Did you know that Layer 2 network scalability has a vast role in increasing the network effects? And that Ethereum benefits massively from network effects for Layer 2?

This and other crucial issues you need to be aware of before getting involved are extensively covered in the latest Onchain research report The Future Is Modular. In this article we discuss the benefits, dynamics, and reactions caused by the network effects in Web3 and blockchain.

How can you create network effects? Why do they matter? What are the advantages and disadvantages? Therefore, understanding how to leverage these benefits is essential.

All this and more is explained here.

What are network effects?

Just to refresh here. Network effects happen when a product or service becomes more valuable as more people start using it. So this in turn increases the value of the service or product for the existing users. This encourages new users to join, increasing its value further, in a positive feedback loop.

So the network effect boosts growth. And this results in the widespread adoption of various technologies and platforms.

The power of network effects in blockchain and Web3

As Web3 apps and networks expand, this enhances value and utility for all participants.

For example, the value of Decentralized Exchanges (DEXs) has increased phenomenally.

Both Sushiswap and Uniswap’s value increases as more users and liquidity providers enter the market. This leads to more competitive prices being offered to traders.

Also, NFT marketplaces such as Rarible and OpenSea benefit from network effects. This occurs as more creators and collectors become part of the community.

So a wider range of products become available. And this leads to increased trading volumes.

Another successful example that has benefitted from network effects is Optimism. A Layer 2 project based on the Ethereum network.

Optimism features a dynamic ecosystem of decentralized applications (dApps) and protocols. This comprises DeFi platforms and NFT marketplaces that seamlessly operate on its optimized infrastructure.

So this varied array of products serves a broad spectrum of crypto users. And this in turn bolsters its network effects.

Network effects and their impact on the crypto and Web3 infrastructure

The impact of network effects have a significant impact on the success of cryptos.

Early adoption can be so crucial for long-term investment returns.

Let’s take the NFT world – as more users adopt and use them, this starts a cycle of growth. In turn increasing the value.

A larger user base has positive network effects. This increases the liquidity and demand. And opens up more avenues for sales and resales.

The Ethereum NFT market rose to a new high of around $42.8m in trading volume so far in 2024.

