AI and Blockchain Disruption: Unveiling Perfect Synergy Use Cases

Partners

-

ORA enables verifiable AI inference on any blockchain.

Visite website -

AI company within life science, exploring onchain market developments for breast cancer data.

Visite website -

AI model designed to provide solutions and applications for the web3 industry.

Visite website

Key Takeaways

- It’s not about assessing whether or not combining AI and blockchain makes sense. The powerful synergy between the two became apparent from the very first industry report we analyzed. The question is, where will it be most beneficial?

- Currently, the largest group of Web3 project types provides other companies with AI-based tools. For example, Fetch.ai and Autonolas facilitate decentralized crypto-AI agents, while ORA Protocol gives them access to open-source AI development communities.

- The adoption of AI x blockchain convergence companies remains mediocre at best. Surprisingly, the industries with the highest adoption rate are healthcare and finance. In general, Web3 projects are more open to integrating AI solutions than the other way around.

- We found four application sectors leveraging this alliance the most: generative AI, battling fake news, micropayments, and smart contract auditing.

- AI & blockchain are used in synergy, mainly to address internal processes and enhance technological efficiency. We have yet to see use cases that provide solutions for more worldly concerns.

Where does blockchain meet AI?

Can blockchain be perceived as disruptive as artificial intelligence? Will rapid AI developments cause VCs to forget entirely about Web3? And does the blockchain world need AI only because of the energy created through the huge hype?

Despite the uneven attention the two technologies have received over the past few months, their disruptive power is quite comparable. However, there is no competition between them. Quite the opposite is true. We believe AI and blockchain can and should coexist and cooperate.

This research report reveals why and explores how.

Source: https://medium.com/@scalingx/exploring-the-horizon-the-convergence-of-ai-crypto-38086af96987

Our initial research for this report led us in a distinct direction. We quickly realized that it’s not about assessing whether or not combining AI and blockchain makes sense. The powerful synergy between the two became obvious from the very first industry report we analyzed.

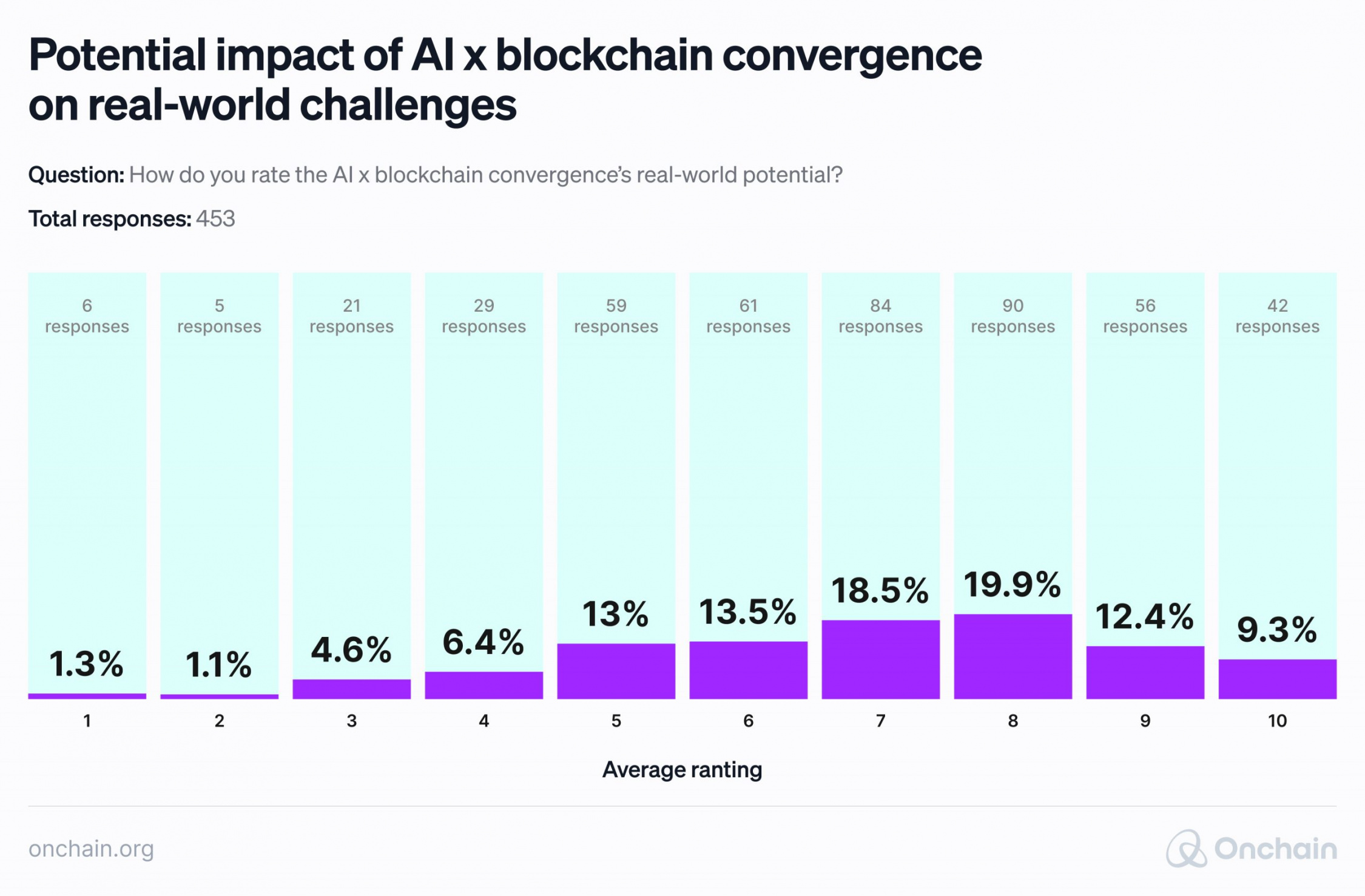

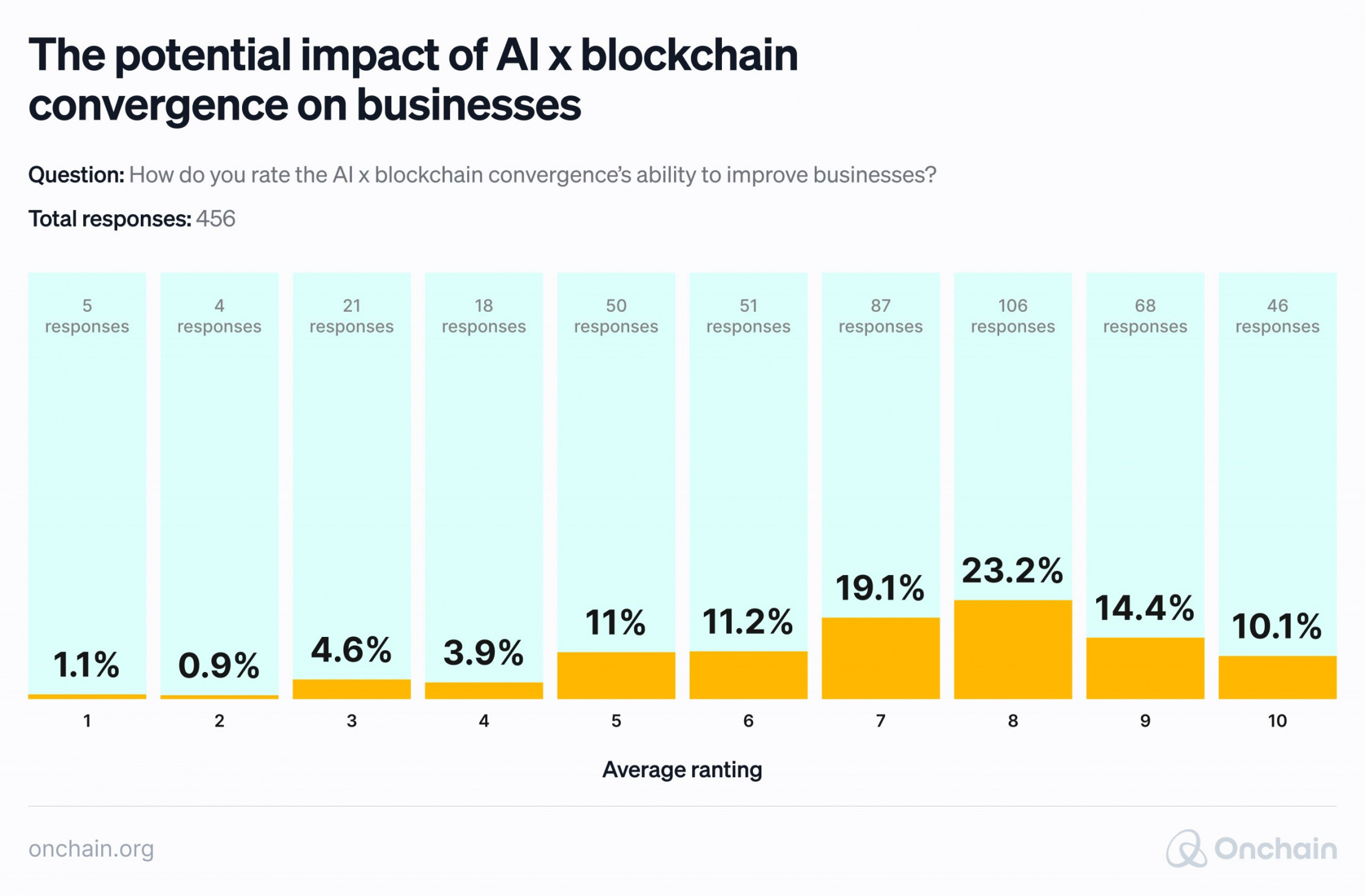

The data collected from the survey respondents (including people familiar with AI, blockchain, or both) further confirmed this assessment. This convergence’s transformative potential became apparent in real-world challenges and its ability to improve businesses.

Hence, this paper focuses on when and where the combination of AI and blockchain can bring the most value.

Is it particularly useful for a specific industry? Can it enhance or create a unique business model? Or are there internal company processes that are particularly “revolutionizable” by the convergence?

Stay with us as we dig deep into these critical entrepreneurial considerations.

Everything you’ve wanted to know about AI (but were afraid to ask?)

Before we embark on a journey to explore the most useful, promising, and popular synergies between AI and blockchain, let’s clarify the term that you are probably less familiar with: AI. We believe you already know a thing or two about blockchain.

What is artificial intelligence, anyway?

Artificial intelligence is a field of computer science that started in the late 1950s. It is dedicated to creating intelligent machines that can think, learn, and act autonomously – similar to humans. The idea is to make computers smart enough to carry out simple tasks that usually require human intelligence, like understanding language, recognizing patterns, or making decisions.

This is how AI operates in a nutshell: AI gathers data from various sources and preprocesses it for analysis and selection of appropriate algorithms for the task at hand. It trains machine learning models if needed, makes predictions or decisions based on the analyzed data, and incorporates feedback to improve performance over time. This enables AI systems to emulate human-like intelligence and autonomously perform tasks ranging from image recognition to recommendation systems and self-driving cars.

ChatGPT isn’t all that artificial intelligence has to offer

ChatGPT is a specific type of AI, like a powerful tool in a toolbox. It’s a large language model (LLM) that excels at generating human-quality text. But artificial intelligence is much broader. It encompasses everything from self-driving cars that learn to navigate to medical diagnosis tools that identify patterns in patient data.

What’s the difference between artificial intelligence and machine learning?

This is a common question, so how can we stop confusing the two? AI is responsible for achieving the overarching goal of creating intelligent machines, and machine learning is a technique used to fulfill it. Think of it this way: AI is the destination, and machine learning is one of the vehicles that can take us there.

Source: https://www.mlguru.ai/Learn/concepts-deep-learning

Where does blockchain technology fit into the picture?

Blockchain technology serves as the underlying technology for the infrastructure required for many AI tools. At the same time, blockchain adds value to AI projects and AI-driven tools by providing an additional security layer, transparency, decentralization, automated mining processes, data analysis, secure storage, and data management.

In simpler terms, blockchain creates a secure, transparent, and decentralized infrastructure needed for AI tools to function effectively in the world of open-source projects. And we’re happy to elaborate more on this in the following sections.

If you’d like to make yourself familiar with some of the critical terms surrounding blockchain x AI intersections before we dive in, please check out our short glossary.

Web3 AI x blockchain market

Let’s start by reviewing the current state of the AI x blockchain market, giving you an overview of the projects we’ll discuss here.

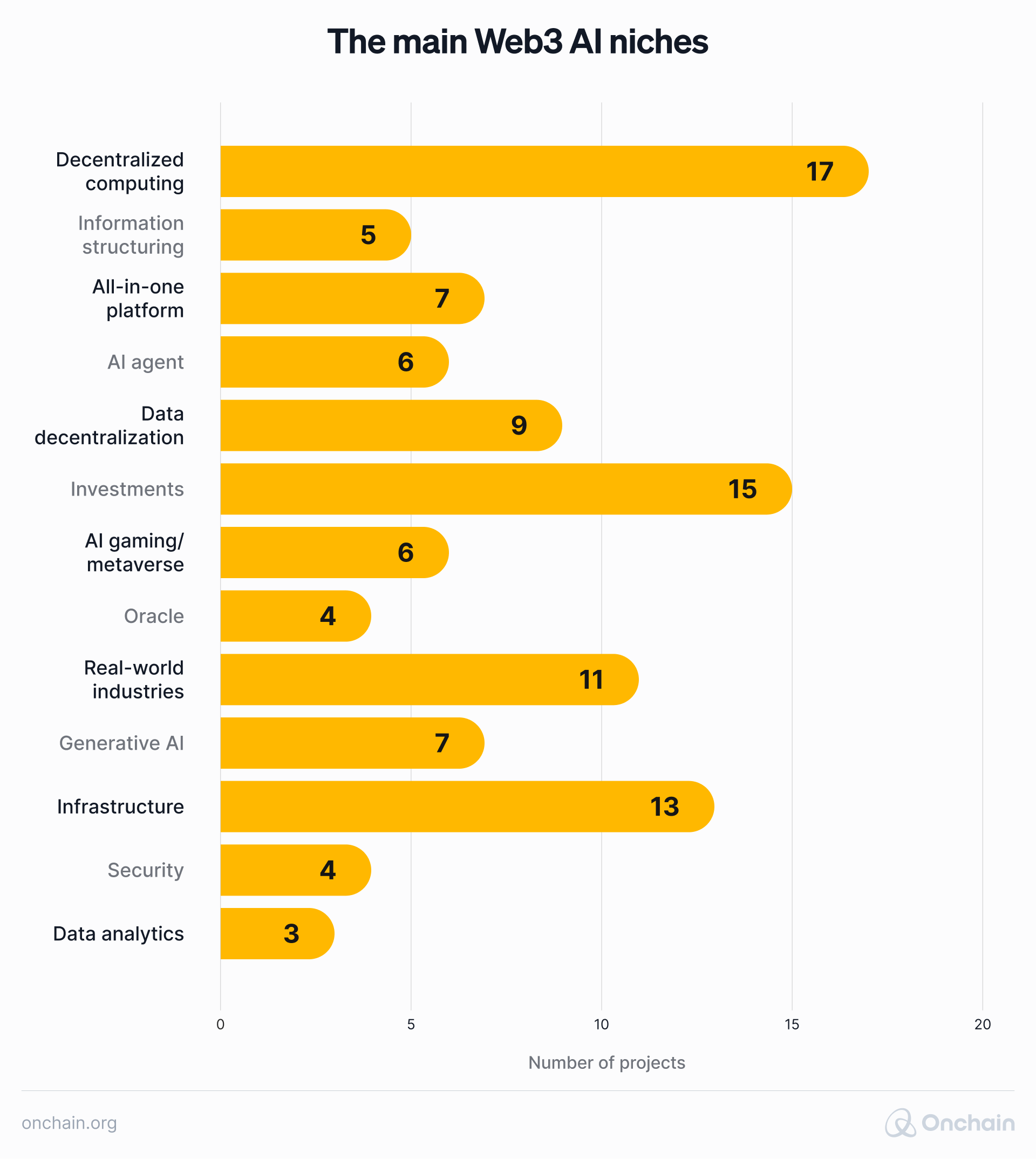

Our first research step was an initial screening of the AI part of the Web3 market. We analyzed 107 companies that fit this description. We then categorized them into the following 13 sectors (this is explained in more detail in the “AI x blockchain – synergies overview” section):

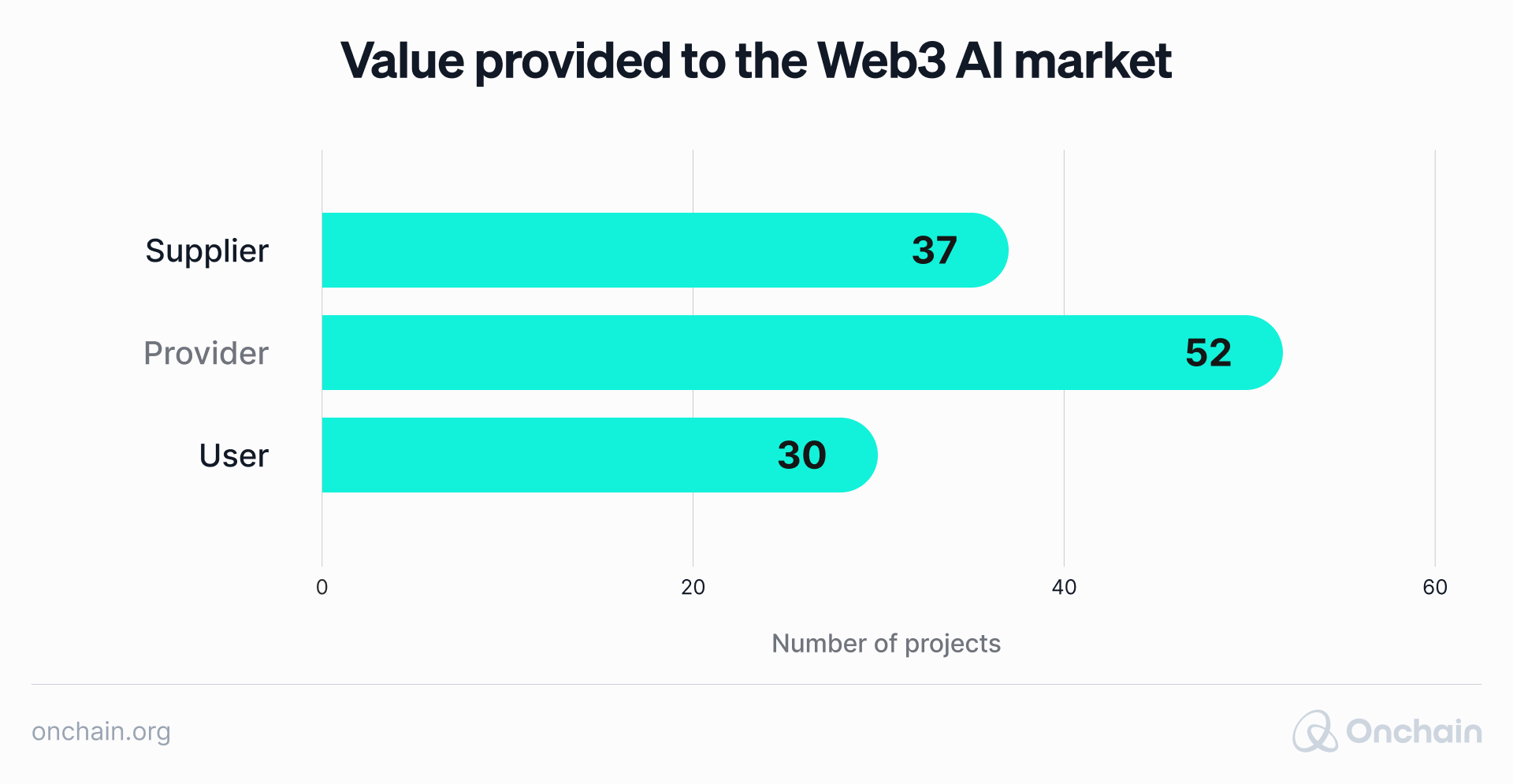

We broke the categories down further based on the value projects bring to the market. We identified the following three main types:

- Suppliers – Web3 projects that provide other companies with resources necessary for creating or maintaining AI tools. Good examples are Akash and OpSec, which use DePIN to deliver computational power, which is essential for AI algorithms.

- Providers – Web3 projects that provide other companies with AI-based tools. For example, Fetch.ai and Autonolas facilitate decentralized crypto-AI agents.

- Users – Web3 projects that implement AI solutions to improve already existing blockchain-based initiatives. For instance, Web3 games like Sleepless.ai and Sidus use artificial intelligence to optimize in-game experiences.

The obvious question now is: How are the Web3 projects distributed among the three types?

It’s safe to say that it’s relatively balanced. The most universal group are the providers, and they’re also the largest, with the abject sides of the spectrum almost identical in size. Note that some companies supply AI tools with data, computational power, etc., and provide solutions on their own. That’s why the sum of the projects in the below graph exceeds 107.

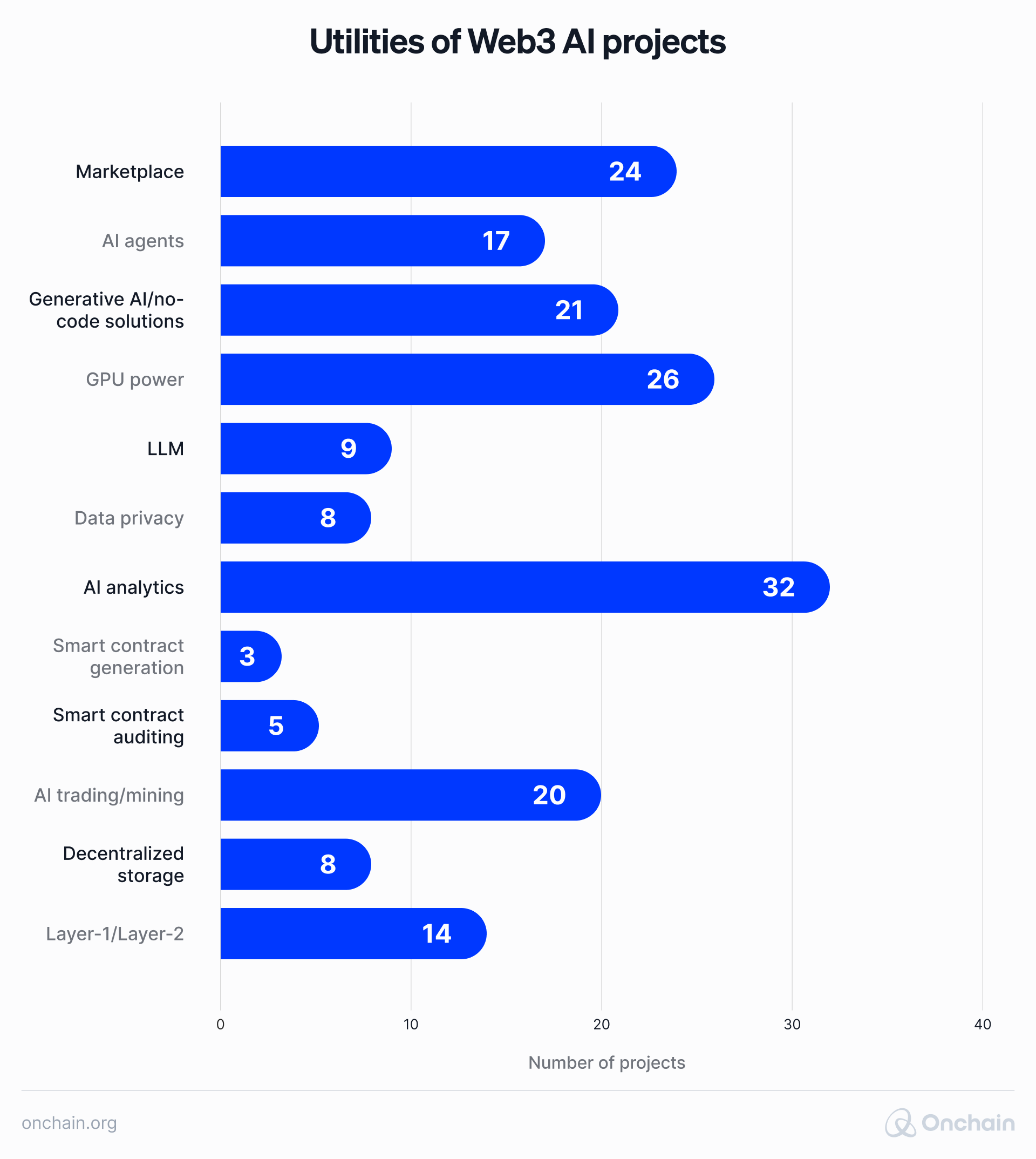

The last part of this initial analysis focused on the services provided by such companies. We investigated the specific utilities Web3 AI projects offer for both users and businesses, starting with the aforementioned decentralized computing, moving through decentralized generative AI models, and ending with smart contract auditing and generation.

