Ethereum ETFs go live

Following the lead of the Bitcoin ETFs, the ETFs for ether (ETH) witnessed eye-opening day one trading volume. Following in the footsteps of Bitcoin ETFs, these financial products now offer investors a fresh avenue to gain exposure to the world’s second-largest cryptocurrency.

After numerous regulatory delays, the launch of Ethereum’s ETH ETFs made their U.S. debut on July 23rd, 2024. This milestone follows the approval of Bitcoin ETFs earlier in the year, making Ethereum the next major cryptocurrency to be packaged in an ETF format for U.S. investors.

At time of writing, BTC has a market cap hovering around $1.1 trillion while ETH’s market cap is approximately one third of that at $310 billion. For context, if ETH were a stock, it’d be in the top 50 — beating out companies like Netflix (NFLX) and Coca-Cola (KO).

Ethereum ETF Options: A Closer Look

At debut, nine ETH ETF options were on offer. Let’s look at their fee structures:

0.12% starting fee, post-waiver fee of 0.25% (for 12 months or until $2.5 billion AUM)

0.00% starting fee, post-waiver fee of 0.25% (until 31/12/2024)

0.00% starting fee, post-waiver fee of 0.20% (for 6 months or until $0.5 billion AUM)

2.5% flat fee (ETHE is an ETF conversion of the Grayscale Ethereum Trust that predates the release of ETH ETFs)

0.00% starting fee, post-waiver fee of 0.15% (for 6 months or until $2 billion AUM)

0.00% starting fee, post-waiver fee of 0.21% (for 6 months or until $0.5 billion AUM)

0.00% starting fee, post-waiver fee of 0.20% (for 1 year or until $1.5 billion AUM)

0.25% flat fee

0.00% starting fee, post-waiver fee of 0.19% (until 31/01/2024 or until $10 billion AUM)

