Stablecoins serve as a stable monetary medium that bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi). Stablecoin usage is projected to increase continually, including the government-controlled subset known as central bank digital currencies (CBDCs). So, what are the potential benefits and downsides of this blockchain trend? And why should you care?

Financial inclusion trends: the world is changing

Today’s financial world is largely unrecognizable to baby boomers and past generations: stablecoins, crypto transactions, crypto-collateralized loans, and decentralized exchanges (DEXs) are just a few examples of DeFi that are changing how global finance works.

Buying a house with a stateless digital currency seemed like science fiction only a couple of decades ago. Now, it’s a reality; People have been buying property with Bitcoin (BTC) for years now. Stablecoins are entering the public zeitgeist as their usage proliferates throughout the developing and developed world.

The transformation of monetary transactions is something that you should understand. For anyone in the finance industry, these financial inclusion trends are of paramount importance as stablecoins and CBDCs roll out worldwide.

Stablecoin adoption: by the numbers

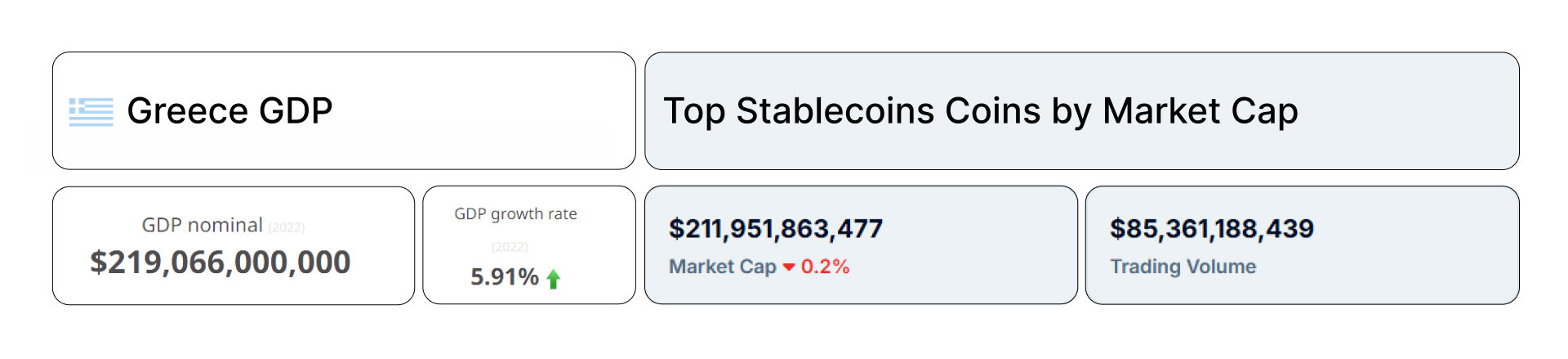

While Bitcoin and Ethereum get most of the crypto headlines, the collective stablecoin market has quietly expanded to the point where it can no longer be ignored. When compared to the gross domestic product (GDP) of countries, the stablecoin market cap would be in 55th place — right behind Greece’s GDP.

As a payment technology, stablecoins are establishing themselves as a competitor to legacy alternatives. Stablecoin adoption is disrupting applications as diverse as remittances, payments, investing, banking, payroll, and a host of other financial services.

Stablecoins comprise a large portion of the burgeoning crypto sector known as real-world asset (RWA) tokenization. The development of stablecoins is being widely researched along with associated Web3 trends. Many predict that future online transactions will largely take place on the blockchain — using a combination of stablecoins, CBDCs, and cryptocurrencies.

Will these transactions primarily use stablecoins — or strictly onchain assets like XRP, XMR, BCH, ETH, BTC, and others? As long as USD and other fiat currencies don’t become too inflationary, they will likely remain a sizeable share of the onchain transaction market.

The price volatility of cryptos like BTC is not ideal when you are frequently conducting business transactions. Who wants to check the crypto price every time you send or receive money?