The following graph shows the number of projects in each service category.

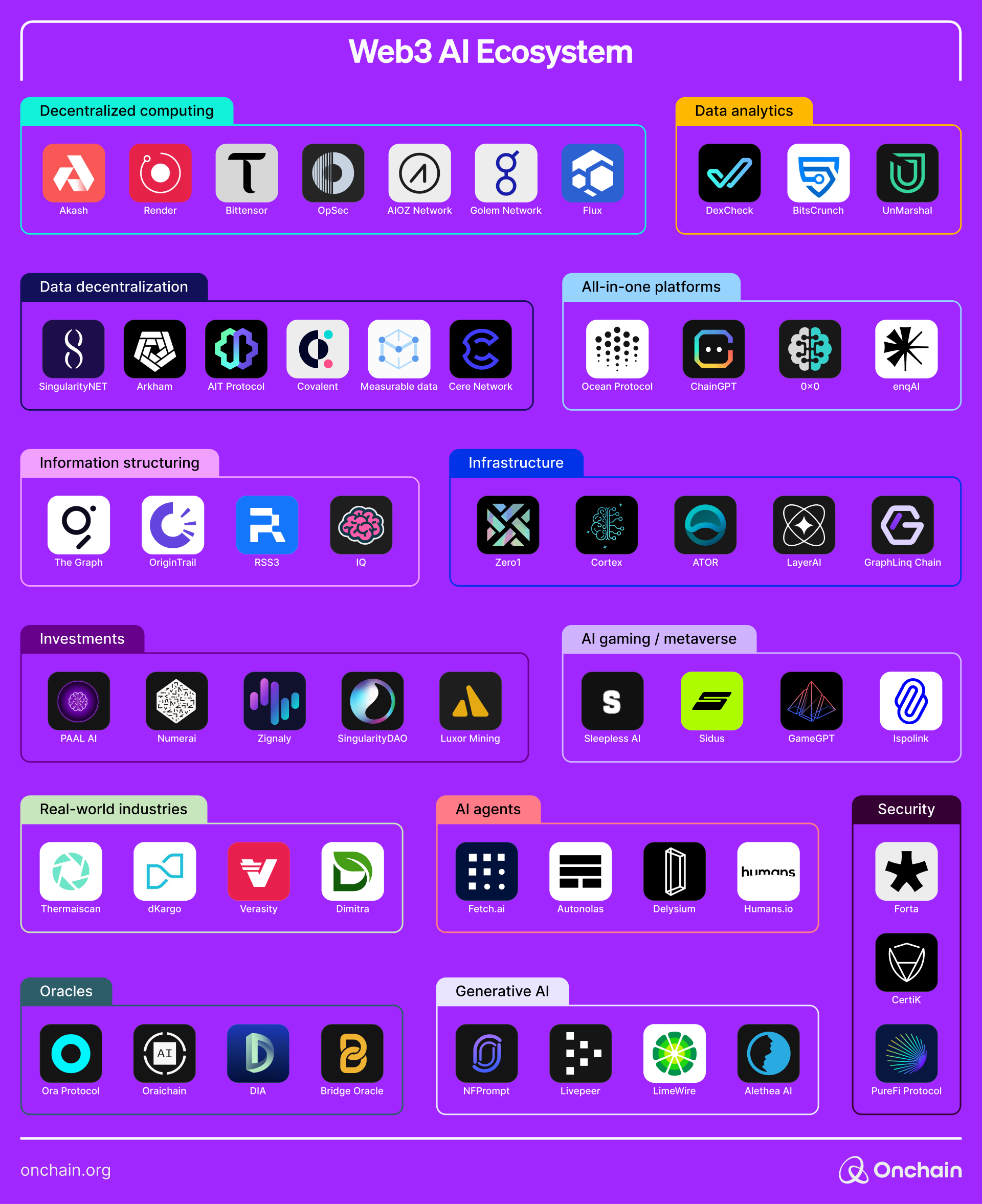

And if you’d like to see more concrete examples of projects operating in specific niches, here is a blockchain x AI sector map for you:

You must be keen to grasp what these niches, utilities, and numbers mean for you as an entrepreneur. Well, now that we are on the same page regarding the projects that capitalize on or provide the most value from AI x blockchain convergence, we can dive into specific use cases of various synergies.

AI x blockchain – synergies overview

To pinpoint the potential impact, it’s best to look at this union from two different angles:

- How does blockchain already help AI? Use cases related to AI problems that blockchain technology addresses, e.g., the lack of computational power to run AI algorithms → utilizing the unused GPU power from personal computers thanks to DePIN technology.

- How does AI already help blockchain? Use cases related to blockchain problems that artificial intelligence addresses, e.g., vulnerabilities in smart contracts → automated AI-based smart contract auditing.

We also included an analysis of specific business implications (e.g., the changes in revenue streams, cost structure, and accessible markets thanks to implementing AI x blockchain synergies). You’ll find it all in the following three sections of the report.

How does blockchain already help AI?

Decentralized computing power

AI is currently not in a position to overtake the world. It’s way more focused on ordinary, playful, or routine tasks. Like this one: finding enough computational power to create yet another image based on the “Dwayne The Rock Johnson as a Rock” prompt.

Source: TBC

Regardless of the task, AI algorithms always need graphic processing units (GPUs) to perform them. The sudden increase in demand for advanced chips such as Nvidia’s H100 has caused a shortage, driving up the costs of such computational power. Therefore, it may become impossible for individuals or smaller businesses to use AI at full scale, leaving it in the hands of well-funded corporations.

That’s where DePIN, a blockchain-based technology covered in our previous report, comes in, along with projects like Akash, OpSec, and the Golem Network. They serve as a type of Uber or Airbnb for computational power and create a two-sided marketplace. Companies needing GPUs can “rent” them from businesses and individuals who share them in exchange for token-based incentives.

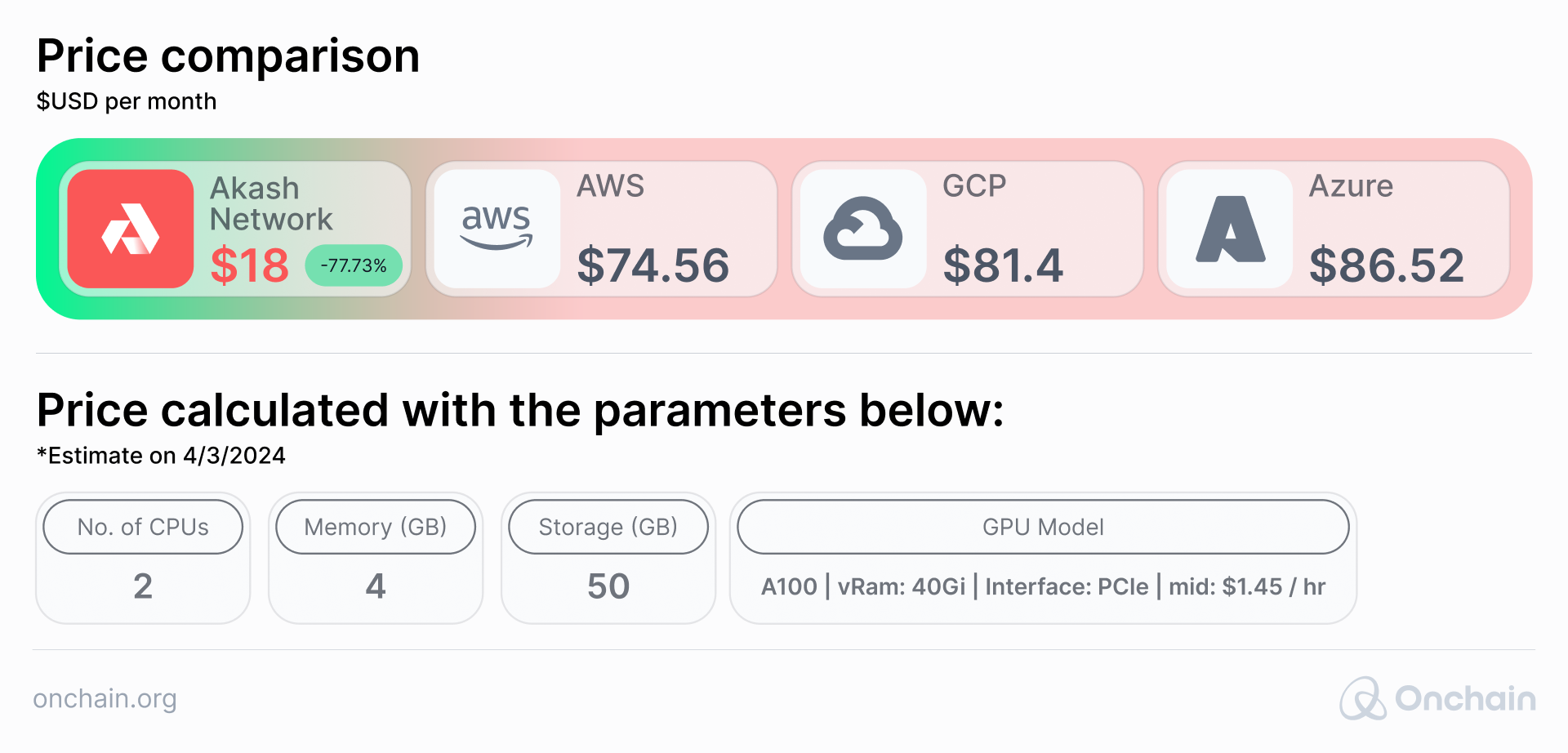

Such an approach significantly decreases the cost of computational power. Look at a simple comparison of Akash pricing with the largest representatives of a non-Web3 computing market:

It’s also important to mention that the DePIN x AI intersection benefits aren’t limited to businesses or people using high-end GPUs such as Nvidia A100s. The recently well-funded GPU network io.net ($30 million in Series A) allows the sharing of the power coming from the Apple’s M1 or M2 chips.

So, if you’re currently reading this report on your Macbook, you may consider an additional source of income.

Security risks in AI

As artificial intelligence systems become increasingly sophisticated and integrated into our lives, they also introduce potential security risks that need careful consideration.

- One major concern is the trust problem surrounding AI data. How can we ensure the data used to train these systems is accurate, unbiased, and ethically sourced?

- Additionally, the centralized nature of many AI platforms raises a red flag about the potential misuse of data and lack of control for individuals.

Therefore, safeguarding privacy and establishing security measures are crucial to maintaining trust and ensuring the ethical and responsible use of AI technology.

The fundamental trust problem for AI data

AI adoption expands at an extraordinary pace – especially when fueled by Big Data, the resource that enables AI to learn, become smarter, and unlock insights from an ocean of information.

Source: https://www.instagram.com/p/C3RmRXvrMEw/

However, as AI advances, the trust problem grows proportionately. Discerning between genuine and AI-generated content becomes increasingly difficult. Generative AI, while capable of stunning creativity, lowers the barrier for misinformation and deepfakes, demanding a renewed focus on content authentication. For example, an AI system trained primarily on images of white men performs poorly when identifying people of color or women, leading to biases and discrimination.

This erosion of trust fuels the need for solutions, and blockchain can offer some. Take these four as examples:

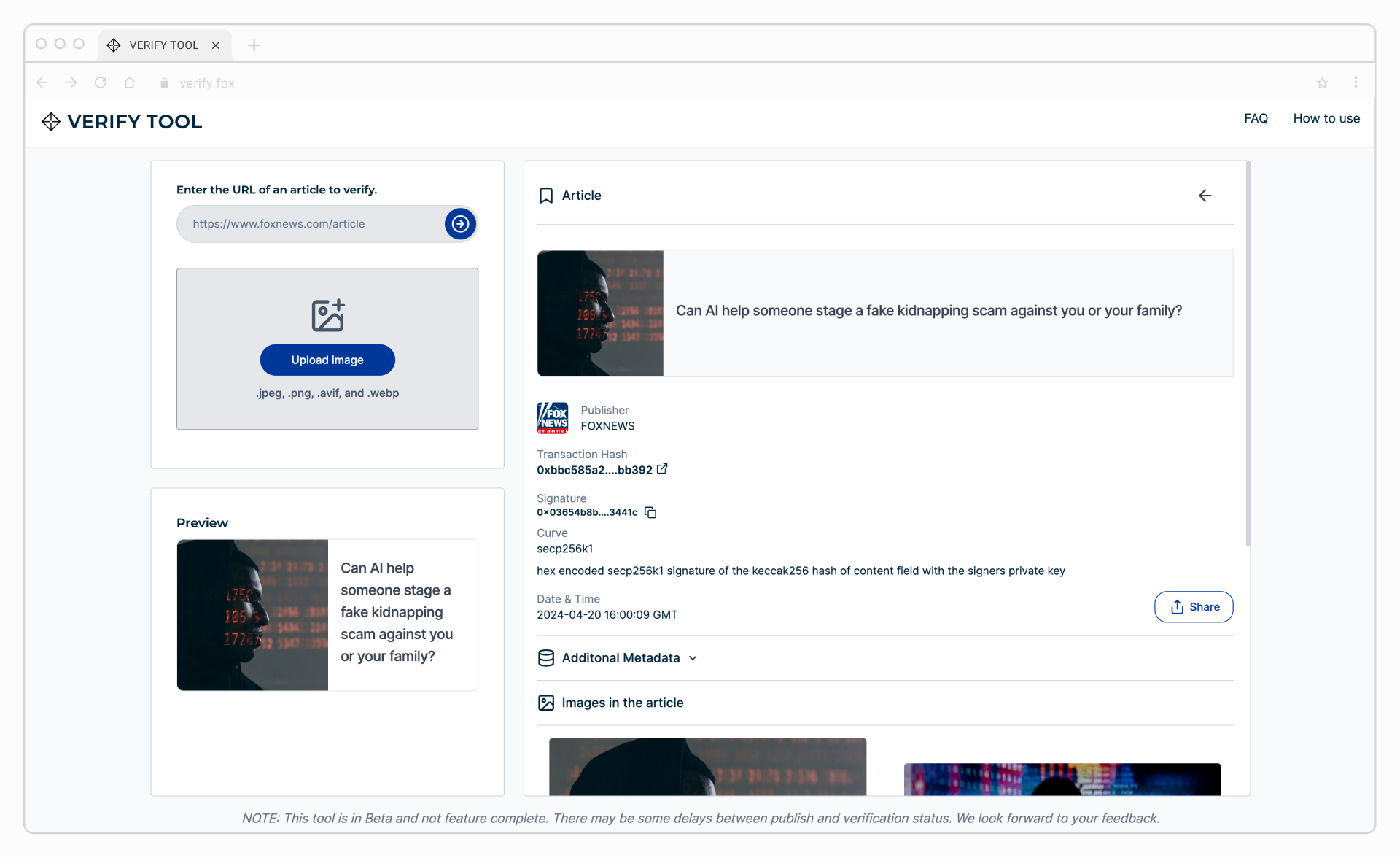

1. For those who are already tired of fake news and misleading AI-generated media (all of us?), Fox Corporation has taken a bold step. The news company launched Verify, a tool built on Polygon where publishers establish undeniable proof of content ownership. Each piece is secured on the blockchain, empowering consumers to easily identify trustworthy sources using the Verify Tool.

Source: https://www.verify.fox/find/article?url=https%3A%2F%2Ffoxnews.com%2Ftech%2Fcan-ai-help-someone-stage-fake-kidnapping-scam-against-you-or-your-family

2. Teams from the Arweave blockchain and the provenance layer, Irys (formerly Bundlr), have followed suit and developed the Digital Content Provenance Record (DCPR) standard. This innovative solution utilizes the Arweave blockchain to timestamp and verify digital content. By providing reliable metadata, DCPR empowers users to assess the credibility of online information with greater confidence.

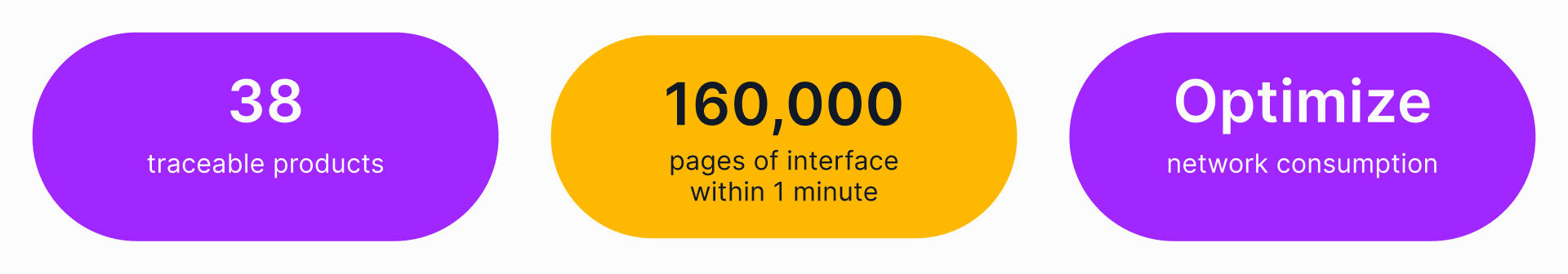

3. Similarly, skincare firm Clarins combats counterfeit ingredients with cutting-edge blockchain verification. Partnering with NeuroChain, an ML-based consensus blockchain and Community, they built the Clarins T.R.U.S.T. solution. Suppliers log ingredients into the system, while the blockchain provides proof of authenticity, ensuring only genuine materials enter their supply chain.

A scalability test carried out by Clarins produced the following results: They were able to open 160,000 pages of their website/software interface within 1 minute without any degradation and without any negative effects on response times or availability.

Source: Clarins

4. The last example comes from the world of global enterprises. The Geoscience Team of the Abu Dhabi National Oil Company (ADNOC) used AI to augment and accelerate the visual photography process. ADNOC has partnered with software giant IBM to pilot blockchain-powered transaction management for its oil and gas operations. This combined solution helps the organization automatically track, validate, and execute transactions throughout the supply chain.

Centralization risk of AI

While open-source AI promises democratization, a closer look reveals a troubling reality: the control seems to remain in the hands of a few tech leaders. Google, Amazon, and Microsoft appear to dominate AI development by concentrating the necessary data.

Centralized data storage raises the following concerns:

- A single point of vulnerability: breaches at large data holders expose vast amounts of information.

- Lack of transparency: users often have little control or visibility over how their data is used.

To combat these challenges, companies are leveraging blockchain and AI to revolutionize how data is stored, managed, and used, with profound implications for healthcare and beyond. One such example is the partnership between Akash Network and Solve.Care, which is using these technologies to change how patient data is handled.

Due to current industry regulations, patient data must be stored in environments such as Amazon Web Services (AWS) and Google Cloud Platform (GCP). Under this system, patients lack sovereignty over their own data. Additionally, there is no guarantee of digital permanence if data is lost.

Akash Network and Solve.Care’s partnership allows patients to own and control their health information securely through blockchain technology. Akash provides the computing power necessary to deploy Solve.Care’s proprietary node infrastructure (Care.Nodes) to patients globally. As a distributed network with compute providers worldwide, Akash allows Solve.Care to access computing resources without permission in the regions where their enterprise clients and patients reside and receive care.

Another inspiring example of this approach is Thermaiscan, which explores blockchain to improve healthcare data security:

Combining AI and blockchain makes achieving a good level of healthcare data security way more possible. It’s a completely different approach to databases compared to how it’s being done today in Web2

However, such a transition doesn’t happen without challenges. Especially in an “analog” industry like healthcare. As stated by Arby, “Many countries and healthcare systems still use paper and pens. Moving into digital systems powered by blockchain will require them to make a “jump” compared to some developed western countries that use standard databases provided and hosted by big cloud server companies.

But according to Thermaiscan, it’s still achievable. Especially in emerging markets: “If we take Swedish healthcare providers, they still use hard disks to store data – since they don’t want to contract international cloud providers. However, low and middle-income countries where Thermaiscan has been engaged have a higher adoption and acceptance rate of new technologies. There, it’s way easier to find right-minded, healthcare-oriented people and convince them to at least start testing such solutions.

Healthcare is by far not the only industry experimenting with this synergy of technologies. In a joint effort, Fetch.ai (partnering with peaq), Deutsche Telekom, and Bosch use the AI x blockchain convergence to transform IoT devices.

At the heart of their collaboration is the Bosch XDK110 sensor kit, which serves as a self-contained data acquisition solution and is capable of measuring environmental factors (such as seismic activity, humidity, pressure, etc.) for various applications. Each sensor has a secure, blockchain-powered identity that enables the identification of a machine by giving it a unique identifier generated by the blockchain protocol of peaq ID. Fetch.ai’s AI agent allows the sensor to learn, function independently, and even earn revenue by selling its data. At the same time, the sensor data can improve traffic management or air quality monitoring. You’ll learn more about AI agents in the “Crypto Infrastructure for Agents” section.

Machine learning privacy

AI systems are hungry for vast datasets, regardless of whether they contain sensitive information or not.

