Tokenization has a long history. It predates the blockchain by thousands of years.

Combining the “new” with the “old” enables features that were previously impossible, and even unthinkable. Tokenized whiskey barrels, for example.

From intangible memecoins to tokens linked to tangible hard assets, tokenization is providing humanity with more options — and founders with more opportunities.

Some crypto insiders predict that the tokenization market will balloon to $30 tril by 2030. Not everyone is so optimistic. Understanding what tokenization means for the real world will help you make sense of both the optimism and the concerns.

What is asset tokenization?

Asset tokenization is the process of converting a tangible or intangible asset into a token that represents its value or quality. In the Web3 world, this means placing this token on a blockchain such as Arbitrum, Base, Ethereum, Solana, or others.

The token contains information about the reference asset (crypto or otherwise), its properties, and other data that is encoded within the smart contract that initiated the tokenization process.

The technical details are important, sure, but what really matters are the practical advantages of onchain tokenization.

Asset tokenization benefits

Once tokens are created, you can use them in a number of interesting ways. Freely trade, exchange, or store them in compatible crypto wallets and exchanges. The tokenization process allows you to use tokens in new onchain use cases.

Ownership options for gold and many other real-world assets is nothing new. However, tokenization makes these assets more accessible and easier to trade on a global scale. Transferring tokens is straightforward, but transferring or selling offchain stock or commodities can include counterparties, paperwork, delivery services, and other legal or logistical headaches.

Even transferring regular USD can be a problem in places with capital controls or a lackluster banking infrastructure. Stablecoins are a simple, yet profound, onchain solution to fiat transfer issues that affect billions worldwide.

Once you have a token allocation, you can do far more than simply hold them in a wallet. You can integrate tokenized assets into the vast blockchain ecosystem.

Use them as a trading pair in the growing crypto trading economy. Leverage them as collateral in the expanding decentralized finance (DeFi) ecosystem.

Tokenization enables you to have blockchain-based versions of banks and trading accounts, but even better.

Onchain tokens tend to be available 24/7, cheaper to trade, and more accessible. And these crypto tokens are under your control, not an institution’s. This is a significant benefit if you worry about asset confiscation or live in an area without access to robust banking and financial services.

🔸TIP: Tokenization is simply the representation of something else as a token. It doesn’t have to be gold or bitcoin (BTC). Digital arcades replace your fiat money for gaming tokens, an in-arcade currency that is only valid within the arcade.

While arcade tokens severely limit the wider utility of fiat money, tokenization typically provides users with much more utility (like the ability to send tokenized gold to another country with a few clicks).

Some tokens are tied to real-world assets (RWAs) like real estate, gold, or other commodities. Other tokens are strictly onchain with little-to-no connection to the offchain, or “real,” world. Let’s break this down.

What are crypto tokens?

Crypto tokens are countable, onchain units that are stored on a blockchain or multiple blockchains. They may derive their value from their utility, usefulness, or their perceived inherent value. Popular examples of blockchain tokens include bitcoin (BTC), ether (ETH), ada (ADA), and many more.

🔸 Coin or token, what’s the difference? Some will differentiate between coin and token, considering a coin as the primary unit of a blockchain. Tokens would be secondary onchain units built on the same blockchain. For example, on Ethereum, ether (ETH) is considered a coin, while every other Ethereum-based asset (there are thousands) is considered a token.

To avoid confusion, Onchain refers to every onchain asset as a token.

Tokens come in many types. Some are strictly onchain assets with no offchain ties. BTC, ETH, ADA, and many others would fit into this category. Others derive their value or usefulness as a tokenized representation of something offchain or physical, commonly referred to as RWA tokens.

What are tokenized RWAs?

Tokenized RWAs are tokens that are linked to offchain assets found in the real world. This includes tokenized versions of fiat money (USD, EUR), gold, real estate, stocks, and more.

