2. Real-World Assets for Real-World Purposes - The Ranking

You’ll learn:

- Which RWA categories rank highest for real-world impact.

- How to evaluate an RWA niche using criteria like financial benefit, adoption, and regulatory risk.

- Why some domains (like stablecoins, agriculture, and private credit) lead the charge and what still holds others back.

- Strategic insights for founders on where to focus next in the RWA ecosystem.

What’s the impact score?

Our analysis covers Real-World Asset categories that serve the most important real-world purposes. To evaluate them based on their potential impact on emerging and frontier markets, we developed a unique scoring system. This impact score allows us to organize them by rank.

Here’s how it works. The scoring mechanism builds on the analysis of the following criteria:

- How much do individuals and businesses benefit from RWAs?

- Financial inclusion

- Reducing poverty

- Fighting inflation

- Boosting investments

- Stimulating business growth (access to capital, new business models)

- Improving infrastructure and addressing regulatory and political instability

- How developed are RWAs in this application area? (existing projects, traction)

- What is the hype level around RWAs? (popularity in the web3 space and beyond)

- How much money is poured into RWAs? (market trends)

- What limitations do RWAs face in the category? (legal, technological, market-oriented)

Note: If a particular criteria was not included in the analysis of a specific niche, it means RWAs don’t address it.

Here’s where the excitement begins. We allocated points per criteria to each RWA domain. The maximum number of points any domain could accumulate was 80.

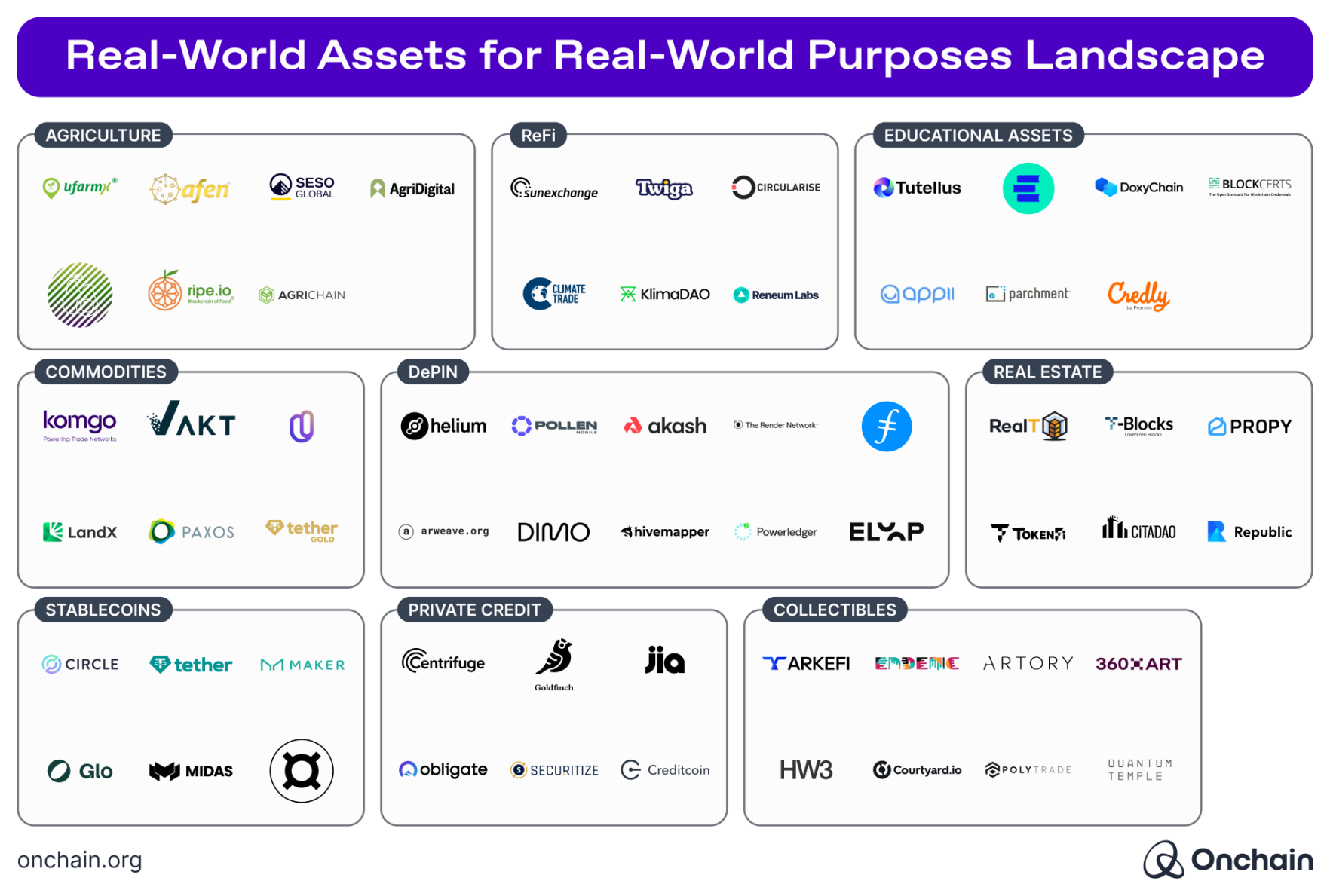

Presented here are the top 9 RWA usage areas with the highest impact scores.

You can use this information as a pointer where to locate beneficial RWA projects. You can also view it as a barometer for predictions where the market is going.

We hope it’ll help you in your entrepreneurial decisions!

Rank 9. Educational assets

Impact Score: 35.4

RWA’s most promising potential: improving the administrative infrastructure of education in emerging economies.

The fusion of tokenization and blockchain technology might bring about a significant transformation in the current educational landscape.

We all keep our academic certificates in some basement closet where they turn yellow. Maybe you have a digital transcript stored in some institution’s cloud. It’s highly inefficient, insecure, and easily forgeable.

NFTs as a tokenized version of the official paper documents present a revolutionary alternative.

Non-fungibly tokenized certificates make for a secure and tamper-proof means of credential verification and introduce a level of transparency that was previously unattainable. And they can be applied to teaching materials and courses just the same.

Graduates and job-seekers can effortlessly share their digital credentials with potential employers across the globe without the need for further verification. And recruiters can be sure the documentation is authentic.

To ensure that blockchain-in-education solutions scale worldwide and sustainably, the market adoption challenge must be addressed actively. And that’s tricky. It requires governments, educational institutions, and innovators to come together and promote blockchain-in-education solutions.

Advancing financial and educational inclusion & removing poverty

Web3 concepts could disrupt traditional education models by introducing decentralization, transparency, and financial incentives, which can indirectly alleviate poverty.

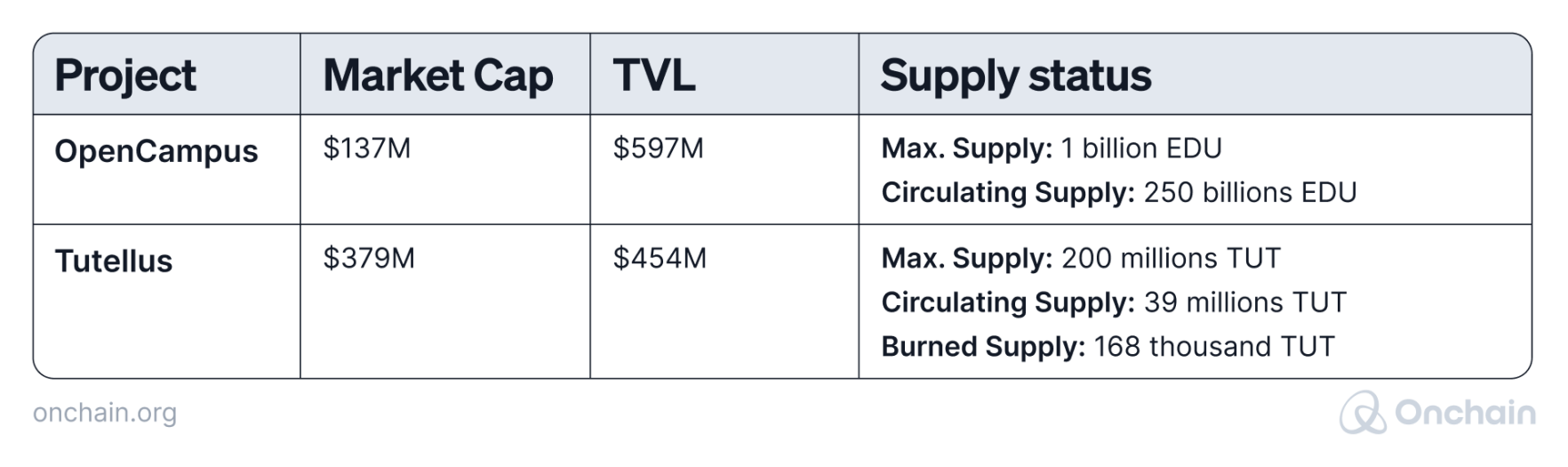

Tokenized EdTech platforms, such as Tutellus, operate as a value-as-a-service (VaaS) model. They provide tokenization services for others to incorporate the concept in their educational evaluation mechanisms.

The idea of tokenizing educational resources includes the fragmentation of courses, certifications, and learning materials into single elements represented by tokens. Higher education becomes more accessible by lowering the entry barrier and enabling micro-purchases.

OpenCampus is another example of a blockchain-based EdTech platform. In both, token holders can participate in staking and governance, thereby, generating passive income and influencing platform development.

Real-World Assets technology can also transform learning and teaching methodologies directly in several ways:

- In some models, tokens gamify the learning process. Every time students accomplish an assignment, engage in a discussion, or reach a specific learning objective, they are rewarded with a token. Rewards are always effective, but resonate particularly well with a generation of gamers who are more attuned to tokens than traditional grading systems.

- Blockchain allows for personalized learning experiences. Educational institutions can craft customized learning pathways for students, tailored to their individual interests, skills, and career aspirations.

- RWAs encourage lifelong learning. Educational institutions can use tokens to reward students for ongoing commitment to learning and upskilling throughout their careers. It motivates and enables people of all ages to keep developing their professional growth. Institutions can extend students’ engagement beyond the completion of their formal education.

Improving administrative, educational infrastructures

- Tokenizing educational certificates reduces forgery and ensures transparency and fairness. Additionally, using RWAs in this context, reduces bureaucracy, saves everyone time and opens the global job market. Graduates can share their certificates quickly with any institution in the world. Job applicants can instantly provide proof of skills and increase their chances in the job market. Companies don’t need to spend time and effort verifying certificates manually.

- Establishing a reliable, decentralized, and collaborative infrastructure would set the benchmark for issuing, storing, displaying, and verifying academic credentials in a digital format.

- It would further allow institutions to distribute these records in a safer and inexpensive way, thereby, reducing identity frauds.

Traction

- Since 2016, several companies like BlockCerts, APPII, and Parchment have been designing platforms for creating, issuing, and verifying blockchain-backed certificates.

- In 2018, a number of leading universities, including MIT, founded the Digital Credentials Consortium to design an infrastructure for digital credentials of academic achievement. The institutions recognized blockchain’s potential to improve the administrative infrastructure of higher education and help maintain academic integrity.

- To make this possible, the Consortium is developing a mobile wallet for securely storing and sharing the academic achievements with others. Sony Global Education, is already collaborating with industry leaders such as IBM to provide the Consortium with the required technological solutions.

These are promising, but rather isolated initiatives. The road to widespread adoption of RWA’s in educational systems is still long and winding. One critical point is that adoption is necessary on a global, institutional scale to make Real-World Assets valuable in this sector.