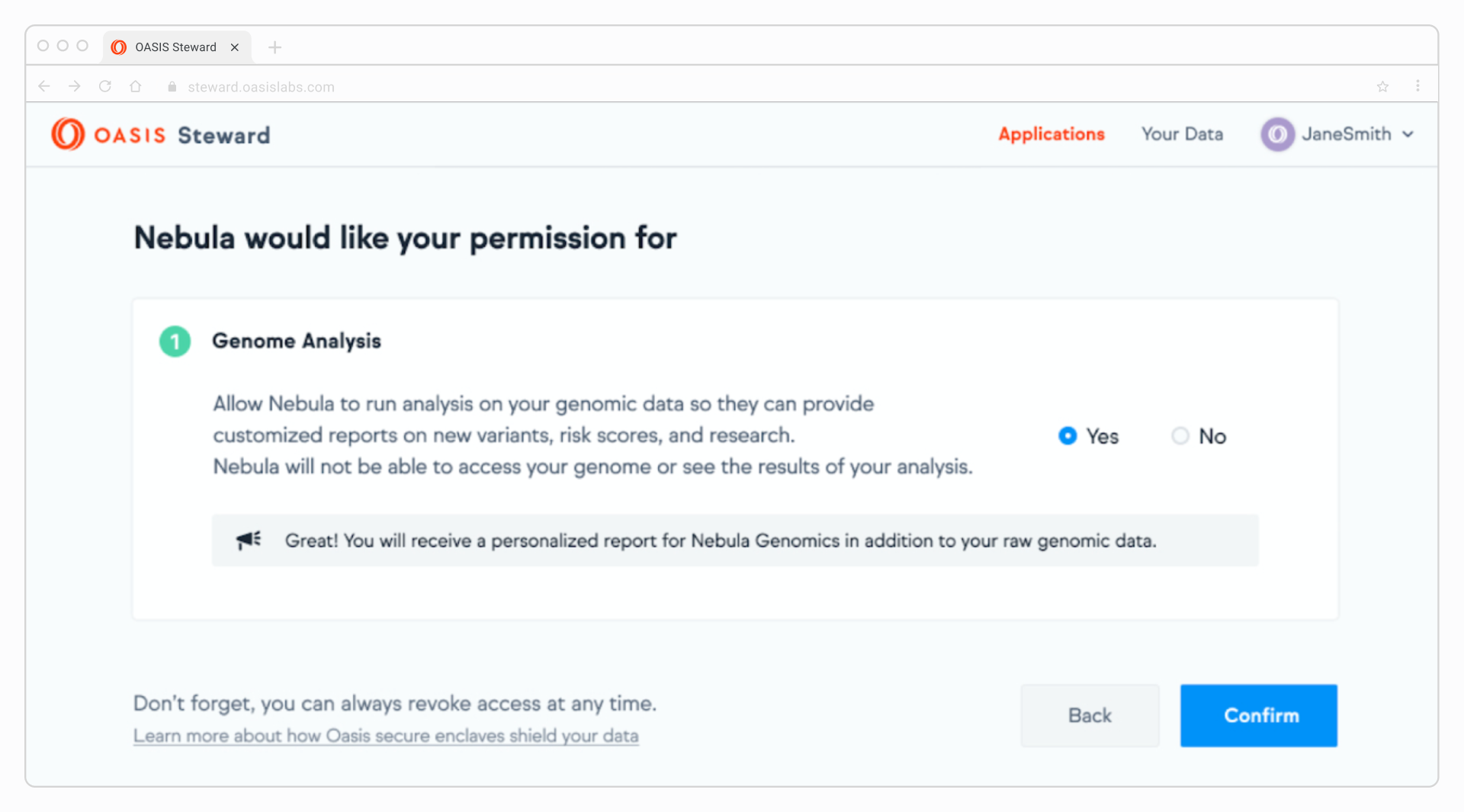

Let’s stick to the example of health data because privacy is particularly critical here. The personal genomics company Nebula Genomics teamed up with Web3 company Oasis Labs to give people more control over their genetic information. They use a new tool called Parcel which is designed to let users decide who can access their data based on a complete history of information usage stored on the blockchain. This way, patients can see who has looked at their genetic information and stop such activities whenever they want.

Source: https://nebula.org/blog/oasis-labs-partnership/

In another example, iExec, a marketplace for AI models, leverages blockchain technology and Intel’s SGX hardware to ensure secure sharing and utilization of AI models. When these models are rented on iExec, they remain encrypted until reaching a secure environment provided by Intel SGX. This protects the intellectual property of AI developers and promotes trust within the AI ecosystem, where concerns about model theft and misuse are prevalent.

AI data decentralization

Research on AI is flourishing. Based on the results derived from the EBSCO database, since 2021, over 1,300,000 academic papers have been published on this topic. That’s more than throughout the entire last decade (1,100,000).

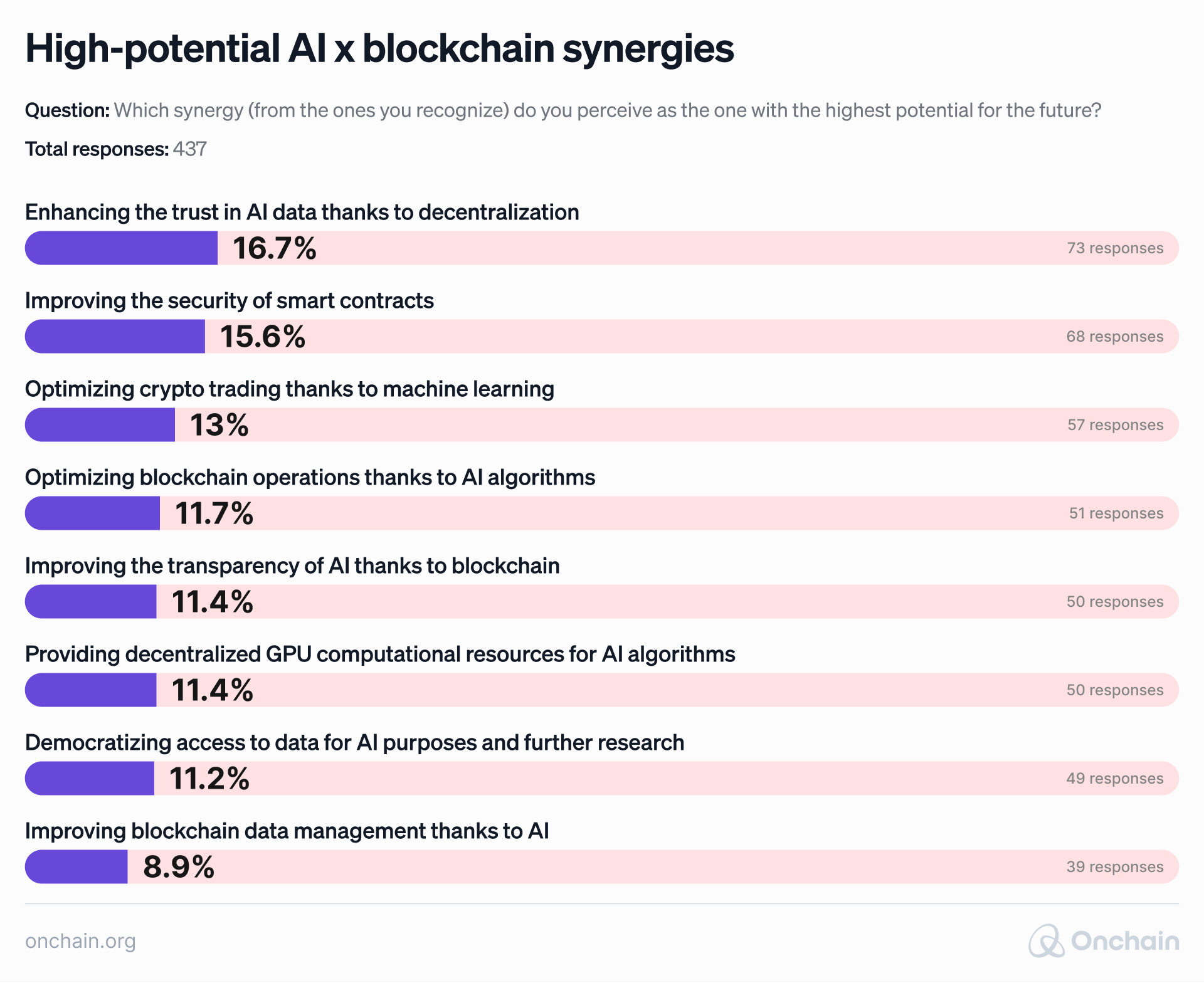

Does the quality meet the quantity, though? Not quite. Research is done repetitively by a small group of authors, and there is a growing number of flashy journals and biased reviews. This suggests that there’s a need for change. Another argument is that “data” remains the most frequently cited challenge in discussions surrounding AI, as our survey indicates (you can see it from the following graphic).

That’s where decentralized AI research fits in. It’s an innovation highly focused on incentivizing data sharing. Projects like Bittensor and Allora use the weighing system to encourage participants to co-create ML models by focusing on the most useful data. This approach is based on analyzing a specific task (e.g., predicting the weather), weighing the importance of specific data when building a model to conduct it, and – most importantly – incentivizing participants through economic rewards to share the most vital data.

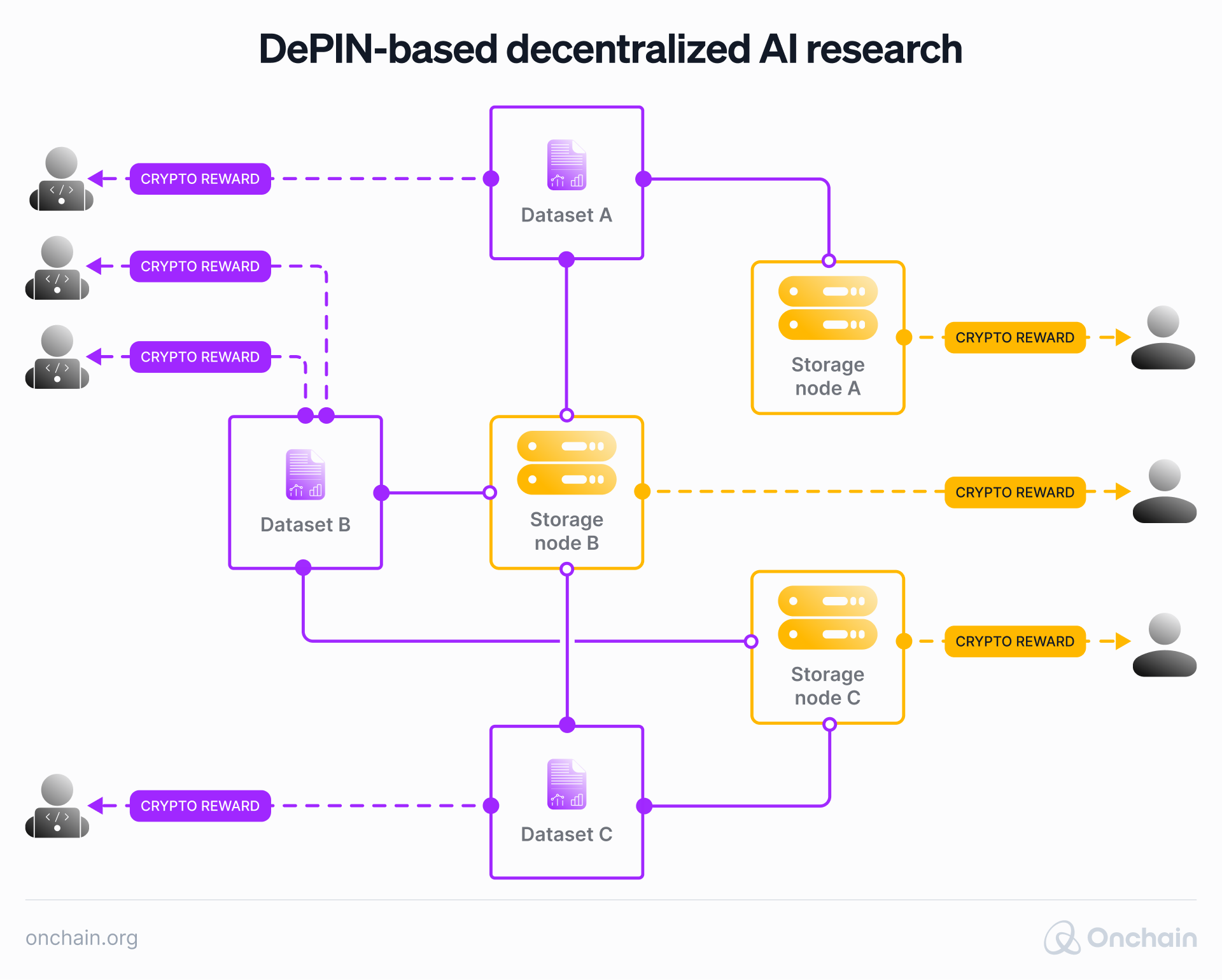

If you read our previous report on DePIN business opportunities, you discovered that decentralized AI research is often combined with DePIN mechanisms. A simple example is Grass, which pays its users to share data scraped from the public web. This is essential for even basic AI tools such as ChatGPT.

The casual gaming company NeuroMesh invests significant resources in building distributed training networks. Its executives believe in the potential that incentivization brings to building AI models.

I see blockchain itself - or, let's say, Web3 itself as a very good provider of computing power. It's perfect for incentivizing GPU provision, data training, or addressing cross-country demands. It's basically the infrastructure upon which we can build larger AI applications and models.

Similarly, the Chief Scientist of the AI-powered oracle ORA Protocol sees it as one of the most powerful convergences of both technologies.

Especially when we consider the latest development by ORA (optimistic machine learning), one of the most promising intersections would probably be the open source movement, based on the incentives. I think we’ve kind of solved this aspect in Web3, which means we know how to use crypto-economics to help this open-source ecosystem grow. Whereas in AI, I think we're still figuring it out. But that’s basically why we need this synergy so much.

It’s also worth mentioning that, in the case of AI research, decentralization goes beyond expanding the number of data sources through incentivization. Cere Network takes it one step further and adds a layer of shared storage.

A single point of failure is perceived as something blockchain can successfully address; therefore, securing AI data by decentralizing serves as a viable option. It’s another intersection between AI and DePIN – Cere Network compensates its users for providing storage in the same way as Filecoin and Arveawe.

All these factors contribute to the shared view among people familiar with blockchain, AI, or either of these areas that decentralized AI is the synergy with the highest potential for the future.

How does ORA Protocol contribute to the Web3 x AI landscape?

The ORA Protocol contributed significantly to our research. Read how the ORA team sees its role in the field of decentralized open-source AI:

Open-source AI startups face a major hurdle in securing the funding that would enable them to stay competitive in the rapidly growing industry. ORA’s recently developed Initial Model Offering (IMO) framework acts as an expansive tool for funding, allowing open-source AI to compete with closed-source AI and combat the emerging AI monopoly.

AI development is an extremely resource-intensive undertaking for a business, and open-source is not viewed as attractive to investors. OpenAI itself has adjusted its capital structure three times over its lifetime in order to adopt a sustainable business approach in this industry. From a non-profit to a for-profit to a limited partnership (LP), OpenAI has strategically positioned itself to raise the capital it needs to remain competitive without giving up equity. As a LP, OpenAI exchanges a percentage of future revenue and future asset appreciation for capital via limited partner deals.

For open-source AI, the head start that the incumbent giants have is vast and leaves little opportunity for capital raising. The Initial Model Offering (IMO), pioneered by ORA, provides open-source AI development communities with a framework to fundraise rapidly from an international market. Through the IMO framework, the value of the model and its applications are represented onchain as a verifiable tokenized model, which can be used to incentivize the continued development of the model. Moreover, the IMO includes an automated revenue-sharing mechanism so that a percentage of future revenue generated by the model flows back to the token holders. IMO provides open-source AI communities with the same powers as the capital structure of OpenAI.

Crypto infrastructure for AI agents

A dystopian vision of an army of autonomous AI-powered individuals is already coming to fruition. And blockchain can make it even more frightening – or promising.

A so-called AI agent is a software program that acts on your behalf based on provided data. The data can come from a variety of sources, including manual input from humans, sensors, or cameras. An AI agent is designed to make an informed decision and act according to specifically defined requirements.

It may sound a bit vague and complicated, but examples of AI agents are already surrounding us. Innovations such as autonomous vehicles, virtual assistants, or even good old chatbots in the form of ChatGPT all rely on AI agent principles.

However, despite a vast set of use cases already present, such solutions lack one important aspect to become truly powerful: built-in economics. AI agents are unable to open or use a bank account and spend money on your behalf. Let’s be honest; they’d immediately fail the KYC process. And even if we provided them with the necessary permissions (you can imagine the endless back-and-forth with the bank or its chatbot AI agent), such a tandem would likely become cumbersome, inefficient, and dangerous for your personal finances.

Providing crypto-AI agents with a blockchain infrastructure adds an economic layer to their work while also addressing security concerns.

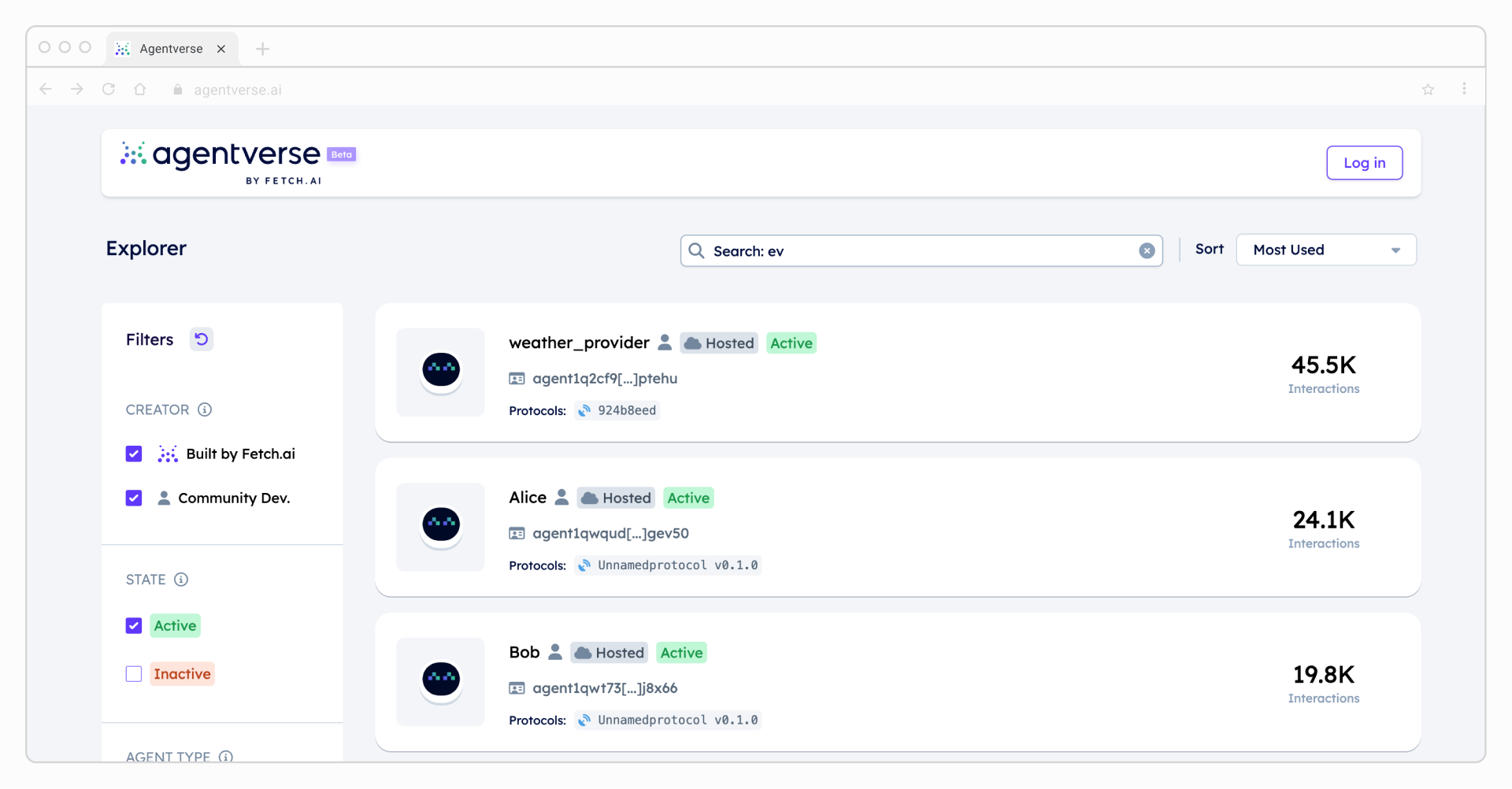

One of the most promising examples of this intersection is Fetch.ai. On the one hand, it enables developers to build secure and token-governed autonomous agents with the Fetch.ai software. On the other hand, it provides a marketplace called agentverse, where AI deputies can transact, negotiate, and chain with each other, forming “working groups.”

As a result, AI agents become more autonomous and accomplish tasks in a collective manner. When an agent requires data or a specific activity, it can purchase it from another participant in the agentverse. At the same time, the entire network is still governed by humans and Fetch.ai token holders. They need to ensure their agents focus on assigned duties, such as building real-time EV charging station maps (an actual use case), instead of taking over the entire world.

Source: https://agentverse.ai/

Ocean Protocol also explores this particular use case. Ocean sees blockchain as a decentralized substrate to support sovereign AI agents, i.e., “AI DAOs”:

In such a case, the agent itself is not owned or controlled by anyone. It literally owns itself. We can basically imagine a smart contract that simply has “more intelligence” and takes the AI agent shape. It can then sense the world, build a model of the world (a model relevant for itself), take actions, get feedback and update its model, or even accumulate resources (coins, data, compute, data storage, bandwidth, etc.).

Another project that utilizes the AI DAO concept is Autonolas. Here, a group of OLAS token holders facilitates governance over the AI agents, enabling more complex cooperation methods between contracts. By doing so, the project helps businesses and developers build an army of autonomous agents that work collectively towards an outlined goal. Companies, teams, people… who needs them anyway? Scrap that; we never said that!