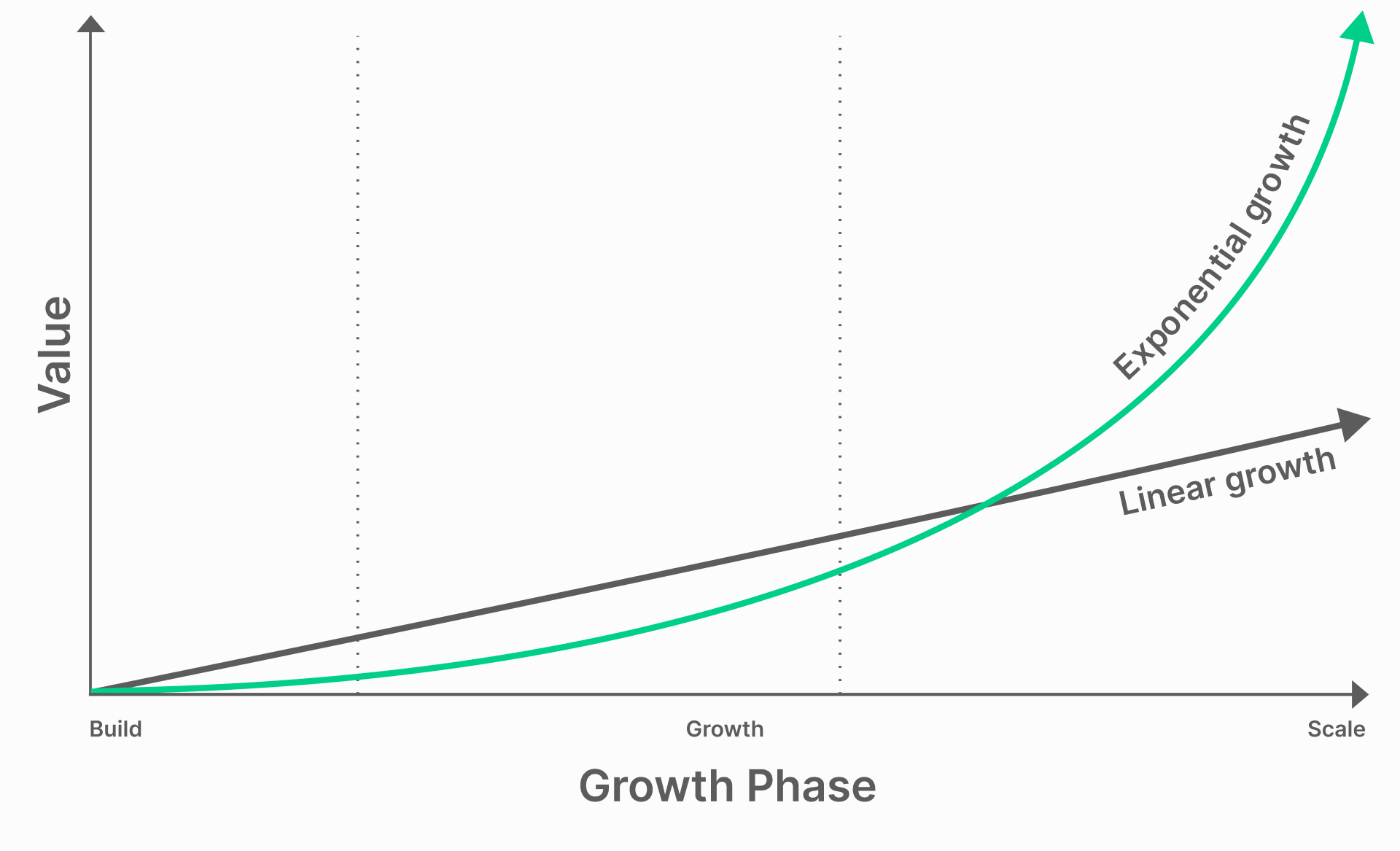

Once the growth phase reaches a pivotal point, this is where the network effects can cause the value to increase exponentially. See figure 2.

