When I first encountered stablecoins, I dismissed them as just another crypto fad. How wrong I was. These digital dollars are reshaping the financial landscape in ways that impact businesses, consumers, and the entire global economy. Let me take you on a journey through this revolution and show you why it matters.

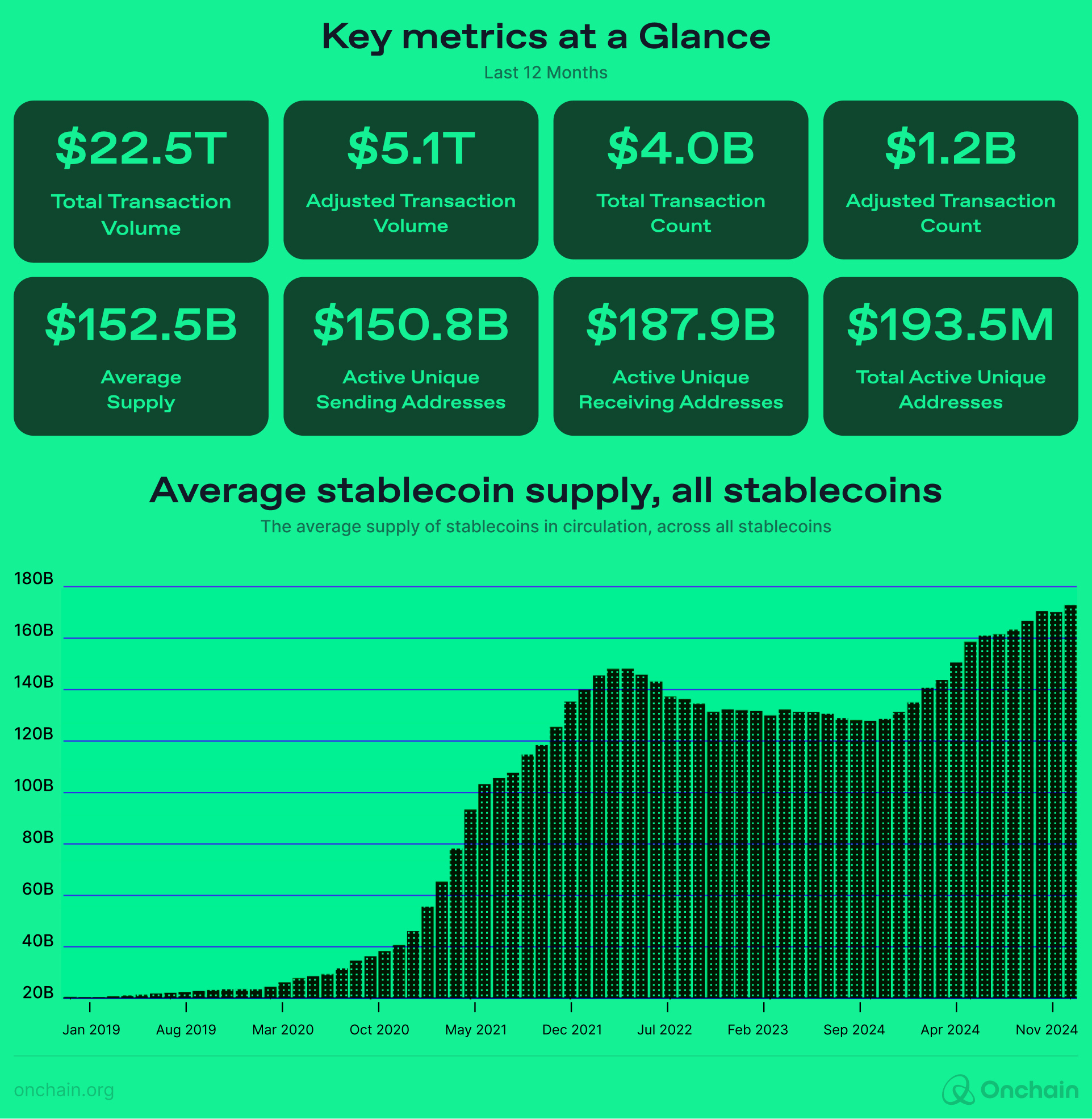

The stablecoin explosion: Numbers that can’t be ignored

The growth of stablecoins has been nothing short of astronomical:

- Stablecoins facilitated a staggering $22.5 trillion in transactions last year, surpassing both Visa ($14.8 trillion) and Mastercard ($9.03 trillion).

