DePIN (decentralized physical infrastructure network) has been described as “the next frontier,” “a key narrative in the bull run,” and “a disruptive force in the crypto world.” So what is all the fuss about?

There is currently a general lack of knowledge out there regarding this exciting new technology. This article will put you on the right path to understanding how you can unlock the potential of DePIN for business.

Our report, DePIN Brings Real-World Opportunities for Web3, provides extensive and detailed insight into this exciting new world.

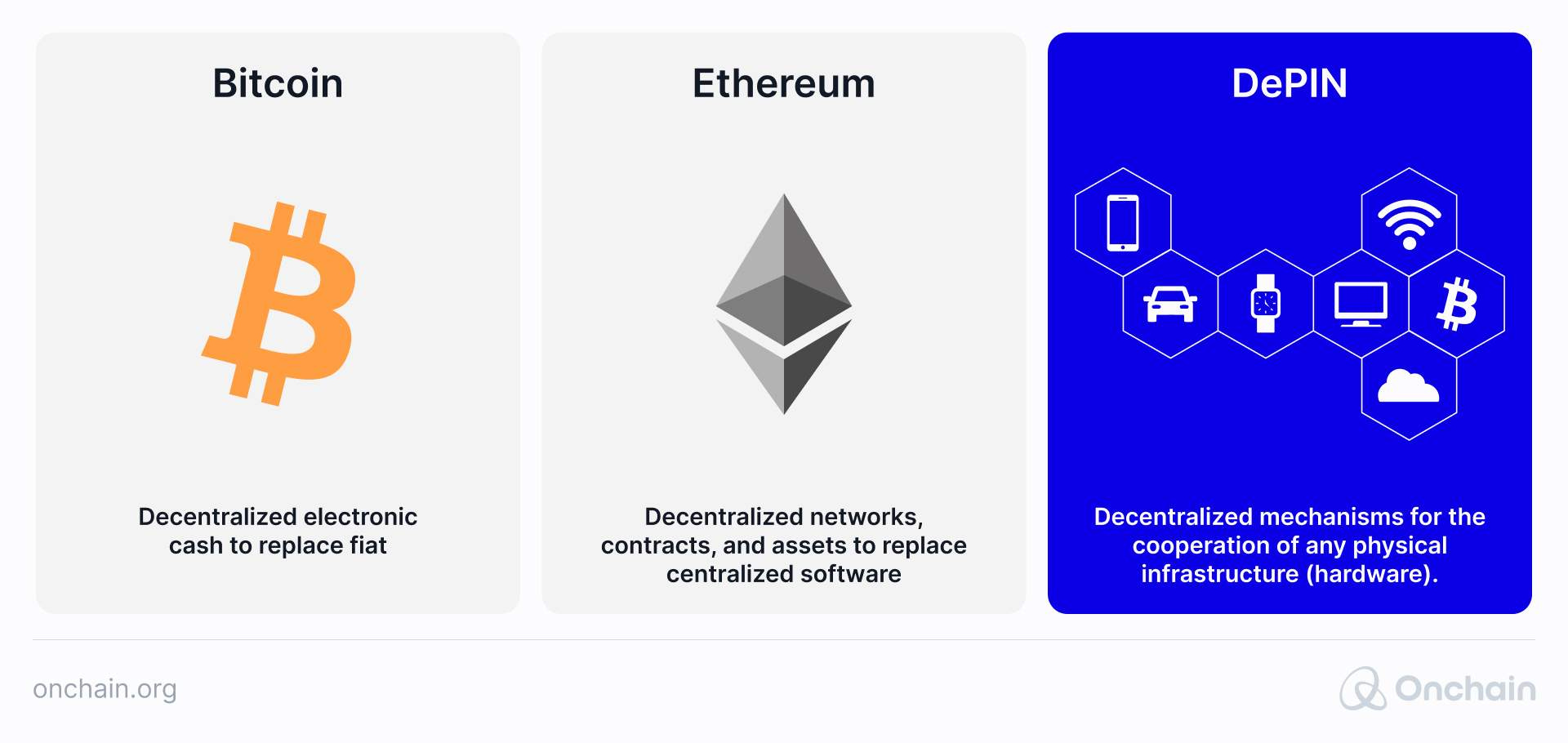

What is DePIN?

Let’s start by defining it simply:

DePIN is a blockchain protocol that decentralizes the management of physical network infrastructure, enticing participants with token-based rewards.

