In the unpredictable seas of crypto, gold-backed stablecoins are emerging as an anchor, offering investors and developers a rare mix of digital liquidity and old-world stability.

With both real-world asset (RWA) tokenization and decentralized finance (DeFi) converging, gold-backed stablecoins are no longer a fringe experiment. They’re becoming a cornerstone of a new, programmable economy where trust is algorithmic and value is tangible.

Here’s what you need to know.

What are gold-backed stablecoins?

To put it in layman’s terms, gold-backed stablecoins are digital tokens backed 1:1 by physical gold stored in secure vaults. Think of them as certificates of ownership with a bonus: they are programmable, tradable 24/7, and borderless.

On the whole, here’s how they work:

- Backing mechanism: Each token represents ownership of a specific weight (usually one troy ounce) of gold stored by a custodian.

- Minting/burning: Tokens are minted when gold is deposited and burned when redeemed.

- Audits: Reputable issuers undergo regular audits to verify reserves, adding trust to transparency.

- Custody: Third-party institutions, sometimes regulated, hold the physical gold in highly secure vaults.

In contrast to fiat-backed stablecoins (like USDC or USDT), which are pegged to fiat currencies like the USD, gold-backed tokens derive their value from a universally accepted, time-tested store of value.

How does gold-backed crypto work?

Gold-backed stablecoins marry the stability of gold with the utility of blockchain. When a user buys a token (e.g., PAXG or XAUT), they gain ownership of actual gold. The token can be held, transferred, staked in DeFi, or even spent using crypto cards, just like digital cash, but with the security of gold reserves behind it.

Imagine you’re holding digital gold dust in your wallet — spendable, stakable, and viewable onchain in real-time.

