4. How to build RWA Projects for Real-World Impact

You’ll learn:

- How to evaluate blockchain infrastructure (throughput, consensus, gas fees) for your RWA use case.

- Key decisions around L1 vs. L2, single vs. cross-chain strategies, and onchain vs. offchain data.

- Tokenization workflows and emerging token standards for fractionalized or yield-bearing assets.

- Role of oracles in bridging real-world data to blockchain securely

Let’s assume you’d like to build an RWA application using Onvest and choose one of the most promising niches according to our ranking. Where should you start?

There’s no straightforward answer to the question of what’s the best platform for designing a Real-Word Asset tokenization. It depends on numerous factors and requires careful evaluation of your specific needs and goals. Check the following key factors to narrow down your choices:

Blockchain design decisions

- Transaction processing rate is critical for enabling sustainable liquidity in the market. Platforms like Ethereum, Binance Smart Chain, Polygon, and others have different throughput levels, and considerations must be based on the use case, security requirements, and scalability needs.

- Gas Fees are like the toll on an information highway. High gas fees can scare away potential users, especially retail investors, hindering platform adoption and limiting liquidity. Imagine buying tiny fractions of real estate – high gas costs may outweigh the benefits.

- Consensus algorithm selection (PoS/DPoS). The consensus algorithm plays a crucial role in the design of a Real-Word Asset tokenization platform, impacting everything from security and scalability to sustainability and regulatory compliance.

- Algorithms like Proof-of-Stake (PoS) with BFT properties ensure data consistency and transaction finality even in the face of malicious actors or network disruptions. This is crucial for safeguarding valuable Real-Word Assets on the platform.

- However, some consensus mechanisms, like DPoS, raise concerns about potential centralization, which might clash with regulatory requirements for decentralized finance (DeFi) platforms.

- Platforms like RealT use PoS to ensure security and scalability for fractionalized real estate ownership, whereas platforms like ADDX use DPoS to enable efficient issuance and trading of tokenized securities with high user participation in governance.

- L1 vs. L2 chains. Both Layer 1 and Layer 2 blockchain technologies play significant roles in designing Real-Word Asset platforms, each addressing distinct challenges and offering unique advantages. You can check more on this topic in our previous report on the differences between L1s and L2s. Also, it’s vital to look for RWA-focused infrastructure, such as Lisk that aims directly at Real World solutions for emerging markets.

