DePIN businesses push the decentralized concept out of the pure digital realm into the physical world. With a decentralized physical infrastructure network (DePIN), projects can connect real-world services to the decentralized digital world and integrate crypto naturally into regular businesses.

This way, decentralized physical infrastructures could form the basis for a wide variety of onchain and even offchain businesses. In this article, we’ll look at how DePIN projects make money and what characterizes their business models. We’ll also glimpse at the competitive landscape beyond Web3.

If you want to dig down to the core of the subject and understand the details of how DePIN businesses work, study our recent research report: DePIN Brings Real-World Business Opportunities for Web3.

How does DePIN work?

Networks seem like the magic potion for businesses in the 2020s. Everything runs on, involves, or expands into a network – typically of data. Networks require infrastructure—in other words, hardware devices that collect, process, and transport data.

In traditional businesses, the company that runs the network either owns the infrastructure or uses a centralized infrastructure provider who controls it. Not so in the decentralized business model. Individuals or organizations make their devices available to perform a specific service in return for compensation in the form of crypto tokens.

Let’s take a very trivial example, shall we? Any weather forecast provider derives data from a huge network. Everyone from logistics to construction, agriculture, and event planners trusts the information’s accuracy. Even you turn to weather network data when you plan your next vacation.

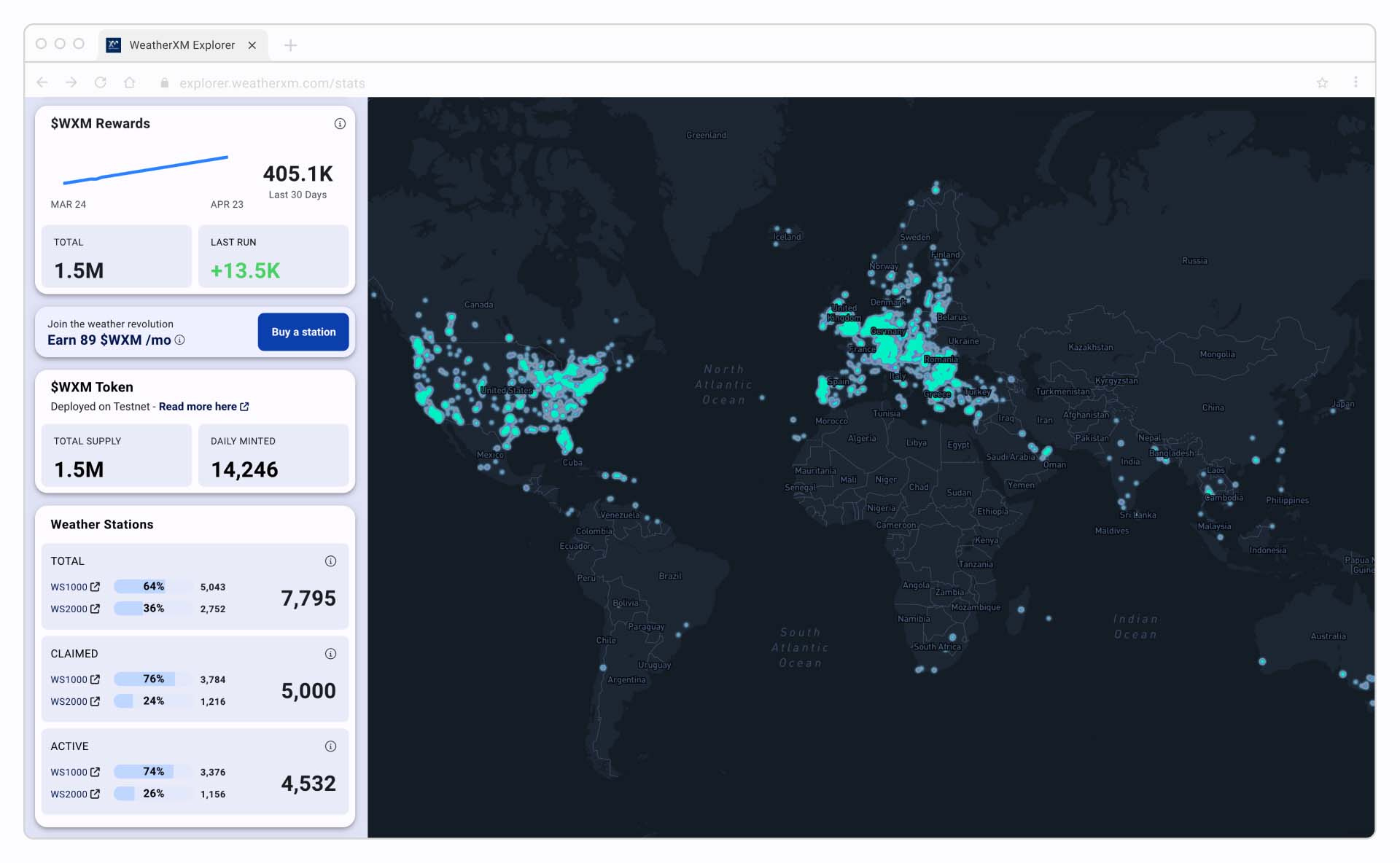

In a decentralized physical network infrastructure, the weather stations measuring temperature and humidity function as a community. Each member feeds data into the network, which becomes available to the community and can be offered to others in need. Why didn’t we think of this before, right? It’s so simple, cost-effective, and beneficial to everyone! Well, quick-acting entrepreneurs have started turning the idea into business. Some are successful and show excellent potential to keep expanding. (And in case you were wondering, yes, a decentralized weather network also exists: WeatherXM.)

The question is, will the success last, and can DePIN businesses break the monopolies of powerful networks that won’t willingly give up control and ownership of their networks?

Could DePIN realistically replace traditional network infrastructures and keep its promise to emerging markets? This would be a huge step towards Web3 and away from the centralized Web2 concept.

