Company

RFS Consulting empowers organizations to navigate the complexities of Web3 and crypto. The company provides unparalleled risk intelligence, fostering growth and resilience for their clients.

Challenge

To remain relevant, RFS Consulting depends on regular exposure to timely, data-driven intelligence. The insights must consider emerging regulatory, technical, or market shifts that impact their clients and internal risk modeling. Building selectively customized data sets requires time, effort, and resources the firm prefers to invest in revenue-generating initiatives.

Solution

RFS Consulting Global partnered with Onchain to save time, reduce effort and utilize our resources. Onchain delivered three custom research products:

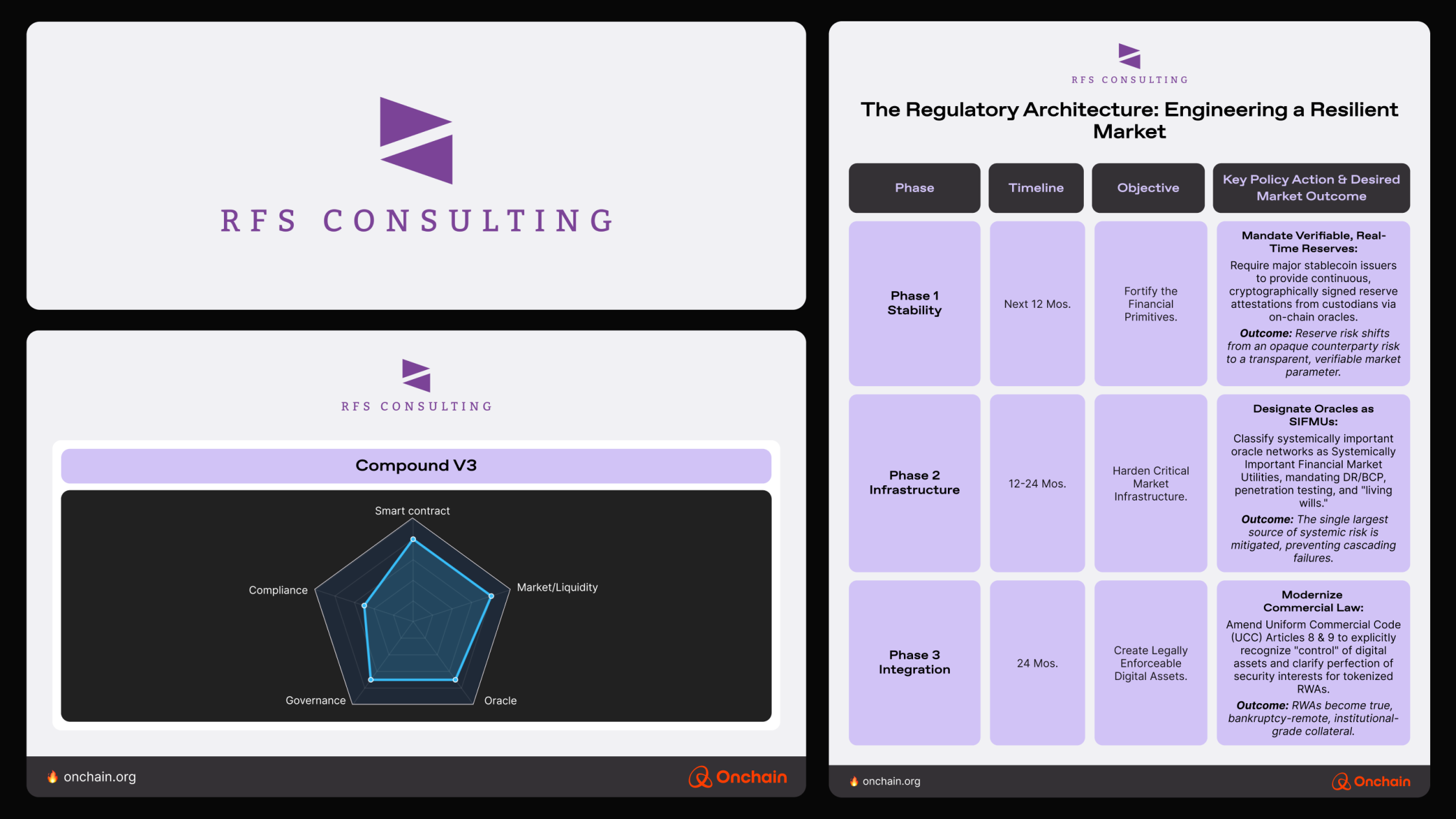

- A DeFi risk dashboard with protocol-level alerts and executive-ready visuals.

- A co-branded whitepaper focused on stablecoin oversight and liquidity benchmarking.

- A rapid turn-around research brief on DeFi risk & policy delivered in 72 hours.

Results

Driving client growth and market credibility

Onchain’s targeted research brief has become a cornerstone of RFS Consulting’s client acquisition strategy. The team uses it actively as a resource to engage and convert new leads. This positions RFS as an informed, forward-thinking advisor in the web3 compliance space.

Establishing thought leadership and attracting high-value clients

The whitepaper developed by Onchain has strengthened RFS’s reputation as a trusted authority in blockchain and digital asset compliance. It continues to attract revenue-heavy clients and has opened doors to strategic meetings with city municipalities exploring digital bond markets, as well as retirement entities evaluating tokenized treasury solutions.

Enhancing operational efficiency through integrated data systems

Onchain’s development of a custom risk compliance dashboard has significantly reduced RFS’s operational overhead. The company saves both time and internal hiring costs. By integrating data from RFS’s preferred partners, the dashboard delivers real-time insights that now inform client advisory recommendations. It creates a seamless and scalable experience for the RFS team.

Results link: RFS Consulting Whitepaper – Benchmarking DeFi Risk

“Onchain Foundation brings unmatched depth and clarity to institutional conversations around DeFi risk and policy. Their collaborative approach has been instrumental in shaping research and frameworks that our clients can trust. We’re proud to partner with Onchain in advancing responsible innovation across the digital asset ecosystem.”

– Robert M. Franklin III, Managing Partner, RFS Consulting