“The problem with charity is that in the end you have no idea what exactly is happening with your money.” — My dad sometime in the 90s during a late night TV show.

A boomer taught his millennial son not to blindly trust charities.

Some thirty years later, I and 1.8 billion millennials are the next generation for charities to court. And guess what, my dad seems to have influenced my entire generation.

But I’m not just a millennial, I’m part of the Web3 donor demographic that we’re about to dive into. And let me tell you, we’re a unique bunch. For us, Web3 isn’t just about cryptocurrency speculation. To be fair, for some it is. And that’s okay – it’s not necessarily bad for you.

Web3 stands for transparency. Putting power back in the hands of the people. And making a real difference by getting involved in the causes we care about. That’s what Web3 means to us.

You see, our incentives are already aligned. The question is, how do we come together?

I’ve dug through the most interesting developments in Web3 charity and extracted 3 strategies to help you prepare for the Web3 era.

But first, let’s dive into your foundation: your next generation of donors.

A new generation of philanthropists

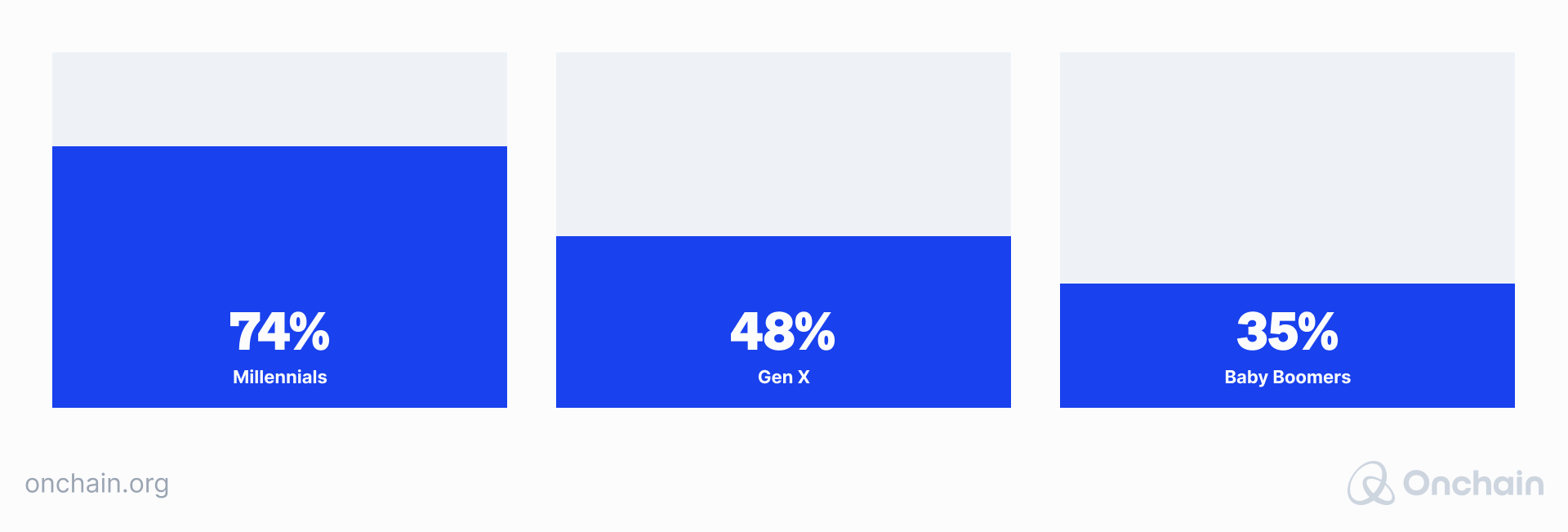

There’s a shift in the mindset of young donors, says Fidelity Charitable’s Future of Philanthropy report. For them, a philanthropist is someone who contributes time, skills, or resources to make the world a better place. With this self-image, 74% of millennials consider themselves to be philanthropists.