Limitations:

- EU’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act of 2018 (CCPA) may impose limitations on how personal data is transacted on the blockchain. Definitions of personal data also remain vague in legislation.

- University leaders and staff have limited knowledge of how to apply and maintain such applications internally, and this has slowed down the overall adoption by different institutes.

Rank 8. DePIN – Decentralized Physical Network Infrastructure

Impact Score: 40.6

RWA’s most promising potential: improving the technological infrastructure (i.e., network, computational power).

Most RWA categories refer to the process of putting assets onchain while utilizing the existing infrastructure. DePIN goes one step further and incentivizes people to actually build infrastructure, not only for RWAs.

DePIN – Decentralized Physical Infrastructure Networks – use blockchain to coordinate participants and enable them to build their own networks with real-world purposes. They may be focused on providing wireless connectivity (e.g., Helium, Pollen), computing power (e.g., Akash, Aleph, Render), storage (e.g., Filecoin, Arweave, Storj), sensor data (e.g., DIMO, Hivemapper), or general DePIN-focused infrastructure (e.g., Lisk, IoTeX).

In this respect, DePIN adds one more important layer to the RWA landscape. Although such apps don’t focus directly on bringing assets onchain, they improve physical assets with the help of onchain architecture. An example could be incentivizing Helium network participants to deploy wireless hotspots and enhance internet connectivity or encouraging car owners to share their mobility data through the DIMO network.

Financial inclusion

Wireless infrastructure provided by projects like Helium can significantly boost financial inclusion. They don’t have a direct impact but assist other RWA application areas, such as stablecoins, which require a robust internet connection.

Unfortunately, a glance at the Helium Hotspot Map reveals that currently, the vast majority of hotspots are placed outside the emerging countries. It appears they primarily address connectivity problems in developed economies where financial inclusion is less of an issue.

Reducing poverty

DePIN provides additional earning opportunities for people regardless of their location. They can be especially attractive for those living in lower-income areas, who can significantly improve their earnings.

Examples include:

- Earning by providing data storage (e.g., Filecoin)

- Earning by providing car-related data (e.g., DIMO)

- Earning by providing mobility data (e.g., NATIX Network)

- Distributing a share of revenues (e.g., ELOOP and car-sharing earnings)

- Earning by providing battery power for decentralized energy grids (e.g., React)

Fighting inflation

Aside from the opportunity to earn money in another currency than that controlled by the central bank (i.e., crypto), DePIN doesn’t offer specific advantages. Additionally, the earning potential highly depends on how stable the relevant cryptocurrency is. Nearly all protocols pay in their own volatile tokens or use ETH, which remains more unstable than, for example, USDC.

On the other hand, if DePIN can provide working internet infrastructure, it can contribute to fighting inflation through stablecoins, which require an internet connection.

Stimulating business growth

DePIN networks are fully transparent and open. This enables businesses and individuals to easily scrape data for research and other purposes, accelerating business development and advancing DeSci (Decentralized Science) initiatives.

It’s still a promise rather than an actual use case. However, the accessibility and globality of DePIN applications could enable people to run businesses based on its underlying principles. As an example, a company focused on providing decentralized computing power through Akash, sounds like a reasonable idea.

Improving technological infrastructure

DePIN projects that focus on storage (e.g., Filecoin, Arweave, BitTorrent) could improve technological infrastructures in emerging markets – at least when it comes to solving data storage issues (e.g., insufficiently secured servers). For now, these protocols mainly attract other Web3 apps, not individuals or non-web3 businesses.

Current traction

There are currently over 650 DePIN projects. The biggest niches are Computing, with 250+ projects, and AI, with 200+ projects, according to Messari.

- For emerging markets, these application areas are less critical than others, like Wireless or Energy. When looking a little closer, computing, in combination with sustainability, shows some potential. Some projects allow users to share their computing power in return for financial incentives.

- DePIN protocols tend to lose traction over time. The best examples are Filecoin and Helium, which are considered the most representative of the entire domain. Both attracted lavish numbers of users right after launching and during the most bullish period in the usual crypto cycle.

- DePIN projects often struggle with generating revenue – a sad reality for many Web3 initiatives that we addressed in depth in our previous report. Messari claims the only categories with notable revenue are computing (e.g., Filecoin, Akash) and services (e.g., Braintrust).

Limitations

- DePIN is an RWA category that requires very fast, low-cost, and reliable blockchain infrastructure. Hence, the most dominant Layer 1, Ethereum, seemed to impose limitations in this area. Further development of Layer 2s promises to address this more efficiently. In particular, you should keep an eye on the emergence of EIP-4844. Recently, Solana tried to position itself as a new leader in this space due to their market focus on DePIN and a fast, low-cost blockchain. Concerns about its security may, however, move DePIN entrepreneurs back to Ethereum and its L2s. The most recent data regarding the blockchain usage in DePIN space looks to be confirming it:

- The entire DePIN category highly depends on network effects. If they don’t occur in a particular project or event, the entire application area will dry out.

Rank 7. Real estate

Impact Score: 43.2

RWA’s most promising potential: boosting investment opportunities for individuals from emerging markets.

Traditionally, real estate investments are reserved for high-net-worth individuals because only they can meet the high capital requirements. Tokenization breaks down substantial entry barriers in traditional real estate, allowing anyone to invest in a fraction of a property, even with limited capital.

Unlike traditional real estate, tokenized assets are easily tradable on secondary markets, offering greater liquidity and flexibility for investors. This eliminates the need for complex selling processes, attracting a broader audience and potentially boosting market activity. Other benefits include lower costs and reduced risk of fraud.

Financial Inclusion

Conventional real estate technology lets you register your property on listings that connect sellers with potential buyers. They are meeting platforms where two parties can carry out a certain transaction. Blockchain introduces innovative approaches to real estate trading. The technology enables trading platforms and online marketplaces to provide more comprehensive support for real estate transactions and engage in different types of real estate investments.

For example, RealT developed a platform that uses blockchain technology to facilitate U.S. residential real estate investments. It transforms traditional paper deeds into tokens on the Ethereum and Gnosis blockchains. Qualified investors can acquire fractionalized ownership in real estate properties.