The beauty of DePIN is that it covers various infrastructure types, including data storage, wireless connectivity, computing, data collection, and energy.

Users are enticed with crypto token incentives to enter these P2P-style networks. This, in turn, facilitates the bootstrapping and maintenance of real-world infrastructure projects and services.

What are the advantages and challenges of DePIN?

Briefly, decentralized physical infrastructures offer numerous benefits, such as decentralized control, scalability, resilience, fair resource access, and sustainability, to name a few.

This concept aligns with the objectives of ReFi, where the goal is to create long-term financial sustainability through decentralized solutions.

However, hurdles such as regulations, scalability, and security pose challenges, especially in regulated industries such as telecommunications, hindering widespread adoption.

Now that we’ve explored the surface of this complex landscape, it’s time to unravel the intricacies, and lay out the full story.

DePIN narrative – why is it important?

Envision a world where the construction and maintenance of essential infrastructure such as roads, power grids, and communication networks are overseen not by centralized authorities but by a global community.

The DePIN narrative mixes Web3 with the physical world as a promising way to bridge real-world business with the crypto realm. Furthermore, as earning tokens is a unique feature of DePIN, this brings both speculative and tangible value, which sets them apart from non-Web3 enterprises.

This is the vision driving DePINs – they combine blockchain, the Internet of Things (IoT), and the Web3 ecosystem in a decentralized manner.

If implemented correctly, the technological edge here could disrupt the market as we know it and help shape emerging markets. Integrating tech innovation with business acumen could finally unlock blockchain’s long-awaited killer use case. Decentralized physical infrastructure networks can merge the digital realm with the physical.

Unlike other Web3 verticals, DePIN systems can tap into existing markets and potentially expand them, allowing for early revenue generation.

This capability to fulfill real-world demand early on is one of DePIN’s greatest advantages.