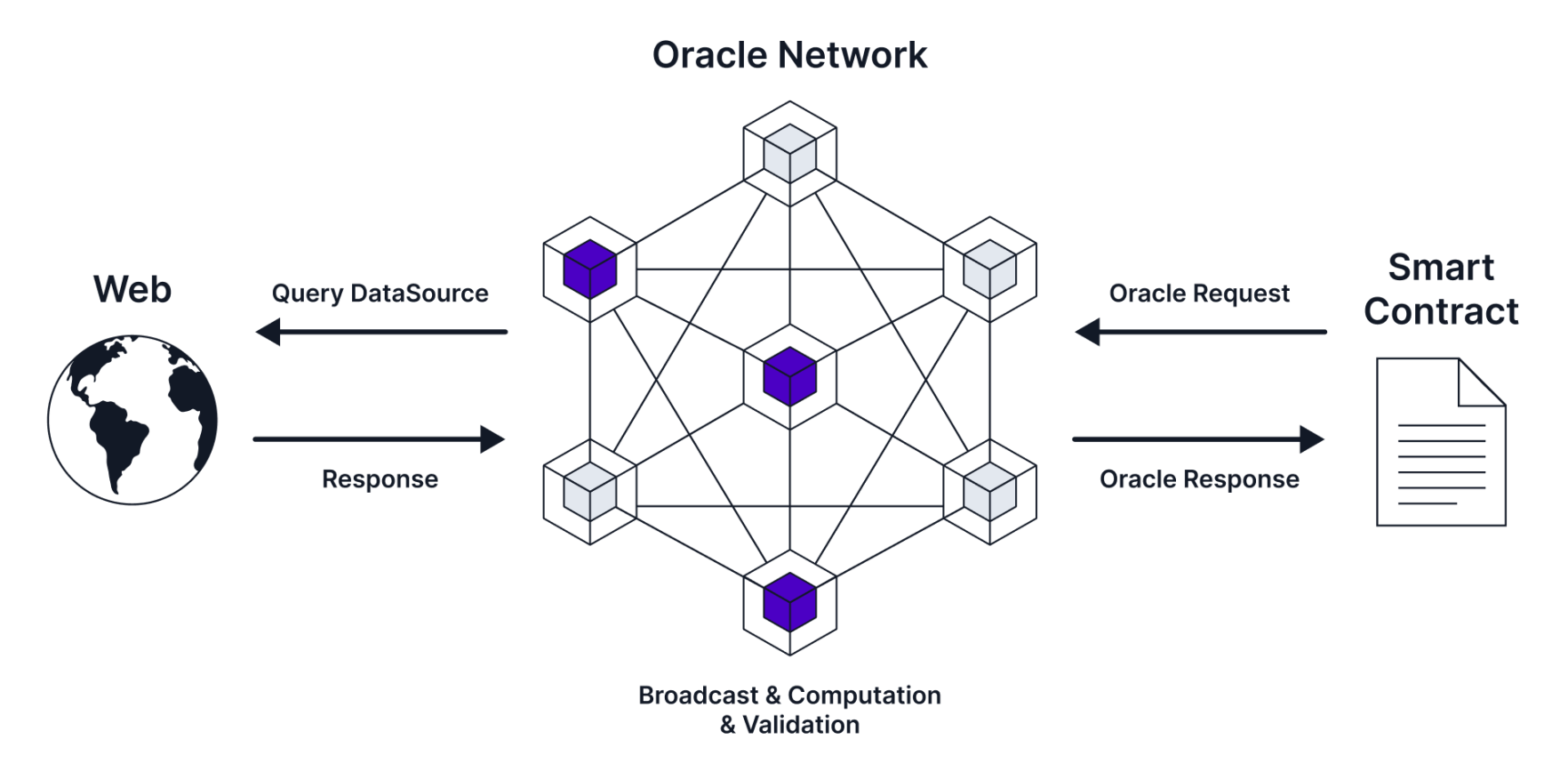

- Oracles. In Real-Word Asset platforms, oracles play a critical role. They bridge the gap between the blockchain and the external world – the onchain and the offchain space. You will find more on this in the section about the onchain tokenization process.

- Single vs. cross-chain asset handling. The current RWA landscape is fragmented across chains like Ethereum, Solana, Polygon, Polkadot, and Avalanche. While Ethereum is still the most dominant chain, its TVL share dropped from ~96% in 2021 to ~59% in 2023.

- Going cross-chain enables RWA projects to tap into capital and liquidity along with more retail and institutional users.

- However, in some cases, a hybrid approach may be adopted, leveraging cross-chain solutions for specific functionalities while keeping the majority of assets on a single blockchain.

Centrifuge is developing a modular, multi-chain architecture that will enable the ultimate flexibility in scaling and building an RWA ecosystem. Within this architecture, our first pools have recently launched using Liquidity Pools, our cross-chain solution for aggregating capital across the fragmented blockchain space. Through the Centrifuge App, we believe users will get the best RWA experience with fast and low-cost transactions and seamless interaction across many networks and ecosystems.

- Asad Khan, Partnerships and Business Development, Centrifuge

Application-specific design decisions

- Onchain vs. offchain data storage. The optimal approach often involves a hybrid strategy that leverages both onchain and offchain data storage based on data type and sensitivity. Here’s a general guideline:

-

- Store critical data onchain for high security and immutability, for example asset ownership records, transaction history, and governance parameters. Less sensitive data like asset descriptions, legal documents, and price feeds can be stored offchain for efficient storage and processing.

- Frequently accessed data like asset prices might benefit from onchain storage for faster retrieval, while historical data can be stored offchain.

- Several tools and technologies can help bridge the gap between onchain and offchain data storage:

- Oracles,

- Data layer solutions,

- ZK-Rollups.