- There’s nearly $180 billion worth of stablecoins in circulation – a 400-fold increase in just 5 years.

Almost $180 billion of stablecoins in circulation; 400x in the last 5 years

- Tether (USDT), the market leader, generates an astounding $62 million in revenue per employee, dwarfing tech giants like Apple ($2.4 million) and Google ($1.7 million).

Why stablecoins matter to businesses and consumers

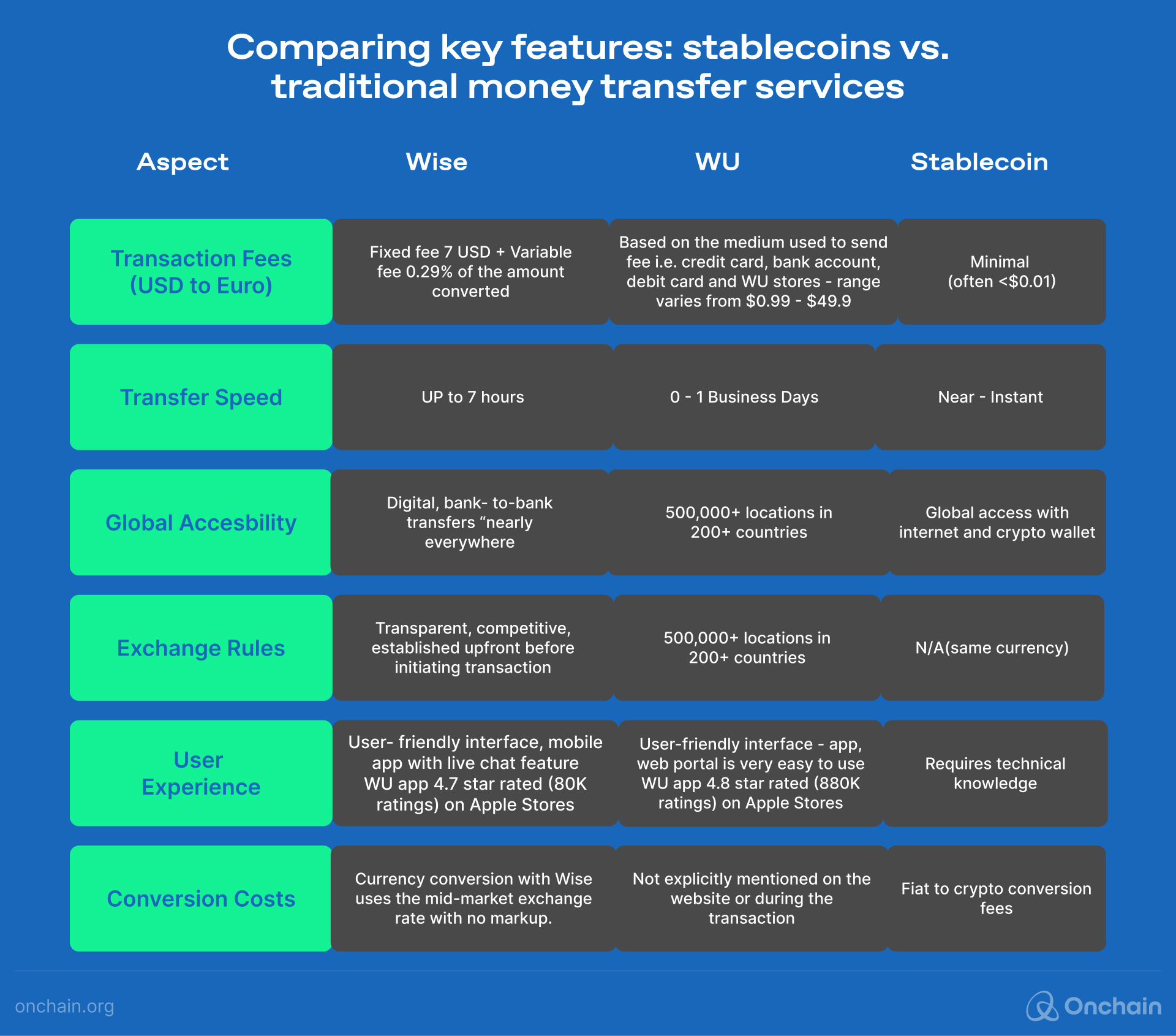

- Lower transaction fees:

Businesses can save significantly on payment processing. For example, Stripe’s 1.5% fee for USDC payments is much lower than the 2.5-3.5% typically charged by traditional processors for cross-border transactions. - Lightning-fast global transfers:

Send money across borders instantly, without the usual delays of traditional banking. This is particularly game-changing for companies with international operations or freelancers working with global clients. - Inflation protection:

In countries with unstable currencies, stablecoins provide a way to preserve value. This is crucial for businesses and individuals in emerging and developing economies like Venezuela or Zimbabwe.