Major centralized exchanges (CEXs) and crypto companies now offer tokenized stocks to a global audience. This provides enhanced access to these stocks outside the U.S. market and is also appealing to those within the United States due to the 24/7 trading window and low fees.

For similar reasons, tokenized USD and gold are also quite popular.

Tokenization example: fiat currency

Fiat currency is, in some ways, an excellent example of tokenization. U.S. dollars (USD) were originally receipts for actual gold. Those greenbacks represented gold ownership; think of a gold-standard era $50 bill as a token, albeit one not stored on a blockchain.

Paxos gold (PAXG) is a token (or receipt) for what? Yep, you guessed it: physical gold. Gold-backed stablecoins are gaining popularity because they are more stable than most other types of crypto. While offchain and onchain tokenization rely on the same concept, the Web3-friendly version enables new possibilities not feasible in the days before blockchain (or the internet in general).

How does tokenization work with fungible tokens?

Most financial value is locked up in fungible tokens. PAXG is an RWA tokenization example that reinvents what USD used to be, but more easily transferable (digital and onchain), usable, and redeemable.

Stablecoins are considered fungible tokens, and so are cryptos like BTC and ETH.

Tokenized RWAs are fungible, meaning they are fully interchangeable. They don’t have any unique characteristics that make them more or less valuable.

Any $10 bill is as valuable as any other $10 bill. The same should apply for $10 worth of stablecoins, tokenized gold, or any other tokenized RWA.

Of course, there are always exceptions to the rule. Dollar bills with rare serial numbers or historical significance, gold salvaged from a Spanish shipwreck, or rare BTC sats can command a premium. Caveats completed, let’s proceed.

What are non-fungible token’s role in RWA tokenization?

Non-fungible tokens (NFTs) are unique (or supply-limited) tokens that are designed to represent a specific RWA or onchain item, like a rare bottle of wine or a CryptoPunk. NFTs were specifically designed to be non-interchangeable tokens.

When it comes to onchain RWAs, NFTs are well suited for real estate. They can represent a specific piece of real estate — or a fraction of it. For example, a house could be tokenized as one NFT.

Or, you could fractionalize that same home into 500 NFTs. In this case, the 500 NFTs would be fungible with themselves, but not with other real estate NFTs. This distinction is important.

Let’s flesh this out with another tokenization example.

- Let’s keep the math simple. A tokenized house is valued at exactly $500,000. Each token represents 1/500th of the house (or $1,000).

- You want all these tokens to have equal value. Your token does not represent the chimney, part of the back porch, or the stairs. It represents a percentage of the entire house.

- If the house goes up in value to $1 mil, everyone has doubled their money. If it goes down in value to $250,000, you’ve lost half your NFT’s value.

RWA NFTs serve a purpose here. These NFTs represent this specific house, not the one down the street or in a different country. A real estate NFT could also represent a share of a specific real estate portfolio, for similar reasons.

Circling back to PAXG and rare Spanish gold, it makes sense for regular gold to be fungible. However, it also makes sense for rare and historically significant Spanish gold bars, which sell for a premium, to be tokenized as NFTs.

How does tokenization work with RWAs?

The RWA tokenization process is quite simple:

- Secure ownership of the RWA to be tokenized: building, gold bar, USD, etc.

- Tie its value and ownership to fungible or non-fungible tokens.

- Put it on the blockchain and enable it to be publicly traded.

- If applicable, implement a redemption mechanism for the RWA token.

Boom, you’ve just tokenized an asset. While simple at first glance, the devil is in the Web3 details.

First, you have to decide what blockchain to tokenize on. You must weigh the tradeoffs related to trust, transaction costs, security, trading liquidity, and other factors.

Some projects address these issues by adopting a multichain approach. For example, you can use the stablecoin USDC on numerous blockchains. This creates better liquidity and lets you use your preferred blockchain.