- Several tools and technologies can help bridge the gap between onchain and offchain data storage:

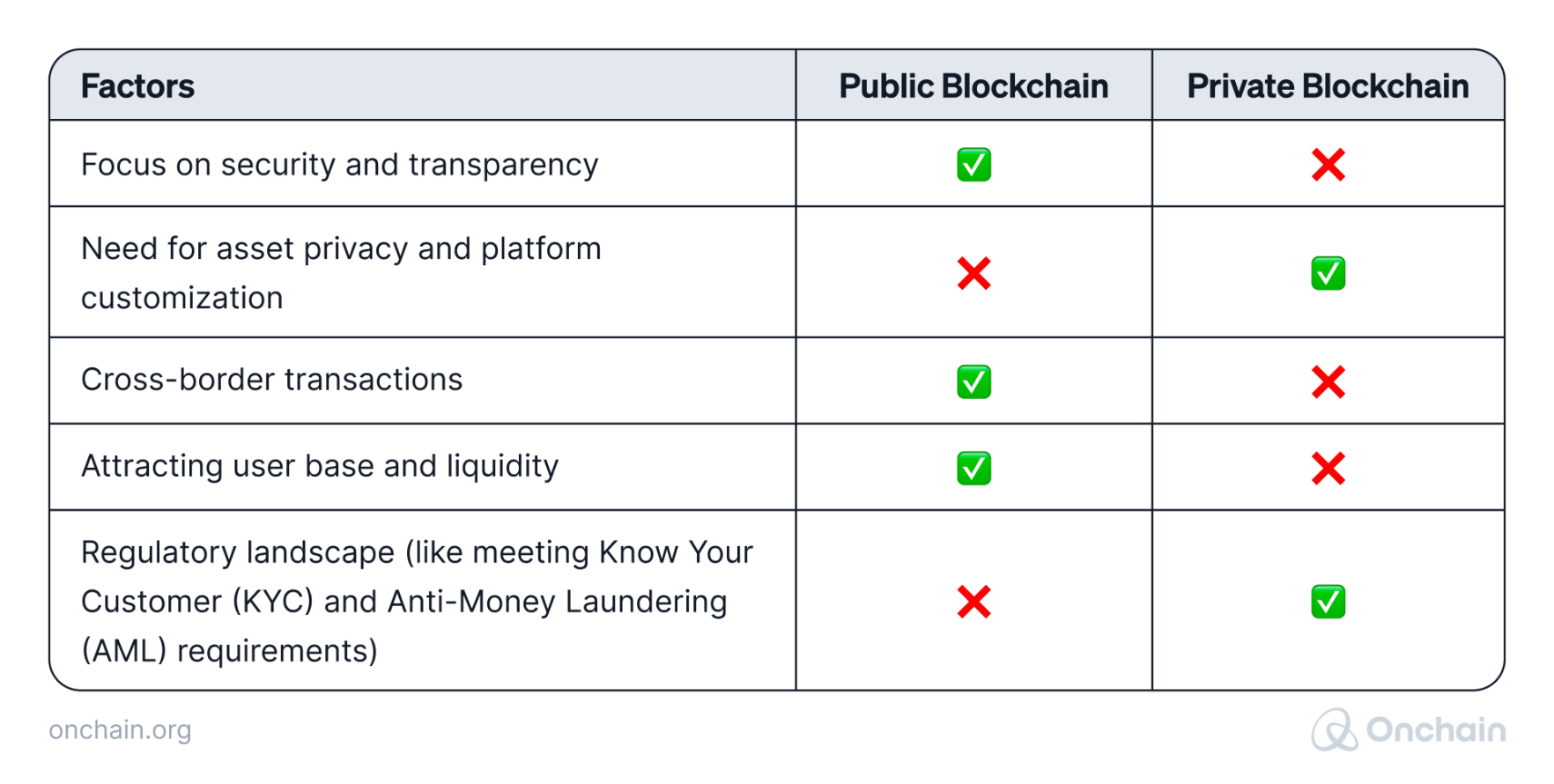

- Public vs. Private Blockchain. Below, you’ll find a table with the main points you should consider. However, note that Hybrid models combining public and private elements may also be worth exploring. For example, you might use a public chain for tokenization and trading while utilizing a private chain for sensitive asset management or regulatory compliance.

Onchain Tokenization process

So far, we’ve discussed how to design a perfect platform for Real-Word Asset tokenization. We have yet to explain how the seamless transition of ownership and representation for these assets is accounted for when transitioning between the digital and physical realms. In this section, we break down the Real-World Asset process into five steps:

STEP 1

Asset sourcing and legal structuring

STEP 1

Asset sourcing and legal structuring

This can encompass any RWA, ranging from real estate to intellectual property. Within this step, legal clarity is paramount to guarantee that the process aligns with regional regulations.