Addressing the AI carbon footprint

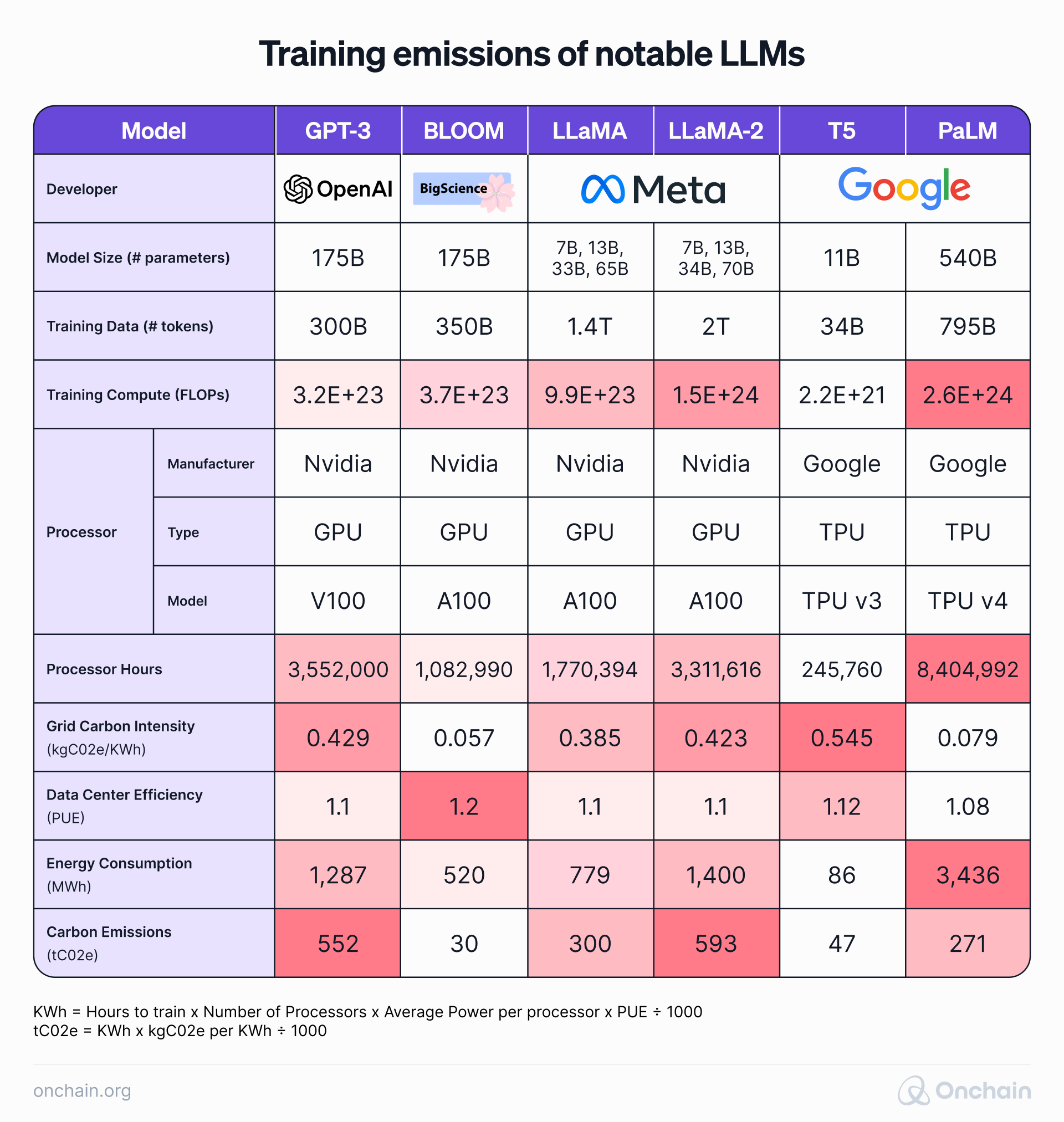

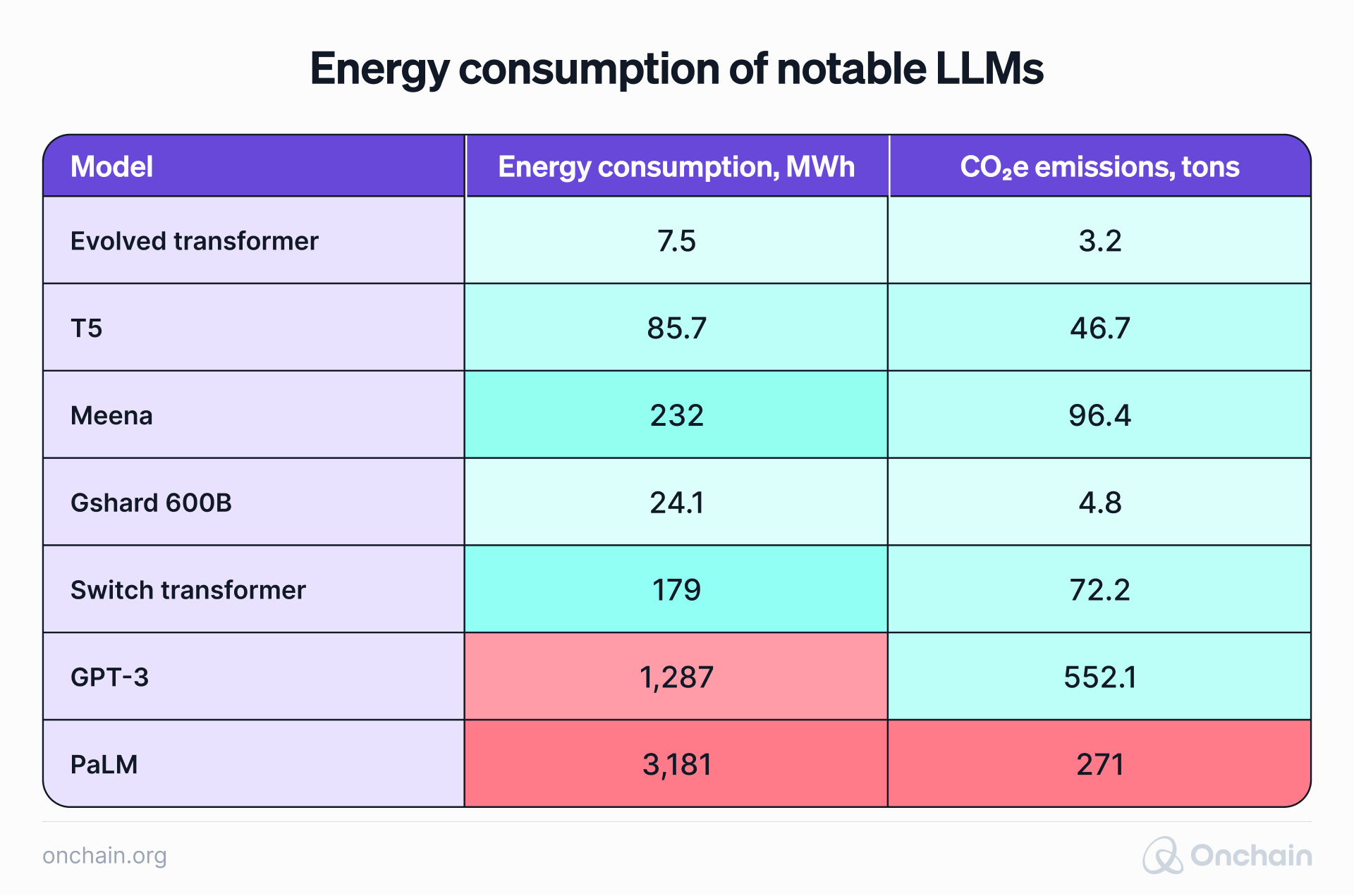

It’s estimated that data center energy consumption in Europe will grow by 28% by 2030. Needless to say, AI is a major contributor to this massive increase. To put things in perspective, training ChatGPT-3 generated 552 metric tonnes of carbon, which is equivalent to driving 112 petrol-powered cars for a year.

Training Emissions of Notable LLMs Source Source: https://www.linkedin.com/pulse/reducing-carbon-footprint-generative-ai-boris-gamazaychikov/

Source: https://towardsdatascience.com/how-to-estimate-and-reduce-the-carbon-footprint-of-machine-learning-models-49f24510880

The AI industry is recognizing the need for more sustainable approaches. These include investing in renewable energy sources to power data centers, developing energy-efficient algorithms, and optimizing hardware designs to reduce power consumption. Does blockchain fit into the puzzle as well?

The landscape of AI companies using blockchain for carbon offsetting is still evolving. As awareness of AI’s environmental impact grows, we expect more companies to explore and adopt blockchain-based solutions to track, verify, and offset their carbon emissions.

Several blockchain startups and platforms already focus on AI-related carbon markets and offsetting. For example, PAAL AI, a leading decentralized AI platform, has partnered with Viridis Network, a digitized carbon credit provider. This collaboration aims to achieve carbon neutrality in PAAL AI’s operations by leveraging Viridis Network’s expertise in carbon offset projects and blockchain-based tokenization to address the environmental impact associated with AI model training and computation.

Even though such cases sound very promising, we need to acknowledge that they are still in a nascent development state. Therefore, their future impact is somewhat debatable.

How does AI already help blockchain?

Blockchain and AI are two-way streets; to assess their true potential, we need to walk them in both directions. It’s time to check use cases that focus on enhancing blockchain by implementing artificial intelligence.

Onchain Security

For onchain applications, security isn’t an optional luxury – it’s the foundation for trust and success. AI can help the blockchain achieve this more efficiently. Such as through automated smart contract auditing and threat detection mechanisms to spam prevention.

Smart contract auditing

Smart contracts are essential for automating and executing contracts without intermediaries. However, they are not immune to security risks.

STEP ONE

INITIAL ANALYSIS

STEP ONE

INITIAL ANALYSIS

The auditing team is provided with the smart contracts to learn their functionalities.

STEP TWO

IDENTIFYING VULNERABILITIES

STEP TWO

IDENTIFYING VULNERABILITIES

Smart contracts are scanned to locate security vulnerabilities

STEP THREE

REPORT GENERATION

STEP THREE

REPORT GENERATION

A detailed audit report including solutions and improvements to detected issues

STEP FOUR

FIXING SECURITY VULNERABILITIES

STEP FOUR

FIXING SECURITY VULNERABILITIES

The team ensures vulnerabilities are fixed, and smart contracts are bug-free and more secure

STEP FIVE

RE-AUDIT

STEP FIVE

RE-AUDIT

A second audit ascertains that everything is perfectly set and ready to publish before deploying to the client’s main network.

Integrating AI into the smart contract auditing process may improve the following:

- Efficiency – through automated scanning and analysis of smart contract code.

- Accuracy – as algorithms can analyze the code with a higher degree of accuracy.

- Scalability – thanks to efficient processing and reviewing vast amounts of smart contract code and data.

- Improvability – due to the auditing process that can be progressively enhanced with machine learning.

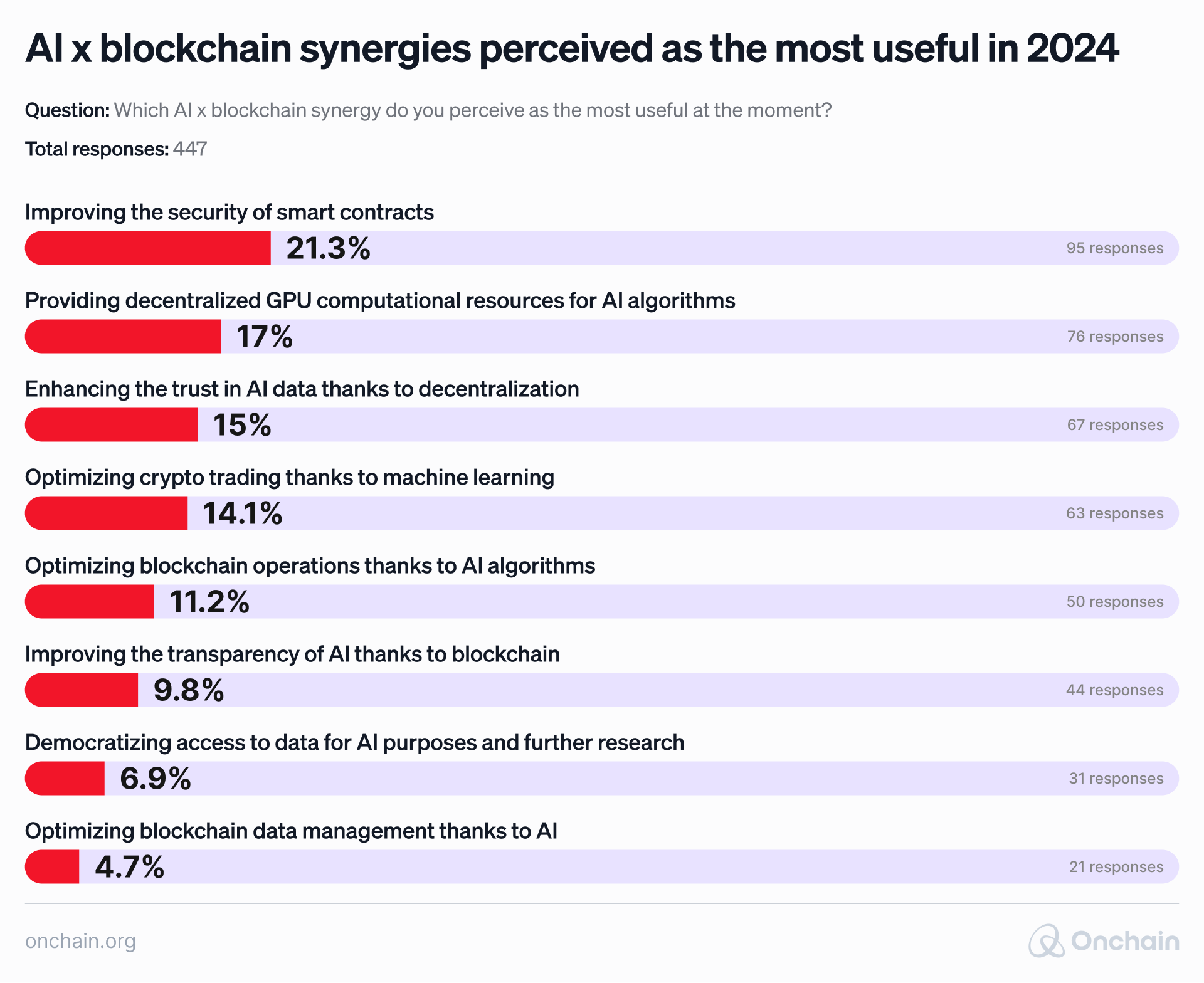

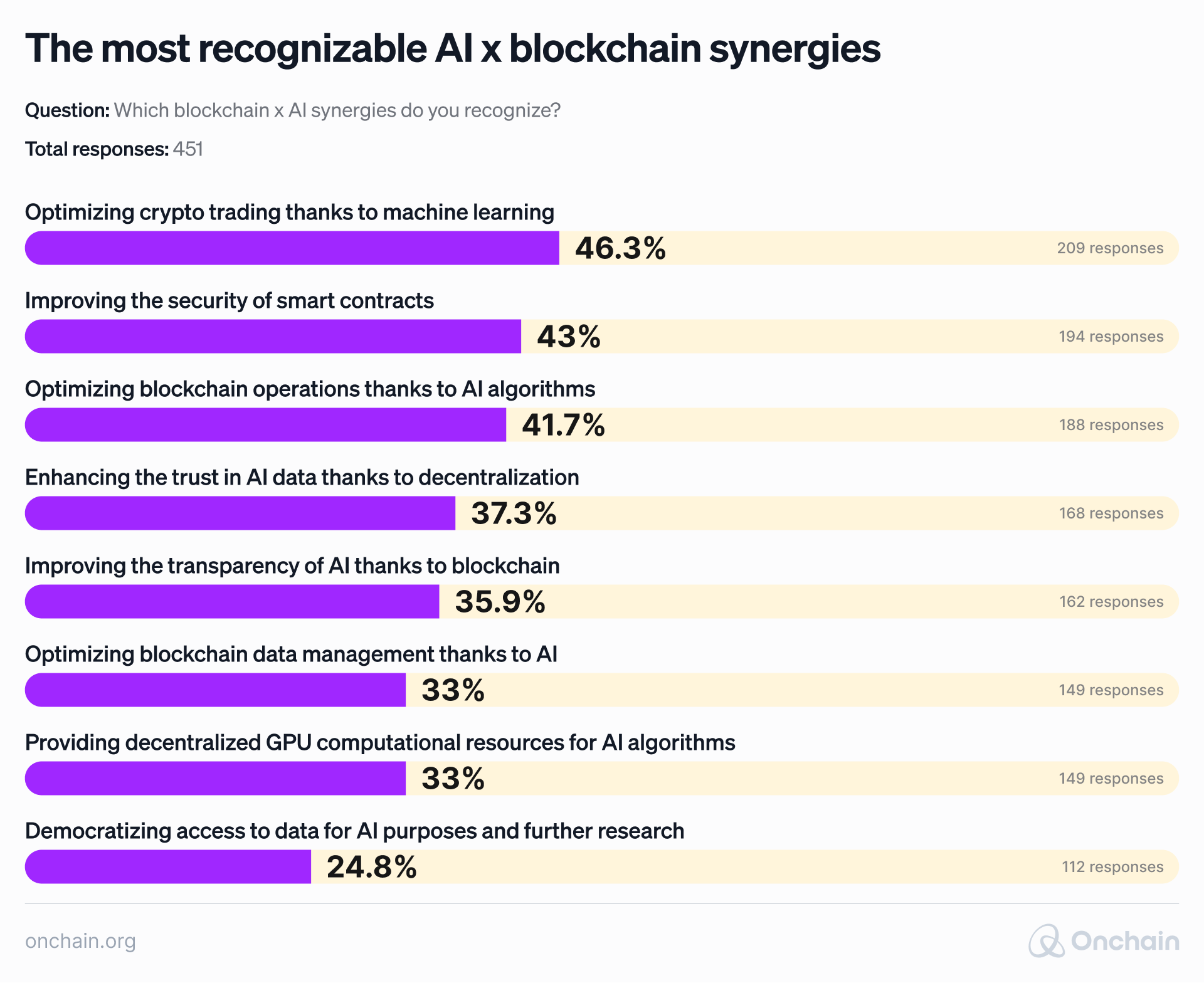

This synergy is currently perceived as the most useful by people involved in AI, blockchain, or both, as you can see from our survey results below.

Several companies at the forefront of innovation leverage AI to enhance their security audits. One example is CertiK, which provides AI-powered tools and formal verification to secure blockchains (L1/L2), smart contracts, and Web3 applications.

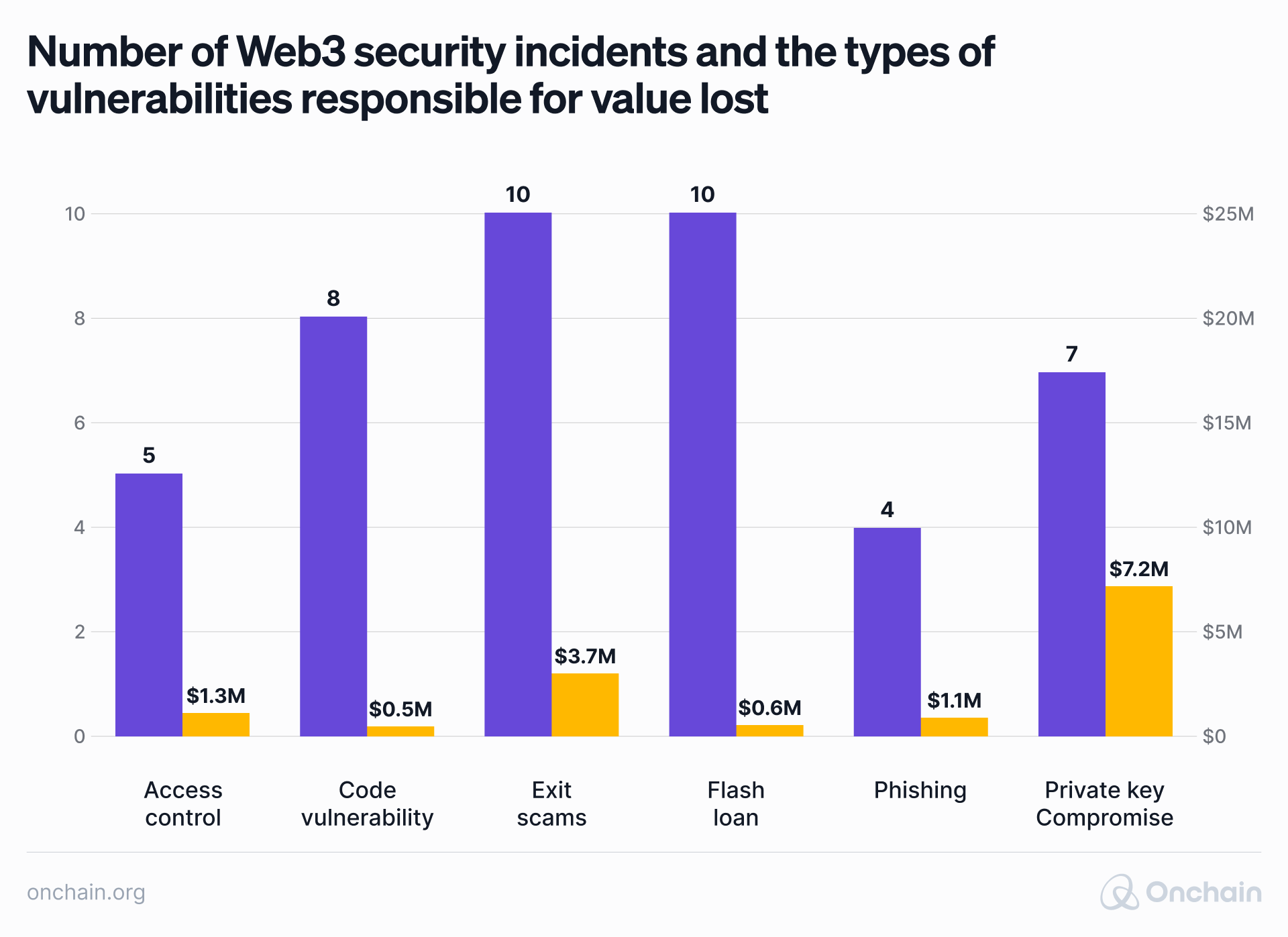

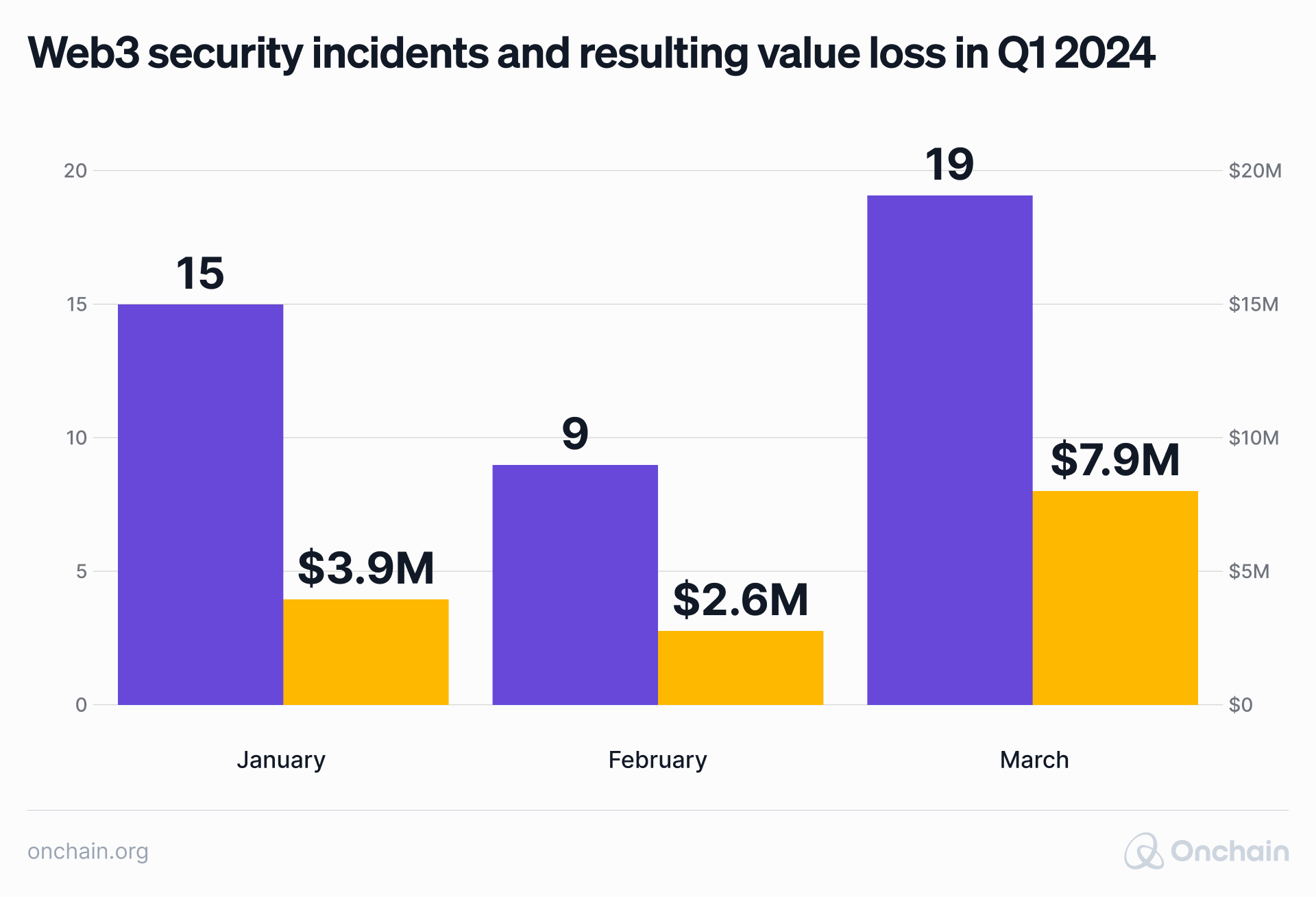

The company recently assisted BNB Chain with its auditing process. BNB Chain reported a 55.8% reduction in value loss due to security incidents in Q1 2024 compared to Q1 2023, which reflects its improved security measures.

