Legally launching a token was, or is, a massive pain point for Web3 entrepreneurs and founders the world over.

Constrictive and prohibitive rulings have hurt the industry and set it back many years. And that opinion of mine is commonly held.

That is especially true in the United States. However, we are seeing glimmers of legal light at the end of the litigative tunnel.

I’m here to give you some practical advice on how to launch a token while navigating the Web3 regulatory landscape. I’ll admit it, I’m not a lawyer — I’m a crypto writer. I cannot provide you with legal advice or argue your token launch case before a judge.*Disclaimer: This article is not legal advice.

Once you’ve got a plan of action, consult with your legal team and prepare your launch strategy.

Now, let’s get started.

Token compliance issues: what you need to know

The technical complexity of launching a Web3 protocol or app can be daunting on its own. And token compliance adds a level of legal complexity on top of that.

Many are worried about navigating the labyrinthian legal environment of Web3 with all the:

- Contradictory legal advice

- Country- and region-specific regulations

- Changing laws and enforcement attitudes

- Rules on who you can and cannot sell tokens to

- Unwillingness from regulators to provide Web3 compliance clarifications

- And much more

Regulatory environment for token launches in 2025 and beyond

Web3 regulations are changing for the better — in some places at least. There is a more pro-crypto sentiment in the United States. The European Union (E.U.) has enacted the initial phases of its crypto-focused Markets in Crypto-Assets (MiCA) legislation.

