The latest underground buzzword to hit the onchain press is InfoFi, and it’s changing Web3 prediction markets, the attention economy, marketing, and much more.

But InfoFi isn’t just another catchy crypto term. It reimagines data usage and monetization in an onchain and AI-powered world.

What is InfoFi?

Information finance (InfoFi) refers to an onchain sector where high-quality data and information play a critical role in decision-making processes or outcomes, often with financial implications. While this describes general financial speculation (such as crypto investing and shorting stocks), InfoFi is far more expansive than that.

Vitalik Buterin describes InfoFi in a 2024 blog post as “(i) start[ing] from a fact that you want to know, and then (ii) deliberately design[ing] a market to optimally elicit that information from market participants.”

A good example of InfoFi is prediction markets. The popular platform Polymarket allows people to wager on crypto prices, sports outcomes, the outcome of U.S. elections, and more. InfoFi is a way for those with informational and predictive advantages to monetize their knowledge.

Those with better predictive powers aren’t necessarily human; large language model-powered AI bots are joining the InfoFi marketplace of crypto-wagered ideas — more on that later.

InfoFi does more than predict outcomes

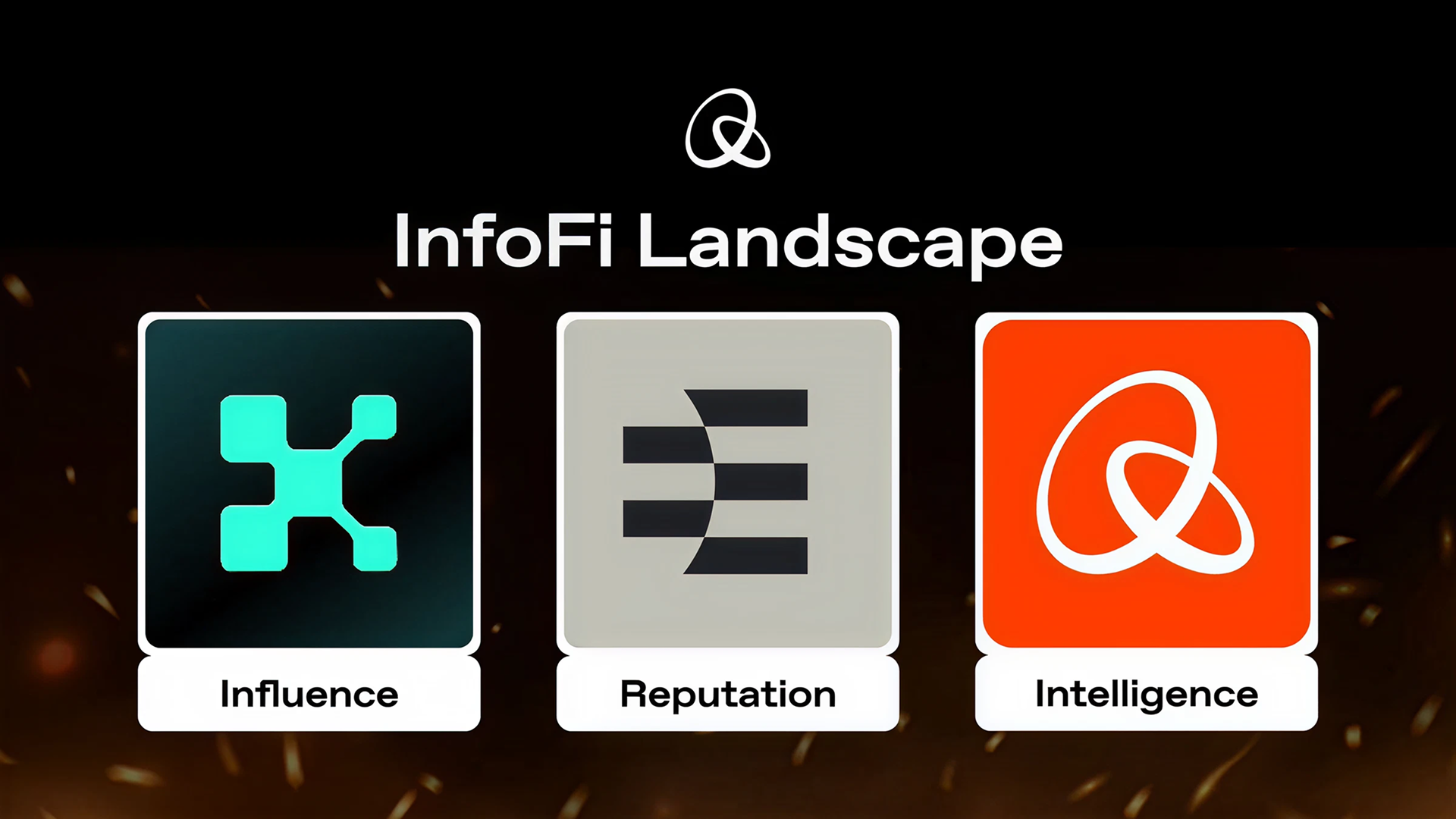

Accurate predictions within probability ranges are valuable, but InfoFi goes beyond predictive onchain sorcery. Current, vetted, and trusted information is also highly valuable. This puts InfoFi in new data-driven sectors you probably haven’t thought of.

