I applied for a Stripe Atlas account and got rejected. Our interest rates are high and our currency volatile. Since 2014 the Kazakhstani Tenge dropped ⅔ against the US dollar. A friend lost $300.000 on corruption – and didn’t even get to start his business. That’s the Kazakhstan challenge.“

My friend Beck was not ready for that, so he and his wife moved to Vietnam, where he could easily start and run his own business. But migration isn’t a viable solution for all.

How might blockchain and Real-World Assets (RWA) make a difference?

Of the nine applications we discuss in our latest report on RWAs in emerging markets, we selected three for a reality check.

Read on for a glimpse into our findings on the impact of stablecoins, decentralized physical network infrastructure (DePIN), and private credit.

What are emerging markets?

Emerging markets are at the crossroads of frontier and developed markets and show strong economic growth.

As such, they are attractive to investors looking for high returns and business opportunities.

What are the challenges of emerging markets?

But these investment opportunities generally come at a cost: the exploitation of cheap labor.

The wealthy benefit, but workers have little chance to save, access capital, or start a profitable business. And so they have no chance of escaping poverty – a perpetual cycle.

Those who do escape have to deal with other challenges. High currency risks, underdeveloped infrastructure and, as if that were not enough, corruption, to name a few.

But a great challenge often masks a great opportunity: an opportunity for borderless solutions to break the cycle of poverty.

Emerging market opportunities

The borderless solutions – you guessed it – are RWAs stored on a distributed ledger.

In fact, people in emerging markets are embracing RWAs. This is especially true when, in some drastic cases such as Nigeria, economic survival depends on it. But more on that later.

Before we dive deeper, let’s take a look at the inherent characteristics of blockchain, which are addressing the barriers to growth.

How blockchain can help emerging markets

- Decentralization: Improves access to financial services by reducing reliance on fragile institutions.

- Transparency: Builds trust in transactions, essential in regions with weak legal frameworks.

- Security: Protects against fraud and addresses the challenges of corruption.

- Immutability: Ensures transaction integrity, providing a stable foundation for economic activities.

- Efficiency: Reduces costs and accelerates operations, critical in resource-constrained environments.

Real-World Assets for emerging markets

RWAs are tangible or physical assets. When you tokenize and store these on a blockchain, they adopt the above mentioned characteristics. And because blockchains know no borders, their inherent economies open the doors to a global marketplace.

Sounds almost too good to be true? For some blockchain use cases, it almost is. Let’s take a closer look at their impact and limitations, starting with stablecoins.

Stablecoin stories from emerging markets

Cheap, instant, global transactions and access to an alternative financial system. That – and financial inclusion – is what you get when you peg tokens to a “hard” FIAT currency and back them with offchain assets.

Stablecoins are changing lives – in Nigeria, for example.

