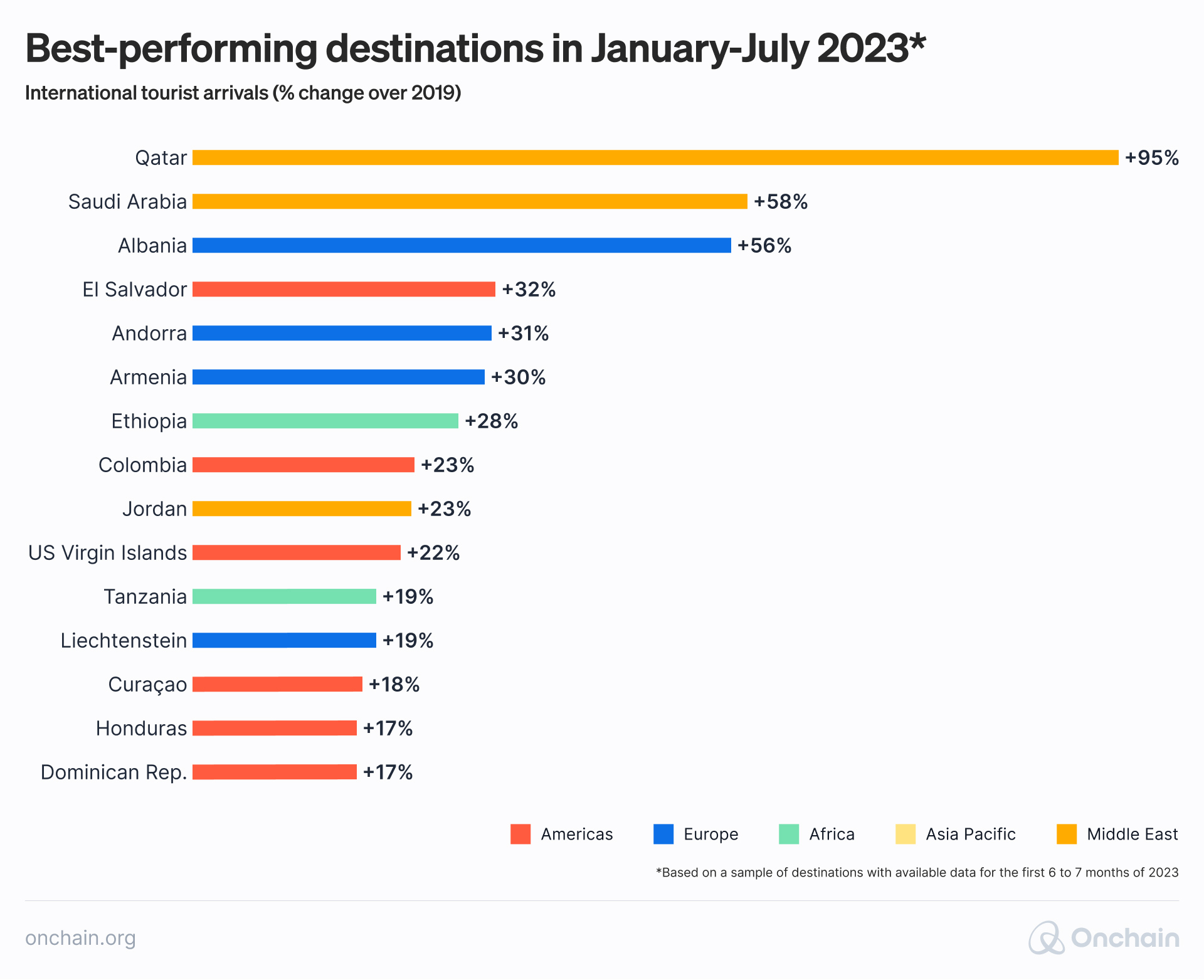

Golden sand beaches, turquoise waters, and pine forests stretch along Albania’s coastline. Once dubbed the North Korea of Europe, Albania has become Europe’s fastest-growing tourist destination.

The land of golden opportunities, you might think. However, an underdeveloped financial market is a barrier to local and international investment. T-Blocks removes these hurdles by tokenizing real estate in the Balkan region.

Henri Ndreca is the project’s co-founder and a major contributor to our research report Real-World Assets for Real-World Purposes. We invited him to explore the nexus of emerging markets, real estate, RWAs, and DeFi.

A passion to bank the unbanked

Q: Henri, you translated The Bitcoin Standard into Albanian – a real blockchain advocate. Where is this passion coming from?