Fidelity’s research also found that in 2017, 60% of Millennial business owners in the U.S. donated $10,000 or more to charity. They far outpaced Gen Xers (43%) and Boomers (42%).

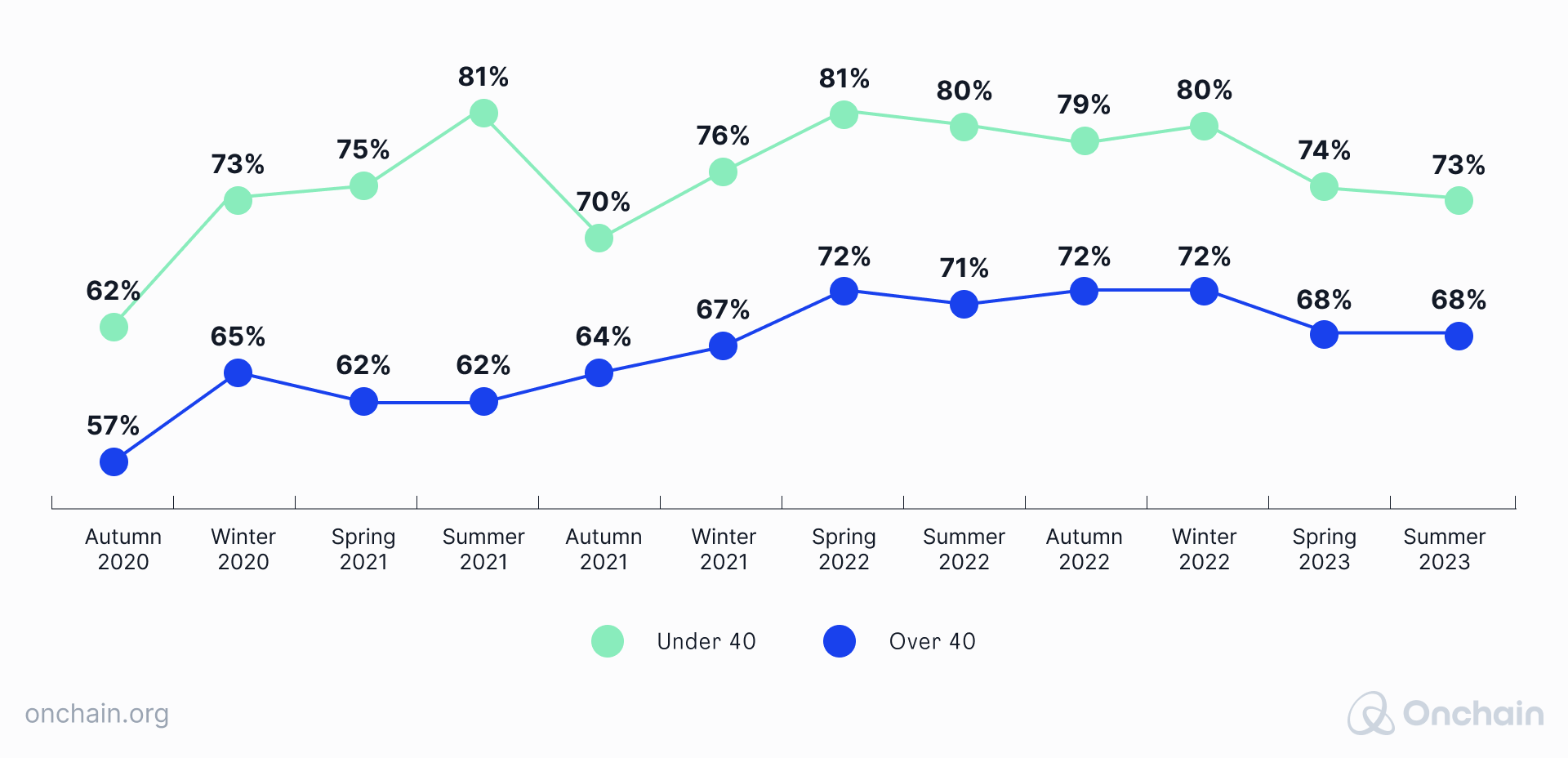

On the other side of the Atlantic, in the UK, the percentage of donors under 40 is also consistently higher than the percentage of donors over 40.