InfoFi marketing in the attention economy

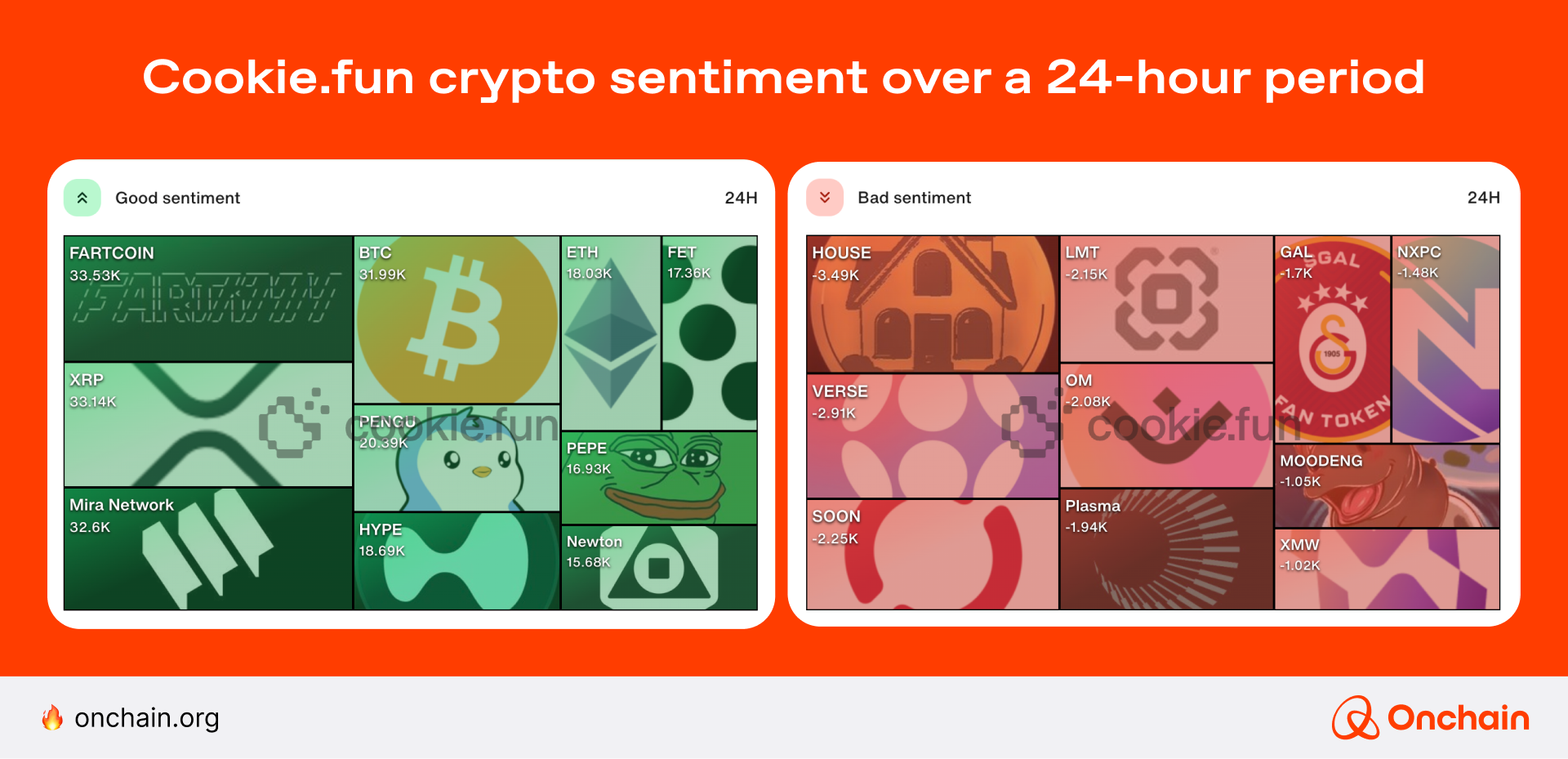

InfoFi provides alternative marketing pathways that don’t require endorsements from celebrities or social media influencers. The attention economy is becoming increasingly fragmented through the proliferation of social media channels, podcasts, and other forms of content. InfoFi projects quantify, measure, and reward quality content that captures mindshare.

While Web2 behemoths (Alphabet, Apple, Meta, Microsoft, etc.) have dominated the marketing and advertising arena for some time, InfoFi offers alternative ways to leverage data and user-generated content. Combined with decentralized social graphs, InfoFi allows you to monetize your data and content.

Kaito AI is a promising project in this sector. It uses decentralized AI to process, analyze, grade, and monetize market-relevant data and engagement. The tool created “Yaps” to track user attention and engagement. By doing so it positions itself as a potential challenger to traditional finance (TradFi) platforms and social media sites.

Similarly, Cookie.fun uses “Snaps” instead of “Yaps,” and innovates in other areas. It features a decentralized rewards mechanism and promotes “quality over quantity” with its access control and exclusivity.

Ethos Network is a new competitor that enables users to rate the reputation of individuals, DAOs, companies, or even AI entities. Oopz is a privacy-focused InfoFi alternative that uses zero-knowledge proofs (ZK proofs). These features may allow them to gain market share.