Source: https://www.certik.com/resources/blog/bnb-chain-q1-2024-security-report

Source: https://www.certik.com/resources/blog/bnb-chain-q1-2024-security-report

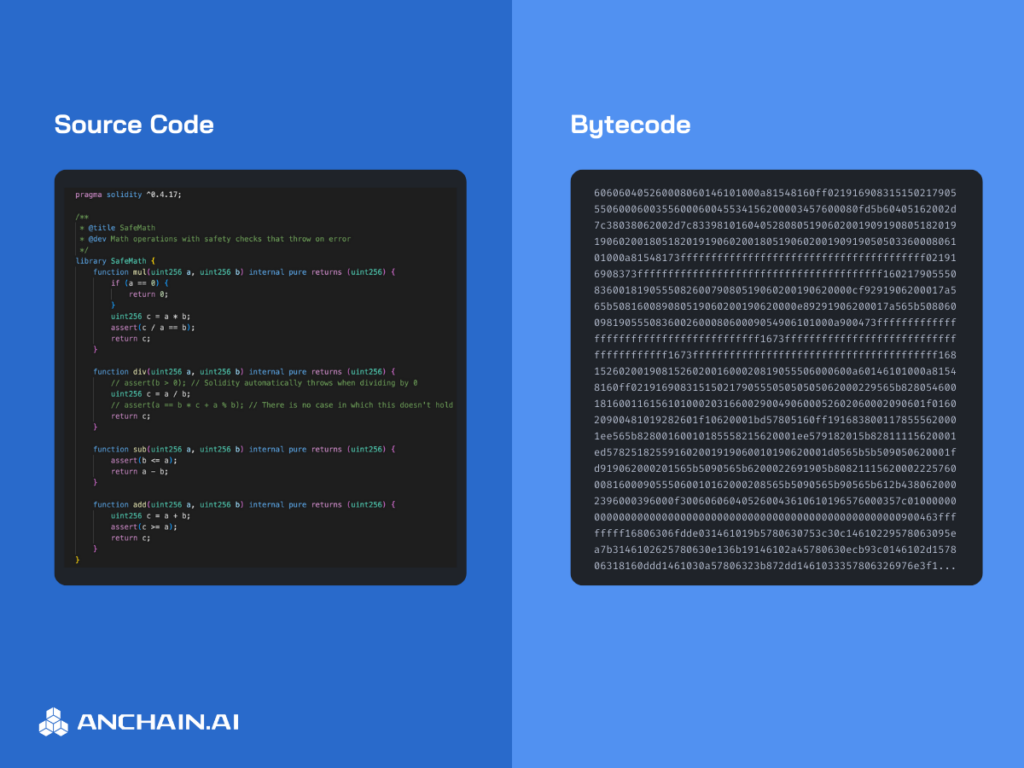

AnChain.AI offers a slightly different approach to smart contract auditing. The company introduced a tool called SCREEN(™) that enables a bytecode analysis of malicious smart contracts that may have hidden their source code, leaving organizations, projects, and startups vulnerable to scams. Bytecode is immutable and transparent as soon as it’s deployed on the blockchain.

An example of a smart contract solidity source code & the compiled bytecode that blockchain networks “understand”.

If you are wondering how useful the tool is and for whom it can benefit, we have an excellent example. AnChain enabled the Whitestown Police Department in Indiana, USA, to recover $300,000 in cryptocurrency stolen in a crypto pig butchering scam. The 1-Click Auto-Trace feature on AnChain, AI’s CISO Investigation Platform, allowed investigators to quickly trace the transaction history, leading them to the scammer’s wallet and revealing that the funds were deposited on the Binance exchange.

Some auditors employ a hybrid method for smart contract auditing. For example, the auditing company Trail of Bits (ToB) combines AI-assisted tools with seasoned auditors to provide rigorous audits. The inspection goes beyond identifying immediate issues and also includes identifying potential long-term security threats. ToB’s approach is followed by Linea, the ConsenSys-backed zkEVM rollup, which proactively safeguards its expanding ecosystem (thanks to its partnership with Hexagate’s Security Platform).

Onchain experiment: Auditing smart contracts with ChainGPT

You see the value of auditing companies, but what about individuals? Some might say that you don’t need tools like CertiK or AnChain to audit a smart contract; ChainGPT will do the job just fine. The tool checks the code much faster and cheaper, leaving us only questioning the audit’s reliability.

We wanted to get to the bottom of this, so we conducted an experiment and tested ChainGPT to audit a simple, smart contract written in Solidity. We have shared with you each step of the test experiment, followed by the results as received from the tool and our own interpretation.

Alternative with a ChatGPT response.

The smart contract code example for ownership written in Solidity

/ SPDX-License-Identifier: GPL-3.0

pragma solidity >=0.7.0 <0.9.0;

import “hardhat/console.sol”;

/**

* @title Owner

* @dev Set & change owner

*/

contract Owner {

address public owner;

// event for EVM logging

event OwnerSet(address indexed oldOwner, address indexed newOwner);

// modifier to check if caller is owner

modifier isOwner() {

// If the first argument of ‘require’ evaluates to ‘false’, execution terminates and all

// changes to the state and to Ether balances are reverted.

// This used to consume all gas in old EVM versions, but not anymore.

// It is often a good idea to use ‘require’ to check if functions are called correctly.

// As a second argument, you can also provide an explanation about what went wrong.

require(msg.sender == owner, “Caller is not owner”);

_;

}

/**

* @dev Set contract deployer as owner

*/

constructor() {

console.log(“Owner contract deployed by:”, msg.sender);

owner = msg.sender; // ‘msg.sender’ is sender of current call, contract deployer for a constructor

emit OwnerSet(address(0), owner);

}

/**

* @dev Change owner

* @param newOwner address of new owner

*/

function changeOwner(address newOwner) public isOwner {

emit OwnerSet(owner, newOwner);

owner = newOwner;

}

/**

* @dev Return owner address

* @return address of owner

*/

function getOwner() external view returns (address) {

return owner;

}

}

The ChainGPT’s auditing result:

The smart contract you provided appears to be a simple contract for managing ownership. It allows the current owner to change owners and for anyone to get the current owner. Here are my findings:

1. Correctness

The contract correctly implements the ownership logic as described above.

2. Testability

The contract uses events, which can be helpful for off-chain testing and debugging. It would be good to write unit tests for it to ensure its functionality.

3. Security

a. Reentrancy: The contract does not call external contracts, so there is no risk of reentrancy attacks.

b. Race Conditions: The contract does not have any transaction ordering dependency, so there is no risk of race conditions.

c. Access Control: The contract uses a simple access control mechanism by checking if the msg.sender is the owner before allowing the owner change function to be called. This is correctly implemented.

d. Integer Overflow and Underflow: The contract does not perform arithmetic operations, so there is no risk of integer overflow or underflow.

e. DoS with Block Gas Limit: The contract does not have loops or arrays, so there is no risk of exceeding the block gas limit.

f. Unchecked External Calls: The contract does not make external calls, so there is no risk of unchecked external calls.

g. Denial of Service: The contract does not seem to have any potential for a denial of service attack.

h. Forced Ether Reception: The contract does not have a payable function or a fallback function, so it cannot be forced to receive Ether.

4. Gas efficiency

The contract is quite gas efficient as it does not have complex computations or large storage variables.

5. Additional recommendations

a. Consider making the owner variable private and only accessible through the getOwner function to follow the encapsulation principle of OOP.

b. If this contract will be part of a larger system, consider using the OpenZeppelin’s Ownable contract, which has been thoroughly tested and reviewed by the community.

c. It’s a good practice to add a requirement in the changeOwner function to prevent the owner from being set to the zero address.

6. Overall

Overall, the contract is simple and well-written, with no major security issues found. However, it’s always a good idea to have your contract audited by multiple auditors to ensure its security.

The bottom line

ChainGPT did a good job of pointing out different functionalities and identifying bugs and security risks. It also found all the bugs we placed intentionally.

Let’s keep in mind, though, that this experiment was performed on a simple, smart contract, and developers still should manually check the output and decide if it is ready for deployment. Smart contract auditing and generation are in the early stages, and projects that seek a thorough analysis of the code should not rely on this alone but work with companies specializing in such audits. In a similar experiment with Google Gemini, we found that while it effectively analyzes the code structure, its ability to identify and describe errors or vulnerabilities clearly requires further development.

To summarize, even though AI tools are useful for automating aspects of code analysis, they shouldn’t be viewed as a replacement for human expertise. The best approach is a collaborative process where AI augments human capabilities. This allows auditors to focus on complex analysis and decision-making while leveraging AI to streamline the initial identification of potential issues.

That wraps up our first hands-on experiment. However, it did not cover additional security-related concerns on the blockchain that can be improved through AI.

Threat detection & spam protection

Web3 has been a popular target for scammers and fraudsters. The technology’s development plays into their hands, making fraud techniques more efficient and harmful.

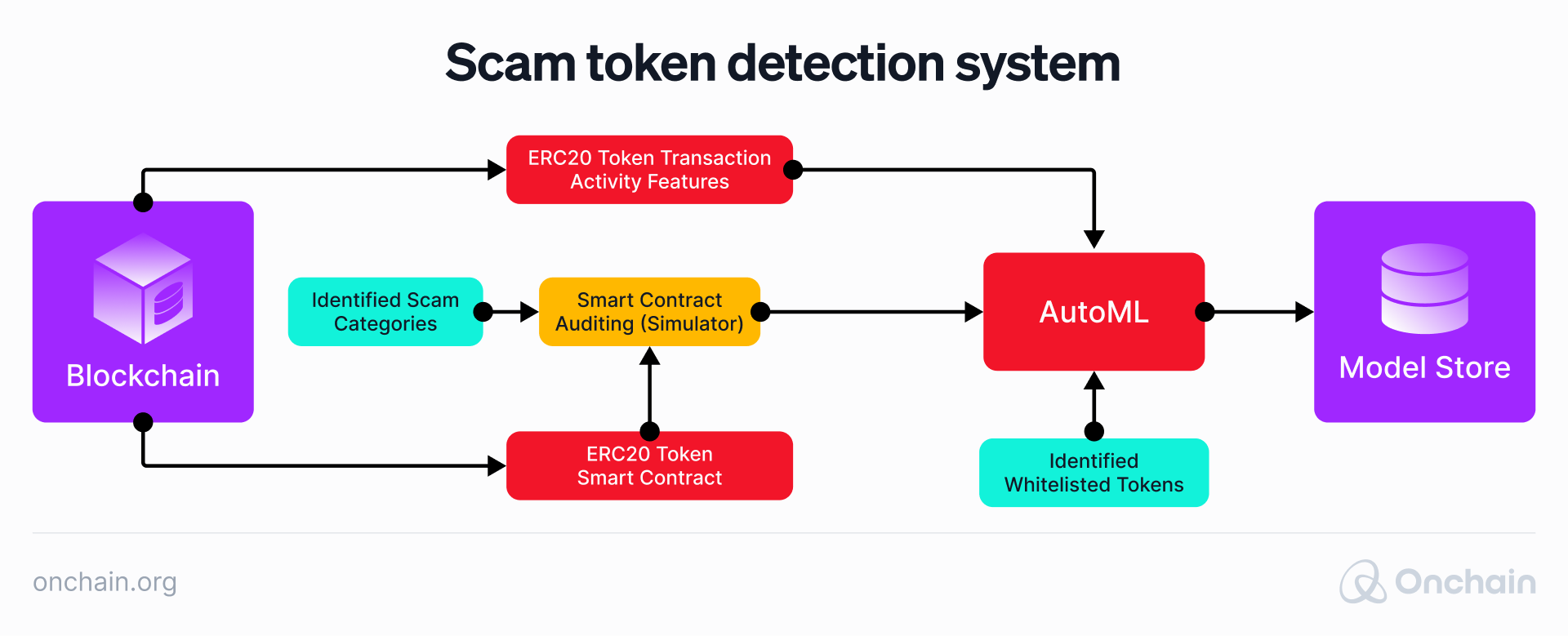

AI can assist and make a genuine impact. For example, Coinbase is fighting against fraudulent ERC-20 tokens with its new Scam Token Detection System. It uses the following two powerful methods to keep users safe: checking the actual code of the tokens (the aforementioned smart contract auditing) and machine learning to find suspicious activity patterns.

The system looks for unusual behavior to catch unprecedented scam schemes. If a group of accounts starts acting abnormally, it might be a sign of a new scam. By analyzing all the activity on the blockchain, the system can spot these irregularities like a detective looking for clues.

Source: https://www.coinbase.com/blog/detecting-the-undetectable-coinbase-erc-20-scam-token-detection-system

Moreover, while self-custody empowers users with control over their assets, it also exposes them to greater risk from hackers and scammers, with limited avenues for assistance.

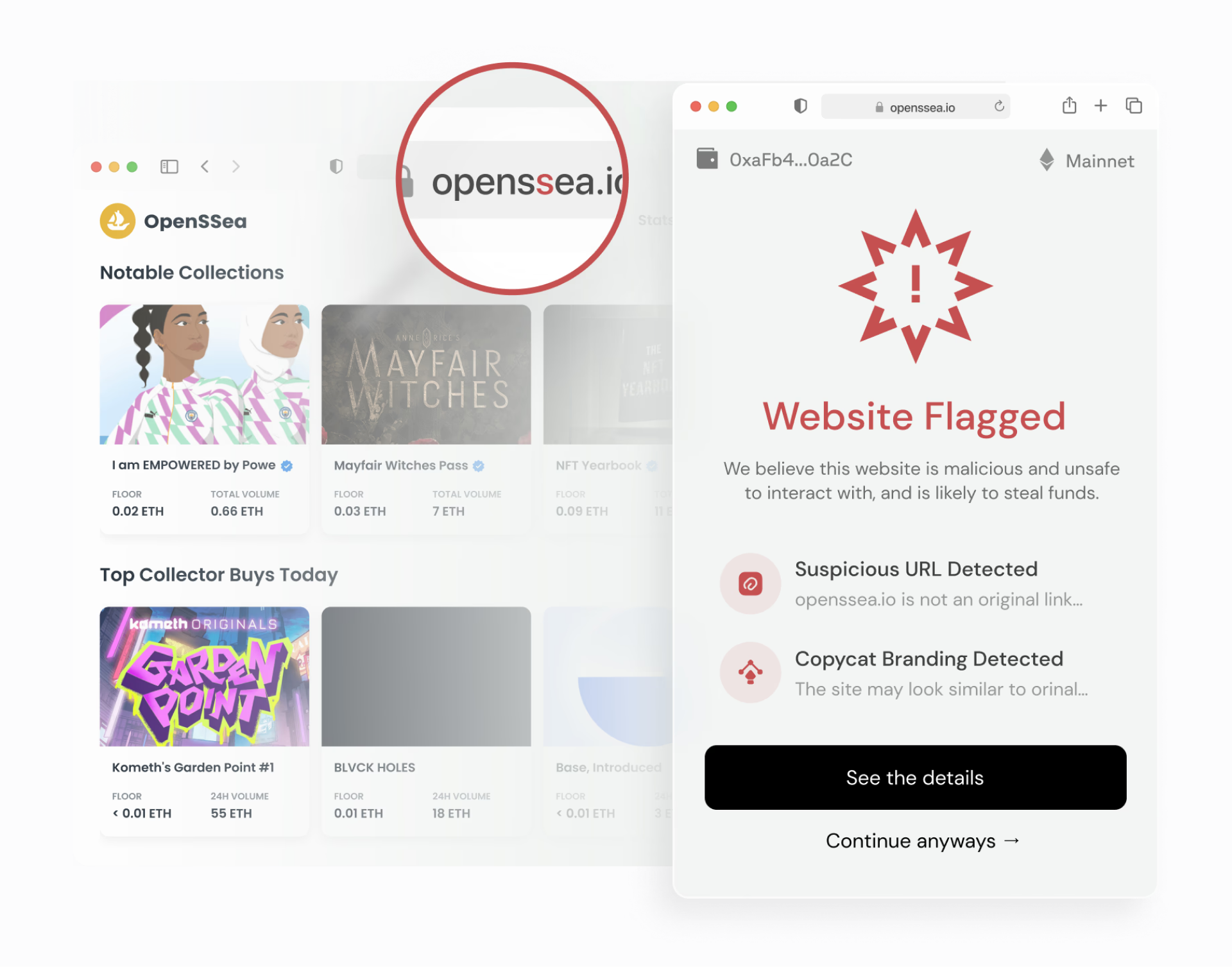

Trading on DeFi apps starts by linking a crypto wallet to the app, enabling interaction. This sounds simple but exposes them to the risk of approval phishing attacks, a leading cause of the $0.37 billion lost in 2023 alone. Phishing sites trick users into connecting their wallet to a fake app, which results in gaining access to funds.

The Fireblocks dApp protection of the secure transfer network automatically detects suspicious contracts, phishing sites, and hacked apps, warning users before they connect. It uses AI-powered real-time threat detection to analyze key risk factors, like fake website addresses, harmful code, and suspicious website registration details. It also checks the app’s code for signs of a bad reputation or common attack patterns.

Similarly, the Web3 project Blowfish introduced a wallet that protects its communities from the darker side of Web3. Their Timeless Wallet enables users to connect to dApps via WalletConnect, so Blowfish safeguards are in place immediately. Blowfish utilizes powerful AI tools, including transaction simulation, threat detection, and anti-phishing technology, to help more and less Web3-savvy people avoid malicious websites.

https://blowfish.xyz/

User privacy

While traditional blockchain networks are secure in many ways, they can inadvertently expose sensitive transaction details and user identities to prying eyes. This raises concerns about surveillance, data breaches, and the misuse of personal information, hindering wider adoption and trust in dApps.

To tackle these challenges, innovators are exploring various strategies that combine blockchain with cutting-edge privacy technologies. From ZK-proofs to homomorphic encryption, these solutions aim to create a more secure and private environment for blockchain users.

Meanwhile, decentralized ZKML search engines are improving online privacy by utilizing the most advanced cryptographic techniques, such as oblivious transfer and secure multi-party computation. These technologies ensure that your searches remain anonymous, your data is never stored, and the results you receive are unbiased and unfiltered. This approach offers a safe haven for researchers, journalists, and anyone seeking accurate information without the fear of being tracked or manipulated.

Smart contract generation

Starting a Web3 and blockchain development project is significantly easier and faster with generated source code or with the help of an AI assistant. Even though popular solutions like Github Copilot have been helping programmers code contracts for years, the newly introduced LLMs are trained on smart contract code and can provide more reliable results.

STEP ONE

STEP TWO

STEP THREE

STEP FOUR

STEP FIVE

STEP SIX

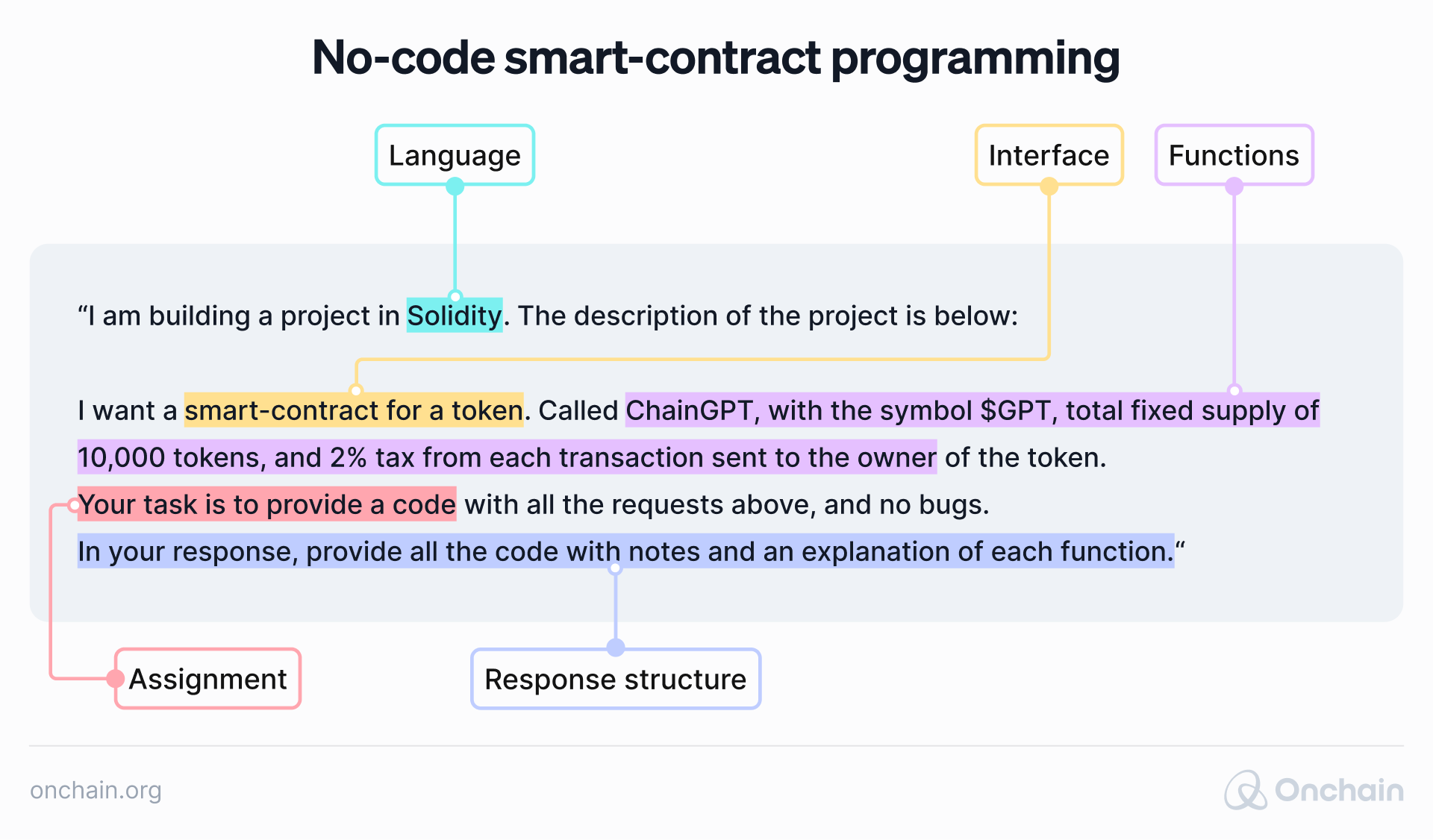

One of the most popular solutions for building smart contracts using generative AI is the tool we have already experimented with, ChainGPT. Its no-code smart contract generator and auditor platform simplify the creation of secure and functional smart contracts using AI algorithms. Moreover, the platform is much more user-friendly than typical Web3 solutions. It automates testing and deployment, making blockchain technology more accessible to newcomers.

An example of a prompt that can be submitted to ChainGPT and similar LLMs to generate smart contract code as an output.

ChainGPT’s popularity indicates a growing interest in generative smart contracts. As of May 2024, it has 120,000+ monthly active users and 52,000 holders of its native utility token, $CGPT. It has already partnered with 80+ leading Web3 companies. Also, ChainGTP’s users generated over 20 million NFTs with ChainGPT.

We are aware that the majority of readers don’t have a developer background. If that’s you, then the solutions mentioned are explicitly designed for you. You can test how easily it is to generate smart contract code with ChainGPT. Simply follow this quick step-by-step guide:

STEP 1

STEP 2

STEP 3

STEP 4

STEP 5

STEP 6

Enhanced data management

AI also helps enhance efficiency and user experience while handling data on decentralized networks. Projects like The Graph and Ocean Protocol are the pioneers in this space, utilizing artificial intelligence to optimize data indexing, querying, and sharing in decentralized ecosystems.

