Many say the global crypto ecosystem is being held back by blockchain compliance issues. Across the globe, both anti- and pro-blockchain laws and regulations are continually being proposed, debated, and then passed — or rejected. Even worse, many of these laws are later changed, rescinded, or reinterpreted via the courts.

It doesn’t sound like a friendly business environment, does it?

There is a great deal of uncertainty and confusion among the general populace, blockchain regulators, and politicians. This has created hesitation and concern among Web3 founders and entrepreneurs who want to build innovative crypto projects while adhering to various Web3 regulations.

Read on to get a breakdown of the latest blockchain regulations, their effects on blockchain entrepreneurship, and the various philosophical approaches to Web3 regulation.

Evolving approaches to global blockchain compliance

Blockchain laws and regulations vary widely by country. You have the “ban everything” approach of China. You have other countries with few, if any, regulations. Ideally, you’re building your company in a region with relatively clear Web3 regulations.

If you are already confused about crypto compliance, you’re in good company. Philosophically speaking, you can see a couple of broad approaches to enacting blockchain laws and regulations.

On one Web3 side, you have countries that handle new industries and sectors with an initial hands-off approach to enacting new restrictions. This approach allows dynamic founders to build, grow, thrive, and innovate — without being held back by their governments.

Then, over time, regulators and policymakers slowly enact modest and sensible regulations to prevent an “anything goes” business environment. This is largely embodied in the patient U.S. approach to regulating social media, AI, and most newer technologies.

However, many would say the United States deviated from this approach when regulating crypto, drones, and some other emerging technologies. Trump has pivoted the conversation by taking a decidedly pro-crypto stance that was largely absent during his first term.

On the other side of Web3, you have the hypercautious “ban it and then decide later” approach that is far more common.

Both Bolivia and Bangladesh banned cryptocurrencies in 2014. While Bangladesh and several other countries still have blanket bans on crypto, Bolivia recently rescinded its crypto ban. We’re seeing a similar regulatory change of heart and warming to the crypto industry from Kenya, Hong Kong, and numerous other countries.

How will jurisdictions approach blockchain regulations in 2025?

For some regions, clear blockchain regulations are already in the books, and they are changing the business calculus of crypto heavyweights and startups alike. Some are moving their headquarters to leverage the benefits of a stable legal environment.

Others are moving out of their headquarters in search of crypto-friendly jurisdictions that have less onerous blockchain compliance requirements. Let’s examine some differing approaches to Web3 regulation.

U.S. blockchain regulation: then and now

The United States is home to a number of huge crypto projects, several major crypto exchanges, and a large number of crypto investors. Many have suffered the antagonistic approach to crypto by various U.S. federal agencies.

Outside of the crypto EFT approvals in 2024, not much progress was made on the regulatory front in the past several years.

- The Commodity Futures Trading Commission (CFTC) has filed questionable suits against Gemini, Binance, KuCoin, Tether, and others.

- The Federal Deposit Insurance Corporation (FDIC) was involved in a secret debanking operation of the crypto industry dubbed Operation Chokepoint 2.0.

- The Gary Gensler-led U.S. Securities and Exchange Commission (SEC) has drawn the most anger from the American crypto community. They have systematically attacked the crypto industry and initiated more than 100 lawsuits in the last four years.

In 2025, U.S. agencies are far more friendly to the domestic crypto market. To start, the new Trump administration has appointed a Cryptocurrency Czar and a pro-crypto SEC chair. He also banned the FDIC from a crypto working group and issued an executive order against the establishment of a U.S. central bank digital currency (CBDC).

There is also talk of future crypto ETF approvals, tax savings for crypto investors, and the upgrade of BTC ETFs to allow for in-kind BTC redemptions.

EU blockchain laws and regulations

The European Union (EU) has been working on its Markets in Crypto-Assets (MiCA) since 2020. Released in stages, the entire MiCA framework went into effect on December 30th, 2024.

It creates separate categories for various token types. It has two categories for tokens that reference another asset’s price. This would include stablecoins pegged to fiat currencies and commodities, as well as other tokenized offerings. The other category is utility tokens, which applies to most other assets.

In January 2026, even stricter measures will go into effect. Crypto service providers will have to record the names of all senders and receivers of crypto transactions. In addition, self-hosted wallets with over $1,000 EUR will need to go through an ownership verification process.

