stablecoins through DeFi protocols such as Aave, Compound, and Uniswap.

- Aave: This leading DeFi protocol allows users to deposit stablecoins like USDC or DAI to earn interest or act as collateral for borrowing other cryptocurrencies.

- Compound: Similar to Aave, Compound enables users to supply stablecoins to liquidity pools and earn interest or borrow against their deposits.

- Uniswap: As a decentralized exchange, Uniswap allows users to provide liquidity to stablecoin pairs and earn fees from trades.

2. Trading: This asset provides a stable base for trading cryptocurrencies on exchanges like Binance, Coinbase, and Uniswap, reducing volatility risks.

3. NFT purchases: Stablecoins can also be used to purchase NFTs, providing a stable medium of exchange for these digital assets. Many NFT platforms accept stablecoins as payment. OpenSea, the largest NFT marketplace today, supports purchases in USDC and USDS, providing a stable pricing mechanism for digital assets.

Throughout this report, we’ll conduct an in-depth exploration of the stablecoin ecosystem, putting two central research questions to the test:

- Are stablecoins truly the most promising and lucrative business opportunity onchain?

- Moreover, what unique characteristics set them apart from other blockchain-based ventures?

Whether you’re aiming to build a new stablecoin protocol or integrate stablecoins into your existing business model, this report will guide you through the dynamic landscape of the stablecoin ecosystem. You’ll gain actionable insights into their business relevance and understand their strategic edge over traditional finance and alternatives like CBDCs. We’ll demonstrate why stablecoins represent a compelling onchain opportunity that no forward-thinking founder, entrepreneur, or company should ignore.

So far we gave you a birds-eye view of the stablecoin landscape and pointed out significant landmarks. Now strap your boots. Read on as we investigate the fertile ground for businesses. You’ll see how giants such as PayPal and J.P. Morgan identified the potential and are leveraging it and why, contrary to CBDCs, stablecoins have found their product-market fit.