Stablecoins are an integral part of the financial system. With a $200 bil.+ market cap, stablecoins are gaining market share by facilitating faster, cheaper, and simpler payments than legacy alternatives.

Sure, you may know what a stablecoin is, but how do the companies behind them earn revenue? More importantly, how can businesses implement stablecoins into their processes to earn yield and become more efficient?

By harnessing blockchain technology, stablecoins offer the benefits of a secure online protocol and a strong fiat currency like USD. Read on to discover how you can implement stablecoins into your business to confer a competitive advantage.

How do stablecoin projects earn revenue?

Before implementing stablecoins into your startup or business, you probably want to know how stablecoins maintain parity with USD or another fiat currency. To get you started with your due diligence, let’s briefly look at a few stablecoin projects.

Tether’s real-world asset tokens

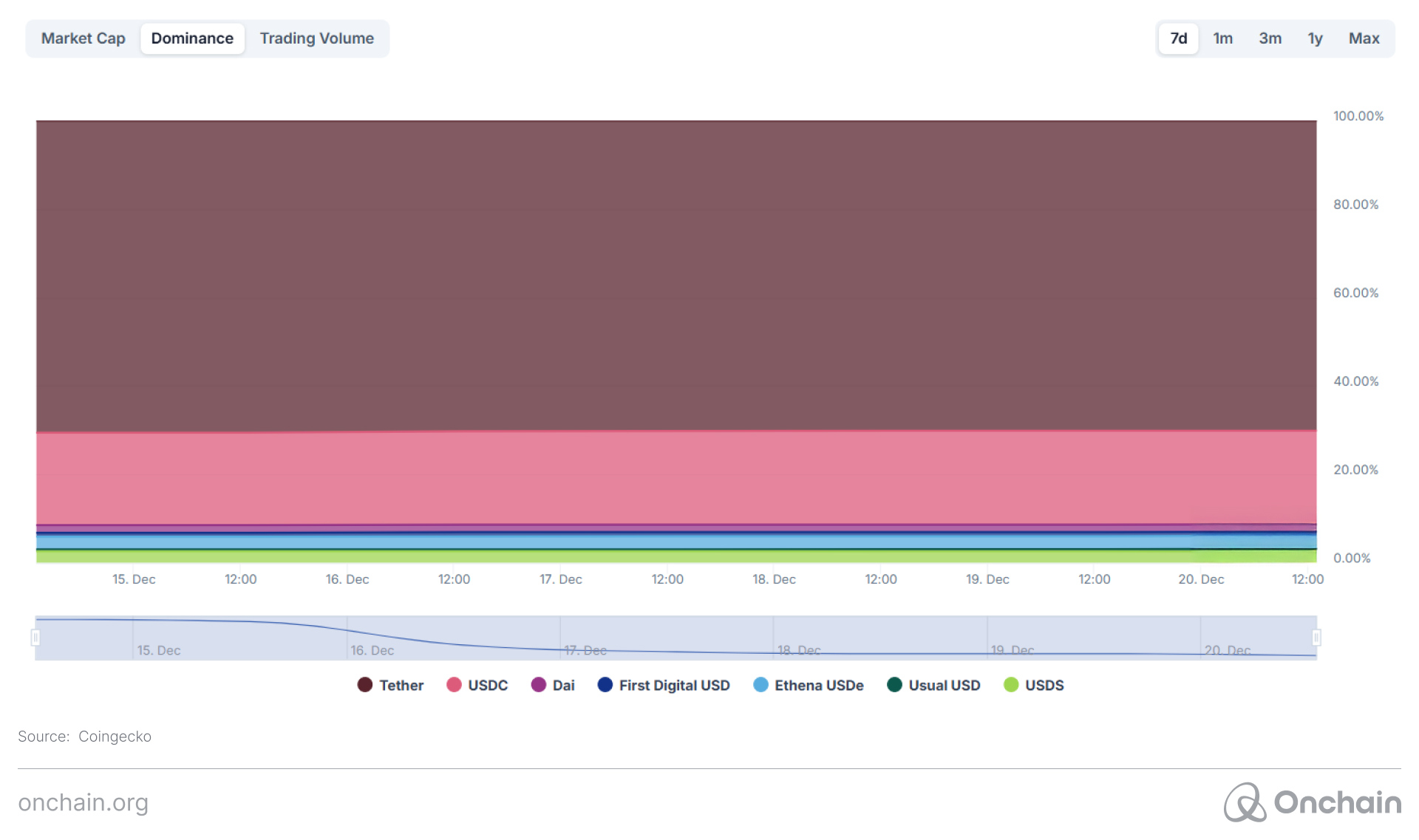

Large reserves can equate to large returns — even with low interest rates. Tether’s USD-pegged USDT alone accounts for around 70% of the total stablecoin market at an astounding ~$140 bil:

Tether drives revenue in two key ways. First, they charge minting and redemption fees when converting between USD and USDT. While these fees are quite reasonable at 0.1%–0.3%, at scale, they can really add up.💰

More importantly, Tether’s dominant market position allows it to earn interest on the reserves backing USDT. Most of the reserves are in the form of short-term U.S. Treasury bills and currently yield over 4%. The remainder are mostly cash equivalents (money market funds, commercial paper) used to meet redemption requests.