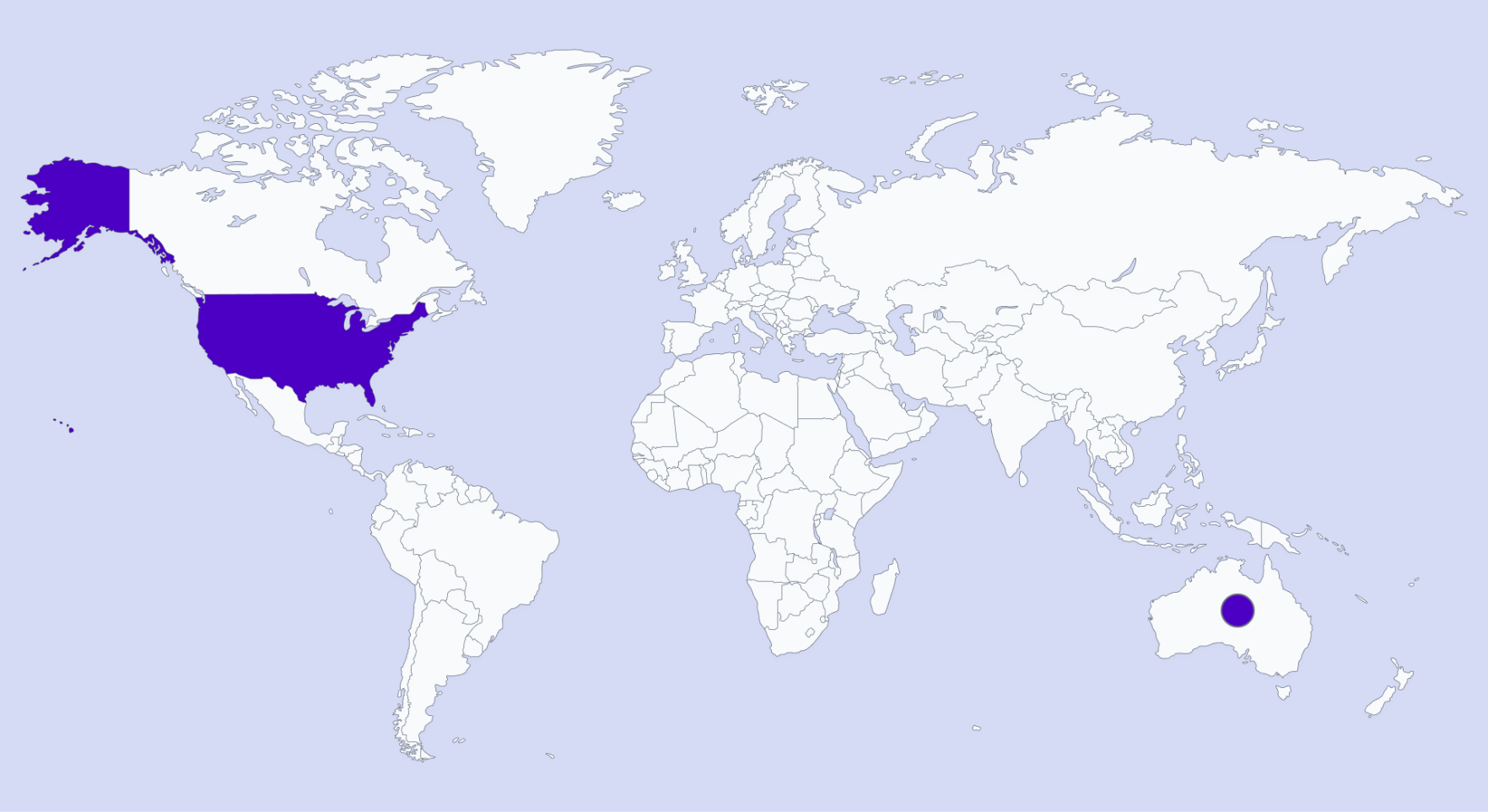

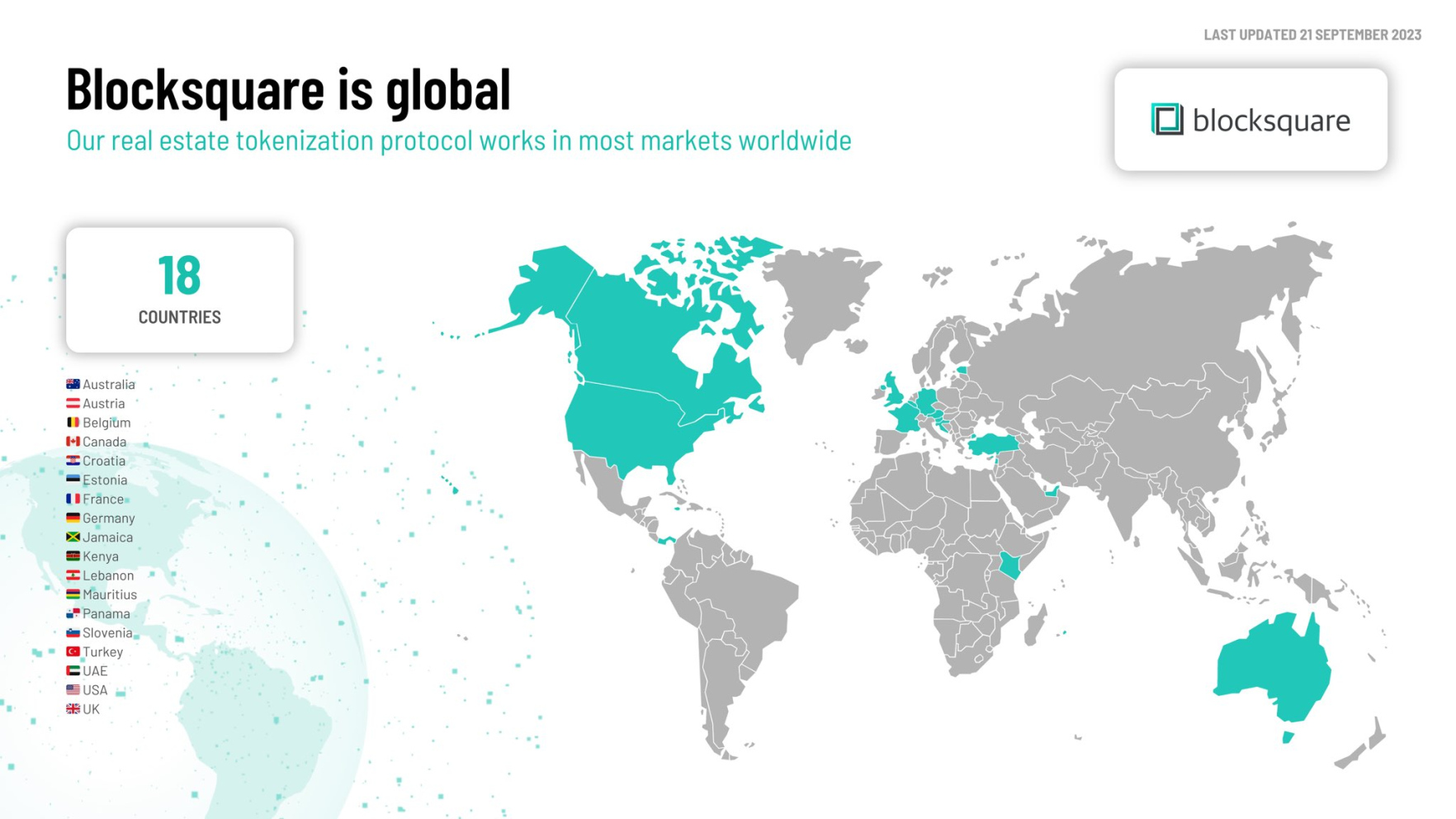

We know of RWA projects addressing real estate in approximately 18 countries across the globe – see the map below. Among them is a large project offering investment in a 4-star hotel in Bali, Indonesia. CoFund launched this first-of-its-kind real estate tokenization project with an investment of $10,000,000 in March 2023.

Reducing poverty

Dematerializing and fragmenting real estate ownership into affordable tokens opens the door to democratized ownership. Private investors can co-own premium residential and commercial properties managed by professionals. The revenue generated from such assets is potentially high and becomes accessible to the common person.

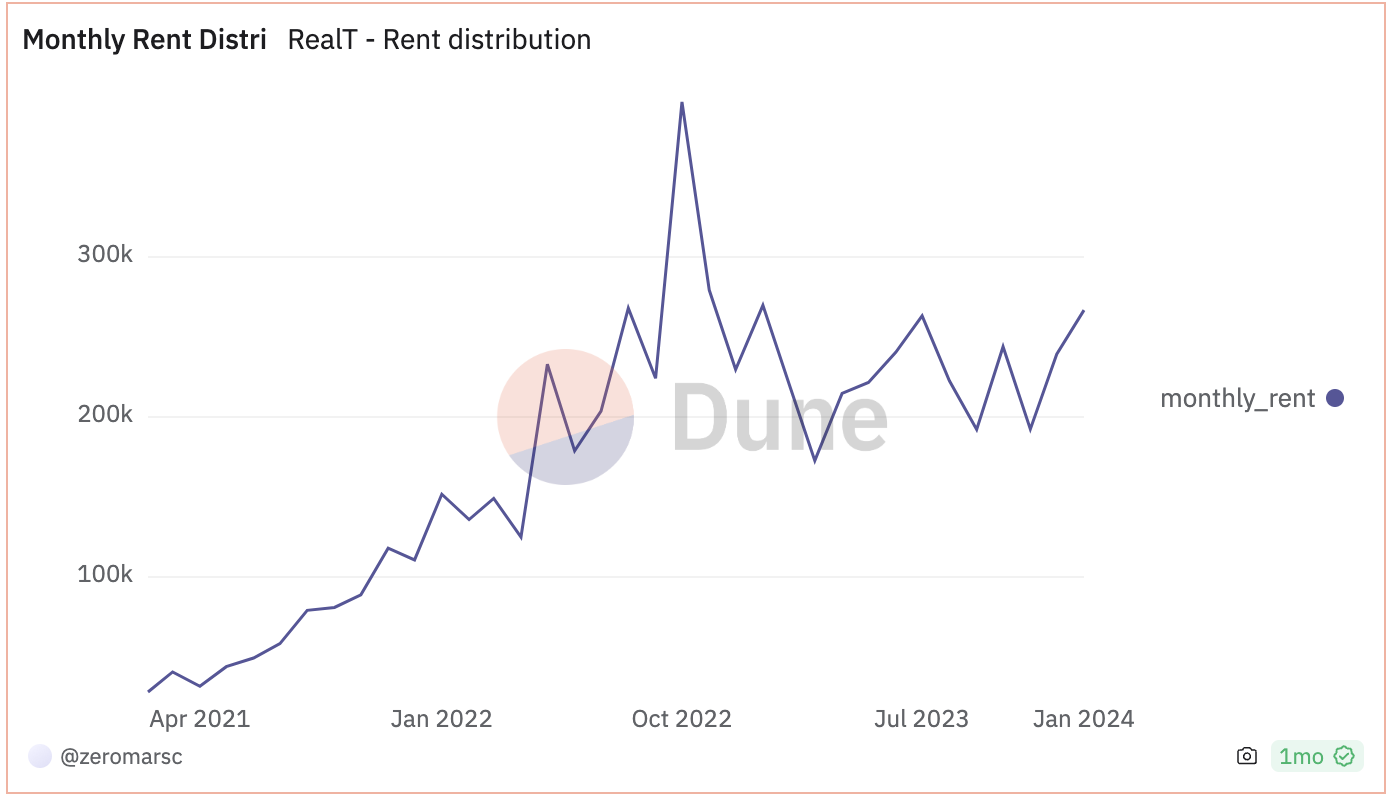

For example, RealT distributes the rent proportionally to each token holder based on the size of their property ownership share in the property ownership. According to Dune Analytics, since the project’s launch in 2021, monthly rent distribution has continuously grown, showing a potential increase in investors’ earnings.

Boosting Investments

Tokenizing real estate can give rise to new investment opportunities for both investors and financial institutions. It simplifies the interaction between buyers and sellers because blockchain removes the need for multiple intermediaries. This creates the possibility to improve real estate liquidity and opens the market to a larger, more diverse range of investors.

Take RealT asset performance as an example. Based on the most recent property evaluations dated January 2024, it’s year-over-year performance rate shows an increase of 23,46%.

“T-Blocks is planning to roll out products that allow for direct tokenized equity investments and opportunities to transition loans to equity through tokenization. Capitalizing on the EU’s frameworks with minimal barriers, our platform further provides an avenue for individual professional investors, especially those from the diaspora, to directly invest in real estate assets directly, bringing both funding and a global perspective to the local market.” – Henri Ndreca, Co-founder and COO, T-Blocks

Traction

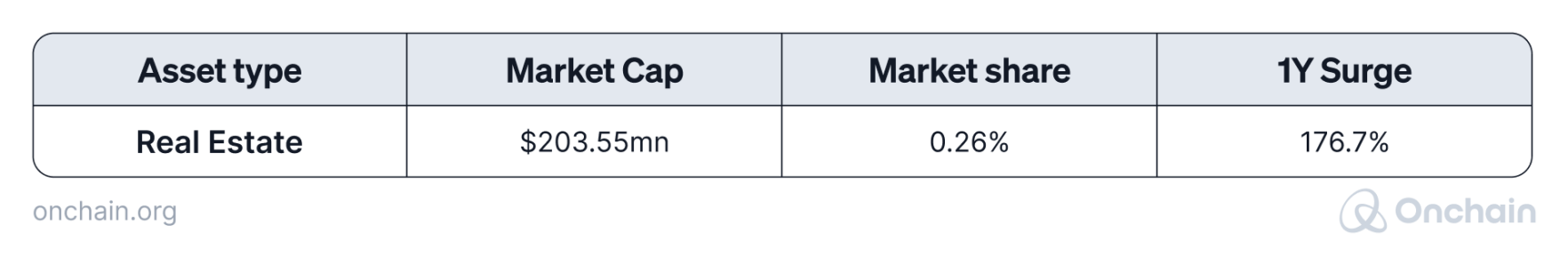

Data from Dune Analytics shows a staggering 176% surge in real estate token market capitalization from the beginning of 2023 till January 2024. The figures illustrate the momentum propelling this sector forward.

At the time of writing this report, the market value is about $200 million and is expected to hit $1.5 billion by 2025. This meteoric rise speaks volumes about the growing interest in this innovative investment avenue.

Despite the challenges, success stories are beginning to surface. Pilot projects and innovative tokenization initiatives are paving the way for broader adoption. A more significant indicator for the potential are the major players in the industry and how they react. We are seeing established real estate firms and leading financial institutions actively explore and invest in this transformative technology.

Examples of projects working in this area are RealT, Propy, TokenFi, CitaDAO, CoFund, Republic, and Ubitquiti. Let’s break down the numbers for the most prominent RealT:

Before you rush to make your next investment, here’s one thing to keep in mind: uncertain regulatory landscapes cast a shadow over the real estate market and slow wider adoption.

Limitations

While property tokenization might occur on the blockchain, the legal transfer of ownership, due diligence processes, and physical property management are conducted offchain. Such operations inherently carry risks.

There are also significant technical limitations mainly related to data authentication and validation.

Starting with challenges of the real estate sector in emerging economies, at least in our market, we notice that asset developers are not inclined much towards technology, and given the lack of capital market developments in the region, they need to become more familiar with capital raising documentation. This lack of know-how and experience in operations and asset management impacts the perceived quality and safety that international investors are used to. We see both of these challenges as opportunities, knowing the potential that the emerging region of Western Balkans has, especially in the light of closer integration with the EU and booming tourism in the Albanian Riviera, often considered a hidden gem of Europe.

- Henri Ndreca, Co-founder and COO, T-Blocks

Rank 6. Collectibles / tokenized art / phygital products

Impact Score: 45.2

RWAs most promising potential: encouraging individuals in creative industries to establish small businesses.

Collectibles range from items like vintage baseball cards to antiques and physical artworks. And RWA infrastructure might currently be the easiest, most reliable way to authenticate authorship and ownership of unique items – if not the only way.

It’s nothing new that people collect anything and everything, however, not necessarily as an investment. Driven by factors like increased disposable income, the collectibles market has seen substantial growth in recent years. This expansion gave birth to the NFT market and other unconventional ideas, such as the Play-to-Earn gaming market.

It’s worth noting that the collectible’s market is extremely diverse and unregulated. Therefore, this category has the highest likelihood of a “custody crisis” regarding real-world Assets.

Financial inclusion & reducing poverty

Similar to commodities and cryptocurrencies, collectibles can be owned by anyone anywhere. Platforms offer tokens that represent a percentage fraction of a collectible’s value rather than the entire piece at full value. You don’t have to be rich to invest in art or antiques anymore.