Market leaders and innovators in gold tokens and gold crypto

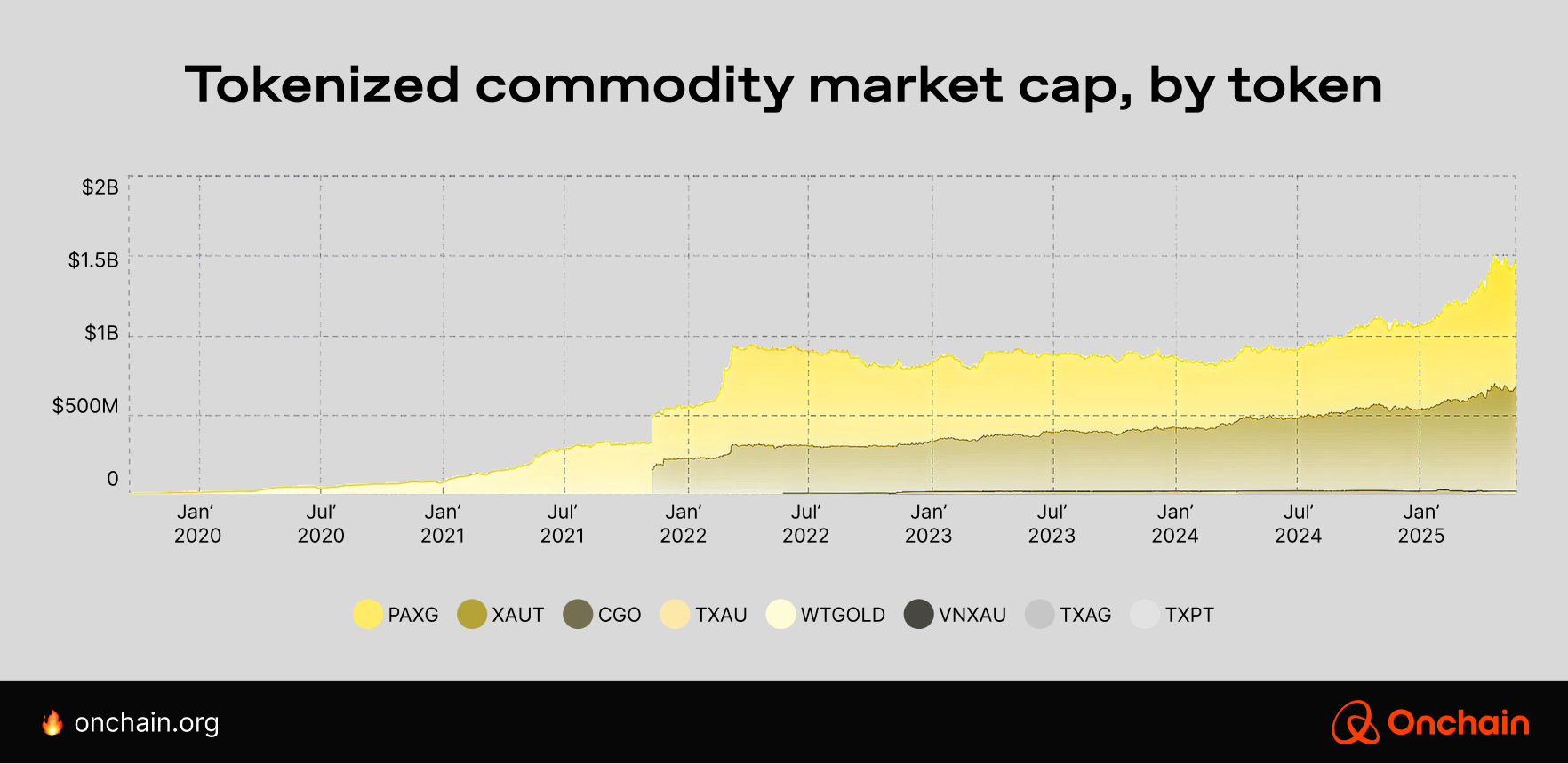

In March 2025, the market capitalization of gold-backed stablecoins hit a record $1.5 billion, with monthly trading volumes.

Tether’s XAUT and Paxos’ PAXG lead the gold-backed stablecoin market, with combined trading volumes topping $1.6 billion. XAUT boasts a market capitalization of around ~$654 million and enjoys strong liquidity across DeFi platforms like Aave and Curve.

Meanwhile, PAXG is backed by the Paxos Trust Company and regularly audited, powers platforms such as Nexo, and commands an even higher market cap of approximately ~$804 million.

For a deeper dive, check out our detailed report: Tokenization Works: Where Founders Should Focus Now.

Beyond single-asset tokens such as XAUT and PAXG, a new wave of innovation is emerging in the form of tokenized baskets, digital assets that combine gold with other real-world assets (RWAs) such as U.S. Treasuries, stablecoins, or commodities.

These hybrid instruments offer a diversified hedge, blending the inflation-resistant quality of gold with the yield-generating properties of treasuries.

According to the RWA.io State of Stablecoins Report, the likes of Tether’s XAUT are emerging as inflation hedges and stores of value outside traditional finance, backed, in Tether’s case, by 7.7 tons of gold and a shifting business model that now spans far beyond crypto trading.

Why gold-backed crypto coins offer a hedge against volatility and inflation

When markets panic, currencies crumble, or inflation erodes purchasing power, investors have historically turned to gold. Why?

Because gold is finite, you can’t print more of it. It’s immune to the whims of central banks and geopolitical chess moves. In that sense, gold is the anti-dollar: a store of value that holds steady when fiat loses footing.

By tokenizing physical gold and minting blockchain-based tokens that are fully backed by audited gold reserves, crypto investors can access the same stability and inflation resistance without needing to store or physically handle the gold.

At a time when inflation, de-dollarization, and crypto volatility are converging, this combination offers a uniquely powerful hedge.

When gold rallied past $3,000 per ounce in early 2025, investors rushed into tokenized gold, which could be staked, swapped, or spent.