This earned Tether $7.7 bil. over the first 9 months of 2024 — putting it on course to earn over $10 bil. for 2024. They also have real-world asset (RWA) tokens backing gold and other fiat currencies.

USDS: The decentralized USD stablecoin

Centralized stablecoins are currently market dominant. Some users prefer decentralized stablecoins that embody – not eschew — crypto values like decentralization and permissionlessness. Released by Sky (formerly known as MakerDAO), USDS is collateralized by both crypto and RWAs — making it a partially decentralized currency in terms of its backing.

USDS is an upgraded version of DAI that can be converted on a 1:1 basis. Combined, these two stablecoins account for around ~4.3% of the entire market. Sky earns revenue from liquidation fees on un- and under-collateralized positions. It also charges a stability fee for USDS borrowers that is fed back into its USDS pool and redistributed to those holding USDS to earn yield.

Additionally, Sky earns yield from its RWAs and is expected to generate around $9 mil. on $200 mil. in collateral – not bad. As the USDS ecosystem and its associated RWA collateral grow, these revenues will scale in tandem.

PYUSD, USDB, and the other stablecoins

Let’s briefly cover some promising projects. PayPal’s PYUSD is a newcomer with potential. PYUSD generates revenue for PayPal through transaction fees, earned interest on collateral, and integrations with its pre-established PayPal ecosystem.

USDB is built on the Ethereum Layer 2 (L2) protocol Blast. It uses staked ETH (sETH) to generate revenue. It also sets itself apart in other ways, including its bank-free operation that resonates with the hardcore crypto natives who trust the blockchain — not a bank. 🏦

At the time of writing, USDT and Circle’s USDC account for over 90% of the stablecoin market. Add in USDS/DAI and USDe, and these stablecoins command a blockchain-busting ~98.5% of the entire market! This leaves only a 1.5% market share for the rest of the contenders.

Can entrepreneurs build out competing stablecoin alternatives?

Based on market analysis, fiat-pegged stablecoins for currencies beyond USD are ripe for growth. Building out a non-USD-pegged version would be an interesting business opportunity.

However, wise entrepreneurs must understand the user needs and market demand for such a stablecoin. Key questions that need to be answered include:

- Can an upstart project compete with the stablecoin behemoths in emerging markets?

- Is there a demand for a (insert name of fiat currency)-pegged stablecoin?

- Will the government associated with the currency allow it?

- Will the business model be sustainable?

Can you answer “Yes” to these key questions? If so, you have a startup idea with strong potential. And if you’re not personally funding your startup, you need to show prospective investors a realistic vision that results in a healthy return on investment (ROI).

The other key area that is ripe for business disruption is a fully decentralized stablecoin with adequate liquidity and market share. While DAI was originally fully backed by crypto, it later adjusted to a hybrid collateral model (crypto and RWAs).

For those in finance who want a fully decentralized stablecoin, the options seem lacking at the moment. Now may be the right time for someone to provide a solution. Are you up to the challenge?

Is a stablecoin treasury right for your business?

While Microstrategy uses Bitcoin (BTC) as its primary treasury reserve asset, many would say that this creates too much risk — particularly over a short time horizon. Treasury management is a critical function for any business. Your enterprise needs proper cash flow and liquidity — while optimizing returns in the process.

The suitability of incorporating a stablecoin treasury depends on your business model, its needs, and a host of other factors. For U.S.-based businesses, a stablecoin treasury may make less sense. With access to good old USD and a robust banking ecosystem, a stablecoin treasury may seem like a low priority.

That being said, the yields from stablecoins are often much higher than from traditional finance (TradFi). The returns and solid liquidity of stablecoin treasuries make sound financial sense for businesses with a lot of undeployed capital.

Outside the United States, a stablecoin treasury could be a complete game changer. In addition to maintaining value better than most fiat alternatives, USD stablecoins are commonly accepted as payment.

Beyond this, a stablecoin treasury can earn higher yields for your business than the returns you can get with your local bank and national currency. Many businesses in emerging markets can’t easily access USD. And if they can? The USD returns simply aren’t as high as those in the stablecoin ecosystem.

