On December 6, 2023, Capitol Hill hosted a fiery Senate Banking Committee hearing.

“The only true use case for it [cryptocurrency] is criminals, drug traffickers … money laundering, tax avoidance,” declared Jamie Dimon, CEO of JPMorgan Chase, responding to Sen. Elizabeth Warren, D-Mass.

He then added: “If I was the government, I’d close it down.”

One year later, the Financial Times dubbed stablecoins the “go-to cryptocurrency” for criminals. After all, their price stability and ease of transfer make them an attractive tool for illicit activities.

With statements like these, it’s no wonder our industry has a bad reputation. But what is fact – and what is fiction? Is it the blockchain, or is it the dollar that attracts bad actors?

To answer these questions, we need to examine two systems that are competing to be the better financial system side by side. We invite you for a ride through the Wild West of global financial crime where traditional banking meets blockchain innovation.

Whether you are a family breadwinner, entrepreneur or a drug lord in Mexico, this journey will reveal which system best suits your needs.

It all begins at the origins of blockchain: the global financial crisis.

Crypto fraud vs banking fraud: A tale of two systems

Unemployment rose to 10%. Millions lost their homes. Homelessness surged. The stock market crash hit retirees’ 401(k)s, forcing them back into the workforce. Taxes rose, the wealth gap widened, bringing stress, anxiety, and despair.

The 2008 financial crisis revealed the risks hidden within opaque banking systems.