The benefits of adding AI and blockchain as ingredients for smarter data management. Source: https://www.turing.com/kb/does-artificial-intelligence-impact-blockchain-technology

The Ocean Protocol taps into a so-called data economy niche. It offers tools and infrastructure that allow data providers to manage and profit from their data assets while maintaining privacy and security via blockchain technology. The project prioritizes AI data, providing a decentralized and transparent marketplace for information and connecting data providers and consumers.

The AI company Thermaiscan focusing on womens health and breast cancer with smartphone based thermal sensor are exploring onchain breast cancer data market, takes similar approach:

Tokenization opens up ways to monetize onchain data and reward communities for that, which would be very cumbersome and difficult if done without Web3. Blockchain basically solves this issue and makes it simple.

Enhanced data management doesn’t stop at optimized indexing or transferring information. AI can even improve the collected information. We can point to some distinct examples examined in our previous report on DePIN projects. Just take Hivemapper, which introduced an AI-based self-labeling feature to its street-level images. Companies and researchers can use and process such labeled data more efficiently, leading to further innovations in this space.

Machine learning crypto investments

Crypto investments are a vast sector in Web3. Of course, AI has its place here as well. Projects utilize ML (Machine Learning) to develop advanced algorithmic cryptocurrency trading strategies. They analyze large amounts of market data, including price movements, trading volumes, sentiment analysis, and other factors, to identify patterns and make trading decisions. This is vital in volatile markets like crypto, especially for businesses trying to diversify their investment portfolios.

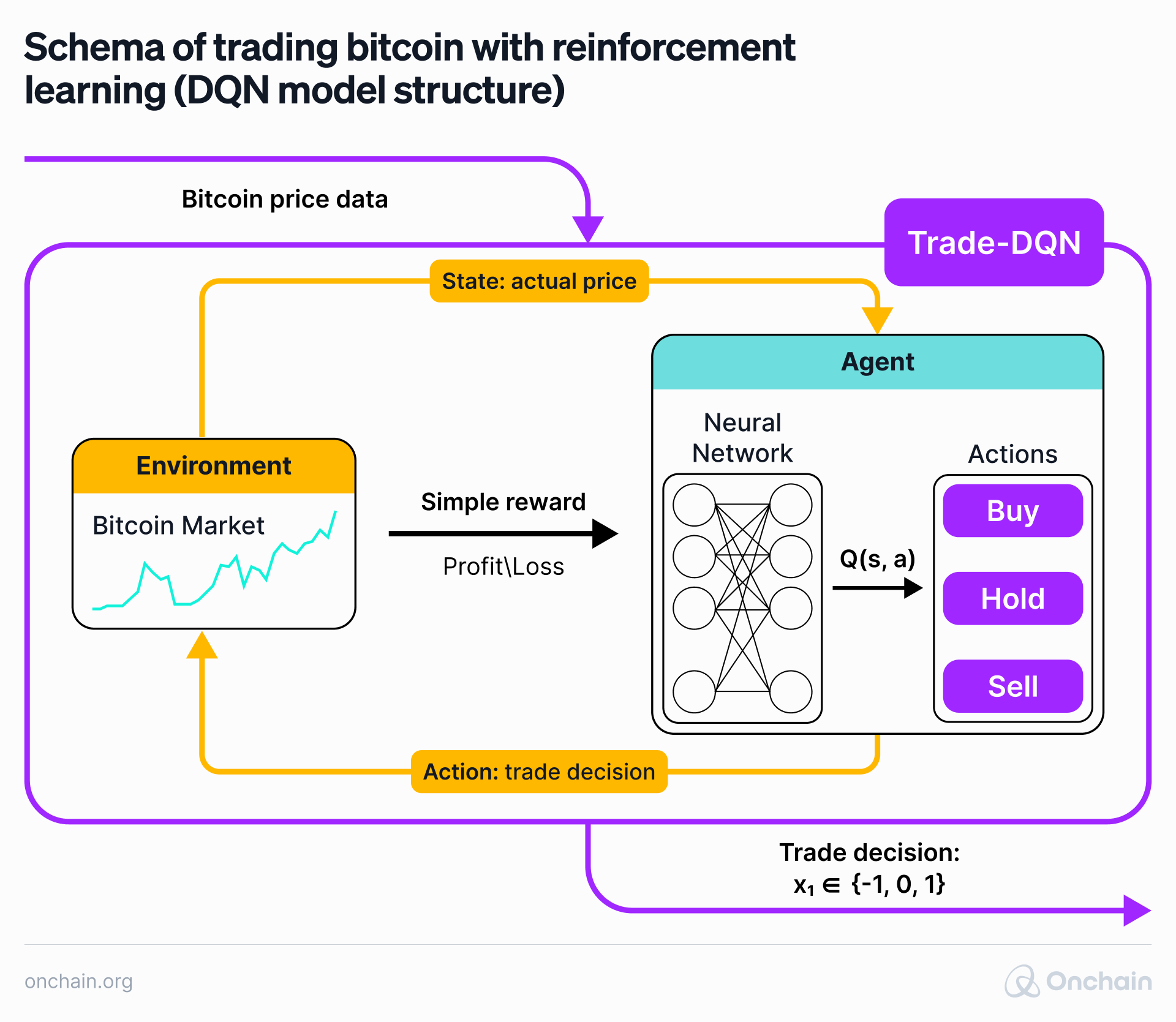

schema of trading bitcoin with reinforcement learning (DQN model structure). Source: https://www.nature.com/articles/s41598-024-51408-w

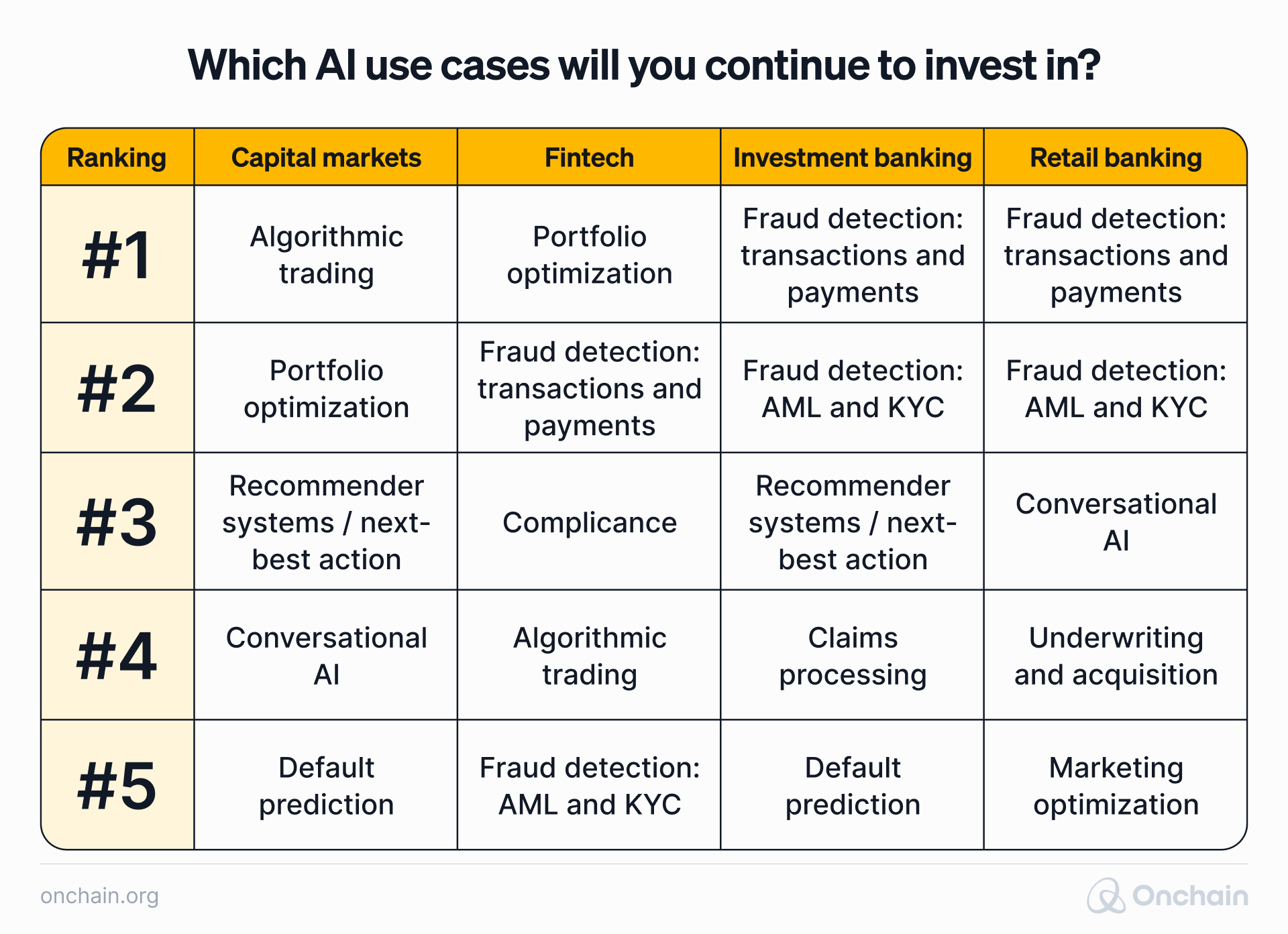

Nvidia’s State of AI in Financial Services report highlights the growing adoption of AI across TradFi and crypto firms, aiming to enhance business performance. The following table lists the most prominent use cases in the various areas of financial services.

NVIDIA State of AI in Financial Services 2022 applicable to crypto, blockchain networks, and onchain transactions. Source: https://www.nvidia.com/content/dam/en-zz/Solutions/industries/finance/ai-financial-services-report-2022/fsi-survey-report-2022-web-1.pdf

What kind of techniques do AI tools use in financial services?

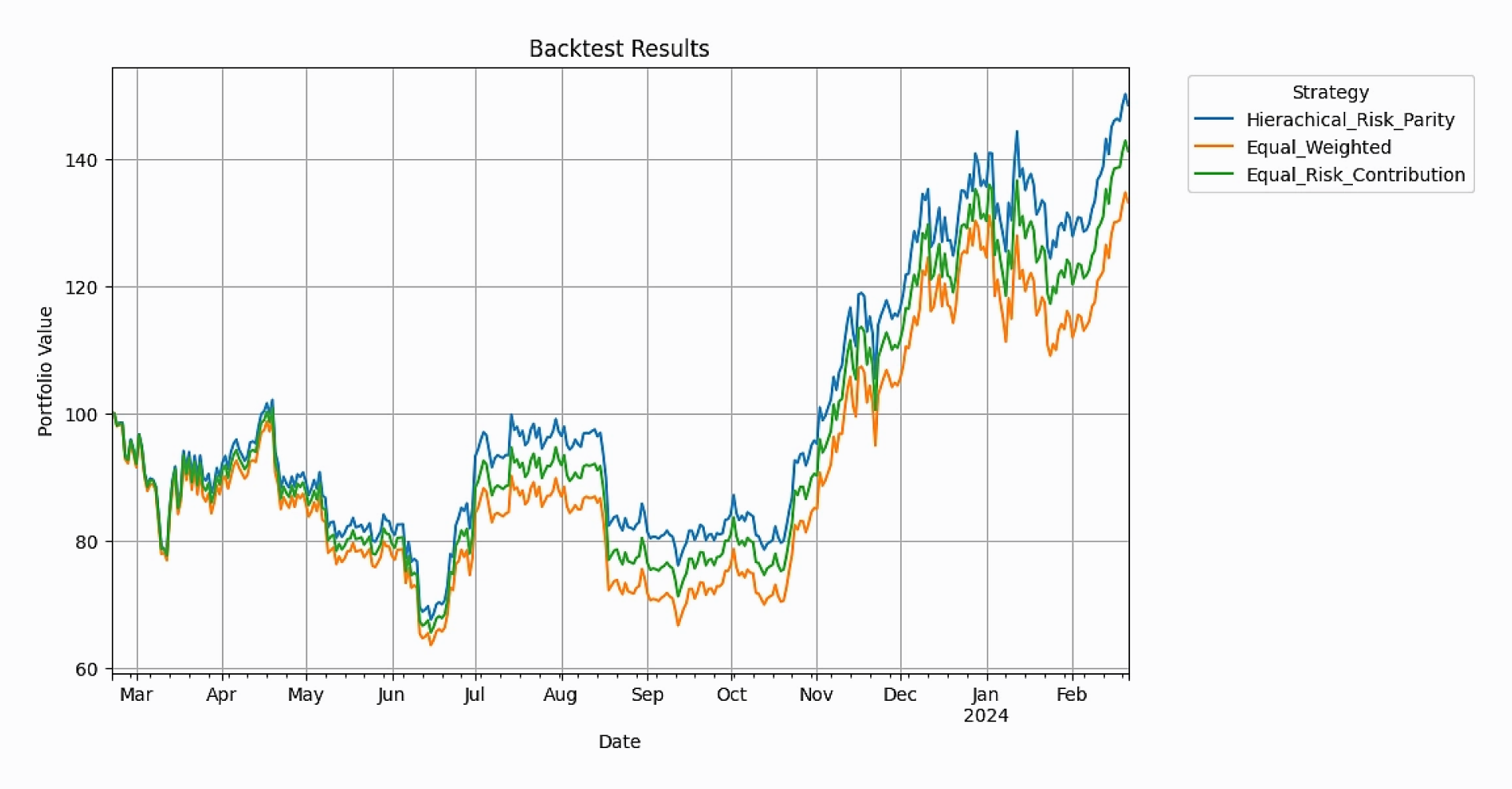

- Data training techniques: supervised learning (e.g., performed by algorithms such as neural networks and random forests) and unsupervised learning (e.g., hierarchical risk parity).

- Sentiment analysis: using natural language processing to gauge market sentiment from social media and other online sources.

- Over time adaptive learning: models adapt and improve as they are exposed to more data, making them more accurate in their crypto trading decisions.

Simulating and plotting the performance results of a $100 starting value portfolio.

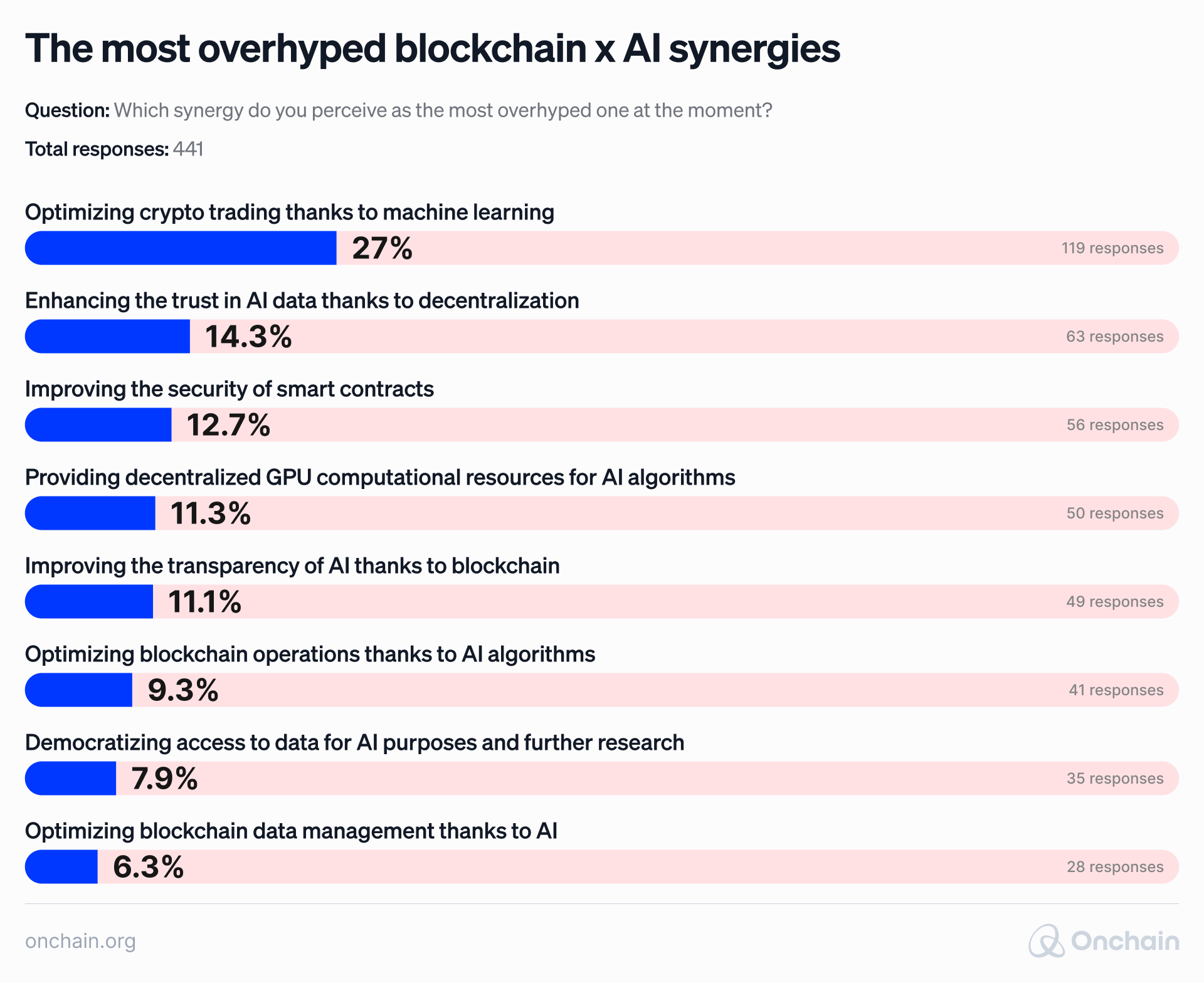

Our research revealed that crypto trading boosted by machine learning is the most recognizable synergy between AI and blockchain. The survey results are shown here.

At the same time, ML-supported crypto trading is seen as the most overhyped example use case of AI in blockchain. It earns its popularity primarily due to opportunistic traders, not the real-world impact it can make.

Another popular AI and blockchain combination is investment-related but doesn’t directly affect actual trading.

AI algorithms analyze data from the blockchain’s security mechanism, popularly called mining. Artificial intelligence predicts potential failures and schedules timely maintenance. This reduces downtime and boosts the operational efficiency of mining hardware. It may also manage the energy consumption of mining rigs, optimizing their operation times to reduce costs and address the environmental impact of crypto mining.

It is close to impossible for humans to perform such analysis manually. One reason is the volatility of cryptocurrencies, and another is the tremendous amount of data that needs analyzing. Also, machine learning algorithms monitor and automatically switch to the most profitable chains more efficiently.

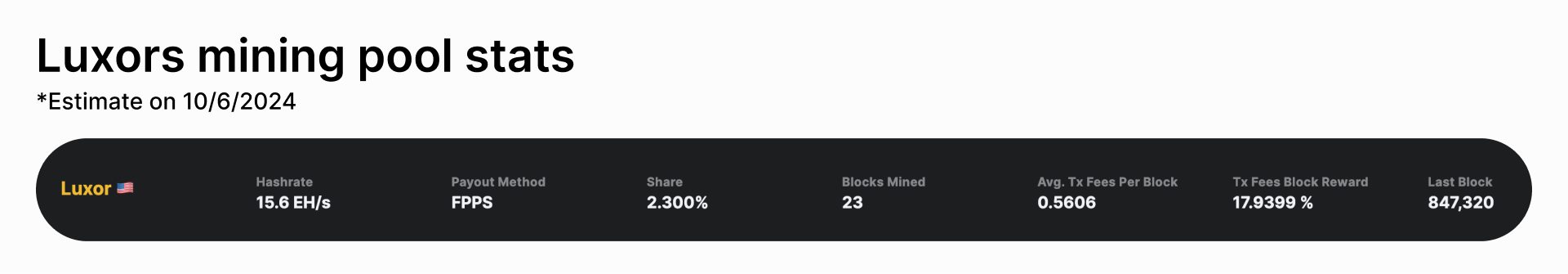

A good example is Luxor, a crypto mining pool and platform with a profit-switching algorithm that automatically decides which cryptocurrencies to mine for maximum profitability. Utilizing multiple blockchains may yield significantly better results than trying to extract profit by mining on a single chain alone.

The stats provided by Luxor show that an entrepreneur can expect around an 8% reward uplift compared to mining just one cryptocurrency.

Luxors mining pool stats. Source: https://hashrateindex.com/

Real-time onchain data analytics

AI makes it possible to collect, analyze, and visualize data from blockchains in real-time. Businesses use this to gain insights into user and market behavior and make informed decisions. This method is particularly valuable in risk mitigation and energy optimization.

Advanced Risk Assessment

Making sense of real-time data is challenging in the blockchain world, where data is transparent but complex. This lack of clarity hinders the team’s ability to make informed decisions.

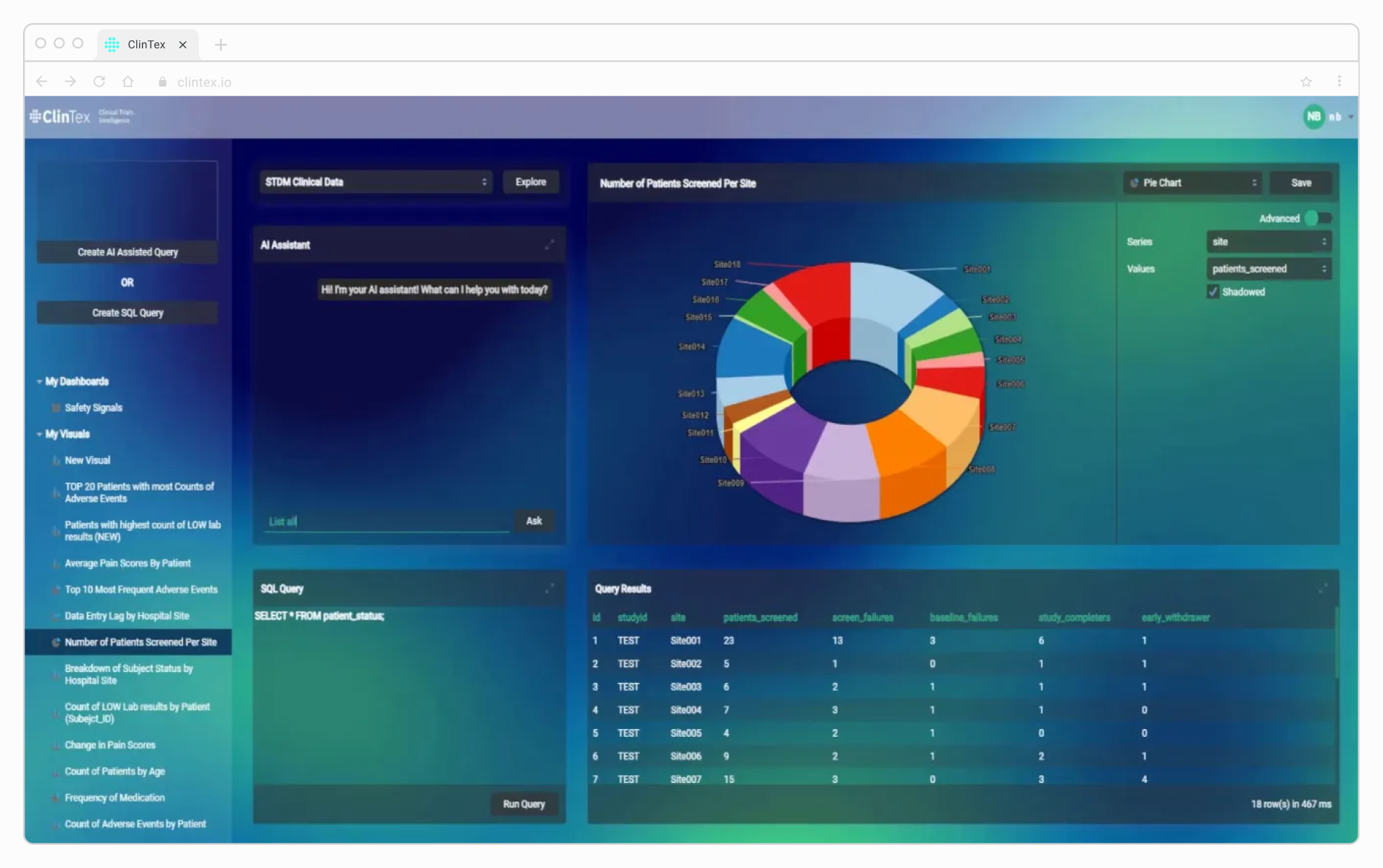

Clinical Trials Intelligence (ClinTex CTI) is a scalable blockchain platform operating in the healthcare sector. ClinTex CTI helps pharmaceutical and medical researchers improve clinical trials. Its Operational Efficiency Application, CTi-OEM, identifies problems that occur during trials, verifies them, and stores them on the blockchain. The Predictive Data Analytics Application CTi-PDA then uses the stored information to predict future problems in drug trials.

