Stablecoins. Are they boring or mission critical? Where you are in the world may determine your outlook. While stablecoins aren’t going to pop off and make degens a bunch of money, they are a reliable currency that offer stability to personal and business finance (hence the name). And big financiers like Stripe are noticing, with a new partnership with Circle (USDC) rolling out.

If you haven’t explored their use for business, now is the time. They make a great option for entrepreneurs moving currency around the world. I, myself, used stablecoins for transactions with clients in currency-unstable regions. Stablecoin adoption in rising markets is going up, up, up. How might you jump on the train? Let’s have a look.

Global stablecoin adoption – a power waiting to disrupt

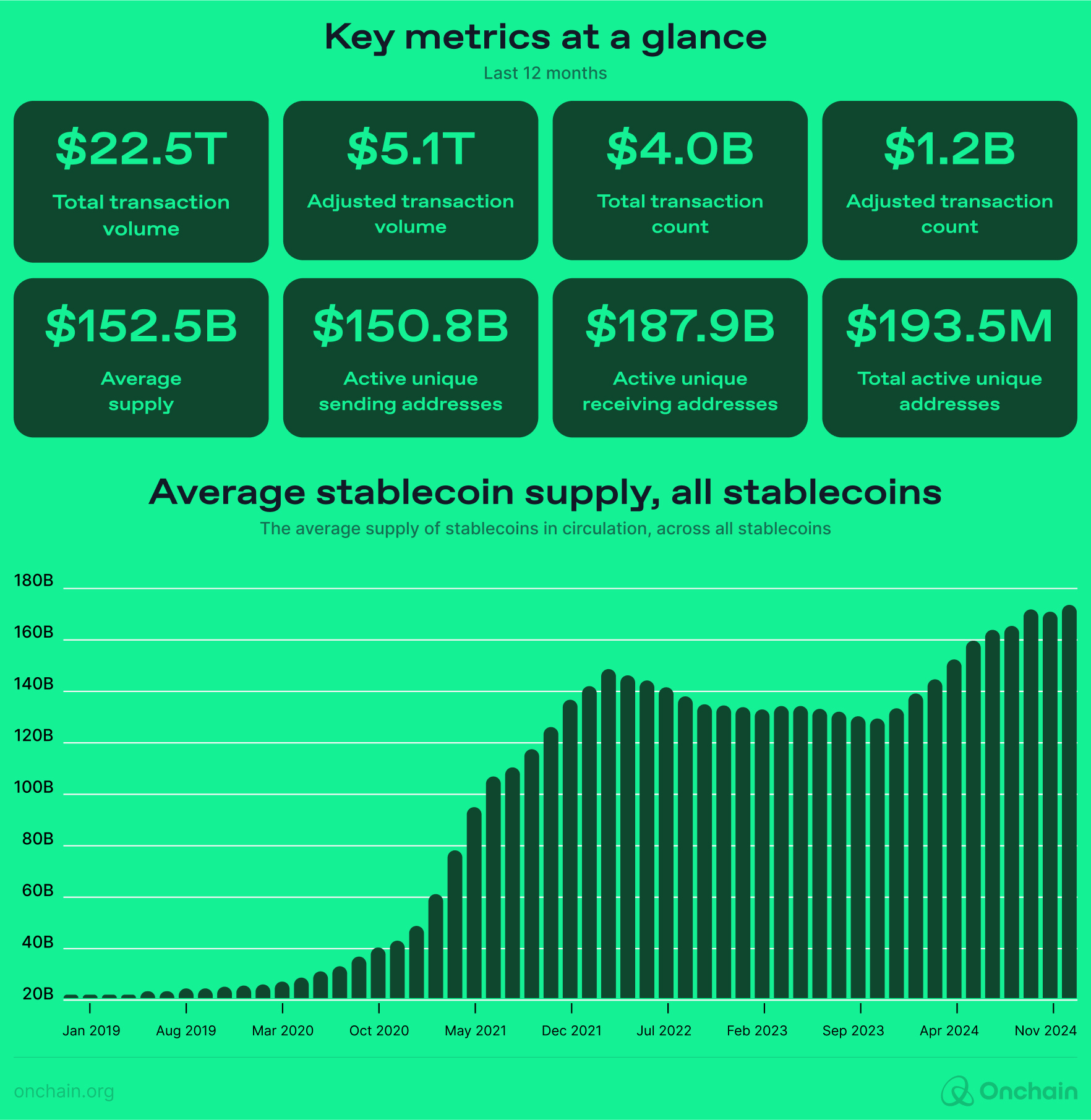

First, let’s take a look at global stablecoin adoption. At the time of writing this article, the global stablecoin market cap is $188 billion. Stablecoins are being leveraged by entrepreneurs and individuals alike, with the forerunner tokens being USDT and USDC. Here’s where they thrive:

- Cross-border payments: Banks like to take a cut. Stablecoins can move wallet to wallet with only gas fees in their way. Transactions are often faster and are more transparent.

- Hedging Volatility: Those who love crypto but don’t love riding the market (yes, we do exist) find stablecoins a solid alternative against volatility. This is especially true for entrepreneurs who must ensure their payments (or remittances) at a guaranteed rate.

- Building savings: A diversified portfolio is a top recommendation by financial advisors. One can invest in gold or a particular currency via stablecoins and have the peace of mind that their savings won’t tank with the next crypto press release.

- On/off ramps: Stablecoins provide an easy on- or off-ramp between crypto and FIAT currency because they mirror FIAT rates. As a result, you can store your crypto in stablecoins and convert to other tokens or back to FIAT with fewer surprises.