“Consumer prices in Venezuela grew at an astounding average rate of 3,608.8% per year during the 40 years from 1980 until 2020. That meant that a product that cost 100 bolivar digitals in 1980 cost 104,800 trillion bolivar digitals by the start of 2021. In 2024, inflation had tapered off to 59% annually.

In these situations, people often turn to alternative stores of value to protect their wealth from their national currency’s rapidly declining purchasing power. This is where stablecoins come in as a potential hedge against inflation, with their value being pegged to more stable assets, such as the US dollar. - Financial inclusion:

Even without a traditional bank account, people can use stablecoins to save, invest, and participate in the global economy. This opens up new markets and customer bases for businesses.

“For example, a small-scale farmer in a rural province can receive a loan in USDC directly to his mobile wallet, use it to purchase seeds and equipment, and repay the loan with his harvest earnings – all without needing to travel to a physical bank”. - Yield generation:

Businesses and individuals can earn interest on their stablecoin holdings through various DeFi platforms, often at rates higher than traditional savings accounts.

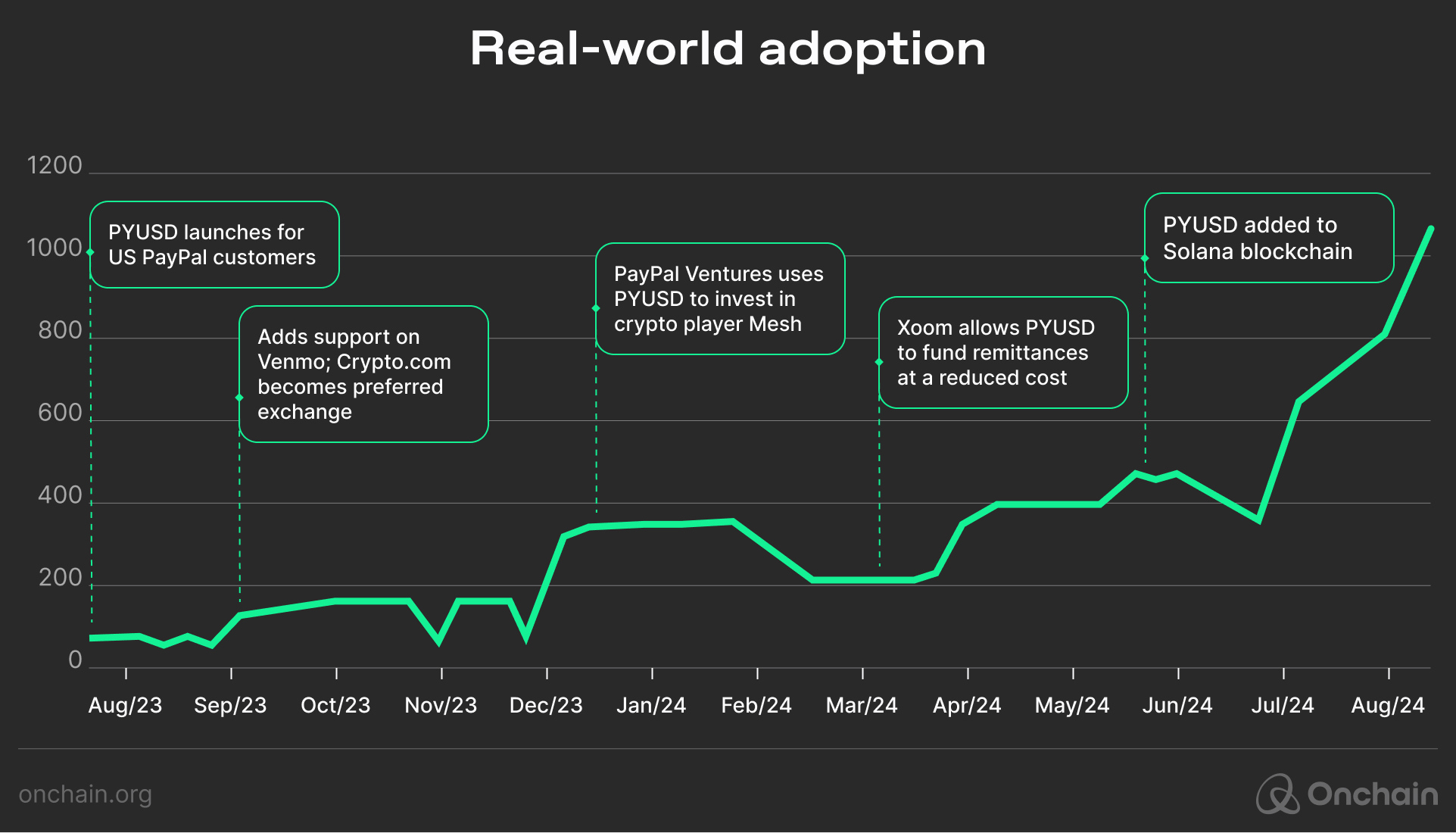

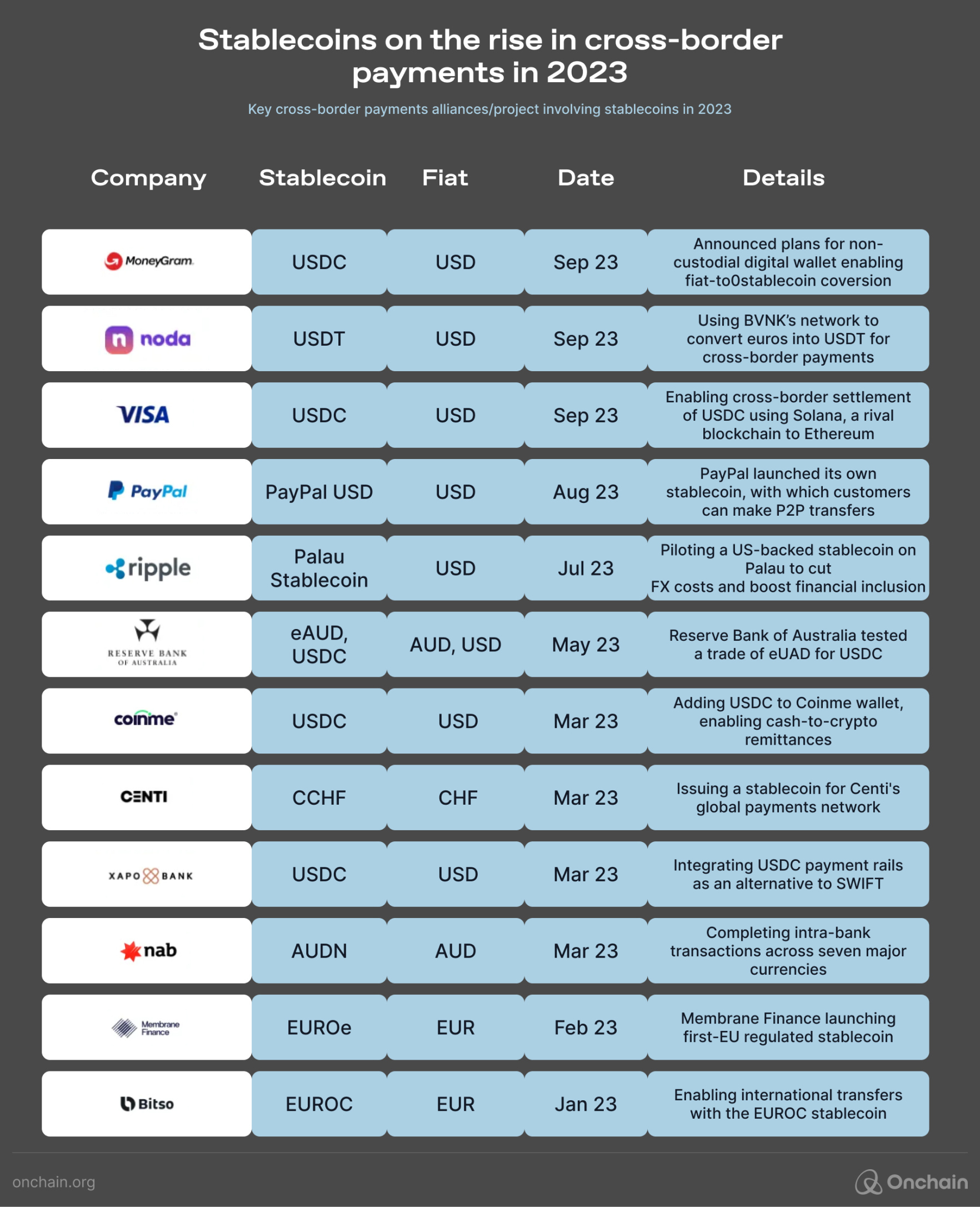

Real-world adoption: It’s happening now

Stablecoins are no longer just a crypto phenomenon. Major players across industries are integrating them:

- PayPal launched its own stablecoin (PYUSD) for its 430 million users, potentially bringing stablecoins to mainstream e-commerce.

- Grab, the Southeast Asian ride-sharing giant, integrated USDC into its app, showcasing how stablecoins can enhance everyday transactions in emerging markets.

- Companies like Request Finance have facilitated crypto payroll solutions using stablecoins. For example, they’ve processed nearly $300 million in total crypto payments, with 60% of these payments made in dollar-denominated stablecoins.

- The UAE government approved AE Coin, a stablecoin pegged to the Dirham, signaling government recognition of stablecoins’ potential.

- Visa and Mastercard are exploring stablecoin integration, with Visa already settling transactions using USDC on the Ethereum blockchain.