Source: https://clintexcti.medium.com/how-ctai-fits-an-evolving-clinical-trials-market-85955dd5d083

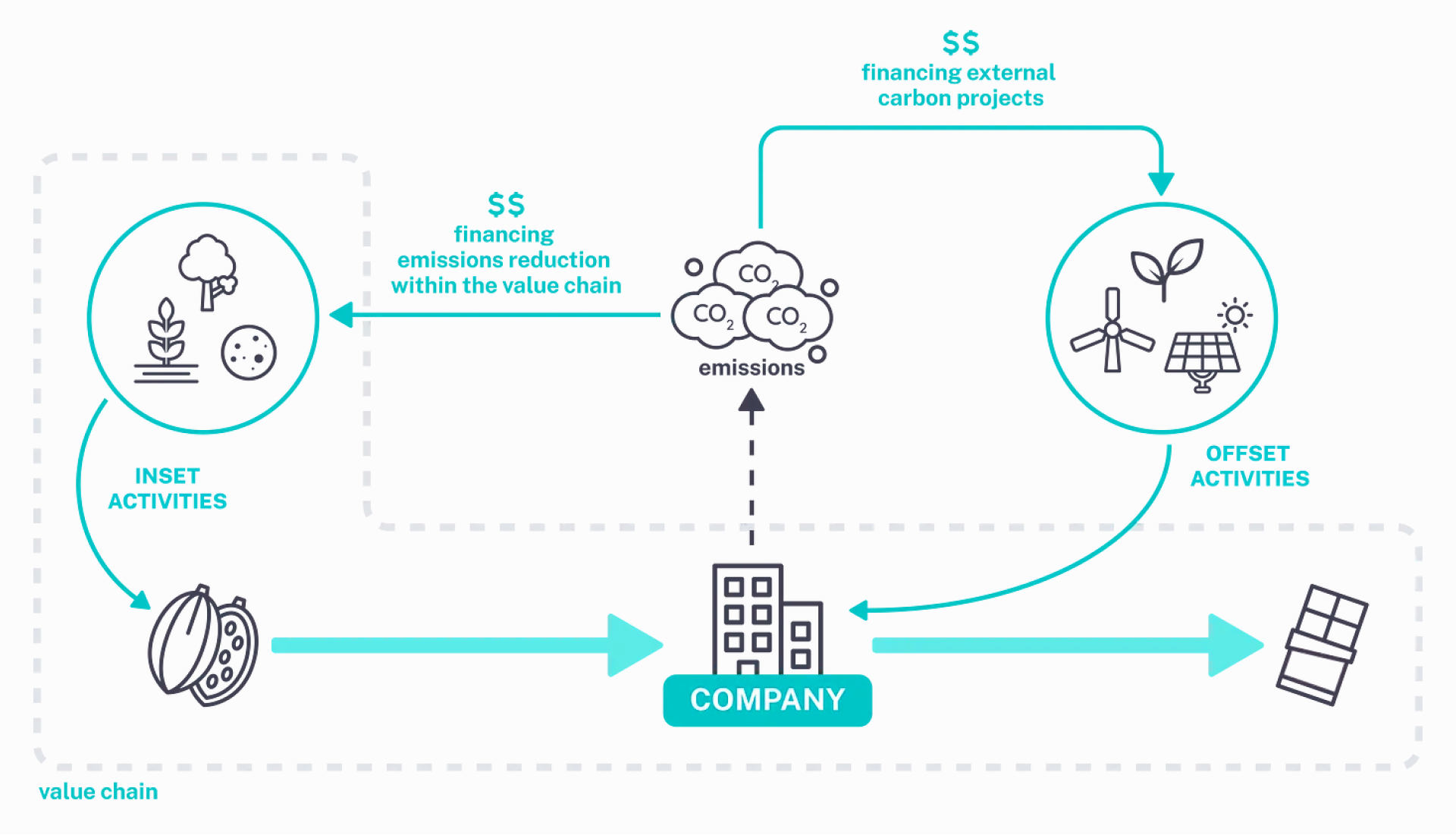

Automated carbon offset verification

Climate change is a critical global issue, and businesses strive to reduce their environmental impact. Carbon offsetting is a concept that supports the reduction of carbon emissions and involves funding projects that remove greenhouse gases, such as tree planting, renewable energy initiatives, or carbon capture technologies.

How does blockchain fit into this picture? Blockchain-based tokenization transforms carbon credits into easily tradeable digital assets. Trading carbon credits on the blockchain eliminates intermediaries, reduces administrative overheads, and accelerates transactions, making the market more efficient.

AI algorithms further automate the process of verifying carbon offset projects, ensuring that they meet specific criteria and deliver the promised environmental benefits. This reduces the need for manual verification, improves efficiency, and reduces costs.

Source: https://blog.tykheblock.ventures/carbon-credits-on-blockchain-b80a96ac848e

Production companies are a considerable contributor to the high level of global carbon emissions. Car manufacturers Hyundai Motor Company and Kia Corporation recognized their responsibility and developed a solution that tracks and manages carbon emissions across their supply chain. The Supplier CO2 Emission Monitoring System, SCEMS, integrates AI and blockchain technology.

It is designed to calculate emissions at every stage of their supplier’s operations and ensure complete transparency and reliable data. The tool reduces the burden on suppliers by automating time-consuming and costly emissions reporting processes. Suppliers can now easily track and manage their carbon footprint with improved accuracy.

In an exclusively Web3 setting, Polygon worked with two carbon offsetting projects, Offsetra and KlimaDAO, to determine the pollution their network has caused since its start. They found it was responsible for 90,654 tons of greenhouse gases, mainly from interactions with the Ethereum network.

Polygon decided to retire carbon credits, in other words, to pay for projects that remove pollution from the air to counteract the damage. They retired 100,300 tonnes via BCT and 4,494 tonnes via MCO2 to cover 104,794 tonnes of greenhouse gases. This is about 1.2 times the yearly emissions of a company like PayPal, or the same as 69,862 flights from London to New York

Source: https://www.klimadao.finance/resources/polygon-goes-carbon-neutral-via-klimadao-the-green-manifesto-in-action

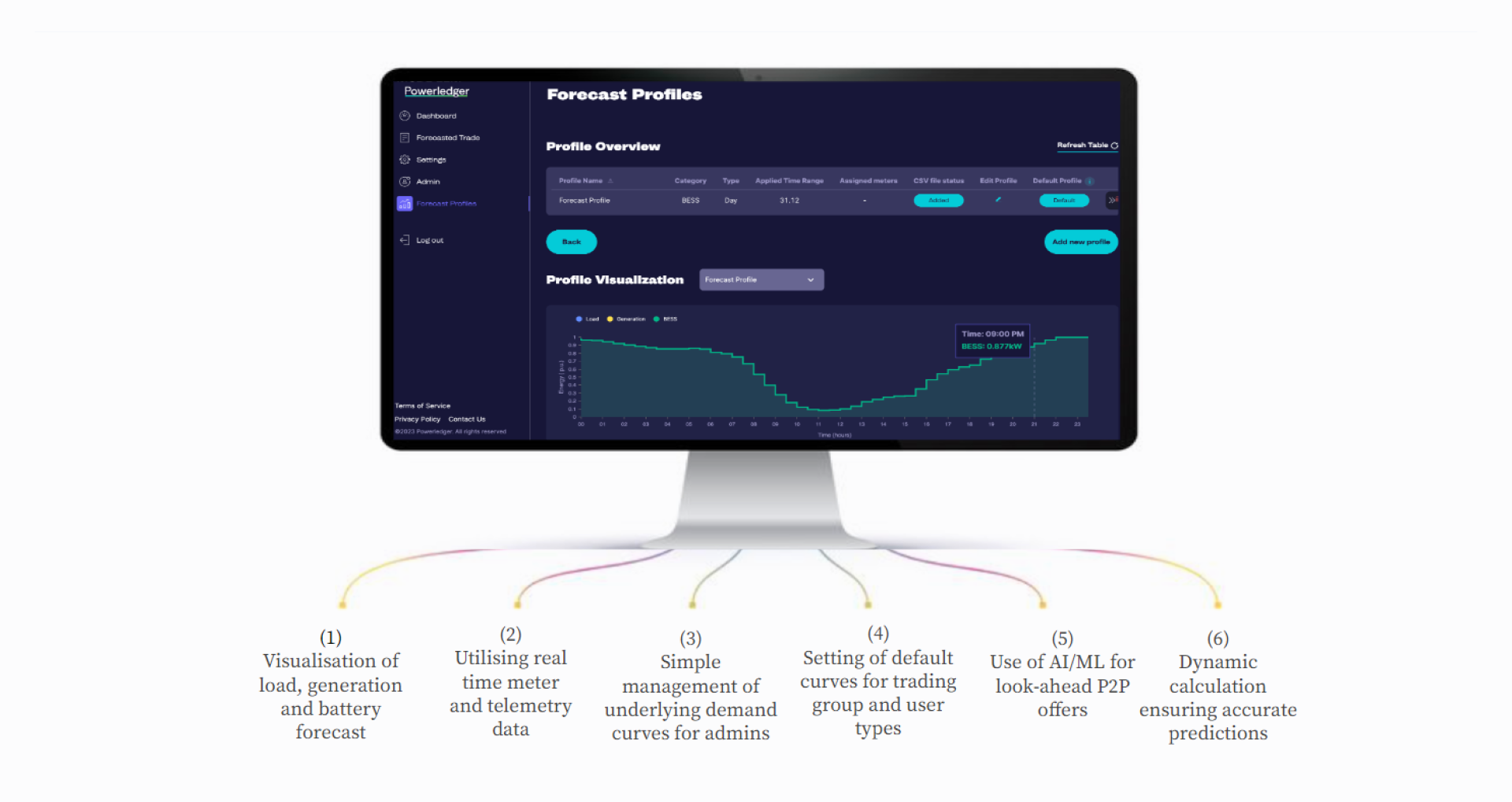

Taking a different approach, Powerledger’s blockchain-based energy trading platform uses an AI-driven algorithm, HWEFA, to provide users with accurate energy predictions. This newly designed tool analyzes energy patterns on the blockchain, providing precise forecasts of future energy needs.

Source: https://www.powerledger.io/media/powerledger-launches-ai-based-hybrid-weighted-energy-forecasting-algorithm-hwefa-for-look-ahead-peer-to-peer-energy-trading#:~:text=Powerledger%27s%20new%20AI%2Dbased%20Hybrid,your%20energy%20consumption%20and%20production.

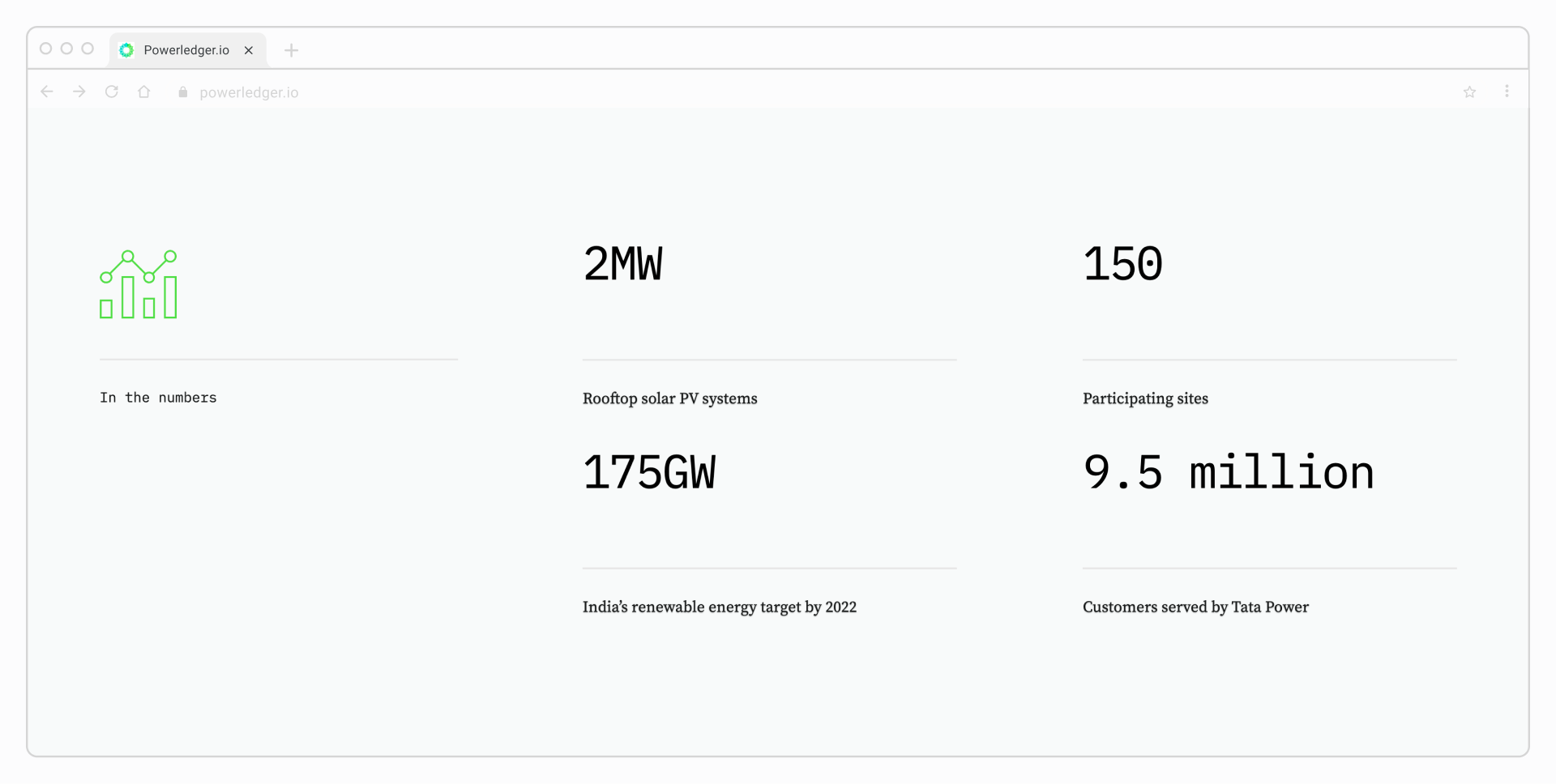

Powerledger’s technology facilitates peer-to-peer (P2P) trading of solar power from over 2 MW of solar PV systems between 150 meters in North Delhi, India. Source: https://www.powerledger.io/clients/tata-power-ddl-india

Powerledger’s partnership with Thai energy group TDED. Source: https://www.powerledger.io/clients/tded-thailand

Business implications of the Blockchain for AI synergies

This is where we get down to business with our Onchain’s research.

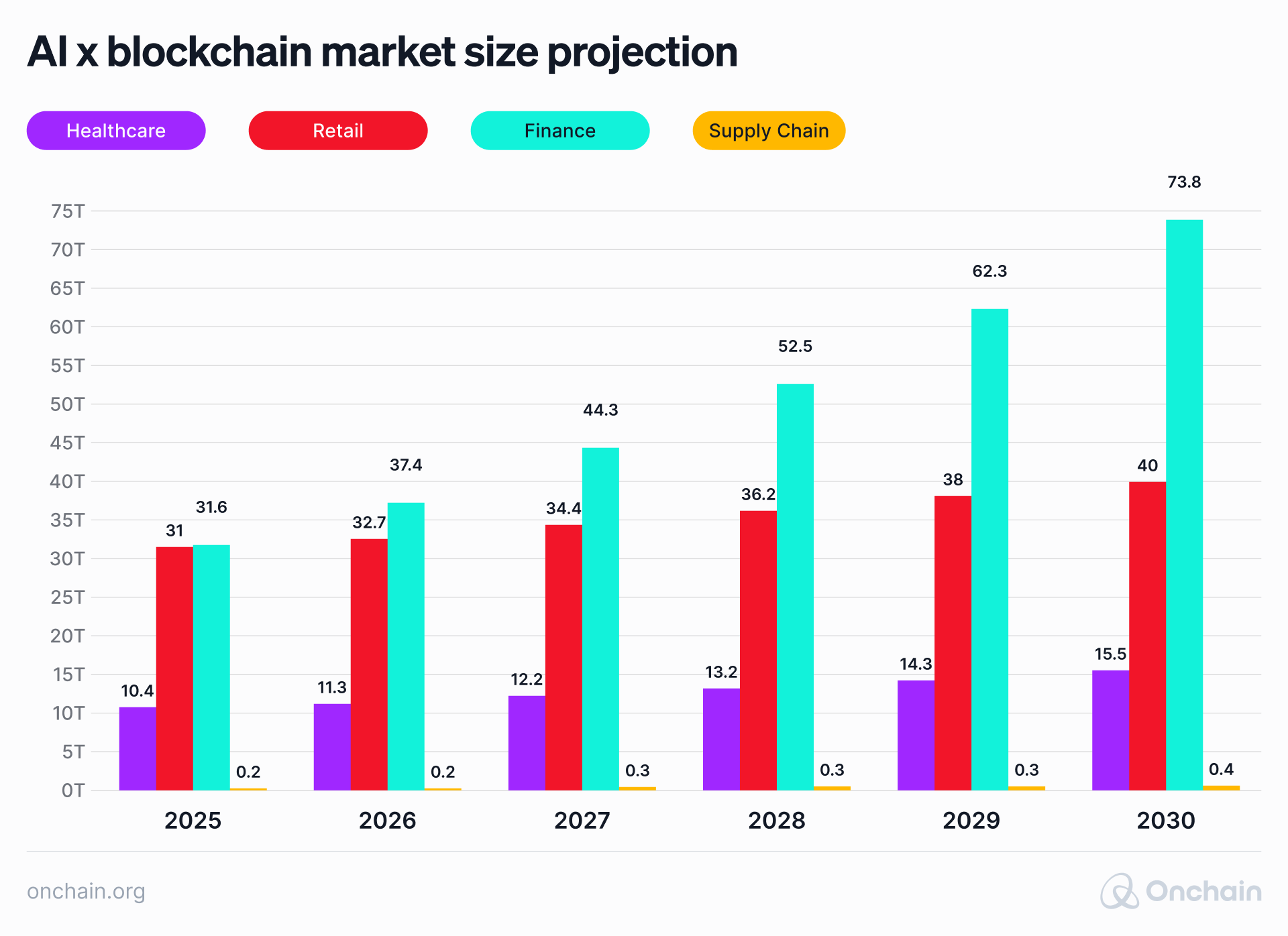

To quantify the impact of the AI x blockchain synergy, we conducted an in-depth market analysis, projecting the growth potential of this integration across four key industries: Healthcare, Retail, Finance, and Supply Chain. We selected these four specific sectors based on their market size, the current level of AI and blockchain adoption, and substantial future synergies.

Market sizing & projection methodology

Below, you can find the methodology we adopted for estimating the market size for AI and blockchain integration across various industries globally.

1. Data collection and validation

- Gathering of historical data (market size, adoption estimate) from 2021 to 2023 for the target industries: Healthcare, Retail, Finance, and Supply Chain across global markets.

- Validation of the data sources to ensure consistency in definitions and methodologies used.

- Normalization of the data to account for fluctuations across the years. In other words, projections (2025-2030) are based on the averaged-out figure in historical years (2021-2023) to form a baseline.

- Addition of notable sources: Statista, WebFX, Vantage Market Research, and Grand View Research.

2. Market size projections

- Calculation of the average growth rate for each industry using historical data from 2021 to 2023.

- Projection of the market size for each industry from 2024 to 2030 by applying the average growth rate to the previous year’s market size, informed by various industry estimates.

3. AI and blockchain adoption estimates

- Estimation of AI and blockchain adoption based on the projected percentage of organizations within an industry that will have implemented these technologies by a certain year, in this case, 2030. For example, analysis utilizes industry-specific AI adoption estimates for 2030, such as 38.5% for Healthcare, 23.9% for Retail, 32% for Finance, and 45% for Supply Chain.

- Insertion of industry-specific blockchain adoption estimates for 2030, such as 68.4% for Healthcare, 45% for Retail, 44% for Finance, and 48% for Supply Chain.

4. Estimates of integration synergies

- When an organization has already adopted blockchain technology, integrating AI can further enhance its capabilities and generate incremental value. This is a theoretical concept and a practical application known as the ‘AI for Blockchain’ synergy. Similarly, if an organization has already implemented AI solutions, integrating blockchain can unlock additional benefits in the real world, known as the ‘Blockchain for AI’ synergy. Then, we used a similar distinction as in the ‘AI x blockchain synergies overview’ part of the report.

- The success of this integration and the amount of additional value or improvement that can be achieved depend on three key factors:

- Industry Size: The larger the industry, the greater the potential for synergies to have a significant impact.

- Adoption Level: The higher the level of adoption of either blockchain or AI, the more room there is for the other technologies to provide additional benefits when integrated.

- Probability Factor: This is an estimate of how likely it is that integrating the two technologies will actually result in the projected improvements or added value. For instance, in the healthcare industry, we found that integrating AI can provide an additional 3.63% integration synergy for organizations that have already adopted blockchain.

- The success of this integration and the amount of additional value or improvement that can be achieved depend on three key factors:

5. Market expansion factors

- Integration synergies result from three expansion factors: revenue uplift, operational expenditure (OPEX) reduction, and improved demand prediction.

- Within these three factors, we further analyzed the specific use cases in an industry.

Based on this research methodology, we anticipate substantial growth across all four industries by 2030, with varied compound annual growth rates (CAGR). The Finance industry is projected to experience the highest growth, with a CAGR of 18.5%. The Supply Chain industry follows closely, with a projected CAGR of 10.32%. The Healthcare industry is expected to grow at a CAGR of 8.27%, while the Retail sector is anticipated to have a CAGR of 5.2%.

4 top industries and how they are impacted

Retail industry

- The retail sector is anticipated to grow to a market size of $40.06 trillion by 2030.

- The integration synergies are estimated to boost the market by 5.90% for blockchain in AI and 8.14% for AI in blockchain.

- The difference in these percentages is rooted in the current varying levels of AI and blockchain technology adoption in the retail industry. The adoption level of AI in the retail industry is 23.9%, which is lower than that of blockchain, which is 45.41%.The general principle is that the wider the technology adoption, the greater the potential for integrating another technology to provide additional benefits and market growth opportunities.

