“I like boring things.” said Andy Warhol. (Of all people!)

Stablecoins are the boring guests at the crypto dinner party. While bitcoin (BTC), ether (ETH), and the rest are financially volatile, unpredictable, and exciting — stablecoins bring a stoic and reliable ambiance to the wild, exhilarating, and dynamic Web3 investing market.

BTC recently increased over $8,400 in a single day. Stablecoins are designed to remain fixed in value. While boring for crypto investors, they serve vital functions in both developed and developing markets. Far from boring at a closer look, stablecoins bridge the gap between onchain assets and fiat currency.

Stablecoin meaning

Stablecoins are a type of cryptocurrency designed to maintain 1:1 price parity with a fiat currency or another real-world asset (RWA). While the most popular stablecoins are pegged to the U.S. dollar (USD), other notable stablecoins are pegged to gold, the euro (EURO), and other state-backed currencies.

You may ask yourself, “What is the purpose of a stablecoin?” Sure, you can directly hold USD, EUR, or gold. But do stablecoins confer advantages over the assets that they represent? They sure do — and not just for crypto investors and Web3 day traders.

The stablecoin ecosystem is driving innovation in ways that will benefit entrepreneurs, founders, promising startups, and established companies. By providing alternative payment rails and systems, stablecoins are letting entities conduct business faster, cheaper, easier, and more efficiently.

What is the benefit of a stablecoin?

Stablecoins have numerous and far-reaching benefits. They are a gateway to the crypto market, serve as a payment alternative, and bridge the worlds of traditional finance (TradFi) and decentralized finance (DeFi).

Like regular USD, USD-pegged stablecoins have three key characteristics that make them useful as money:

- Store of value: While USD-pegged stablecoins are still inflationary, their inflation rate pales in comparison to hyperinflationary currencies. When their local currency (Argentina, Nigeria, Zimbabwe) becomes hyperinflationary, businesses and individuals allocate into USD stablecoins, bitcoin (BTC), and other cryptos.

- Medium of exchange: A good medium of exchange should be stable, established, and widely accepted. USD-backed stablecoins are perhaps the best cryptocurrency to serve as both a medium of exchange and a store of value.

- Unit of account: Put simply, a good or service needs to be valued in a uniform and easily understood way. As BTC and other cryptocurrencies have yet to be widely accepted as a unit of account, a fiat-pegged cryptocurrency is the best option for blockchain-based commerce. Businesses don’t like accepting volatile currencies — and commerce via barter doesn’t cut it in the 21st century.

While the cliché “cash is king” is quite popular, those in the know would say that cash has to relinquish the throne to a new upstart: stablecoins. They can do everything fiat cash can do — and a whole lot more.

Stablecoin transactions are faster, cheaper, and more accessible on a global scale. For entrepreneurs and businesses, stablecoin usage and acceptance make a lot of sense.

Stablecoin use cases

Fiat-backed stablecoins can typically replace traditional fiat while opening new markets and business opportunities. Let’s look at a few ways you can leverage stablecoins in your business infrastructure.

- Remittances and international payments: Send money anywhere in the world. With stablecoins, these remittances are nearly instant, irreversible, and cheaper, saving businesses both time and money.

- Receive general payments: Accept stablecoins for your goods and services. Cut out the payment intermediaries and avoid the ever-increasing commissions from credit cards and financial technology (FinTech) apps.

- Pay salaries and invoices: Pay your invoices, freelancers, and employees with stablecoins. These are often preferred over other forms of payment — especially in countries with high inflation where traditional USD is hard to come by due to outside sanctions, laws, or internal capital controls.

- Crypto trading and investing: For crypto- and DeFi-focused companies like crypto hedge funds, stablecoins are a way to trade in and out of crypto assets. While centralized exchanges (CEXs) support USD and other fiat trading pairs, stablecoins/crypto are required to trade on decentralized exchanges (DEXs).

- USD replacement: In some jurisdictions, acquiring USD through a bank or currency exchange can be challenging. Accessing USD could be expensive, painfully slow, or even illegal. USD stablecoins provide a financial lifeline for entrepreneurs and capitalists in underbanked and unbanked regions.

