When apps took over our mobile devices, blockchain advocates declared: Whatever they can do, we can do better! With crypto rewards added to routine activities, who would resist? Massive investments in technology produced Play-to-Earn , and Move-to-Earn apps. The rest is history. This chapter investigates why they initially failed, what’s left of them, and how recent infrastructure developments may bring a rebound for consumer-targeting crypto apps.

Crypto Apps for Consumers Are Here to Stay

Partners

-

A next-gen membership and payments platform for restaurants, using blockchain to power personalized dining experiences, loyalty rewards, and seamless transactions.

Visit website -

The first self-custodial Visa® Debit Card, spend crypto anywhere Visa® is accepted with up to 5% cashback. (Currently available in EU)

Visit website -

A curated directory of leading crypto consumer apps, helping users discover, track, and engage with top Web3 applications in gaming, social, finance, AI, and many more across various blockchain networks.

Visit website

2. The Crypto Consumer Apps Landscape: Moving Beyond Speculation

A review of 350 projects and a survey of 1000+ consumers reveal which app type dominates the Web3 market: payment services. 25.91% of respondents use them. Here, we’ll break down the evolution of crypto debit and credit cards and the differences between Web2 and Web3. More intriguing is the shift from speculative to tangible value that spreads across the board. How do projects leverage this, and where does AI come into the picture?

3. Beyond Real-World Payments: DePIN Consumer App Case Studies

Limited earnings aren’t necessarily a deal-breaker if the utility is strong. Simplified hardware requirements and consumer-friendly UX are key for DePIN projects to reach beyond a crypto-native audience. That’s only one of the inspiring conclusions after sampling four different DePIN apps. Michal Moneta systematically tested Silencio, Grass, DIMO, and WifiMap. He analyzes functionalities and shares what makes some more attractive to mainstream consumers.

4. Inside Blackbird: A Web3 Loyalty App Built for Mainstream Consumers

Another in-depth consumer test. This time, Kade Garrett tests the Web3 loyalty app Blackbird. He walks you through the download and first use in a restaurant, shares feedback from other users and restaurant owners, and compares the app to Web2 competitors. Through his experience, you’ll understand what makes Web3 apps sustainable and how to conceptualize a Web3 app offering in a common consumer market. Get ready for some serious inspiration.

5. What Crypto Consumer Apps Must Fix to Achieve Mass Adoption

This chapter provides a roadmap for founders, investors, and even policymakers to a truly consumer-focused Web3 ecosystem. User-friendly design, regulatory alignment, and proven revenue streams for long-term viability must replace speculations. It’s not what we want; it's what consumers need. Take a deep dive into tangible utility, stable or redeemable token incentives, AI-assisted onboarding, and compliance-first frameworks. Projects offering these are emerging as clear winners.

Key Takeaways:

- Blockchain infrastructure is now optimized for success of consumer apps. Scalable Layer 1 blockchains like Solana and Sui, together with consumer-friendly Ethereum Layer 2 solutions such as Base, Lisk, and Soneium, created an optimal environment for crypto consumer apps. They lead to increased performance, reduced transaction costs, and improved reliability. These are excellent conditions to bring about adoption by mainstream consumers.

- AI-enhanced UX dramatically lowers adoption barriers. Complex UX and unpredictable transaction costs still present significant barriers, impeding mainstream consumer adoption. The integration of AI simplifies blockchain interactions. AI-powered onboarding and smart wallet technologies reduce friction for non-technical users, boosting retention rates by up to 40%. By the end of 2026 or earlier, we anticipate Web3 app usability to reach parity with Web2.

