Apple, BlackRock and JPMorgan will make you an offer you can’t refuse: Tokenization.

A new buzzword? Maybe, but tokenization has already been part of our evolution for 75,000 years.

This excursion from ancient times to our contemporary network society was inspired by our impact report on real-world assets (RWAs) in emerging markets.

Continue here to discover the transformative impact tokenization has already had on finance and humanity. Our in-depth report picks up where this story ends.

What is a token?

In the time to come, when the shadows grow long and the silence speaks louder than words, I may call upon you to do a service for me. Until that day, accept this as a gift on my daughter’s wedding day.

A promise to Vito – a token for the Godfather.

A token is a representation of value or a promise. It can be tangible, like a coin – or digital, like a Bitcoin.

Your driver’s license is a token, too. Most of us carry it as a card in our physical wallet. But drivers in Arizona, Colorado, Georgia, and Maryland may already have it in their Apple Wallet.

Tokens represent ownership of assets, access rights, or identities. And even the first money was a token.

Tokenization in ancient times – the first proof-of-work consensus

75,000 years ago, tokenization dawned on modern finance – in the form of shells.

Polished, carved, and strung into jewelry, these beautiful beads became a store of value and a medium of exchange. Shells are small, scarce, and durable, making them easy to store and carry.

“The Blombos Cave beads present absolute evidence for perhaps the earliest storage of information outside the human brain,”

– Christopher Henshilwood, program director of the Blombos Cave Project

Consider the hassle of direct barter – The challenge of finding a trading partner who valued what you had to offer at that moment. A handful of beads made it obsolete – a quantum leap in our evolution.

Shells laid the foundation for the monetary systems we use today. However, contrary to our modern financial system of fiat currencies, the shell system was decentralized.

There was a regional consensus on the value of shells. A time-consuming polishing and carving process limited the supply. Each bead was a tangible proof of work. Sounds familiar?

75,000 years later, Bitcoin would digitize the proof of work consensus. But before we get there, let’s take a look at tokenization in the 20th century.

Tokenization in the 20th Century – advancing into the abstract

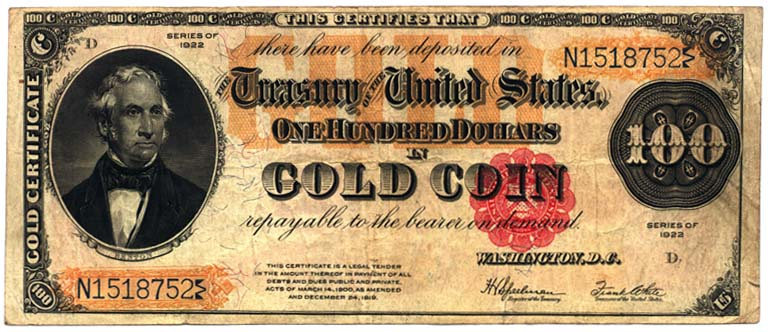

Welcome to the gold standard, a global and centralized approach to tokenization.

The classical gold standard

The classical gold standard was a monetary system in the 19th century. A country’s currency or paper money had a value directly linked to gold. The most prominent currency was, of course, the U.S. dollar.

The standard was centralized, yet effective. It established a stable value for money and provided economic stability and confidence.

With the outbreak of World War I in 1914, countries left the gold standard to fund the war effort

Before World War I broke out, the general consensus was the war couldn’t last more than a few months. Because there certainly wasn’t enough money for the governments to fight their war. Anf of course, that view didn’t understand the first thing the government would do was cancel the right of redemption and print the money fo fight that war.

Daniel J. Oliver, Predisnet of the Committee for Monetary Research & Education

The Bretton Woods system – a “modern” token

After World War II, a modified gold standard, the Bretton Woods system, established the U.S. dollar as the global currency anchor backed by gold. This system pegged other currencies to the dollar’s value.

This system, too, broke down when it could no longer service growing payment deficits.

