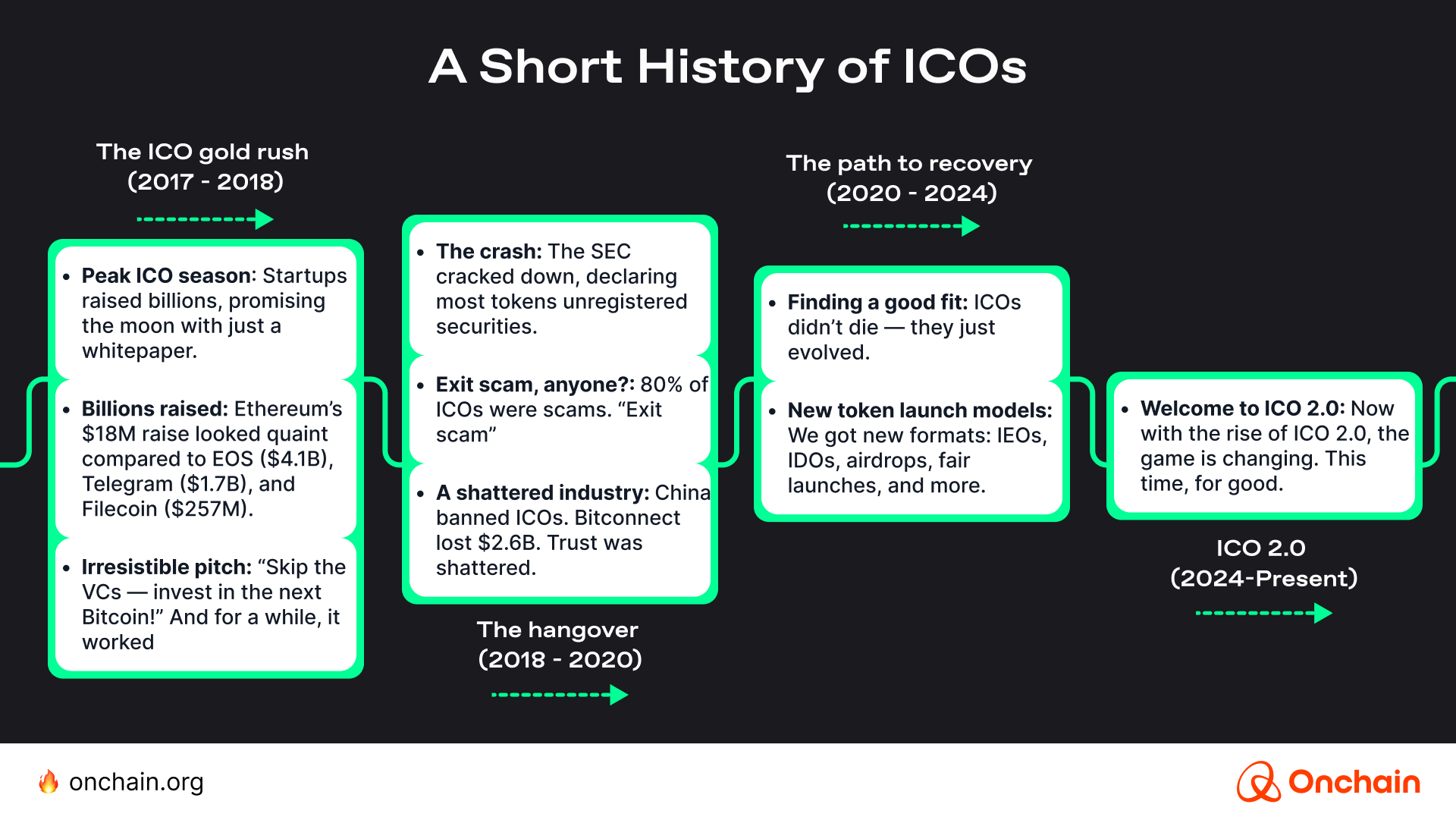

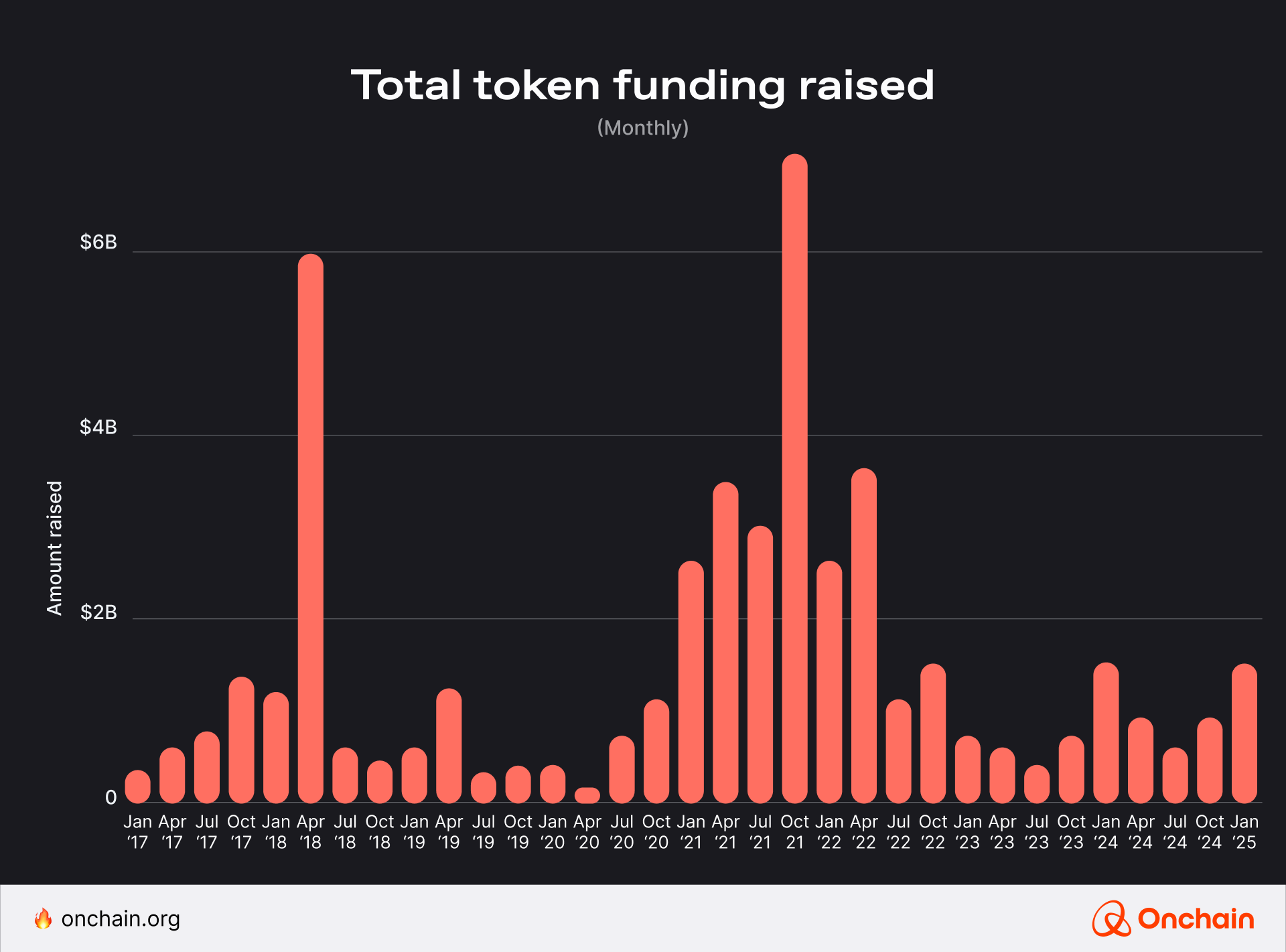

Crypto’s first fundraising boom was electric. Billions raised overnight, tokens flying, and dreams of decentralization on every roadmap.

But when the dust settled, what remained were broken promises, SEC subpoenas, and a sobering lesson: the system was rigged from the start.

Now, a new wave is rising, trading hype for merit and speculation for substance. Welcome to “ICO 2.0”.

Before we jump into that, let’s look into how crypto fundraising has evolved till today.

If you’d like a reminder on how ICOs, IEOs, IDOs work and differ, read this article.

The new era of crypto fundraising

ICOs used to be the industry standard for launching tokens to raise funds. But the crypto fundraising landscape is shifting … again.

The concept of “ICO 2.0” has now emerged., where dDecentralized platforms like Legion and Echo are giving token launches a much-needed upgrade, ensuring onchain transparency, democratic investment approaches, and novel fundraising mechanisms. They offer:

✅ Fair play for all – No VC monopolies, just fair access for all.

✅ Skin in the game – Investors become users, not just bagholders.

✅ 100% onchain execution – Smart contracts ensuring transparency, verifiability, and capital control.

✅ Regulation-ready innovation – Progressive models that work within frameworks.

For the longest time, traditional crypto fundraising has followed a top-down model. where aA small group controls access, terms, and therefore profits. VC coins face backlash for concentrating token supply with insiders, leaving retail investors as exit liquidity. 👎

In reaction, communities now demand fairer distribution models to prevent dumping and align incentives. The result: the rise of next-generation ICO platforms (hence, 2.0).