Stablecoins: Your business’ yield-generating savings account

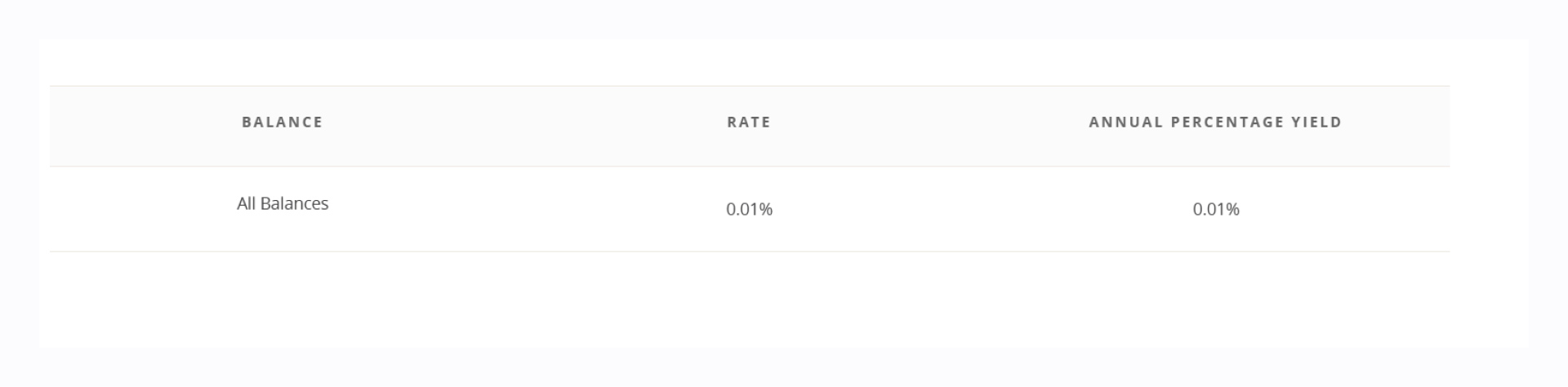

Like me, you were probably taught the importance of interest through savings bonds, savings accounts, and the like. While sometimes interest rates are quite good, they can be less than 1% annual percentage yield (APY).

Let’s compare stablecoin returns with the interest rates found in the TradFi system of banks, credit unions, and related financial institutions. Let me provide a personal example.

One of my bank accounts currently offers 0.01% APY:

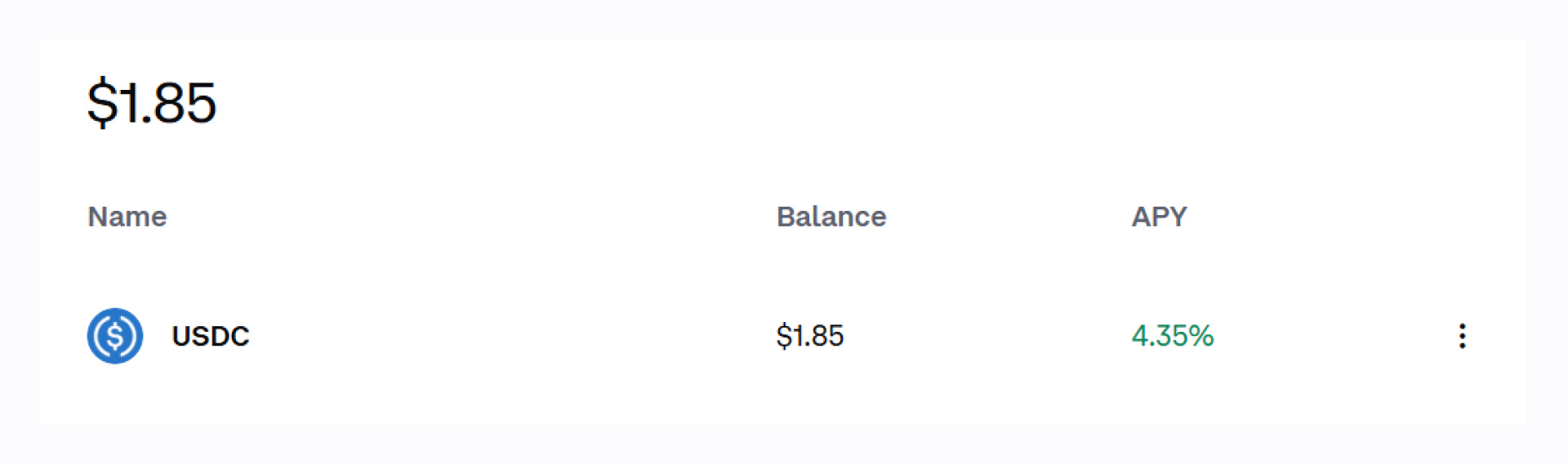

In contrast, I can get stablecoins yields in excess of 4% from Coinbase:

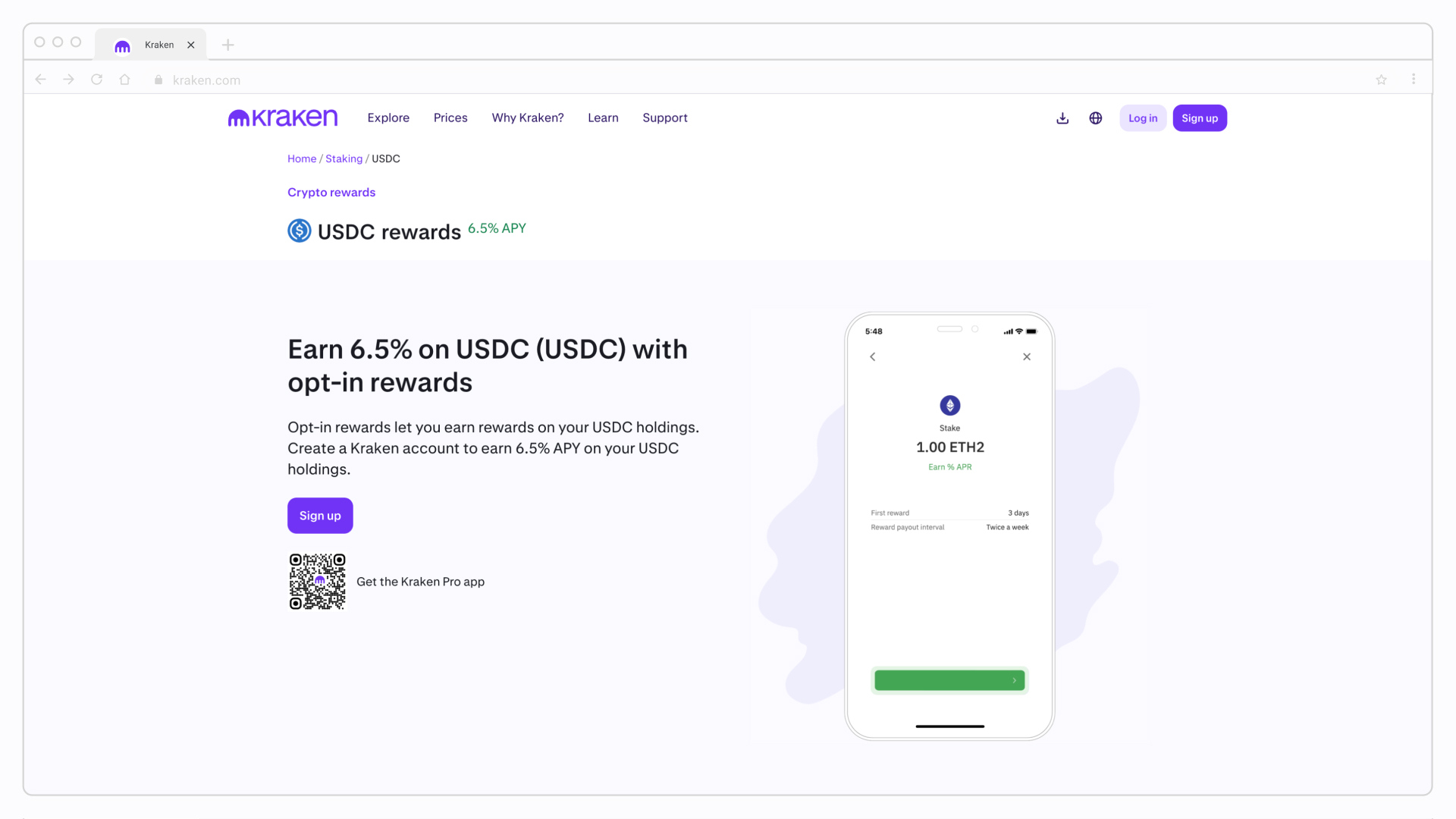

Kraken offers over 6% APY:

This delta in the interest rates should make a stablecoin treasury appealing to many businesses. Using the aforementioned rates, $100 mil. of USD in the bank would see a yearly return of $100,000. Kraken’s yield on $100 mil. in USDC would see a yearly yield of $6.5 mil. 🤯

And these are just the retail return rates. Businesses could likely receive preferential APY rates for large balances.