Imagine this: a little village in Africa has only one solar panel for energy and one smartphone for the whole tribe. Not much, but enough to enable them to acquire and co-own a piece of fractionalized art.

Examples of applications that offer such practices include:

- Arkefi platform.

- arttrade, where people can participate in the performance of blue chip art simply, securely, and easily with minimum investment.

Boosting investments

Real-World Assets in the collectible market offer global reach for sellers, buyers, and owners. The ease of verifying provenance and authenticity reduces the risk of forgery and fraud for artists, collectors, and investors alike.

Examples include:

- Endemic – a social media smart art platform for artists and creators of fine art.

- Artory – a platform that connects the art market with the digital-first financial ecosystem.

- 360xart – a tokenization platform that enables art owners to create digitally secured art tokens and list them on their partner marketplace, 360X.

Stimulating new businesses and business growth

RWAs open new possibilities for creators to offer their work and be discovered by art-lovers, collectors, and investors. They allow for new ownership paradigms and business models.

The artist can tokenize their artwork with an NFT, a non-fungible token. One person will own the unique token representing a specific creation.

Alternatively, they can break down the value of a piece of art and fractionalize it into numerous fungible tokens. This allows co-ownership by many people at an affordable price.

You will often find them referred to as phygital (a combination of physical and digital) collectible projects.

Examples include:

- Tokenizing phygital sculptures: FVCKRENDER, an artist who offers an audio-visual experience for exhibitions with physical objects verified on the blockchain in the form of non-fungible tokens.

- Tokenizing other phygital products: The Whiskey Barrel, where each TWB Scotch whisky bottle features a unique QR code on the label, linking to its unique Digital Provenance Certificate or NFT (Non-Fungible Token).

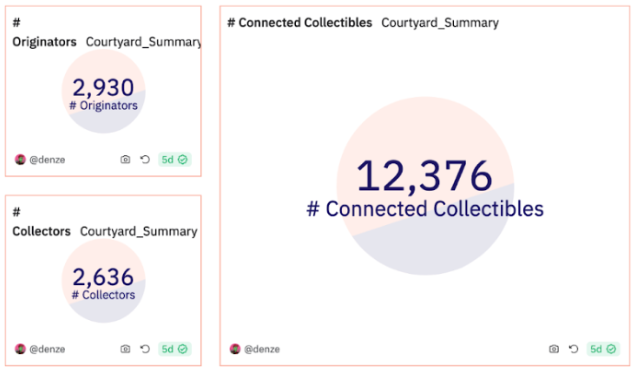

- Tokenizing card collectibles: Courtyard, a marketplace for trading cards, powered by the blockchain and protected by Brink’s (vaulted). Courtyard empowers card collectors to take control of their collection with true digital ownership.

Improving infrastructure

Collectibles as Real-World Assets show great potential to improve the general collectibles trading infrastructure – also in emerging markets. Artists from less-developed regions benefit from the blockchain-related attributes of RWA technology:

- Proof of origin – NFT transactions serve as an immutable voucher for authenticity and provenance.

- Security – a tamper-evident record on a distributed, immutable ledger is made available to investors.

- Contract integration – Smart Contracts remove the need for intermediaries and reduce risk.

- Secondary trading – the immutable ledger technology combined with smart contracts ensures royalty payment upon secondary and future sales.

- Reduction of marketplace risks – various strategies and technologies unique to blockchain mitigate the risks associated with buying, selling, and trading non-fungible tokens.

Examples include:

- The loan protocol for RWA Arcade, provides the infrastructure for NFT lending.

- Polytrade (built on the Polygon chain) is a marketplace for Real-Word Asset discovery, tokenization, and liquidity that provides services for tokenizing anything from Pokemon cards to watches and vintage items.

- 4K is a decentralized protocol for bringing physical assets onchain. It claims to be the first of its kind coordinating a global network of operators to bring physical assets onchain. 4K has its own verification and mining facilities.

- Indonesia’s Ministry of Tourism leverages NFTs to maintain records of its heritage. In the process, they also boost virtual tourism. Web3 platform Quantum Temple works closely with the Southeast Asian country to tokenize both tangible and intangible forms of its cultural heritage.

Traction

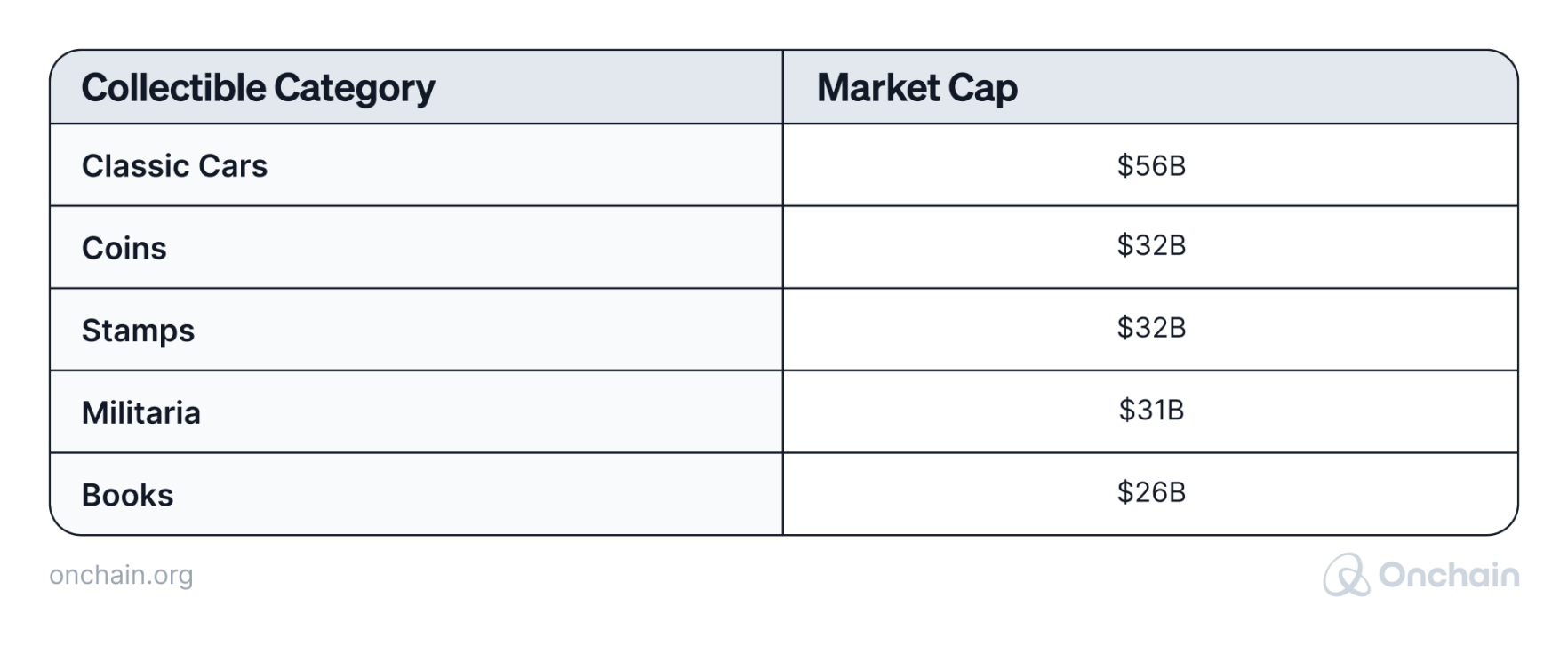

Collectibles global market value in 2023 was $398B.

With the global market size of around $458 billion as of 2022, the collectibles growth of annual compound is 6.2%. Analysts expect a $1 trillion market size by 2030. These figures do not include the rise and fall of the NFT speculation of the early 2020s.

You don’t need to be an expert to detect the rapid growth of RWA usage in the collectibles market. It’s further accelerated by the increased utility of NFTs and digital art.

Limitations:

- The collectible market faces legal challenges in defining and enforcing intellectual property rights related to digital creations and their tokenization.

- The complex technology is an obstacle and high entry barrier for less tech-savvy creators and collectors.

- The market volatility of NFTs is a temptation for speculators and gamblers, compromising the stability and credibility of the market.

- The process of converting collectible Real-World Assets into digital form presents hurdles in managing data, necessitating considerable investments in infrastructure for data entry, upkeep, monitoring, and ensuring data integrity.

Rank 5. Commodities

Impact Score: 46

RWA’s most promising potential: tackling inflation by increasing access to liquid inflation hedges.

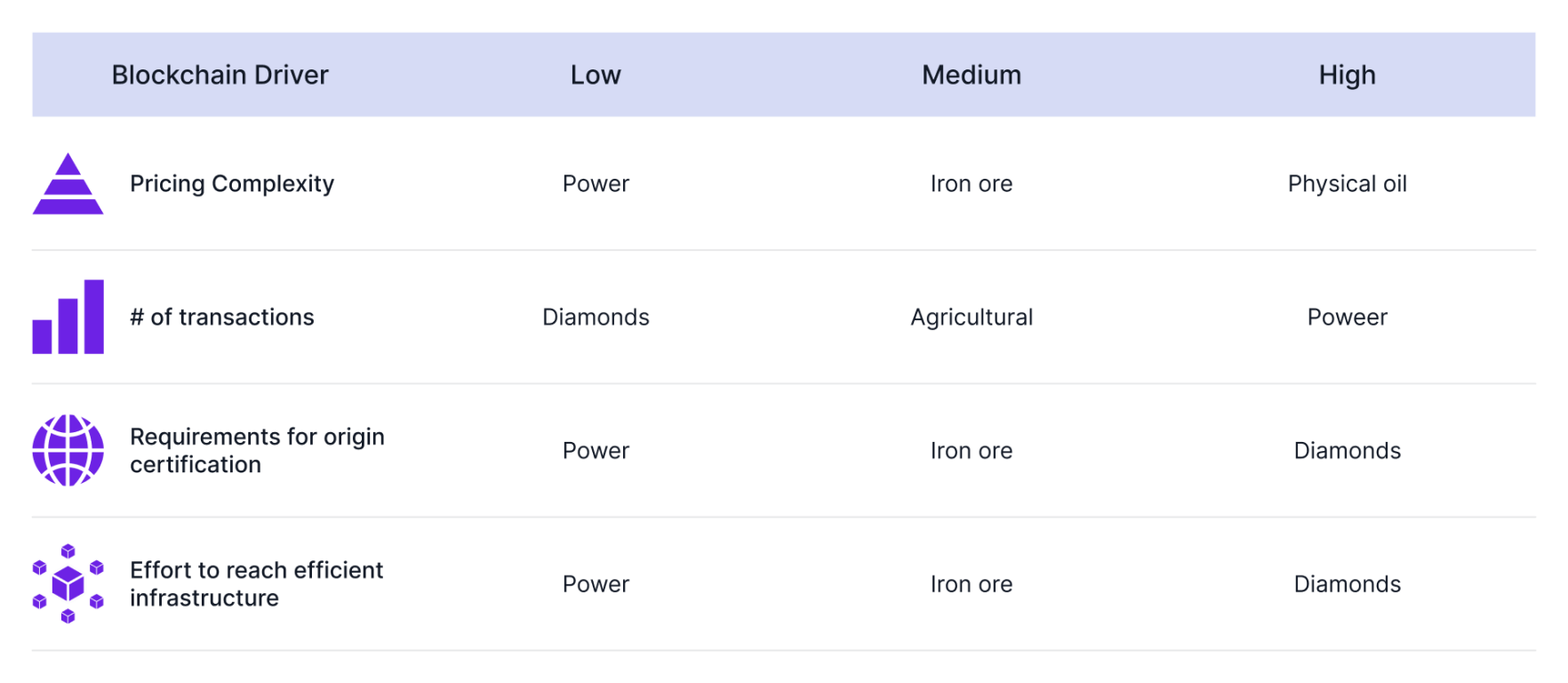

Commodities trading involves many parties and endless transactions. You can view it as a huge web of interconnected supply chains. It is crucial to track and trace origin, quality, and chain of custody, particularly for commodities such as oil, minerals, and agricultural goods.