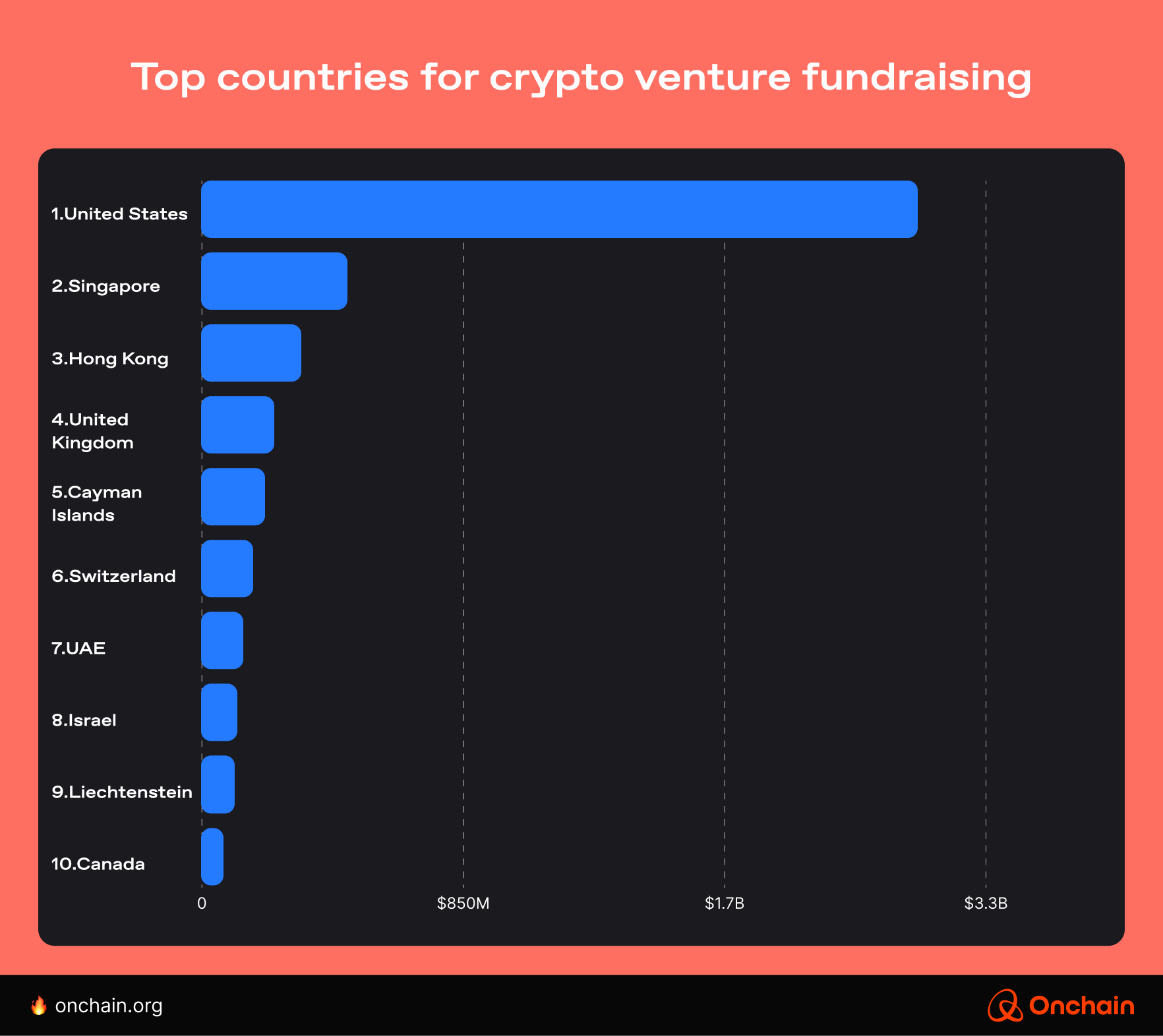

I also see positive regulatory movement in Hong Kong (HK), the United Arab Emirates (UAE), and many other countries. When it comes to token launches specifically, the legal frameworks vary by country. Let’s look at a few preferred countries and identify which to avoid when conducting a token launch.

Is the United States a good locale for Web3 entrepreneurs?

The United States has been notoriously antagonistic to the crypto industry in recent years. Key factors that hurt the U.S. Web3 industry included regulation by enforcement and Operation Chokepoint 2.0.

The U.S. venture capital (VC) ecosystem is known to raise large sums. While VC investments never left, projects that launch tokens have largely avoided the United States to steer clear of U.S. regulators.

However, things are moving in the right direction. First, you’ve got a pro-crypto Trump administration — at least this time around. There is also more bipartisan agreement on the need to enact Web3 laws that protect consumers without overburdening founders with excessive regulations.