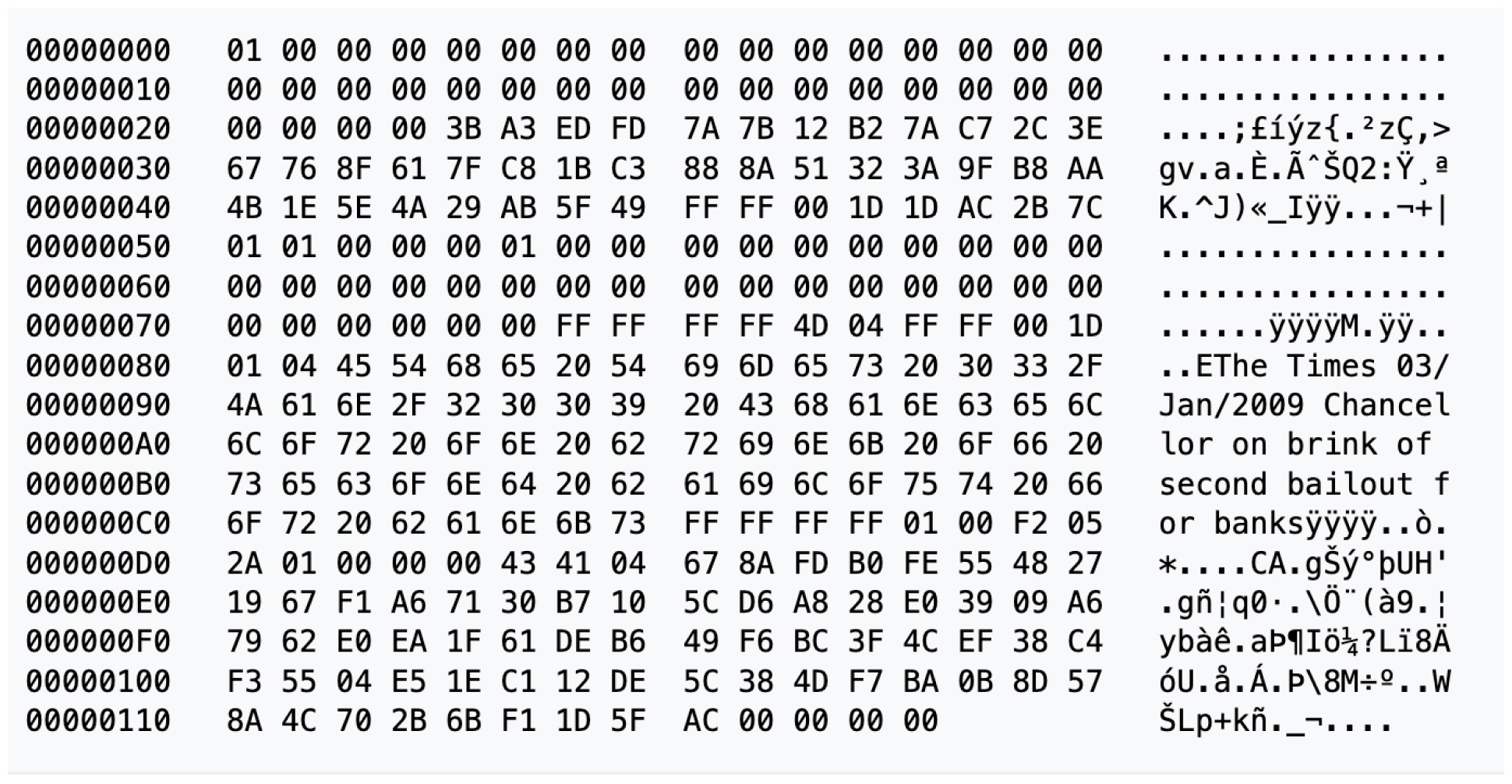

As trust in financial institutions crumbled, Satoshi Nakamoto published the Bitcoin white paper, proposing something revolutionary: a peer-to-peer payment system built with blockchain technology that wouldn’t require trusting banks at all.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Bitcoin’s genesis block carried these words as governments poured billions into failing banks.

Since then, a parallel peer-to-peer financial system built on public blockchain ledgers has emerged. It offers something powerful: transparency.

This transparency allows us to examine illicit financial flows with unprecedented clarity.

Crypto crime trends – the facts

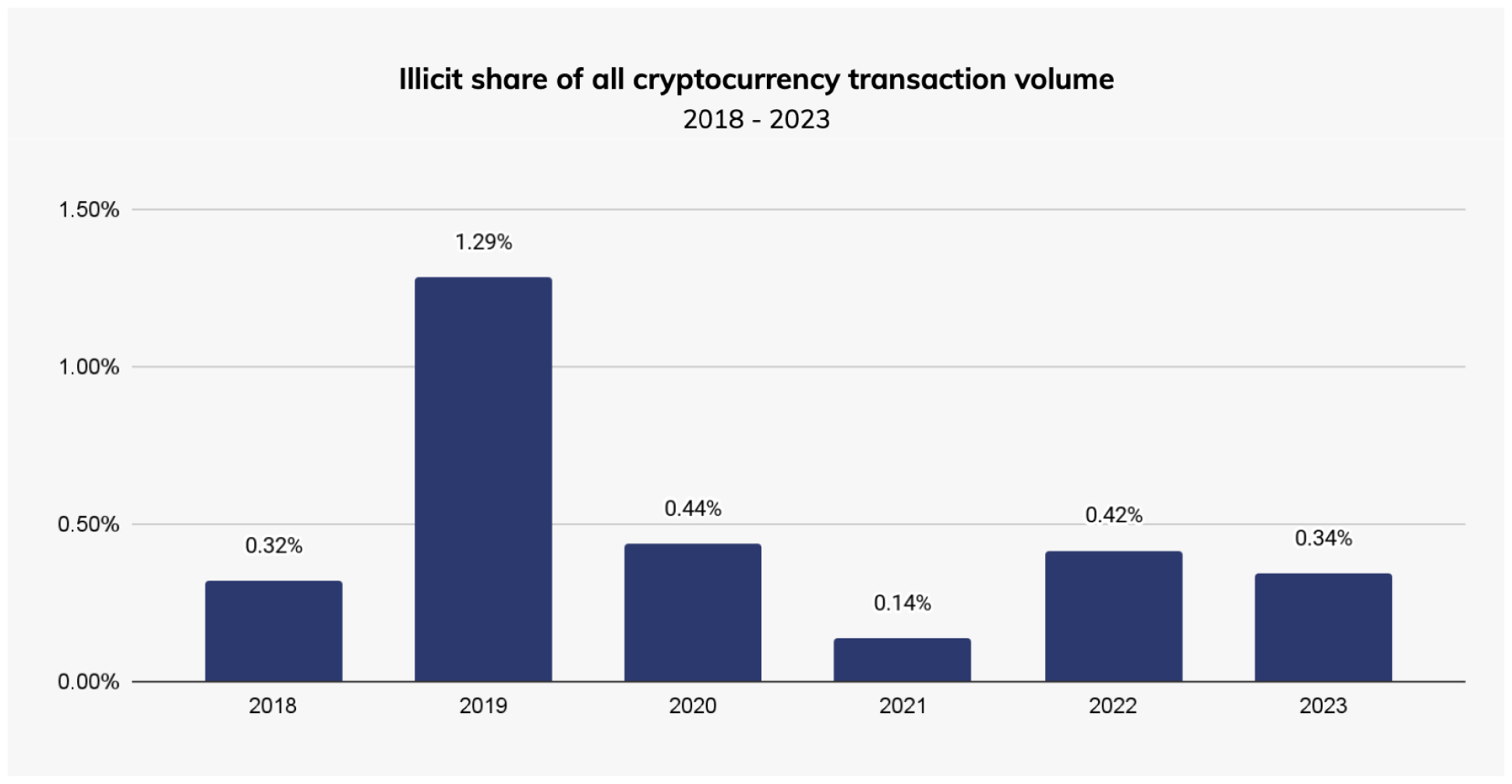

Data platforms like Chainalysis track and analyze blockchain data for investigations to prevent, detect, and investigate cryptocurrency crime. Here’s what their 2024 Crypto Crime Report unveils.