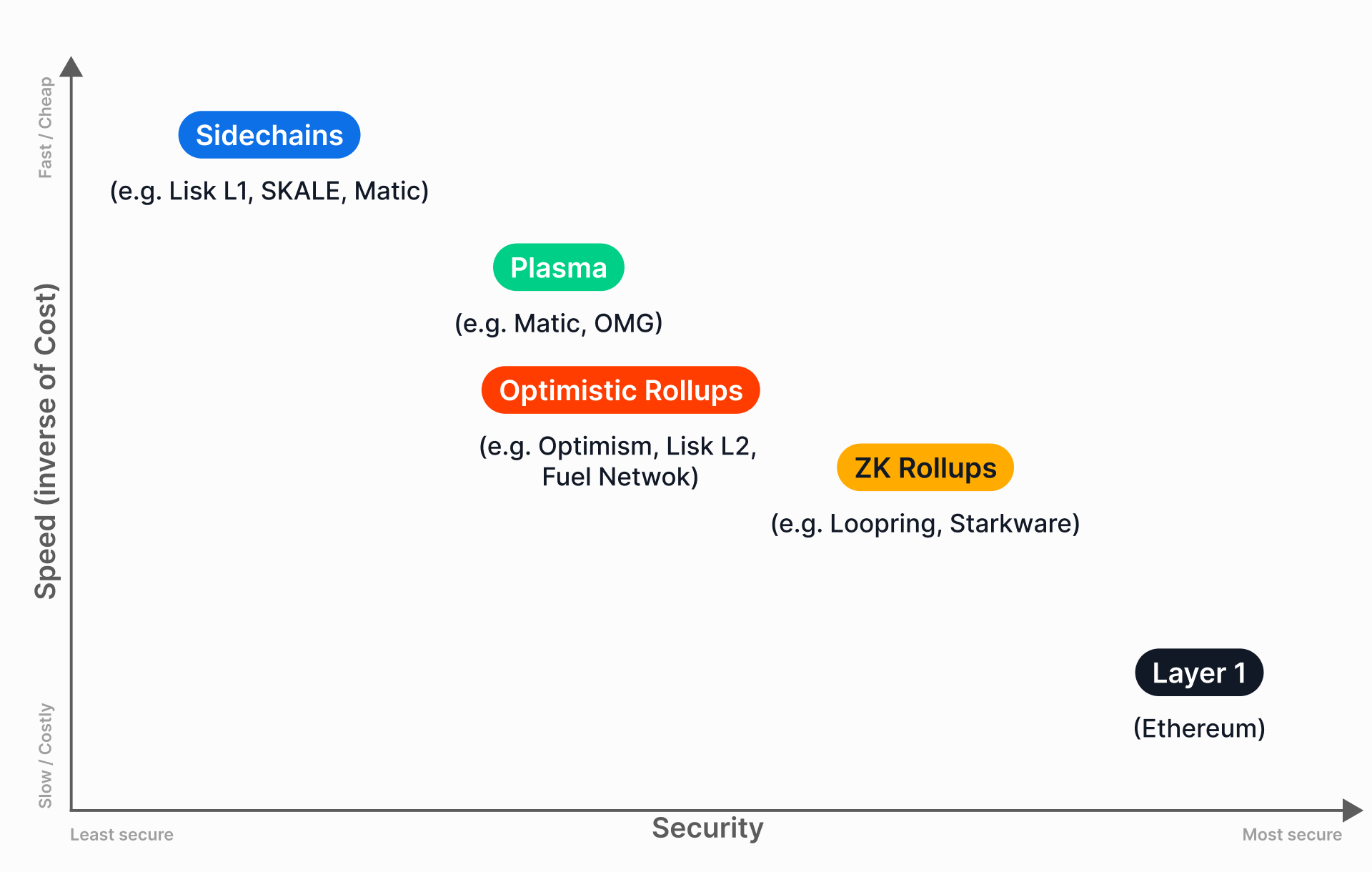

Modular scaling solutions in figure 3 are also important for increasing network effects. They do need to be implemented on Layer 1. So, no changes are needed to the existing protocol.

The most popular modular scaling developments have come about due to Layer 2 solutions. For example, Sidechains, Plasma, Optimistic and ZK rollups.

These solutions scale by processing transactions outside the Layer 1 network. And continue to maintain strong decentralized security.

This enables them to capitalize on its network effects, and developer activity.

In the cryptocurrency realm, the strength of network effects could play a key role in any upcoming bull run.

So the extent to which a blockchain network is well-designed is of vital importance.

Scaling and composability will directly impact its user base. And its network effects.

So, what are the pros and cons of network effects?

| Advantages | Disadvantages |

|---|---|

| Greater value: A product or service becomes more valuable as its user base grows. | High entry barrier: New entrants may find it challenging to attract users away from established players. |

| Improved user experience: This provides opportunities for interaction and collaboration as the user base grows. This dynamic environment is then more enjoyable for users. | Saturation effect: The product or platform reaches saturation point in the target demographic. An inability to adjust in such evolving circumstances, and an unsustainable economic model could result in negative network effects. |

| Competitive edge: Companies with strong network effects gain a significant advantage over competitors. A larger network makes it challenging for others to enter the market and provide a better alternative. | Negative network effects: This can occur If a platform is linked with negative experiences. It could push users away, thus triggering a downward spiral. |

| Increase in innovation: As more users engage with a product, this stimulates innovation. This can lead to the introduction of new features. This approach helps by identifying areas for improvement and discovering new use cases. | Interoperability constraints: Interoperability together with data and reputation portability may result in not being able to extract additional value, or retain the users as effectively. Network effects may cause problems for different products or services to work together. E.g., An Apple smartwatch may have compatibility issues with an Android phone. |