At the time of writing, Kaito and Cookie.fun dominate this sector with a combined market cap exceeding $500 mil.

InfoFi and decentralized governance

While Buterin’s blog post supercharged interest in InfoFi, Vitalik wrote about the importance of information markets over a decade ago. In this post, he discusses governance and voting issues within decentralized autonomous organizations (DAOs). InfoFi can be used to promote decentralized governance and optimize for the best outcomes.

InfoFi could mitigate issues related to good-old centralized governance. Public goods funding, government funding, and charity funding are now often a “vote for me/us/our ____” popularity contest.

InfoFi principles could be layered into the political decision-making process (It wouldn’t hurt, right?).

InfoFi for reputation management

When you place trust in a person, company, or future outcome (like the price of BTC in 2030), you want solid information on which to base your decision. InfoFi projects, such as Ethos Network, can curate trust and reputation scores for individuals, products, companies, and more.

InfoFi’s next-gen trading and prediction markets

Polymarket is nice, but your wagered capital is locked up until the outcome is determined. So, if you want to place a far-off prediction (2026 or later), your capital is locked and idle until then. And if you lose your wager, it’s worse.

Multiverse Finance is an innovative proposal that enables you to borrow while wagering on prediction markets. It proposes a way to borrow conditional tokens — provided they have the same outcome.