Regulatory risks, custody, and risk management in gold-backed stablecoins

As promising as gold-backed stablecoins are, they sit at the intersection of two tightly regulated worlds: precious metals and digital assets. That makes regulatory clarity, custody, and risk management non-negotiable. Let’s break it down:

- Custody risk: If the gold reserves are mismanaged, inaccessible, or misrepresented, the token’s credibility collapses. Top projects, such as PAXG and XAUT, mitigate this risk through partnerships with trusted custodians and vault operators, including Brink’s and the Paxos Trust Company, and undergo regular independent audits. However, it’s important to note that these audits confirm the financial records — they do not involve physical inspections of the gold held in the vaults. While this is standard practice for many tokenized assets, it’s a detail worth highlighting, especially for newcomers seeking full transparency.

- Audit transparency: Clarity here matters. Investors need proof, preferably onchain or via public attestations, that reserves exist and match the circulating token supply.

- Counterparty risk: This emerges when token issuers rely on third parties (vaults, auditors, exchanges). Each layer introduces trust assumptions, and any weak link can result in reputational or systemic failure.

Evolving global regulations and their impact

Regulatory attitudes toward stablecoins are evolving fast, and gold-backed crypto tokens aren’t exempt.

- In the U.S., regulators like the SEC and CFTC are still debating whether specific asset-backed tokens fall under securities or commodities law.

- The EU’s MiCA (Markets in Crypto-Assets) framework, rolling out in phases, may require gold-backed tokens to meet stringent reserve, transparency, and licensing criteria.

- In the Middle East and Asia, jurisdictions such as Dubai and Singapore are demonstrating greater openness, provided projects meet AML/KYC requirements and maintain audited reserves.

The challenge? There’s no unified playbook. Token issuers operating across borders must navigate a complex patchwork of local laws, which often shift in real-time.

As adoption grows, especially among institutional players, the demand for bank-grade security and compliance is rising.

Smart contract audits, insurance on physical gold reserves, and real-time asset tracking are becoming best practices, not luxuries.

Projects like Chrysus, a gold-based cryptocurrency, which combines gold-pegged tokens with crypto overcollateralization and decentralized governance, are responding by embedding transparency and resilience into the protocol itself.

Founders and Web3 builders navigating this landscape, looking to launch or integrate gold-backed stablecoins, should take these recommendations on board:

- Partner wisely: Choose custodians, auditors, and legal counsel with a track record in both commodities and blockchain.

- Design for regulation, not around it: Build frameworks assuming full transparency will be required, even in lenient jurisdictions.

- Diversify jurisdictional exposure: Avoid single-point regulatory failure by distributing infrastructure across friendly, well-regulated environments.

- Over-communicate: Proactively share audit reports, tokenomics, and governance frameworks with users and partners.

- Anticipate change: Stay agile and budget for legal adaptation as global policies shift. What’s compliant today may be noncompliant next quarter.

In short, regulatory maturity is now a competitive advantage. Those who build trust-first infrastructure will be the ones who lead the next wave of gold-backed innovation.

