Ever since I was a child, I loved to play in the forest with my friends. As I grew older, I visited a friend who’s a forester. He said “Hey, Abdullah, I want to show you something”. He took me out to show me some trees and asked, ‘What do you think about the trees?’ I said, ‘Okay, strong trees, big trees, they are very nice.’ He said ‘No, they’re dying!’

What he learned that day “completely messed up” his mind and changed his attitude toward the environment forever. Life isn’t just about having fun, because we are killing the trees, the source of oxygen for life.

Today, Abdullah Yildiz is Executive Director at the European Carbon Offset Tokenization Association ECOTA.

The ECOTA aims at advancing the development of decarbonization utilizing blockchain technology, through research, education and by developing a platform and community.

I spoke with Abdullah to understand more about the carbon market, his work at ECOTA and how blockchain can accelerate and enhance decarbonization projects.

The world’s odyssey to save the planet

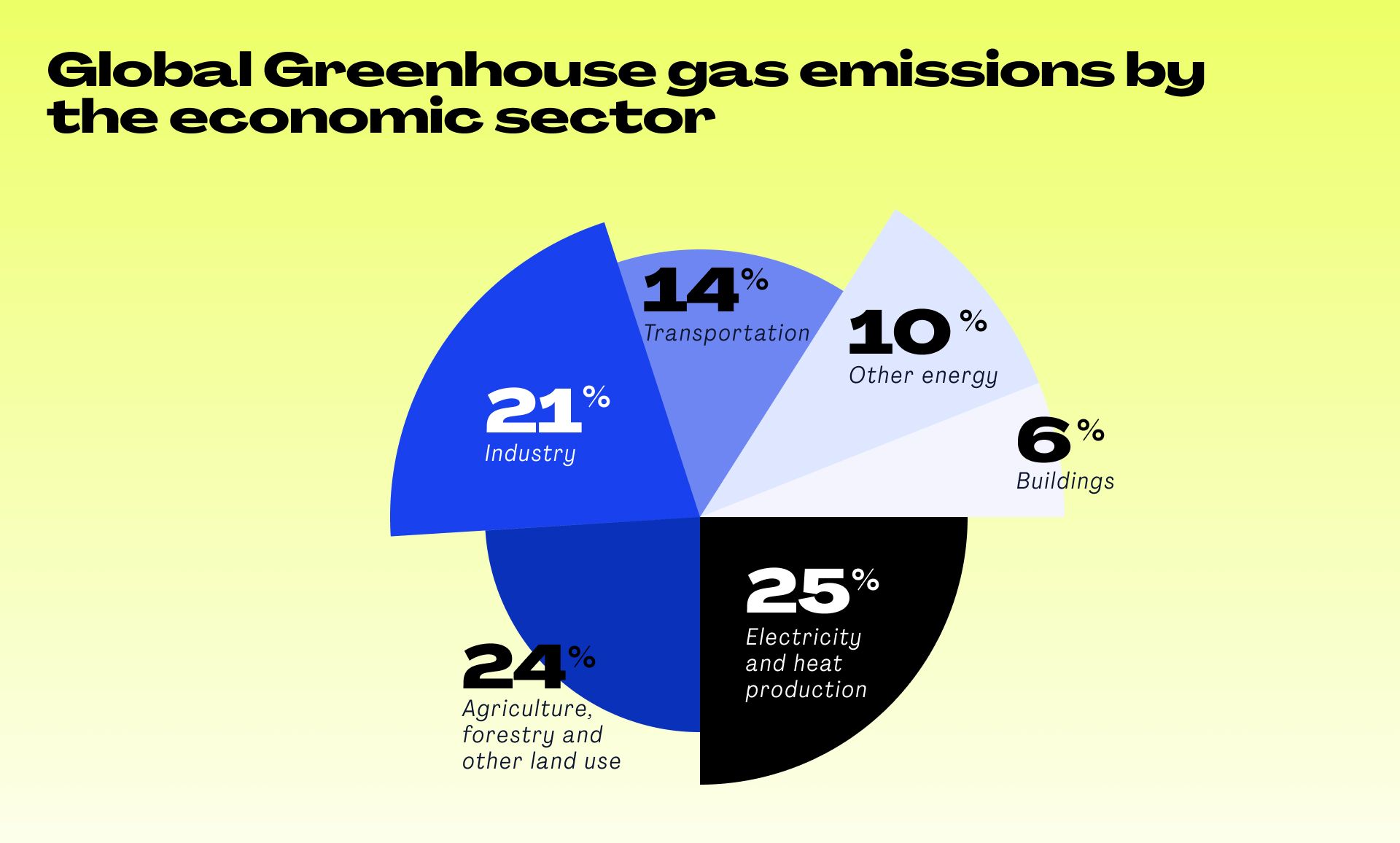

The so-called greenhouse gas (GHG) emissions are the number one contaminator of earth’s natural environment. Carbon dioxide (CO2) makes up 65% of all GHG emissions that contribute to the absorption of infrared radiation – the greenhouse effect. According to the IPCC (Intergovernmental Panel on Climate Change in the UN), electricity and heat production are the largest source of these harmful emissions (25%), closely followed by agriculture, deforestation and other land use (24%) and industry (21%).

To combat the phenomenon, the UN Climate Change Conference in 2015 drafted a plan to reach global net zero emissions by 2050. The is treaty known as the Paris Agreement and has been signed by 194 countries (as of Feb 2023).

Abdullah explains that avoiding and reducing emissions should be the number one priority. Since that’s not always possible, carbon offsetting comes into play.

Carbon offsetting as a last resource

A carbon credit or certificate is a transferable financial instrument issued by governments or independent certification bodies. It represents an emission reduction or removal – also referred to as carbon offsetting – and can be traded.

To put this in practical terms, i.e. manufacturers “have a yearly limit of how much CO2 they are allowed to emit. If they exceed the limit, they need to buy CO2 certificates from other companies or from different exchanges, such as voluntary carbon exchanges.” Abdullah explains.

