“Crypto vs fiat” sounds like a monetary faceoff, but is it really a competition?

It’s kind of like saying “pizza vs sushi” or “bicycle vs car.”

We all have to make choices: how to travel, what’s for dinner, or what money to use. And when it comes to money, you have two major categories: fiat currency and cryptocurrency.

In this article, you’re going to learn what fiat and crypto are, their similarities and differences, and how you can use this information to help build your Web3 business or meet your personal financial goals.

What is fiat currency?

Fiat currency is a government-issued currency. It is generally just called “money” or “cash” and is used worldwide: dollars, euros, yen, pounds, and so on. “Fiat” is defined as an arbitrary order or decree. In Latin, it means “let it be done.” These orders are issued by the governments that issue the currency.

Fiat currency supplies can be expanded or contracted by governments in an attempt to adjust or improve inflation rates, employment rates, trade dynamics, and other state-sanctioned financial goals. This ability gives the currency issuer great power.

This power can be used in positive ways. However, irresponsible or short-sighted policymakers can also pull these monetary levers in ways that create financial instability and chaos — more on that below.

What is cryptocurrency?

Cryptocurrency is a newer type of currency that combines blockchain-powered cryptography with currency (cryptography + currency = cryptocurrency). Launched in 2009, bitcoin (BTC) is widely considered the first cryptocurrency, often called “crypto” for short.

Although they’re commonly used interchangeably, not all blockchain tokens are cryptocurrency. In this article, we’re going to consider BTC, bitcoin cash (BCH), litecoin (LTC), monero (XMR), zcash (ZEC), and other tokens that are primarily used for payments as cryptocurrency.

Other large market cap tokens like ether (ETH), solana (SOL), and chainlink (LINK) technically can be used for payments; they have monetary value after all. However, that typically isn’t their primary purpose. For example, LINK derives its value as the native token of the decentralized oracle project Chainlink.

NOTE: To be crystal clear, the shorthand “crypto” is a catch-all onchain term that has evolved to encompass both cryptocurrency and anything that utilizes blockchain technology. In this article, “crypto” will only refer to the currency use case. So, using this definition, Chainlink would be considered a “crypto project” but not a “cryptocurrency project.”

Fiat currency pros, cons, and caveats

Fiat currency is widespread but is not without its downsides. Every government has the authority to issue its own currency, but not all governments do. Why? Fiat money isn’t backed by anything other than a government decree.

As a result, less established currencies often lack some of the key characteristics of sound money. For this reason, many countries either use the U.S. dollar (USD) as their currency or peg their currency to USD, as it is widely considered one of the strongest fiat options.

This is because it fulfills (largely, but not perfectly) a currency’s three primary functions:

- Medium of exchange: Money is used as the medium for the purchase and sale of goods and services. Not only is USD widely used within the United States, but it is also popular for international trade. As I have found in my travels to SE Asia and elsewhere, it is often preferred over the local currency due to the next characteristic.

- Store of value: Put simply, you want your money to maintain its value. This means its purchasing power shouldn’t drastically diminish over time. This lowering of value is simply referred to as inflation, and most people don’t think it’s a good thing, especially in the crypto world. This is why you want your savings in a “harder” currency — and why merchants were happy to accept my dollars in Myanmar, Laos, and elsewhere.

- Unit of account: This one is often overlooked, but it’s likely a major reason money was invented. You need a way to measure, compare, and exchange value in a simple and straightforward way. Barter isn’t commonplace because money simply works better. That’s why people price things in fiat and increasingly, crypto.

For example, you couldn’t barter for the Onchain Founding NFT Membership; it was priced in crypto (0.077 ETH). The collection sold out on June 2, 2025. Did you get yours? If not, and you want one, you might be able to find a willing seller (but the ETH price is likely higher).

Of course, USD isn’t perfectly sound money. If it were, there wouldn’t have been a need to reinvent money on the blockchain. Since 1950, USD has lost 90% of its value.

And if you go back further, USD has lost even more value. Although this may come as a shock, this depreciation has occurred over decades. But it can be much, much worse.

CAUTION: Using fiat money that isn’t commonly accepted or suffers from high inflation rates can create financial havoc in your startup or business. Aim to use the strongest fiat (or crypto) option available.