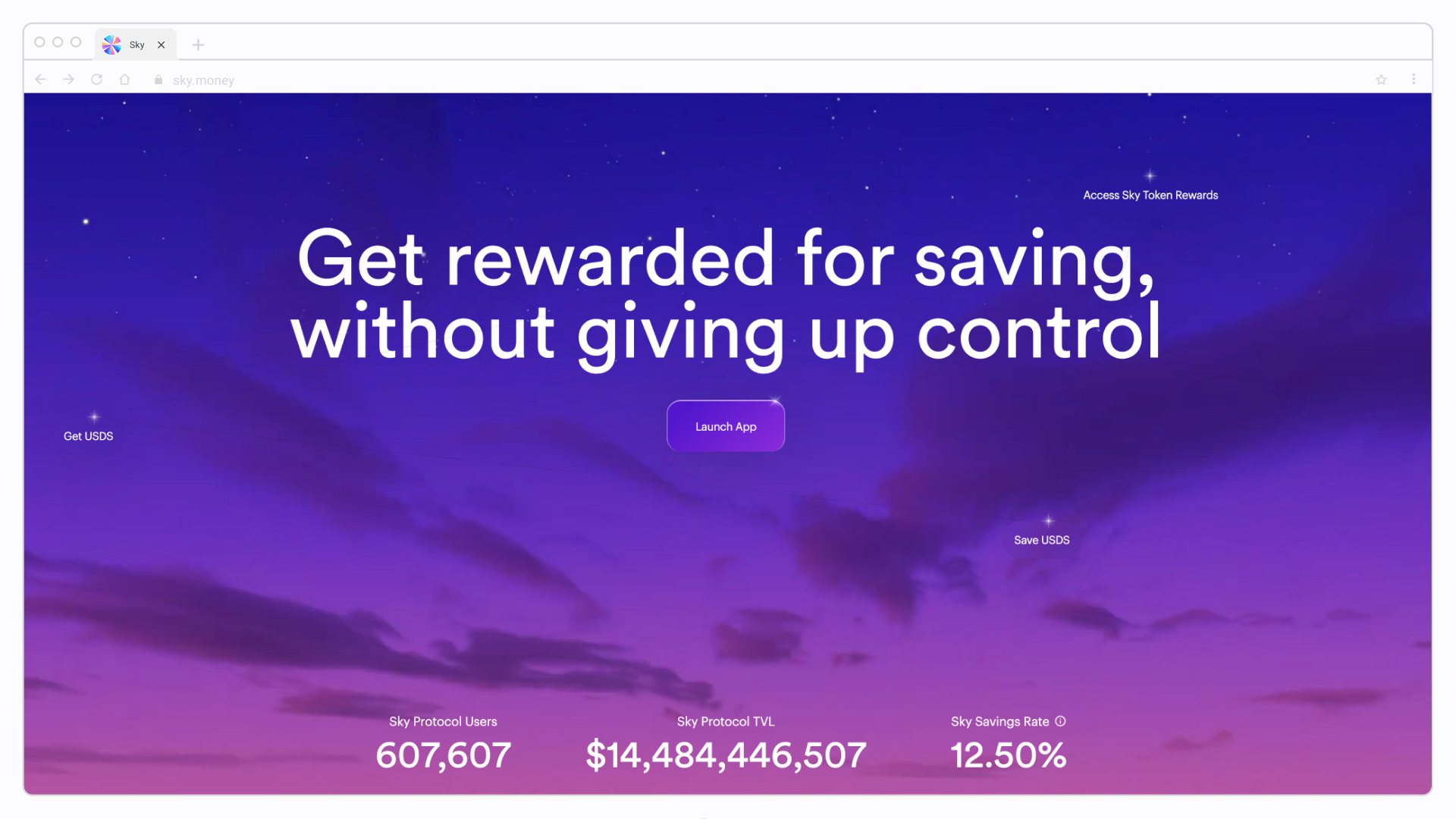

On USDS, the returns are even better:

The same $100 mil. in USDS would see a return of $12.5 mil. per annum. Decentralized saving options often offer better returns to account for the perception — warranted or not — of being more high-risk platforms.

They also pass on more of the interest to the end user. Centralized platforms need to pay salaries and expenses — and make a profit.

Stablecoin rates vary substantially and can be either fixed or variable depending on the platform and a number of other factors. One throughline is that they almost always offer much better APYs.

For those searching for even better returns than those found in interest-bearing accounts, you can deploy stablecoins throughout the decentralized finance (DeFi) ecosystem in a number of innovative ways.

Other yield-generation options for stablecoins

If those yields sound good to you, there’s no need to search for more esoteric options. However, some may want to deploy a portion of their stablecoin capital into other yield-bearing opportunities.

In addition, rates fluctuate based on market conditions. You may be content with 6%+ returns, but if the rate drops, it may be prudent to explore other options. Here are some worth considering:

DeFi lending protocols

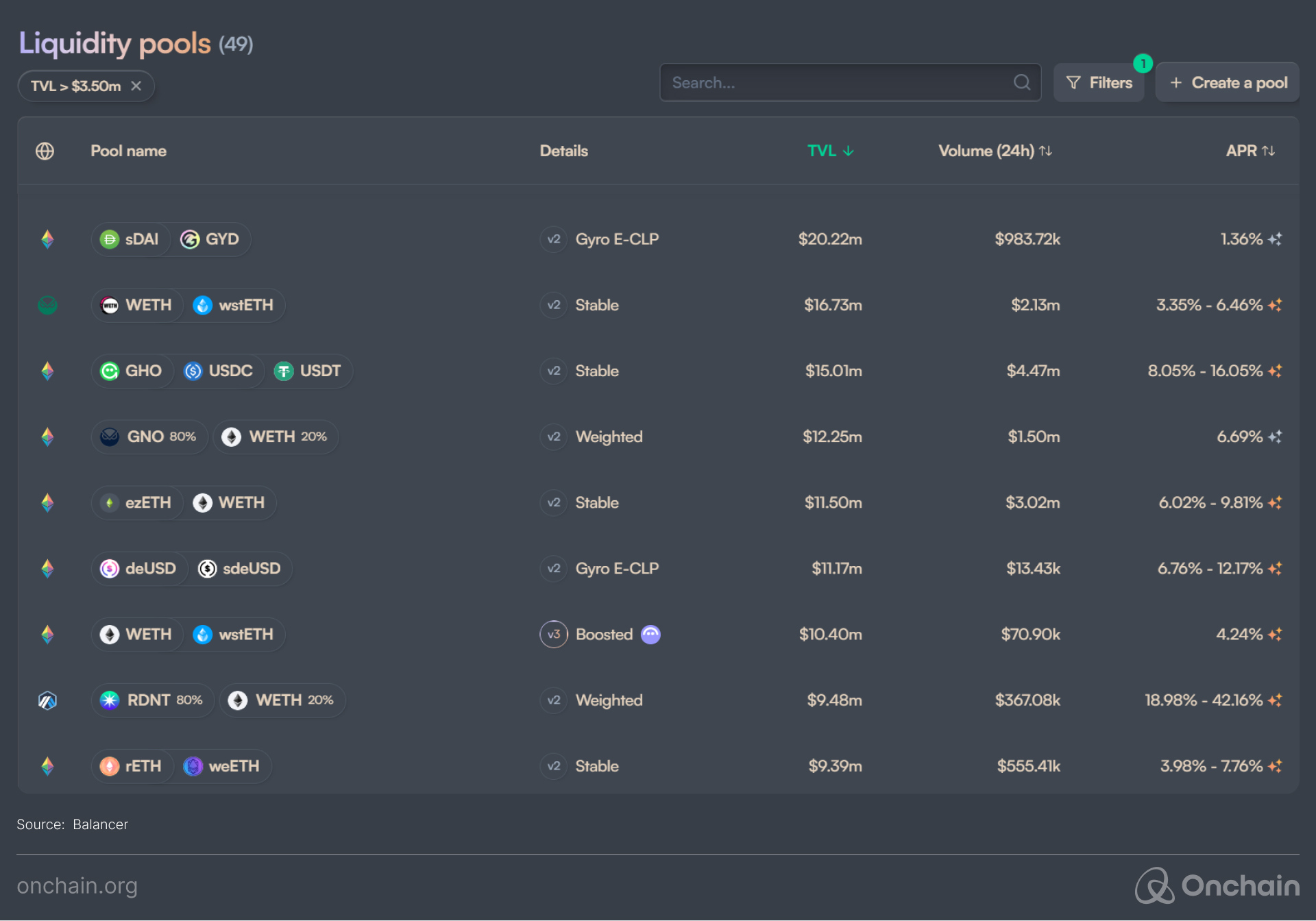

Lending protocols allow you to lend/borrow stablecoins — and other cryptos — and earn yield in return for doing so. These rates can fluctuate dramatically and vary by asset. That being said, during bull markets, you can often earn 10%+ yields. Options to consider include Aave, Balancer, Curve, Sky, and a host of other options.

Note the yields for stablecoins on Balancer:

Here are the rates for Aave:

Stablecoin lending to RWA protocols

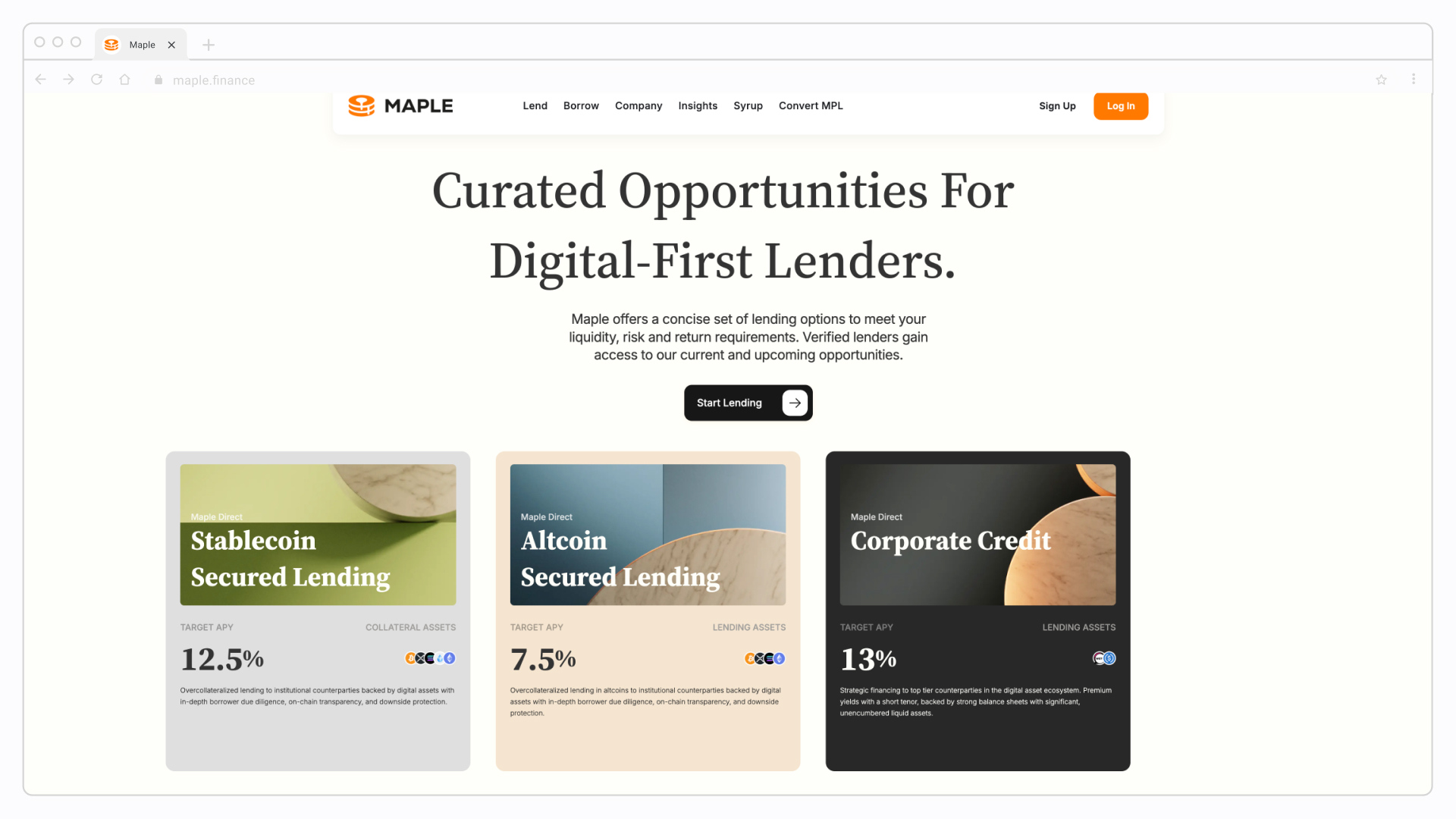

Platforms like MAPLE and Centrifuge let you lend stablecoins — and other tokenized RWAs — in order to earn yield. Maple offers secured lending options for stablecoin and altcoins — in addition to a corporate credit offering that targets a 13% APY. It features protections common in TradFi — including institutional counterparties, due diligence, and downside protection.

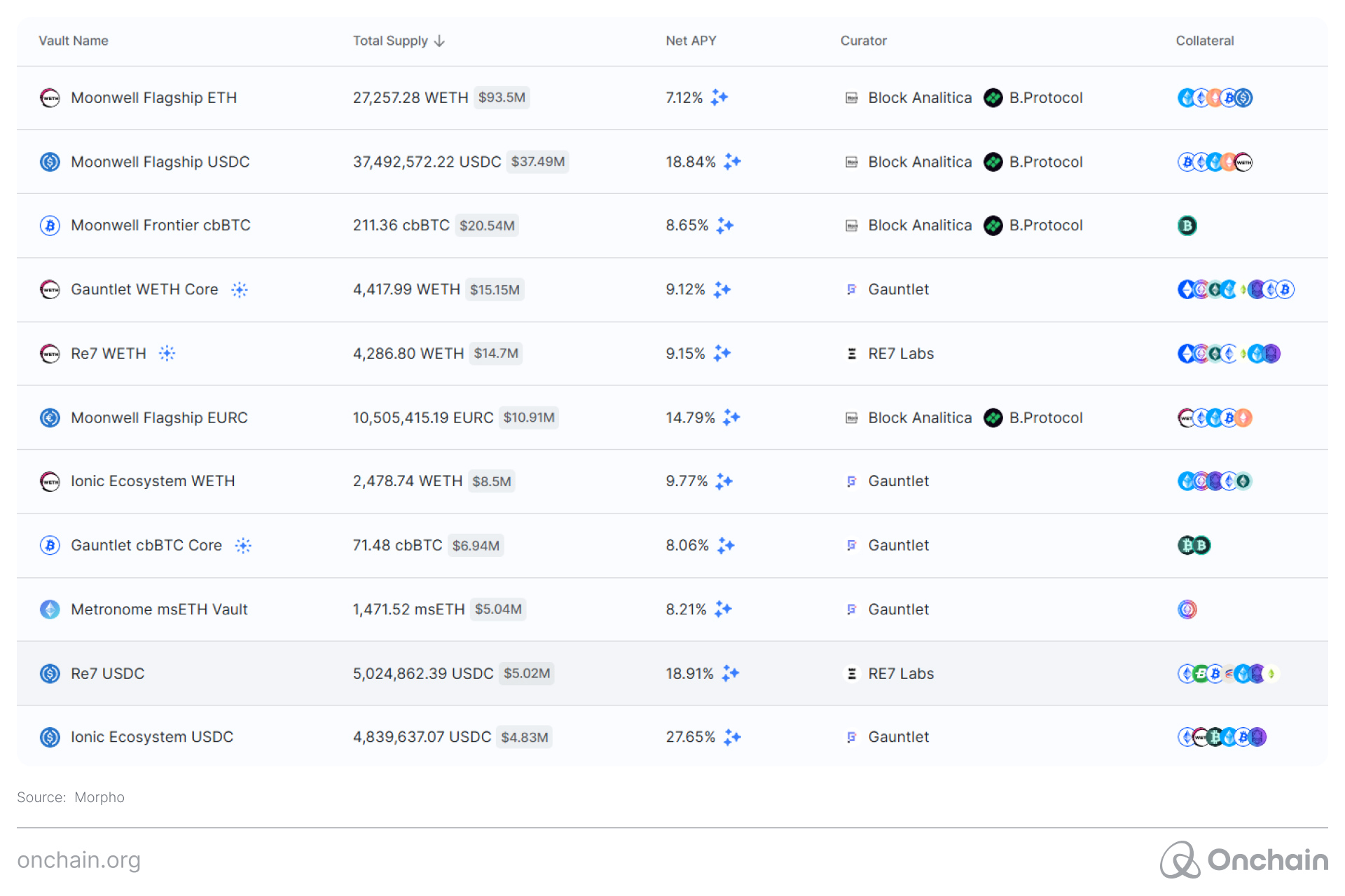

Centrifuge offers plenty of lending/borrowing markets with some APYs in excess of 20%. Users can access these markets on Morpho, an onchain marketplace that runs on the Ethereum L2 Base.

Yield-bearing stablecoins

We’ve covered how to deploy stablecoins to earn yield. Some stablecoin projects have abstracted away the yield process. Aptly named “yield-bearing stablecoins,” these assets automatically accrue yield as you hold them — no questions asked.