For Web3 founders and builders, these decentralized platforms provide a better alternative to launch tokens. They’re specifically designed to solve the core persistent problems of traditional launches: VC gatekeeping, misaligned incentives, and short-term hype that leaves real users behind. 🚀

How do they stack up against the old guard? Just look at how they compare to traditional models.

Intrigued? Let’s take a closer look at some of these platforms.

Echo: A community-first token launchpad

Echo gives Web3 founders the best of both worlds — the strategic capital of VCs and the grassroots power of the crypto community — without compromising fairness or control.

Built to fix the broken dynamics of traditional fundraising, Echo ensures that everyone, from top-tier investors to individual supporters, participates on equal terms.

No special access. No backchannel negotiations. Just pure, onchain equality.

For your project, that translates into fairer access and aligned incentives: By letting VCs and retail invest side by side, Echo ensures launches that are not only well-funded, but community-backed, fair, and built for long-term success.

How it works

Echo basically operates like a decentralized syndicate (think AngelList). Through its unique Group Lead system, experienced lead investors vetted by the platform open their deals to the public. , allowing aAnyone canto pool capital under identical conditions.

These aren’t second-tier opportunities; they’re the same early-stage rounds that would typically require a seven-figure check and a warm intro, now accessible to anyone. It works through:

- Lead investors (funds, angels, DAOs, etc.) create onchain investment groups.

- Individual members join with as little as a few hundred dollars.

- Smart contracts enforce term transparency — no hidden discounts, no preferential treatment.