What are two types of stablecoins?

There are two types of stablecoins: collateralized and uncollateralized. Uncollateralized stablecoins use an algorithmic model to maintain a price peg with the underlying asset, typically USD. Via smart contracts, they modify the supply and demand of a stablecoin to maintain a stable price — in practice.

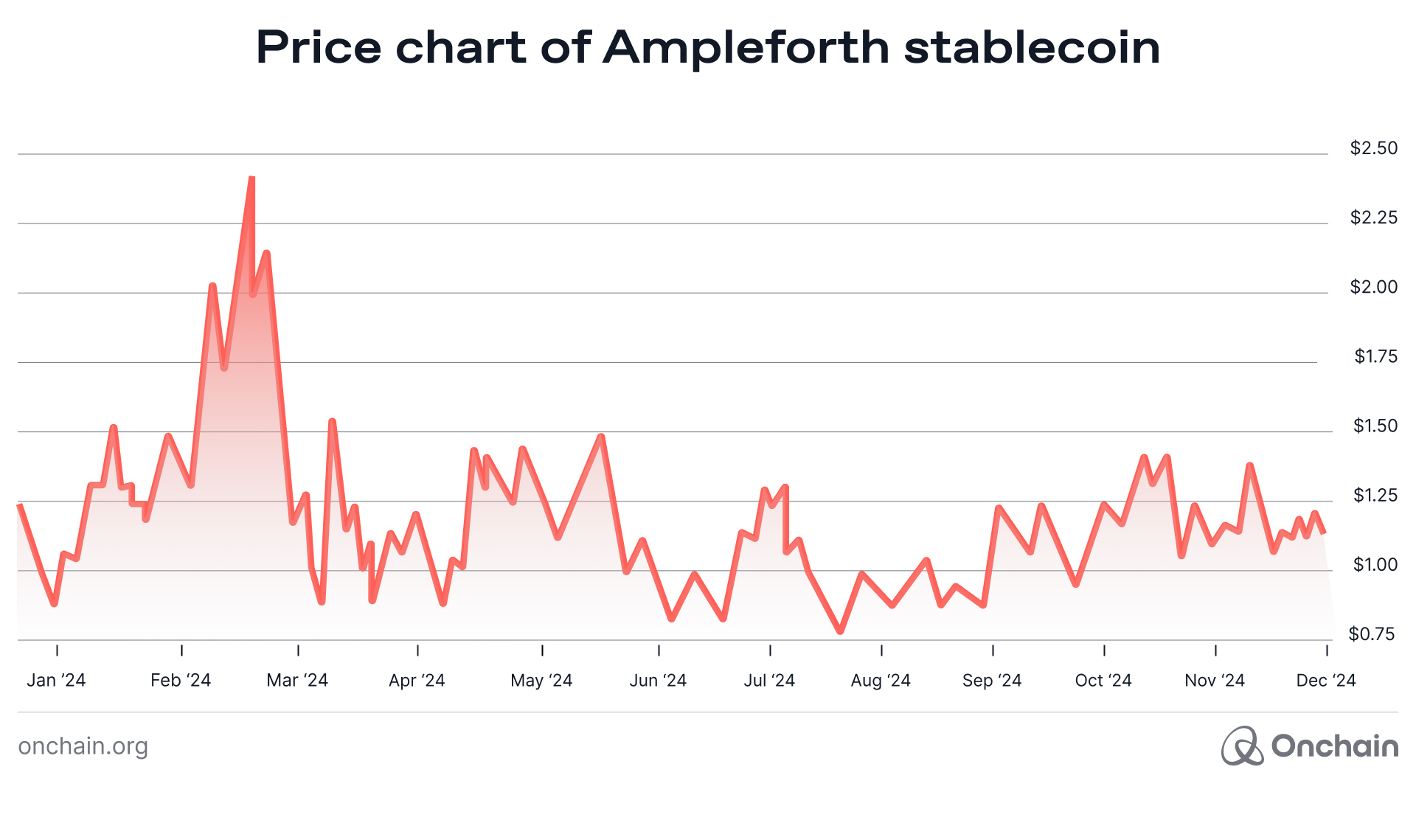

For example, Ampleforth (AMPL) expands and contracts the supply every 24 hours in order to target an AMPL price of exactly $1. Yet, as you can see, this stablecoin can lack its key characteristic — stability.