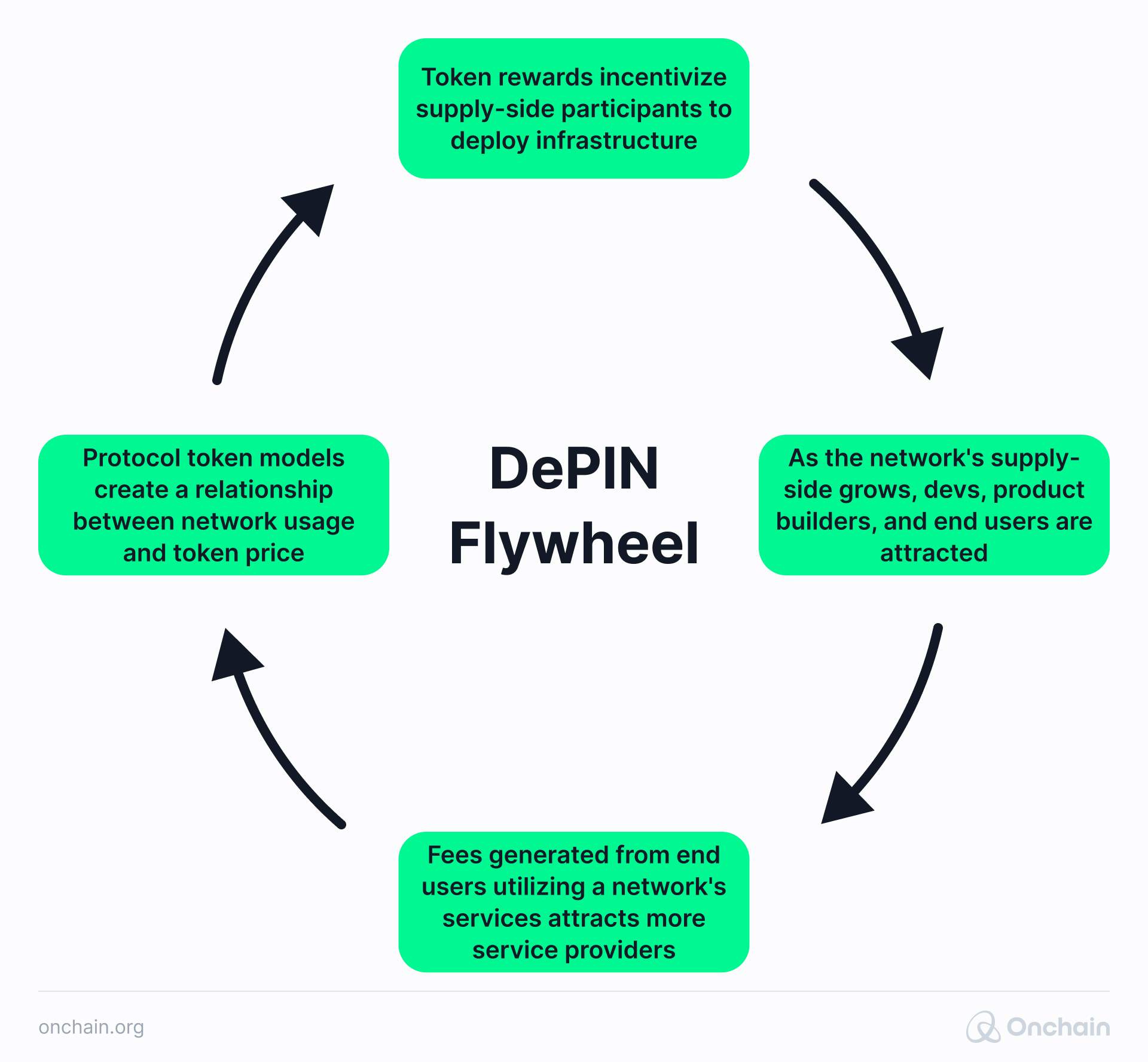

DePIN offers a momentum boost for Web3 entrepreneurs, creating a flywheel effect that accelerates project growth.

For DePIN crypto projects aiming to broaden their influence, scalability is crucial. Drawing in more asset providers and expanding infrastructure deployment enables the project to meet rising demand. In turn, this can extend the network coverage and accommodate a larger user base.

Here’s also where the rise of Web3 AI projects may play a role. The blockchain and AI combination is creating new avenues for how decentralized networks can integrate advanced artificial intelligence capabilities, enhancing their functionality and efficiency.

The DePIN market is on course to be a $3.5 trillion market by 2030, according to Messari, who created the DePIN flywheel.

The best DePIN crypto projects: A journey into innovative, decentralized niches

If we take a peek at some of the DePIN project valuations from 2023 to early 2024, the results are striking – several DePIN protocols saw growth exceeding 200%.

Now, let’s delve into some fascinating DePIN projects that are already thriving in the world of decentralized computing, storage, wireless, and sensor networks.

Decentralized computing for the masses

Firstly, decentralized computing allocates computational resources between individual users instead of being centrally controlled. This allows users to share their unused computing power on a decentralized cloud network in exchange for tokens.

Three examples of DePIN Web3 projects for decentralized computing:

- Akash is a great example. It is a computing marketplace that efficiently links GPU power lenders with businesses and individuals. It allows people to rent out their unused computing capacity to those who need it.

AKT is the Akash native token. It plays a crucial role in governing and securing the network. It also facilitates staking and transactions, incentivizing correct network usage.

Furthermore, the global computing market could grow from $58 billion in 2023 to $1.24 trillion in 2028. Akash aims to create Supercloud that could reduce cloud costs by 85%. - In the same sector, Livepeer aims to revolutionize streaming by distributing the computing power needed for transcoding and hosting videos across its network. It’s a decentralized video infrastructure catering primarily to filmmakers and live streamers, providing cost-effective access to unused computing resources.

The LPT token acts as an incentive mechanism. It motivates participants to work together to ensure that the Livepeer network remains affordable, efficient, secure, reliable, and beneficial for all users.

Livepeer demand-side revenue increased by 34% quarter-on-quarter (QoQ) in US$ terms in 2023, and the revenue from staking rewards went up by 33%. - The Solana-based peer-to-peer DePIN compute protocol IO.NET’s latest announcement unveiled their IO.NET’s project after securing $30 million in funding to create the world’s largest decentralized physical infrastructure network. The project aims to combine DePIN and AI.

IO.NET is the sole solution capable of distributing ML workloads among GPU nodes worldwide. This enormous project will enable the creation of superclusters comprising 100K, 500K, or even 1 million GPUs globally.

Their innovative IO token economics model features a deflationary reward model and programmed token destruction. The IO token will drive economic incentives in the network, ensuring a balance between GPU renters, GPU owners, and IO token holders. Their vision is that the IO token will become the AI compute currency of the future.