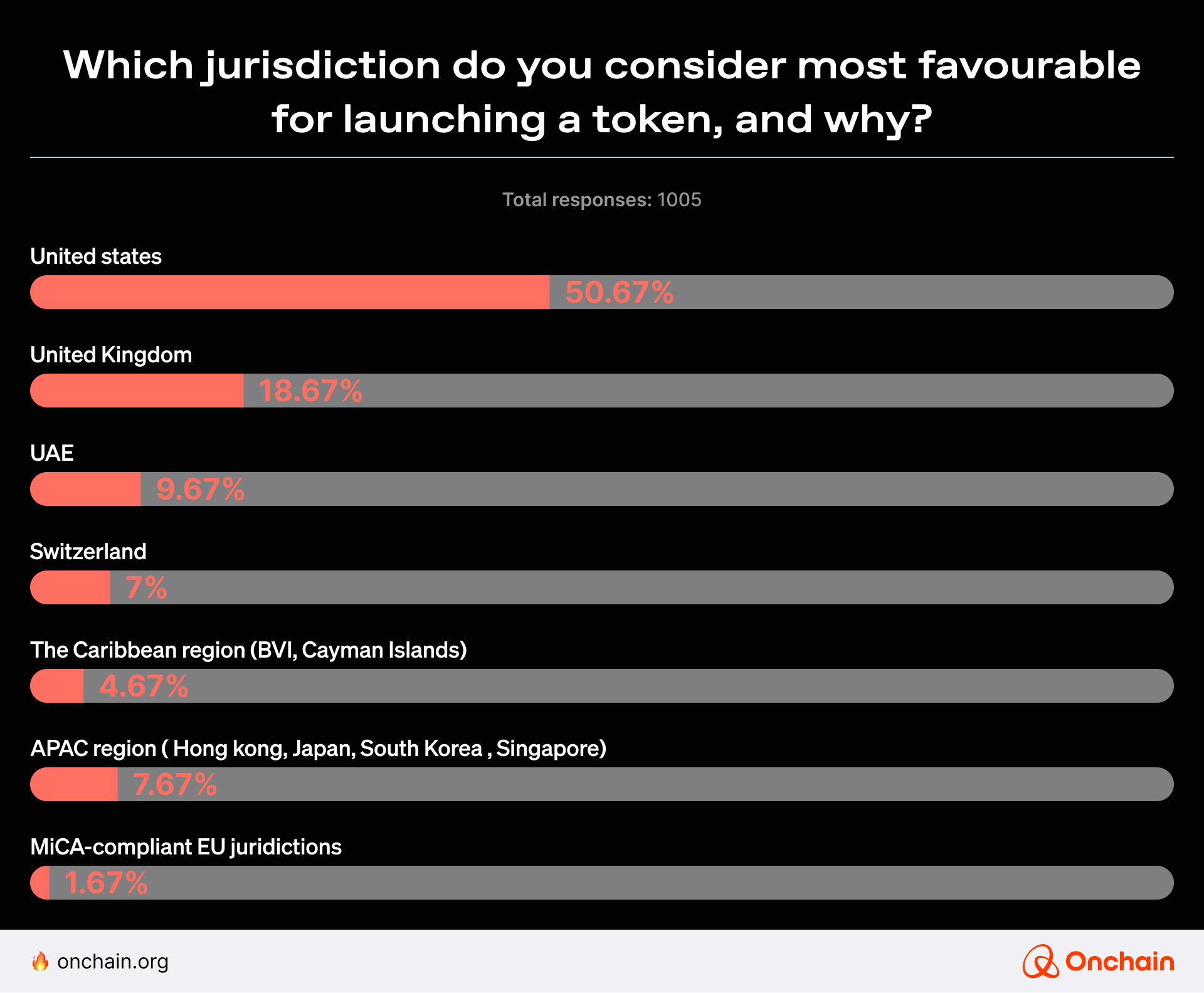

You may want to take a wait-and-see approach with a U.S.-based token launch strategy. Despite the apparent regulatory hurdles, a recent Onchain survey showed that many entrepreneurs and founders consider a U.S. launch a favorable option.

If you’re one of them, make sure you have all the information you need.

Is Dubai a better place to launch a Web3 token?

Dubai enacted the Virtual Asset Regulatory Authority (VARA) in 2022. It established clear rules for crypto assets, which founders, entrepreneurs, and most importantly, lawyers, seek.

It helps you determine where to locate your company’s headquarters — or launch a Web3 token. For many crypto thought leaders, Dubai and the wider UAE strike a good regulatory balance.

Are other countries better for a token launch strategy?

There is no consensus on the best country to be based in. With Web3 regulations continually being modified, enacted, or removed, it may require a change of plans. What’s a good token launch strategy now might not be in a few years.

You have to be nimble in Web3. This could even require moving your headquarters. Here are a few more options to keep in mind.

Hong Kong

Hong Kong boasts the largest digital asset ETF market in Asia, aiming to establish itself as a regional hub for Web3 entrepreneurs and investors. HK plans to roll out a new Web3 compliance framework by the end of 2025. It’s a country to keep an eye on.

The E.U.

The E.U. has taken its time in enacting its digital asset regulations. After years of discussions, the first MiCA-related rules went into effect at the end of 2024. Were regulators dragging their feet? Or was this careful planning needed? Opinions are mixed.

While MiCA certainly provides clearer regulatory guidance, some say its legislation will stifle innovation. We’ve already seen E.U. token delistings, so is a token launch here ideal?

If you’re looking at the E.U., you may need to be a “big player” to meet the MiCA standards. In fact, some predict that most E.U. crypto firms will have to close because they can’t afford to comply with the new standards.

The Cayman Islands

The Cayman Islands are another popular option thanks to their friendly regulatory frameworks. To get a feel for the global legal landscape, check out this blockchain compliance overview.

Token launch strategy tip: it’s not where, it’s how

Depending on your token launch strategy, your location could be less of a factor. What really matters is how you launch your token, your legal structure, and how you behave pre- and post-token launch. Here are a few things to consider.