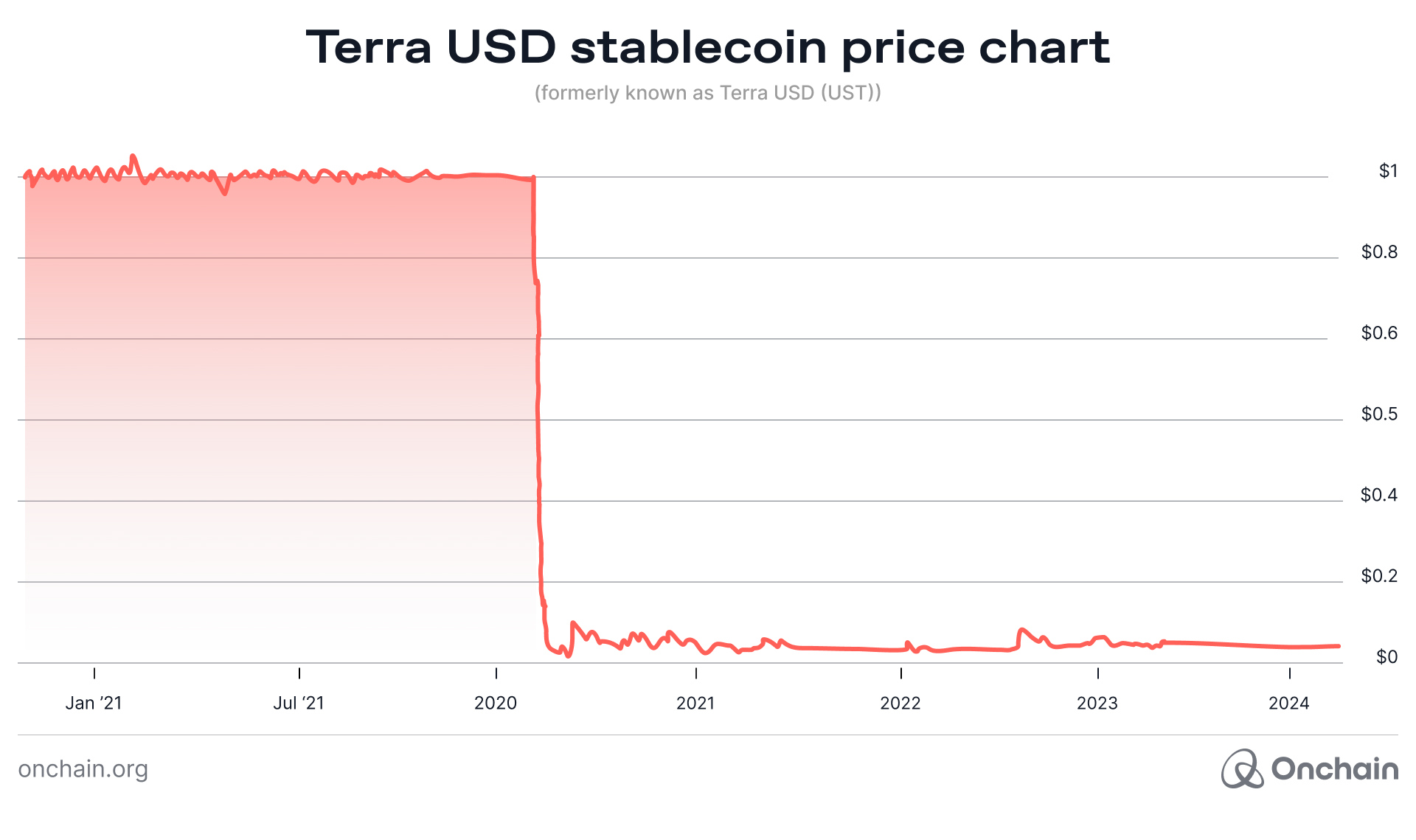

Even worse, some uncollateralized stablecoins have lost their peg completely — with huge losses and consequences for holders of these stablecoins. Perhaps the most famous example is Terra USD (UST). It worked really well — until it didn’t. 🤷

For this reason, many recommend using collateralized stablecoins — more on that below. With collateral backing, the risks for the price de-pegging from the reference asset are greatly reduced. Collateralized stablecoins are now dominant, and different approaches are being taken to back them.