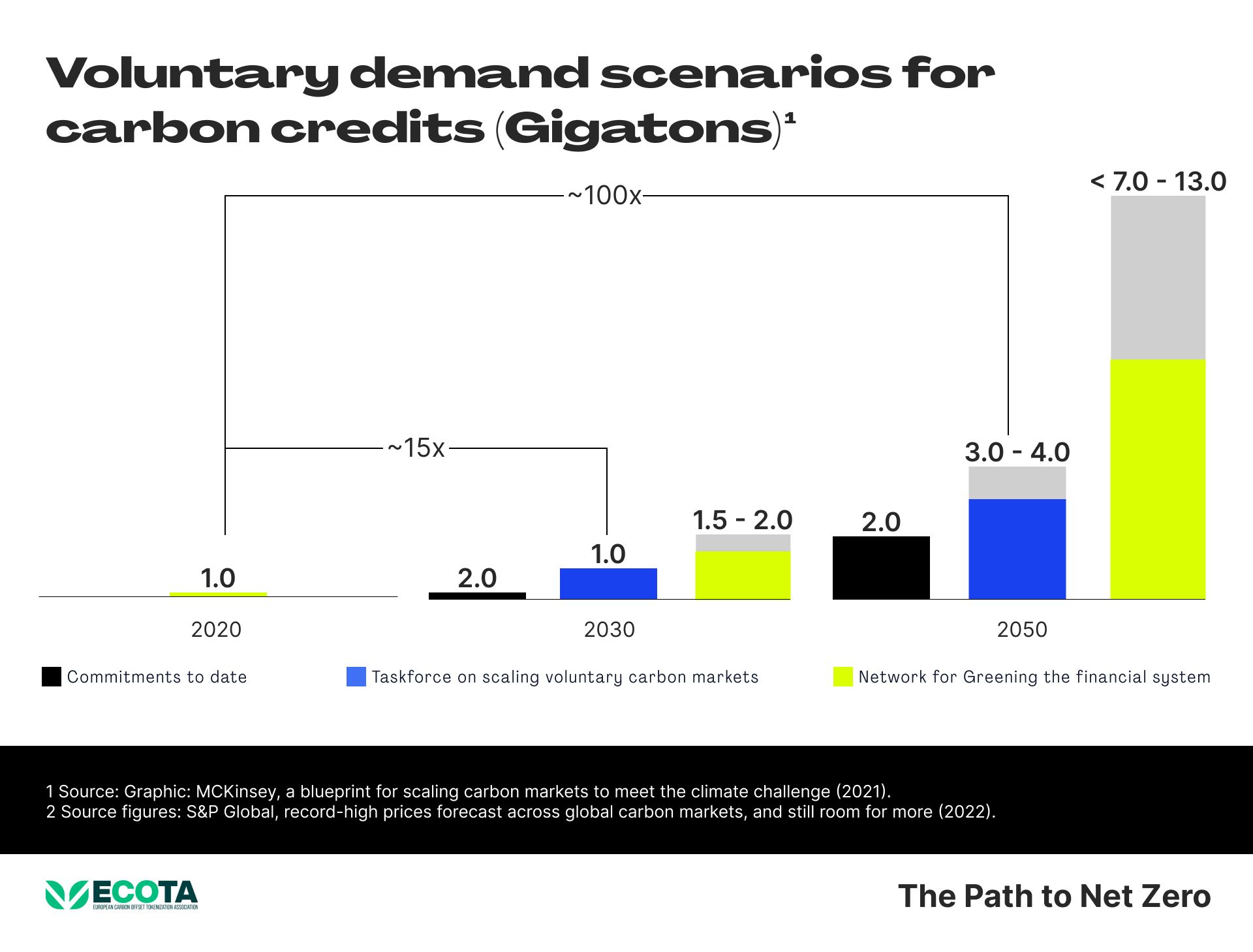

In other words, they can buy carbon credits from companies who have not reached their limit, or projects that actively remove or reduce emissions to compensate for their excess emissions. He goes on to tell me that according to McKinsey, global demand for carbon offsets could increase 15-fold by 2030 and 100-fold by 2050.

This escalates the need for voluntary exchange markets, because “the current market environment doesn’t allow for the necessary scale.” The supply chain of certificates for carbon offset projects is inefficient, lacks transparency and incurs high costs.

This is where it gets interesting for blockchain connoisseurs.