Gold-backed stablecoins vs USD-backed stablecoins

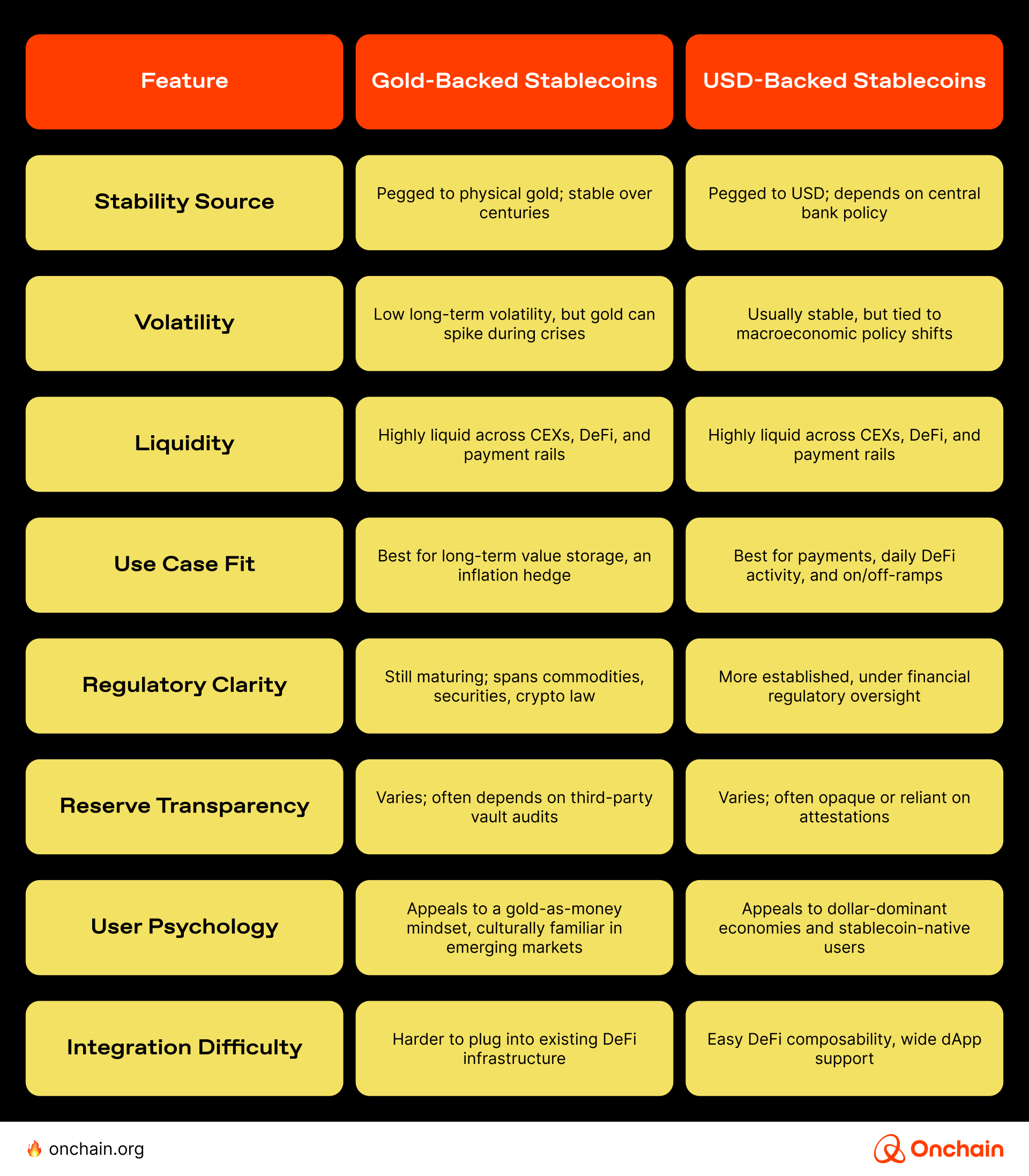

For founders building in DeFi, payments, or asset tokenization, choosing between gold-pegged and USD-pegged stablecoins isn’t just about market preference; it’s a strategic decision with long-term implications.

At first glance, both gold-backed and fiat-backed stablecoins seem to serve the same function: stability. But scratch the surface, and they offer very different tradeoffs in terms of user psychology, regulatory exposure, collateral strategy, and risk profile.

Here’s a comparison breakdown:

There’s no one-size-fits-all choice. The bottom line is that USD stablecoins may be more liquid, but gold-backed stablecoins offer durability and differentiation, especially in markets where fiat trust is low.

Gold brings trust and timelessness. Fiat brings scale and speed.

Implications for liquidity, transparency, and the Web3 economy

Gold-backed stablecoins are increasingly being used as collateral in lending protocols, such as the previously mentioned Aave protocol, or as stable trading pairs on decentralized exchanges.

In times of market stress, gold tokens serve as a liquidity anchor, enabling DeFi users to hedge risk without fully exiting the onchain ecosystem. They offer DeFi a greater element of stability in lending protocols.