Stablecoin and CBDC use cases: global transactions and more

Cumulative global trade for 2024 was an estimated $33 trillion — a new record. Legacy solutions for cross-border transactions create problems for both individuals and businesses, including:

- High fees

- Currency conversion costs

- Delayed payments and settlement

- The need for escrow services

- Capital controls

- Fiat inflation

To combat these issues, you can use alternative payment methods. Financial technology (FinTech) apps like Samsung Pay, Venmo, Apple Pay, Stripe, and a plethora of others have seen widespread adoption. Yet, these apps don’t provide worldwide coverage — a stumbling block when global transactions are involved.

For example, Stripe is available in 46 countries. What if you need to conduct business in South Korea or Scotland, where Stripe isn’t supported? This creates another obstacle, overcome only with a hodgepodge of various apps and payment service providers. This is not ideal and creates payment friction issues.

This has opened the door to globally accessible payment alternatives like stablecoins and CBDCs.

Stablecoin adoption: USD reigns supreme

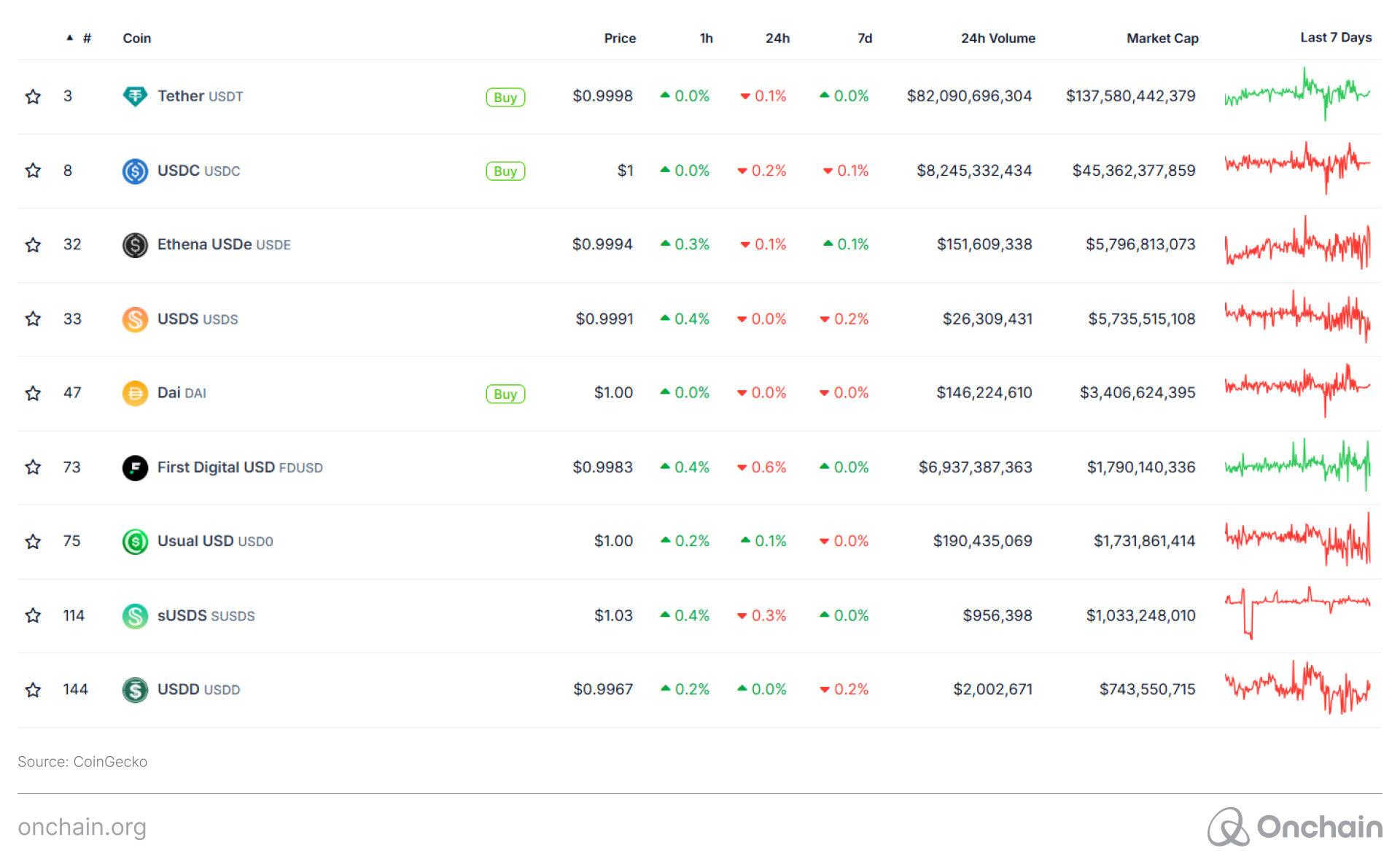

The U.S. dollar (USD) has been the dominant global currency since the 1920s – and is still used in the majority of foreign trade invoices. When it comes to fiat-pegged stablecoins, USD accounts for nearly the entire fiat market:

The market cap of stablecoins pegged to other currencies barely registers on the charts. Could that change in 2025?

The first part of Europe’s Markets in Crypto-Assets (MiCA) regulation went into effect on December 30th, 2024. Proponents say it provides a great deal of regulatory clarity and several projects are expected to launch EUR-pegged stablecoins in 2025. Critics counter that MiCA is overregulated, which will lead to high compliance costs while stifling global payment innovation.

CBDC implementation across the globe

Companies run stablecoin projects as private ventures. While they must adhere to government regulations, they are independent entities.