Henri: Just take a look at the status quo. 1.4 billion people are still unbanked – many more underbanked. There is a lot to do.

With blockchain, we have a technology that allows us to onboard these people over the internet. It allows us to democratize value the same way that we democratized information before.

But really, it all started during my high school and university years when I fell down the Bitcoin rabbit hole. I went so deep that I dedicated my academic thesis to crypto-economics and blockchain applications.

I saw so much potential in the Internet of Value, but my community was only approaching crypto in a speculative way. There was no content in our native language to help them understand its importance. So I decided to translate The Bitcoin Standard.

How Real-World Assets fit into the blockchain idea

Q: How do Real-World Assets fit in?

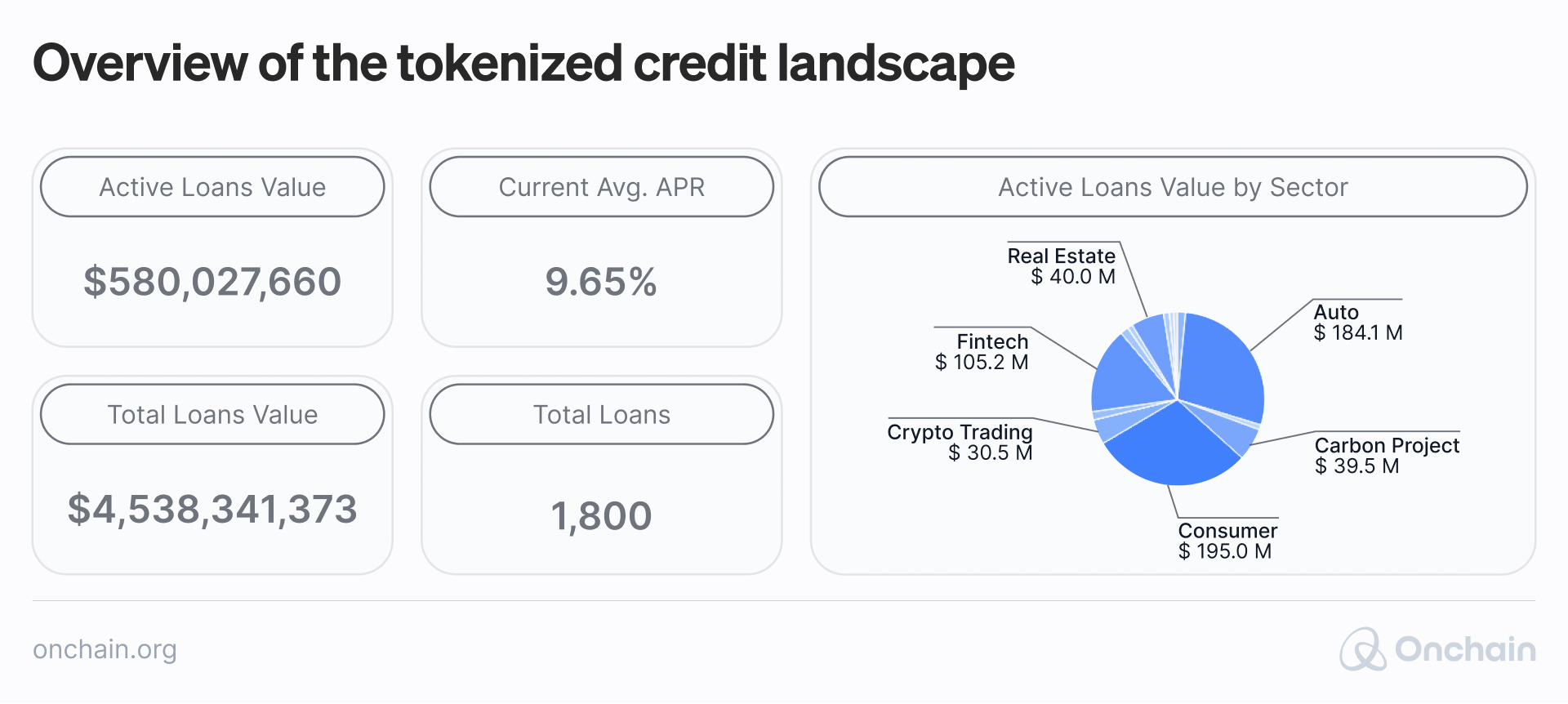

Henri: Finance, of course, is more than cryptocurrencies and peer-to-peer payments. We also need to enable investing, borrowing, and lending.