Nigerians escape inflation with stablecoins

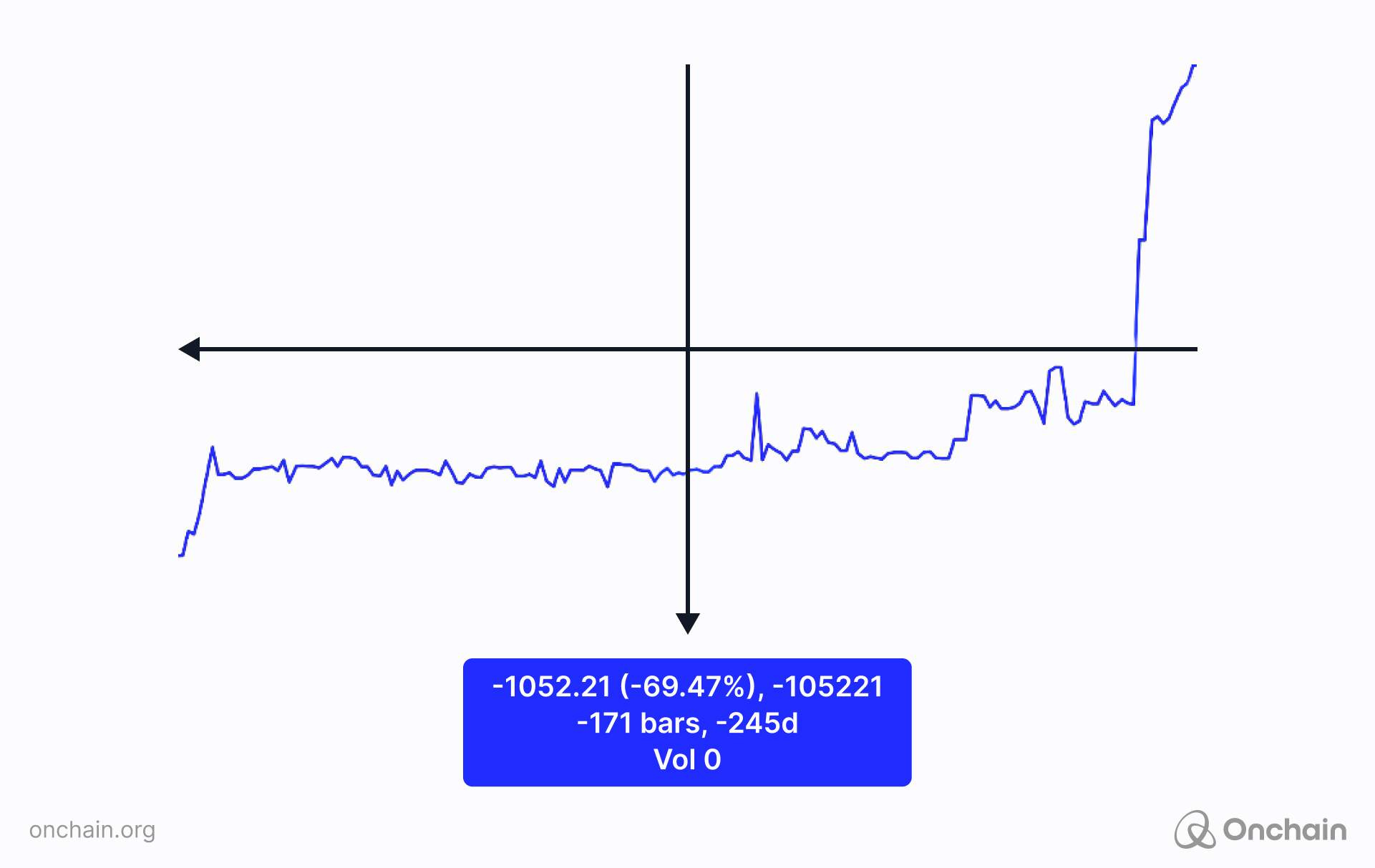

While the Kazakh Tenge fell ⅔ against the US dollar in 10 years, the Nigerian Naira did the same in 9 months.

Nigeria is home to over 230 million people, of whom those who had savings in domestic cash lost 70% of their purchasing power. Anyone without a 200% salary boost faces the same loss.

In Web3 jargon, you call this a rug pull. And if the Nigerian Naira were a cryptocurrency, it’d be history’s most significant.

To protect themselves, some Nigerians turned to harder assets. For them, stablecoins pegged to the US dollar mean the difference between financial exclusion and inclusion.