STEP 2

Asset verification and valuation

STEP 2

Asset verification and valuation

Typically, this step involves a professional evaluation to determine its current market worth. Then, comprehensive due diligence is conducted.

STEP 3

Coupling offchain assets

STEP 3

Coupling offchain assets

To accurately represent the value of offchain assets within RWAs, external data sources are necessary. Decentralized oracles are used to offchain asset data to smart contracts.

STEP 4

Asset tokenization & issuance

STEP 4

Asset tokenization & issuance

Once the assets are tokenized, they can be issued to others via minting. We elaborate on this topic more in the next section.

STEP 5

Token distribution & marketing

STEP 5

Token distribution & marketing

Choose a distribution method for your tokens, whether through a private sale, public sale, or airdrops. This is an optional step for domains like educational assets.

After you’ve reached the basic decisions and understood the essential steps, let’s now deep dive into the intricacies of the tokenization process as a pivotal step in structuring your Real-World Assets. From a technical perspective, this process can be deconstructed into the following steps:

1. Selection of tokenization standard

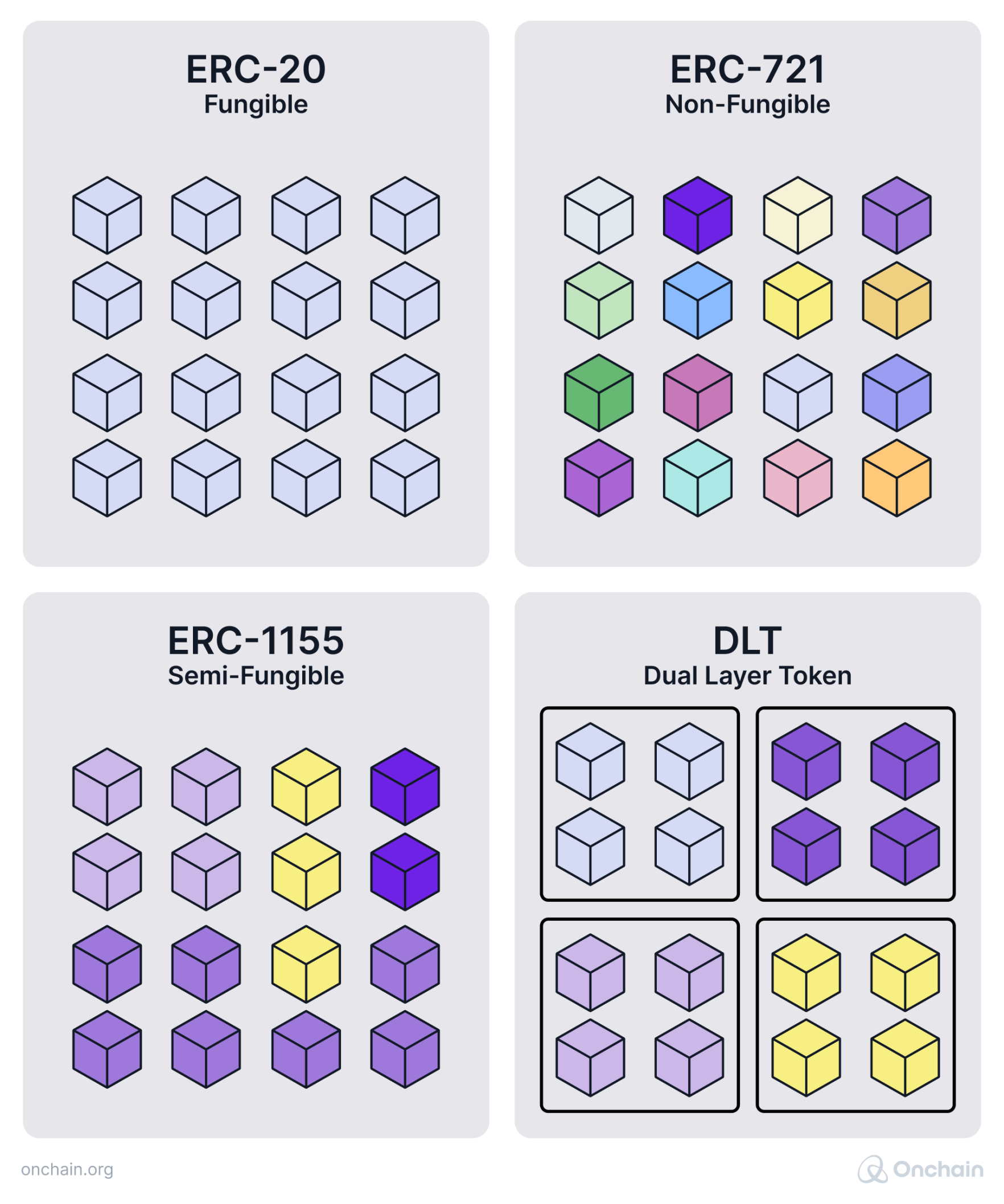

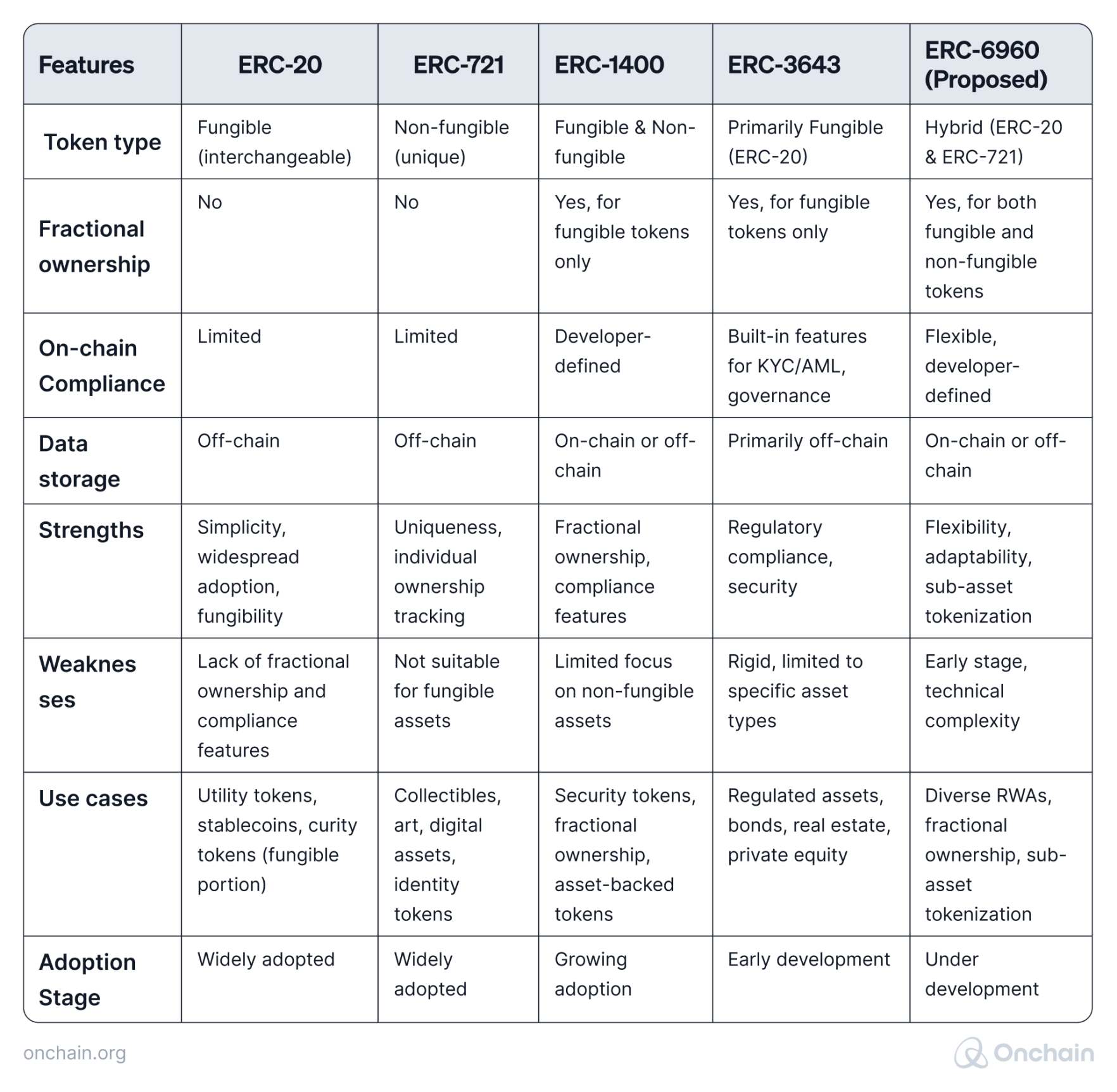

A token standard comprises a predefined set of functions and/or attributes intentionally incorporated to depict the unique features of each asset. The prevalent token standards include the following:

Ethereum-based standards:

Other blockchain-based standards:

- Hyperledger Fabric: offering several tokenization standards, including the Hyperledger Composer Token and the Hyperledger Fabric Private Data Collection, suitable for confidential and sensitive RWA transactions.

- Tezos: featuring the FA1.2 and FA2 standards, enabling efficient tokenization of both fungible and non-fungible RWAs with a focus on security and governance.

- Solana: with the SPL Token Standard that allows for fast and low-cost tokenization of various asset classes, including RWAs, such as dynamic supply adjustments, minting, freezing, burning, and more.

The main challenge is initial fit. With so many chains, both new and old, all with growing ecosystems, it's important to identify networks and protocols most aligned with the offering (such as lending protocols). The primary opportunities are improved onchain yield, the establishment of a "DeFi cost of capital", and an ideal collateral/treasury asset.

- Dennis Dinkelmeyer, Co-Founder and CEO, Midas

Emerging token standards:

- ERC-7208: Proposed by AllianceBlock, this standard creates Onchain Data Containers (ODCs) holding data and metadata for RWAs. It aims to improve the efficiency and flexibility of handling non-fungible and fractionalized assets on Ethereum.

- EIP (Ethereum Improvement Proposal) for Tokenized Vault Standards: This evolving proposal introduces asynchronous deposit and redemption flows for yield-bearing vaults holding RWAs. This would enable more flexible investment strategies and liquidity options.

- These emerging standards are still under development and may not be widely adopted yet.

We are noticing better token standards embedded into regulatory requirements to comply fully with financial authorities. However, a joint and agreed-upon global token standard has not yet been established.

- Henri Ndreca, Co-founder and COO, T-Blocks

2. Bridging offchain and onchain information: Oracles

An oracle is a mechanism or service that provides external information to smart contracts. Smart contracts on blockchain networks are typically isolated and don’t have direct access to real-world data. Oracles bridge this gap by fetching and delivering real-world data to the blockchain, enabling smart contracts to react to external events.

Oracles ensure that the underlying asset value is represented accurately on the ledger. In other words, ensuring value offchain is adequate with the outstanding value onchain. These Oracles can be either created internally by a project or service providers such as Chainlink or RedStone can create a customized flow, i.e. Proof of Reserves.

