3. Existing RWA Business Models and a New One to Try

You’ll learn:

- How leading RWA platforms structure their models and where each excels or falls short.

- Why hybrid architectures may be best suited to address complex needs in underserved regions.

- How a model like Onvest can enable end-to-end value creation connecting creators, investors, and sustainable impact in a single ecosystem.

Real-World Asset-based business strategies are becoming increasingly popular in the various usage areas discussed above. Moving on to more practical aspects of RWA, we categorized the most common platform frameworks companies can use.

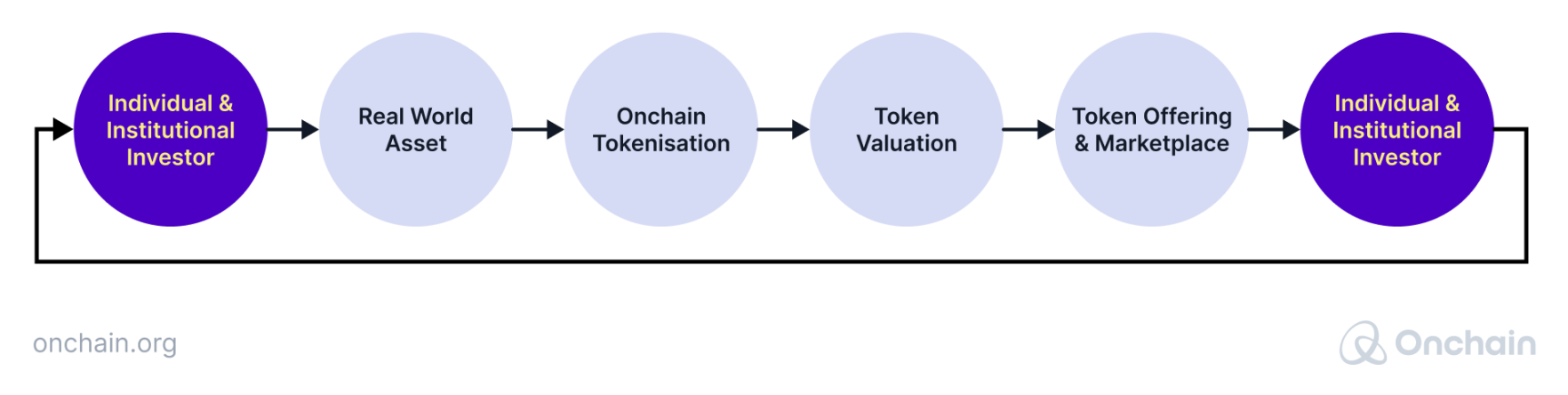

1. RWA Tokenization: This approach involves transforming tangible assets like real estate, bonds, or consumer goods into digital tokens and making them tradable on blockchain platforms.

Examples include EktaChain – a marketplace for tokenized and fractional real estate properties – and Robinland – offering fixed passive income to retail investors via tokenized institutional-grade real estate.

RWA Tokenization offers increased authenticity, security, and liquidity through blockchain technology. This comes with some risks, including smart contract vulnerabilities and interoperability

2. Asset Trading: Companies such as Parcl and Propy Inc. utilize Real-World Assets to facilitate the buying and selling of diverse asset classes via digital tokens or fractional ownership.

It involves the transfer of ownership rights from one party to another, often facilitated by intermediaries. This approach democratizes market access and enhances their efficiency.

On the downside, RWA trading can require considerable initial investment and may involve intricate regulatory issues.

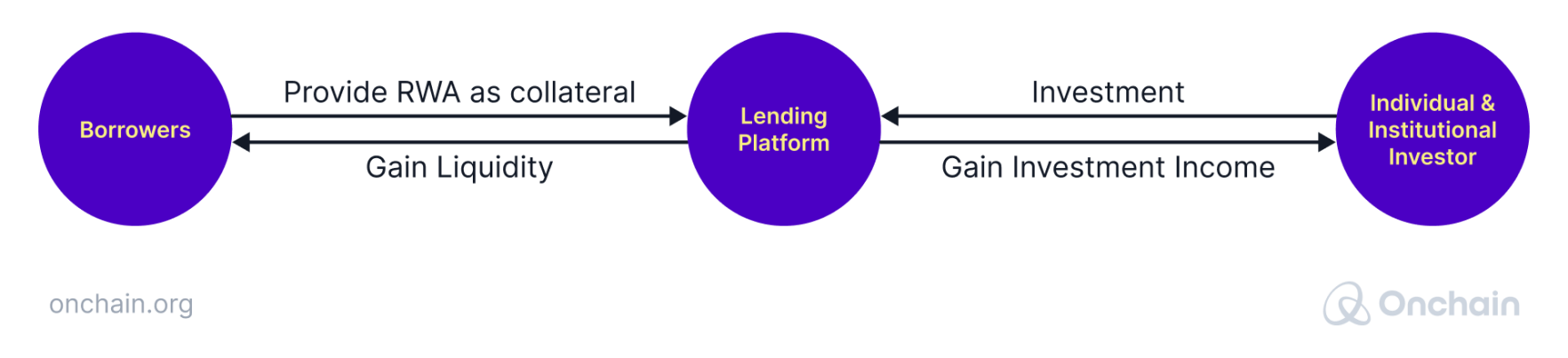

3. Lending Protocols: Lending protocols have incorporated RWAs, allowing borrowers to use them as collateral on DeFi platforms and lending services to offer collateral-based loans. Some credit lending services operate solely on brand reputation without requiring collateral.