Survey Insights

According to our survey data, stablecoin adoption in emerging markets is significantly higher than in advanced economies, with 45% of consumers from emerging markets using stablecoins, compared to only 17% in developed regions.

Tokenization concern with RWAs

There are other potential downsides to RWA tokenization. Most importantly, you need to be confident that the assets linked to the RWA tokens are actually owned, secured, and safely custodied by the company tokenizing them. Investor confidence and trust are vitally important in the RWA sector.

At a minimum, tokens need to be backed 1:1 (fully collateralized) with their underlying assets to maintain the “real world” price peg. For example, fiat-backed stablecoins should be fully backed by cash or highly liquid cash equivalents; the vault needs enough gold to fully redeem every gold token, and so on.

🔸What are your investors and users looking for? RWA token buyers and investors are seeking RWA projects in jurisdictions with robust investor protections and well-established legal frameworks.

They don’t want to end up holding a gold token with no gold collateral (making it worthless once everyone finds out). Collateral transparency is crucial for establishing trust with investors and token holders.

Any RWA project you launch will have more credibility with potential users and investors if it’s based in a jurisdiction with strong blockchain legislation and legal enforcement infrastructure.

To build additional trust, be open and transparent about your RWA reserves, their storage, and the redemption process for tokens. Consider releasing monthly or quarterly third-party audits that verify your collateral reserves.

These collateral concerns are the reason some prefer BTC and other onchain cryptos; they have no associated counterparty risk. The same can’t be said for tokenized RWAs.

“Trust, but verify” is a Web3 mantra. In RWA circles, it should be “Trust, but verify RWA collateral reserves.”

Another concern is local crypto regulations and blockchain compliance issues. Potential problems include high compliance costs, licensing issues and delays, and even regulatory actions against you or your company.

Selecting a friendly jurisdiction (for both your headquarters and where you conduct business) is an important decision that you shouldn’t take lightly.