One point worth mentioning is that MiCA doesn’t require EU member states to enact national legislation. However, states that enact separate blockchain compliance rules must make sure their legislation aligns with MiCA. This should ensure compatible blockchain regulations throughout the Eurozone.

Proponents will tell you all these EU measures provide regulatory clarity, protect investors, and mitigate money laundering activities. There is also a regulatory sandbox that allows entrepreneurs to test their products in a transparent, controlled, and legal manner.

Critics will counter that these rules are prohibitively expensive, stifle innovation, and run counter to crypto values like trustlessness, privacy, and free exchange. MiCA is already having an effect, with crypto exchanges operating in Europe having already delisted stablecoins and liquid-staked tokens (LSTs) to comply with these new rules. Some critics say that Europe leads in regulating groundbreaking innovations developed elsewhere.

Web3 regulation in Asia and other regions

In Asia, legislators are increasingly accepting crypto.

- While China has banned crypto, Hong Kong has established a regulatory framework for crypto ETFs, crypto exchanges, and related services.

- South Korea is a hotbed of retail crypto trading activity and is cracking down on fraudulent exchanges and crypto scams.

- Japan is contemplating simultaneously loosening and tightening aspects of its blockchain compliance rulebook.

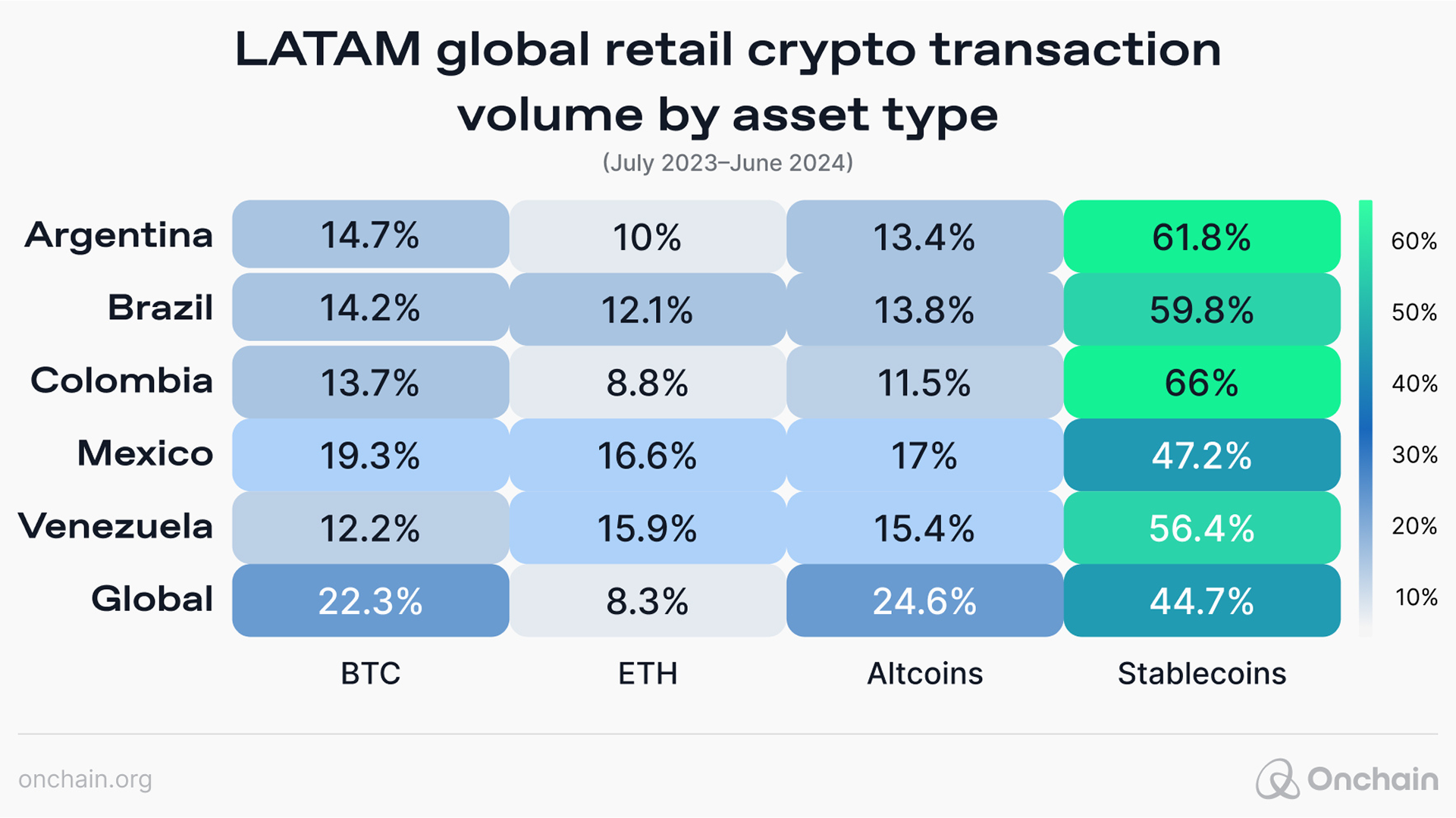

In Latin America (LATAM), stablecoin usage is thriving as a real-world medium of exchange and remittance option. Yet, LATAM countries are taking diverging approaches to their citizens’ use of crypto.

- Argentina is becoming increasingly open to crypto.

- Brazil is proposing a 2025 ban on stablecoin transfers to self-custodial wallets.

Blockchain entrepreneurship and Web3 regulations

If you’re an aspiring crypto founder or have an idea for a startup, finding a country with friendly blockchain regulations is key. Let’s give you a quick rundown of the pros and cons of offchain rules for the onchain world.

Positives of blockchain regulation include:

- Increased institutional adoption: Clear operational and compliance frameworks allow institutions to gain exposure to digital assets through crypto ETFs, offer real-world asset (RWA) tokenization, and much more.

- Crypto consumer protections: From insolvent crypto exchanges to collapsing tokens, these new laws are designed to protect investors from catastrophic and preventable financial losses. This is promising for crypto investors/users and the entrepreneurs who want to provide them with services.