Types of collateralized stablecoins

Collateralized stablecoins come in three main varieties: crypto-collateralized, fiat-collateralized, and commodity-collateralized. Gold-backed tokens are the most popular form of commodity-backed stablecoin. Backed by audited and vaulted gold bars, Tether gold (XAUT) and Pax gold (PAXG) can both be redeemed for physical gold bars.

Fiat-collateralized and crypto-collateralized stablecoins are the two main types of fiat-pegged stablecoins. USDT, USDC, and many other major stablecoins maintain 1:1 reserves of cash and liquid cash equivalents (like U.S. Treasuries) for the stablecoins in circulation. This transparent 1:1 backing has gained market support and is used by the most popular fiat stablecoins.

Crypto-collateralized stablecoins are typically overcollateralized to account for the fluctuating value of the associated collateral. DAI is a popular crypto-collateralized stablecoin. Originally backed solely by cryptocurrency, DAI later expanded to accept other fiat-backed stablecoins as collateral — making its current collateralization a blend of fiat and crypto.

In August 2024, DAI creator MakerDAO rebranded to Sky and launched a companion stablecoin called USDS. DAI and USDS are now two of the most popular crypto-backed stablecoins.

Another popular crypto-backed stablecoin is Ethena USDe (USDE). It is backed by staked Ether (stETH) and utilizes a bespoke delta-hedging algorithm to mitigate price volatility.

In practice, which type of stablecoin you prefer depends on your needs, preferences, and ideology. Fiat-backed stablecoins rely on trusting the stablecoin issuer, their collateral custodian, and the regulators and politicians that regulate those entities.

Crypto-backed stablecoins are more for the permissionless “not your keys, not your coins” crowd that wants completely decentralized stablecoins. These stablecoins do not require the trust of crypto companies, financial institutions, or politicians.

How many stablecoins are there?