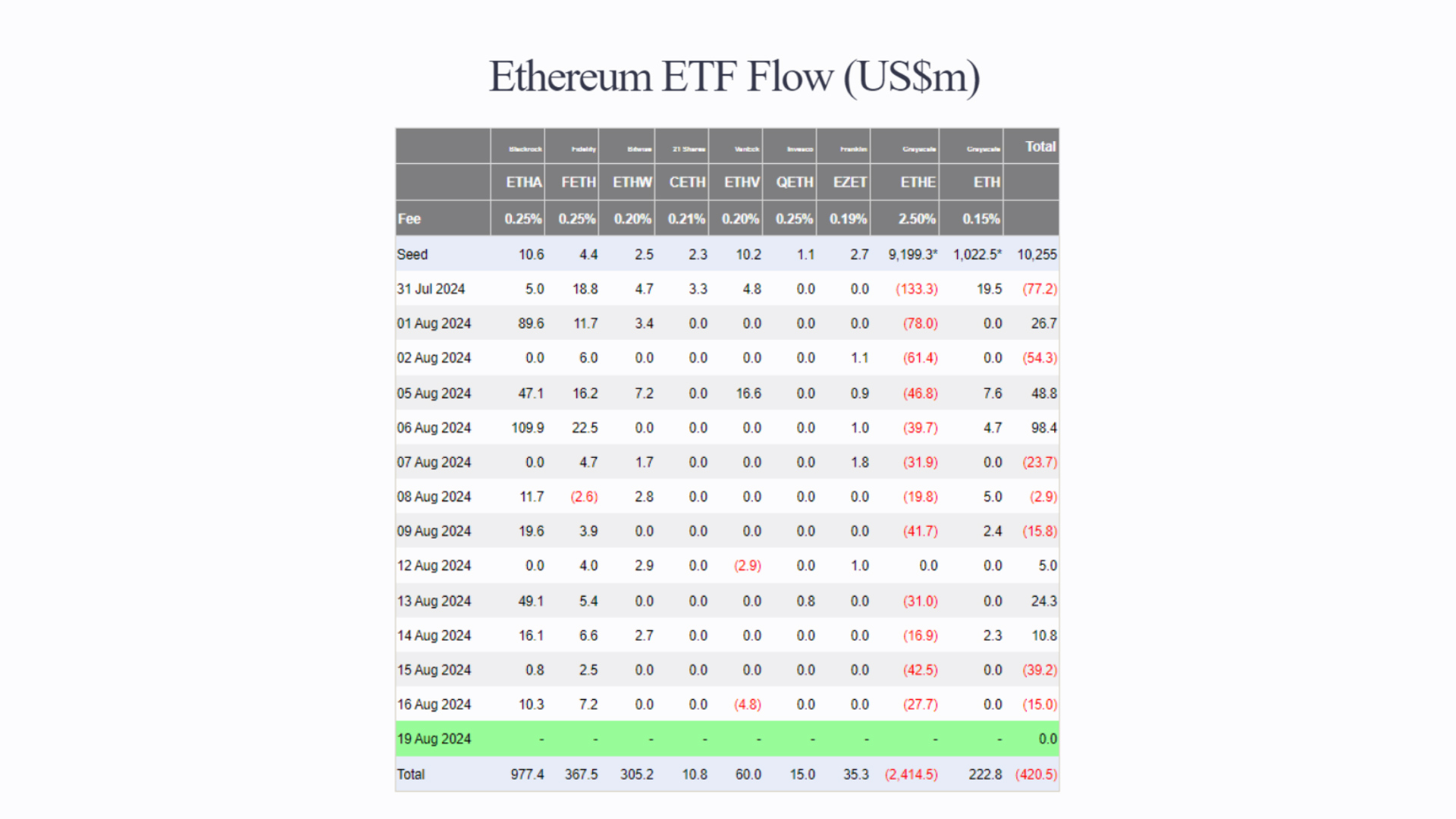

As seen above, the numerous ETH ETF options are competitively priced with many waving starting fees altogether. After a certain grace period or AUM (Asset Under Management) is reached, the initial discounted fee is changed to the regular — or post-waiver — fee. A couple of the funds charged a standard flat fee that doesn’t offer early investors a discount and remains constant throughout the life of the ETF.

Post-waiver fees hover between 0.15 – 0.25% with one exception, ETHE. Like their Bitcoin ETF GBTC, this Grayscale product was previously a trust and has had a significant impact on first-month ETH ETF trading inflows and outflows.

Unlike an ETF, this trust was initially available to only accredited and institutional investors. Without an Ethereum ETF available, many of these investors chose the trust as it allowed them to trade ETH trust shares using a regular brokerage account.

The Grayscale effect on early BTC/ETH ETF volumes

Before the release of ETH ETFs, the Grayscale Ethereum Trust had around $10 billion in AUM (equivalent to about 2.5% of the total ETH supply). This trust solved a pain point for institutional investors who wanted risk-mitigated and legally compliant ETH exposure.