These protocols offer new revenue opportunities and enhanced accessibility but may face challenges in accumulating a substantial collateral asset pool and navigating regulatory norms.

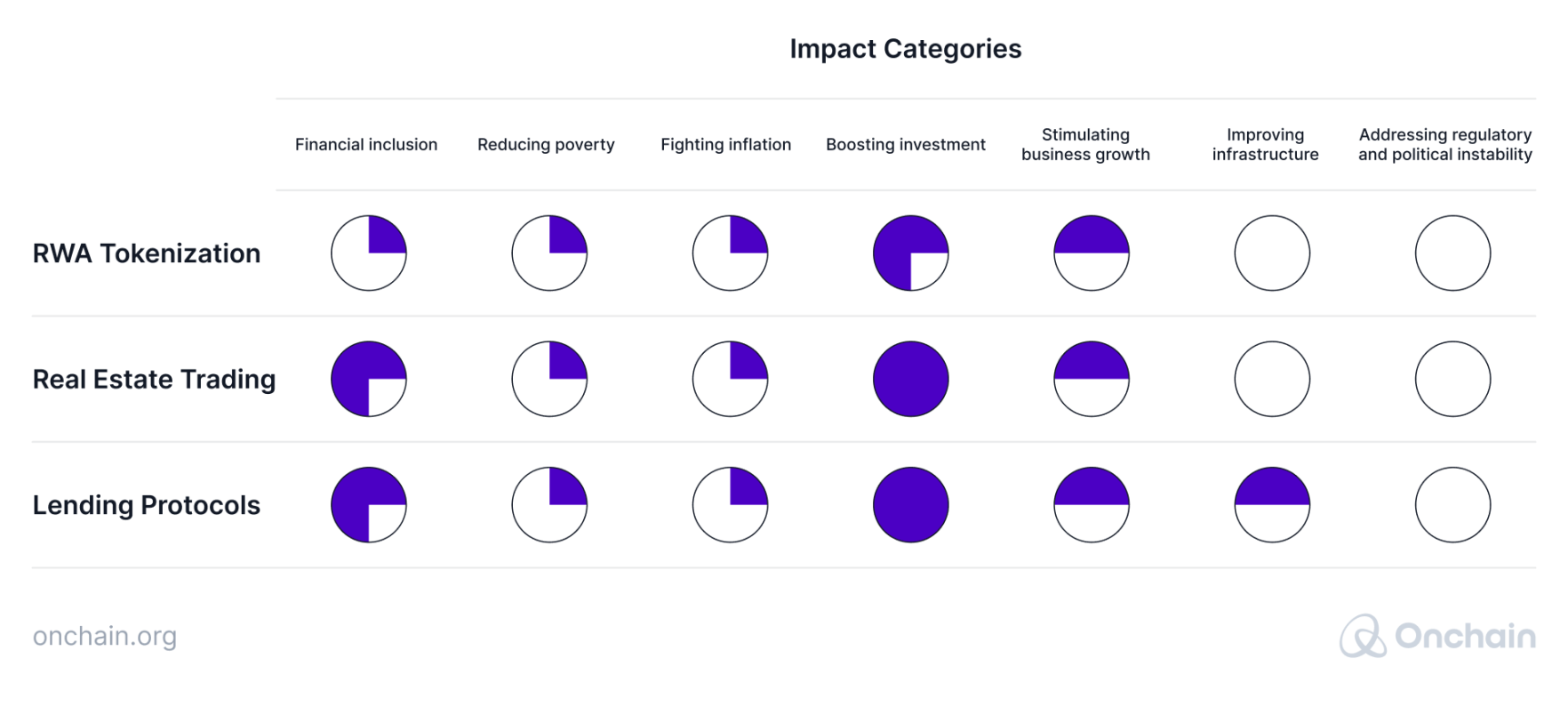

The various RWA platform models address emerging market’s needs in different ways we have already touched on before. The table below provides an overview of our analysis findings.

You can see clearly what we already suspected. When measuring the models’ potential impact in the seven areas investigated, we find that a hybrid model can address the needs more holistically.

That’s why we’d like to propose a business model that overcomes the segmentation and offers an effective way forward. Meet “Onvest”.