- Clear rules for entrepreneurs: Many well-intentioned blockchain entrepreneurs existed in a legal gray area with little guidance on what was permitted. These newly enacted blockchain laws and regulations allow them to create without worrying about receiving massive fines, facing business license revocation, or even getting locked up.

- Web industry legitimacy: Some think of this sector as a Web3 wild west where anything goes. This sentiment is changing as the industry is gaining widespread acceptance. This warming to the industry is partly attributed to new blockchain compliance frameworks.

Negative aspects of Web3 regulation include:

- Burdensome compliance costs: High financial costs and legal requirements create barriers for small companies and aspiring entrepreneurs. With these new regulations, some innovative ideas may be too costly to bring to market. Many crypto companies changed countries to survive or simply closed their doors.

- Constraints on innovation and experimentation: Certain regulations ban entire processes, tokens, or crypto products. While regulatory sandboxes mitigate this negative impact to a point, other rules take innovation off the table from the onset.

- Cross-border rules: Countries impose different Web3 regulations but no viable agreements and compromises among them. This makes international transactions and blockchain integrations difficult.

Will countries with stricter laws compel companies in other countries to comply with their laws? How can a global company comply with different countries’ conflicting laws? These questions remain unanswered.

Recommendations and trends for blockchain entrepreneurship

With a plethora of new blockchain regulations hitting the books in 2024 and early 2025, blockchain entrepreneurship may return in a big way. Business opportunities abound and include opportunities in AI, stablecoins, and numerous other crypto sectors.

One of the most difficult choices you’ll have to make is deciding where to build your blockchain business. Many recommend the United States, Dubai, Singapore, and Switzerland. With the MiCA legislation now in full effect, some builders are taking a second look at the EU in general.

MiCA certainly gives businesses and entrepreneurs regulatory clarity. However, many crypto firms say they lack the resources to comply and that the financial downsides are too costly. The recent USDT delistings could be an ominous sign of further trouble.

I personally think the blockchain is like the internet: a global technology that works best with few cross-border impediments. You should make your Web3 business idea a reality outside the EU zone, especially if you’re a smaller startup with less capital for compliance costs.

But, don’t only take my word for it. Get a second opinion on where to build Web3 companies.

Read why Onchain Foundation’s President Max Kordek thinks we’re entering A Golden Era for Crypto.