Platform

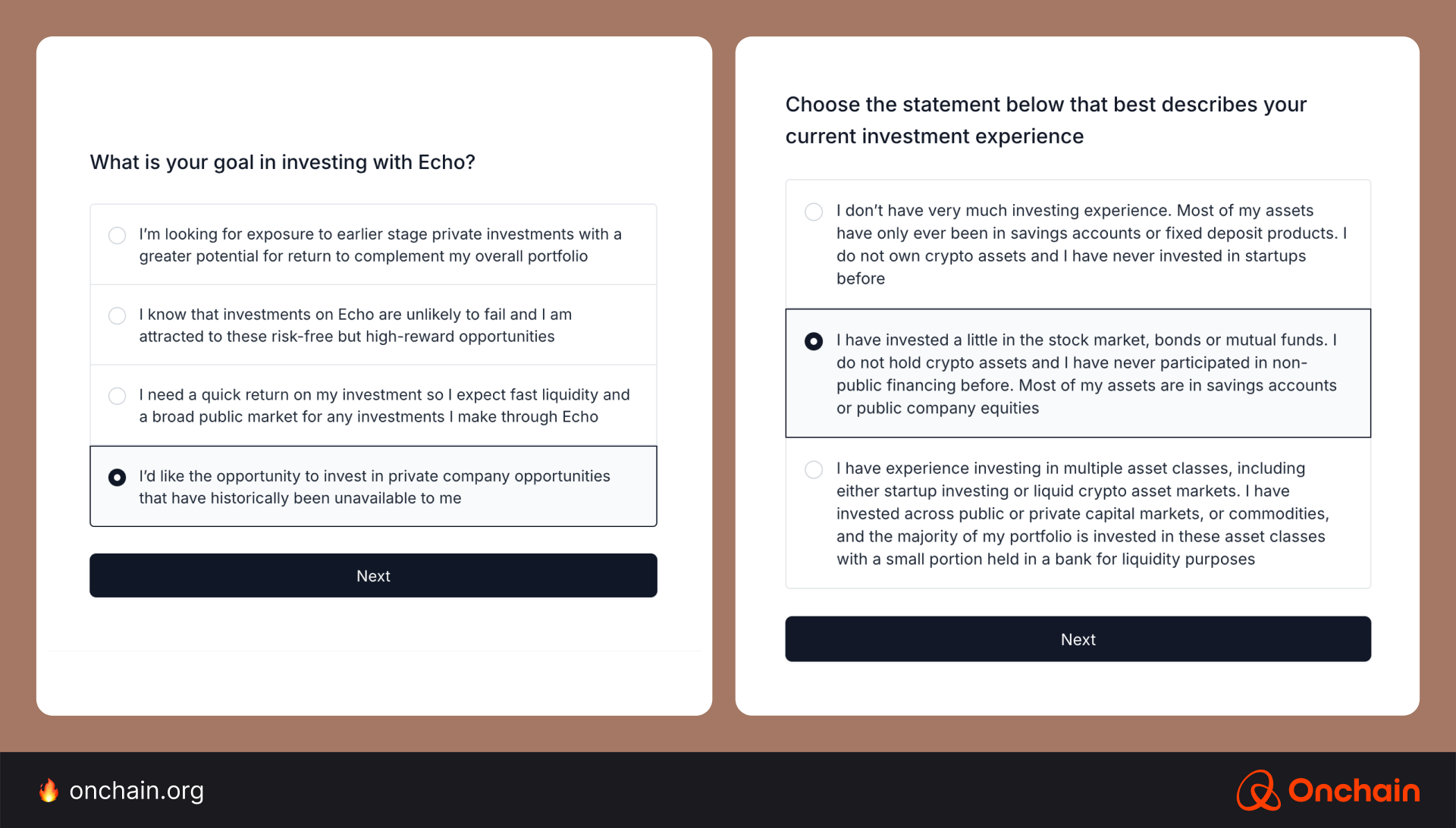

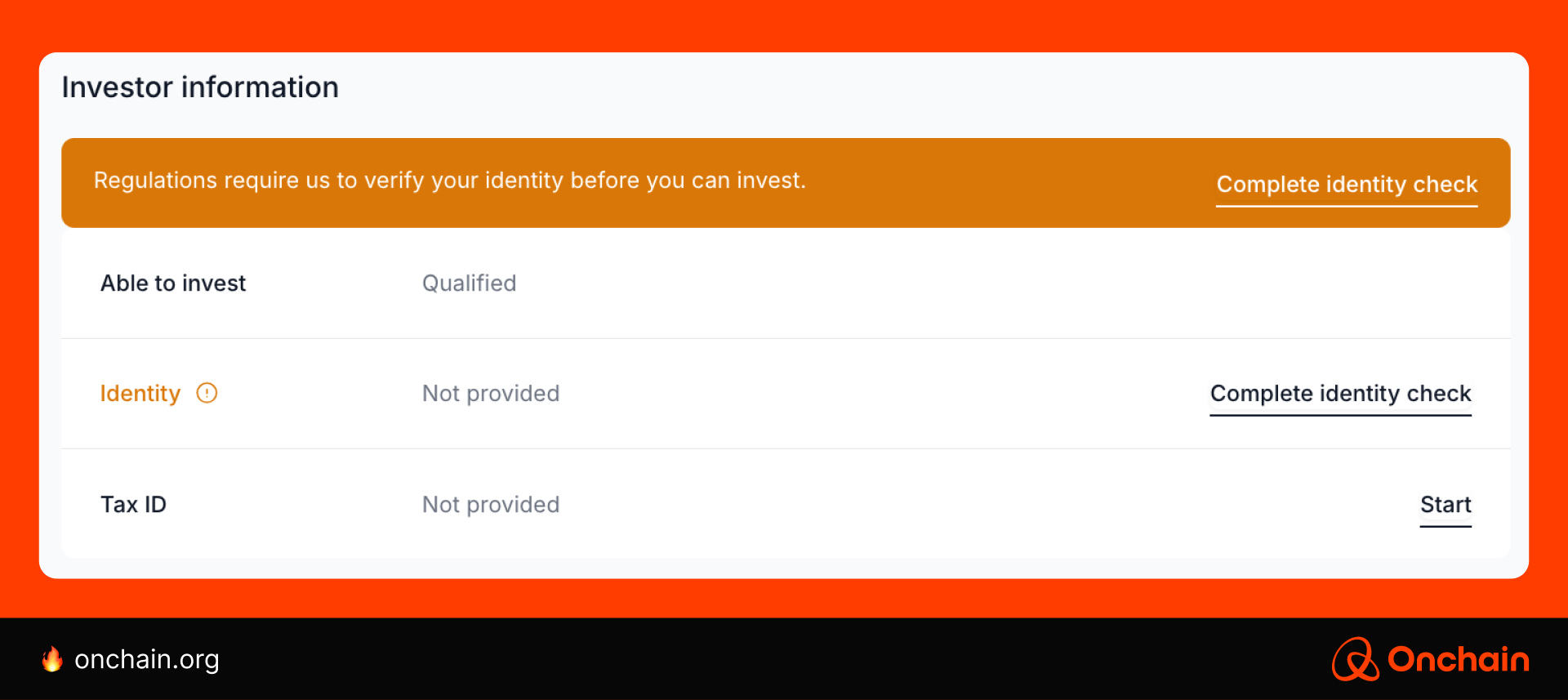

All individual investors are subject to a review process by Echo. Questions help them evaluate their investing knowledge and motivations, providing a unique experience that prioritizes investor education.

Echo spells out the risks upfront, balancing safety measures for users and protection for the platform itself.

It does this by reinforcing associated risks for the user’s awareness, all while ensuring compliance with jurisdictional rules.

In Echo, Group Leads aren’t their financial advisors — they’re just opening doors. The platform gives everyone access, but members call the shots. While the platform remains accessible to anyone, they still have to do their own due diligence and research.

Adoption

Over $109M funds have been raised so far in Echo spread across nearly 8,000 unique investors and 266 deals.

Turns out when you ditch the gatekeepers and get incentives right, everybody eats. Projects land real funding. Degens get legit early access.

Just look at the major launches under Echo that are already creating a buzz in the space: Ethena ($300K), Initia ($2.5M in under 2 hours), and Fogo ($8M in under 2 hours). The most notable isarebeing MegaETH, whichraising raised $10M raised in sub-3 minutes, if you need further proof.

Community feedback

The demand for community-powered investing is exploding: Positive reception for Echo from VC, institutional, and retail fronts strongly demonstrates this.

Abstract Chain, 1kx, and Hack VC are just a few of the many big players building their investor squads within Echo.

Coinbase (yes, that Coinbase) also recently became one of the Group Leads in the platform. It opened the floodgates to over 40 projects building on Base as part of its Base Ecosystem Fund.

Legion: Where skill, not capital, determines access

For Web3 founders, Legion offers a smart way to launch by prioritizing meaningful project contributions over passive capital.

Instead of relying on VCs or speculative public sales, it uses a merit-based system to distribute tokens to those who actually help you build: developers, users, and engaged community members.

This means, in Legion, your tokens do more than raise capital: They enable the creation of loyal, aligned ecosystem.

With Legion Score tracking things like open-source activity, onchain engagement, and project contributions, you attract genuine supporters who’ve earned their allocation.

The result? A stronger launch, healthier post-token dynamics, and long-term community-driven growth.