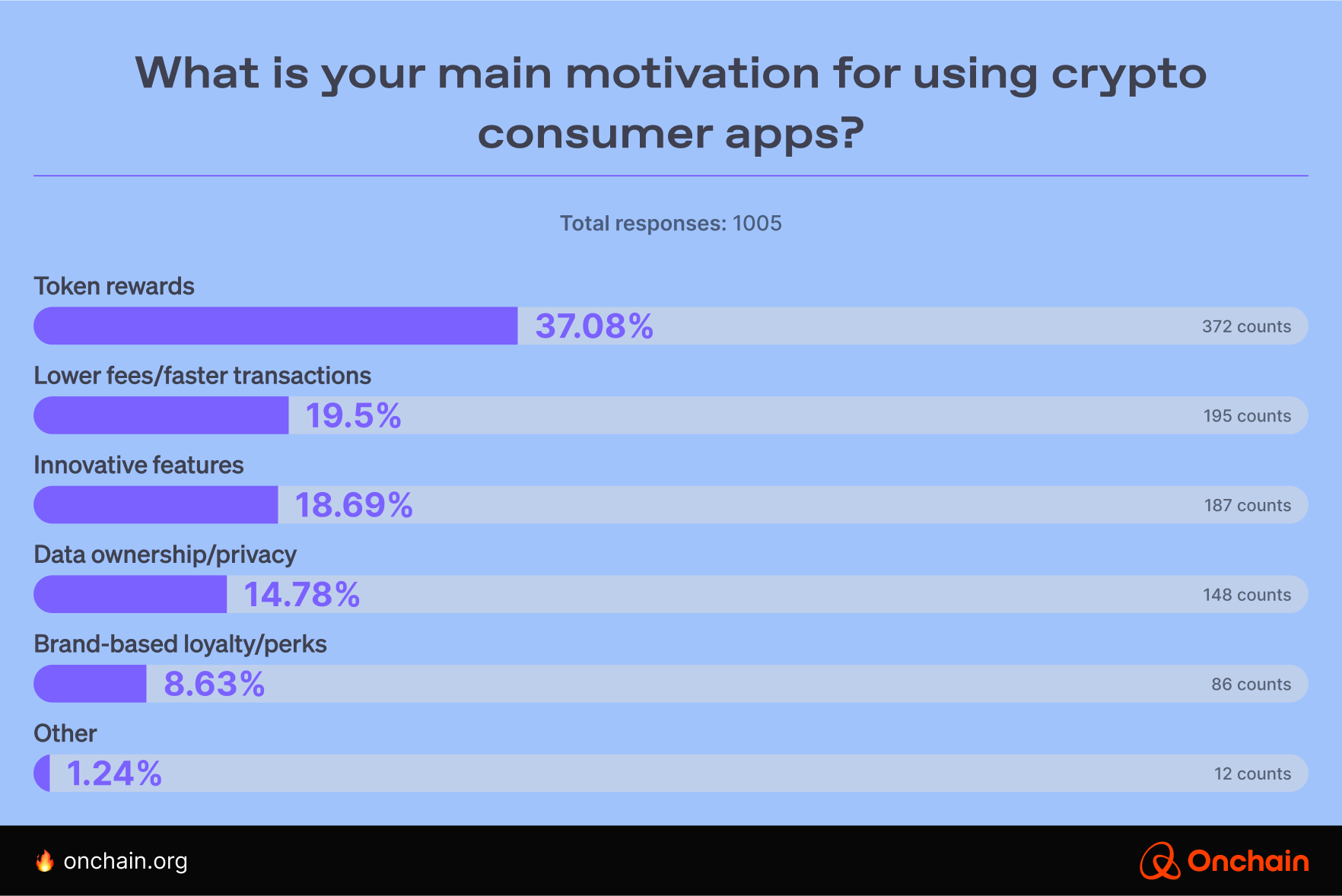

- Purely token-driven incentives have proven unsustainable. Apps relying solely on speculative token incentives, such as Axie Infinity (P2E) and StepN (M2E), saw sharp user drop-offs once token values declined. We see this as an indicator of the necessity of intrinsic, practical value and genuinely enjoyable user experiences for sustained adoption. The success of apps like WiFi Map point at the significance of offering practical, real-world utilities over purely financial incentives.

- Crypto payment solutions lead in adoption among consumer apps. Our global consumer survey conducted among over 1,000 Web3 app users, confirms that crypto payment apps are the dominant category. 25.91% of respondents state that they use them regularly. More and more consumers require borderless transactions and seek to reduce financial friction. This is also reflected in the rapid growth of crypto debit and credit card solutions.

- Regulatory uncertainty remains a substantial hurdle. Despite technological advancements, regulatory uncertainty and inconsistent licensing across jurisdictions continue to restrict growth and scalability. Recent developments indicate a change in attitude. Crypto regulations are being addressed with the sincerity they deserve. However, projects need to stay alert and be ready for quick changes.