| Reduction in costs: The expansion of the network leads to a decrease in user costs. With greater network effects the fixed costs such as infrastructure are distributed across more users. This enables companies to offer more affordable products and services, reaching a wider audience. | Competition deficiency: Can be difficult for new companies to enter the market. This may result in a lack of competition, potentially leading to monopolies. This can cause higher prices and less innovation in the market. |

| Stronger and more identifiable brand: Companies benefiting from strong network effects establish a robust brand identity. As this becomes part of users’ daily routines, a powerful association between the brand and its users is formed. This connection can be effectively leveraged in advertising and marketing. |

How network effects in Ethereum contribute to its dominance

Which platform solution and network can benefit your project from a network effects perspective?

The Ethereum platform ticks all of the boxes. It provides all the right tools, an advanced smart contracts model, and more.

The impact of the Ethereum network is extensive and multifaceted. This results in a multitude of benefits. Such as user adoption and developer communities to DeFi protocols. And token standards and developer tools.

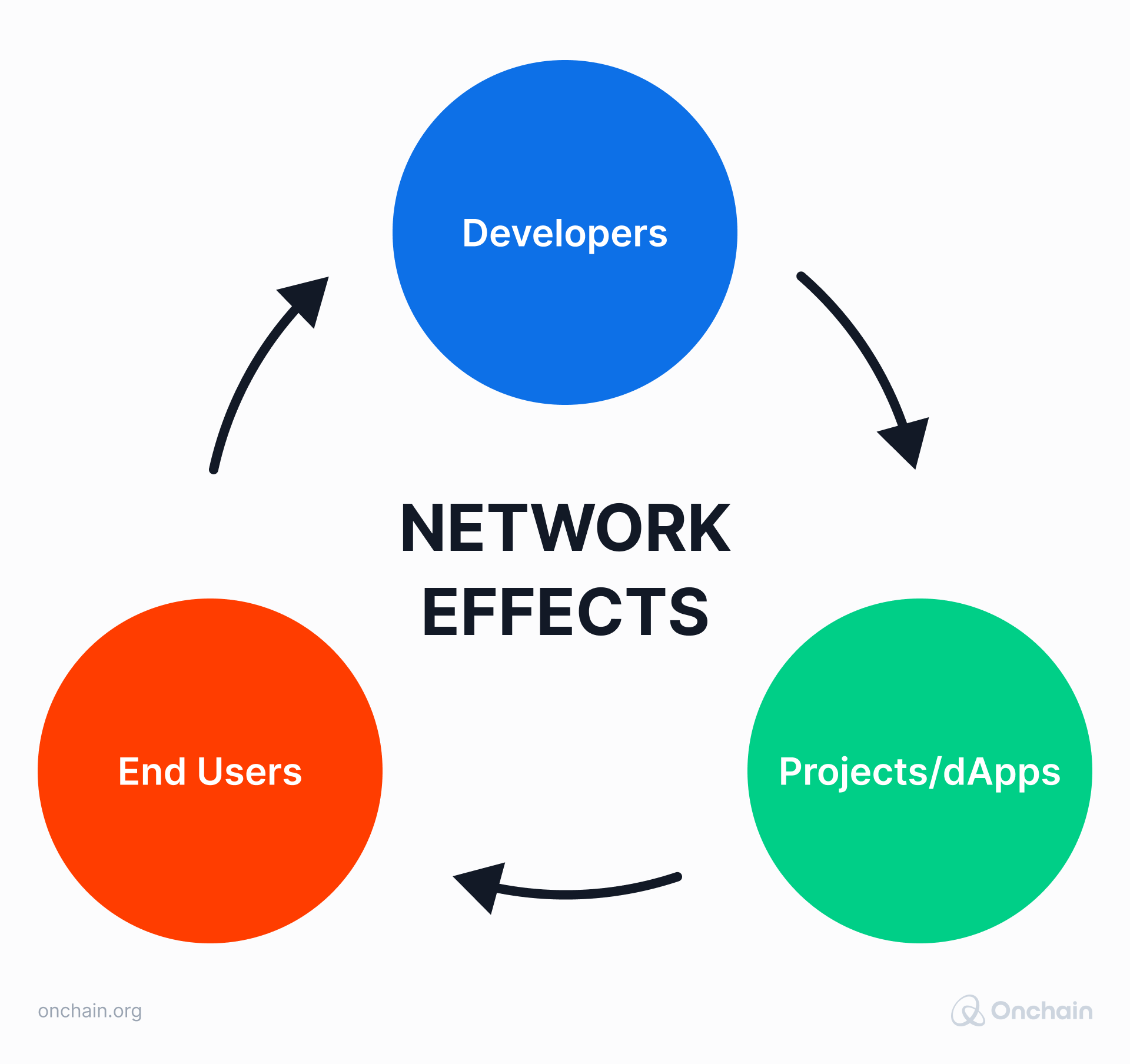

These all result in creating positive network effects – more users attract more developers, and vice versa.