Overall illicit volume

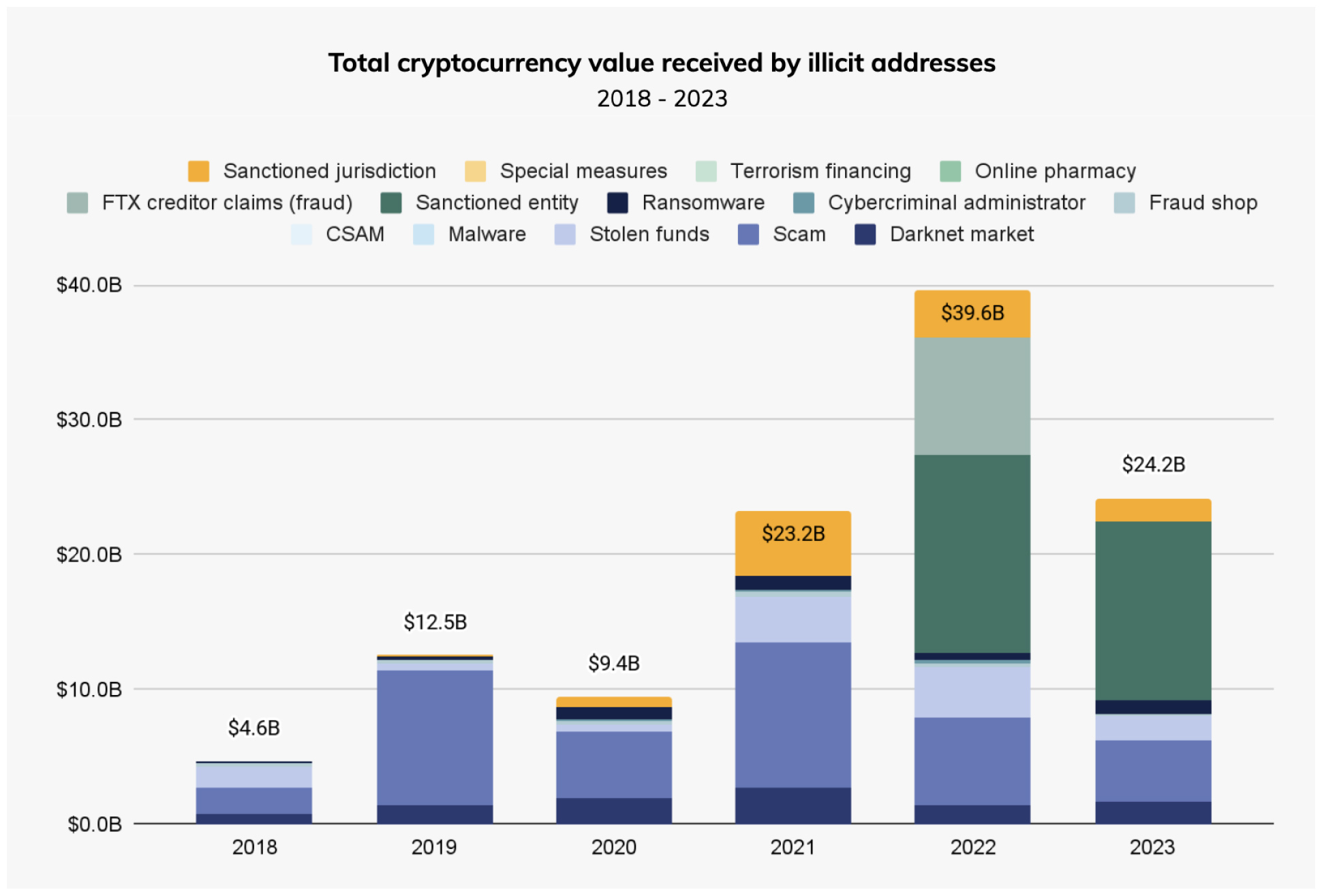

Illicit cryptocurrency transactions dropped from $39.6b in 2022 to $24.2b in 2023.

With the right framing, $24.2b raises eyebrows, but it represents just 0.34% of total onchain volume.