Now that you have a sense of their strengths, let’s have a look into why stablecoin adoption in emerging markets in particular is so hot.

Stablecoin adoption in Africa in the numbers

Stablecoins are ‘nice’ for many entrepreneurs. However, stablecoin adoption in rising markets has become a critical component of infrastructure. Stablecoin adoption in Africa has surged in recent years, drawing attention toward their business use cases. Several factors drive this adoption. Let’s have a look.

Adoption Rates and Trends

- Sub-Saharan Africa: As of October 2024, stablecoin transactions account for 43% of total volume in the region. This is largely due to currency devaluation, which is a major driver for stablecoin adoption in Africa.

- Nigeria and Ethiopia: Both countries have seen a surge in stablecoin usage. From July 2023 to July 2024, Nigeria saw nearly $59 billion in crypto transactions. Ethiopia, too, saw a 180% increase in crypto usage over the previous year.

- South Africa: Late 2023 saw a 50% month-over-month increase in stablecoin use in the country, likely due to inflation.

Adoption Drivers

- Currency Devaluation: Stablecoins provide strong purchasing power in regions experiencing currency devaluation. In recent years, devaluation has hit Nigeria and South Africa alike.

- Foreign Exchange Shortages: Approximately 70% of African countries are facing foreign exchange shortages. Stablecoins provide oxygen to businesses that need currency to thrive.

- Financial Inclusion: A considerable amount of people are unbanked, whether due to access, restrictions, or other hurdles. Stablecoins provide individuals access to financial markets where banks have failed.

- Remittances: Sending remittances via stablecoin can reduce fees by up to 60% when compared to FIAT options. That would motivate anyone to make the transition to stablecoins!