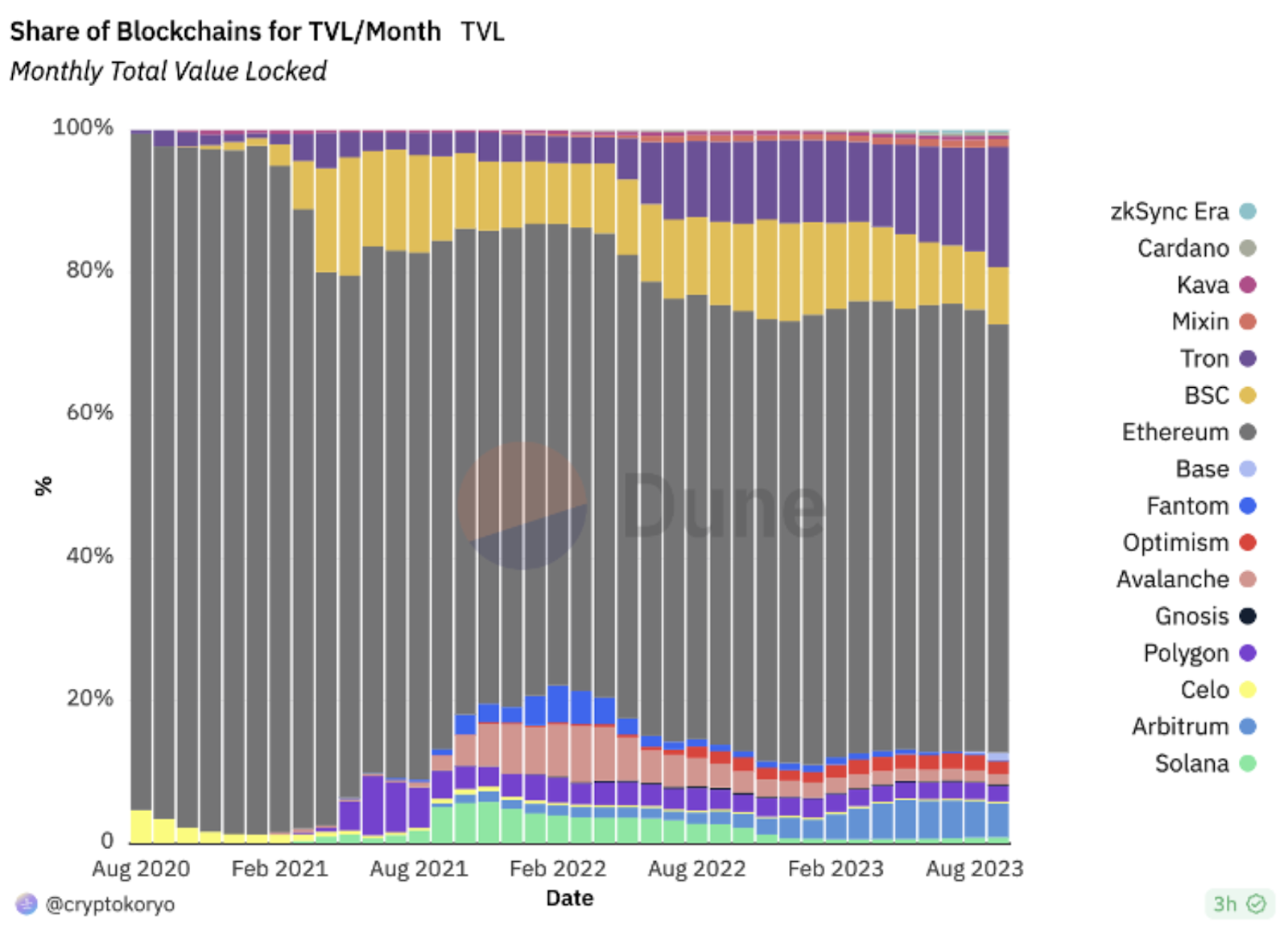

Ethereum has the largest amount of, TVL (Total Value Locked), in a multitude of dApps built on their platform. This has surged to 60-70% over the previous 2 years.

In fact, the latest data indicates that Ethereum’s Layer 2 total value locked (TVL) achieved an all-time high of $21.16 billion. This is around a 330% increase from January 2023.

This has had a significant impact on many Ethereum Layer 2 networks. The likes of Arbitrum and Optimism are classic examples.

The network effects of the Ethereum ecosystem are a significant contributory factor. This can be seen in the comparison of Web3 verticals graphs in the Onchain research report.