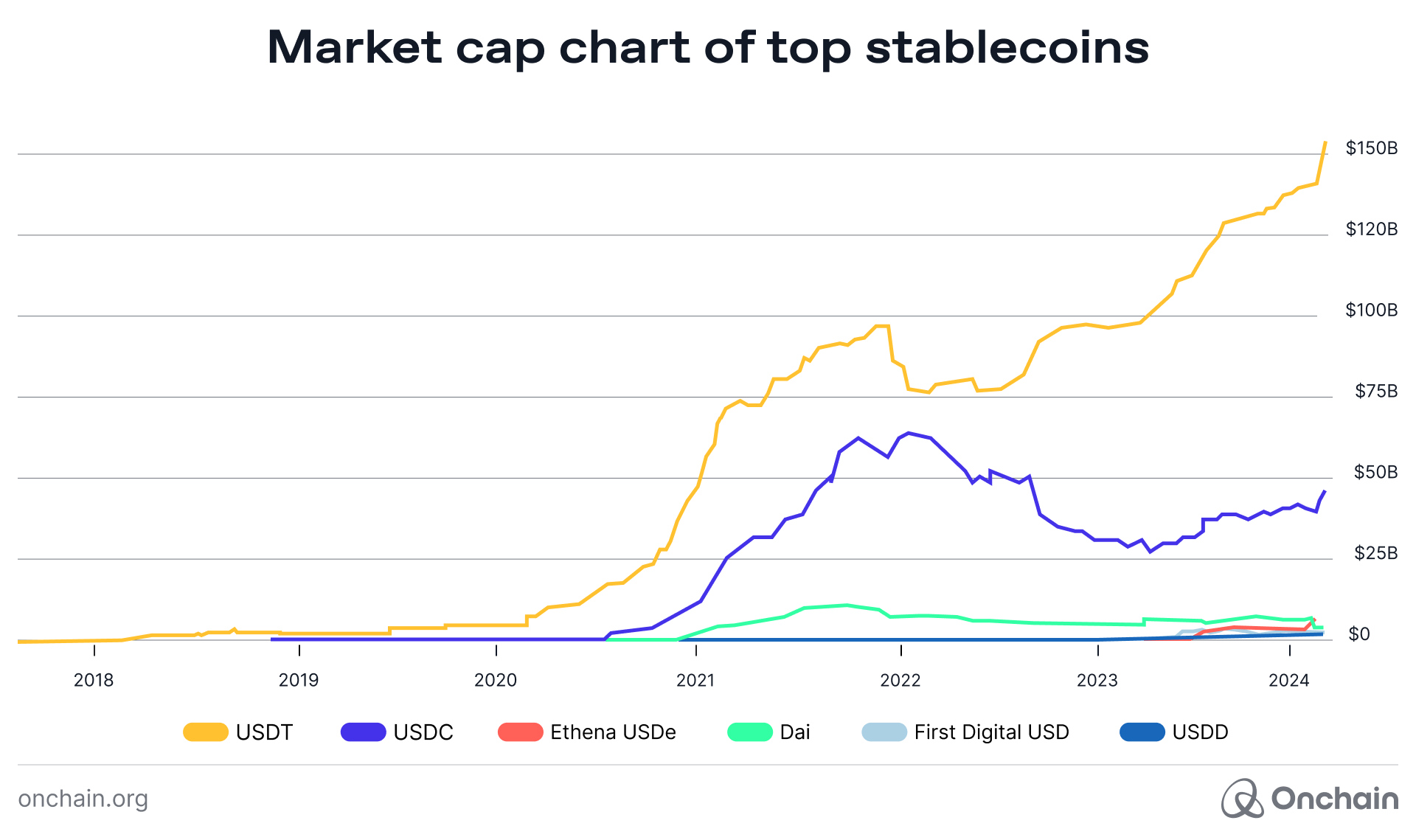

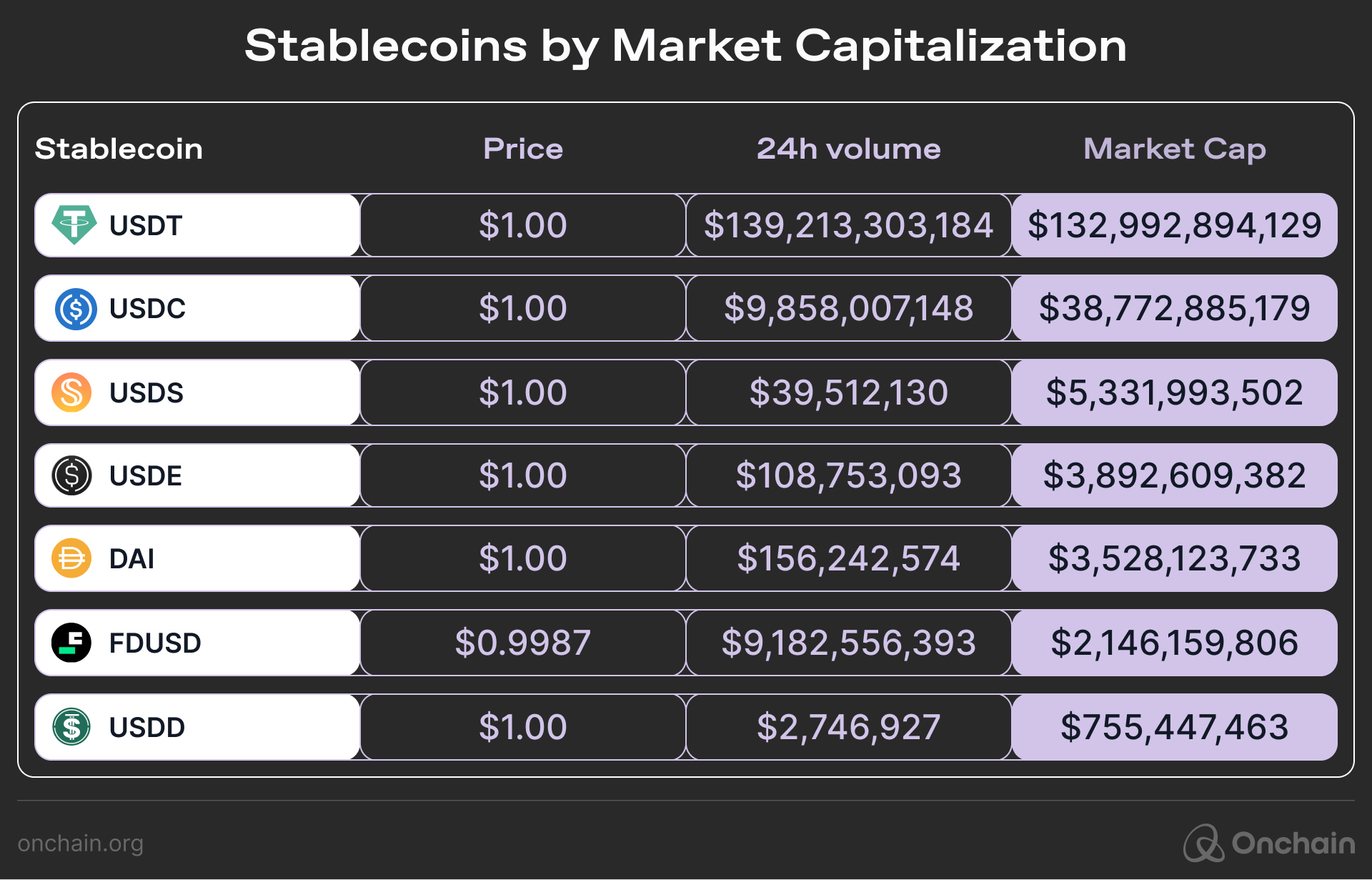

Stablecoins — like other cryptos — come and go. As of November 2024, there are around 190 stablecoin projects. However, USDT and USDC are the two dominant players and account for the vast majority of the market.

Which stablecoin is the best?

The best stablecoin is the one that most fittingly serves your needs. A good stablecoin maintains a solid 1:1 peg, has reasonable transaction fees, and is widely accepted by buyers and sellers. For these reasons, many stablecoin users recommend DAI, USDS, USDC, USDT, and the other popular USD stablecoins.

As the market grows and gains mainstream popularity, FinTech and TradFi firms like PayPal have started to offer their own stablecoins. By market cap, the stablecoin market is currently dominated by USD-pegged stablecoins.

As USD is the most popular fiat currency in the world, it makes sense that USD-pegged stablecoins would be dominant. Outside of USD, the top two stablecoins by market cap are backed by gold. Yet, these two stablecoins combined only have a market cap a little north of $1 bil. The top USD-pegged stablecoin alone, Tether (USDT), has a market cap north of $125 bil.

The EURO is the second most popular fiat stablecoin. Yet, EURS, the most popular EUR-pegged stablecoin, only has a market cap of around $130 mil. It’s hard to speculate on the reasons for the overwhelming USD stablecoin dominance; it likely comes down to a few factors:

- USD (stablecoins) are a popular crypto trading pair.

- USD is the most popular fiat for international trade and commerce.

- Inflation-wise, USD has maintained its value much better than most fiat alternatives.

- Stablecoins backed by USD had an early mover advantage and the associated network effects.

Getting involved with stablecoins

Like those who downplayed the internet and were left by the wayside, the acceptance of stablecoins and the onchain world is becoming increasingly important. With a market capitalization approaching $200 bil., stablecoins aren’t going anywhere — but up (in market cap). 📈

Next up in this Learning Track, discover the nuances of the stablecoin market, weigh your options, and decide if incorporating stablecoins into your business makes sense. Hit the arrow below to move on.