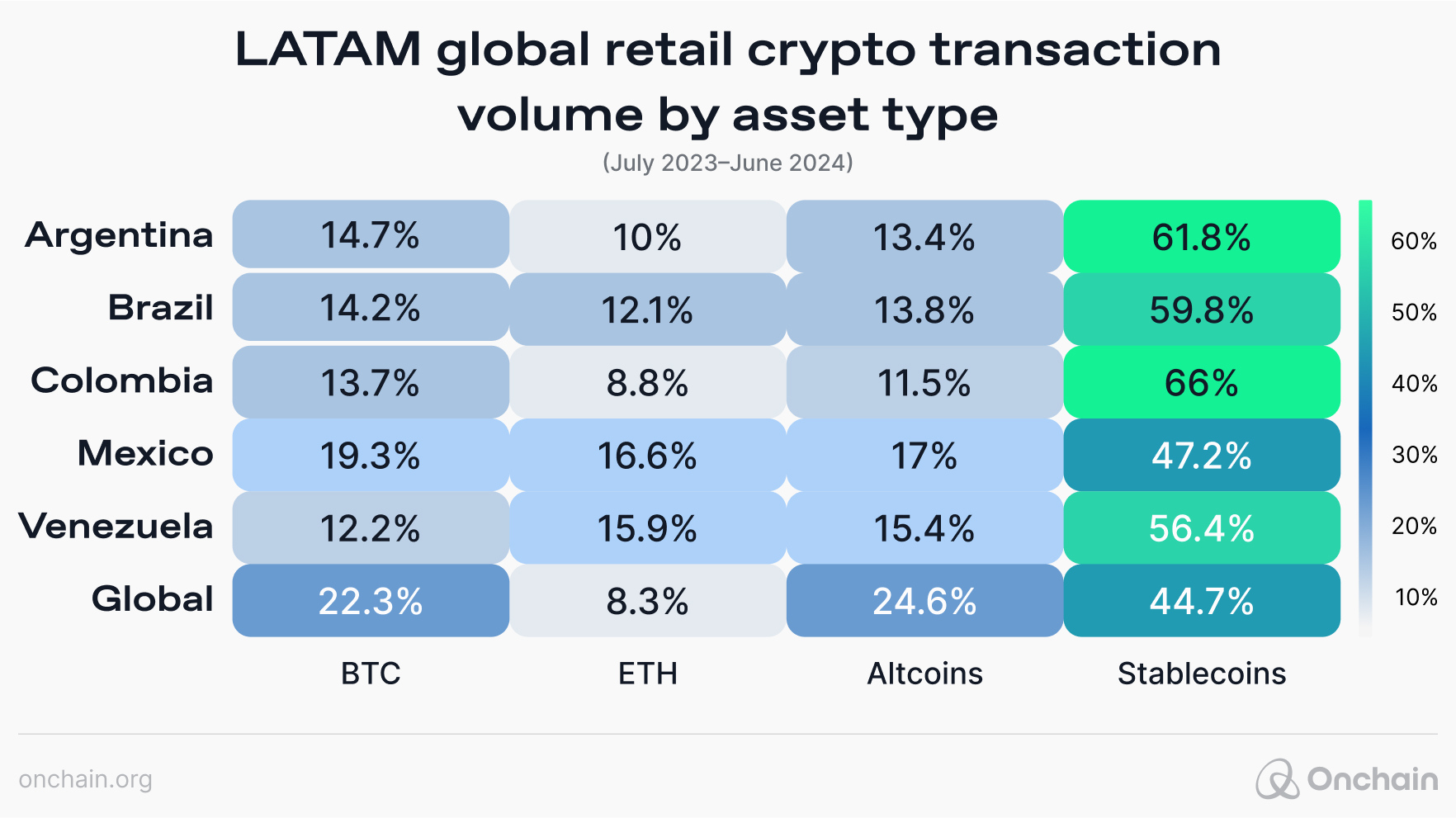

The surge of stablecoins in LatAm (Latin America)

African countries aren’t the only ones taking advantage of stablecoins. Stablecoins in LatAm have seen a significant increase in recent years, experiencing a 42.5% YoY increase, primarily on centralized exchanges.

Adoption Rates and Trends

- LatAm Stablecoin Growth: Between June 2024 and June 2024, stablecoins in LatAm saw nearly $415 billion in crypto transactions, making up approximately 9.1% of global crypto activity.

- Argentina and Brazil: Argentina tops the leaderboard for LatAm countries using stablecoins at $91.1 billion received. Brazil follows closely behind at an estimated $90.3 billion coins received.