Hyperinflation: when fiat currency goes off the rails

Store of value is fiat currency’s Achilles’ heel, and inflation is what strikes the fatal blow. The average lifespan of a fiat currency is 27 years. The worse the inflation is, the faster a currency takes its last breath.

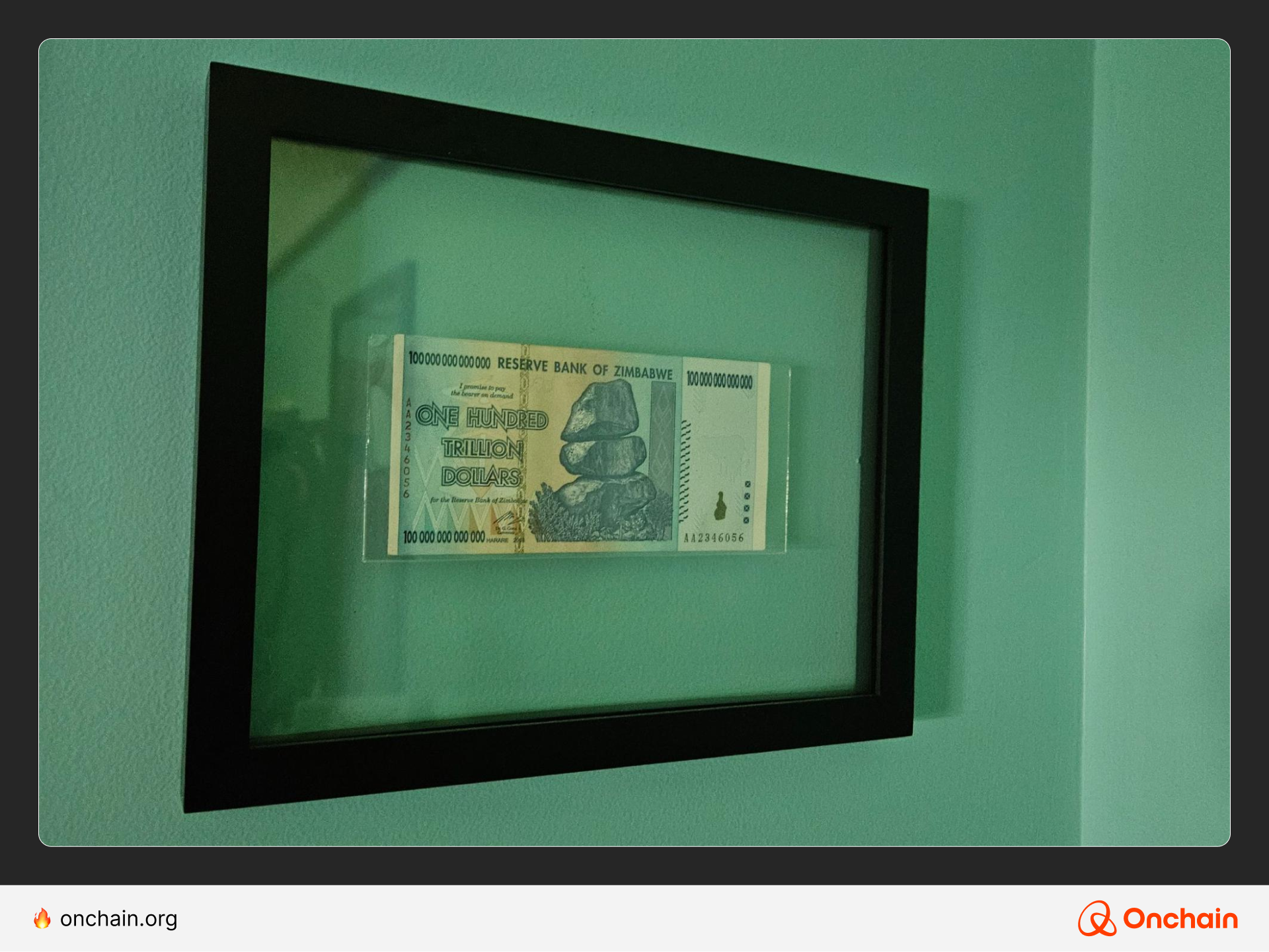

How bad can it get, you ask? Do you really want to know? You might think that 10% inflation is bad. How about inflation rates of 100%, 1,000%, or 10,000%? In recent memory, two countries stood out for their extreme financial mismanagement: Zimbabwe and Venezuela.