- DePIN consumer apps see rapid growth but monetization remains a challenge. The DePIN sector has significantly expanded its reach. Projects increased user accessibility by shifting from costly hardware-dependent nodes to accessible smartphone-based “light nodes”. Despite the growing user numbers, monetization remains modest.

- Blockchain-powered loyalty programs achieve remarkably high retention.

Customer loyalty programs powered by blockchain consistently outperform traditional token-incentive models. Practical rewards, such as restaurant discounts offered by apps like Blackbird, drive user retention rates as high as 70%. This signals strong market potential for loyalty-focused Web3 solutions.

Led by

-

Leon Waidmann

Head of Research

Conducted by

-

Ananya Shrivastava

Research Analyst

-

Arin Soleymani

Head of Business Development

-

Michał Moneta

Leader & Chief Strategy Officer

-

Kade Garrett

Blockchain Writer

Contributors

-

Chris Braithwaite

Content & Technical Writer

-

Ruth M. Trucks

Head of Content

-

Veronica Kirin

Content Writer

-

Lucas De Melo

UX Designer

-

Adewale Aloba

Graphic Designer

-

Ashton Barger

Product Marketing Manager

-

Boris Agatić

Data Scientist

Thought leaders

-

Josh Ben-David

CEO, Pass App

-

Jennifer Roebuck

Chair, Lumen Prize

-

Robby Yung

CEO Investments, Animoca Brands

How did we approach the research?

The research was based on the "grounded theory." It means we had no specific presumptions before starting the work. The "business" part of the analysis relied primarily on qualitative research methods.

Our research framework

This report follows a multi-faceted research methodology to analyze the Web3 consumer application landscape. We combined qualitative and quantitative research methods to assess adoption trends, technological advancements, business models, and real-world use cases. Our approach integrates user surveys, onchain analytics, case study evaluations, and comparative market research to provide a well-rounded analysis.