Putting blockchain on the quest

Less riddles and mazes

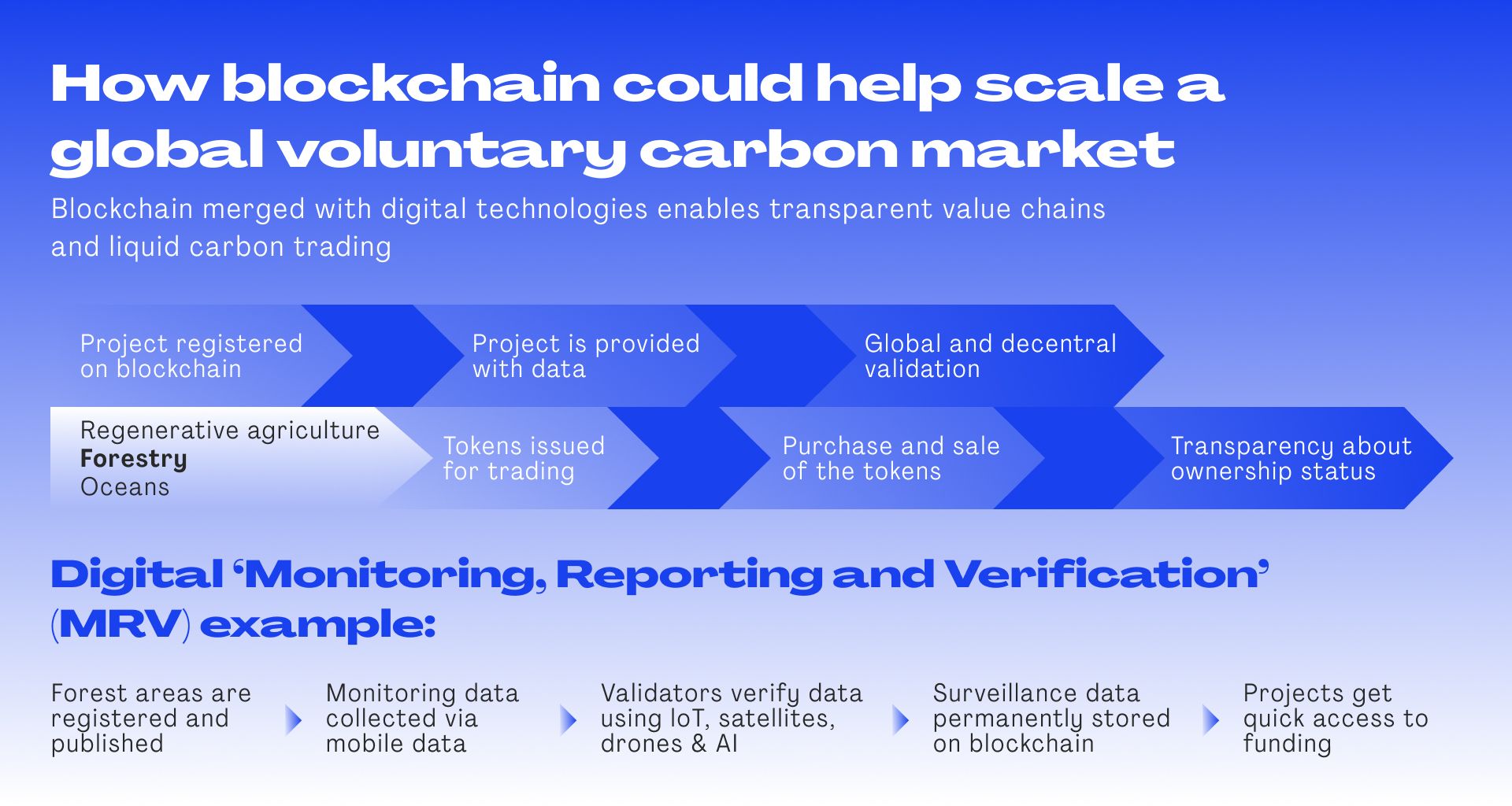

Abdullah knows about the inefficiencies “ Until you can issue and trade CO2 [certificates], it takes up to five years. That’s a very long time.” The verification process presents a bottle neck. There are few authorized registries and they apply different standards with different variables. “With the blockchain, the issuer, the current holder, and the registrar, they can see each other’s interaction.“

This includes data needed to verify the effectiveness of a carbon offsetting project. Such data can be collected through the use of sensor and IoT technologies. At this point the ECOTA executive started getting excited “You can use it to tokenize assets in DeFi and other ways.”

He recalls this remarkable project: “I had a talk with a man from Africa two weeks ago. The man told me, ‘People here are burning wood to cook their meals in very old stoves and it causes a lot of CO2 emission. So, I had an idea. I give them some very nice stoves which are tracking the CO2 decarbonization and I give them some CO2 neutral briquettes. And with these briquettes and the stove, I can track the CO2 decarbonization. I issue them as NFTs and sell them on different exchanges on the blockchain’.”

One-on-one for everyone

“On the blockchain everyone has access to it. That’s also one of the most important parts:.” Abdullah continues.

“It’s difficult to get access to the voluntary market places for CO2 certificates. But on the blockchain it’s transparent. You enter your wallet address, a KYC process and then you’re almost done. It helps to reduce costs throughout organizations. Another important part is there are – I wouldn’t say no middlemen – but you are removing a lot.”

Direct trains arrive faster

This may seem like a logical consequence, but I decided to ask anyway, whether all this speeds up the processes.