Decentralized storage – improving resilience

Secondly, decentralized storage works by using a distributed network of nodes to store data instead of a centralized server. Files are encrypted, divided into pieces, and distributed across multiple independent computers. This enables redundancy, ensuring resilience against outages.

Filecoin is a classic example in the decentralized storage sector:

Filecoin is a peer-to-peer network that securely stores files using economic incentives and cryptography.

Users pay storage providers to store their files in the marketplace, ensuring reliability and security. Hence, they earn FIL tokens by offering storage space.

Just in Q2 of 2023, Filecoin’s revenue increased by 91%, driven by a 64% QoQ increase in active storage deals and a 60% increase in the number of large dataset clients.

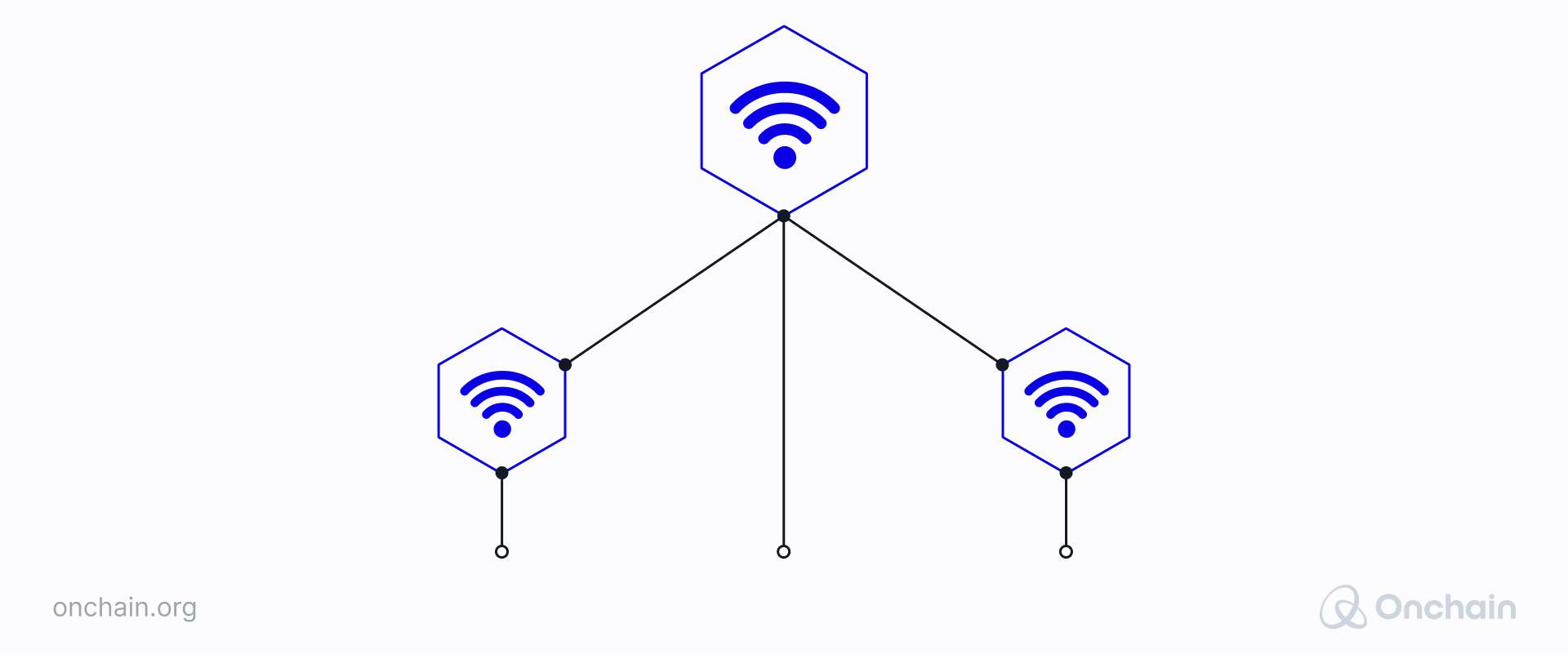

Decentralized wireless networks – increasing network coverage

Thirdly, decentralized wireless networks use blockchain and token incentives to establish and sustain communication networks.

Individuals contribute hardware, such as hotspots and routers, to offer services. Hence, the users control the network and host wireless devices.