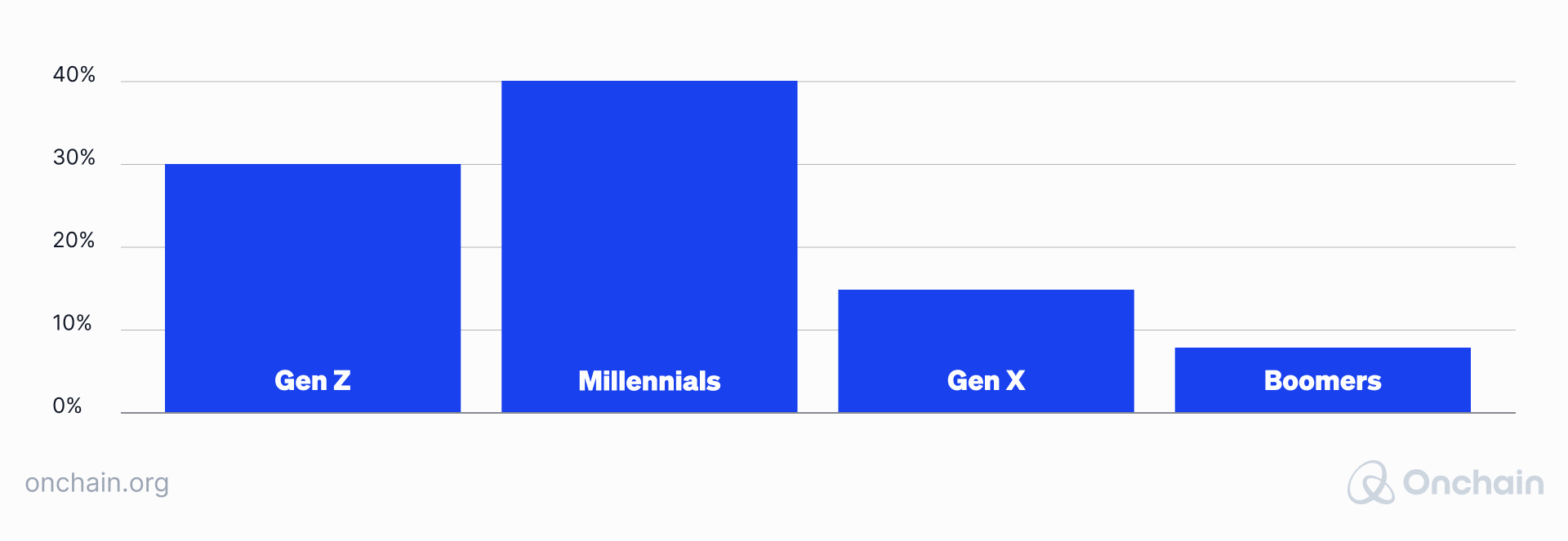

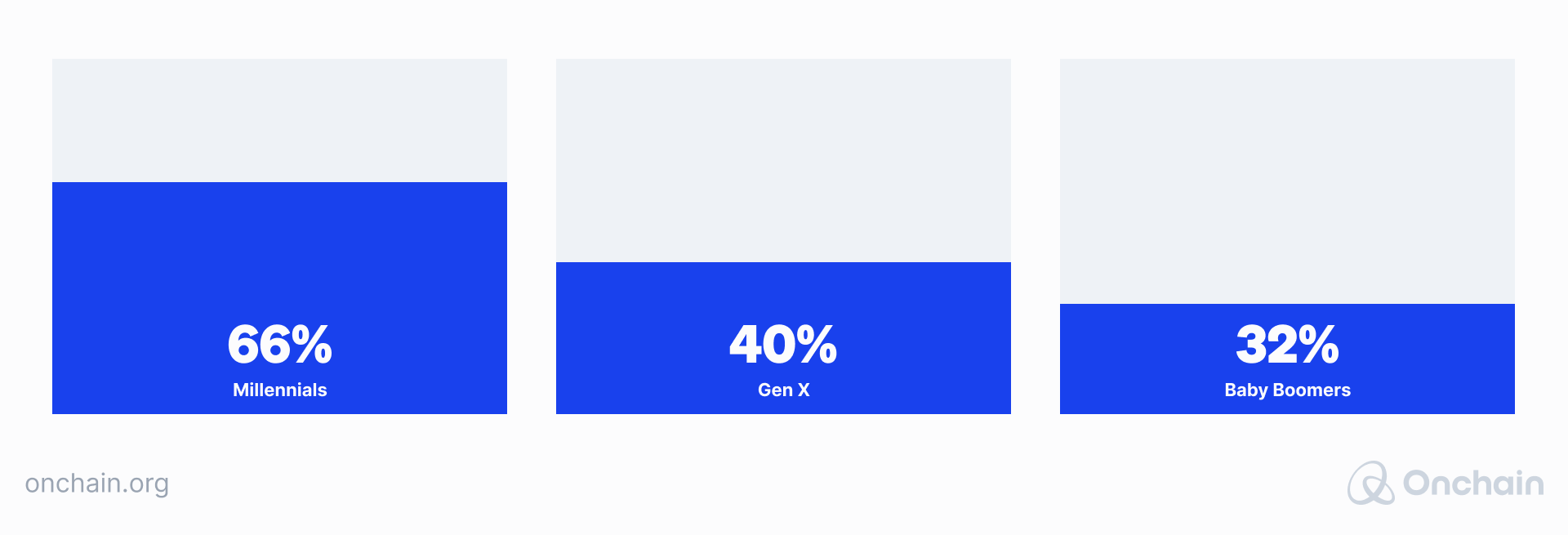

Not only are millennials more willing to donate to charity, they also lead in digital asset ownership, says Alto’s 2022 Alternative Investing Report.