The Nixon Shock – and the broken promise of tokenization

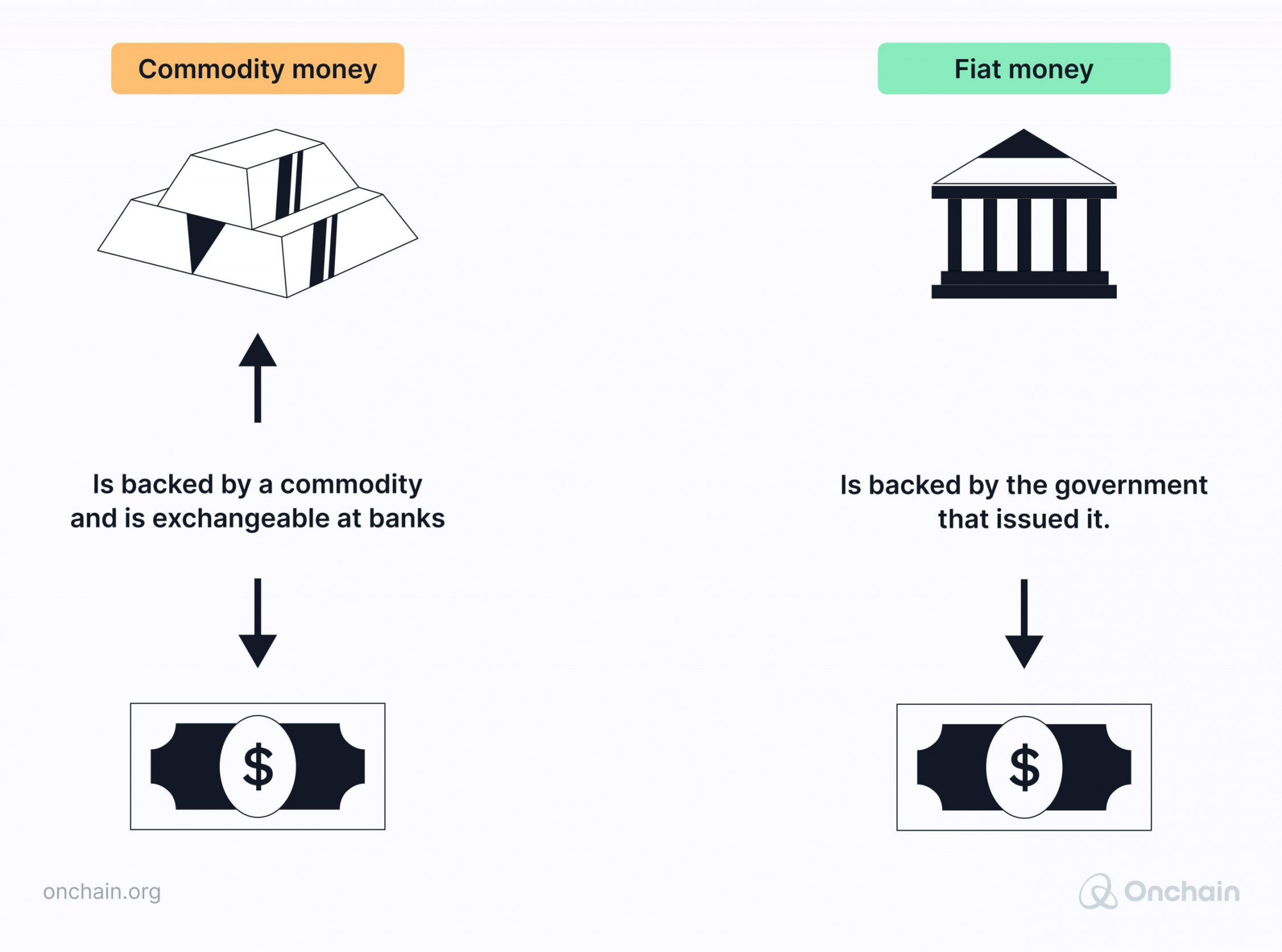

Historians and economists refer to this pivotal moment as the Nixon Shock. It ended the dollar’s convertibility into gold, marking the transition from commodity to fiat money.