- Marcin Kaźmierczak, Co-Founder, RedStone Oracles

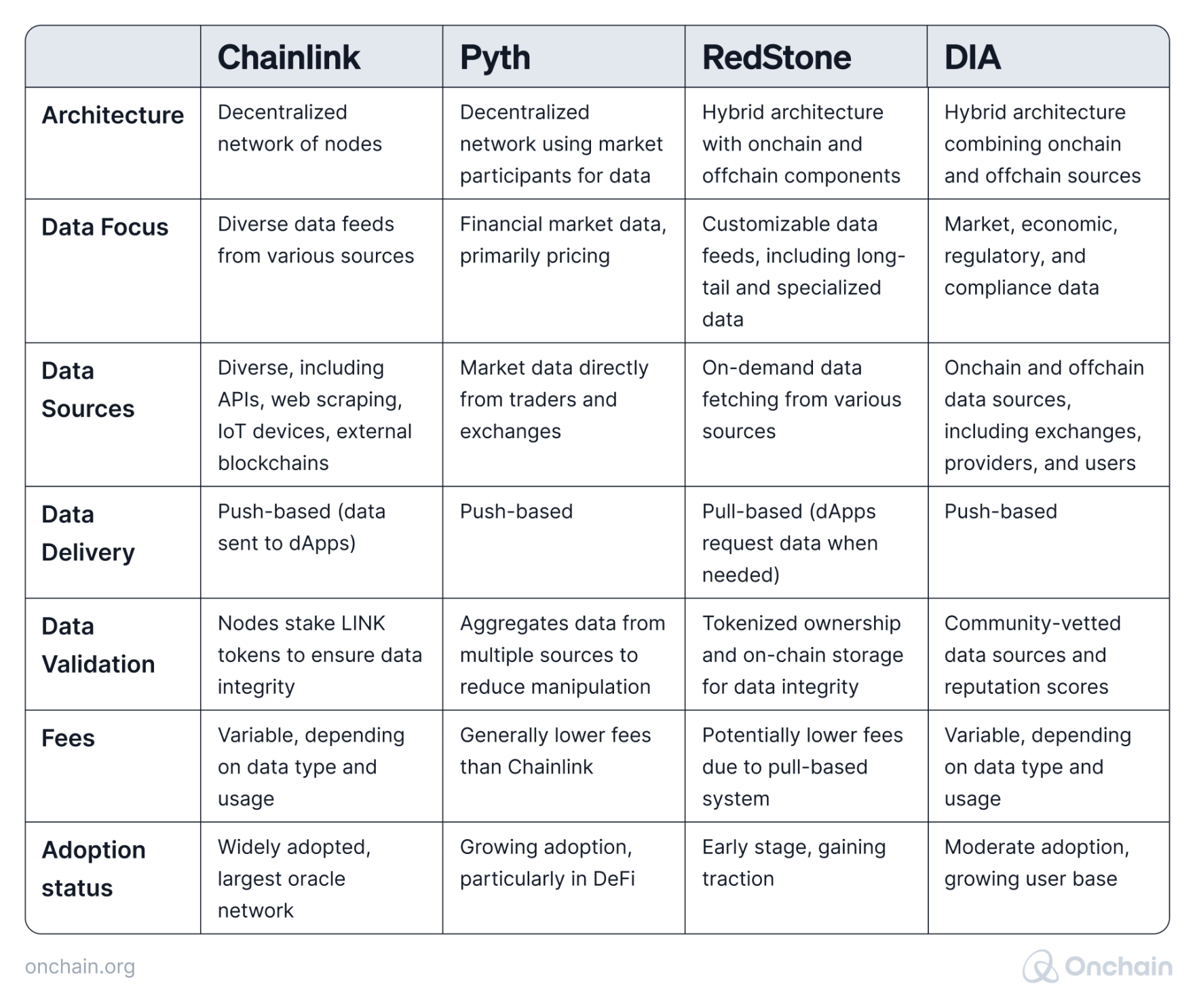

Potential oracle providers

No solution is ideal and the main question is about what trade-offs users want to accept. The Push model standardized by Chainlink is elegant and very simple to use, therefore, RedStone also adopted that technique to go across the needs of developers and users. However, in a world where gas spikes, we need to innovate.