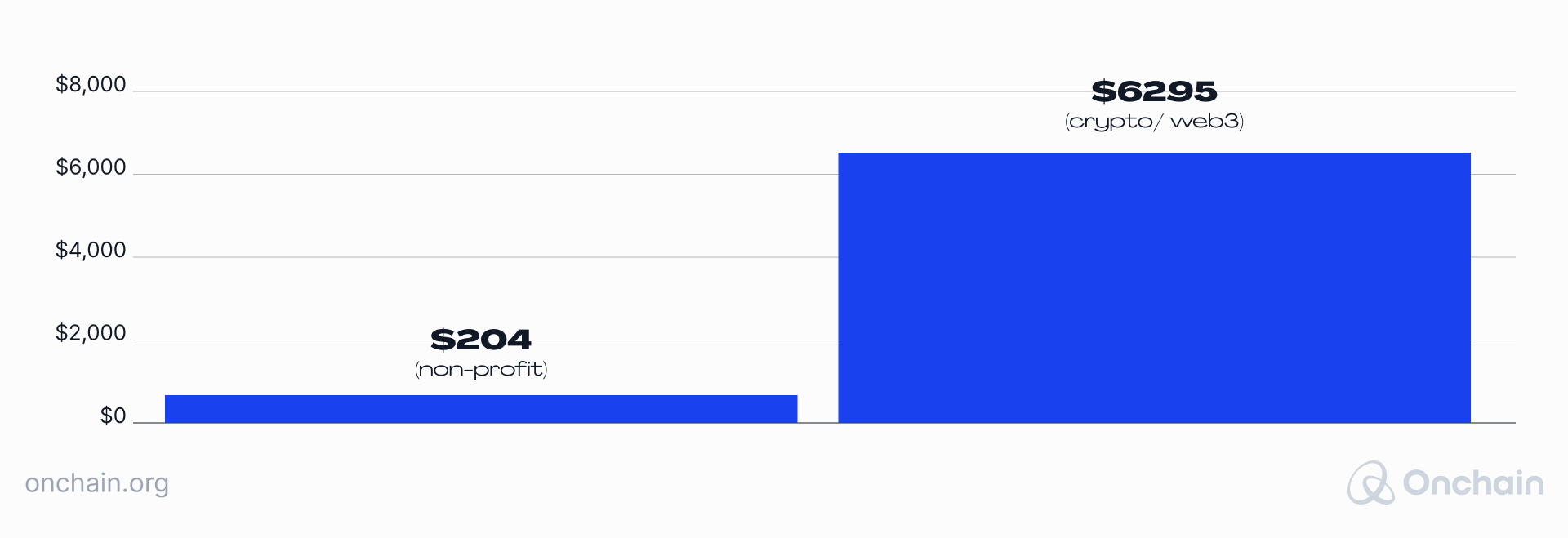

And the average crypto donation was nearly 31 times larger than the average online donation in 2022, according to The Giving Block.

Of course, Web3 charity is still a niche. In the end of 2022, only 425 million people owned cryptocurrency, roughly 5% of the world’s population. But despite the 2022 crypto bear market, this number increased by 39% in 2022.

And despite these unfavorable conditions, crypto donors gave $172 for every dollar of bitcoin’s market value. This marks a 41% increase over 2021, with an average donation size of $6,295.

What we see could become the foundation for the golden era of Web3 charity.

And enabling crypto donations is the first step in tapping into the emerging Web3 donor pool.

Step 1 – Embrace digital asset donations and blockchain payments

In 2022, Deloitte discovered that 93% of businesses that accepted cryptocurrency payments experienced significant growth in customer numbers.

Perhaps that’s why, in the same year, 49 of Forbes America’s top 100 charities accepted cryptocurrency donations. Four times more than in 2019.

Some of these charities are getting support from projects like The Giving Block, which help nonprofits accept cryptocurrency donations.

The project raised $69 million for nonprofits in 2021 and solves multiple problems that charities encounter when accepting blockchain based donations.

- It enables your charity to accept multiple cryptocurrencies and even NFTs, addressing the complexity of handling diverse digital assets.

- It automatically converts donations into cash to mitigate price volatility,

- while donors automatically receive tax receipts.

Which, in most countries, they can use to get a tax break.

Give your donor a break from capital gains tax

Capital gains tax? As it turns out, 38% of crypto investors don’t realize that selling digital assets incurs taxes. Even less know that they can avoid those taxes by donating digital assets to charities.