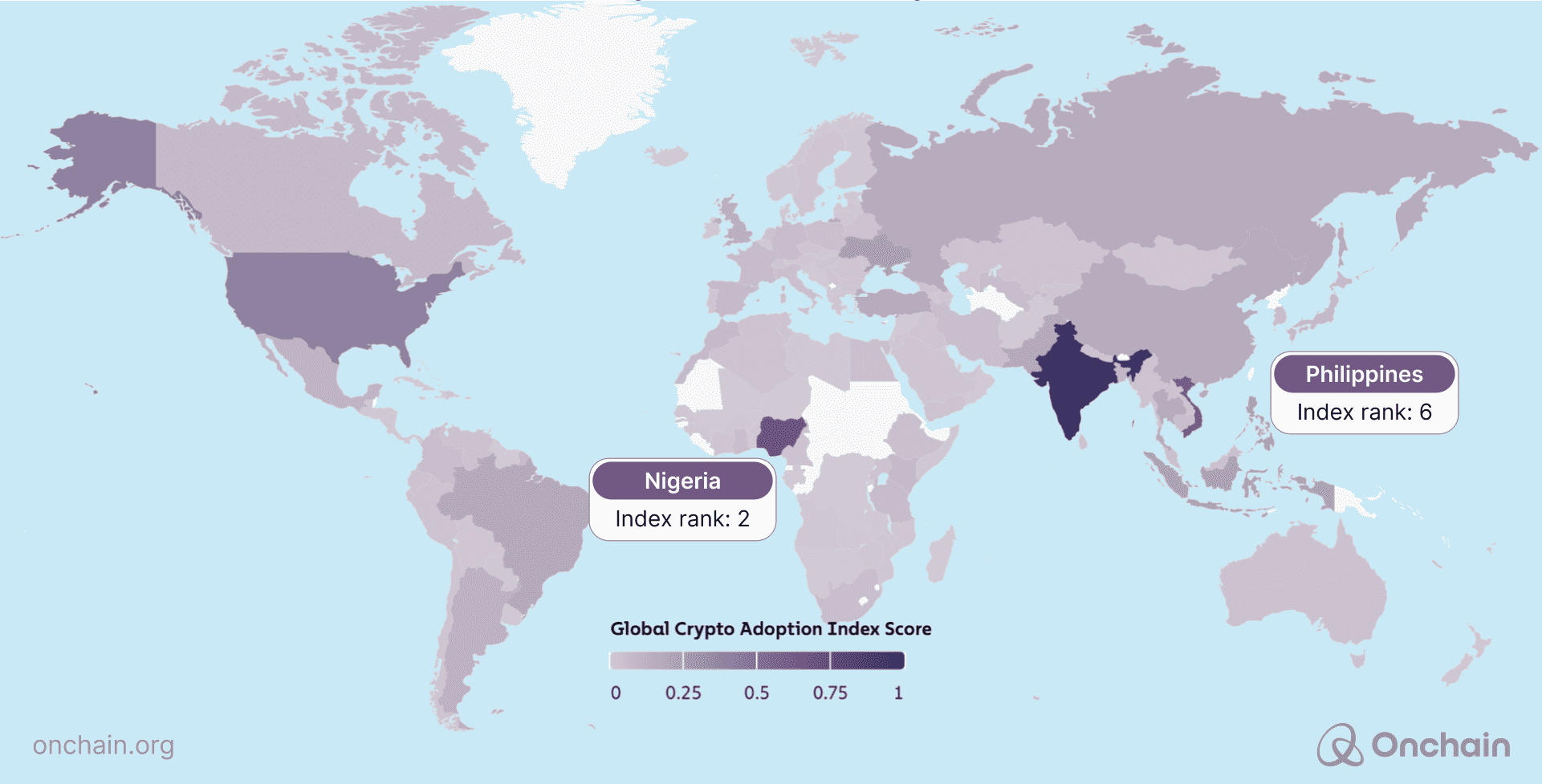

Nigeria ranks second on Chainalysis 2023 Global Crypto Adoption Index.

Filipinos escape remittance fees with stablecoins

Deploying more capital – steady lads.

The Philippines is the number one country in labor exportation. Almost 2 million overseas Filipino workers account for 8.5% of the Philippines’ GDP in 2023.

The constant inflow of foreign money keeps the Philippine Peso’s exchange rate stable, so Filipinos cannot fight inflation with stablecoins.

Instead, they could save money that gets lost to remittance fees: $1.5B or 0.35% of the Philippine GDP in 2023. That year, $33.5B went through banks, with an average transaction cost of 4.5%.

Remittances received through stablecoin transactions are not included in these figures reported by the Philippine News Agency.

Stablecoin transactions are available for less than 1¢.

The Philippines ranks sixth on the Global Crypto Adoption Index.

The limits of stablecoins

The Philippines is a young, tech-savvy nation. Unfortunately, the critical internet connection is holding back the potential of blockchain adoption.

This article itself is a testament to overcoming such infrastructure challenges. SpaceX’s Starlink saved the day when local infrastructure failed just before deadline.

DePIN — Decentralized physical network infrastructure

Blockchain offers an alternative to Elon Musk’s global but centralized internet provider. Helium incentivizes its users to create a global, decentralized wireless network.

Users can earn rewards for providing internet coverage. The result could make applications such as stablecoins even more accessible. Reduced poverty and increased growth follow.