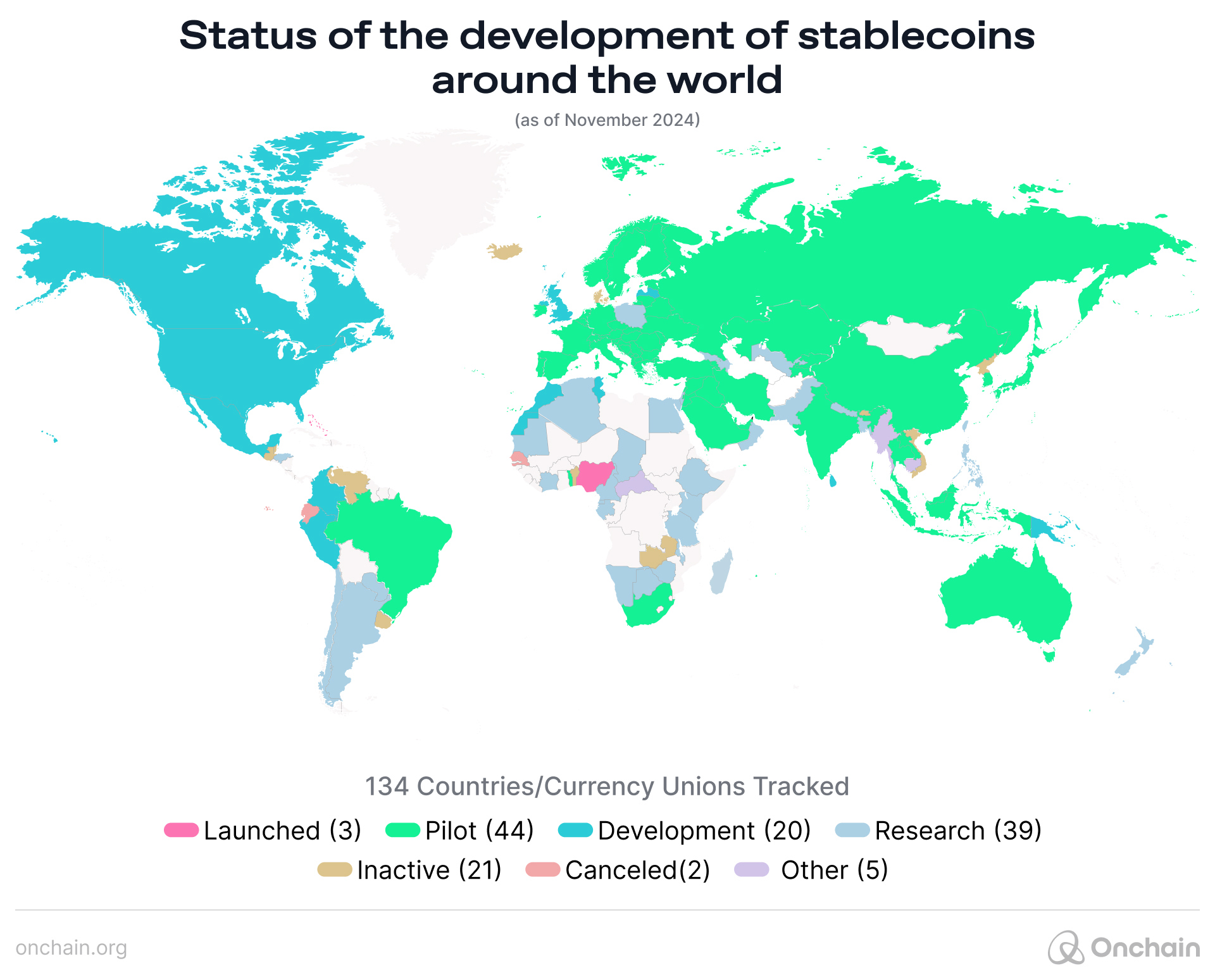

On the other hand, governments run CBDCs. That is the key distinction between stablecoins and CBDCs. Only Jamaica, Nigeria, and the Bahamas have fully launched a CBDC. These countries are currently focused on increasing domestic retail use of their CBDCs.

Many other CBDC projects are in various stages of development:

Many critics point out that these CBDC projects could lead to financial exclusion, not financial inclusion. These CBDC projects would give governments increased ability to both monitor and censor your transactions, potentially based solely on your social credit score.

Financial censorship isn’t limited to China and other countries with low financial freedom scores. North American examples include the Canadian trucker protest and Operation Chokepoint 2.0. Across the pond, debanking complaints in the UK number in the thousands.

Those wary of CBDCs see them as an Orwellian fiat-and-blockchain Frankenstein that would make debanking and financial exclusion effortless. In North Carolina, CBDCs are already banned and anti-CBDC sentiment in the European parliament is on the rise. At the national level, there are many pro-crypto members of the U.S. Congress who simultaneously oppose CBDCs.

Digital financial inclusion via stablecoins and CBDCs

For millions of people, USD-pegged stablecoins have been a blockchain-enabled lifeline. This is particularly true for those who live in countries with high inflation and capital controls on USD. The proven real-world use cases for stablecoins are undeniable. As for CBDCs, opinions are divided.