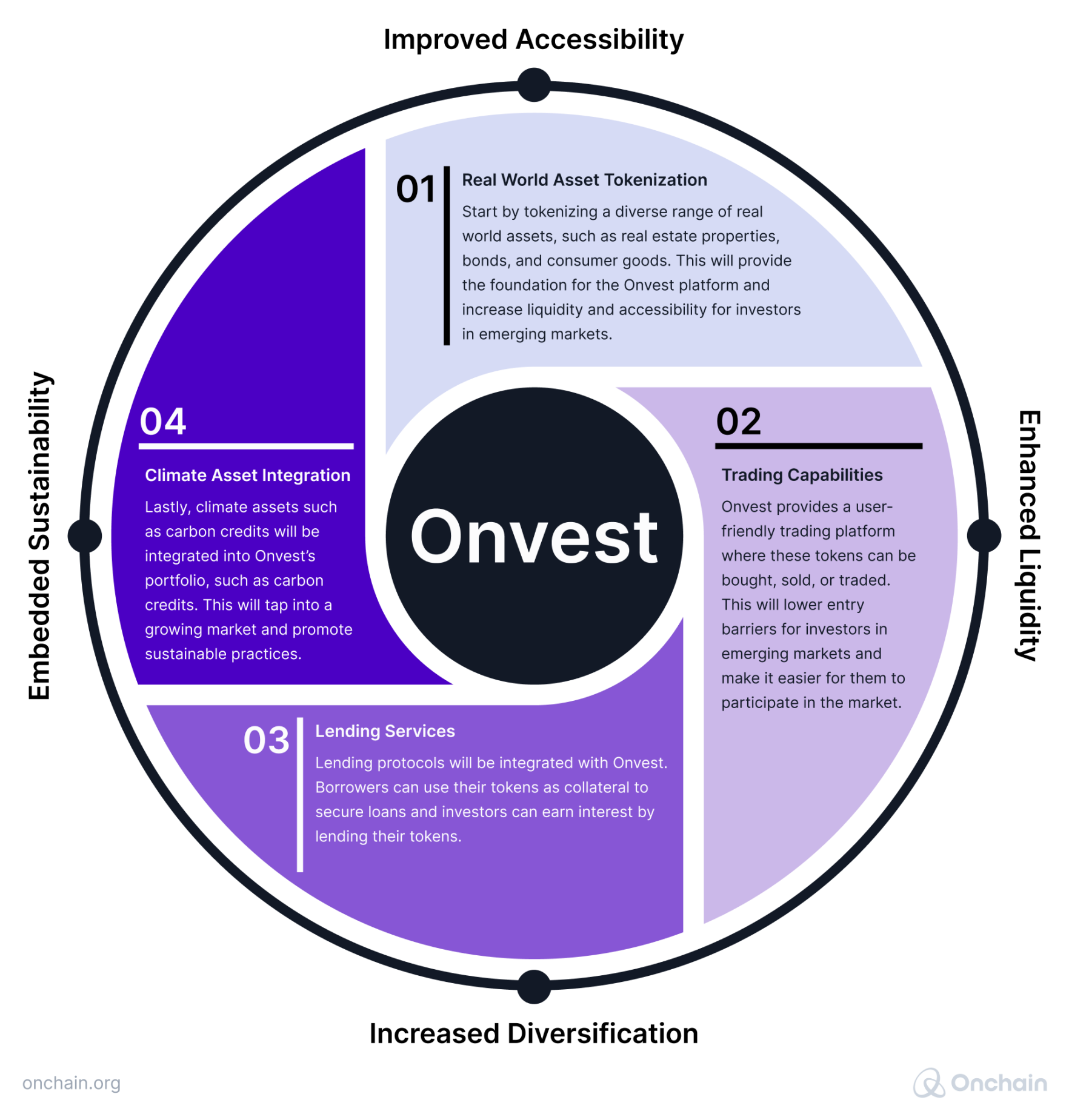

Introducing a hybrid platform model – Onvest

The purpose of Onvest is to create a tangible, positive impact end to end. The concept leverages the power of digital assets and sustainable lending to foster an eco-friendly financial ecosystem. The idea is to connect investors with green initiatives, facilitating the exchange of tokenized assets that yield financial returns and simultaneously contribute to environmental preservation. With the Onvest model, investment goes beyond profit – it becomes a tool for sustainable change.

Onvest in action – a real-life use case scenario

How does this work in praxis? Take the following scenario: An emerging artist in Indonesia creates a unique artwork, which is tokenized into digital assets via Onvest. These tokens, representing fractions of the art’s value, are traded on Onvest. An art-lover in New York comes across the beautiful digital art and falls in love with it. She purchases only a few tokens because that’s what she can afford. And so do 20 other art lovers in Paris, Berlin, Johanisbourgh, a remote village in Alaska, and who knows where else.

The artist benefits from global exposure. As the artist gains fame, the token value increases. All 21 token holders and the artist made a profit. And they can cash in on it when they decide to sell tokens.

The artist’s profit from selling tokens, allows them to create more art. Moreover, artists can raise funds for upcoming projects via Onvest and choose to invest in climate-backed assets. This end-to-end integrated model democratizes investments, enhances liquidity, and provides a new funding model for Real-World Asset categories.