No traction for critical DePIN projects in emerging markets

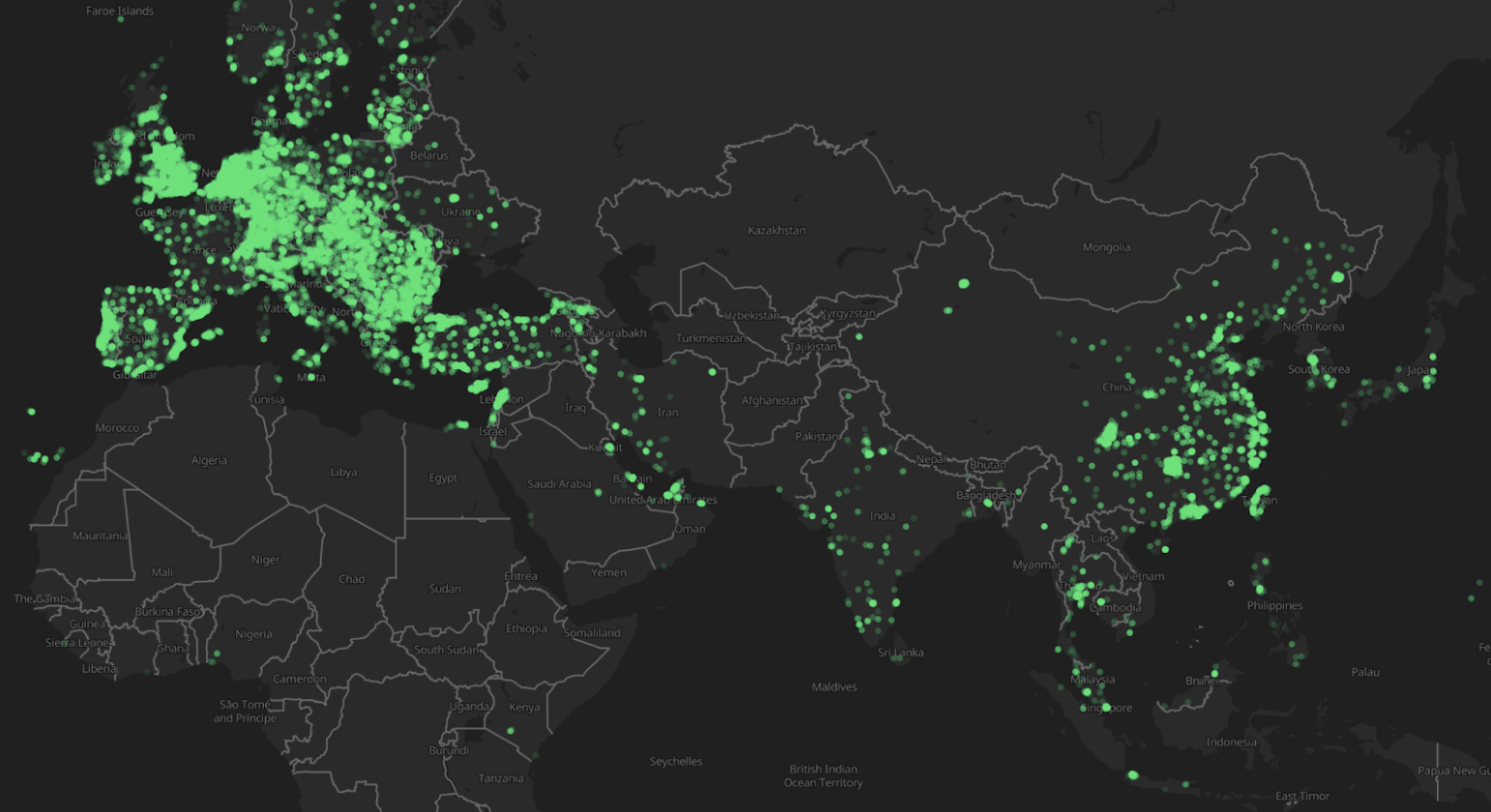

However, a look at the Helium Hotspot Map reveals a sobering truth: most of these innovative hotspots are in developed countries. Emerging markets like the Philippines stay thirsty for connectivity.

Other DePIN projects use blockchain to coordinate computing power (e.g., Render), storage (e.g., Filecoin), or sensor data (e.g., Hivemapper).

The potential is monumental. But the journey is fraught with challenges. DePIN projects rely on long-lasting network effects. Without these, they are prone to failure.

By early 2024, the only niches with substantial revenues are decentralized computing and talent networks.

Both are less relevant to emerging markets than a stable power grid, internet connectivity, or access to capital. Access to capital leads us to the next application: the tokenization of private credit.

Tokenization of private credit

Private credit, or lending by non-bank lenders, is an asset class with $1.5 trillion in assets under management globally. It has a high potential to stimulate economic growth, especially for small and medium-sized enterprises (SMEs) – a chance to break the cycle of poverty.

But SMEs are often left out by traditional lenders. Meanwhile, the tokenization of private credit promises a more fair, transparent and efficient financial landscape.

The promise of tokenized private credit

- Accessible loans.

- Low transaction costs.

- Surging entrepreneurial activity & economic development.

- The IMF reports that DeFi could offer annual savings of up to 12% compared to traditional lenders.