RWA tokenization examples

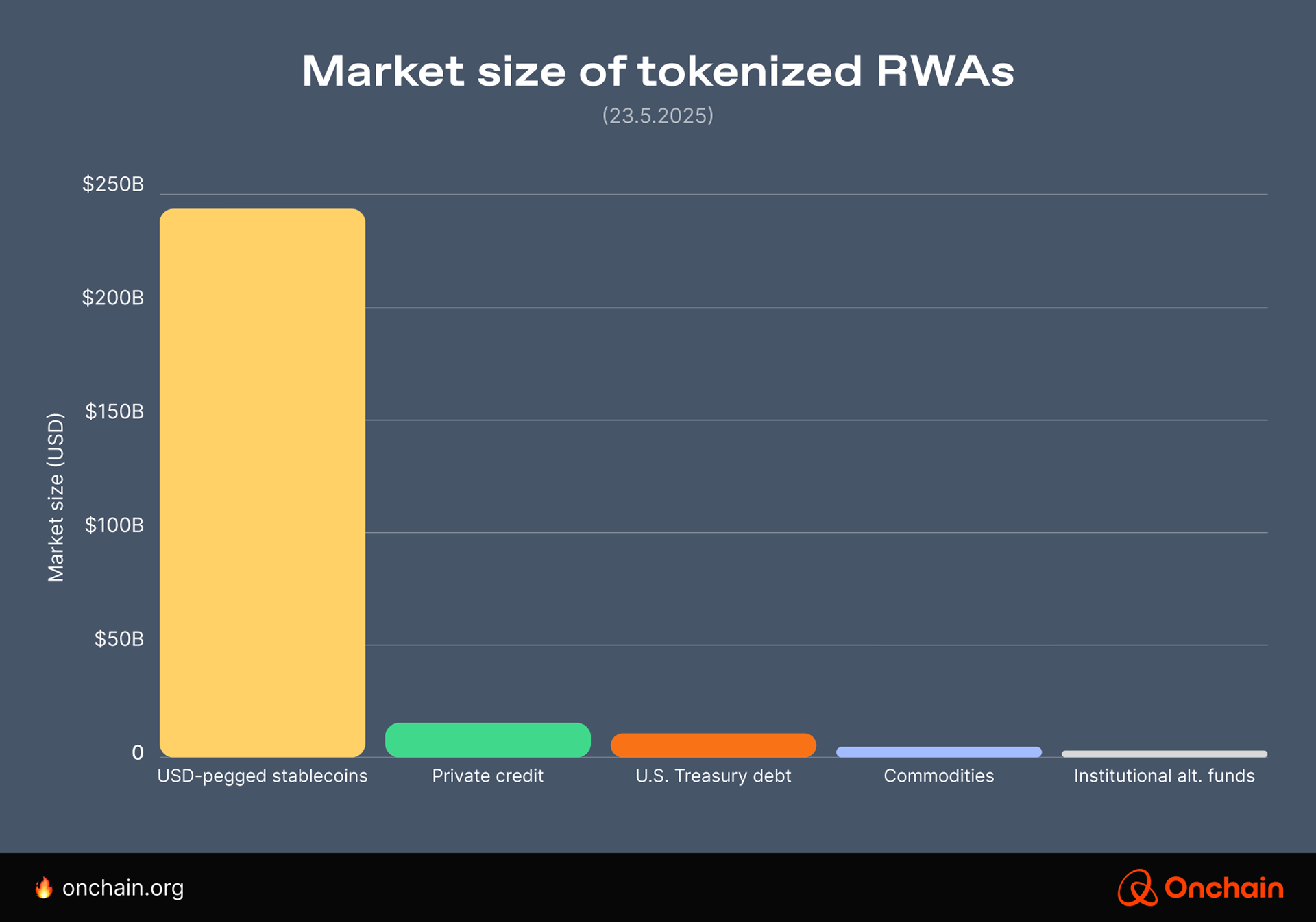

Stablecoins and treasuries are some of the most popular RWA-backed token sectors. These markets are large, highly liquid, and well developed, making them excellent RWA tokenization markets.

- Fiat-backed stablecoins: pegged to fiat, the market is dominated by USD-backed varieties

- Gold-backed stablecoins: backed by vaulted gold, currently dominated by offerings from Tether and Paxos