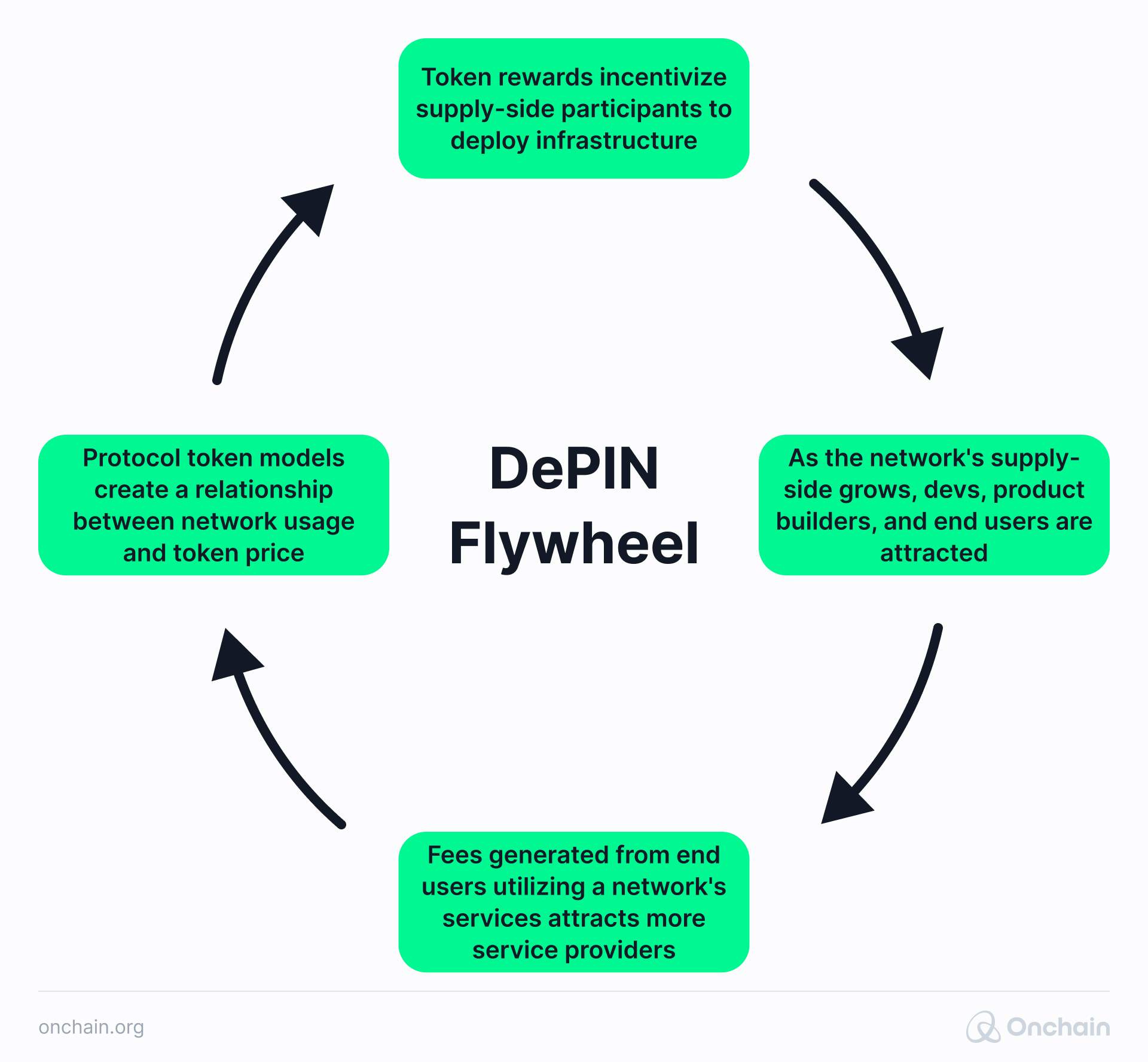

So, let’s start by exploring how DePIN projects make money and how individuals and SMBs can make money from DePIN projects. The DePIN flywheel explains the business dynamics of a decentralized physical infrastructure network.

What are the DePIN business models that fuel the flywheel?

The secret is to keep the DePIN flywheel turning perpetually without spinning out of balance. The concept devolves on a delicate balance between the demand and the supply side. Projects need to add ‘fuel’ at the right time and in the right amount in the right place. In business terms, it needs to generate steady revenue.

Most existing DePINs use Web3-typical methods of commission and transaction fees. Many rely on token value appreciation.

Both these methods are Web3 native and tailored to the speculative nature of the crypto world. It’s questionable whether they are sufficient for businesses that aim at a wider market.

But DePIN entrepreneurs are getting smart. In this case, smart means ‘less revolutionary’. Rather than rejecting everything that reminds them of Web2, they realize that tricks that work online may also work onchain. After all, business is business.

How do DePIN projects make money? Six examples

Our report discovered eight main revenue streams used by DePIN Web3 projects. We’ll share some of them and illustrate them with examples.

Four examples of Web3-typical DePIN business approaches:

1. Transaction fees/commission: deducting a percentage or amount from transactions or a commission on a service.

Example:

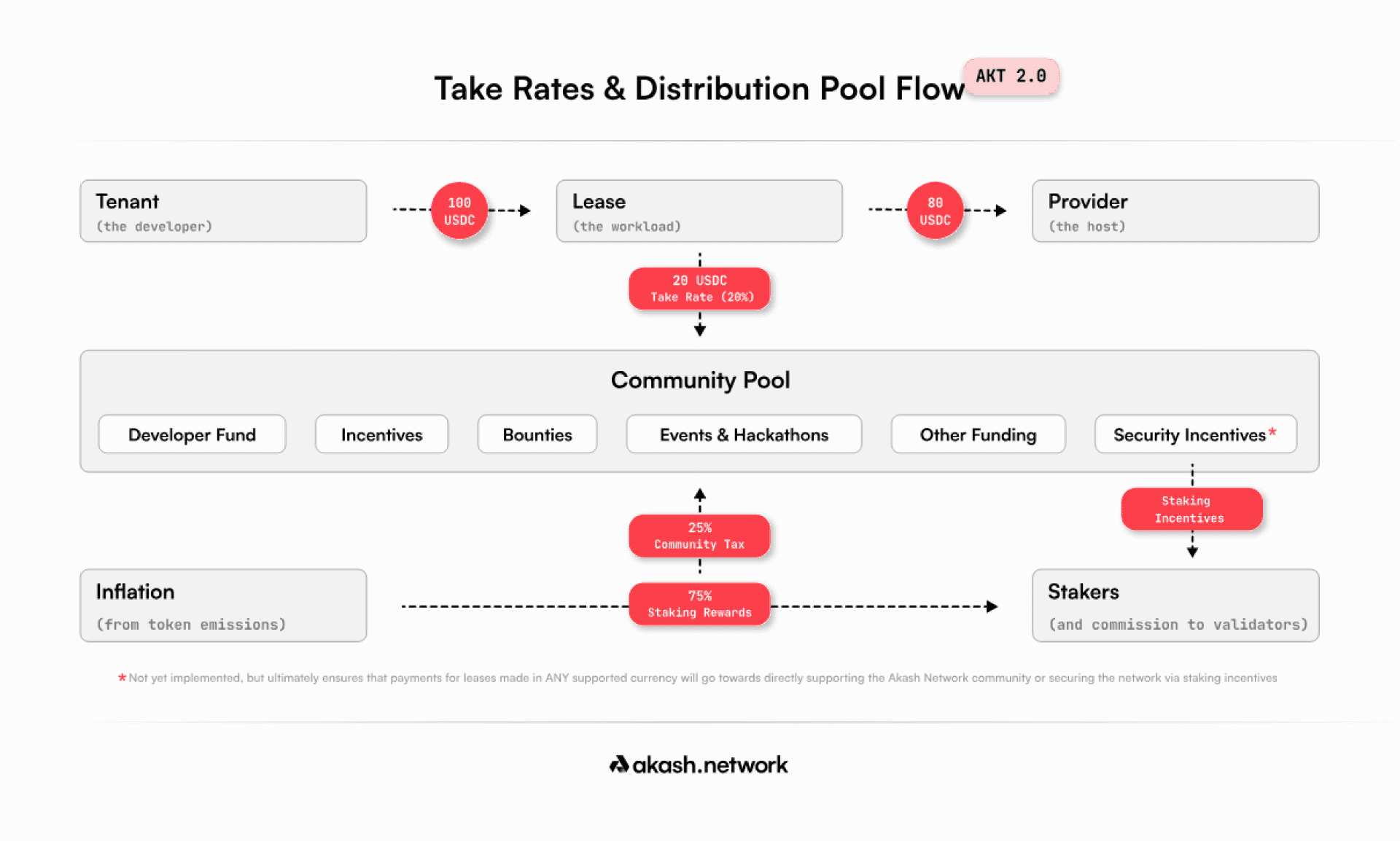

Akash is the prime example of a decentralized computing DePIN with remarkable success. The project uses an Airbnb-like concept for data centers. Participants can lend unused computing power to others in need and collect rewards.

Their business model is Web3-typical, although a bit more complex than most others. The company’s revenue comes from transaction fees charged on the lease, which are deposited into the community pool.

2. Token value appreciation: projects keep a token reserve and earn on value increase.

Example:

DIMO is a network of drivers for drivers. The project monetizes vehicle data and rewards user contributions with token incentives. DIMO generated revenue by allocating $224M worth of DIMO tokens to the initial team. This resulted in 500% growth over the entire 2023.

3. Upfront payment/hardware: a one-time fee or selling hardware required to become part of the network.

Examples:

Hivemapper builds the infrastructure network for its decentralized app to manage and operate transportation and mobility. Users pay in cryptocurrency to acquire the dedicated dashcam to collect and upload data to the network.

DIMO sells the sensors necessary to collect the data for its operation.

4. API access/onchain data selling: offering API integration and data for sale.

Example:

Hivemapper is the decentralized version of Google Maps. The DePIN sells map image APIs and grants access to street-level imagery from around the globe to insurance companies and similar customers. Pricing is calculated per road kilometer per week.

Two DePIN business examples borrowed from Web2

5. Enterprise/governmental integration is relevant for services that address the basic needs of the population, such as access to a wireless network or affordable energy.