How it works

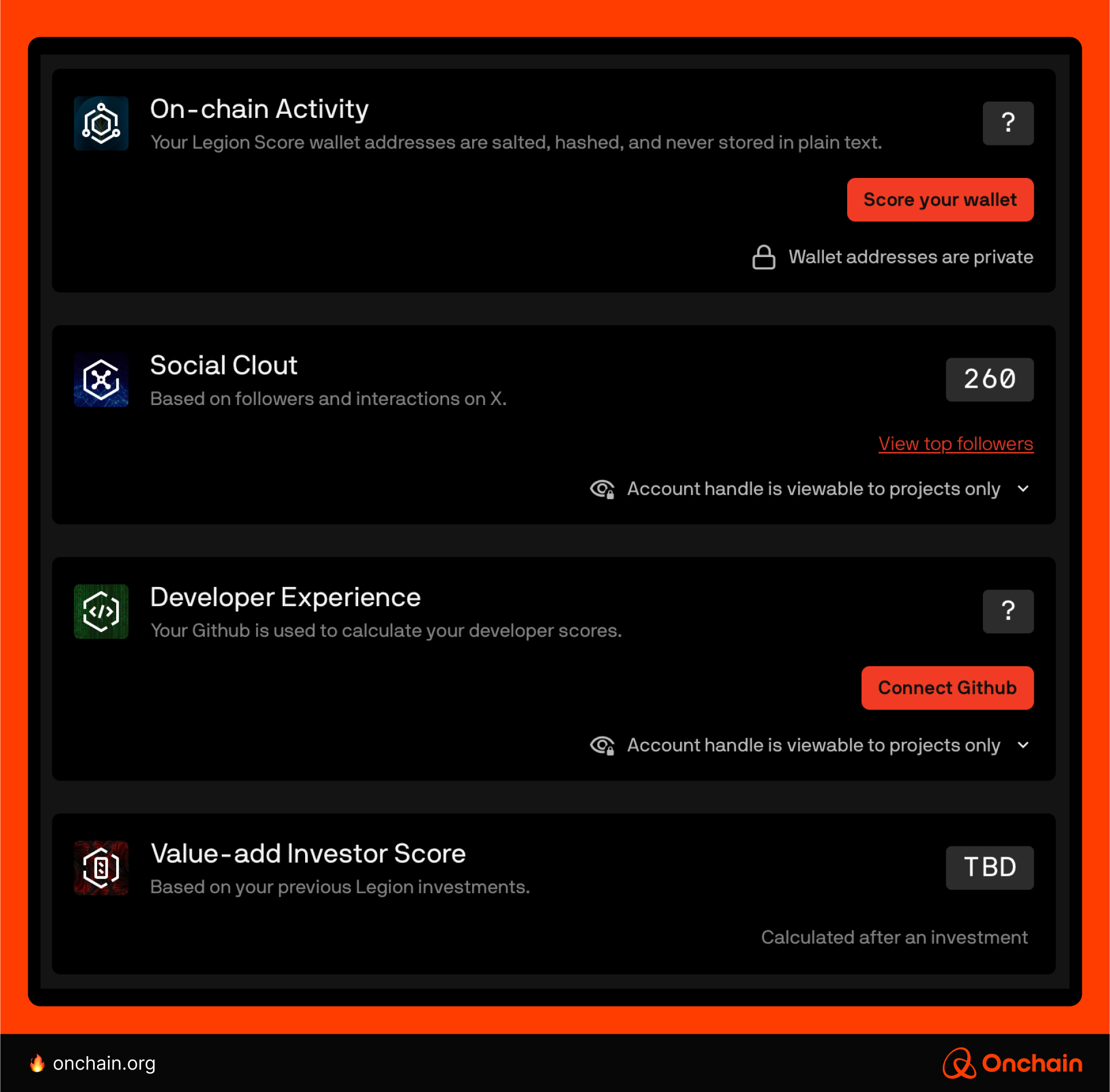

Legion operates on Legion Score. You are looking at a reputation scoring system that quantifies and rewards meaningful participation and contributions across multiple dimensions:

👾 Clout score – Social influence ≠ follower count. Legion measures meaningful engagement.

💻 Dev score – GitHub activity and open-source code contributions that matter

⛓️ Chain score – Organic on-chain activity. So forget whale transactions, they won’t really count here.

🤝 Interaction score – How you engage with projects and community, in a way that actually helps builders.

🏆 Endorsement score – The ultimate rep check: Teams can privately flag flaky “contributors” who don’t deliver.

For project teams, this onchain scoring system serves as the basis for token allocations, whitelists, discounts, and other parameters. This way, you get to assemble a community of genuine supporters who are aligned with your values and objectives.

Platform

Unlike platforms with rigid questionnaires, Legion taps directly into onchain activity, Github commits, and social engagement to surface high-signal participants.

Legion’s scoring system does the heavy lifting for you because it helps you identify and reward genuine contributors across dev work, community interaction, and onchain behavior.