The emerging market opportunity

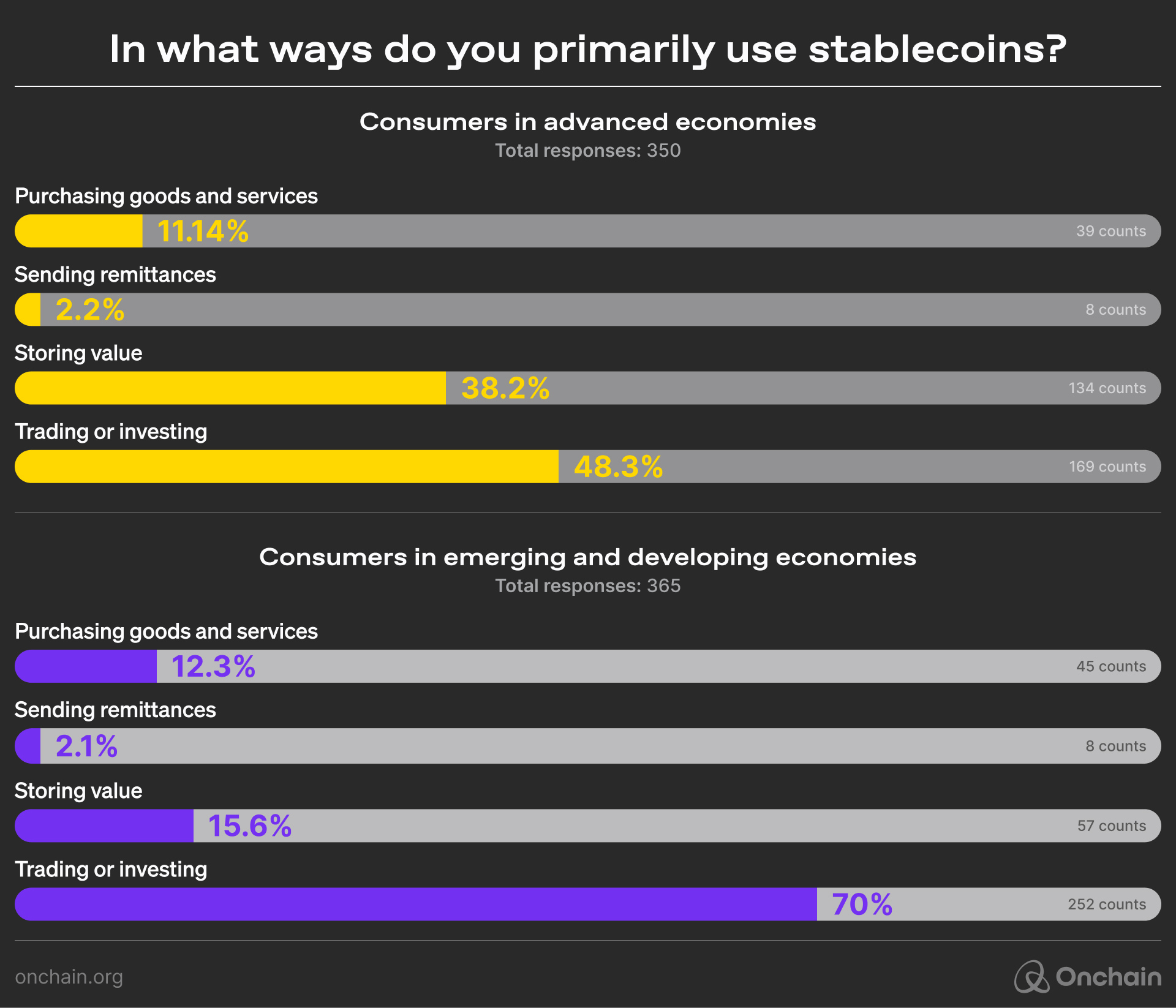

Here’s a surprising fact: businesses in emerging economies are leading the stablecoin adoption race. Survey data from the Onchain Research team underscores that stablecoins are predominantly used for trading, investing, and storing value, with notable differences between consumers in Advanced Economies and Emerging Market and Developing Economies. In advanced economies, stablecoin usage is concentrated on trading and storing value, while in emerging economies, trading dominates, complemented by growing use for remittances. These insights align with the IMF’s classification of Advanced Economies and Emerging and Developing Economies (IMF, 2023). The survey gathered responses from 1,450 participants.

Our survey showed that across both emerging and advanced economies, stablecoin is utilized for trading, investing or storing value. Remittance continues to be an area with significant growth potentials across all markets.

Key Insights in Percentages:

- Advanced Economies

- 48% use stablecoins primarily for trading or investing.

- 38% use them for storing value.

- Emerging Economies

- 69% use stablecoins primarily for trading or investing.

- 16% use them for storing value.

The following graphics represent the findings of surveys the Onchain Research Team conducted in November 2024 as part of our report on Stablecoins. Each graphic shows the count for the possible answers to a specific question, first posed to an audience in advanced economies, followed by the responses from emerging and developing economies.