Example:

PowerLedger, a decentralized energy trading network, integrates with E-NEXT by Energie Steiermark (an Austrian energy company), Feníe Energía (a Spanish energy company), and the Government of Uttar Pradesh (a state in northern India), among other organizations.

Our report found this to be the most promising revenue stream for the majority of DePIN businesses. The decentralized network places itself right in the core and creates interdependency. The DePIN becomes an integral part of the entity that provides essential services to the population.

Less common but promising for apps targeting individual users is this revenue model:

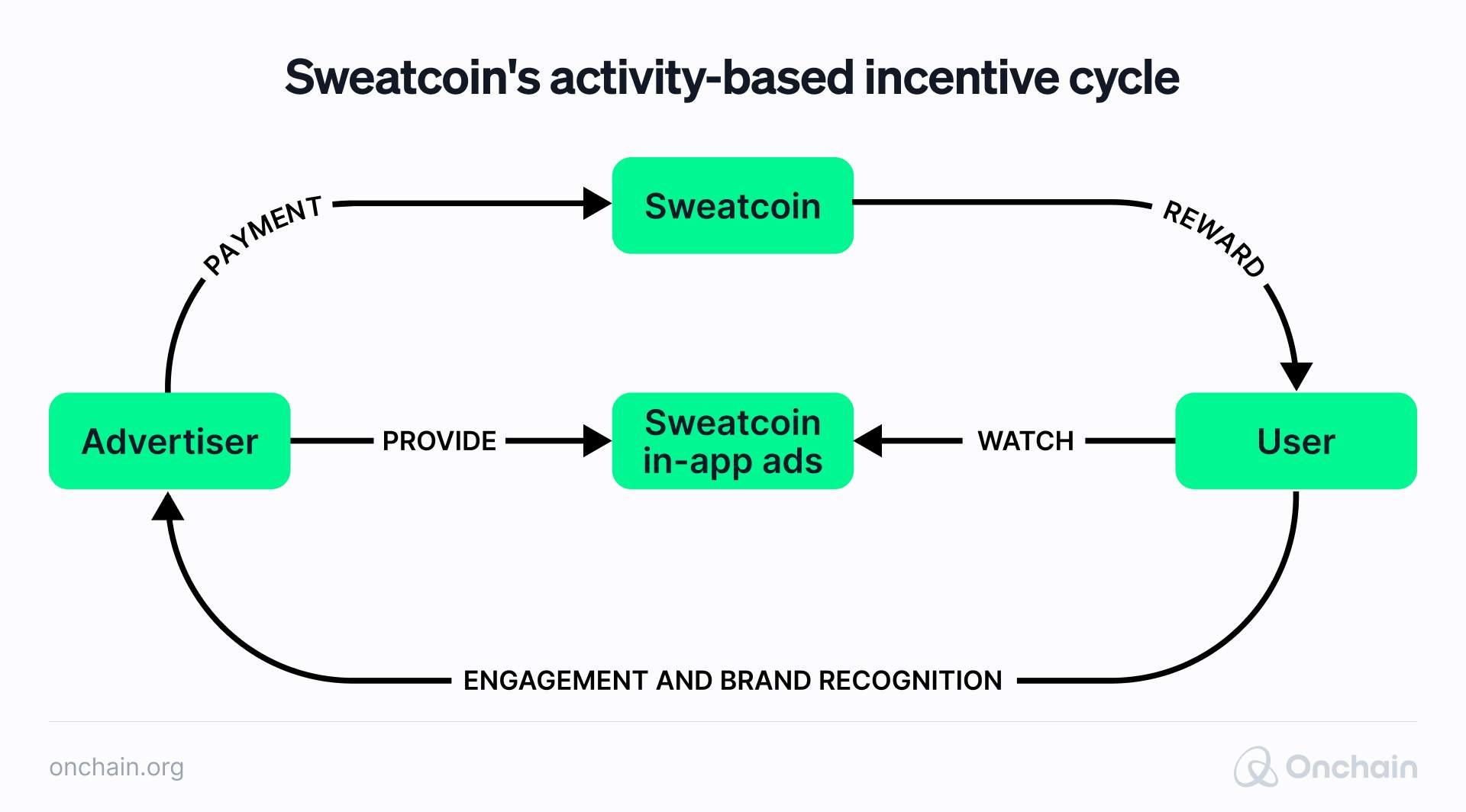

6. In-app advertising/brand affiliation: offering advertising space for sale and connecting affiliates who receive result-based rewards.