“Exactly. you don’t have to wait for one middleman to finish their process till the next middleman finishes their process and so on. […] So it goes a lot faster.”

Many projects aim to provide solutions for more efficient, standardized verification processes leveraging the immutability and traceability of data on the blockchain.

“For example, a partner of ours, Particula, is working on validating CO2 projects on the blockchain. The tokens are issued for trading – some ERC20 tokens or ERC721 tokens. The information is completely transparent. You can’t change it.”

Washing out the greenwashers

“And one of the important things is there’s no double selling. In the normal, voluntary carbon markets people can sell one CO2 certificate and if they don’t register it fast enough, they can sell it again.

“This is not possible on the blockchain. This is one really big factor, why people want to use the blockchain for this technology”

To summarize the advantages Abdullah described: Using blockchain technology for carbon credit issuance and trading

- Simplifies the process

- Speeds up the process

- Increases accessibility

- Eliminates greenwashing

ECOTA shows the ropes

The advantages of blockchain are undeniable, and after realizing the bureaucracy behind carbon certificates, seem even more valuable. It’s time to talk about how ECOTA fits into the puzzle.

“We want to help people understand what CO2 certificates are, what voluntary marketplaces are and we want to build up a huge community. For example, like you asked me, what the CO2 emission market is all about. And not only you have this question. A lot of people don’t know about this.”

ECOTA is a non-profit organization that was established in early 2022 through the ITSA (International Tokenization Standardization Association) who were looking for someone to attend to the European market. The association is managed by three executive directors, Abdullah Yildiz, Maximilain Roesgen and Cara Reuner.