From a transparency perspective, gold-backed cryptos offer more than stability; they introduce new levels of transparency to traditionally opaque commodities markets.

Many projects provide onchain audit trails, where token holders can verify gold reserves and vault locations in real-time. For example, gold-backed crypto coin PAXG gives token holders the ability to track the exact serial number of the gold bar backing their token.

For developers, these tokens unlock opportunities in synthetic assets, real-world lending, and cross-chain liquidity, tapping into a centuries-old value system using modern rails.

Furthermore, tokenized gold sits at the intersection of composability and inclusion. It allows developers to integrate traditional assets into next-gen financial primitives, opening up new combinations of utility and stability.

Emerging market adoption and use cases

Gold-backed stablecoins are becoming powerful tools in regions where fiat currencies are unstable, inflation is high, or access to traditional banking is limited.

According to Ment Tech, in emerging markets like Nigeria and Argentina, where inflation erodes local currencies, residents are increasingly turning to tokenized gold as a stable store of value and a hedge against economic volatility.

Here is an overview of some of the use cases:

💳 Spending via crypto cards

Gold-backed stablecoins, such as PAXG and XAUT, can be loaded onto crypto debit cards, enabling users to spend digital gold for everyday purchases and bridge the gap between traditional gold ownership and modern payments.

🏦 Collateral in DeFi

Platforms such as Aave and MakerDAO accept tokenized gold as collateral, enabling users to borrow against their gold holdings without selling them, offering a stable asset base in volatile markets.

🌍 Cross-border payments

Tokenized gold offers a borderless alternative to fiat for international transfers. With low fees and no banking middlemen, it’s instrumental in emerging markets with unstable currencies.

💰 Hedging and wealth preservation

Investors can hold tokenized gold in digital wallets as a hedge against inflation or crypto volatility, combining the stability of gold with the flexibility of blockchain technology.

Taking this into account, what should founders and crypto market insiders be looking to build on? Let’s find out.

What founders should build around gold-backed stablecoins

There’s a wide-open runway for Web3 entrepreneurs to build financial products that merge gold’s timeless value with the flexibility of DeFi and Web3 infrastructure. Here are some opportunities to explore:

- DeFi lending platforms that accept gold tokens as collateral.

- Hybrid tokens that combine gold backing with yield-bearing DeFi strategies.

- Mobile-first crypto wallets designed for gold savings in emerging markets.

- Gold-backed debit cards or e-commerce integrations.

- Local exchange integrations that allow seamless swaps between fiat, crypto, and tokenized gold.

- Education-focused platforms that help communities understand how to use gold tokens for wealth preservation.

This should give you more than enough food for thought; however, don’t stop here, get more in-depth analysis in our article on stablecoin revenue models and yield strategies for businesses.

Conclusion: The future of gold and cryptocurrency integration

Gold-backed stablecoins are the missing link between the past and the future of money. They preserve value like gold, move like crypto, and scale like software.

For users weary of volatility, for Web3 builders ready to deploy new use cases, and for entrepreneurs searching for the next frontier, these crypto-backed gold tokens are more than stable. They’re strategic.

Clearly, this space is ripe with opportunity, from DeFi lending platforms secured by gold to hybrid yield-bearing instruments and globally accessible payment solutions.

We’ve also covered this topic in our Onchain newsletter, and we’ll continue tracking key developments, innovations, and founder opportunities in the gold-backed stablecoin arena. Subscribe to stay ahead of what’s next in the world of Web3 and beyond.

Finally, as the convergence of real-world assets and decentralized finance accelerates, gold-backed stablecoins may well serve as a bridge between traditional stability and the future of open financial infrastructure.

The Onchain Research Team took a took a fine-toothed comb across all aspects of stablecoins, from business adoption to international payments and everything in between. The resulting report includes case studies, business model examples, and real world use cases. You won’t find this level of insight anywhere else. Before you invest or implement, move forward in the Track to read the report.