Example:

Sweatcoin is a decentralized sensor network monitoring a person’s physical activity and rewarding them for improvement. Advertisers can place ads inside the app. There’s also a program that allows users to earn when they bring new users.

If you paid close attention, you noticed that several projects were mentioned more than once. Decentralized businesses seldom rely on a single revenue stream. Multiple concepts enables them to attract a wider audience of users, maximize earnings generated from each user, and cultivate their loyalty.

How do individuals make money on DePIN?

The entire decentralized network idea is possible only if individuals are willing to contribute. So, the reward must be worth the effort. The obvious way is by offering crypto tokens per contribution.

This looks different in the various types of DePIN businesses:

- Decentralized computing – receive tokens equivalent to computing power

- Decentralized data storage – receive tokens for data storage space

- Decentralized wireless network – receive tokens when your hotspot is accessed

- Decentralized sensor network – receive tokens for data provided by a sensor

- Decentralized energy trading – receive tokens for unused energy

To make contributing more attractive, projects offer additional incentives.

Filecoin, a data storage network, offers discounts on the use of the platform. With DIMO, top contributors can benefit from features such as private location tracking, vehicle health diagnostics, virtual glovebox, and privacy-protected GPS.

Such an approach can be very helpful when the app’s token offers little utility or at the beginning of a project’s journey.

Sweatcoin promotes itself as a health app that helps users improve their well-being. The app also offers ways to donate to humanitarian, environmental, and animal preservation causes.

You see, money isn’t everything. Many individual contributors are driven by more ideological motivation. The possibility to make a social or environmental impact is often a strong incentive.

Power Ledger and other decentralized energy networks trade exclusively in clean energy. Every individual selling their extra solar or wind energy contributes to a cleaner global environment.

There’s something good in it for everyone. Then what could stand in the way of DePINs convincing the masses? Well, it’s time to look around and evaluate the neighborhood.

A novel business model – but can DePIN compete?

I’m glad you asked! It’s the key question you should be asking at this point. To answer it, you need to look at the supply side—the consumer demanding whatever the network provides.

There’s no question that the demand for the services offered by DePINs exists. However, for most, there are also sufficient traditional suppliers.

Decentralized computing & storage, map services, VPNs, video streaming, and energy suppliers face severe competition. DePINs that offer a specialized solution or a unique concept face less competition from the Web2 space.

The truth is that decentralized solutions have distinct advantages. Their success may depend on how well DePIN business owners and influencers communicate them. Here’s what our report reveals:

- Lower prices: The most basic and frequent competitive advantage offered by DePIN projects is significantly lower prices for services, particularly computing and data storage services. For example, Akash charges 75% less than AWS. With the growing need for computing power due to the increased use of AI, DePIN’s advantage could become more significant in the near future.

- Token rewards for end users: Token earnings are unique to the DePIN app design. They deliver speculative but real value, which non-Web3 apps can’t offer. The more useful the tokens, the stronger the incentive.

- Data ownership and privacy: Global concern regarding these issues is growing, adding to the competitiveness of privacy-oriented Web3 applications. In this area, Web3 apps are superior due to the immutability of blockchain data.

Our report has more on the competitive advantages over Web2 businesses and also the unique advantages the more successful DePINs offer over their competitors.

You can convince some of the people some of the time….

But convincing everyone all the time is a completely different expectation. Let’s assume ambitious DePIN entrepreneurs manage to launch and market their projects effectively and enter the real-world market. It’s probably just a matter of time.

