In the world of cryptocurrencies, where prices can swing wildly in minutes, stablecoins offer a haven of stability. They are a type of digital currency designed to maintain a stable value by pegging them to a more stable asset, such as the US dollar or gold. This makes them ideal for everyday transactions, as they avoid the volatility that can make other cryptocurrencies like Bitcoin less practical for buying goods and services.

Think of them as the digital equivalent of traditional currencies. They offer the benefits of cryptocurrencies (like fast and borderless transactions) without the price fluctuations that can make other cryptocurrencies risky for everyday use.

While stablecoins offer clear benefits for individuals, their potential impact on institutional finance is even more significant.

The rise of stablecoins: A game-changer for institutions

For organizations ranging from traditional banks to agile fintech startups, stablecoins are rapidly changing how they manage finances, conduct business, and interact with the digital economy:

- Stablecoins as a reserve asset: Holding stablecoins allows institutions to diversify their portfolios and potentially gain exposure to higher yields than traditional cash equivalents. Imagine a company holding a portion of its reserves in a stablecoin that offers a 5% interest rate, compared to a near-zero rate in a traditional bank account.

- Efficient liquidity management: Stablecoins enable quick and low-cost transfers, making it easier to manage liquidity across different accounts and jurisdictions. This is particularly useful for multinational corporations that need to move funds quickly between subsidiaries.

“As a company or a DAO, you need stablecoins for your treasury because you can’t hold all your assets in volatile cryptocurrencies.” —Cyrille Briere, Contributor at fxProtocol

- Access to digital asset markets: Stablecoins provide a gateway for institutions to participate in cryptocurrency trading and investment. A hedge fund, for example, might use stablecoins to invest in various cryptocurrencies.

- DeFi participation: Institutions can use stablecoins to access decentralized finance (DeFi) protocols, unlocking opportunities for lending, borrowing, and yield farming. This allows them to explore new investment strategies and potentially earn higher returns.

Aave, a leading DeFi protocol, allows users/institutions to deposit stablecoins like USDC or DAI to earn interest or use them as collateral for borrowing other cryptocurrencies.

- Payroll management: Institutions can use stablecoins for efficient and cost-effective payroll processing, especially for remote or international employees.

Companies like Request Finance have facilitated crypto payroll solutions using stablecoins. For example, they’ve processed nearly $300 million in total crypto payments, with 60% of these payments made in dollar-denominated stablecoins.

- Cross-border payments/remittance: Stablecoins facilitate faster and cheaper cross-border payments, reducing reliance on traditional correspondent banking networks. This is a major advantage for businesses with international suppliers or customers

In countries like Nigeria, stablecoins have become a popular option for remittances. For example, many Nigerians working abroad use USDT to send money back home, bypassing traditional remittance services.

Stablecoins in action: Real-world examples

Several prominent institutions have already embraced stablecoins, making them important from a business case perspective:

1. PayPal’s PYUSD: Recently launched, PYUSD aims to simplify cross-border payments for businesses and reduce transaction fees. It’s designed for easy integration into PayPal’s ecosystem, making it a trusted option for businesses engaging in global transactions.

On September 23, 2024, PayPal used PYUSD to pay Ernst & Young LLP via an SAP SE platform, demonstrating its potential for B2B payments and ERP integration.

This move by PayPal aligns with a growing trend observed in a survey recently conducted by the Onchain Research Team as part of our study for Stablecoins. While businesses in advanced economies and emerging economies have been cautious about adopting stablecoins, our survey highlights that 90% of vendors globally are ready to accept them:

- In advanced economies, 67% of vendors reported some degree of readiness to accept stablecoins.

- In emerging economies (as defined by the IMF), this readiness rises to 92%, showing strong support for stablecoin adoption.

Note that the participants of the survey already had some previous Web3 knowledge and are active cryptocurrency users, often with full-time jobs or entrepreneurial backgrounds, offering diverse perspectives.

This indicates that businesses hesitant to adopt stablecoins are operating within an ecosystem already primed for stablecoin-based transactions.