The number one benefit of using Real-World Asset infrastructure is transparency. On the blockchain, all essential data can be stored, shared, and tracked securely. As a result, you can:

- simplify processes through smart contracts to automate contracts and transactions,

- significantly reduce paperwork and

- expedite transaction speed.

The future of commodity tokenization is poised for explosive growth because it builds on existing multilateral frameworks. Entities like Komgo set a precedent for incorporating tokenization into the commodity industry by using blockchain.

Continuous innovation and collaboration between technology providers and industry players are the propellers for RWA’s success in commodities.

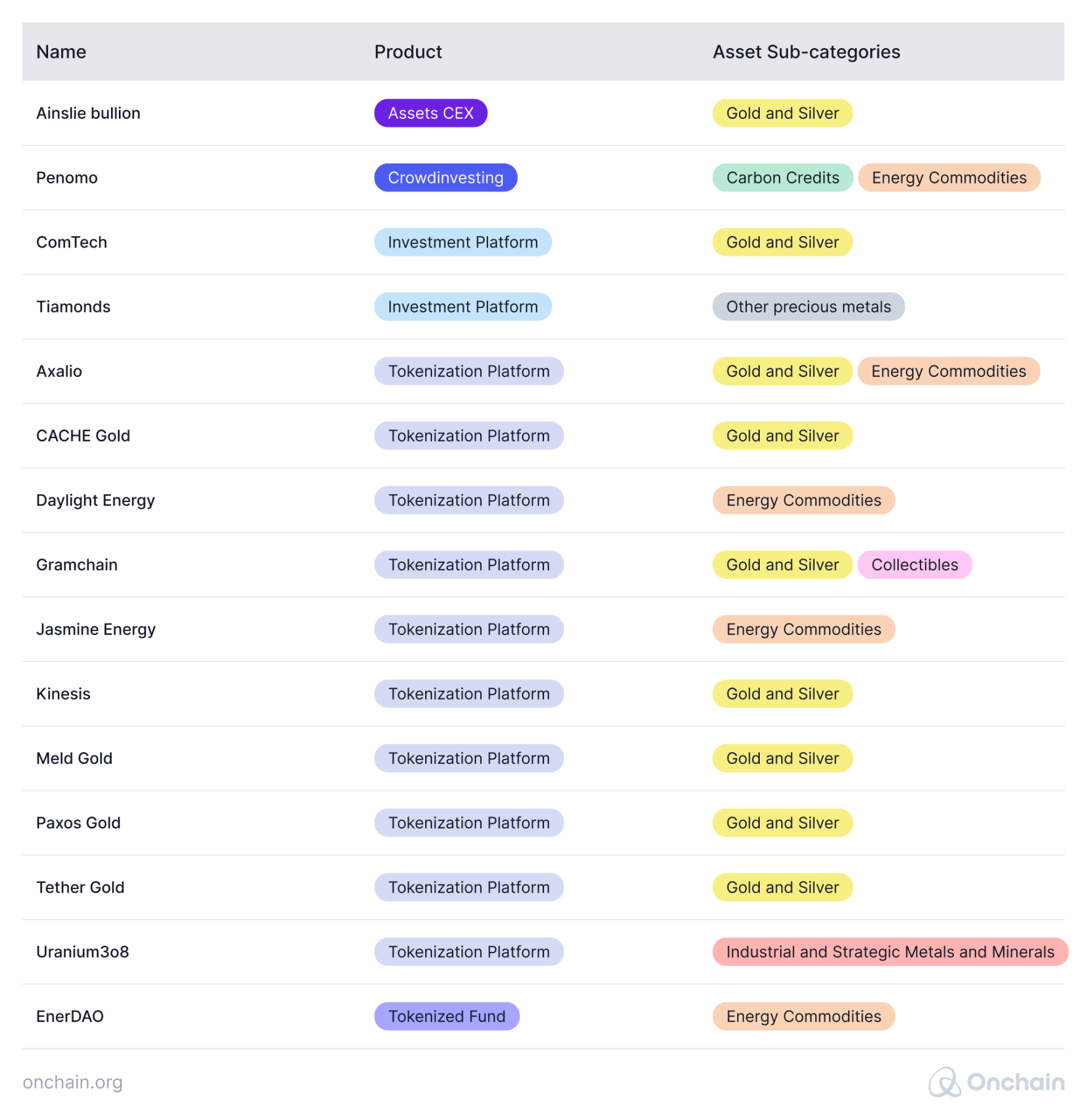

Several noteworthy projects demonstrate the potential of blockchain in commodity trading. For instance, platforms like Komgo and Vakt are leveraging blockchain for energy and commodities trading, aiming to enhance efficiency and transparency. Commodities make up 6% of all RWA categories represented.

Financial inclusion & reducing poverty

Two aspects are significant here in making financial products and means more widely accessible in emerging markets:

- Fractionalization and tokenization: RWA in commodities enable more accessible and affordable financial investments and/or services, especially in underbanked regions. The concept of fractionalization allows you to co-own gold bars or precious metals through mobile and web wallets.

- The ability to track and trace: Blockchain can also support efforts to certify sustainability of smallholder farmers, potentially enhancing the value of their products. Initiatives such as the Programme for the Endorsement of Forestry Certification are exploring blockchain for tracing wood products through the supply chain all the way back to the forest. The goal is to fight deforestation through certification and support local communities.

Fighting inflation & boosting investments

Commodities tend to maintain their real value independent of currency fluctuations. By putting them onchain as Real-World Assets, more people can benefit from and access such inflation hedging.

Assets like gold can act as a hedge against inflation. When the value of fiat currencies decreases due to inflation, the value of gold often rises. This can help protect the purchasing power of individuals and safeguard their savings, especially in regions where inflation rates are high.

- Deepika Karanji, Co-Chair, Hyperledger India Chapter

Moreover, the tokenization of commodities for fractional ownership lowers the entry barrier for small investors.

Examples include:

- Umoja Finance – synthetic options to hedge tokenized RWA exposure

- LandX – commodity vault protocols provide investors with an inflation-hedged return backed by a legal contract secured by the underlying farmland.

Improving the administrative infrastructure

Many parties involved in commodities trading are agents, brokers, and other intermediaries with little value input. Real-time transactions and settlements on an immutable ledger eliminate the need for extra middlemen and simplify the entire process. Other obvious outcomes are reduced fraud and corruption and enhanced security.

Democratizing access to the commodities markets opens it to more, smaller participants. We are talking about those who would traditionally remain excluded due to the lack of infrastructure or resources.

An example is GAVE, a public blockchain that gives producers access to more market opportunities without incurring additional costs. It’s a one-stop shop to manage the entire trading process without leaving the platform, from offering the product to signing the contract. You can trade any commodity, from Soybeans and coffee beans to heavy metals.

Another advantage of commodity blockchain systems for commodities offers is that you can automate many aspects of the trading process.

What’s coming next? We can anticipate the following global trends to make their way into the blockchain space as well:

- Integration of IoT combining blockchain for real world tracking

- Integration of AI for predictive analytics in commodity trading

Traction

We identified several promising pilot projects and growing industry interest in commodity RWAs. However, looking at the overall RWA landscape, adoption is still lagging. Among the top 25 RWA projects, only 3 focus on commodities, which is 12%. And when we take the total of 325 RWA projects, the percentage plunges to 4.6%. You’ll immediately wonder, why? The answers may be in the next paragraph (at least partially).

Limitations

It remains to be seen if RWA and blockchain in commodity trading can turn into the next “killer app.” Industry leaders have yet to come to grips with blockchain technology.

- The technology has drawbacks for some in the market. Greater transparency results in fairer prices and might impact the profits of traders, especially the market leaders.

- Many companies have invested huge sums in IT systems to manage the complex task of commodity trading to gain a competitive advantage over rivals. Blockchain technology means taking a step back and jeopardizing what they gained.

- On top of that, onchain commodity trading would require further investments. The simplification of the process would also remove the advantage of those IT systems purchased in the first place.

- In trading, collateral is often used to mitigate credit risk. Parties hold this as a form of security until the trade is settled. In a real-time settlement system, the collateral would be released faster. The early release of collateral reduces the time window in which potential issues can be detected, such as non-payment or market fluctuations.

In terms of regulations, adding decentralized ledger systems presents a serious challenge for the complex web of regulations that govern global commodity trade.

Hesitation and resistance from key players in commodity trading leads to market fragmentation. Only certain parts of commodity trading are ready to operate on the blockchain, while the rest remains traditional.

Interoperability gaps present additional issues calling for solutions. Not all trading platforms are compatible with each other. And then, there’s the gap in knowledge and understanding of blockchain-based solutions among market participants.

I believe a lot in agriculture and other commodities: Almost 45% of the population in the world lives in households where agricultural activities represent the main occupation. 20 million people work in mines, and many more are impacted by it. We are talking here about a sector with many problems known for decades and unbalanced power structures.

- Lucas Zaehringer, Founder & Blockchain Positivist, Positive Blockchain

Rank 4. ReFi – Regenerative Finance

Impact Score: 51.2

RWA’s most promising potential: improving energy-related infrastructures.

ReFi is a concept that combines DeFi with sustainable, regenerative actions. The goal is to provide inclusiveness by incentivizing the participants to reach environmental goals. Blockchain adds extra value and ease in achieving this through decentralization. ReFi has the potential to impact local emerging communities with global participation and liquidity.

Moving the economy closer to where value is originally generated allows the community to be included in the value sharing. In addition, with more accessible funding, additional investment opportunities are created. International investors can support and participate in local communities and projects. Newly developed ReFi methodologies support landholding realities in the global south with its many smallholders.

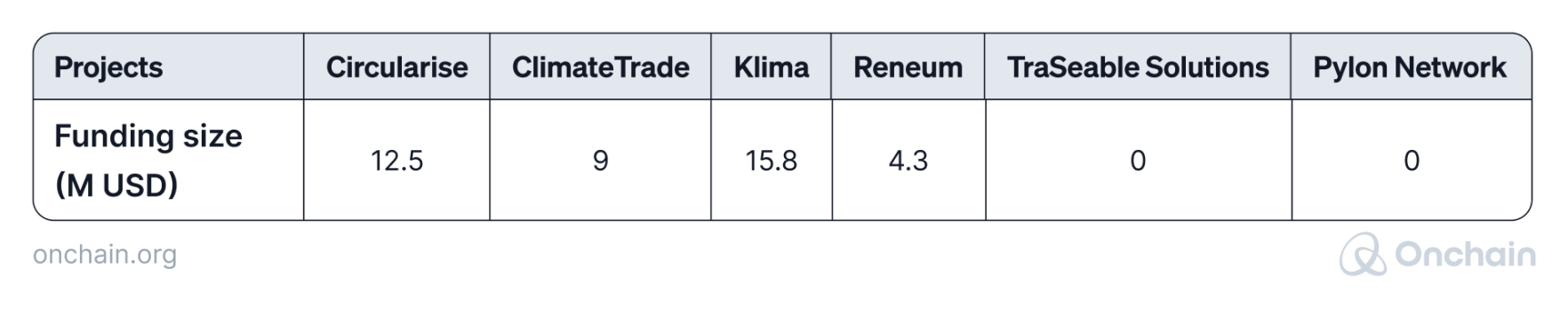

Investments in this RWA category are relatively low compared to others. On the other hand, the vast number of active projects demonstrates that blockchain ReFi has future potential.