Breaking down crypto fraud

For 2023, the data shows significant declines across most categories, though sanctions-related transactions remain a major concern.

- Scamming revenue: Fell by 29.2%

- Stolen funds: Dropped by 54.3%

- Sanctions-related transactions: Accounted for $14.9b (61.5% of illicit volume)

Stablecoins: Popularity and misuse

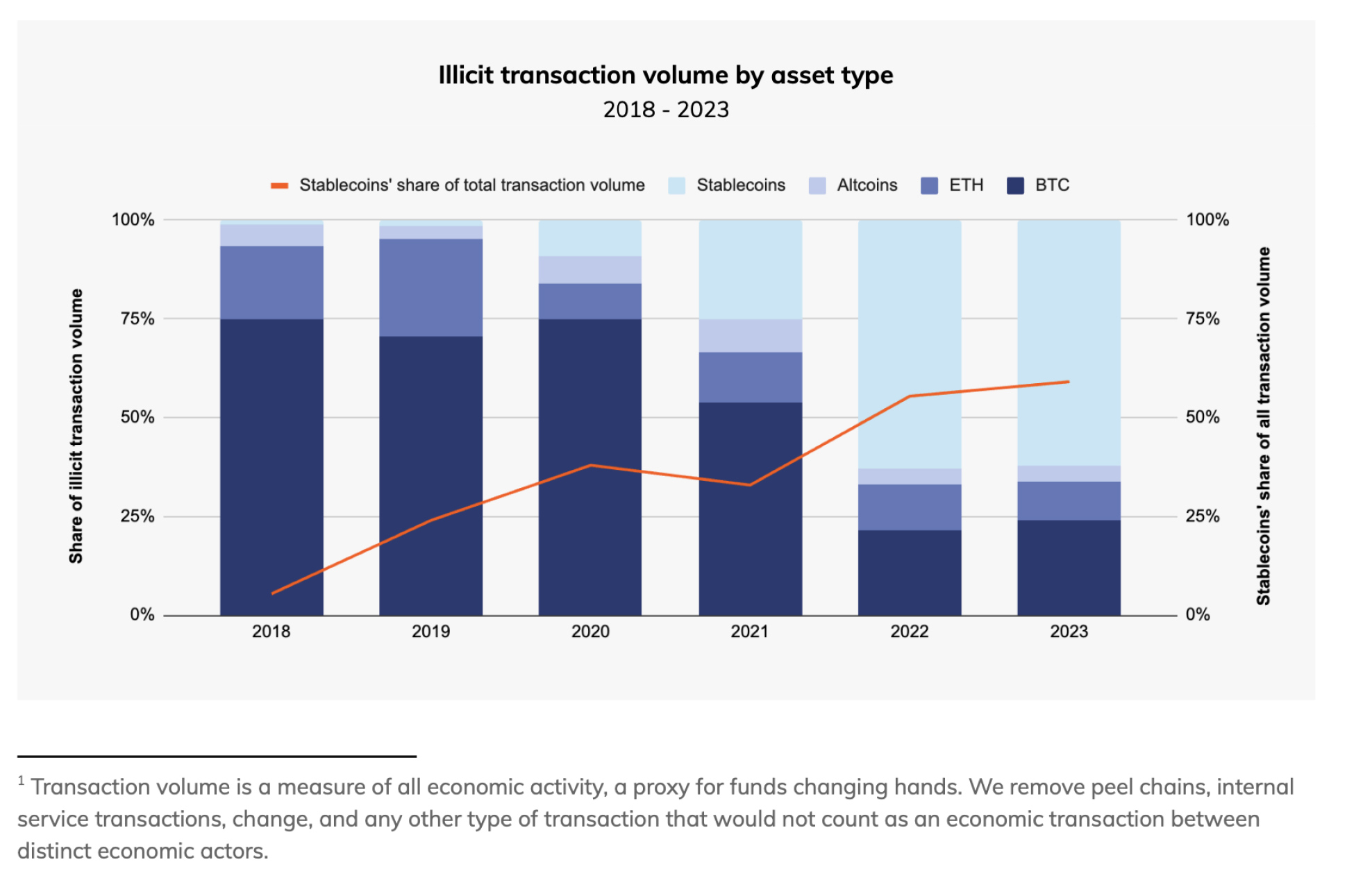

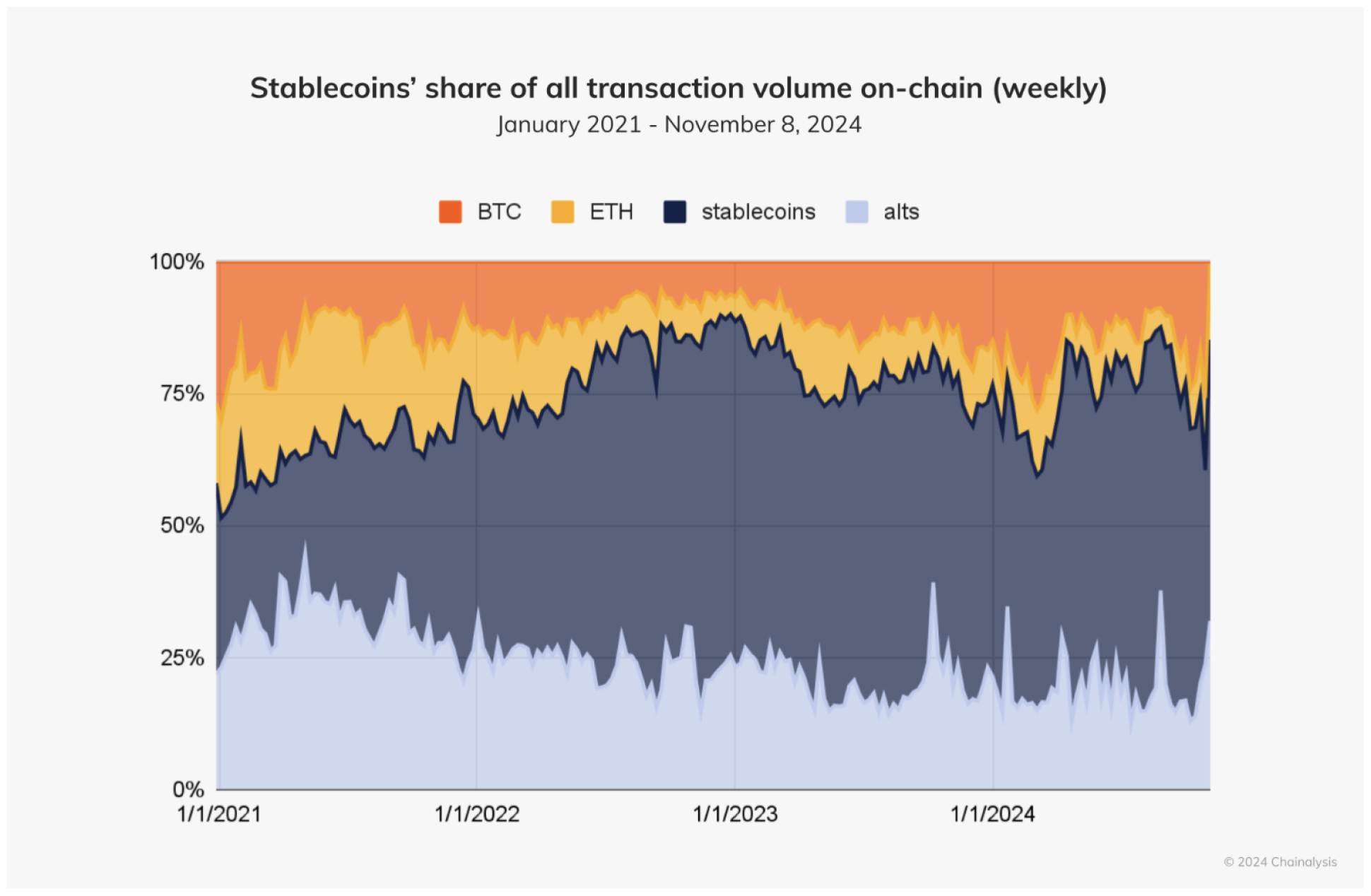

Since 2022, stablecoins replaced Bitcoin as the preferred currency for illicit transactions.

Stablecoins’ growing popularity spans both legitimate and illicit transactions in the blockchain ecosystem.

People worldwide now use their basic mobile phones to send money across borders instantly, protect their savings from inflation, and access financial services – all for less than a penny.

Given their dual use in both legitimate and illicit activities, it’s natural to ask the big question:

Are stablecoins safe? From misconception to innovation

Humans have misused every technology from fire to the internet and now stablecoins.