Real-world assets (RWAs) are an important building block for such activities and the financial markets. We need to integrate them onchain – they are part of the big picture. RWAs are the next big step in the evolution of finance.

The whole premise of Bitcoin and Ethereum is to have programmable money and assets that live in a public, global and trustless infrastructure. This is arguably a major financial revolution compared to the current siloed banking and capital markets infrastructure.

The chance to revolutionize a fragmented market

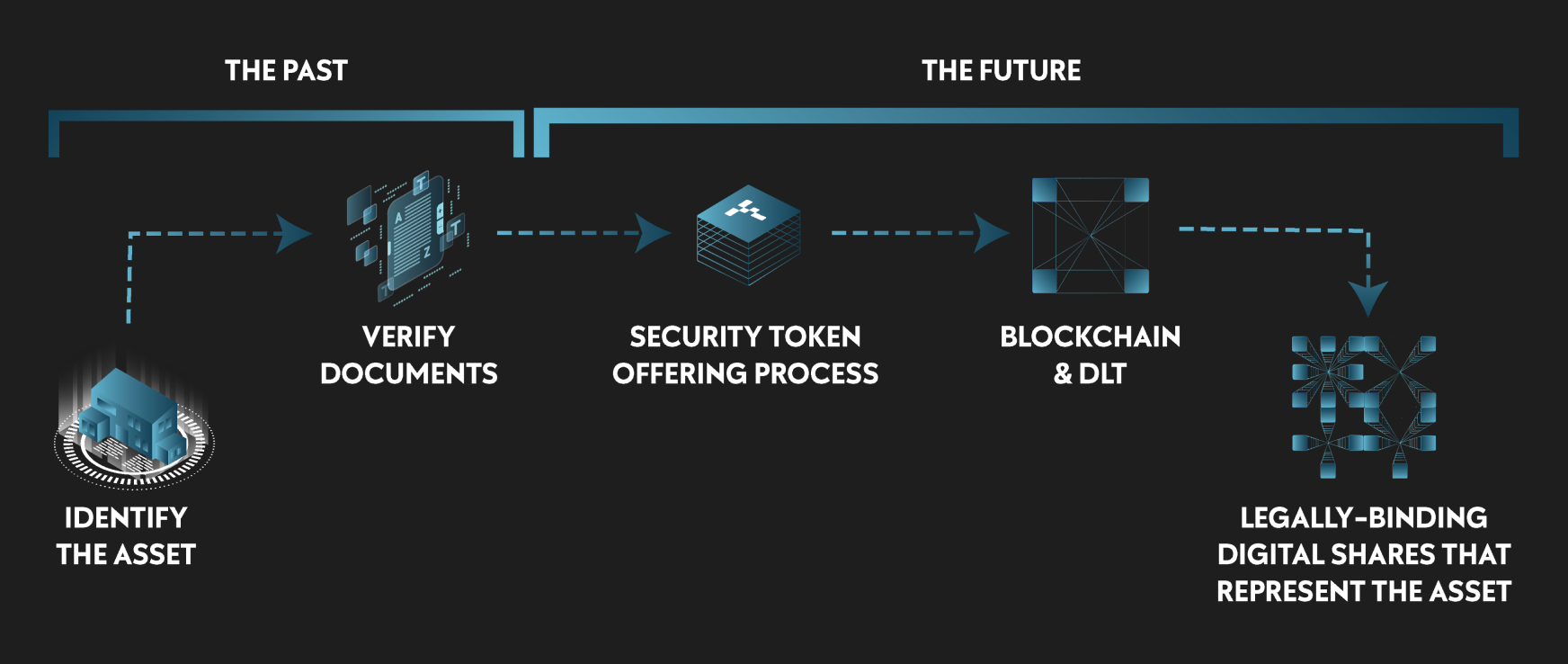

Q: In this revolution, where do we come from, and where are we going?

Henri: We are now leaving behind the fragmented financial market of the 20th century. This is great.

Because the TradFi market serves the developed world better than the emerging and frontier markets, but those markets are where the greatest potential lies.

And so we are creating a global and automated financial market. By adding RWAs to the blockchain, we are giving them instant settlement, and global liquidity, and making them accessible.

In other words: At T-Blocks, we connect emerging markets to a global financial system that works at the speed of the Internet, at a fraction of the cost.

Q: And once we get there, what will the future look like?

Henri: Is that an invitation to share my dream?

Q: Please go ahead!

Henri: I envision an e-commerce revolution for financial assets.