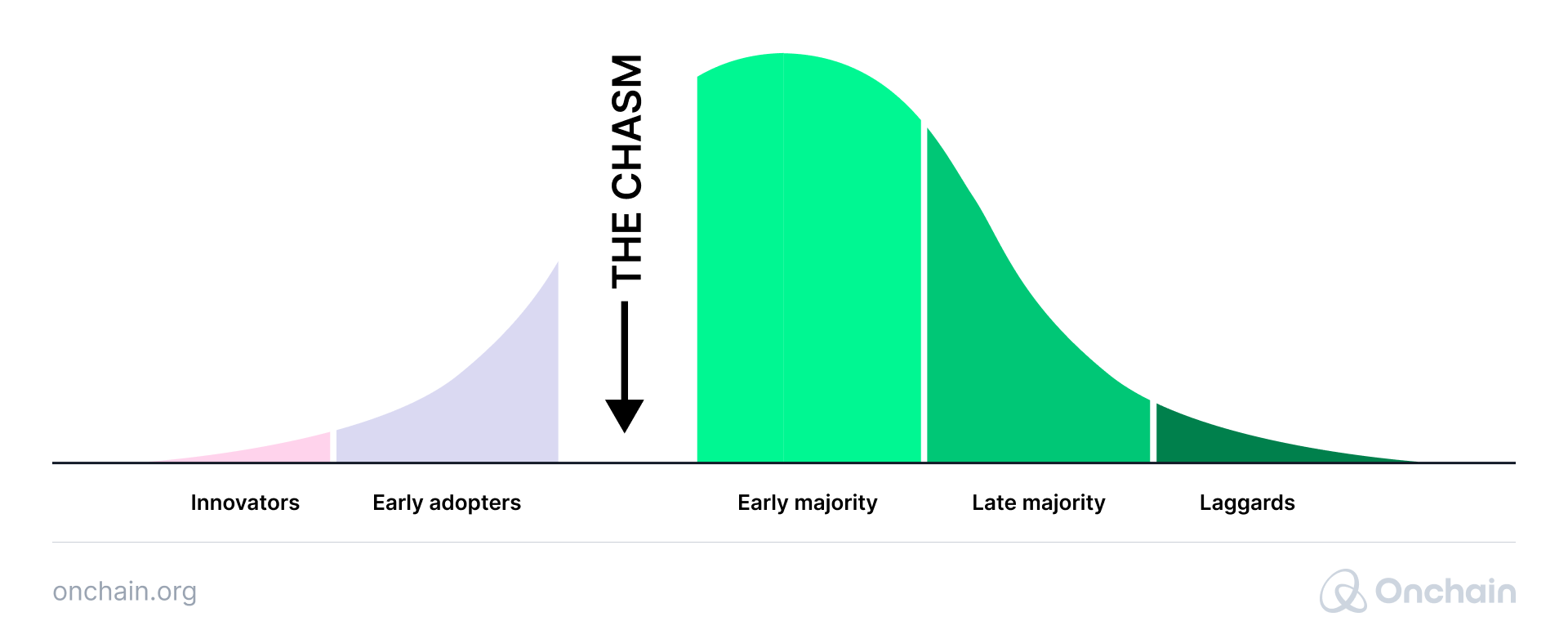

There’s yet another factor to consider – an inevitable challenge every disruptive technology faces. The marketing classic “Crossing the Chasm” explains what it takes to market and sell disruptive products to the mainstream market. It identifies a gap between early adoption success and mass adoption.

Early adopters are an audience of adventurous tech enthusiasts who enjoy trying out new things. You can convince them with relative ease. The masses, on the other hand, are reluctant to turn their backs on conventional technology, especially if it may compromise convenience and familiar routine use.

Every groundbreaking technology needs to bridge the gap that follows early adoption to reach the masses. This often requires a completely different approach and possibly amendments to the technology itself.

DePIN businesses have their work cut out; let’s get started!

There’s much work to be done, but it’s possible. If implemented properly and managed efficiently, the DePIN business could break out of the Web3 bubble and disrupt the current Web2 imbalance of superpowers.

Find out more about the specific DePIN business models, how they can be optimized, and how the individual projects compete in the Web3 and general markets. Read the Onchain research report on DePIN now.