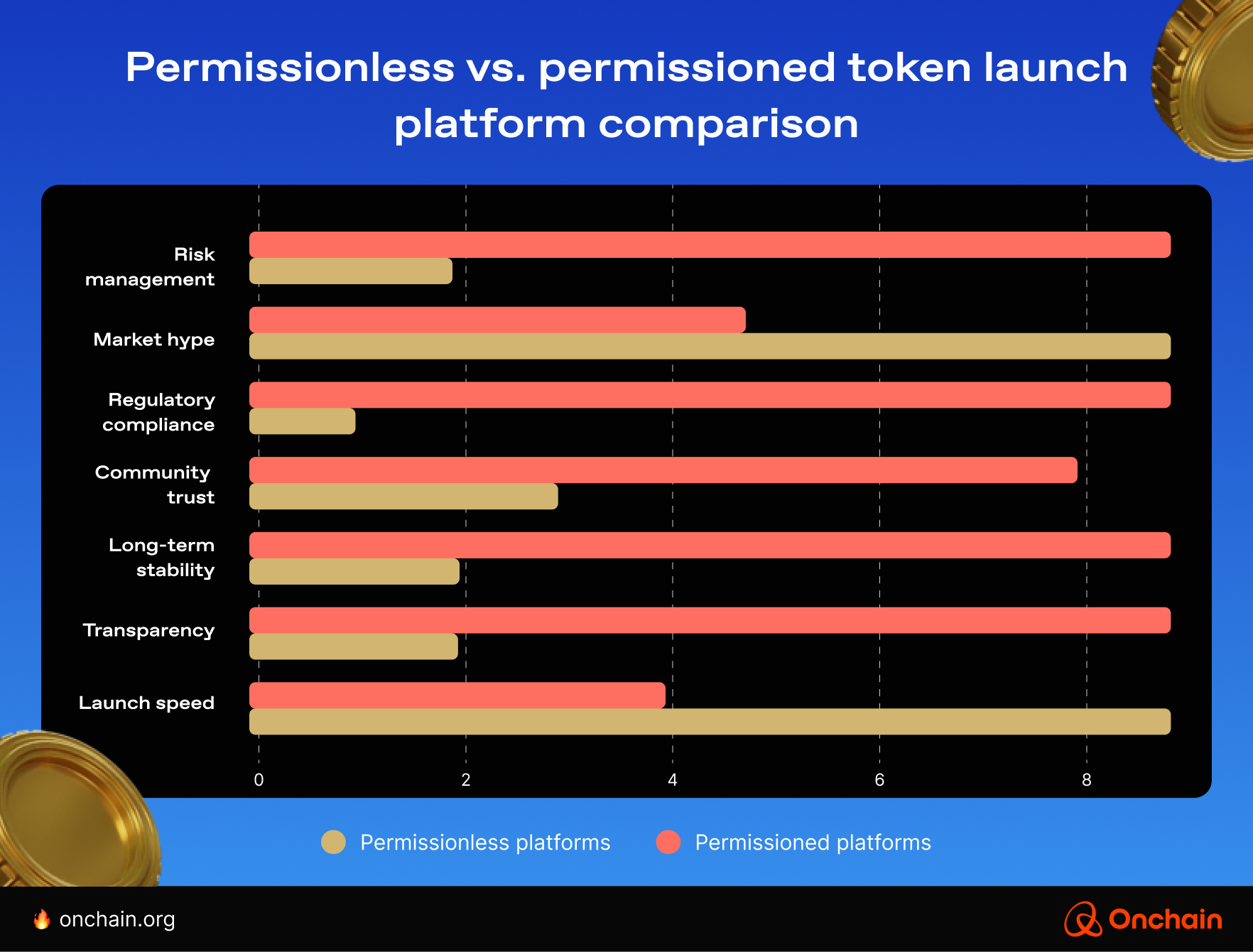

Token compliance consideration: decentralized vs. centralized

Token launches can use an ICO, IDO, IEO, fair launch, LBP, and much more. We’re not going to spell them all out for you here. This article breaks down the pros and cons for you. In general, token launches can be separated into two categories: centralized and decentralized.

From a legal point of view, the roadmaps for centralized and decentralized token releases are completely different. This is a big decision if you plan on issuing tokens or conducting a future token launch.

But new token launch strategies complicate this choice. Using a hybrid token launch strategy, you can launch a Web3 token in both a centralized and decentralized manner. For example, you may have an early, more centralized investor round for institutions and accredited investors.

Later, you could have an airdrop or LBP that launches the token in a decentralized way. Sometimes these hybrid options are done in stages, sometimes they can be done simultaneously. This opens your project to a wider pool of potential investors, but can complicate your operations on the legal front.