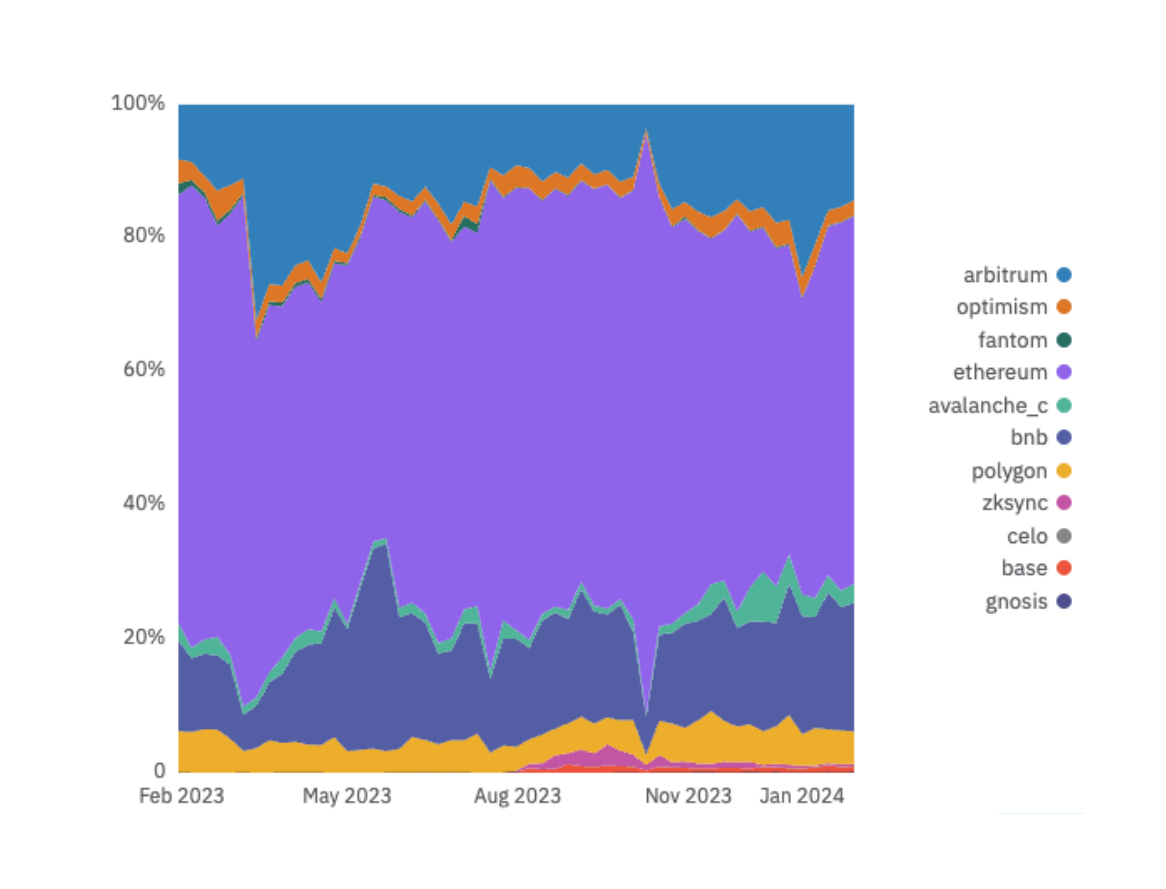

The network effects around DeFi liquidity, composability, and developers have all boosted the DEX volumes.

And Ethereum leads the pack. See figure 5.

As more developers enter Ethereum’s foundation, more dApps will emerge. This will draw in more users. And, therefore, attract additional protocol developers.

So this will result in a perpetual self-reinforcing cycle – See figure 6.

Ethereum will continue to attract more investors, users, and developers. – Further boosted by its network effects.

Lisk is currently working on integrating with the Ethereum ecosystem as a L2. This will result in enabling a new era of innovation and decentralization.

Exploring network effects in Layer 2

Layer 2, network scalability has a vast role in increasing the network effects. Layer 2 solutions support each other’s growth.

On the other hand, Layer 1 platforms tend to compete more with each other. As network effects increase, more applications will transition to Layer 2.

With network effects, the operational costs of Layer 2 solutions are anticipated to decline. This is evident from the introduction of different data availability options.

As time progresses, L2 solutions may evolve into separate instances with distinct adaptations and structures.

It is clear-cut today that the primary users of the Ethereum block space will be on Layer 2 networks.

How to create network effects in Web3

The scaling and creation of network effects in Web3 also pose challenges. In order to scale network effects in Web3, using tokens can be beneficial.

Enterprises that are able to use tokens, can initially supply their platform with them. As the value increases, these can be exchanged, increasing market activity.