Methodology

1. Data collection methods

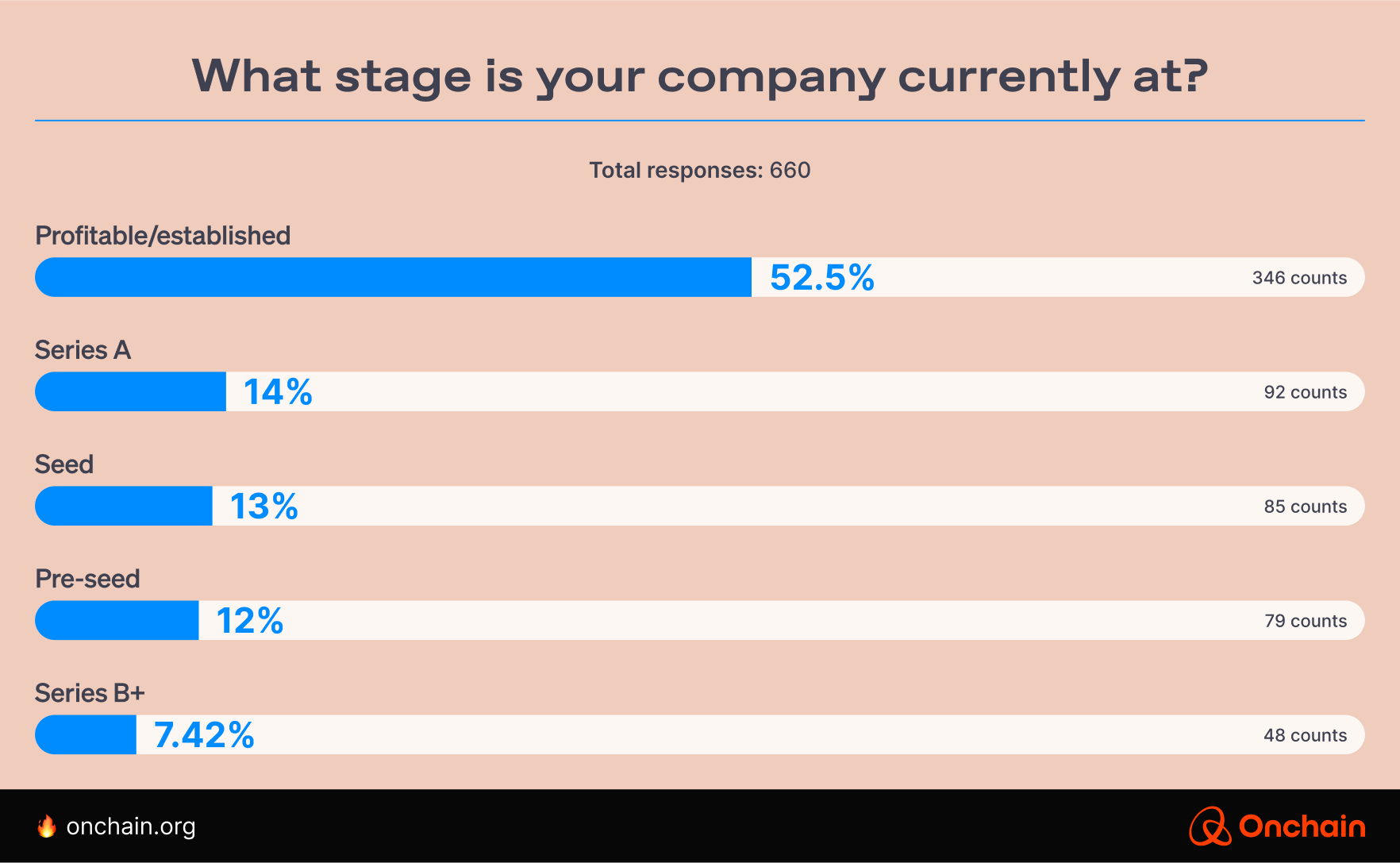

We conducted two comprehensive surveys: one targeting 1,005 Web3 users and another involving 660 founders and executives, all building or actively using consumer-facing blockchain applications. The survey gathered insights on adoption barriers, onboarding challenges, token incentives, and preferred ecosystems.

Survey participant breakdown:

1. Company stage (founders and executives)

2. Web3 consumer app involvement (users)

- Onchain analytics

We analyzed transaction volumes, active wallet addresses, and engagement metrics using Dune Analytics, Etherscan, and other blockchain data platforms to evaluate real-world traction. - Case studies

We conducted in-depth testing of Web3 consumer applications such as Gnosis Pay, Blackbird, WiFi Map, Silencio, and Fuse Pay. This allowed us to assess usability, onboarding processes, and retention strategies. - Comparative market analysis

We benchmarked Web3 consumer apps against traditional Web2 Fintechs and loyalty platforms such as PayPal, Stripe, and Revolut to identify competitive advantages and friction points.

- Industry reports and expert insights

We incorporated secondary data from market research firms, crypto-native think tanks, and regulatory bodies to provide a broader industry perspective.

2. Case study evaluation criteria

To ensure a structured and consistent analysis, we developed an evaluation framework that assesses each Web3 consumer app based on:

- Onboarding and UX

How easy is it for non-crypto-native users to set up and navigate the application?

- Incentive design and tokenomics

Does the app rely on sustainable token incentives, or does it depend on speculative token models?

- Real-world utility and adoption

Does the app solve tangible consumer problems or primarily cater to crypto-native users?

- Regulatory and compliance factors

Are there legal hurdles that could affect the app’s ability to scale?

- Revenue models and sustainability

Does the app generate revenue beyond token incentives, such as merchant fees, premium subscriptions, or other monetization strategies?

Applying this structured framework, we extracted actionable insights to highlight what works and what does not in Web3 consumer applications.

Research limitations

While this report provides a comprehensive analysis of Web3 consumer applications, you should note certain limitations:

- Rapidly evolving market

The Web3 industry changes quickly, with new technological advancements and regulatory shifts regularly emerging. Findings in this report reflect the current state of Web3 but may evolve.

- Survey sample bias

Despite efforts to include a broad demographic, survey respondents were primarily individuals already engaged with Web3. Survey results may underrepresent perspectives from mainstream consumers new to the Web3 industry.

- Limited geographic scope

While emerging markets play a crucial role in Web3 adoption, this report primarily focuses on North America, Europe, and selected Asian regions due to data availability.

- Challenges in measuring long-term viability

Many Web3 consumer applications are in early developmental stages, making assessing long-term sustainability and mass adoption potential difficult.

- Regulatory uncertainty

Web3 consumer applications operate in a fluid legal landscape. While we analyze current regulations, future policies may impact adoption and compliance strategies.