In November 2008, Zimbabwe had an inflation rate of 79,600,000,000%, which translates to prices doubling roughly every 24 hours. A decade later, in Venezuela, it was estimated that its currency had an inflation rate of 25,000%. With this rate, prices only doubled once a month.😮

Let’s run through a quick example. Say you wanted to buy a $20 pizza. You decided to wait until next weekend and were experiencing Zimbabwe’s 2008 inflation rate. Here is how the price would change:

- Sunday: $20 pizza 🍕

- Monday: $40 pizza

- Tuesday: $80 pizza…

By Saturday, that same pizza would cost you $1,280! This example illustrates why hyperinflation can be so crippling, and why people experiencing it rush to spend their paychecks.

Money rewind: commodities vs fiat vs crypto

Before we break down crypto, we need to understand what money was used before fiat currency. It was commodity money: typically silver or gold. In fact, USD was commodity money until the United States went off the gold standard in 1971.

Commodity money: Does it need state backing?

Commodity money can function with or without a government. That is why they used to be distinguished by the terms “bullion” and “coinage.” The Romans introduced state-issued coinage to Britannia (or Great Britain) over a millennium before Hibernia (or Ireland).

The native Irish resisted the introduction of coinage and continued to rely on bullion and barter. This monetary preference makes sense as Ireland was a decentralized and largely stateless clan-based society at the time.

Cryptocurrency: Is money coming full circle?

Is cryptocurrency a new monetary invention? Or is it reinventing the wheel? Maybe it’s a little of both. Cryptocurrency must also satisfy the three characteristics of money to succeed. And it’s looking good so far.📈

It may seem like physical bullion/rounds and cryptos like BTC have nothing in common, but you’d be wrong: They are both stateless currencies. Critics say that’s a fatal flaw, proponents highlight it as a huge advantage. Who’s right?

Well, gold has lasted for millennia, while most fiat currencies never reach middle age. Can BTC and other cryptos last? Only time will tell, but the following characteristics make it compelling:

- Permissionless: Anyone can buy, sell, trade, or transact with crypto.

- Decentralized: Most cryptos are highly decentralized and have no central issuer (like a government). No one can control transactions, the token issuance rate, or any other critical metric.

- Borderless: Cryptocurrency can be sent across the world to anyone with a crypto wallet and an internet connection.

Now, read that back again with gold in mind. The same characteristics ring true. No one controls the gold supply; it is permissionless and borderless, but much harder to send across the globe. This is why some refer to BTC as “digital gold.”

And it’s not just BTC, low-fee crypto options like BCH and XMR have multi-billion-dollar market caps and may be more suitable for daily use and low-cost transactions.

TIP: Accepting crypto can be a good business strategy. It can often be simpler, faster, and cheaper, especially for cross-border transactions. It can then be converted to local fiat currency if needed. It’s also a good way to pay employees in other countries.

Is cryptocurrency the next evolution of money?

It depends on who you ask, but most take a strong yes/no position, with few fencesitters. Some say the European Central Bank (ECB) is declaring war on BTC. This begs the question: If crypto wasn’t a viable long-term option, why do some central banks and governments spend so much time bashing it?

Other governments are adopting it: the United States, El Salvador, and many others. It’s kind of odd when you think about it: States adopting a stateless currency (BTC primarily). Things really are coming full circle.

Some Irish crypto proponents are now advocating for a return to the region’s stateless currency roots by advocating for their own BTC reserves. Bitcoin Network Ireland is pushing back against the ECB’s critiques, releasing a paper that ranks EUR poorly against BTC.

Crypto vs fiat: characteristics compared

Outside its key properties, there are more aspects of money that you should consider: who controls it, who issues it, where it’s used and accepted, and much more.

Control: crypto vs. fiat

Fiat currency is a permissioned form of money, issued and regulated by the state. It dictates how it’s issued, used, and where it can be transferred. Many governments only allow their own fiat currency to be used within their borders.

Citizens usually go along with this, provided there isn’t massive inflation. In that case, they often ignore the rules and use USD, crypto, or other alternatives.