For example, I can place a Polymarket bet on another country by purchasing BTC in 2025. With conditional tokens, I could take my “Yes” shares and immediately borrow or lend against them or (provide liquidity). If the market resolves to “No,” there is no liquidation issue because both tokens are now worthless. Pretty cool, huh?

Noise is another noteworthy project. It allows you to bet on tokenless projects. For example, you could place a bet on fellow InfoFi project Polymarket.

InfoFi for DeSci

Science has a black eye. In one analysis, 60% of scientific results couldn’t be replicated. Called the replicability crisis, the issue affects scientific disciplines across the board. Harvard recently fired a dishonesty researcher for, ironically, dishonesty. 🤥

Combine InfoFi with AI that can solve in days what takes human researchers a decade, and we could be at the dawn of a new scientific golden age.

InfoFi — where there are pros, there are cons

Most income-generating InfoFi opportunities are tied to content and engagement: publishing thoughtful content on X, engaging in Discord debates, refining open-source data and models, or participating in DAO governance.

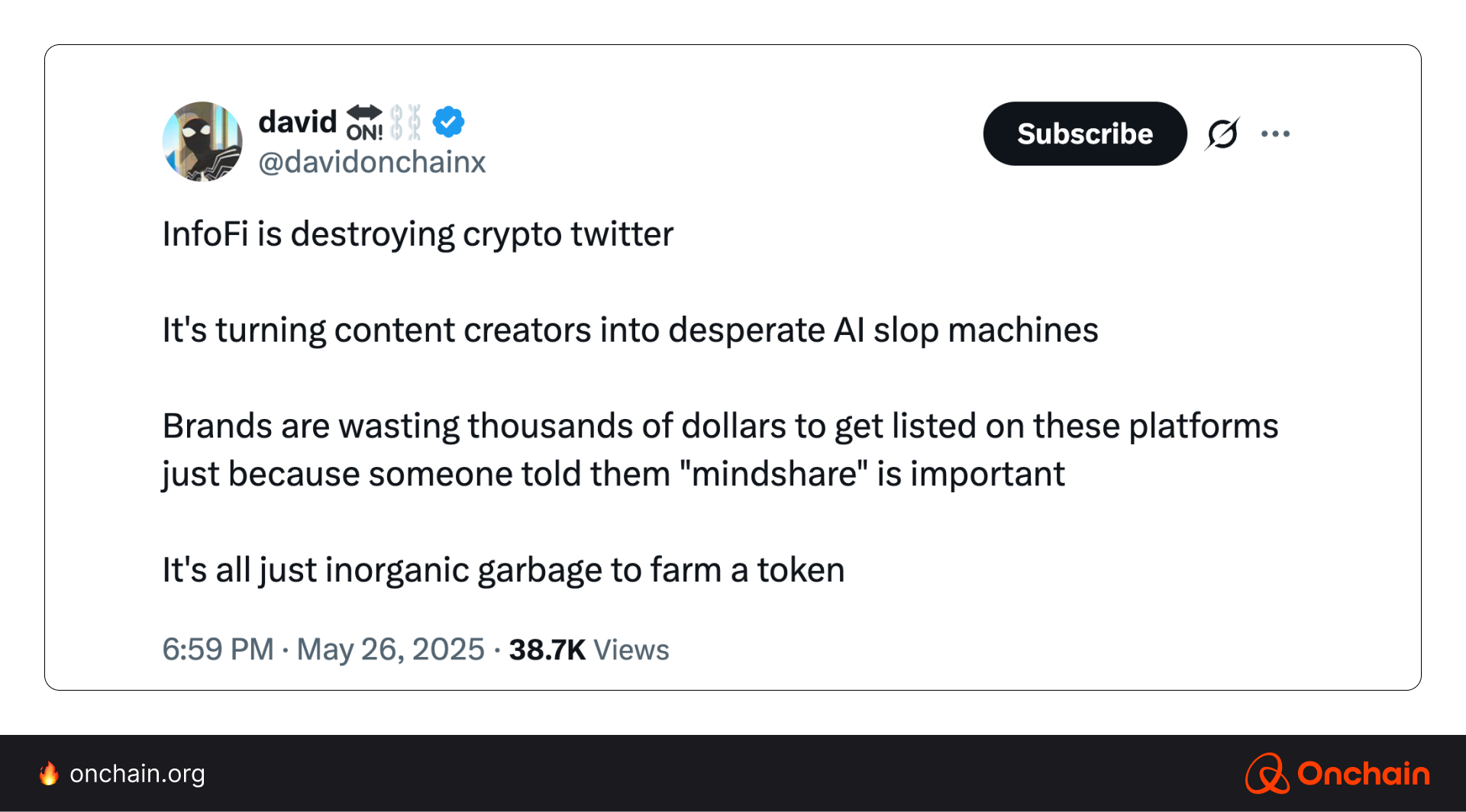

InfoFi rewards active, informed participation in public knowledge economies and markets. It makes sense to reward users with tokens for creating high-quality content. But money chases incentives — often with unforeseen consequences.

When people get paid to post, it opens a Pandora’s box: Web3 trolls, low-quality content, and AI bots gone wild. It reminds me of the complaints leveled at tokenized gaming rewards: People want to play games for fun and not worry about how they will or won’t get “paid.” Now, the same issue is proliferating on social media.

Also, if people know about these InfoFi rewards, they have to wonder whether someone is really passionate about a project, or simply promoting it for InfoFi rewards. You’re kind of reinventing the paid post or celebrity endorsement issue — albeit in a more open and decentralized way.