You will only need a laptop and an Internet connection to invest globally and in emerging markets. You will hold real world assets in your personal wallet – a piece of the best Albanian, Philippine, African tourist resorts, a piece of green energy parks, commodities, maybe some whiskey?

For emerging markets, this financial inclusion would be a paradigm shift. It would increase foreign investment for local communities and contribute to a more balanced development in the world.

But we get a glimpse of this paradigm shift when we look at Stablecoins, the first RWA with rapid adoption.

Stablecoins enable faster and cheaper remittances, global trade, and forex hedging. These use cases are particularly effective in emerging markets.

Financial inclusion in a market owned by the wealthy

Q: With T-Blocks, you are bringing real estate onchain. What’s the vision that drives your effort?

Henri: Real estate is worth over $300 trillion. Yet, it’s an asset class for the wealthy. This is because the barrier to entry is quite high, and it’s less liquid than other financial assets.

Tokenization solves both of these problems. It brings fractionalization and distribution to the world’s largest and safest asset class, and it provides access to secluded high-growth regions previously untapped and with a limited access to global participants.

And as a result, we are driving financial inclusion forward.

Think about this: Right now, globally, the most accessible alternative asset class is the volatile crypto market. Real estate, in contrast, is stable and can add robust returns to a growing DeFi market.

The benefit for the Balkan region

Q: You onboard the local real estate market to a global financial system. What’s in it for the Balkan region?

Henri: In the Balkan region, the lack of developed capital markets and technology forces project developers to seek primitive and risky financing methods. Project pre-sales to finance construction are a prime example.

This is where fractionalization shines. It lowers investment entry points and reaches a larger user base of investors. This gives developers the liquidity they need to overcome their initial challenges and execute even larger projects.

We build with best international practices in mind and comply with EU regulations. This also educates and forces developers to raise their standards. Over time, this process also reduces risk for investors.

This sparks an upward spiral. The local population has greater access to finance and investment. At the same time, developers in the Balkan region see an influx of capital from local and international investors who want to participate in the upside and beta that emerging markets have to offer.

This process continues as we distribute RWAs over the existing Internet infrastructure. At the same time, we are standardizing and streamlining procedures in the tokenization process. This further enhances the quality and security that international investors have come to expect.

Challenges on the way to achieving the vision

Q: When things sound too good, it’s usually a good time to focus on the challenges. What is the greatest challenge to achieving your vision?

Henri: One word: regulation.

Our current regulatory framework is just departing from the 20th century. But we’re seeing progress. The UK, the EU, Singapore, and Hong Kong are all taking steps in the right direction, providing clear guidelines not only to companies like T-Blocks, but also to international investors.

As part of these efforts, we see regulatory standards embedding better token standards.

But the magic begins when we finally can agree on a global token standard. This brings us to the next challenge: blockchain interoperability.

In 2024, users still have to navigate a fragmented blockchain ecosystem that relies on clunky bridges.

It’s almost ironic. The magic of Bitcoin was having a unified, shared ledger instead of thousands of banks running their own. Now we’re solving the same problem again for hundreds of blockchains. But it won’t take us another 4,000 years to solve this step, rather a few.

Looking at the impressive progress the industry has made in solving technical challenges, I remain optimistic that a unified token standard and interoperability will be resolved in time to provide a more streamlined approach to distributing these investments.

These two points have a direct impact on adoption by large institutions. They need automated, efficient, battle-tested, easy-to-use, and compliant solutions to replace their existing infrastructures.

T-Blocks specific role

Q: Let’s zoom out a bit. If you look at the big RWA picture, what role is T-Blocks going to play?

Henri: I remain of the idea that Real World Assets are the missing puzzle for DeFi.

I stand by the idea that Real World Assets are the missing puzzle for DeFi. On the one hand, we have tremendous potential in the Balkans region. On the other hand, there’s a technology that turns potential into opportunity.

But this can only happen if someone streamlines the tokenization process and programs compliance into RWAs.

What we get is an accessible, effective, and compliant investment opportunity in Europe’s best-performing tourist destinations that plugs seamlessly into the ever-growing tokenization and DeFi market.

The potential isn’t going anywhere – our job is to unleash it.

But our mission is not limited to the Balkan. We can, and will, apply our model to other emerging economies to redefine and democratize real estate and bring markets onchain.

Our conversation with Henri shows why RWAs are the talk of the town. They are, in fact, the next big step in the evolution of finance. Now it’s time to take a look under the hood at how smart contracts that power RWAs.