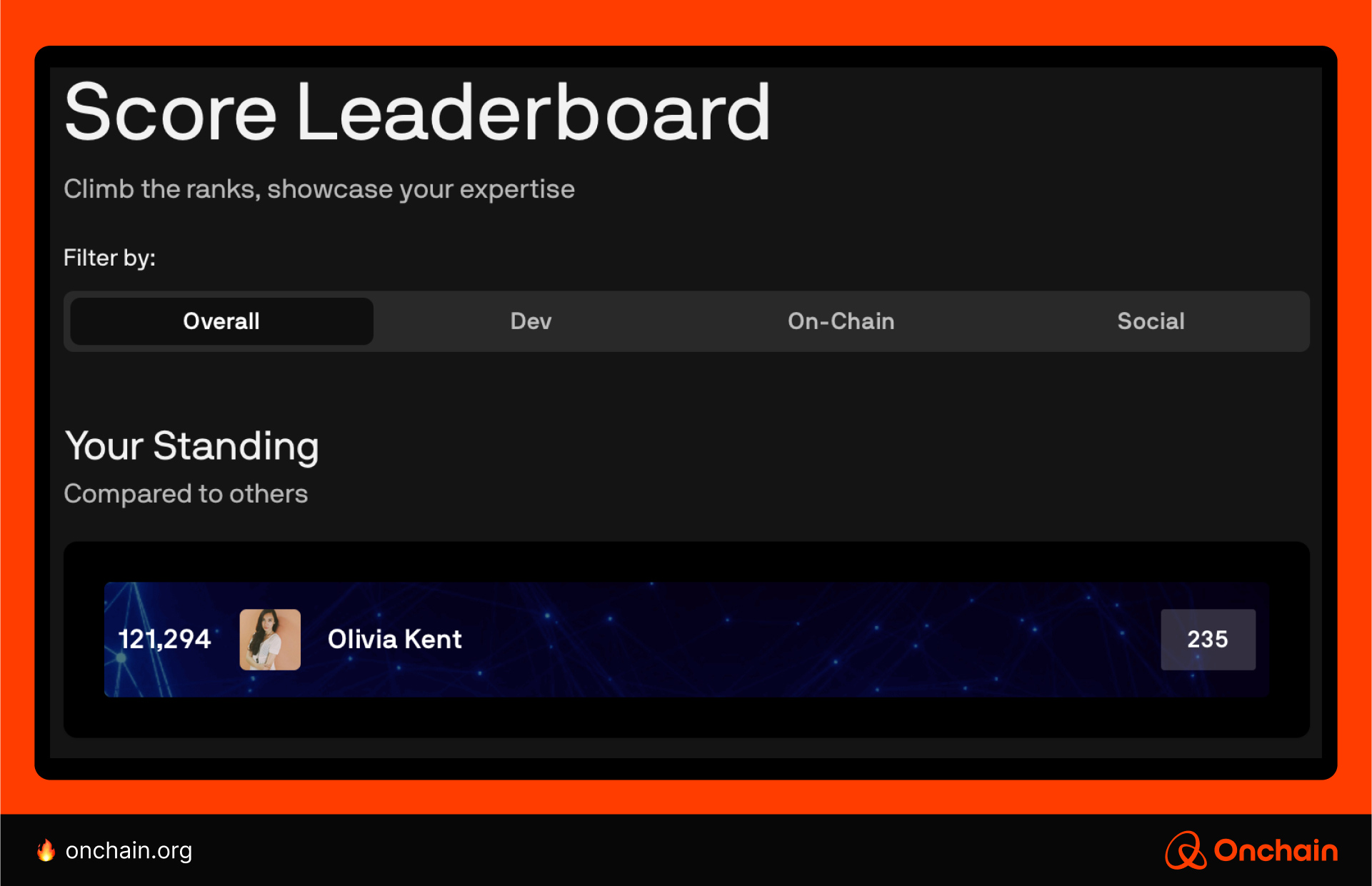

With gamified leaderboards and real-time updates, it filters out low-effort actors, and also keeps your community active and engaged.