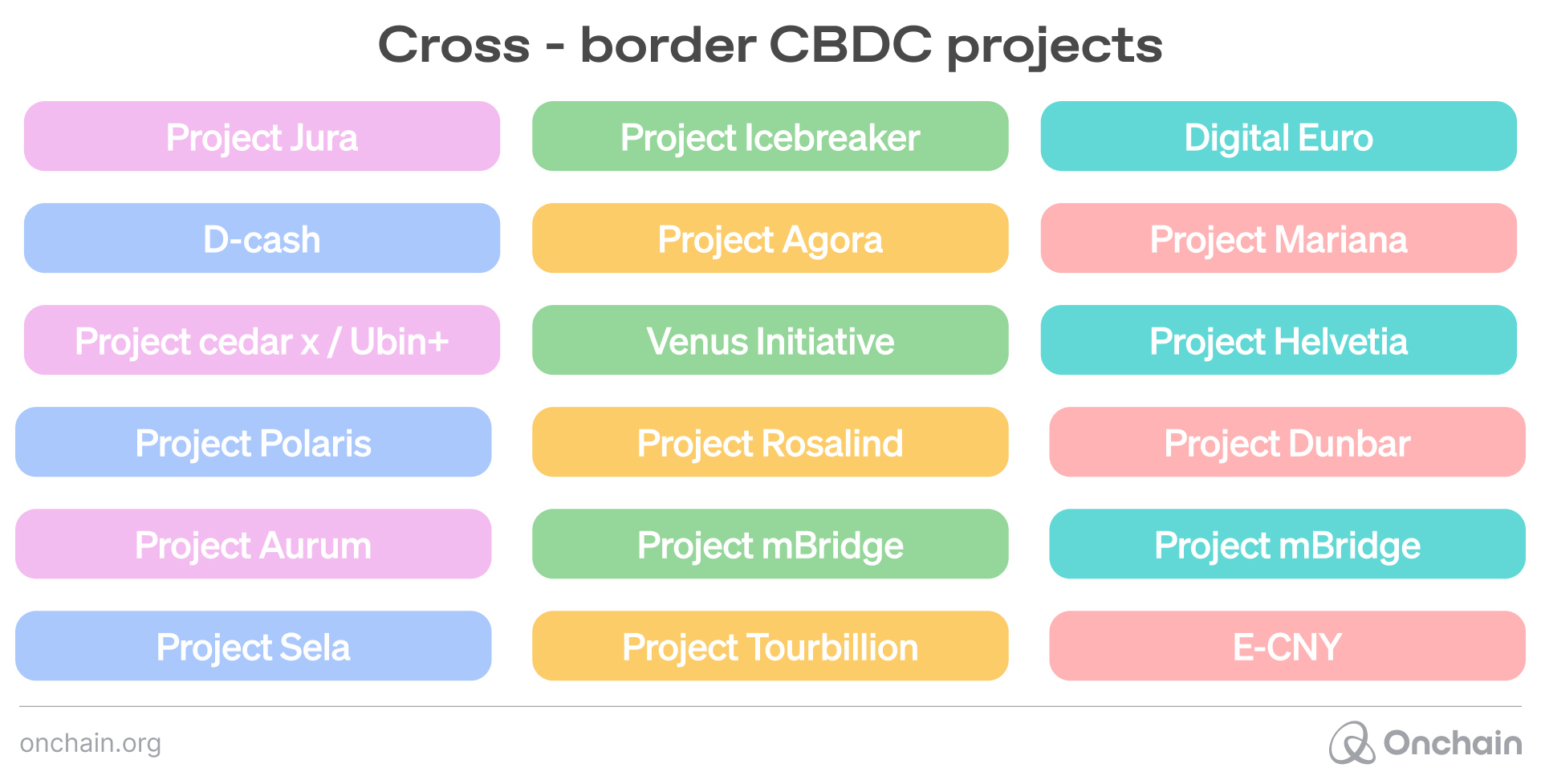

The CBDCs that have been fully rolled out are focused on domestic — not international — transactions. This is puzzling as cross-border payments seem like a better use case for adoption.

If these CBDCs still suffer from significant inflation, that is also a problem. Turning a fiat currency into a CBDC won’t fix monetary debasement. Lastly, a CBDC requires the trust of the issuing authority — your government. Are you willing to put your trust in a centralized CBDC?

Global digital finance in 2025: Stablecoins and crypto

Crypto tokens pegged to USD and other currencies seem inevitable. The unresolved questions for global payments innovation hide in the details — and the control of these assets.

- Will USD stablecoins continue to dominate? Or will other currencies gobble up stablecoin market share?

- Will CBDCs see additional national releases? Or will concerned citizens and legislators seek to ban them?

- How will MiCA affect stablecoin usage in Europe? Will EUR-pegged stablecoins flourish? Or will stablecoin projects leave Europe due to regulatory hurdles?

- Will major stablecoin projects like Tether and Circle be the new payment juggernauts? Or will Visa, Mastercard, PayPal, and other payment providers launch competitive stablecoin alternatives?

To answer that question, take a look at the next article in the Track, which breaks down just how stablecoin and crypto payments can work for founders across transactions via crypto debit cards.