1. How frequently do you utilize stablecoins in your transactions?

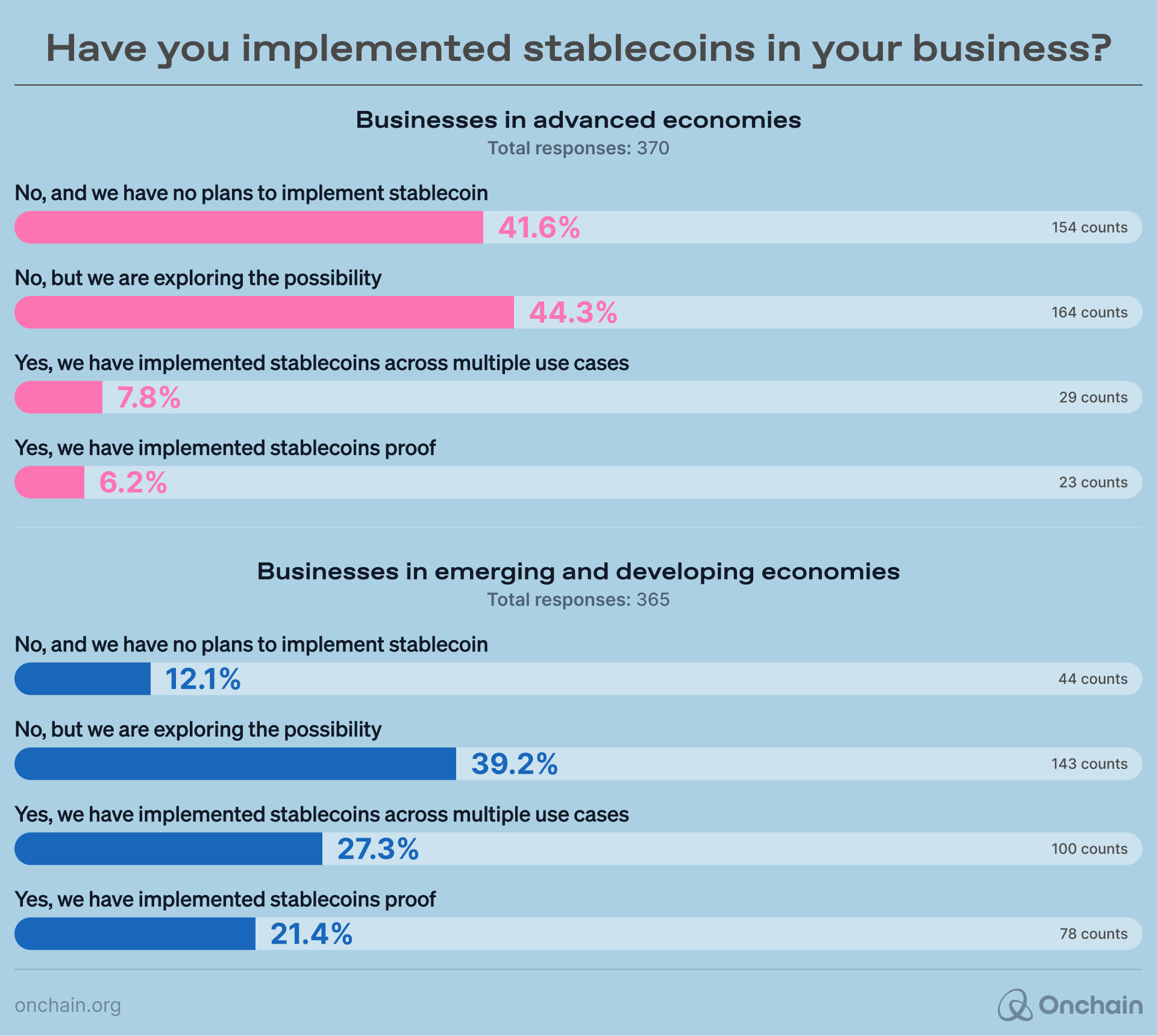

According to this survey 48% of businesses in emerging and developing economies have either implemented stablecoins or are in the proof-of-concept stage, compared to only 18% in advanced economies.

Why? Stablecoins solve critical problems in these markets:

- They provide access to stable currency in countries with volatile local currencies.

- They enable cheaper and faster remittances, a lifeline for many families.

- They offer financial services to the unbanked population.

According to Onchain survey, stablecoin adoption in emerging economies is substantially higher (18% vs 48%) than emerging economies.48% businesses have either implemented stablecoin or are in POC stage with another 40% exploration possibility to implement business use cases. Its alarming to see advanced economies limited adoption and minimal future plan to adopt stablecoin.

The following graphic shows the Stablecoin adoption by businesses in emerging and advanced economies according to the survey conducted by Onchain, 2024)

2. Have you implemented stablecoins in your business

As decentralized finance continues to reshape the financial landscape, stablecoins have emerged as a pivotal element, driving innovation and accessibility in a wide range of web3 enabled financial applications.