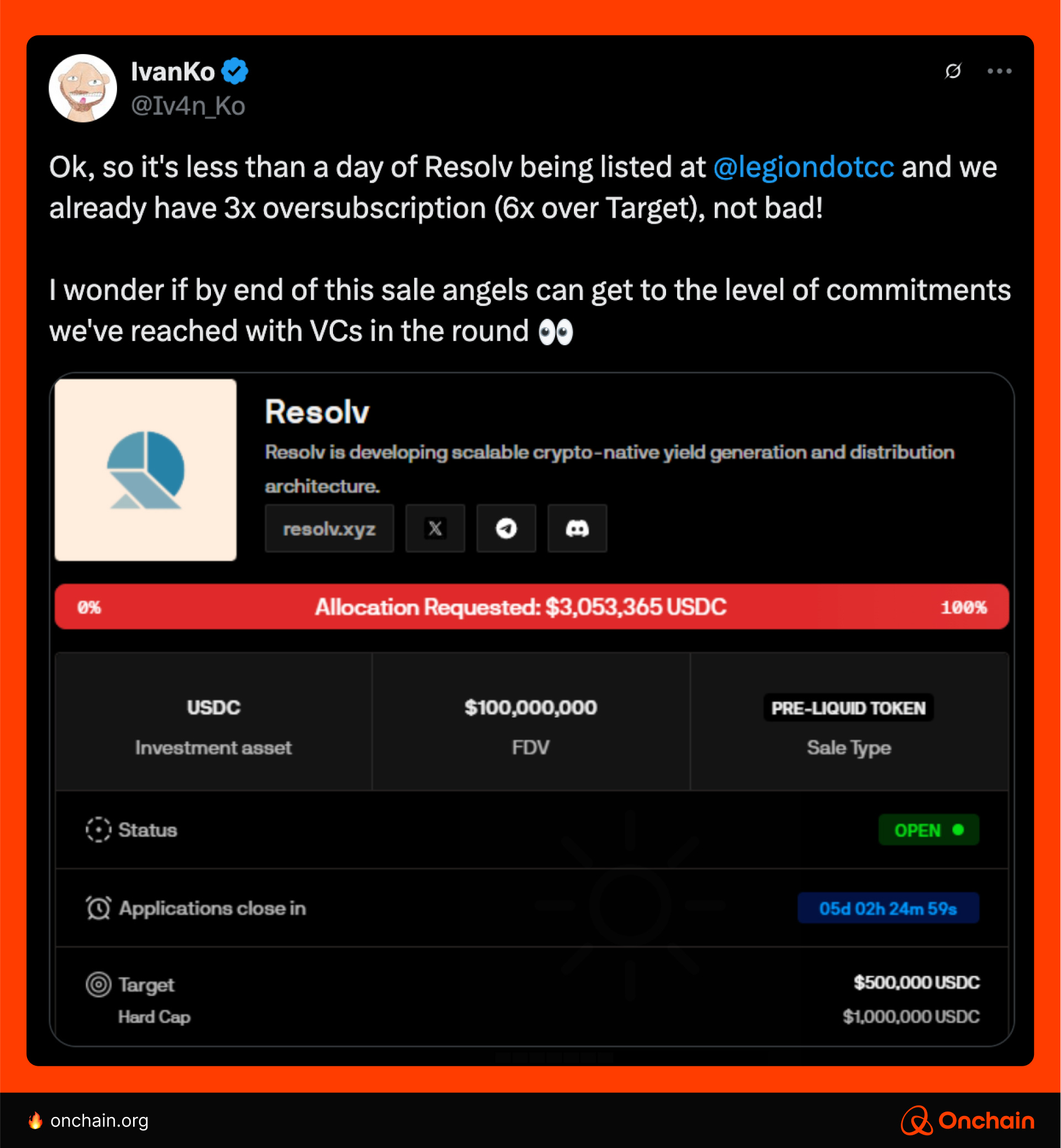

Adoption

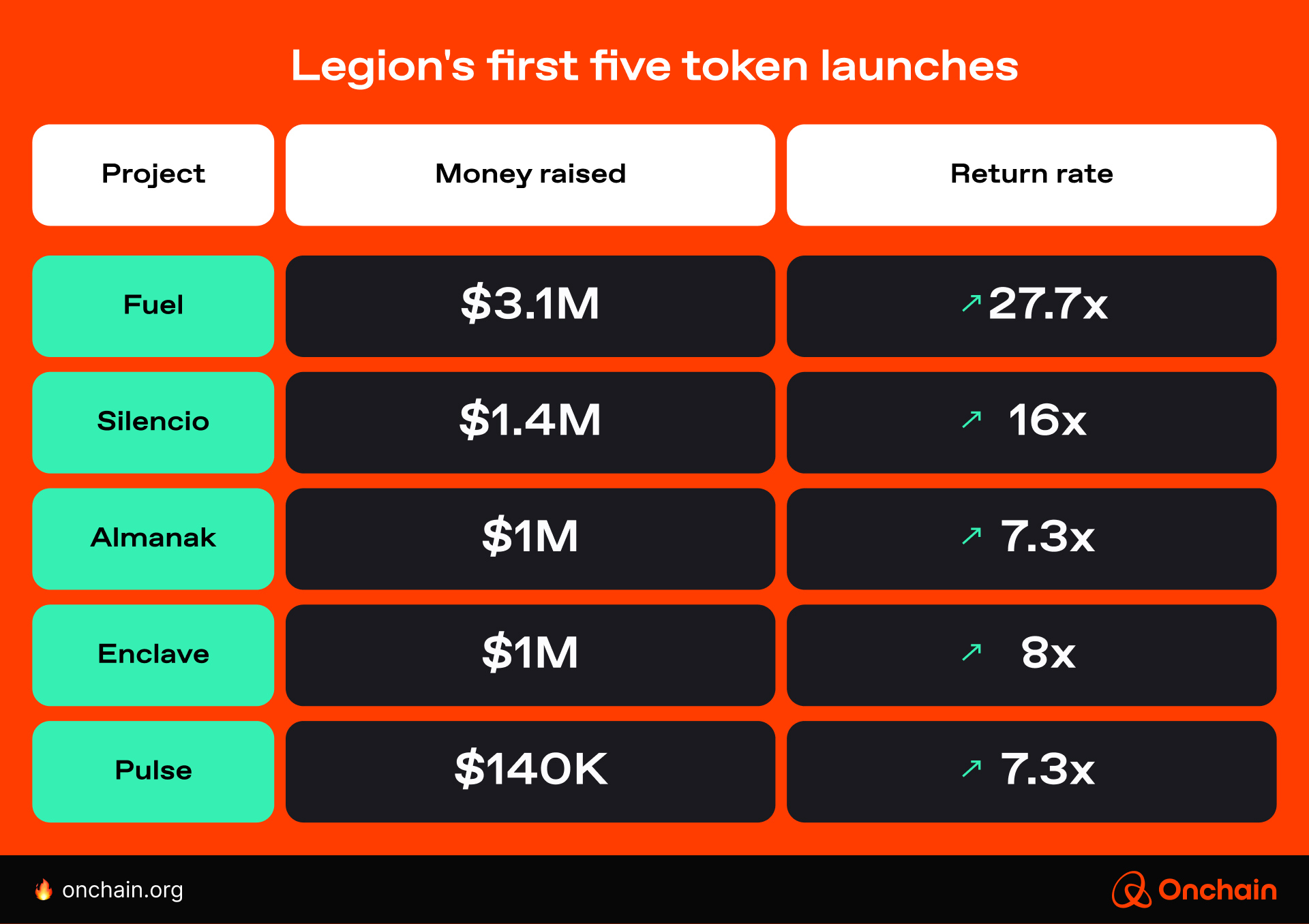

Legion’s impact is already clear: projects like Almanak ($1M), Enclave ($1M), and Silencio ($1.3M from $112M in requests) launched within six months; Some, like Fuel Network, even delivering 27x returns.

With $19M raised across 16 ICOs and 7,000+ unique investors, Legion’s merit-based model proves its value — fueling stronger, more engaged communities from day one.

Community feedback

The buzz around Legion is real. Builders, degens, and early adopters alike embrace its merit-based model. With growing momentum on X and a string of successful raises, the platform is quickly becoming the go-to for contributors who want more than just airdrops.