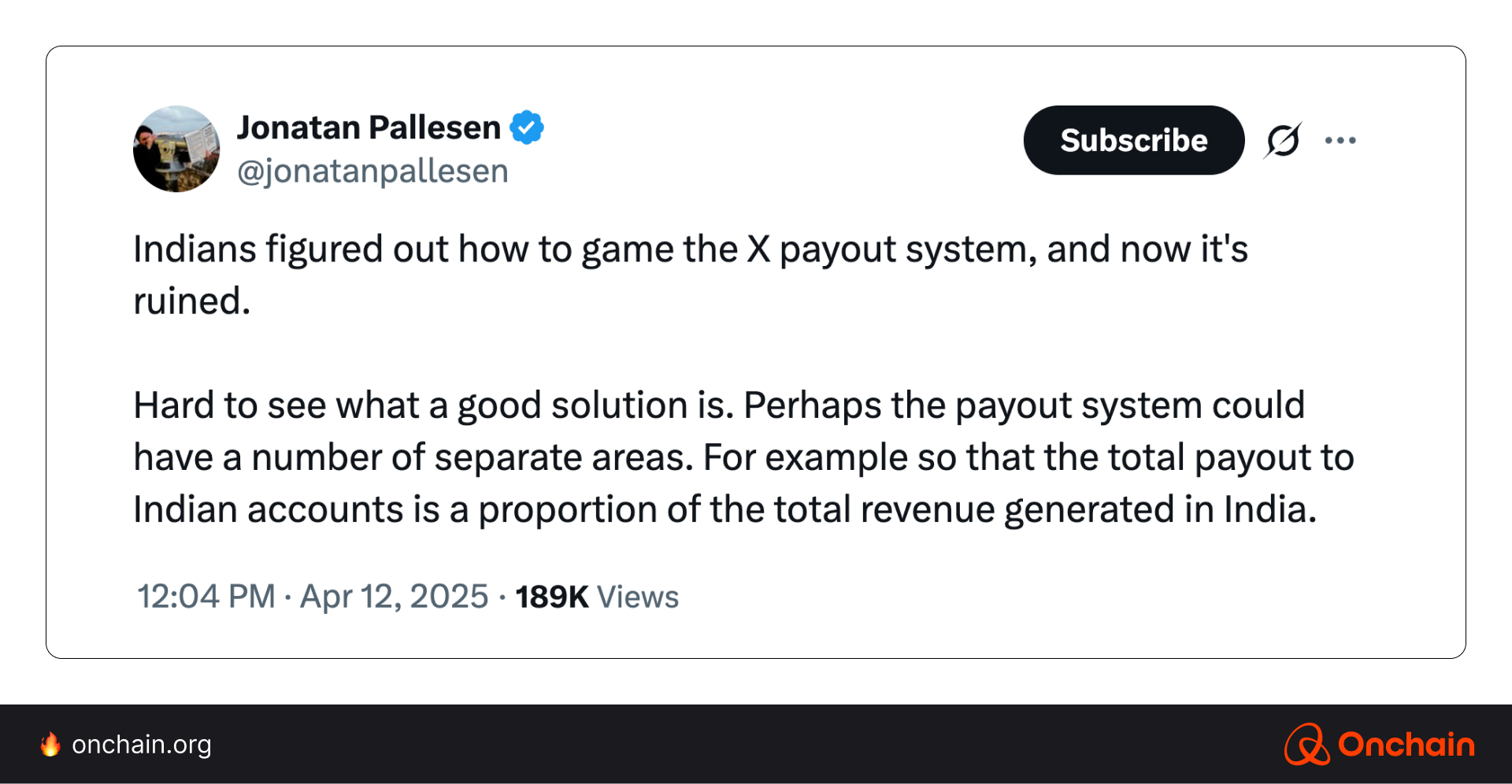

Of course, the problem isn’t limited to onchain InfoFi projects. X had the same problem when it released monetization. Some Indian posters used the social media version of a peer-review ring to game the system and suck the liquidity out of X’s rewards pool.

InfoFi: an incentive-driven arms race

Ultimately, there could be an AI arms race between those who want to receive rewards regardless of the consequences and those who want to create projects and systems that reward positive behavior. This will require mechanisms to disincentivize and punish negative and anti-social behavior, whether by humans or bots.

“Info finance solves trust problems that people actually have. A common concern of this era is the lack of knowledge (and worse, lack of consensus) about whom to trust, in political, scientific and commercial contexts. Info finance applications could help be part of the solution.” – Vitalik Buterin,

source: https://vitalik.eth.limo/general/2024/11/09/infofinance.html

Vitalik’s first sentence sums it up nicely. People just want to solve the “Who do you trust?” question. They want predictions to be accurate, not biased. They want social posts to be honest and well-informed, not rewards-led. And they’d like to know that the latest scientific study is accurate and can be replicated.

All this is close to our hearts and aligns with our mission. Onchain, is an intelligent InfoFi solution that provides, incentivizes, and rewards sincere and accurate data, insights, and contributions.

The future of InfoFi: place your bets