This is your opportunity to turn an investor into a philanthropist. The key is to educate potential donors about the financial benefits of their donations.

Some donors embrace price volatility

While projects like The Giving Block allow you to escape price volatility, some Web3 investors might not want to escape it. This is because many believe in the appreciation of their assets over time. As a result, their donations could do more good in the future.

“If bitcoin appreciates, like so many people believe, there’s going to be an extraordinary amount of wealth created,” says Scott Harrison, CEO of Charity Water, in an interview with Real Vision.

This is why Charity Water’s Bitcoin Water Trust intends to allocate any donated bitcoin toward funding clean water projects worldwide after holding them until January 1, 2025.

Hopefully with a greater impact than it would have today.

Goodbye remittance fees, hello unbanked

In the Azraq refugee camp in Jordan, a woman finds food for her family. At the exit of the store, she authorizes a payment from her blockchain wallet with a blink of an eye – a scan of her iris.

It sounds futuristic, and she might not know what a blockchain is. But this is how Building Blocks, the largest blockchain-based humanitarian cash distribution system, provides assistance to 4 million people every month.

The original use case of blockchain, peer-to-peer payments, is a big opportunity for global operating charities. When combined with stablecoins, tokens pegged to a fiat currency, people can send money around the globe in an instant and for negligible fees.

The impact?

- Building Blocks helps 4 million people every month

- The project saved over $3 million in banking fees.

- And is capable to reach the 1.4 billion without banking access.

Blockchain rails are effective for the distribution and donation process. And they know no borders – and neither does charity.