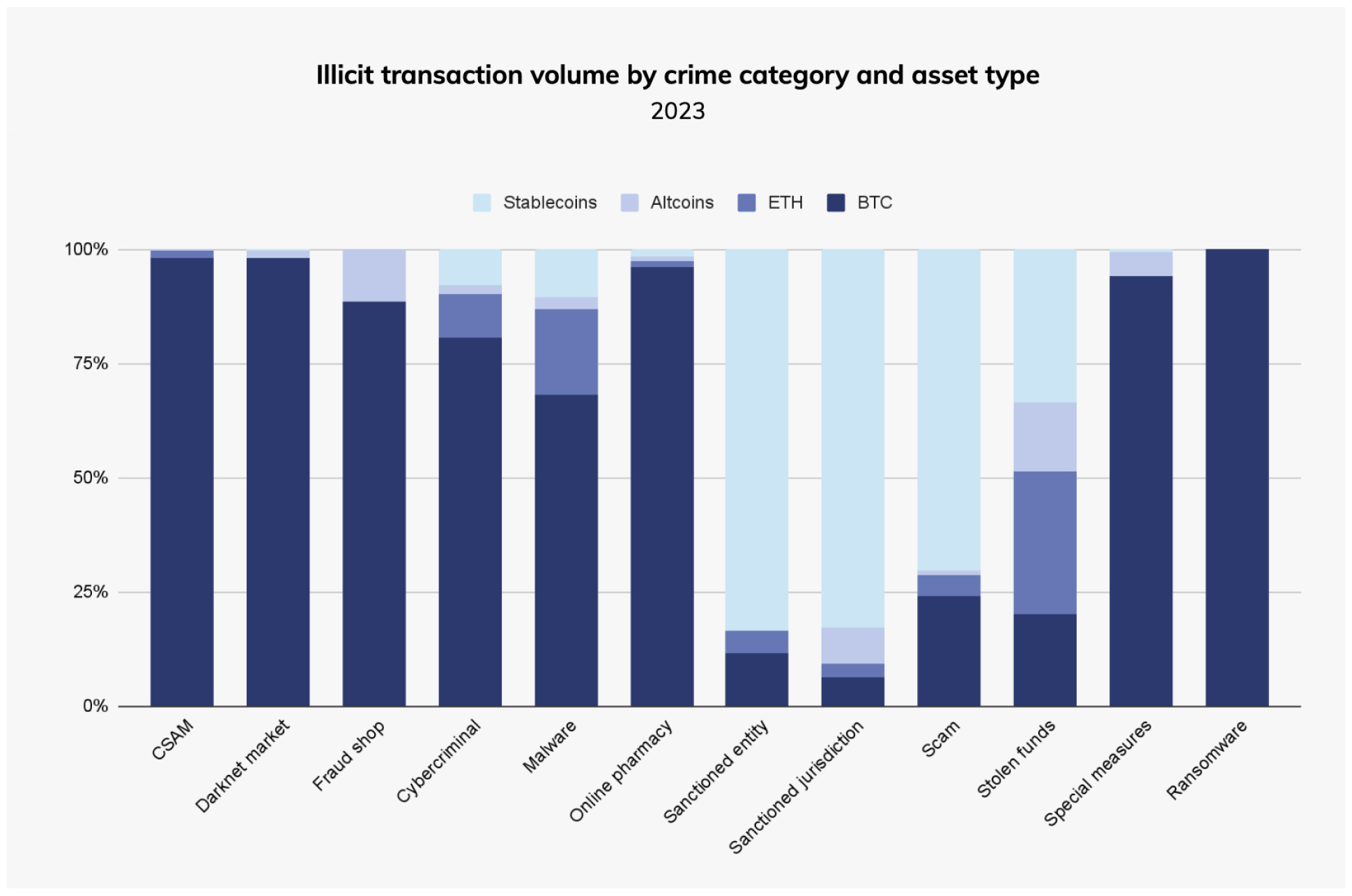

The chart below shows how sanctioned services and those operating in sanctioned jurisdictions generate most stablecoin transactions related to Office of Foreign Assets Control (OFAC) sanctions.

Here’s why transparency is a game changer. When Chainalysis detects suspicious transactions, stablecoin issuers like Tether can halt funds linked to sanctioned addresses.

This creates a fundamental shift in financial security:

- Analysts detect suspicious patterns in real time.

- Issuers freeze compromised funds immediately.

- The blockchain records every transaction permanently.

Compare this to traditional finance, where banks maintain private ledgers and cash moves without trace.

Thanks to the International Consortium of Investigative Journalists (ICIJ), we can peek behind 23 Wall Street’s closed doors.

Traditional financial crime – the estimates

On 20 September 2020, the ICIJ headlines “Global banks defy U.S. crackdowns by serving oligarchs, criminals and terrorists”.

Leaked bank documents, called the FinCEN (Financial Crimes Enforcement Network) Files, exposed how the world’s largest banks served criminal networks that have “undermined democracy around the world”.