A more even distribution of projects across global locations could lead to more effective allocation of funding. Most of the generated value gets exported to headquarters regardless of where the impact and development are created.

Existing ReFi projects are not necessarily adopting blockchain technology. The fact that blockchain is not the only technology that facilitates ReFi adds challenges and competition. There are implementation obstacles posed by the concept itself, regardless whether blockchain is applied or not.

Financial inclusion

Innovative financing systems can ease some of the hardships small enterprises face and advance financial inclusion.

Examples are projects run by Nairobi-based IBM researchers and Twiga Foods. Twiga is a food distribution company that uses blockchain to assist farmers in getting loans. 220 retailers in Kenya are using the platform.

The financing system simplifies the process of obtaining funding. Typically, this is a major challenge due to high costs, collateral requirements, and lack of credit score. Credit providers gain confidence because creditworthiness is calculated by analyzing purchase records on mobile phones. The whole process is managed onchain.

Reducing poverty

Quantifying the direct impact of ReFi in reducing poverty is tricky. It’s evident that RWAs can stimulate economic growth by supporting local businesses and farmers, improving infrastructure, and fostering sustainable development. This, in turn, helps in lifting communities out of poverty by creating a conducive environment for entrepreneurship and trade.

We can see how this works with the example of Buhle Farmers’ Academy. The institution takes part in the ReFi project SunExchange and generates revenues from implementing solar panels invested onchain. The funds are then reinvested in trainees from all over South Africa who learn practical farming and management skills in various farming sectors, including vegetables, crops, poultry, livestock production, and mixed farming. This helps farmers to start their own businesses and rise above poverty.

Fighting inflation

ReFi helps fight inflation in emerging markets through diversification into stable assets in three key areas: tokenization of agricultural goods or assets, renewable energy, and real estate. The fact that the tokens can be traded counteracts inflation. Investments are paid in more stable assets than NAIRA or other hyper-inflated currencies.

Boosting investments

The map below shows where SDG’s (Sustainable Development Goals) apply, which means investments are currently being boosted. In addition to the strong markets like the USA and Australia, there are countries in Africa and India that are receiving investments based on SDG’s.

Traction

ReFi projects are mostly in the pilot and testing phase in regions like Asia and Africa, but also parts of Europe and the USA.

Out of the 1477 Refi projects launched, 540 have been inactive since. This still indicates that approximately 60% of the projects with a positive impact intention are still active. Moreover, 244 out of active projects focus on climate and environment.

The exact amount invested globally into actual ReFi projects is difficult to measure. We do know that ReFi infrastructure and governance projects have received over $50M+ USD in investments.

Limitations

Projects supporting Sustainable Development Goals are scattered around the world. Many address emerging markets, and we can assume it’s because their legal status is ‘green to go’ in those countries.

However, a closer look at specific projects shows that most headquarters are located in the United States. In other words, the revenues are not necessarily shared where they are generated – the emerging countries. Often, the final beneficiaries are developed countries and not the ones in need.

Rank 3. Private credit

Impact Score: 51.4

RWA’s most promising potential: increasing financial inclusion and stimulating business growth in emerging markets.

Private credit refers to loans by non-bank lenders, such as investment funds and specialty finance companies, that aren’t issued or traded on public exchanges. It has become a significant asset class, with a global total of $1.5 trillion in assets under management, including dry powder (uninvested capital).

This usage of RWAs has outperformed traditional fixed income in recent years. Between 2020 and 2023, the RWA-based private credit sector shows an annual growth rate of 23%.

Impact private credit is also gaining traction as an innovative way to invest beyond the bottom line, challenging the common view that impact investments are only possible via equity.

Financial Inclusion & reducing poverty

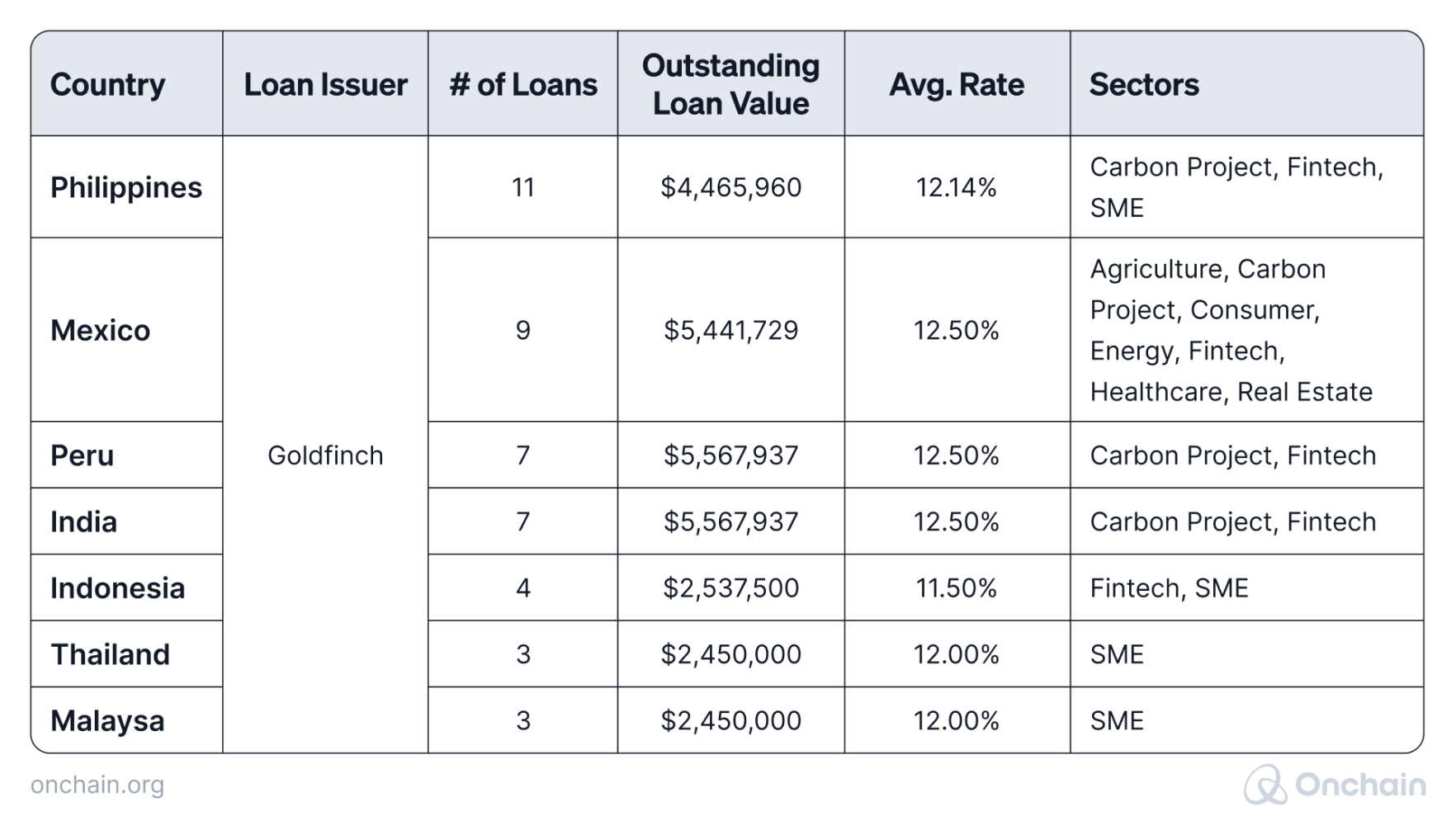

According to RWA.xyz, there has been a 133% surge in active private loans via digital ledgers since the beginning of 2023. The total value is currently (January 2024) at around $581 million. Most loans are issued to countries in emerging markets e.g. the Philippines and Mexico.

Credit underwriting, information sharing, and due diligence, identity and permissioning, and risk management are just some of the examples of services needed. On an infrastructure side, compliant and viable markets that can facilitate secondary market trading and leverage RWA as collateral in further utility markets are important

- Asad Khan, Partnerships and Business Development, Centrifuge

The Impact Database of the Phoenix Investment Group shows 158 private debt impact funds focused on emerging markets targeting UN Sustainable Development Goal (SDG) 1, aimed at eradicating poverty.

The capital accessed on Goldfinch has now reached over a million people across 20+ countries. The initiatives range from providing accessible debt to early-stage and sustainability-focused agrotech companies in Mexico to financing small business ownership in Kenya and beyond.

Fighting inflation

Private credits are an excellent hedge against inflation and rising interest rates. Companies generally receive them with floating interest rates, making it effective in combating inflation.

According to current Trading Economics data, the US has seen 1.6% year-over-year GDP growth, and the Euro Area has seen 3.9% growth. Here’s the interesting fact: the majority of Goldfinch’s Borrowers’ regions have seen higher growth, up to 13.5% — displaying the strength of emerging market economies during global downturns.

In addition, emerging market credit funds and fintechs with proven lending track records continue to display successful models that are still unknown to North American and European businesses. They seem to prove themselves during periods of inflation and economic uncertainty.

Boosting investments

The IMF (International Monetary Fund) noted in their recent Global Financial Stability Report that DeFi could generate up to 12% in annual savings for borrowers when comparing DeFi vs. non-bank financial sources for emerging markets. These figures demonstrate an enormous advantage to tokenized private credit utilization.

Since launching in early 2021, Goldfinch has doubled its active loans every two months (154x growth), now reaching a value of over $100M. The main beneficiaries are fintechs and credit funds in emerging markets.

Current traction

Private credits have seen an 89% increase in investments in 2022, marking the highest increase ever, compared to previous periods.

The establishment of private credit as an asset class, with improvements in the way these assets are exchanged and traded, will have the largest impact on everyday individuals. Private credit is typically the asset class in which small and medium businesses are able to tap into capital markets financing.

- Asad Khan, Partnerships and Business Development, Centrifuge

The market in emerging countries has seen substantial growth, with $1.4 trillion in outstanding allocations and a significant increase in fundraising from 2009 to 2019.

Take Jia as an example and their dedication to serving small businesses in emerging markets. The company launched a $100K pool on Huma in May this year, which it used to originate loans to more than 500 borrowers in Kenya and the Philippines.

Limitations:

- Despite the growing acceptance of tokenization, regulatory frameworks are still evolving at a dawdling pace. This causes uncertainty and potentially leads to legal issues in some jurisdictions.

- The investor base for tokenized private credit is still developing. Many traditional investors may be hesitant to engage because they are unfamiliar with the technology and perceive it as riskier than it is.

As with any financial asset, tokenized private credits are subject to market volatility. This risk can be amplified in the crypto market due to its nascent nature and high volatility.

The other challenge is the investor side– i.e., attracting sophisticated traditional investors. They will only come once credible rating of onchain credit is available. Obligate uses Credora here. But the true value will come once S&P etc. will move onchain.

- Benedikt Schuppli, Co-CEO, Obligate

Rank 2. Agriculture

Impact Score: 51.8

RWA’s most promising potential: reduce poverty in the least-developed countries.

Monitoring crops, managing supply chains, and opening new investment opportunities are the primary areas where RWAs can be beneficial in agriculture. Similar to ReFi, blockchain in agriculture allows small-scale farmers in emerging markets to access liquidity and scale their businesses faster and more efficiently.