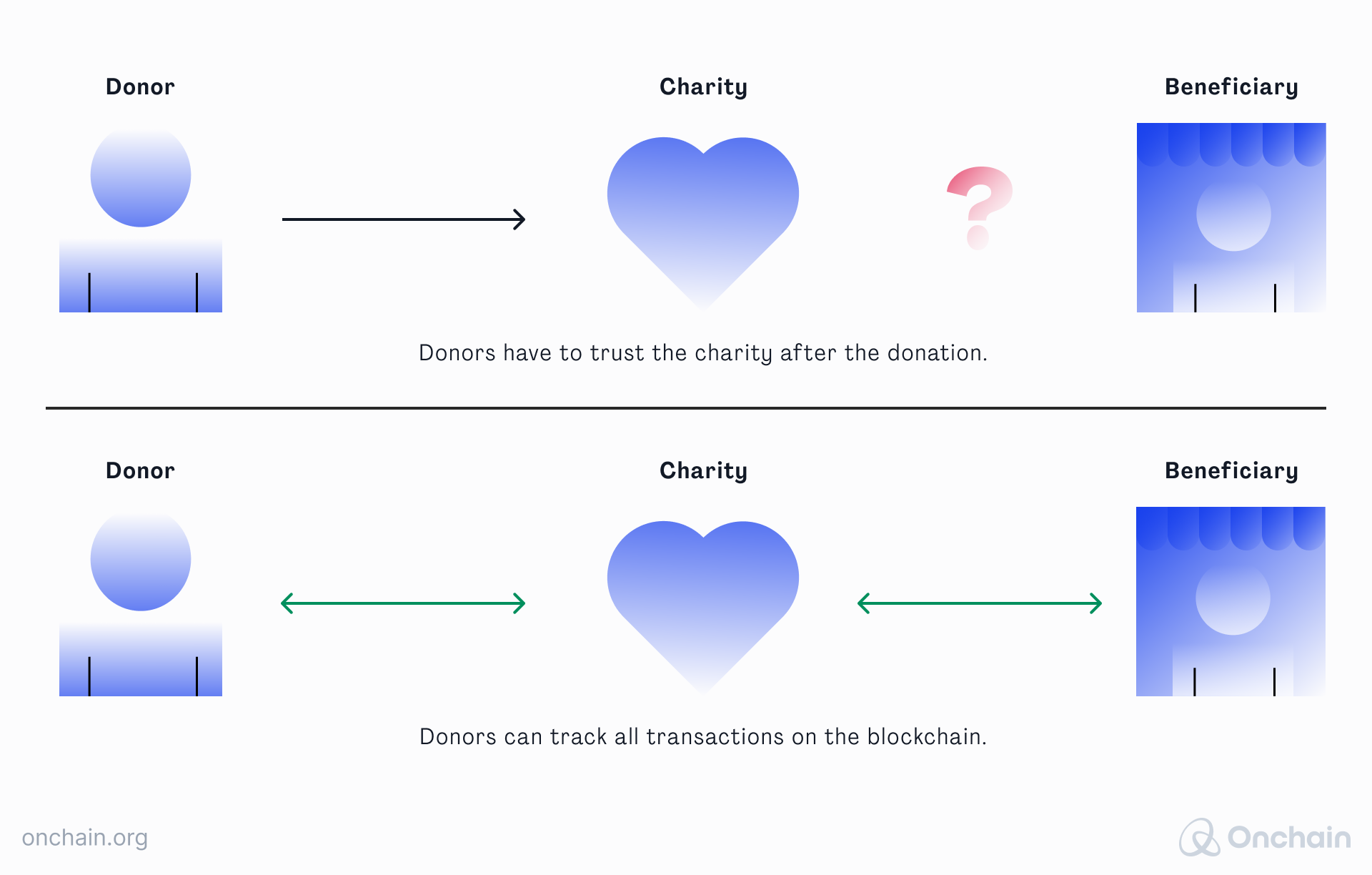

This is, however, only the first step in attracting Web3 donors. They have more choices than ever, but their key demand is rarely met: transparency and accountability.