Most troubling – they kept doing so after incurring regulatory penalties.

Serving bad actors is a good business, it seems. The risk? Hefty fines from US agencies – just the cost of doing business.

JPMorgan, Madoff and history’s largest Ponzi scheme

Bernie Madoff stole $65b in history’s biggest Ponzi scheme, crushing thousands of investors.

This single fraud tops all blockchain crime from 2022-2023 combined – including FTX’s $8.7b collapse.

JPMorgan earned $500 million in fees for serving Madoff’s operations. The fine? A $2.6b settlement reducing the bank’s profit to merely $22b.

HSBC – the go-to-bank for drug cartels

How would you move $881 million in drug money through the global financial system?

For Latin American drug cartels the answer involved custom-designed boxes built to fit HSBC teller windows. Europe’s largest bank – dubbed the “place to launder money” by a Mexican drug lord – received a $1.9b fine and promised reform in 2008.

HSBC kept serving suspected Russian money launderers and a global Ponzi scheme. Five years later, prosecutors dropped all criminal charges, letting HSBC claim it had “lived up to all of its commitments”.

Wall Street’s trillion-dollar shadow

These stories might be shocking, but the banking system casts a long shadow that stretches far beyond the marble floors of Wall Street.

The FinCEN Files shined a light on $2 trillion in shady transactions from 1999 to 2017. But here’s the thing: these files reveal less than 0.02% of all suspicious activity reports banks have sent to FinCEN. The system keeps most misconduct in the shadows.

The bottom line, as the ICIJ reports, is that trillions, not billions, of illicit money flows through Wall Street banks. Against this backdrop, illicit stablecoin transactions are a drop in the ocean.

If Wall Street were running on blockchain rails, would Web3 projects like Chainalysis let them get away with it?

With fees this high, who needs crime?

Here’s the irony: banks don’t need to engage in criminal activity to generate massive profits. Their legitimate customers already pay a steep price for basic financial services.

The bank in the middle

- Banks collect $200b in payment fees each year.

- Cross-border transaction fees average around 6.7%.

- Which generates over $50b in remittance fees each year.

The Visa/Mastercard duopoly

- Banks launched credit cards in the 1950s.

- Visa and Mastercard charge 2-3% per transaction.

- These fees generate $50b each year.

While generating billions in profits, banks haven’t advanced global financial inclusion. In fact, the right to own property – a basic human right – remains inaccessible for many. In 2021, 23% of the global population still lacked access to a bank account.

Opening a Web3 wallet is simpler. You need no ID, no minimum balance, and just a basic phone. Plus, blockchain lets people send money directly to each other, while smart contracts handle the work banks used to do – all for mere cents.

The impact extends beyond mere access to financial services.

The real-world impact of stablecoins in emerging markets

The United Nations Sustainable Development Goals (SDGs) aim to end poverty and give everyone access to healthcare, education, and jobs. Stablecoins can’t solve everything. But they’re helping people build better lives in ways traditional finance hasn’t.