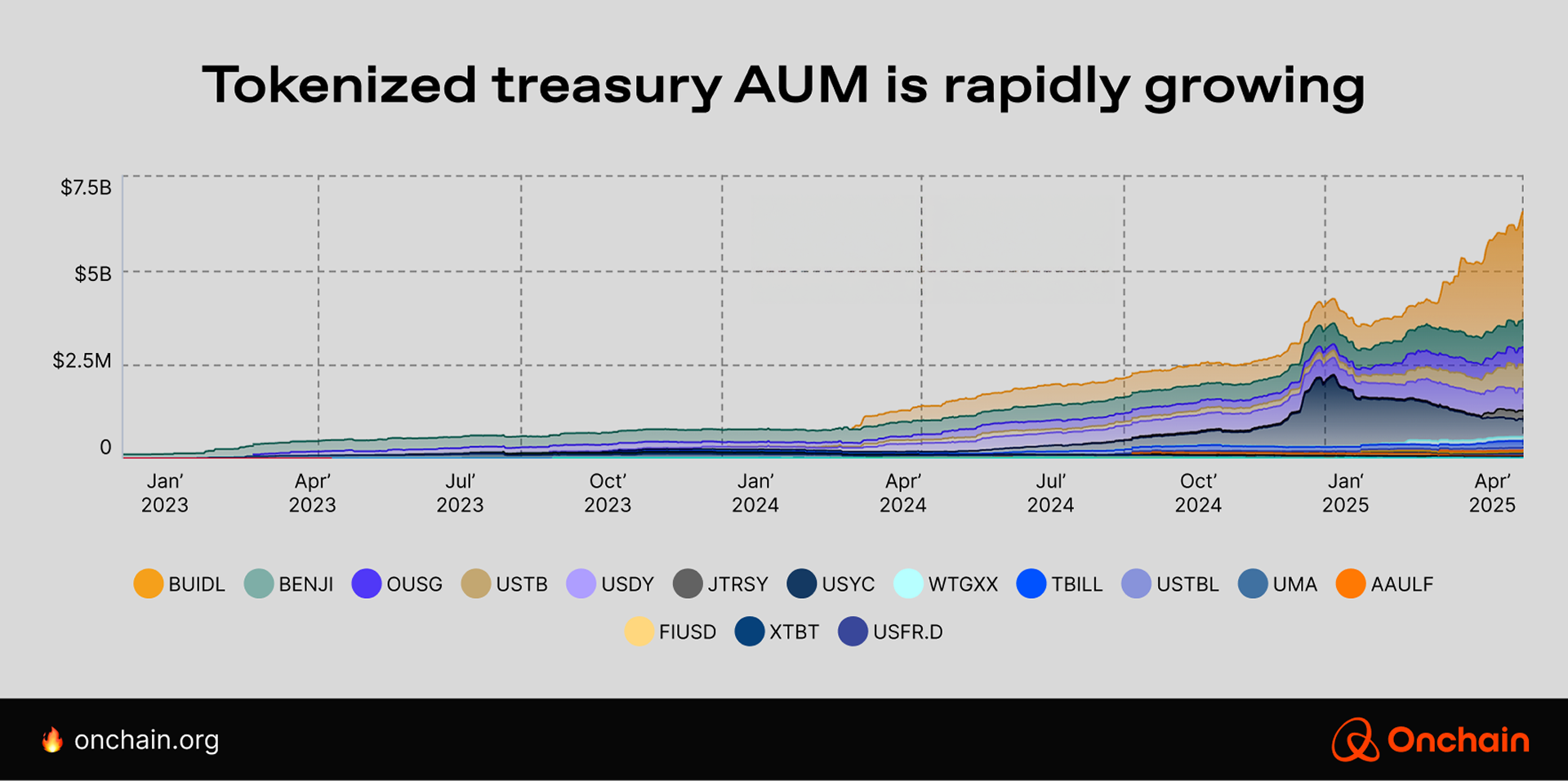

- Tokenized U.S. Treasury bills (or T-bills): like USD-pegged stablecoins, but come with the added benefit of yield

These are popular tokenized RWAs, but tokenization is used in other sectors as well.

- Tokenized private credit

- Tokenized real estate

- Tokenized whiskey (it’s true)

Really, any market with demand and user trust has the potential to be tokenized: trading cards, supercars, and much more. What else do you think could be tokenized?

Benefits of tokenization

Asset tokenization is gaining market share because founders and users alike recognize the benefits of tokenization. They include improved trust, transparency, cost, and accessibility.

Tokenized assets, such as stablecoins, treasuries, and private credit, provide borderless and instant settlement. You can tap into global markets directly and continuously (with 24/7 trading). You can even gain access to assets that might be unavailable otherwise.

In addition to global market accessibility, tokenization improves liquidity and price discovery for unique assets: a tokenized hotel, a rare car, or a bottle of vintage wine.

Getting started with token launch options.

This is just a small sampling of tokenization’s benefits. For Web3 founders, tokenization solutions could be your next big startup. Or, it could be a way to tokenize your current company’s equity during a funding round.

For users, it presents an opportunity to gain exposure to gold, USD, T-bills, or other onchain RWAs in a way that may be more accessible, affordable, and fair. Of course, you can also purchase BTC and other onchain-only cryptos, or trade for them with tokenized RWAs.

To learn more about tokenization, its benefits, and its related business opportunities, move forward to the next article. You’ll learn the difference between an ICO, IEO, and IDO, plus a few other token launch options that might be a better fit for new blockchain projects.