InfoFi is not yet mainstream, perhaps not even to most onchain natives. However, that’s bound to change as the concept accelerates out of its crypto niche and grows into a prime Web3 trend. It has already seen a surge of interest since its 2024 intro. Now you know why.

Some see it as the next big thing. Others simply view it as the latest trend to extract value from, before migrating to the next major innovation or hype (much like airdrop farmers of yesteryear).

InfoFi markets will fluctuate in size and volume as market forces push and pull data, along with the associated monetary rewards. Humans and AI bots will wager in these markets. Both will try to game the InfoFi system, while others will try to financially punish them (much like the slashing mechanisms in blockchain consensus).

InfoFi’s technical nature and focus on AI- and crypto-specific applications will keep it hidden in the shadows of Web3 for now. But its potential to transform data markets and the attention economy is perhaps underestimated, even for battle-hardened InfoFi veterans from 2024.

High-profile projects, high-profile advocates such as Vitalik, and a growing market cap strongly suggest it could gain wider traction and mainstream familiarity in the coming years.

If you are bullish about InfoFi, you might want to put some skin in the game early on. Onchain offers many perks, benefits, and opportunities. We’ll continuously provide credible, high-quality information and research to our members. Even if you missed the NFT mint to get access, you can still purchase an Onchain Founding Member NFT on OpenSea.

See our latest findings on token launch strategies, stablecoins and other major Web3 topics in the research section.