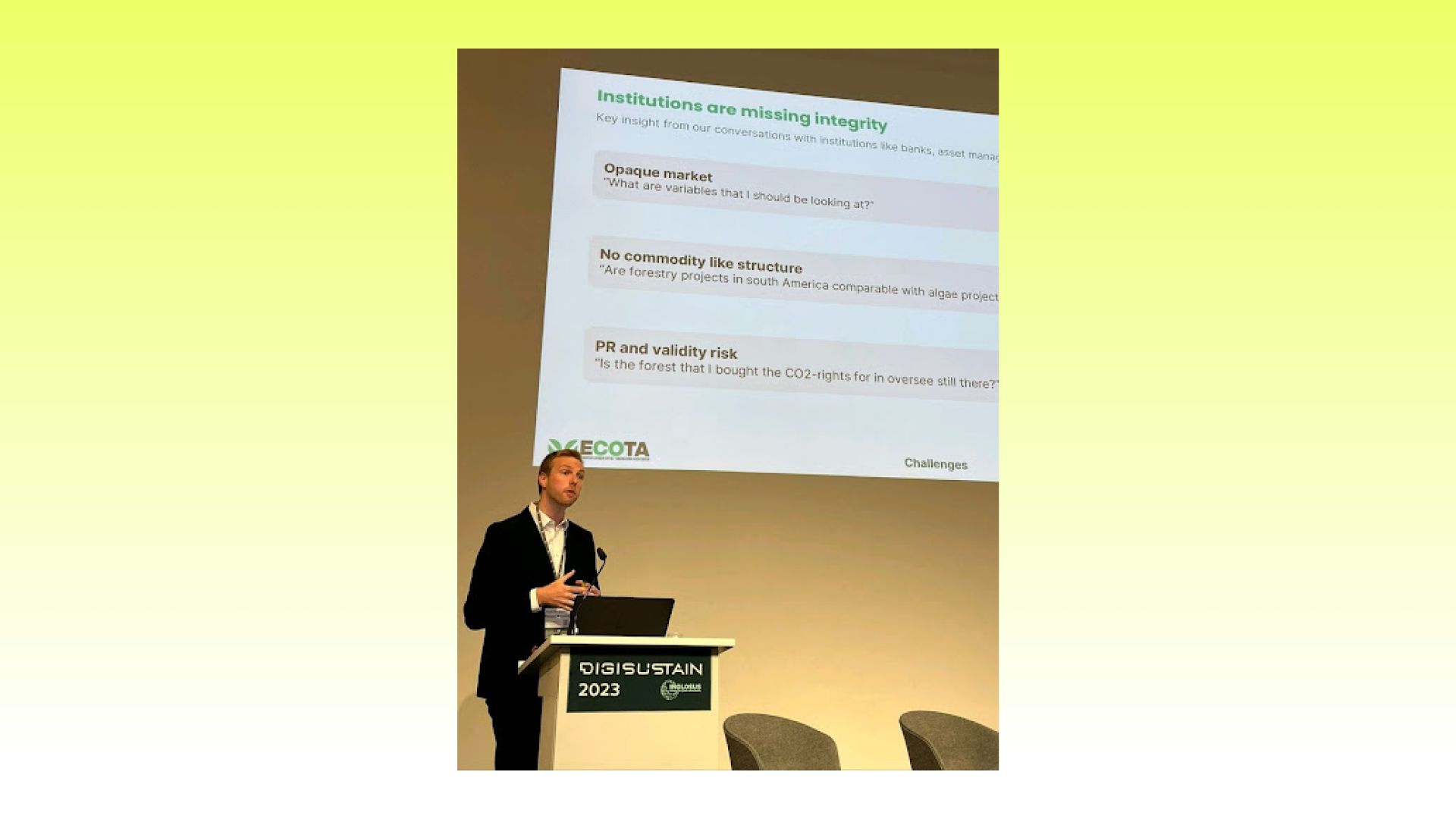

They organize monthly panel discussions and periodic working groups addressing key challenges. They participate in conferences and events, and support and publish research. In addition, ECOTA connects start-ups with experts to help them overcome challenges and enterprises with solution providers.

The association works with “platforms, startups technology, and industry experts who share knowledge and best practices about CO2 tokenization. We have a huge community of experts, fellows and partners”.

Abdullah is particularly proud of the new educational program, “ We have a new program, it’s called ReFi Talents. Have you heard about the DeFi talents and NFT talents? These are educational programs at the Frankfurt School Blockchain Center. [..] We want to do the same for ReFi.”

ReFi is a relatively new term, so I wanted to know how he defines it. The answer was simple: “ReFi – Regenerative Finance – means financial solutions without any CO2 emissions.”

Is there a backside to the token?

Heads and hands together against the storms

So far, so good. It all sounds very positive and agreeable. In every-day operations, there must be some battles to fight as well. “Abdullah, where do you see the main challenges?”

“The biggest challenges are educational borders. This is why ECOTA was created. You can have the best strategy, the best product, the best organization. But if people don’t understand what you are doing this for, it’s nonsense.“

“So this is one of the big challenges that we see, to educate people and companies who are actually buying these CO2 certificates, who are working to reduce and offset carbon to understand why they should use blockchain technology.”

People in different positions have knowledge in specific fields. There is motivation, there are ideas and good intentions. But when it comes to bringing it all together and grasping the concept of the distributed ledger technology, everyone has gaps. ECOTA helps bridge them and keep moving forward. The director had a story to tell about his as well:

“There’s a woman in Mexico, she’s not the owner, but she’s responsible for many hectares of land. She helps the farmers work on decarbonization and thought, ‘We’re working on net zero, so why not take the opportunity and make some NFTs with that?’ She called me and said, ‘Hey, Abdullah, I know a lot about carbon, but I know less about tokenization, could you help me out with this?’”

Abdullah hooked her up with the Defi talents and NFT talents programs at the Frankfurt School. The 18-week courses are free and she could learn everything she needed to realize her idea.

Abdullah goes on to tell me how amazed he is at all the creative ideas people come up with for decarbonization. The tremendous potential to reduce carbon emission with individual initiatives makes him optimistic about the future. “If people just follow their passion they can save the environment for sure,…I believe.”