Tokenized private credit shows traction

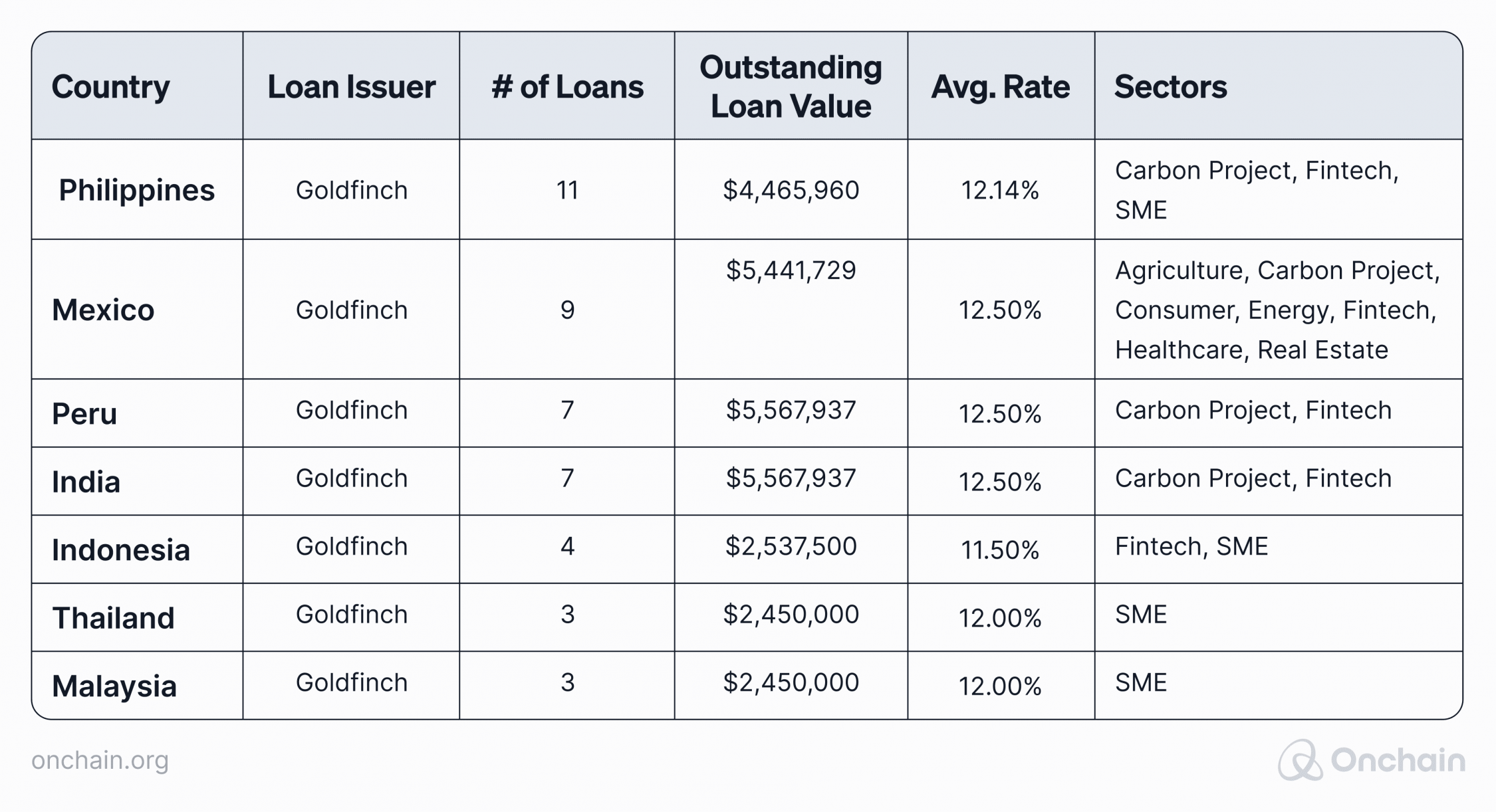

Goldfinch is an example of a decentralized lending protocol. The project has doubled its active loans every two months since its launch in early 2021. It enables crypto borrowing with offchain collateral.

The capital, over $100 million, accessed through Goldfinch, has now reached over a million people in over 20 countries. Such initiatives offer economic resilience in communities long marginalized by traditional financial systems.

The traction of tokenized private credit is promising. Active private loans on blockchains grew 133% to $581 million in 2023, according to RWA.xyz.

The majority of these loans benefit emerging markets.

Blockchain is being used for good — and good investment — in many segments of the RWA sector. Staying on theme with tokenizing expanding borders, use that arrow to move into an interview with T-Blocks founder Henri Ndreca to hear how RWAs have made real impact in the Balkans.