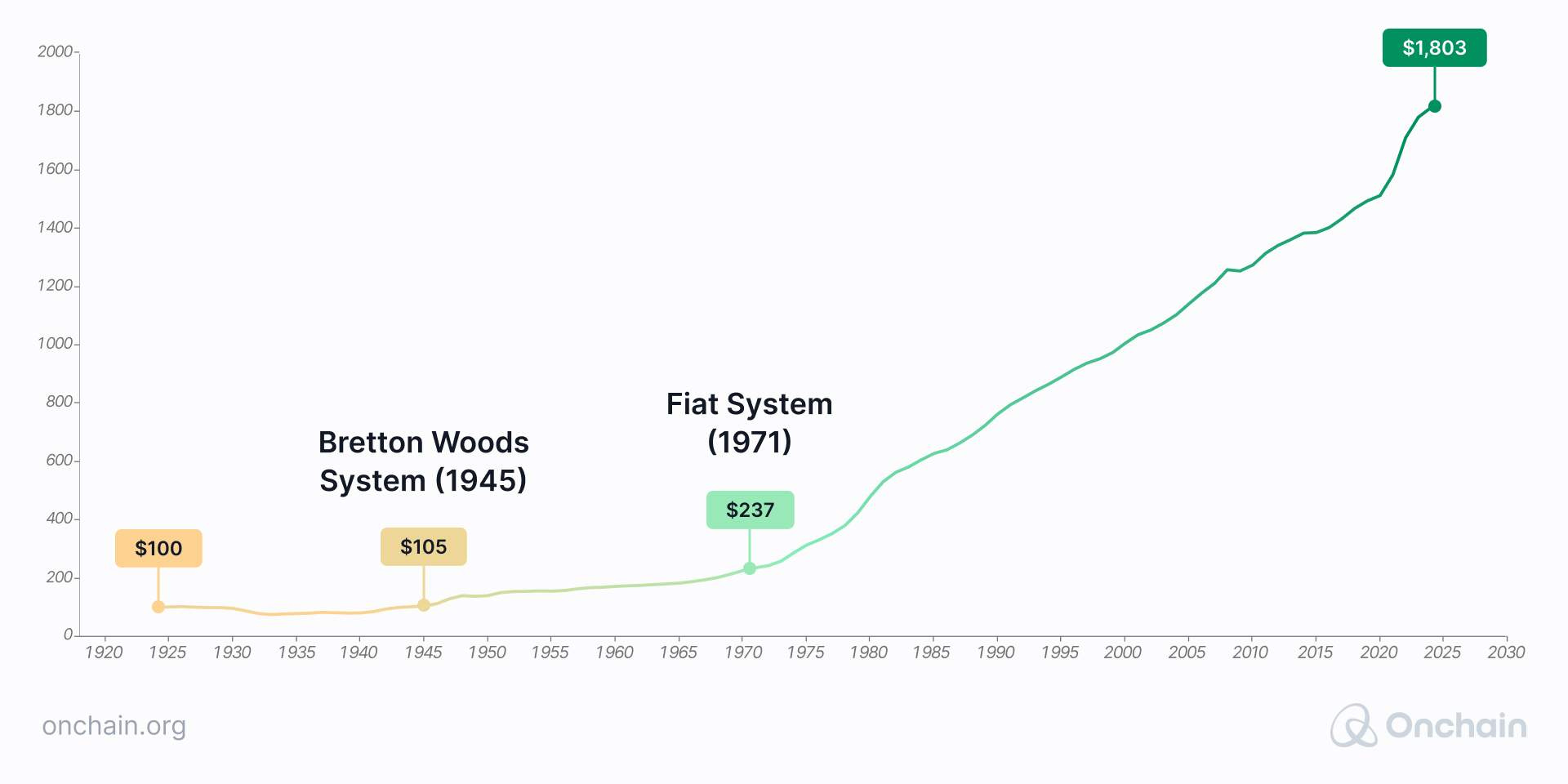

This policy gave central banks more control over interest rates and the money supply. It has also allowed governments to increase debt to unsustainable levels. Savers in turn saw their purchasing power diminish.

$100 in 1924, adjusted for inflation

Shifting from commodity to fiat money represents a move from a tokenized commodity to a tokenized – and often broken – promise.

The result is an erosion of trust in fiat currencies worldwide. Currencies that are struggling to maintain their purchasing power.

And so the longing for a store of value became evident. This in turn has encouraged the development of alternative digital currencies.

Digital currencies – a history of shaky steps

The 1996 launch of e-gold, a digital currency backed by physical gold, pioneered today’s digital assets. E-gold was popular because it was accessible and offered anonymous online transactions. At its peak, it had 5 million accounts.

Unfortunately, its centralized architecture made it a honeypot for hackers. Then in 2007, e-gold shut down after authorities exposed its use for money laundering, leading to a U.S. Department of Justice indictment. Yet another reminder of the shortcomings of centralization.

A stable future on the blockchain

Win or learn is the guiding principle. Shells, sovereign money, and e-gold offer valuable lessons. Bitcoin implemented all – and won.

To create better money, Bitcoin introduced a scarce supply, like the gold standard. It digitized its currency, like e-gold. And it implemented a decentralized consensus mechanism, like shells, to secure its currency.

The resilience, security, and global reach of blockchain, paired with smart contracts, enable the tokenization of almost any real-world asset.

Blockchain equips these assets with instant settlement, enhanced security, and global liquidity. Bitcoin started it, and Ethereum ran with it. Let’s dig into Ethereum’s market dominance and how to manage it as a founder. Hit that button below to move forward.