It is helpful to visualize the big picture at the conception stage. For example, bad design choices can result in causing harm to your platform. Poor user experience may spark a negative feedback loop.

Once negative noise about the platform from the users reaches critical mass, reverse network effects kick in.

So what is the best strategy in Web3 to achieve success in creating network effects?

If you are a startup or entrepreneur..

- Develop your market infrastructure based on the protocol at the infrastructure layer.

- Manage the token liquidity to secure funding. And boost the token value appreciation. This will encourage more users to participate at the funding layer.

- Expand your governance to involve the participants, at the governance layer.

Take a deeper look into your business model.

How will users interact with each other? Would a new user add value to the existing users? Are there likely to be any scalability limitations? And from a defensibility viewpoint, could this change as user traction increases?

Taking the above criteria on board, will give you the edge in using network effects to achieve success.

Conclusion: Network effects in Web3 really matter!

In summary, it is of key importance to understand the influence of network effects. Also how to create them, and why they matter.

If you are a startup or investor, you can create and support new innovative products and services. And with this knowledge, you will be able to choose the right direction.

Joining the ranks of Web3 founders means becoming part of a tight-knit community of entrepreneurs and experts. They have already experienced the journey you are planning to embark on.

Research and study their platforms, products, and strategies. This coupled with the information in this article will lead you on the path to success.

Explore this topic even further – Check out the complete Onchain research report.