The one billion people opportunity

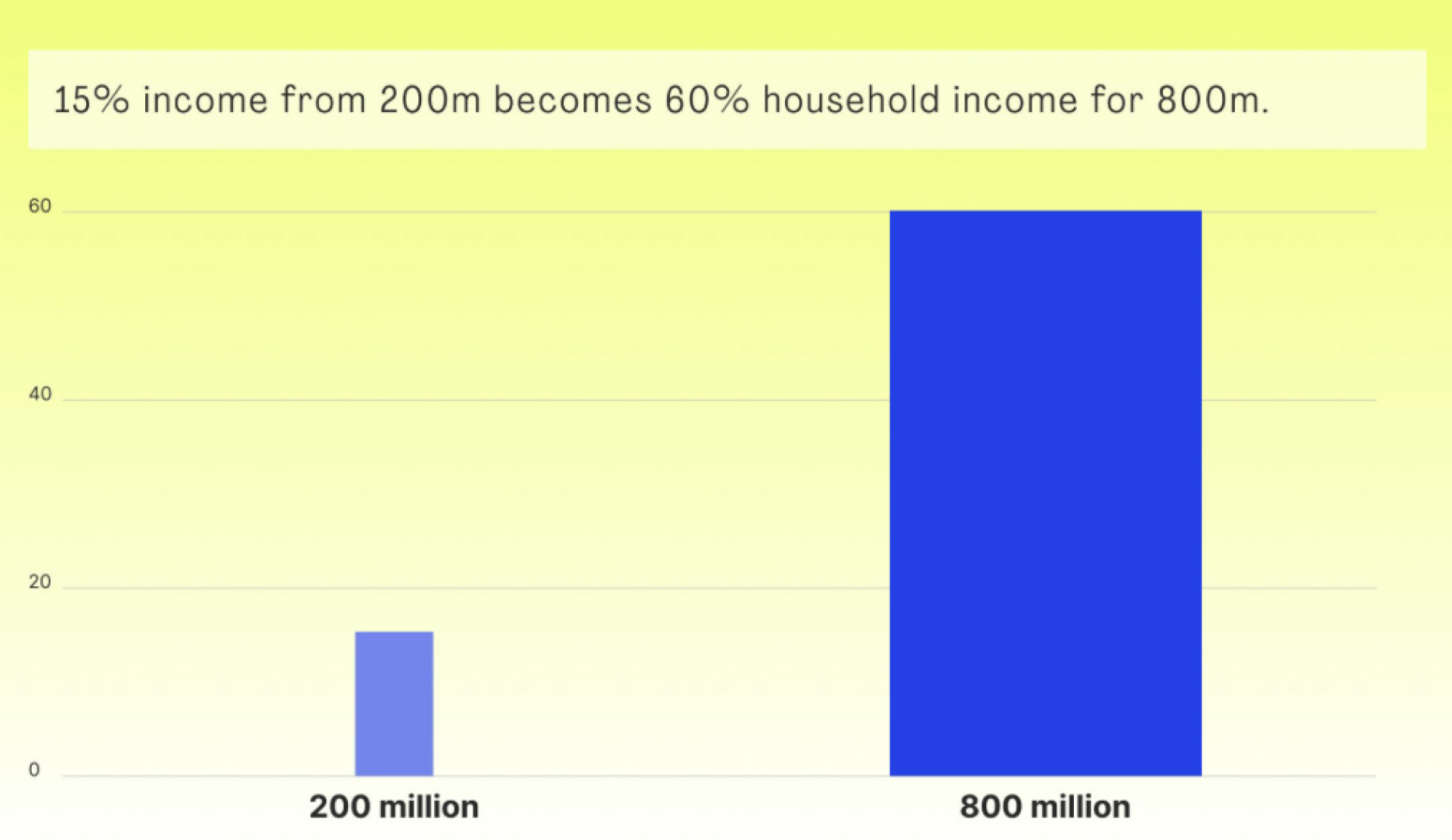

Migrant workers power the global economy. Two hundred million workers send money home to support 800 million family members. Together, they send 15% of their pay, which covers 60% of their families’ needs.

These transfers now top all foreign aid and investment combined. But traditional services take 6.7% from every dollar sent.

The money migrants send back home

Almost 2 million Overseas Filipino Workers push these SDGs forward. In 2023, they sent $38.9b home to their families – equal to 8.9% of the Philippines’ GDP.

Behind these numbers are real lives: education for children, healthcare for elderly parents, and small business capital that sustains entire communities.

But in East Asia and Pacific, money services take 5.9% from each transfer. That’s $2.3 billion in fees – money that could have bought school books, medicine, or helped start new businesses.

Put another way: by bypassing these fees with stablecoins Filipinos could raise their GDP by 0.53%.

How to scale financial inclusion with stablecoins

FinTech spotted this opportunity. GCash, the Philippines’ largest digital wallet, has added stablecoins to its app. Now 86 million users – 74% of all Filipinos – can send and spend digital dollars through their phones. This shows how real financial inclusion works.

The power lies in network effects. The internet connects billions. Apps like GCash already reach 86 million Filipinos. When they add stablecoins, they unlock this technology for millions of users with a single update.

No one wants to lose 6.7% on transfers – and now they don’t have to. A simple integration spreads financial freedom at internet speed. We can grow economies and advance SDGs faster than traditional government initiatives ever could.

It’s fair to say: serving humanity can be excellent business.

The big picture – stablecoins’ the true value proposition

The debate about stablecoins isn’t really about crime – it’s about the kind of world we want to build. Do we want to live in a society built on transparency, trust, and equality?

Then we need to decide which system reflects these values best. It’s a choice between opacity and transparency, between maintaining status quo and empowering billions.

Jamie Dimon is not afraid of criminal activity. He’s afraid of something else entirely: a future where financial power shifts from JPMorgan to individuals.

That’s not a use case, Jamie. That’s our evolution.

Curious what else blockchain can do? Find out how Bitcoin became a trap for trafficking, stablecoins push financial inclusion, and how to get started with stablecoins.

If you are ready for the deep dive, learn about the most lucrative business model onchain in our latest research report. (Yes, it’s about stablecoins)