Two examples of DePIN Web3 projects for wireless connectivity:

- Helium is a blockchain-based wireless infrastructure telecom project that enables individuals and organizations to deploy networks via token incentives.

They employ a system known as LoRaWAN tech to link IoT devices to the internet. Their native crypto token, HNT, fuels the network and acts as a reward whenever hotspots transfer connection data across the network.

Helium achieved over 404,000 active hotspots within the first 30 days of launch and has deployed over 15,000 hotspots worldwide to date. - Pollen Mobile is another decentralized, user-owned mobile network. They use blockchain and token incentives to build a privacy-focused, affordable communication ecosystem. Its privacy-centric model attracts users who value data security and network control.

The Pollen network operates on an economy powered by the PollenCoin (PCN) token. It offers gamified rewards in PCN to encourage early adoption and foster network expansion.

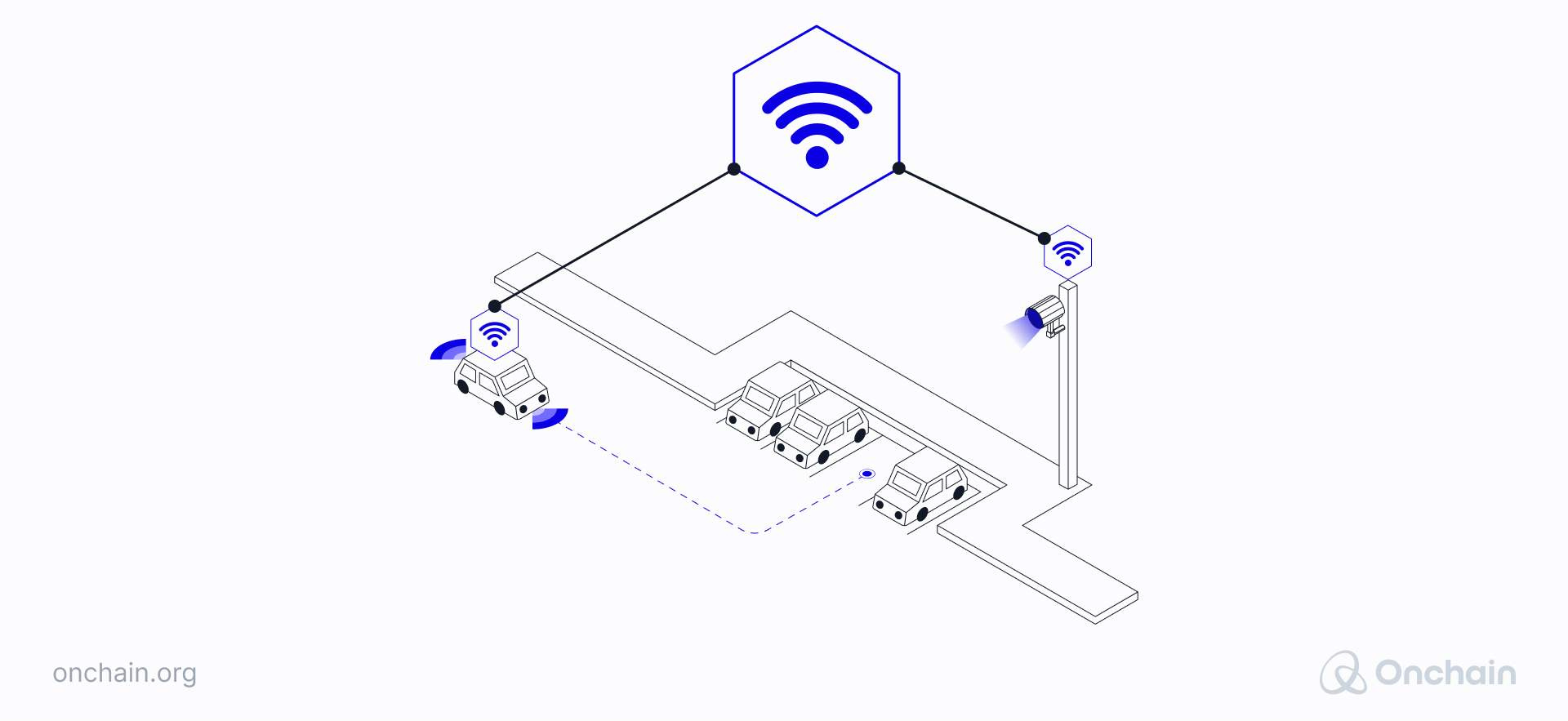

Decentralized sensor networks – boosting accessibility and integrity

Finally, decentralized sensor networks collect user data for resale or analysis, ensuring precision, security, and transparency.