- These synergies can enable seamless supply chain management and improve personalized customer experiences. In addition, the combination can secure transactions more efficiently for an organization than blockchain alone.

Healthcare industry

- The global healthcare market is projected to reach $15.58 trillion by 2030.

- The integration synergies are expected to contribute an additional 4.84% market growth for blockchain in AI and 3.69% for AI in blockchain.

- The difference in these percentages is due to the varying current levels of adoption of AI (38.5%) and blockchain (48.3%)

- These synergies can significantly enhance data security, transparency, and operational efficiency in healthcare systems.

Finance industry

- The market size for the finance industry is projected to reach a staggering $73.83 trillion by 2030.

- The integration synergies are estimated to boost the market by 14.69% market growth for blockchain in AI and 14.55% for AI in blockchain.

- These synergies can enable secure and transparent transactions, fraud detection, and personalized investment strategies.

Supply chain industry

- The supply chain sector is poised to reach a market size of $0.44 trillion by 2030.

- The integration synergies are estimated to contribute an additional 0.09% market growth for blockchain in AI and 0.12% for AI in blockchain.

- These synergies can facilitate efficient logistics, real-time tracking, and secure data sharing across supply chain networks.

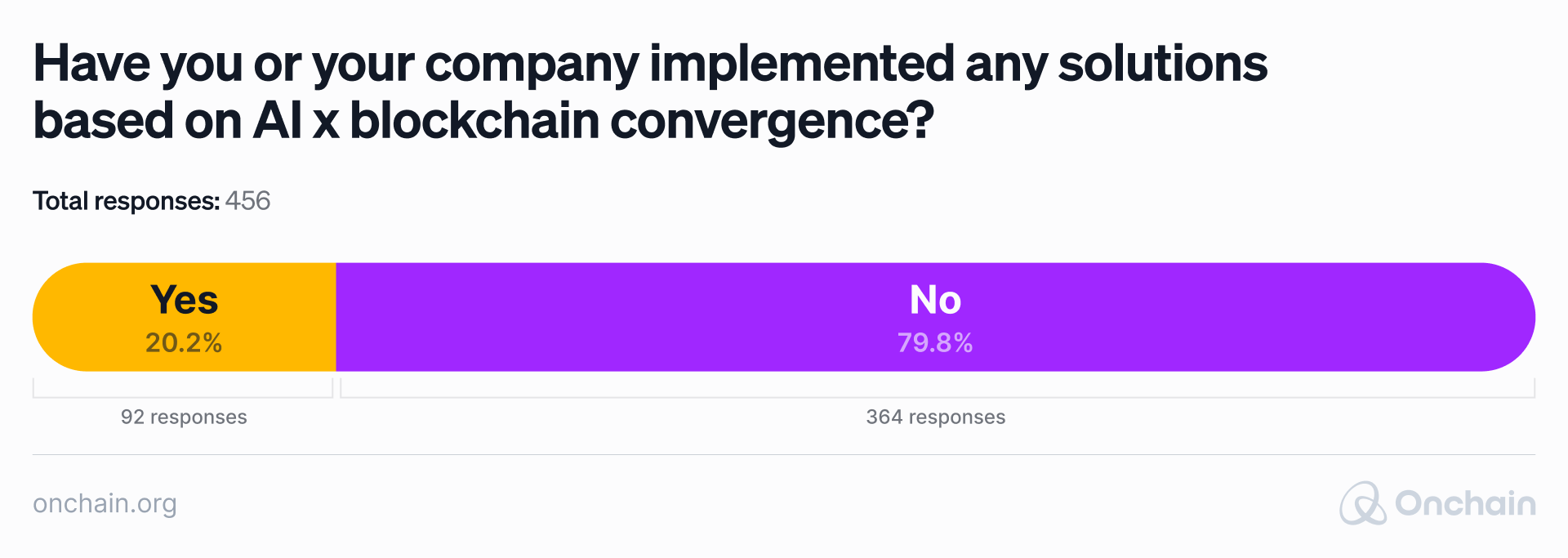

It’s worth noting that currently, the adoption of AI x blockchain convergence companies remains mediocre at best. According to our survey, the percentage of businesses that have already implemented solutions that combine both technologies is only 20.2% of the respondents, despite most of them working in technological industries.

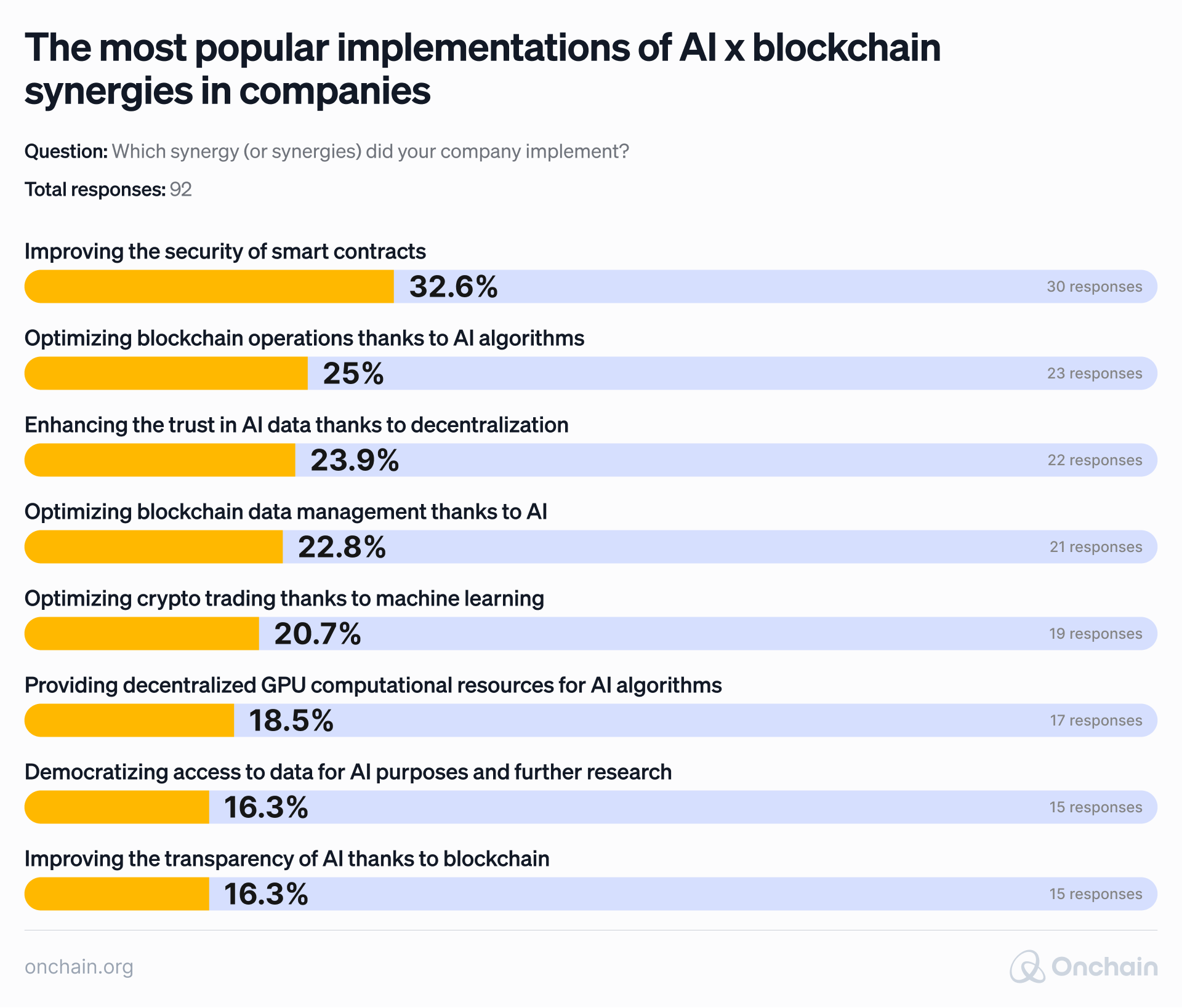

Let’s take a closer look and see which use cases are most frequent. We found that the majority are focused on AI algorithms that increase the security and efficiency of blockchains. However, it’s also worth noticing that 23.9% of companies use the distributed ledger to enhance the trust in AI algorithms, either on their employees’ or clients’ side.

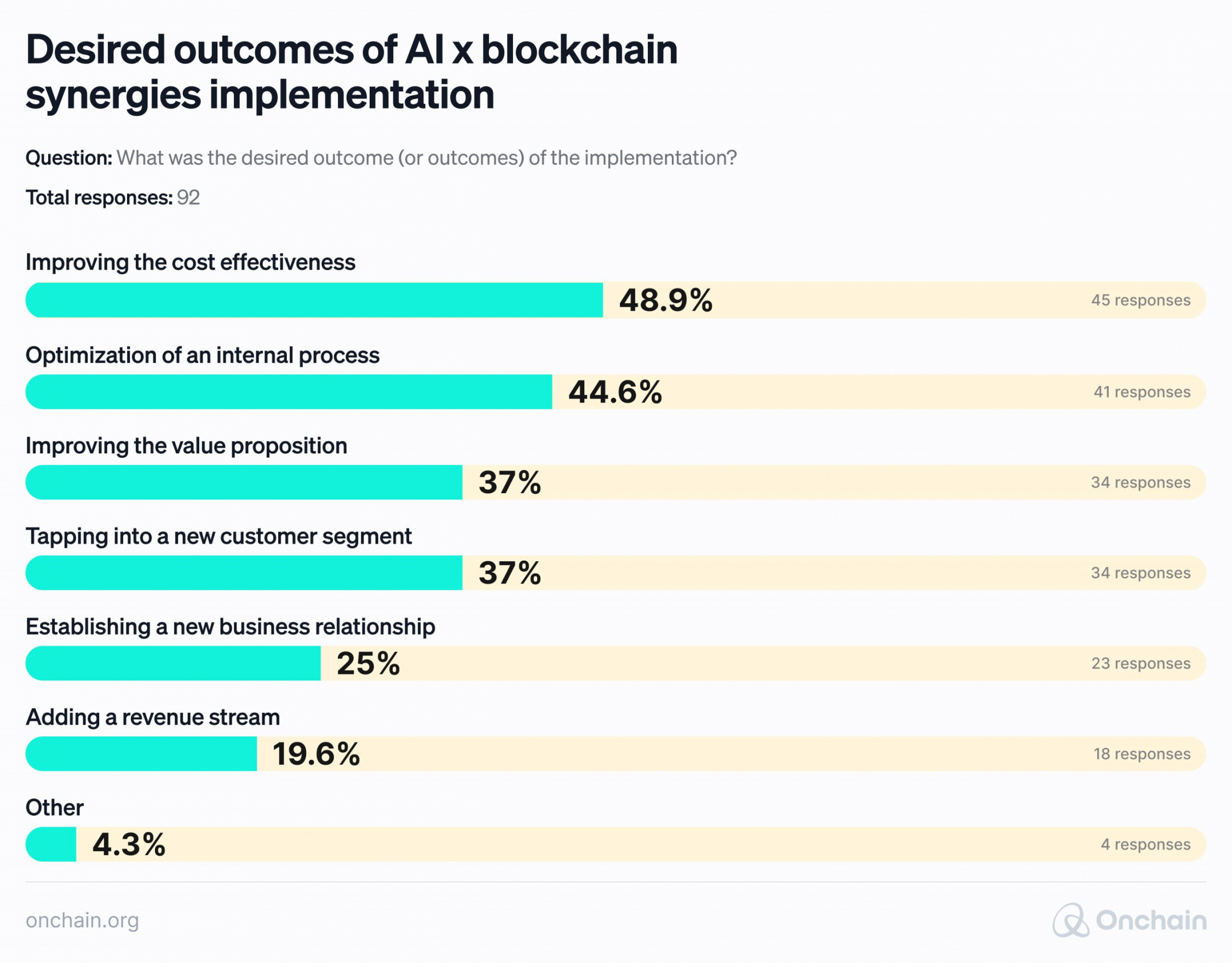

The desired outcomes from implementing the AI x blockchain synergy are primarily internal and related to general improvements in businesses’ operational efficiency. Market-related results seem to play second fiddle at the moment.

Desired outcomes of AI x blockchain synergies implementation

AI x blockchain synergy: use cases analysis

After reading almost 90% of this report, you’ve likely reached the same conclusion as us: AI x blockchain convergence can be seen as a very powerful and promising synergy. The question is, which of the industries, technologies, or processes will it impact the most? Let’s explore them one by one and summarize our findings.

Industries

- Healthcare

- Finance

Healthcare

Out of all the sectors we discussed earlier, healthcare appears to implement combined AI and blockchain solutions most frequently. The AI element enables improved and personalized patient treatment, while blockchain ensures data security and transparency. A good example is Thermaiscan, which explores blockchain to enhance the security of sensitive healthcare information while leveraging AI to provide patients with risk assessments and pre-screening.

In other examples, blockchain x AI synergy creates a kind of data economy for individual patients, such as Akash and Solve.Care are building a secure health data network that allows patients to control and monetize their medical data. At the same time, researchers and organizations can access this data for research purposes. Nebula Genomics and Oasis Labs also implemented similar approaches; the list doesn’t end there. We should see more solutions addressing the struggles of patients and institutions directly, making this a genuine real-world use case of blockchain x AI marriage. The speed and level of progress depend, however, on the willingness to innovate, which is typically somewhat limited and naturally burdened with concern in the healthcare industry.

Finance

The scope of industries that blockchain x AI impacts goes beyond healthcare. However, based on the use case analysis and the numbers collected through the market sizing, we can only add finance as a fertile area. In this sector, the synergy primarily supports fraud detection and enables more efficient finance management without the intention of increasing revenue.

In some cases, this is further enhanced by automated smart contract auditing. Depending on the state of adoption of blockchain solutions in more traditional finance, this is sometimes further enhanced by automated smart contract auditing. Should the DeFi revolution finally reach the world of TradFi, we may see tools like ChainGPT playing an essential role in fund-related risk mitigation.

Another area where the financial industry may be impacted is crypto-AI agents. For now, they are primarily used in prediction markets and to conduct simple non-critical tasks (see the use cases of Fetch.ai outlined in the “Crypto infrastructure for AI agents” part and the AI DAO concept from Autonolas). In the near future though, they may take care of microtransactions and automated payments, especially if they are conducted using cryptocurrencies. Hence, we see the adoption of stablecoins as a critical catalyst for crypto-AI agents.

Technologies

- Generative AI

- Battling fake news

- Micropayments

- Smart contract auditing

Generative AI

When it comes to specific technologies, adopting AI x blockchain convergence may be a critical factor in the further development of generative AI video. In the long run, it’s obviously not possible to create AI videos on a consumer scale without the power collected from decentralized networks of GPUs. Akash, OpSec, or Render will become critical computing resource providers for Web3 solutions such as Livepeer and may become significant for players beyond Web3. However, in this case, it’ll all depend on whether Web3 AI projects operating in the decentralized computing niche are able to cross the chasm that this very disruptive technology faces before mass adoption. Check out our previous report on DePIN business opportunities to understand how they could achieve that.

Battling fake news

The AI x blockchain synergy might prove to be highly beneficial in the battle against fake news and misinformation. Already existing tools, such as Verify (Fox Corporation x Polygon) or the Digital Content Provenance Record standard (Arveawe), may pave the way for solutions that could underlie the entire digital world. Imagine having the opportunity to double-check every suspicious piece of information you come across on the internet.

Micropayments

The third powerful use case is micropayments. Currently, they are not very economical due to the huge fees involved in the traditional payment system. Decentralized AI agents can automate micropayment processing, reducing costs associated with manual handling and allowing even the smallest transactions to be profitable. The Agentverse marketplace provided by Fetch.ai shows how this can be implemented in various business circumstances.

Smart contract auditing

Lastly, we need to mention automated smart contract auditing. Based on our findings, we believe that blockchain technology will be gradually implemented in the already existing non-Web3 solutions. And if it does, smart contract technology will be at the forefront of this incremental revolution.

Such solutions are not immune to risks and fraud, a fact that anyone with basic crypto familiarity can confirm. Fortunately, our research, AnChain.AI and CertiK case studies, and our own experiment confirmed that adding an AI audit element to smart contracts can improve their security and lead to safer Web3 implementation. However, it’s important to note that this particular enhancement is still in the (non-distant) future. For now, AI-based smart contract audits require manual double-checks.

Internal processes and tools

- Decentralized AI tools

- Enhanced data security

Decentralized AI tools

The AI x blockchain convergence is all about incremental improvements – at least until the Web3 technology is widely adopted. Oddly enough, at this point, we’re mostly discussing the ability of this synergy to improve itself.

Thanks to blockchain-enabled decentralized AI research, we should expect less biased and more accurate AI solutions. Tools like Bittensor, Alora, or AIT Protocol show that it’s possible to train AI models in a more inclusive manner, involving more parties (including individuals) in building algorithms than just the big tech giants. This could lead to an improved state of AI in general, including solutions that we use daily as humans or businesses. Yes, the decentralized ChatGPT is already here, and you should definitely check it out: enqAI.

Enhanced data security

Besides that, we see great potential in areas where blockchain addresses AI challenges, particularly regarding data security. As demonstrated with examples from diverse industries, DLT is partnering with artificial intelligence primarily to enhance the safety of information used to power AI algorithms.

Therefore, when combined with the ability to incentivize specific data type sharing (the aforementioned decentralized AI research), such use cases could open the gates for a safer, more inclusive AI-powered world. However, this is again a future utility that builds on the AI x blockchain tandem, raising concerns about its actual usefulness.

Limitations: between ethics and technology

Technological and legal limitations

- Integrating AI and blockchain technologies may encounter scalability issues due to the computational demands of AI algorithms and the consensus mechanisms of blockchain networks. Overcoming these challenges is essential for efficiently operating AI x blockchain applications. It once again undermines the need for decentralized computing implemented on a larger scale.

- Integrating AI and blockchain technologies from different platforms or providers may present interoperability challenges. The necessity of standardization efforts and protocols cannot be ignored, as they are crucial to facilitating seamless communication and data exchange between AI and blockchain systems.

- Overregulation in the EU with the AI and Blockchain Acts can result in not becoming relevant in those two domains.

Ethical considerations

- Regardless of the use case, blockchain and AI convergence face ethical challenges similar to those in other areas where artificial intelligence is involved. These include possibly biased data, the lack of transparency when collecting and processing it, and the potential misuse of this technology.

- Adding blockchain technology to the mix brings additional concerns in three areas. Firstly, regarding the potential anonymity of AI data, which may reduce transparency. Secondly, the immutability of AI errors – in other words, biased AI data cannot be corrected if recorded on the blockchain. Thirdly, there are additional vulnerabilities due to unsecured smart contracts running AI x blockchain applications.

- It’s important to note that blockchain is not just a source of ethical concerns but also a potential solution. For instance, the European Parliament Research Service sees Distributed Ledger Technology (DLT) as a means to reduce data biases and mitigate risks associated with data breaches, offering a promising avenue for addressing AI’s ethical challenges.

- Furthermore, our research reveals a proactive approach to deploying blockchain for AI projects, focusing primarily on addressing AI’s ethical concerns. These initiatives aim to enhance transparency, improve the security of AI data, and decentralize its sources. This evidence supports our belief that the convergence of AI and blockchain has the potential to significantly reduce the ‘moral’ challenges the AI sector currently faces.

Conclusion

- We started our research strongly believing that blockchain x AI synergy can make a real-world impact. Our only uncertainty concerned its distinct purposes, goals, and the time needed to make it a reality.

- Various types of research (use case analysis, quantitative analysis of Web3 AI companies, quantitative surveys) confirmed our presumption. We also reaffiremed our concern regarding the time needed to make the use cases work at full scale.

- The synergy of AI and blockchain is already making a significant impact in areas such as the healthcare industry, where these technologies are demonstrating harmonious collaboration.

- However, the most promising use cases, such as decentralized AI research, combating fake news, or using crypto-AI agents in the finance industry (and beyond), are still in their developmental stages. Their further growth will depend primarily on the adoption of blockchain.

- The future is not dim. Our research has shown that blockchain is a powerful tool for tackling primary AI concerns, including a lack of transparency, trust issues, and centralization. This is not mere speculation but a fact supported by existing use cases currently implemented on a smaller scale.

- Hence, the amplification from the AI side of the market is critical, meaning AI supports blockchain by addressing its vulnerabilities, security concerns, and cumbersome nature. In that case, it could facilitate the growth of this particular technology and eventually build a mutually beneficial relationship for both businesses and individuals—whether they’re onchain or offchain.

How did we approach the research?

The research was based on the "grounded theory." It means we had no specific presumptions before staring the work. The "business" part of the analysis relied on the chosen elements of the Business Model Canvas (A. Osterwalder, Y. Pigneur) and was primarily based on the qualitative research methods.

Research limitation

-

General: It was sometimes challenging to clearly indicate whether a project applies to the “blockchain for AI” or “AI for blockchain” category. Some of the use cases may be included in both. Several projects started their PoC, but there was no up-to-date information on whether they made any progress in mainnet development.

-

Quantitative research: The research on AI companies included only a portion of Web3 AI companies (the ones that appeared in the TOP1500 of CMC at the time of the research, i.e., April 2024). It also didn’t include companies that don’t use tokens (besides CertiK). The results of the quantitative survey on AI and blockchain experts may be slightly biased due to the unequal structure of the sample (e.g., it included more AI than Web3 experts; the majority of respondents represented technological industries). However, considering the nature of the research, which has a distinct focus on technology, the effect on the final results should be minor.

-

AI experiments: The source code that was tested and audited was a simple, smart contract example, and the output is just to demonstrate generative AI systems for blockchain and smart contract development. Generative AI systems are still in the early stages of smart contract development and auditing. Hence, it is not recommended to use them on a larger scale beyond such simple experiments.

Methodology

- The research was conducted using a grounded theory approach. However, before starting it, we had one presumption: AI x blockchain synergy is useful for both Web3 and non-Web3 companies. The presented use cases, industries, or technologies in which the combination of the two technologies fits best were selected based on further research.

- The quantitative research on Web3 AI projects (from the “Web3 AI x blockchain market” section) was done on the first 1500 projects from CoinMarketCap (as of April 2024). The choice of the 107 Web3 AI projects was based on (1) AI services – we looked only for the companies that implemented them or solutions that aim at helping AI; (2) traction – we looked only for projects with working use cases; and (3) the stage of development – we looked only for projects that have at least a PoC in place.

- The quantitative survey was conducted with a diverse group of 464 respondents. A significant portion (41.4%) indicated AI as their area of expertise, while 25% identified with blockchain. The remaining respondents represented a mix of both or other completely different industries. The majority of respondents (32%) came from technological industries, with job roles primarily in Lead/Managerial (36.4%) or C-level/Founding (22.4%).

Glossary

- Deep Learning (DL) – a subset of machine learning where algorithms with multiple successive layers (known as neural networks) can extract features from the input data and make predictions like classic machine learning algorithms.

- Machine Learning (ML) – a core AI technique in which algorithms learn from data to make predictions or decisions without explicit programming.

- Decentralized Artificial Intelligence (DAI) – AI models trained and executed on decentralized networks, that eliminate reliance on a single entity for control or data storage.

- Natural Language Processing (NLP) – enables AI to understand and generate human language. NLP can be used to analyze sentiment in social media data on blockchains or to create chatbots for interacting with decentralized applications (dApps).

- Generative AI – models that can create new data, like images, video, audio, or text. While not directly used in core blockchain functions, generative AI has the potential to create new user experiences within Web3 environments.