Crypto is a permissionless currency that anyone can use. It is also a stateless currency not controlled by anyone. For crypto components, this is a key selling point.

CAUTION: Dominant in international trade, the United States can use USD as both a powerful financial tool and a potent weapon. U.S. sanctions can remove entities or entire countries from Swift, a critical service that connects thousands of financial institutions and enables cross-border fiat transactions.

Issuance and supply: centralized fiat vs decentralized crypto

When too much fiat currency is issued, or “printed,” you experience inflation. These results are predictable and easily explained.

However, it’s tempting for leaders to “print money out of thin air” to promise their citizens “something for nothing.” When hyperinflation hits, they scapegoat domestic and foreign “enemies,” blaming everything but the actual cause.

Crypto is issued by the associated blockchain protocol. The supply is hardcoded into its design. More importantly, the supply and issuance are public, transparent, and resistant to change.

Nobody can wake up one day and decide to double the BTC supply, not even Satoshi himself. However, politicians can print fiat at will. This makes crypto more akin to commodity money like gold, which also can’t be “printed.” 🙂

Borders vs Borderless: crypto vs fiat

Fiat currencies are typically confined to their country of origin: yen in Japan, pesos in Mexico, won in Korea, and so on. This can be cumbersome for international business or travel, which is one reason why the euro (EUR) was established to simplify payments within Europe.

A few fiat options like USD are widely accepted internationally, but they are an exception to the rule.

Crypto is a borderless and permissionless alternative. You can send it anywhere in the world at any time. For business owners, this is hugely advantageous. It’s often used as a workaround in places with oppressive capital controls or inflation-related problems. Critics would argue that this permits money laundering and criminal activity.

However, crypto proponents have a good counterargument. Estimates suggest $41 bil of criminal activity was tied to crypto in 2024; This pales in comparison to the estimated $3–$5 tril in illicit trade every year, with the vast majority of it conducted in fiat, primarily USD.

Backing: crypto vs fiat

What backs, or supports, the value of a currency? Commodity money like gold is backed by its physical properties and value in jewelry, electronics, and other commercial uses.

Critics argue that crypto lacks inherent value because it has no physical backing, unlike gold. However, they are overlooking an ironic contradiction: Fiat currency also has no intrinsic worth; it’s just paper, or a number on a balance sheet.

A $10 bill only has value if people trust its value. Before its decoupling, you could theoretically exchange that $10 bill for gold, but that window closed over 50 years ago.

Fiat currency is backed by decree and government enforcement. Crypto is backed by cryptographic algorithms and decentralized issuance and security.

Stablecoins: an onchain fiat currency

You may be asking yourself: How are stablecoins categorized? It depends on who you ask, but I’d describe them as an onchain fiat currency. However, they do have some crypto aspects.

Stablecoins are a crypto that is backed by fiat currency, usually USD. With a crypto wallet, you can send, save, and spend these digital dollars like other cryptocurrencies. Stablecoins are popular in emerging economies where USD is hard to come by.

It’s also more “stable” when compared to the price volatility of regular cryptocurrencies. Check out our stablecoin report to get a comprehensive crash course on this topic. You’ll get some great insights on how to leverage stablecoins in your business.

TIP: USD-pegged stablecoins can be a good option if you’re a business owner in a country with capital controls, poor banking infrastructure, or high inflation. They are highly liquid and have an enormous $253 bil market cap (May 2025).

Crypto vs fiat: a monetary showdown in the making?

The currency you choose is solely up to you. Do you trust governments or code? Do you want to hold your savings in a bank or a crypto wallet? Crypto and BTC have been written off numerous times, but it doesn’t look like they’re going anywhere anytime soon.

Fiat systems create monetary policies based on what politicians and lawmakers believe is necessary. BTC and other cryptos are decentralized currencies that run autonomously based on preprogrammed rules.

Some believe that crypto will supersede fiat currency and gradually – or perhaps quickly – replace it. Others think that crypto is a fad that will eventually fade away, while some see them as perpetually coexisting currency options.

Still, more and more crypto-based options are opening up to both business owners and investors worldwide. Progress in the Track to learn about tokenized stocks and how they can provide a solid foundation for your global financial plans.