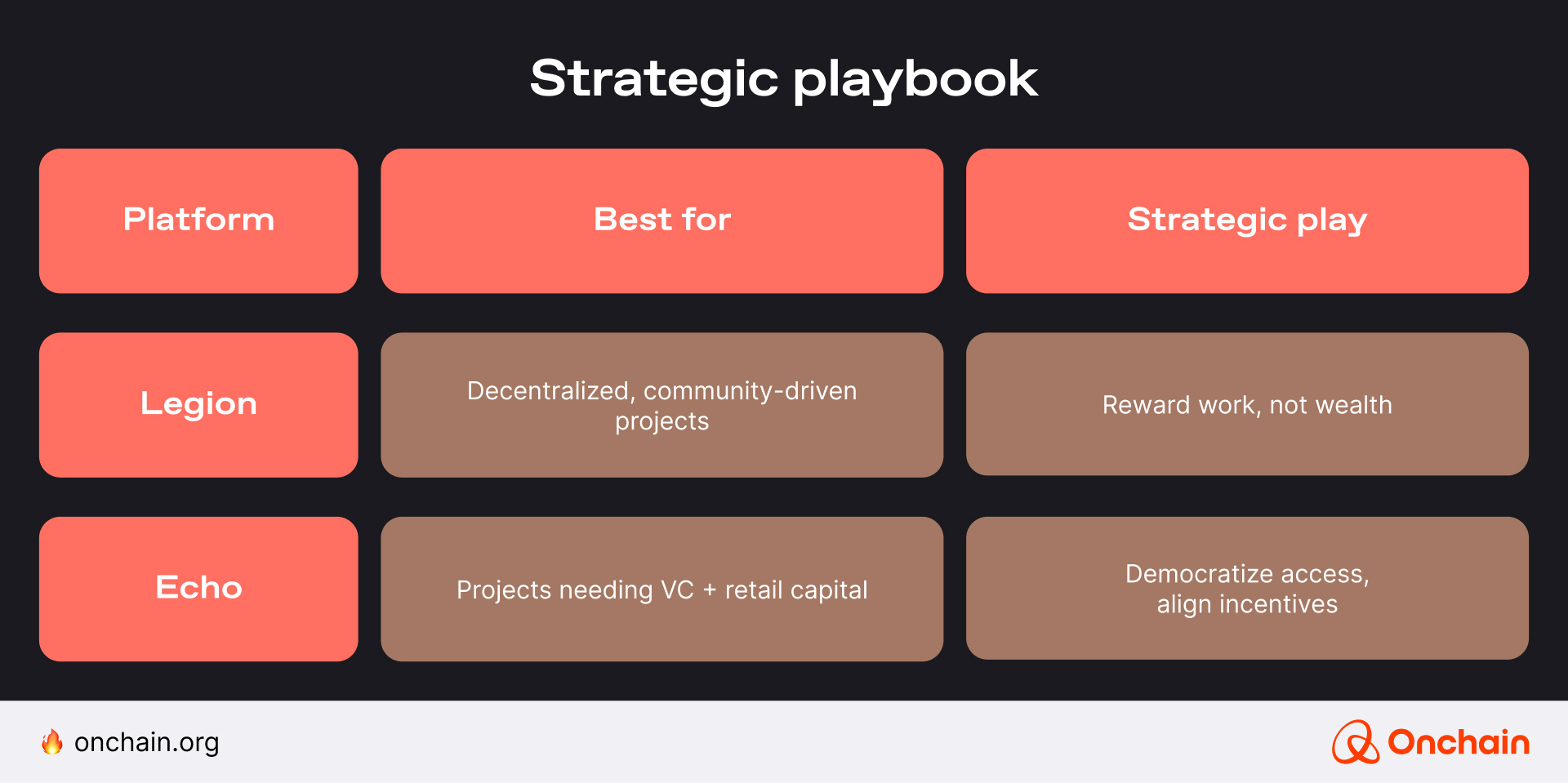

Now that we’ve broken down how Legion and Echo platforms work, let’s get practical. Here’s what it means for you as founders and how you can use these insights to your their advantage.

💡 Founder takeaways

If you’re planning a token launch, ICO 2.0 platforms like Legion and Echo offer a smarter, fairer alternative to traditional fundraising, with the following strengths:

- Better alignment, sustainable growth

- Legion rewards contributors with tokens, ensuring your early adopters are invested long-term — not just flipping for profit.

- Echo lets you raise alongside VCs on equal terms, using smart contracts to enforce fairness and prevent whale dominance.

- Faster, more inclusive fundraising

- Traditional VC rounds take months; ICO 2.0 launches happen in days, or even less.

- Legion’s merit-based system means you can leverage talent anywhere to help grow your project.

The future of crypto fundraising: Will ICO 2.0 reshape Web3 projects?

The numbers don’t lie: in March 2025 alone, token launches raised $3.4B. It’s a resurgence matching 2021’s bull market peak, but this time with a crucial difference: the capital is flowing smarter. 🤓

This explosive growth raises an essential question: Can decentralized fundraising models like Echo and Legion truly disrupt traditional venture capital?

Here’s the bottom line: Echo and Legion aren’t just fundraising alternatives. In today’s world, ICO 2.0 is a path towards decentralized, sustainable solutions to these flaws. How?

Through merit-based participation, equitable investing, community-centric approach, and aligned incentives while moving at crypto’s breakneck pace. ✅

They are not alone. Other platforms like Buidlpad and Launchpool also push for the principles and ethos that define ICO 2.0. Together they, form a collective of next-generation fundraising platforms.

Yet challenges loom. Can these platforms maintain decentralization while scaling? Will regulators allow their innovation, or force them into legacy frameworks? And crucially: Can community-driven models attract the institutional capital needed for mass adoption?

For now, there is some proof in the capital pudding. Echo’s $10M MegaETH raise in under 3 minutes and Legion’s 27x returns for Fuel Network investors demonstrate that decentralized fundraising provides a viable way of creating sustainable token economies.

What’s next for you?

See it for yourself. If you’re planning to launch your token soon, ICO 2.0 might just be the way to go. Our upcoming research report covers the various token launch strategies, examines their effectiveness and challenges with the help of case studies, investigates the legal frameworks and provides hands-on advice for founders, entrepreneurs and strategists.

Sign up for the newsletter, so you don’t miss it. Or join the whitelist to become one of Onchain’s Founding Members.