- Marcin Kaźmierczak, Co-Founder, RedStone Oracles

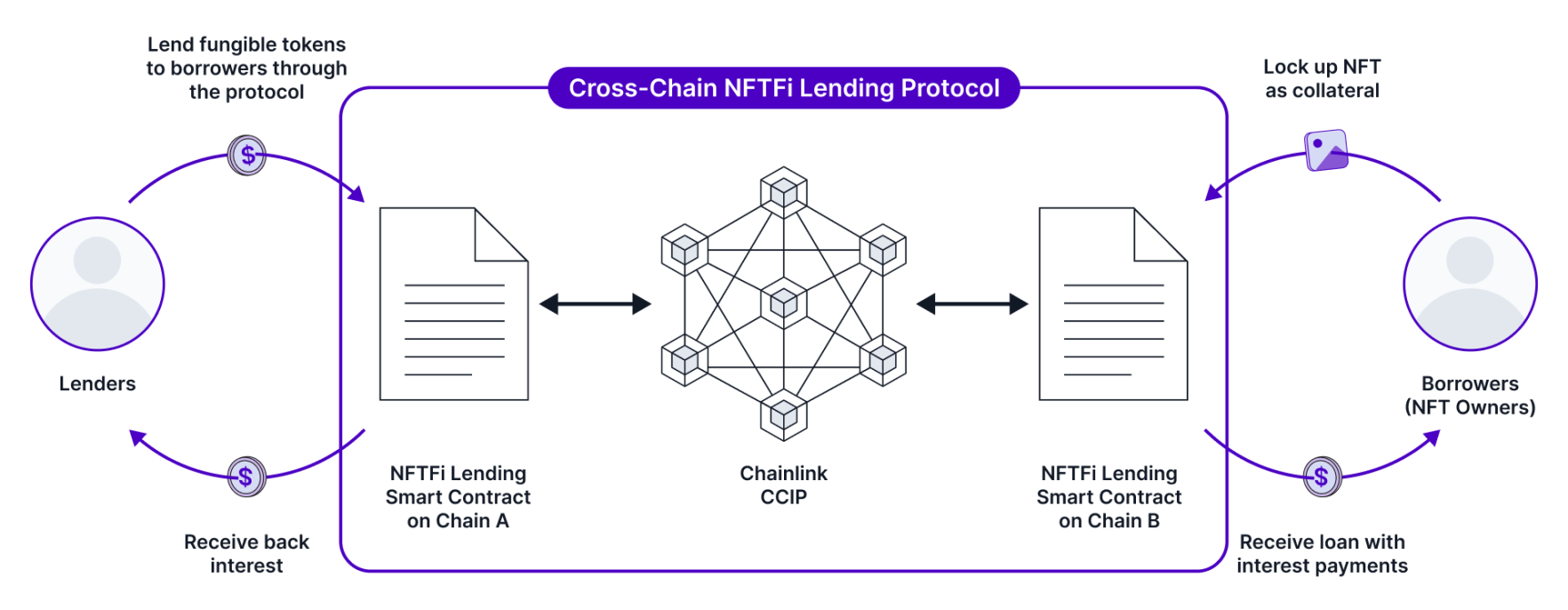

3. Cross-chain requirements

The final step in determining an appropriate tokenization process relates to the cross-chain requirements. In the realm of blockchain technology, cross-chain asset transfer refers to the movement of digital assets between different blockchains.

The RedStone Oracles Core model offers a much wider spectrum for experimentation. The difference is visible in update time (10 seconds vs. minutes or even hours), diversity of data feeds (1,000+ vs. 100+), and ability to serve innovative use cases (our modular Oracle design allows developers flexibility to some extent). Nevertheless, the Push model is not going anywhere and will keep serving established use cases. Therefore, we add new feeds, i.e. Liquid Staking Tokens or RWAs, that the market needs and the ones that are not supported by other providers, even though there is a burning need among the developers.

- Marcin Kaźmierczak, Co-Founder, RedStone Oracles

Imagine your assets as suitcases. Instead of airports, you have blockchains, and each blockchain has its own set of rules and checkpoints. Cross-chain transfer is like sending those suitcases securely and reliably from one blockchain “airport” to another.

Final thoughts: A call to action

This report has shown that RWAs offer diverse applications, from improving financial inclusion of rural farmers, the digitization of educational credentials, the financing of local infrastructure, or the unlocking of new liquidity channels in fragile economies.

Yet the full potential of RWAs remains largely unrealized. Their promise will only translate into impact if key stakeholders take deliberate action.

What comes next?

For builders: Expand the scope of innovation. While areas like stablecoins and tokenized real estate have gained early traction, emerging sectors such as agriculture, decentralized infrastructure (DePIN), and trade finance hold significant untapped potential. These domains are deeply valuable for the real economy.

For founders: Use the insights in this report as a strategic compass. Our impact ranking highlights where RWAs can drive the greatest change. Identify the segments where your expertise and ecosystem positioning can deliver differentiated value and begin executing.

For policymakers and regulators: The success of RWAs depends on regulatory clarity and supportive frameworks. Forward-looking policies, including regulatory sandboxes and clear compliance pathways, could unlock responsible experimentation in sectors like education, credit, and green finance, especially in emerging markets.

For investors: Focus on real-world traction rather than speculative metrics. The most transformative RWA projects are often those solving structural problems in emerging markets such as capital access, currency volatility, or lack of verifiable records. These efforts may not attract immediate attention, but they lay the groundwork for sustainable, long-term growth.

Ultimately, the promise of RWAs lie in its ability to expand economic participation, modernize legacy systems, and bring meaningful improvements to people’s lives especially where conventional systems have failed.

It is now time to build with purpose and commitment.