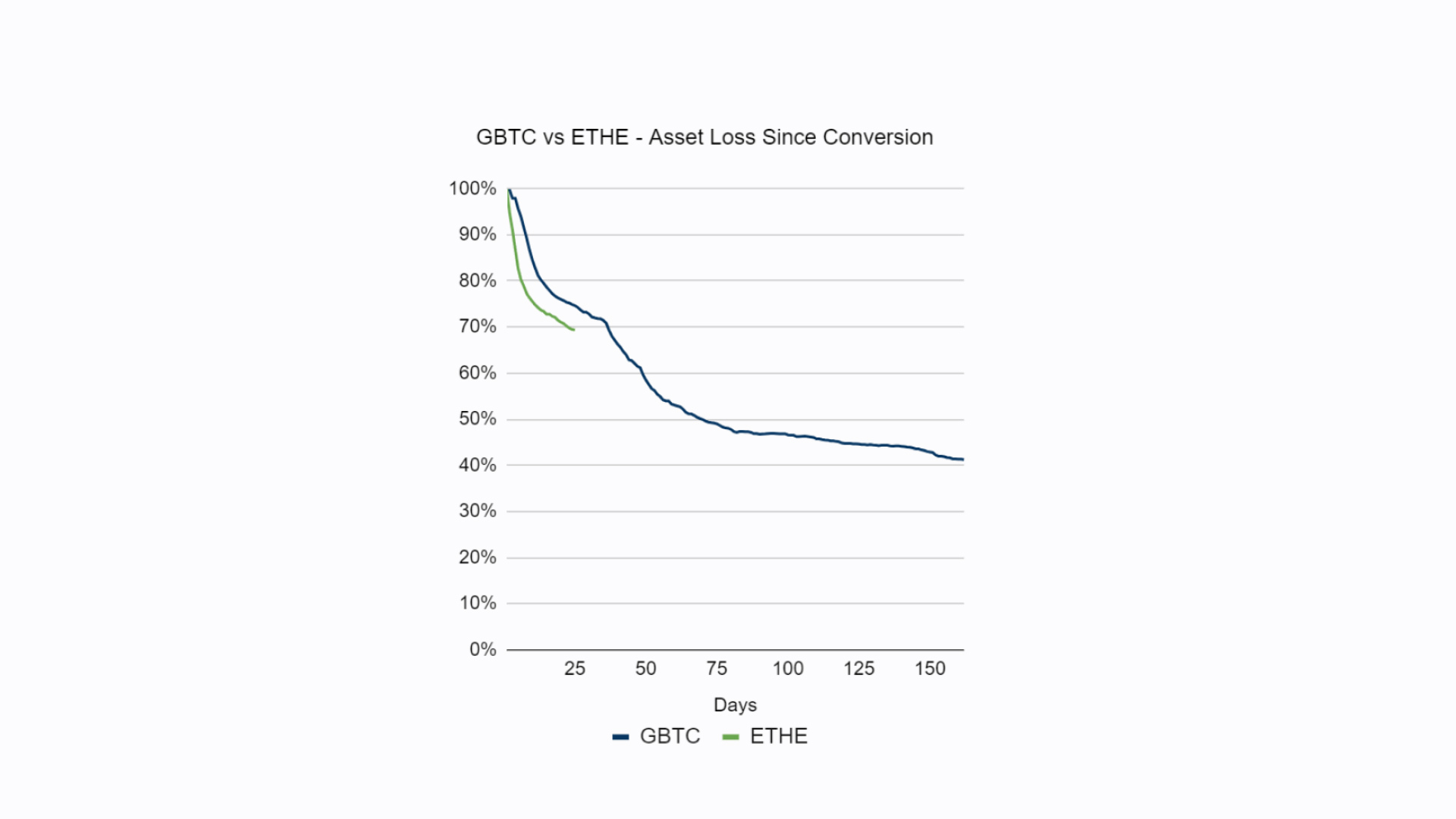

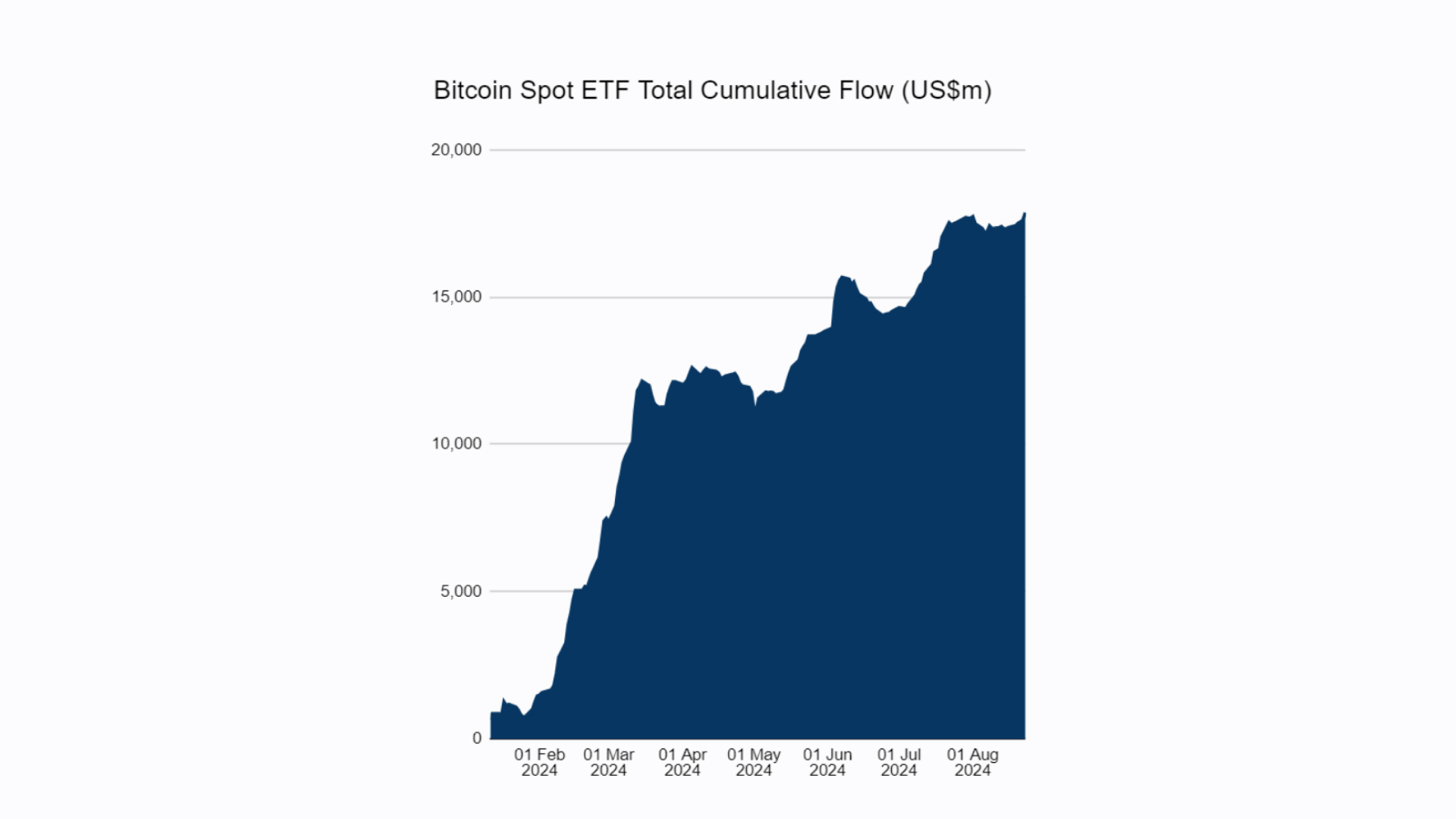

However, it also came with a substantial 2.5% fee. With the debut of lower fee options, many of these investors have exited for profit — or to competing offerings. This echoes the behavior of Grayscale BTC investors who left when lower-fee BTC ETF alternatives became available.