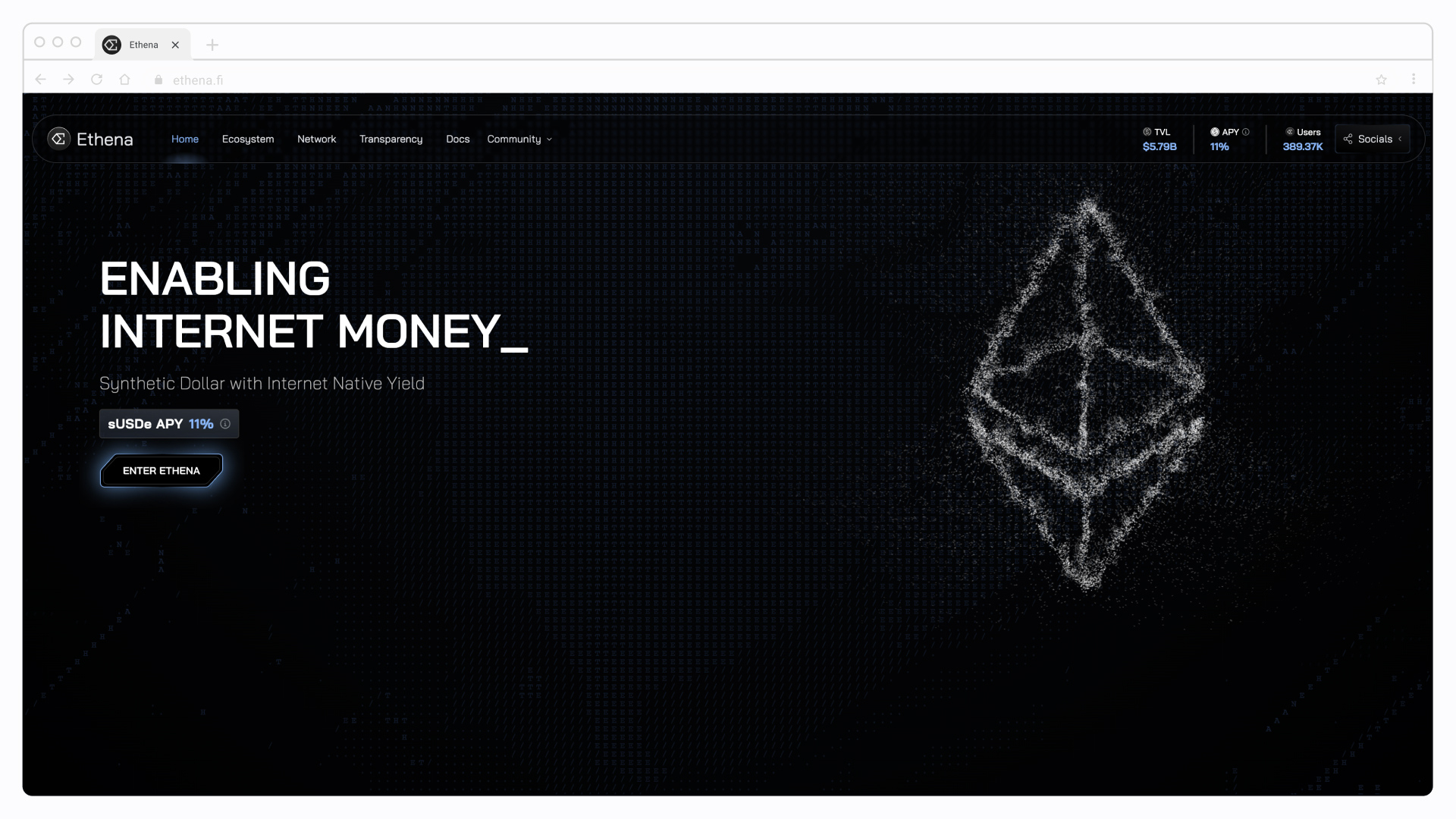

Ethena’s USDe (USDE) is one example and has risen to become the third largest by market cap. It currently offers an attractive yield of 12% APY.

Yield-bearing stablecoins may gain market share due to their built-in returns. They recently made worldwide headlines when President-elect Trump’s World Liberty Financial decided to incorporate Ethena’s stablecoin.

Stablecoin treasuries: Is there a catch?

Before we go, we should provide some balance. With all these benefits, you may be asking yourself: What’s the catch? Why isn’t everyone choosing stablecoins over USD? That’s a good question — and here are a few explanations.

- Transitioning to something new is always painful. Until enough financial pain is inflicted, some may have a “this is good enough” type of attitude.

- Many are wary of issues related to accounting, taxes, and regulations. This is improving as numerous countries are implementing clearer and more comprehensive financial regulations.

- There is some risk. Lending protocols can be susceptible to hacks and smart contract bugs. More importantly, some stablecoins have famously de-pegged and collapsed in value. These were primarily algorithmic stablecoins without reserves, which is one reason that fiat-backed stablecoins have gained widespread acceptance.

That’s what we’re going to unpack next. Payroll-specific implementation of stablecoins can be a game changer as long as you prepare some key factors. Progress in the Learning Track to find out more.