Stablecoins in DeFi: A new financial frontier

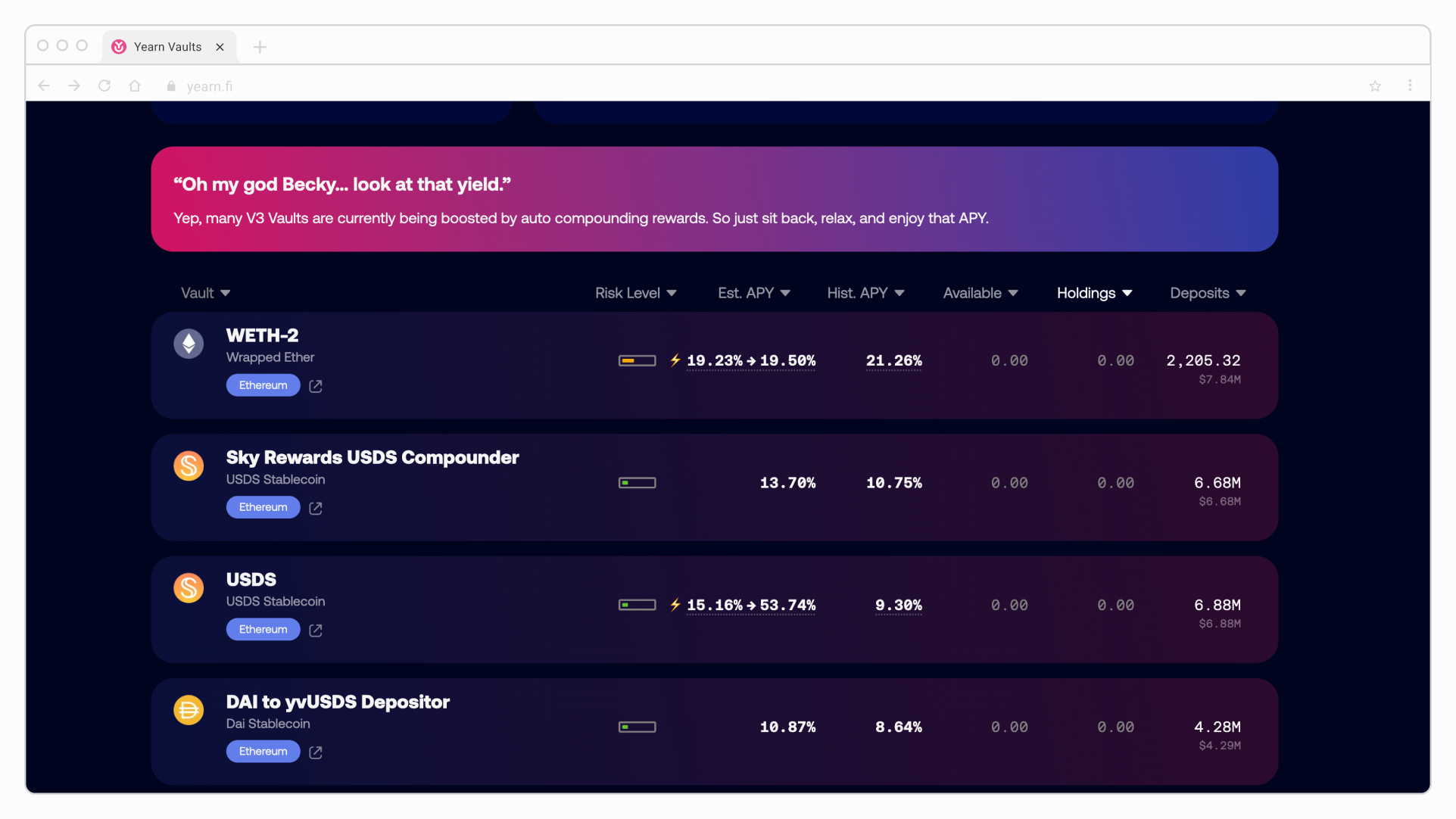

Stablecoins are the backbone of decentralized finance (DeFi), enabling a whole new world of financial products:

- Lending and borrowing: Platforms like Aave and Compound use stablecoins as collateral, allowing users to earn interest or take out loans without traditional banks.

“As of October 2024, Aave v3 has over $19.3 billion in total net deposits across 13 networks(or liquidity), and 6.75% average stablecoin supply APY Ethereum network in 2023.” - Liquidity provision: Stablecoins are crucial in providing liquidity to decentralized exchanges, enabling efficient trading.

- Yield Farming: Users can earn high yields by providing stablecoin liquidity to various DeFi protocols.

Getting started with stablecoins: A guide for businesses and individuals

Ready to explore this new financial frontier? Here’s how to get started:

- Choose your stablecoin:

USDC and USDT are popular choices, but research to find the best fit for your needs. - Set up a digital wallet:

MetaMask for Ethereum-based stablecoins or TrustWallet for multi-chain support are good options. - Start small:

Begin with small transactions to get comfortable with the technology. - Explore use cases:

For businesses, consider using stablecoins for international payments or payroll. Individuals might start with savings or exploring DeFi yields.

According to Onchain survey across both emerging and advanced economies, stablecoin is utilized for trading, investing or storing value. Remittance continues to be an area with significant growth potentials across all markets. Global political changes and the growing regulatory clarity around stablecoins are setting the stage for their deeper integration into traditional financial systems. - Stay informed:

The stablecoin landscape is evolving rapidly. Keep up with regulatory developments and new use cases.

The future is stable(coin)

As we look ahead, stablecoins’ potential seems boundless. From transforming cross-border trade to enabling micro-investments in emerging economies, stablecoins pave the way for a more inclusive and efficient global financial system.

But are businesses and governments accommodating stablecoins fast enough to make business adoption make sense? The next article will hold the lens up to institutional adoption (or not) of stablecoins to help you make sense of the landscape.