Step 2 – Make donations and distributions transparent

“There are lots of things you can tell your donors, but what they want to know, above all else, is how their gifts are helping you achieve measurable results. If you showcase your progress, your donors will want to know even more of your story,” says Penelope Burk, author of Donor-Centered Fundraising, in a 2021 blog post.

At the same time, a stunning 95 % of charity leaders believed there had been a decline in public trust in 2020, according to NPC, a think tank for the charity sector.

In such a landscape, charities must use strategic communication to highlight their unique mission and demonstrate their impact, which 66% of millennials actively track.

However, traditional methods, such as publishing quarterly or annual reports on initiatives and project results, are time-consuming, lagging, costly and do not provide indisputable expense records.

Luckily, the Web3 Charity Toolkit provides you with a solution.

Transparency builds trust – trust generates donations

Data and transactions on a public blockchain are immutably recorded across a distributed ledger. As such, the data is tamper-proof and trustable.

The part of UNICEF’s Innovation Fund that accepts bitcoin and ether to support early-stage startups uses these properties to allow donors to track donations and distributions in real time.

A new standard in funding transparency.

Transparency can help you to generate donations, but millennial philanthropists have more to offer than just donations. They want to get involved, and contribute with their time and skills.

Step 3 – Community and new governance models

At the outset of this text, I emphasized that Web3 is fundamentally about returning power to the people.

One project that does this is the Big Green DAO. A grant-making, decentralized, autonomous community where donors and nonprofit workers on the frontline – those who know where funding is needed most – collectively decide how to distribute money.

The Big Green DAO was founded by Kimbal Musk, entrepreneur and philanthropist known for his work in sustainability and technology. Kimbal sees the potential of decentralized autonomous organizations (DAOs) as a more efficient form of governance and decision-making. At the same time, he acknowledges the shortcomings of traditional philanthropy.

In an interview with CoinDesk, Kimbal shared his insights, stating

“When you’re a nonprofit, 25% of your time, resources, and people goes towards fundraising – 25%. Brutal.

And when you’re a foundation and you’re giving money away, up to 15% of your resources goes towards personnel who will provide the grants.”

In the end, only 65% of donations go to work. In contrast, the Big Green DAO operates with an overhead allowance as low as 5%, ensuring that a significantly higher percentage of donations directly support the intended causes.

But how does this work in practice?

- As a nonprofit, you can apply for a grant with a couple of sentences and a link to your website.

- The DAO community members, who govern the DAO, decide if your project will receive the grant.

- To become a member, you either need to be a donor of at least one ether or be one of the previous rounds nonprofit grantees.

Kimbal calls the Big Green DAO and experiment. But what is the takeaway? To him, it’s the power of decentralized voting, which transforms the fundraising landscape for nonprofits, making it straightforward compared to traditional methods.

The power of decentralized voting

- In 5 grant rounds, the Big Green DAO has awarded $2,200,000 in funding.

- The DAO distributes money to nonprofits with as little as 5% overhead.

- For nonprofits, fundraising is effortless compared to the traditional way.

- The members’ shared passion and mission promote an engaged community that serves as a hub for networking and learning.

This innovative approach could indeed pioneer the frontier of Web3 charity, aligning with the ethos of decentralization and empowerment that defines the Web3 era.

Outlook for Web3 charity

Getting Web3-ready demands resources. And gaining board approval for this shift takes an open mindset.

However, there’s a new generation of philanthropist gaining financial influence, while Web3 meets their demands.

Cerulli, a research and consulting firm specializing in asset management, projects that younger generations in the U.S. will inherit $84 trillion by 2045, with an expected flow of $12 trillion into charities.

Opportunities are luring in Web3, and early adopters stand to gain.

At the same time, Web3 offers many experts ready to assist you.

The Giving Block specializes in digital asset donations. Building Blocks welcomes other humanitarian organizations to join the network.