Winds of changing regulations

I persisted to challenge Abdullah’s optimism and asked if he encounters a lot of bias against blockchain. To my surprise, he remained unshaken.

“We talk to a lot of traditional organizations. For example, I had a call with a car manufacturer in Germany – one of the biggest. And they ask me, ‘What are the benefits for blockchain? Because we’re doing it actually the traditional way.’ And I showed them and they said, ‘Well, that’s great, we didn’t know this’.”

“That’s why education is so important. If you tell people it’s transparent, you reduce your costs, and you don’t have too many intermediaries, why should they say no?”

He didn’t stop there. The ECOTA director went on to elaborated on the attitude of financial institutions towards using blockchain technology:

“I worked for Wepex [Financial Consulting] last year, and we did market research on how much the banks are involved in the blockchain area and how many solutions they’re working on. Almost every third bank is working on becoming crypto custodian to get the license and to offer their customers to buy crypto via their banking solutions”

Based on an amendment to the eWpG (German Electronic Securities Act) in September 2022, it is permissible to issue digital bonds on the blockchain in Germany. Traditionally, you’d have to get a notarized document which is kept in a secure vault in the bank safe. This is a long and costly process.

“For example, Siemens made a very big transaction on the blockchain – I’m almost sure it was this year in January or February – about 60 million of bonds issued.”

There’s also a new law called ‘Zukunftsfinanzierungsgesetz’ [Future Financing Act] which would allow banks to issue securities – like ‘Aktien’ [stock shares] on the blockchain. So it’s a huge market and it’s developing because banks are slowly but surely understanding the positive ways of the blockchain. And regarding carbon credits companies will also see the development and the benefits of the blockchain. So it’s just a matter of time.”

Hopefully other countries will follow suit and implement similar blockchain-friendly regulations. For now the situation works in ECOTA’s favor, “good thing about Europe: We are regulated. […] Companies from other countries like the US or Latin America, want to enter the European market because they see they’re regulated.”

Abdullah has a real-life example from his work at ECOTA:

“We just had a request from a partner in South America. He wanted to enter the European market to build a voluntary carbon market on the blockchain. Europe is very regulated and he wasn’t sure. He didn’t want to do anything wrong and asked us for help. We are no lawyers but we have enough lawyers among our experts and fellows with whom we can connect them and help build a regulatory foundation so they won’t have any problems with that.”

Inside ECOTA

If the future was up to Abdullah Yildiz, we would reach the net zero goal through the use of blockchain technology way before 2050. He doesn’t determine it, but certainly does his part through passionate advocacy.

I’m interested to know who he thinks should know about ECOTA. Who can benefit from the work they do and for whom is it most helpful?

“Well, we are free for all – every kind of organization. But mainly for those who are working with CO2: Startups, big companies, and verification standardization organizations. those who issue the verification certificate and confirm CO2 projects,”

“Private persons can also join as fellows. Our experts can help to get more knowledge and information”. So anyone who wants to get a better understanding of the potential of blockchain-based technologies in decarbonization or wants to get involved in carbon certificate trading has a place in ECOTA.

To finance the educational activity, ECOTA has a list of members who contribute annual membership fees based on their size and number of full-time employees. Among them also the Liechtensteiner Bank. “We have bronze, silver and gold partners and also light membership for startups. It is very interesting and very important to support startups in this area because they are building the new solutions on the blockchain.[..] we want them to be part of our organization“

The future looks green on the blockchain

It’s hard to remain indifferent to Abdullah’s enthusiasm and optimism. His faith and belief in the cause helps to realize once more that relying on official news gives us little more than a scratch on the surface – and it usually only brings up dirt. There is a lot more going on underneath the surface and climate action combined with blockchain is becoming a reality.

Abdullah’s final advice to anyone who wants to make an impact: “Most important is to get the education. It takes some time. You won’t become an expert from today to tomorrow. But if you have a passion, if you have a goal, just follow it and do every day like one or two hours in different topics. […] this education is for free. You just need to grab the opportunity”.