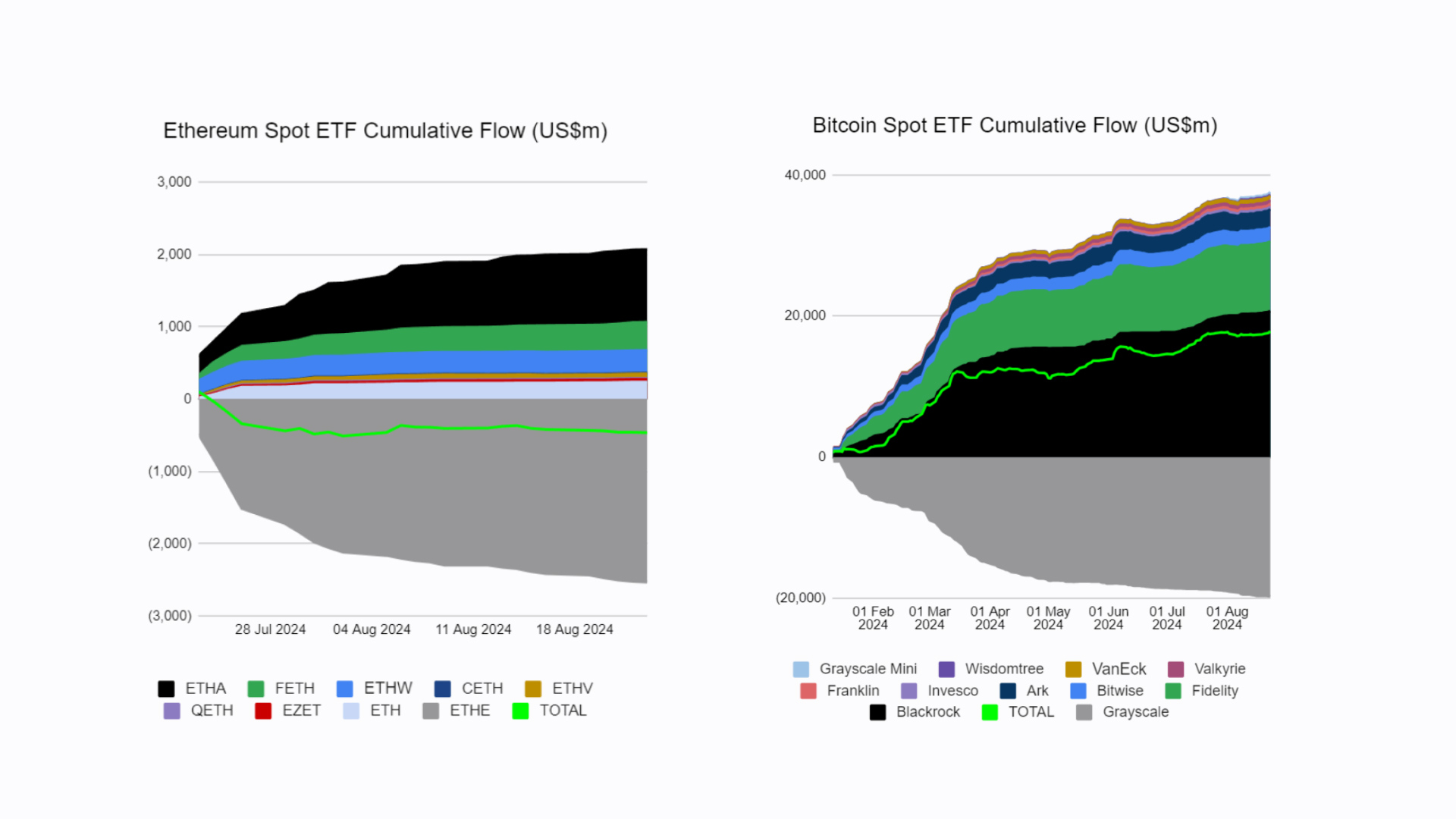

Despite launching during the summer when trading activity tends to be lower, ETH ETFs saw around $1.1 billion in opening day trading volume. This is nearly a fourth of the $4.6 billion in trading volume seen for BTC ETFs during their opening day.

While first-month inflows have been substantial, they have largely been offset by ETHE outflows. The three largest ETH ETFs have over $300 million in AUM, with ETHA alone approaching $1 billion in AUM.

Why an ETH ETF?

Many passionate crypto enthusiasts want projects like Bitcoin and Ethereum to largely replace banks, payment systems, and investing platforms found in traditional finance (TradFi). But even for those more skeptical investors, crypto ETFs promote a synergistic effect in the ever-growing onchain and DeFi world.

For starters, many speculate that crypto ETFs like the ETH ETF will have positive upward pressure on asset prices. Yet, these ETFs might also have significant downward price pressure due to crypto ETF outflows.

One primary benefit of this TradFi-friendly option is that crypto ETFs open up the alternative asset crypto ecosystem to investors and institutions who are more familiar — and comfortable — with ETFs.

Let’s compare the 20-year track record of gold ETFs with the nascent ETH ETF ecosystem to make an educated forecast on how ETFs can affect asset demand. Since U.S. gold ETFs launched in 2004, the price of gold has increased more than fourfold. Once Grayscale outflows subside, it is likely that Ethereum ETFs will attract sustained investment flows over the coming years.

The downsides of ETH ETFs

While ETFs are an investment vehicle that many are comfortable with, many crypto native ETH investors aren’t interested in ETH ETFs — and with good reason(s). First, many ETH holders use a crypto wallet and don’t want to pay a management fee — even a low one. This also allows them to maintain control over their ETH — no custodian required.