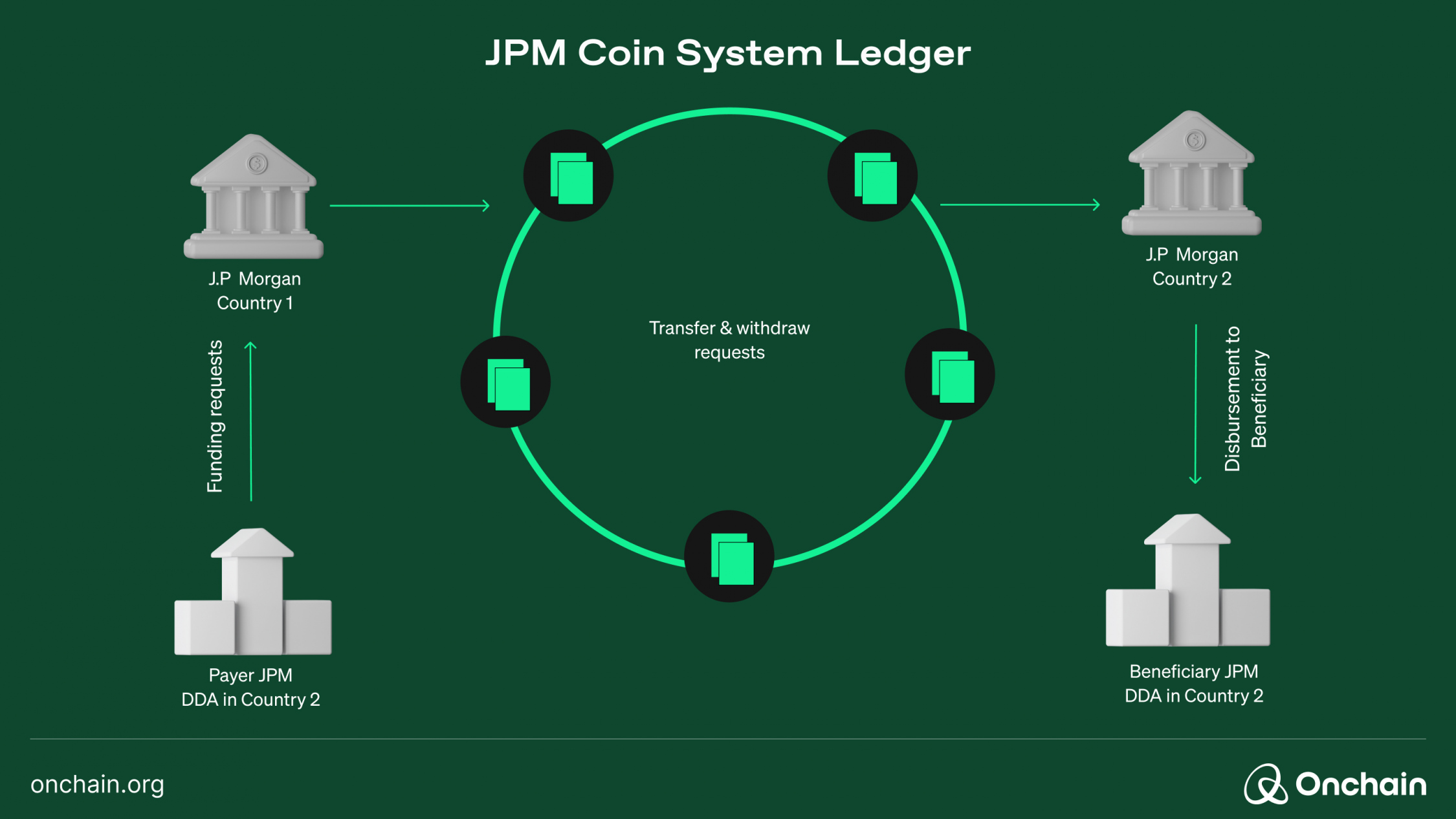

2. JP Morgan’s JPM Coin: Large institutions use JPM Coin for secure, real-time settlements. Its strong presence in institutional finance makes it a key player for businesses seeking a reliable solution for cross-border payments, especially in the B2B space.

Imagine a large company needs to move money between different countries. JPM Coin allows them to do this instantly, 24/7, regardless of time zones or bank holidays. This significantly speeds up operations and improves cash flow.

JPM Coin isn’t just about speed; it’s also about smart transactions. Think of it like setting rules for your payments. For example, a payment can be automatically triggered when certain conditions are met, like a shipment arriving or a contract being signed. This automation saves time and reduces errors.

And these advantages are not just theoretical.This technology is already being used by major companies like Siemens and Ant International, proving its real-world value and scalability.

The future of stablecoins in business

Stablecoins are not merely a passing trend; they represent a fundamental shift in how institutions manage their finances, conduct business, and interact with the digital economy. With major players like PayPal backing stablecoins, we may be witnessing the early stages of a significant transformation in how money moves around the world.

Are they ushering in a new era of business transactions? The answer is increasingly clear: Yes, and the transformation is just beginning. To get ready, move forward in the Track to learn about stablecoin revenue models.