The network connects devices with sensors for real-time data gathering, enhancing integrity and mapping capabilities.

Three examples of sensor useage in DePIN crypto projects:

- The NATIX Network is a smartphone-based DePIN. It leverages proprietary AI-powered cameras to gather valuable mobility data and create an open geospatial intelligence network. This, in turn, enables real-time applications, such as autonomous driving and smart city services, to enhance driving experiences by sharing user-generated data.

The native utility token is NATIX, which rewards users for collecting geospatial data through their app. This serves as a payment method, offers staking benefits, and plays a vital role in facilitating the network ecosystem functionalities.

NATIX now has over 60K registered users, and has covered over 13 million kilometers. Furthermore, it now has a presence in 200 countries and independent territories worldwide. - Hivemapper incentivizes individuals to share vehicle-generated map data using plug-and-play sensors.

It operates as a community-owned alternative to Google Maps, employing crowd-sourced mapping by rewarding contributors with HONEY tokens.

Hivemapper has more than 75 million road kilometers mapped to date and has over 30,000 pre-orders for its products. - DIMO, like Hivemapper, centers on vehicle data, rewarding users with token incentives and features such as private location tracking and car health diagnostics. It’s an open-connected-vehicle protocol with insights and data control.

The DIMO token holders have the power to vote on protocol operations, such as software upgrades, licensing IP, fee generation, and reward distribution.

Today, DIMO has over 81 unique countries represented in the network, with over 28,000 vehicles connected, and is still growing strong.

As the industry develops and matures, numerous examples emerge that broaden the initial DePIN classification. According to our report, it is more than evident that DePIN extends beyond just these four niches.

Cryptocurrencies: Fueling the success of the DePIN revolution

The heart of the DePIN sector is based on a cryptocurrency economy, as this plays a central role in building the DePIN community.

Participants are rewarded with tokens for supplying resources such as processing power, internet connectivity, and storage capacity.

So, what incentive mechanisms are available to invest in a DePIN-based project?

It is clear that incentive mechanisms differ for each DePIN sector. Hence, there is no one-size-fits-all solution here. To effectively manage this, a DePIN project requires a suitable tokenomics model tailored to the network’s needs and user profiles.

Let’s take the Helium network. The incentive to participate was the implementation of physical network hotspots. This brought in individuals and companies who contributed their resources and time, ultimately being rewarded with HNT tokens.

This methodology bootstraps the network by offering a compelling reason for potential participants to join in.

In Akash, the AKT token is the lifeblood of the Akash network. It has real value and can be used for services offering highly competitive prices for CPU usage within the network. This strategy maintains growth by enticing user participation from the outset and building strong network effects. It is a truly community-driven ecosystem.

For instance, Akash has surged with a YoY increase of 1313% from 2022 to 2023.

Without incentives to attract and align a large number of participants, DePIN projects couldn’t develop innovative new products that were previously unattainable. And if widely adopted, DePIN can also help further enhance the acceptance and adoption of cryptocurrencies.

Unlocking the future: The road forward for DePIN

DePIN constitutes a real link between the tangible world and the blockchain. It offers a viable solution, bridging real-world commerce with the crypto realm.

Based on the research performed for our DePIN report, it is clear that avenues for sustainable revenue models exist. DePIN has competitive edges over its Web3 and Web2 counterparts and the ability to reach a wider audience.

The success of DePIN hinges on the design of its tokenomics and creative incentive mechanisms. On the whole, to shape the ecosystem’s sustainability, this new domain will be dependent on seamlessly blending these revolutionary incentive structures with conventional revenue streams.

Combining the DePIN flywheel approach with existing business models appears to be the most favorable option.

Designing incentives will be challenging; however, if stakeholders are held accountable, then DePIN builders can fulfill their potential. This will result in a world where network infrastructure is owned and managed by its users.

DePINs are positioned to lead the way in cryptocurrency investments, providing an opportunity to rival mainstream Big Tech. Their founders and investors are going to need robust money-making business models to do so. You’ll find a breakdown of the leading DePIN income streams next. Click below to have a look.