Adoption Drivers

- Economic Instability: Similar to the leaderboard countries in Africa, stablecoins in LatAm countries are seeing high adoption rates where inflation is equally high. In Argentina, for example, stablecoins have overtaken Bitcoin, accounting for 60% of transactions.

- Remittances: Equally, cross-border remittances using stablecoins are highly attractive where FIAT transfers incur an average 5.8% transaction fee. Stablecoin transfers are more transparent, faster, and have a higher cost savings than with FIAT currency in LatAm countries.

- Financial Inclusion: The stats vary, but some Latin American countries have unbanked populations of nearly 40%. Where traditional banking may be out of reach, crypto and stablecoins fill the gap. This is especially critical for emerging businesses in the region that need access to cash.

Stablecoin adoption is not without growing pains

Seems like stablecoins are the superhero of our era, right? Unfortunately, stablecoin adoption in rising markets faces some challenges. Let’s have a look at the speed bumps so you know how to navigate them.

- Regulatory Uncertainty: It’s probably no surprise that stablecoins are part of the larger regulatory mire involving crypto. On July 23 of this year, the Financial Stability Board (FSB) released a report highlighting concerns about market integrity and the security of the coins. This makes stablecoin legislation across jurisdictions important to watch.

- Technological Access: Crypto cannot exist without the internet. Approximately 43% of the African continent had access to the internet in 2021 (that number is now likely higher), below the global average of 66%. This underscores the financial disparity between those with access to tech and those without.

- Financial Literacy: Understanding of how money works is critical knowledge for any population. With the additional complexity of crypto, people may not engage with stablecoins due to lack of awareness. Those that do may be at greater risk.

- Price Volatility: The price of stablecoins themselves, and their relationship to an individual’s local FIAT value, can add risk to those using the stablecoins to manage that very volatility.

Stablecoin adoption in emerging markets are an entrepreneur’s kick at the can

Global stablecoin adoption is surging. Opportunities for entrepreneurs in emerging markets abound. So what are the use cases for stablecoins? Let’s see how you can get involved.

- Cross-border transactions: As we’ve already covered, stablecoins make transactions abroad easy, fast, and secure. Entrepreneurs can add stablecoin payments to their ecommerce offerings, payout for freelancers, and more. For example, this has helped me expand my reach to clients whose FIAT exchange rate would have excluded them from working with me.

- Financial inclusion solutions: Entrepreneurs who wish to enter emerging markets could develop stablecoin SAAS solutions to expand current utility in these regions. Platforms like Stellar, Lisk, and Celo are already exploring such offerings.

- Stablecoin lending platforms: Further expanding access, microgrants using stablecoins can help jumpstart businesses in emerging markets while avoiding local FIAT volatility.

- Real World Asset Tokenization: Stablecoins can offer fractionalized access to RWA investments in emerging markets. This further expands the financial freedom of those who do not have access to traditional investment or banking options. Our DePIN report will take you further into real-world stablecoin opportunities.

- Private Credit Tokenization: Entrepreneurs can explore the opportunities in private credit tokenization, which allows for more inclusive lending and investment options in emerging markets, providing greater access to capital for both borrowers and investors.

The asset class that opens up new frontier markets

As fellow entrepreneurs, we think the future looks bright for stablecoins. We’re especially excited to see stablecoin adoption in rising markets as a hack for existing restrictive and unfavorable systems. That’s why The Onchain Foundation’s project Lisk is focused solely on emerging markets. Do you see the opportunity? How might you leverage stablecoins to expand your global offerings and enter new markets?

To help you with that, we’ve just published our own stablecoin research findings in a new report. We wanted to know if they indeed open remarkable conditions to enable business onchain. And if yes, what makes them so potent, and how can you get involved?

What we found is this: Coming onchain is reasonably easy with stablecoins, and the opportunities are worth it. So check out what Stabecoins hold for you and how to make them work for you. Read the onchain research report Stablecoins: The Most Lucrative Business Onchain.