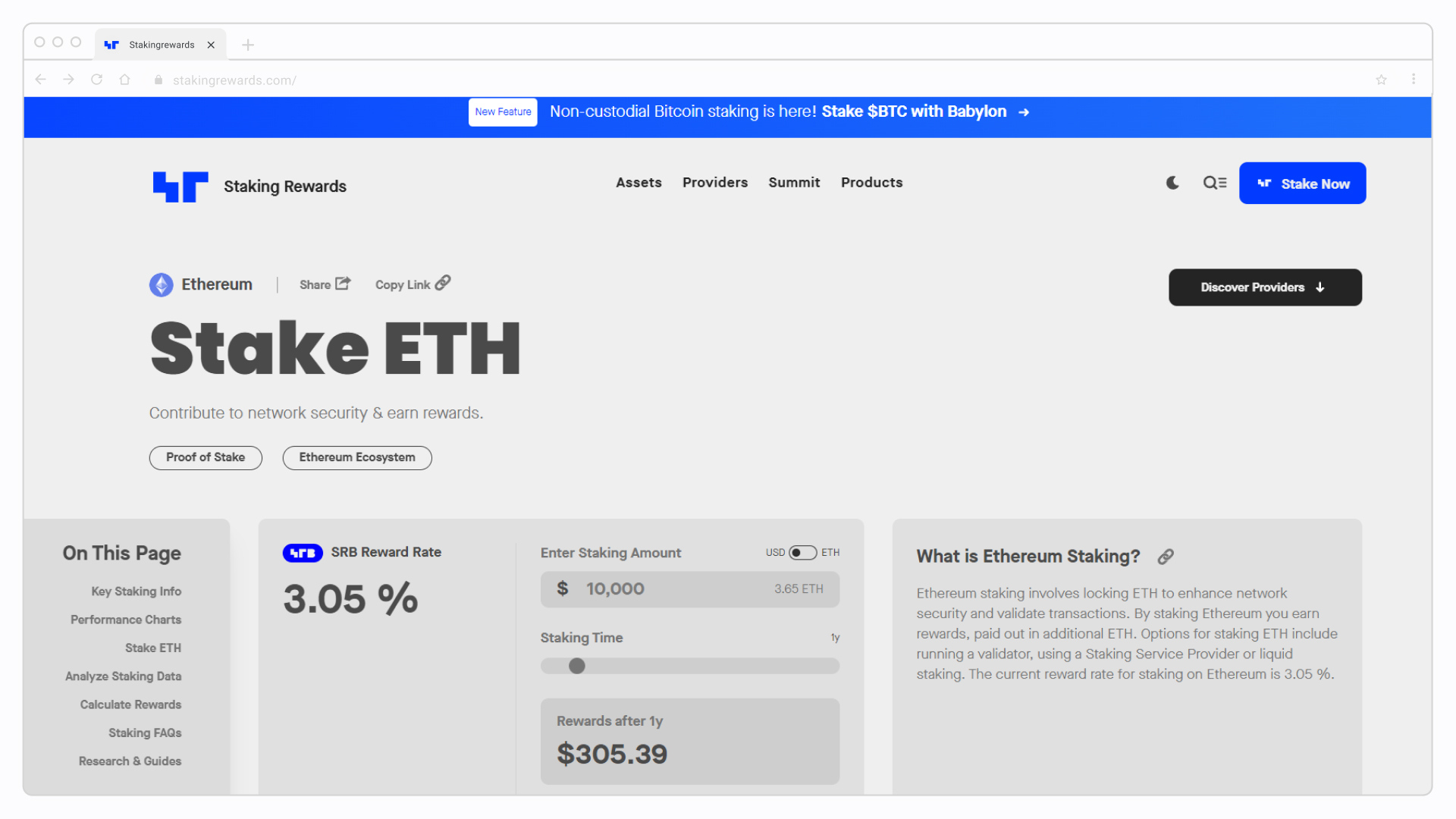

Perhaps most importantly, the ETH ETFs don’t offer staking rewards, a painful omission for those that want to maximize their returns. The annualized ETH staking rewards rate is currently over 3% — and can supercharge your returns in tandem with ostensible price appreciation.

If U.S. regulators warm to crypto ETFs, there is hope that Ethereum ETFs will eventually incorporate staking rewards. That being said, you may not want to count on a timely staking-friendly ETH ETF offering. The first U.S. spot Bitcoin ETF application was filed in 2013 — resulting in a decade-long approval process before they finally hit the market this year.

Traditional investors might also encounter limitations with Ethereum ETFs, such as the current absence of in-kind creation and redemption options, as well as the lack of available options trading. These factors could, for now, limit the appeal of Ethereum ETFs for certain segments of the market.

Are more crypto ETFs on the horizon?

With only a month of data, it’s too soon to determine how ETH ETFs will affect the price of ETH, BTC, and various other competing crypto assets. Many are speculating that future U.S. crypto ETFs will be joining the Wall Street party over the coming years. While an application for a hybrid BTC-and-ETH ETF is pending— and Brazil is expected to launch the first spot SOL ETF, the U.S. faces hurdles. Some experts suggest that Solana ETFs might only have a chance of approval in 2025, depending on changes in the White House and SEC administration.

Despite these short-term challenges, the release of other crypto ETFs (and ETPs, trusts, and other crypto investment vehicles) is expected to be only a matter of time. While there has been — and still is — some antipathy between the TradFi and DeFi camps, it’s hard not to notice the growing, but optional, interconnectedness between these two pecuniary realms.

We can now purchase DeFi assets in TradFi wrappers (like ETH ETFs) and TradFi assets in DeFi wrappers (like tokenized stocks and treasuries).

You yourself may have noticed the widening bridges between these formerly separate financial paradigms. One positive is that this will likely force U.S. regulators and politicians to embrace the burgeoning crypto ecosystem in good faith. Failure risks further reputational damage to themselves — and the legacy financial system that they claim to cherish and protect.