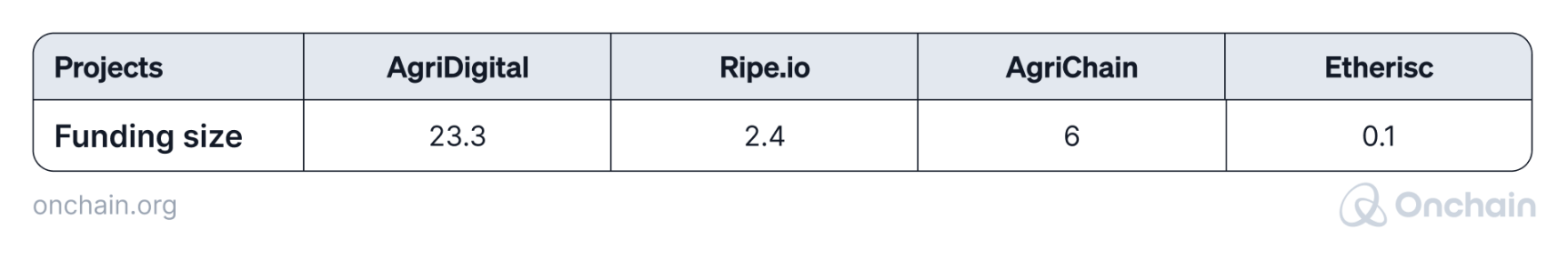

RWA technology in agriculture is still young. Many early projects fail or simply cease operations. Hence, we will turn our attention to the surviving initiatives. They bear significant potential for a meaningful impact, especially in emerging markets where agriculture is crucial for survival. This includes regions like Africa, South Africa, and Asia (blockchain adoption in agriculture here remains limited).

Compared to other Real-World Assets categories, agriculture has seen fewer investments despite its critical role in daily life. There’s substantial room for growth in making agricultural resources more accessible to farmers globally using blockchain technology.

AFEN is actively engaged in various RWA niches in Africa, notably through the AFEN Launchpad program. Currently, we are accelerating tokenization projects with a focus on Whiskey and Gold. This initiative is just the beginning, as our future plans involve expanding our efforts, particularly in the realm of agriculture.

- Deborah Ojengbede, Co-founder, AFEN Blockchain Group

Financial inclusion & reducing poverty

Blockchain projects like UfarmX advance financial inclusion by improving access to funding, stores, and logistics. They’ve helped over 600 small farmers and lifted them out of poverty.

In India, agriculture is the primary source of income for a large percentage of the population. Farmers face challenges accessing financial services and insurance, which could help mitigate the risks associated with agriculture, such as crop failures, pests, and adverse weather conditions.

Stimulating business activity and growth

A great example is One million avocados, working in collaboration with Dimitra Technology. The project develops data collection methods that integrate GIS (Geographic Information Systems) on the blockchain and is applied in Kenya. The digital assets created allow for precision agriculture based on a variety of data sets, including yield, tree health, etc. The assets serve as a testament to the positive impact of each investment, offering continuous updates and transparent valuation.

Traction

- We analyzed the locations of currently active RWA projects in agriculture projects. The data shows the majority in emerging markets in Africa, India, with East-Asia gaining traction.

- 10% out of all active projects in the positive impact sector address agriculture. Despite the hype cooling down, we found that about 60% of the 143 listed projects are active, and only a little more than 40 have gone inactive.

- The scope of investments in agricultural projects is at a similar level as positive impact ReFi projects. Looking at the major players in the field, their total investments reach around $30M.

Limitations

Similarly to ReFi, the agriculture sector has regulatory limitations in market regions like Africa. Insufficient regulation has a significant impact on the revenue generation potential in this context. Cryptocurrencies and blockchain are allowed only in a few African countries.

Nevertheless, decentralized technology is clearly popular in agricultural applications. And, as our analysis showed, it’s Ethereum that is used in most of the emerging markets as the go-to technology for overcoming these limitations.

Rank 1. Stablecoins

Impact Score: 57.2

RWA’s most promising potential: increasing financial inclusion in emerging markets and providing individuals with unique business opportunities.

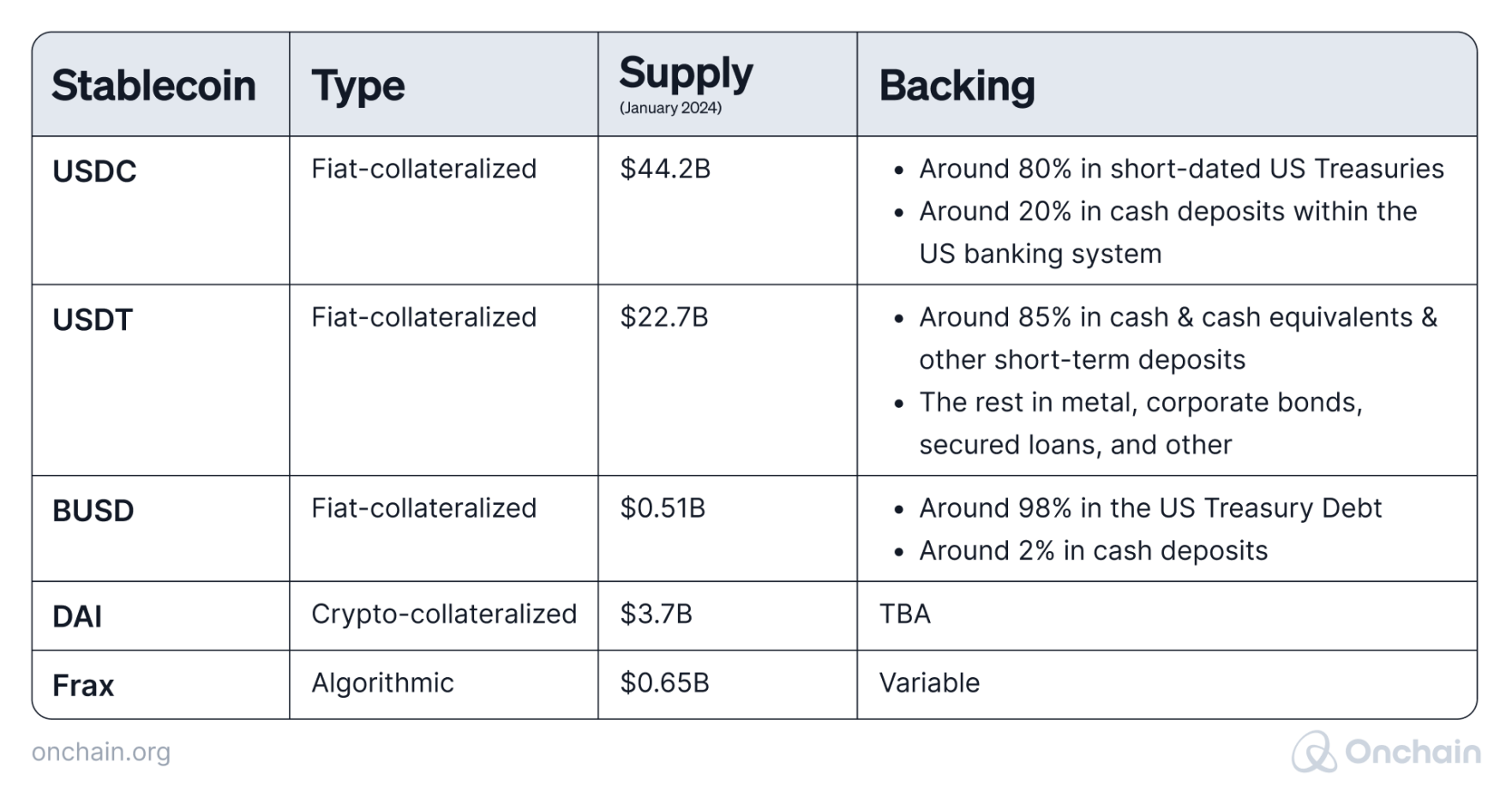

Stablecoins may serve as the pioneering example of Real-World-Assets on blockchain. These cryptocurrencies are backed by physical assets to maintain the 1:1 peg with the underlying fiat currency. Often, these assets are commodities or cash.

Not all stablecoins are equal, and as the Web3 industry develops, there is no need to rely only on relatively centralized USDC or USDT. DAI, a top example of a crypto-collateralized stablecoin, is backed by cryptocurrencies as a reserve, and they remain onchain. It’s a riskier type of asset but, at the same time, more aligned with Web3 primitives.

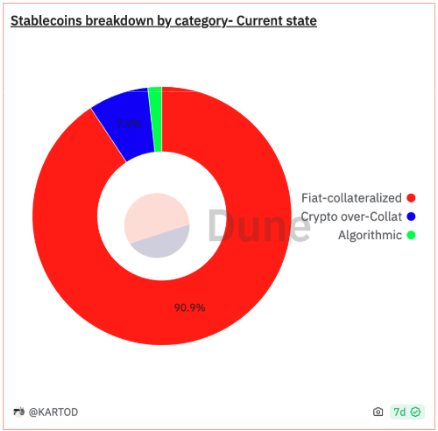

Although there are other types, this report refers to stablecoins with a backing that fits the following definition: “an asset that exists in the physical world but can be brought onchain.” In other words, stablecoins backed by cash, commodities, or other real-world resources. These stablecoins fit RWA primitives and remain the dominant force in the current Web3 market.

Financial inclusion & reducing poverty

Stablecoins address three main concerns related to the lack of financial inclusion in emerging markets: banking the unbanked, enabling cross-border transfers, and enabling transfers using a stable currency.

Fortunately, not only stablecoin issuers and fintech startups are concerned with improving the situation. In December 2023, the biggest consumer bank in Latin America, Brazilian Nubank, added USDC to its offering. This step instantly opened the stablecoin opportunity to over 90 million consumers.

Usually, the stablecoin business model relies on earning yield on the underlying assets of the coin, i.e., a fiat currency or commodity. Glo Dollar, a project aimed primarily at reducing poverty, decided to donate the entire yield to people in need and rely only on individual investments from people willing to support their ambitious initiative. This way, they should be able to lift one person out of extreme poverty for every $20,000 of Glo Dollar.

While the potential of RWA investments is significant, it's essential to address challenges such as regulatory frameworks, education, and infrastructure limitations to fully realize the poverty-fighting impact of RWAs in the African region. Collaborative efforts between governments, businesses, and the financial sector will play a crucial role in harnessing the transformative power of Real-Word asset investments

- Deborah Ojengbede, Co-Founder, AFEN Blockchain Group

Fighting inflation

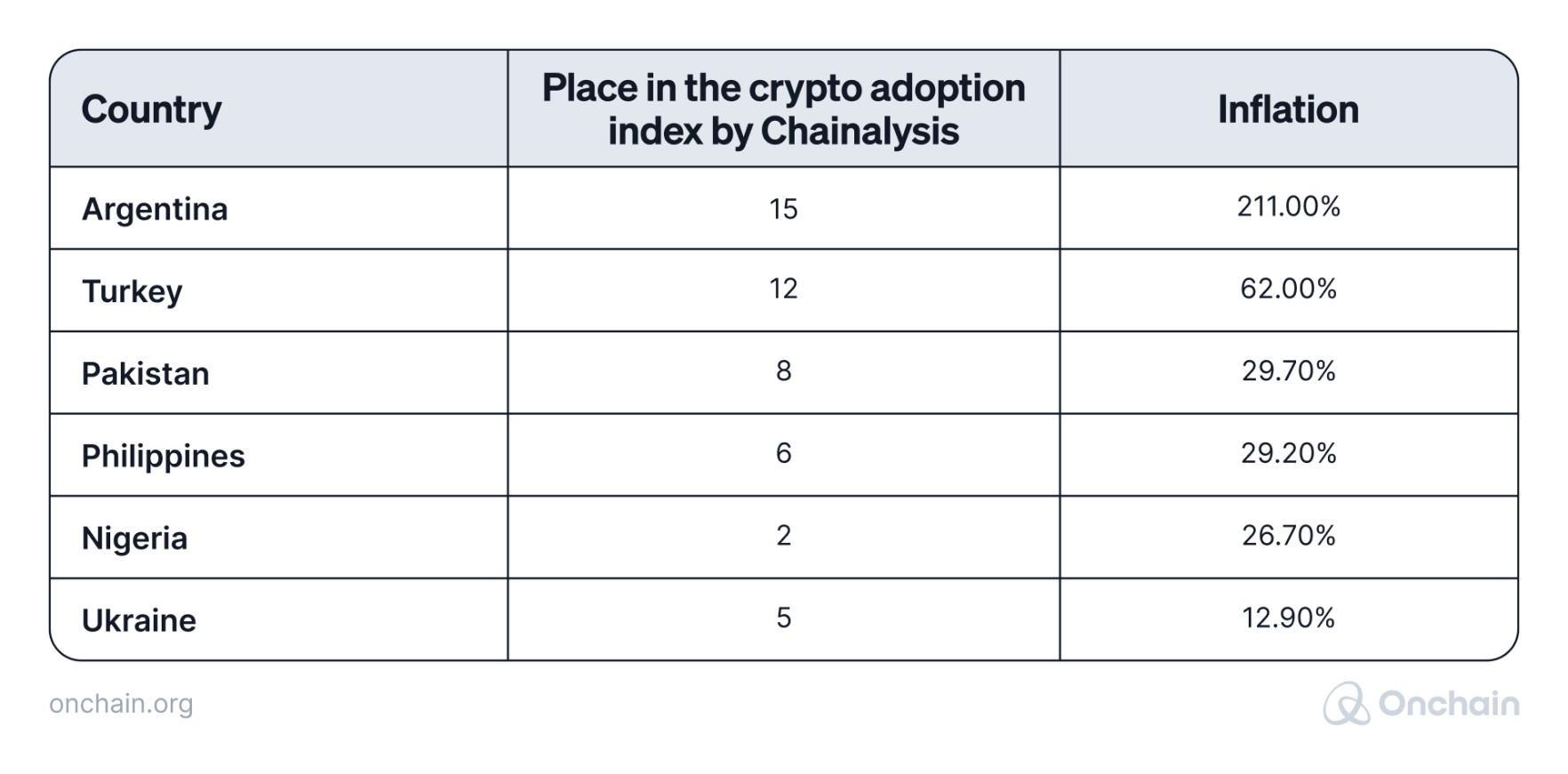

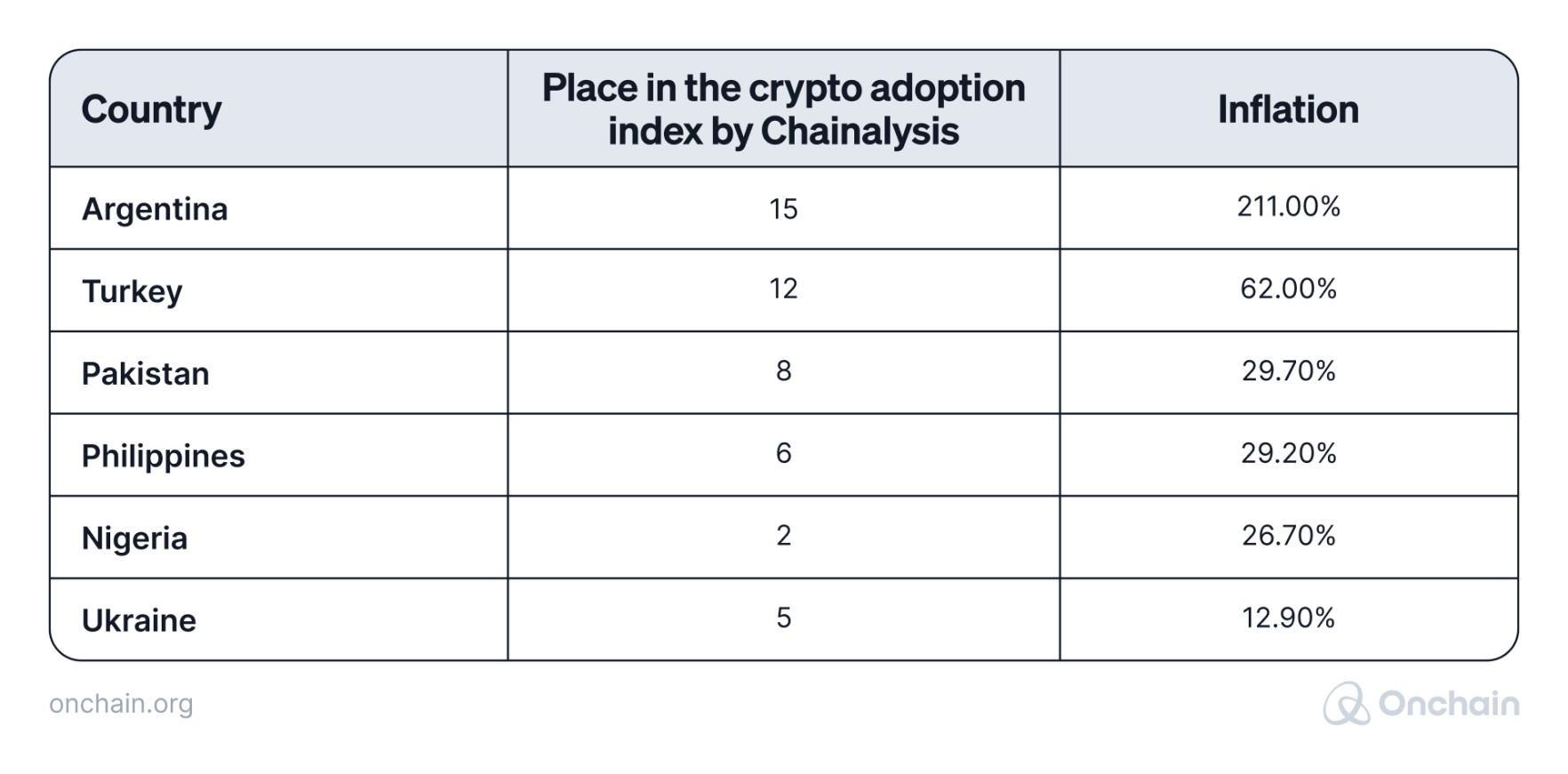

Stablecoins are considered a hedge against inflation in frontier and emerging economies. We can identify a correlation between the level of stablecoin adoption in a country and the irrational monetary policy of the country’s central bank. It appears that the less rational the policy, the higher the adoption.

Out of 20 countries included in Chainalysis’s Crypto Adoption Index 2023, at least six suffer from dramatic inflation rates. One such country is Argentina, which has a yearly price increase of 211% as of 2023.

RWAs provide myriad benefits for all users, and this is far from exclusive to Midas tokens. It extends to all legitimate Stablecoins, which are among the most critical sectors for the growth and overall health of DeFi.

- Dennis Dinkelmeyer, Co-Founder and CEO, Midas

Boosting investments

For stablecoin issuers, Africa and other frontier and emerging economies are a perfect place to gain market share. These projects partner with local startups and try to grow businesses there.

An example of such entrepreneurship is Circle, which recently partnered with Aza Finance. The initiative aims to increase financial inclusion and subsidize local businesses (especially from the fintech category) that may potentially choose USDC over other stablecoins as its primary means of payment.

Stablecoins like USDC allow individuals in emerging markets with a lack of access to dollars and other international currencies to transfer money cheaper, send internationally (not with 10% fees like WesternUnion) but also invest in stable, yielding products like Bonds to which they currently don’t have access to, especially a problem in high-inflation countries.

- Benedikt Schuppli, CEO, Obligate

Other protocols (focused on RWAs in general, not stablecoin issuers), such as Stellar, create funds specifically supporting emerging economies. For example, Stellar Development Foundation launched a “Matching Fund” boosting investments that could improve financial inclusion in these regions.

Moreover, based on the data from RWA.xyz, emerging and frontier economies are the biggest beneficiaries of private credit issued in stablecoins. This shows that such instruments are a valuable addition to other RWA niches that focus on improving the financial situation of the population in emerging markets and strengthening the economy.

Improving the financial infrastructure

In francophone Africa, 162 million people use a fiat currency called CFA (Communauté Financière Africaine). In 1964, the currency was devalued by 50% by French authorities, who still controlled it. Apps like Ejara or Aza Finance promote the use of stablecoins as a more stable option for the people (pun intended).

RWAs provide a permissionless route for obtaining dollar-denominated stablecoins, particularly crucial in struggling or growing economies. They enable the low-cost, global transfer of funds without paying an intermediary fee. Also, RWAs serve as a hedge against crypto’s volatility, offering investors a means to take profits without moving the capital offchain. And lastly, they’re used as a Treasury backing for countless protocols and act as the primary liquidity hub for DEXs and Lending markets

- Dennis Dinkelmeyer, Co-Founder and CEO, Midas

Also, looking at the sometimes implausible monetary policy in many emerging economies, we see horrendous inflation rates. For example, 211% in Argentina, 62% in Turkey, or 26% in Nigeria demonstrate the need for businesses and individuals to protect themselves against the consequences of the government’s inability to stabilize the country’s currency.

Current traction

The Chainalysis Global Crypto Adoption Index states that of the ten countries with the highest crypto adoption, four are emerging economies, and 5 are frontier economies. These countries lead the global stablecoin adoption movement.

Also, lower-middle-income countries like India or Nigeria maintained the highest adoption rates after the 2022 drama.

Limitations

In 2023, emerging countries from the G20 raised concerns over stablecoins. They claimed that the alternative currency may threaten their monetary policy. From a government’s point of view, this is true, however, it’s not negative for the population.

Generally, governments of countries with the highest need for financial inclusion and the highest adoption rate are often vigorously opposed to cryptocurrency. The Central Bank of Nigeria, for instance, initially took a hostile stance toward cryptocurrencies and even proposed a complete ban.

Technological obstacles in emerging countries are not necessarily related to crypto or blockchain. Projects and users struggle with more basic challenges that arise from poor, unstable or non-existing internet connectivity (especially in Africa).

However, as you’ve learned in the section about DePins, there are Web3 solutions to address these challenges.

The collapse of TerraUSD triggered concerns in the financial and crypto space over the true stability of stablecoins. It caused a lot of harm to the credibility of this financial instrument.

The ranking at a glance

What can we learn from the ranking and the research that produced it? Let’s quickly recap:

- In general, RWAs can contribute to increasing financial inclusion, reducing poverty, and stimulating business activity – if not directly, then indirectly.

- Among the categories, stablecoins clearly show the highest potential to impact emerging economies positively. The runners-up are agriculture, private credit, and ReFi, all with similar potential.

- However, we found many challenges in all application areas – mainly regulatory, political, and technological. The best option to overcome the obstacles and utilize the potential is to combine different RWA concepts, such as DePIN and Stablecoins or agriculture and ReFi.

In the next section, we’ll take a close look at actual business concepts and use cases.