Another popular approach is to start with a token launch and a project that are both highly centralized. Over time, you gradually decentralize your project to open up new token investing pathways while staying out of legal hot water.

If you plan to use this token compliance strategy, you transition control over time so that no person, legal entity, or team is running the project behind the scenes. Getting the company structure and public messaging right here is crucial. Otherwise, you could still be considered a “centralized” project. Try to look at it from the regulators’ perspective.

What you do pre- and post-token launch matters

You know that the day of the token launch matters. It is also important to get the before-and-after right. The legality of your offering can be dynamic and based on what stage of the token launch you are at.

What was legal before you launched may not be legal anymore.

Token compliance structure for Web3 entrepreneurs

You’ve seen that your project location is a factor to consider. But it’s not just that, it’s also your company structure. You may want to implement a two-entity or three-entity structure. This can be done to ease the transition from a centralized to a decentralized token offering.

Compared to a single-entity structure, a multiple-entity structure can be a better way to gain token compliance in various jurisdictions.

This lets you protect yourself, your investors, and the general public. For example, you could structure it like this:

- Development entity: This company would be focused on project development. Here, you’d have your programmers, blockchain gurus, and other technical and operational staff.

- Token-focused entity: This company would be focused on fundraising, regulations, and adherence to financial and securities laws. A key task of this entity is the pre-token launch legal setup.

- Foundation: Typically in the form of a nonprofit, this supplementary entity can provide more legal leeway as your project develops. It’s very useful to have if you want to smooth the path for future project decentralization. As your project decentralizes, the foundation starts taking over while the other entities either fade into the background or disband entirely.

While a multiple-entity setup may make more sense for many projects, it’s not always the case. A fully decentralized fair launch may only need a project development company to implement the technical details of its project and associated token launch.

And to be honest, you don’t even need that. People launch thousands of memecoins every day, and most of them launch with just a few keystrokes: no entities needed. That being said, a random memecoin isn’t aiming for long-term growth (or global legal compliance).

Stay up to date with Web3 law changes

Sound legal advice is temporary. It changes with new legal interpretations, new laws, and new token launch strategies — among other things. If there’s regulatory ambiguity in the air, it may be best to play it safe. You can also get a sense of how cautious you should be by reading the legal tea leaves.

Are you seeing that regulators are strongly going after crypto companies similar to yours? What is the legal forecast? Is it “sunny, clear, and a great year to build” or is it more like “cloudy, with a 20% chance of jail time?”

You may need to move countries, change legal entities, or even completely shutter your project to avoid negative consequences.

We haven’t even talked about how your token is classified, which is another onchain story. And even if it is classified one way now, that could be subject to change. Ethereum’s ether (ETH) could be Exhibit A.

ETH’s American classification has alternated between being a security and not being a security multiple times. This has changed based on different regulatory interpretations, U.S. case law development, and even Ethereum’s transition to Proof of Stake.

Don’t risk it: take time to launch your Web3 token

Doing things right takes time, whether that’s changing your consensus algorithm or launching your token. Some token launch strategies require third-party custody. Securing an agreement with a high-quality custodian can take up to a year or more. You need time to vet them, and they need time to build out a secure custody solutions that support your Web3 token launch.

Rome wasn’t built in a day. A legal token compliance strategy won’t be crafted in 24 hours, either. Don’t rush, get partners onboarded early, and try to plan ahead well in advance. Delay your launch if you have to.

Token launch lessons

If you planning on issuing Web3 tokens, it’s critical to consider the legal ramifications of your token launch. Since the 2017 ICO boom, the methods for launching a crypto product have become more sophisticated.

There are new types of Web3 projects, new ways to launch these projects, and even new kinds of tokens to launch with — like NFT-based launches. And as token launch strategies have evolved, so have blockchain regulations and case law.

With the Web3 law books ever changing, token launch legality is a moving target. You need to factor in what stage your token launch is at and how you market it at each stage.

How you make code updates is also an important consideration. Even if they aren’t critical from a technical perspective, these changes could impact project decentralization. If you have a centralized-to-decentralized token launch strategy, a poorly planned code change could have legal consequences.

But getting the token compliance right is important. You want to focus on the Web3 future you’re building, not worry about fines, a legal summons, or potential jail time.

Want a token launch strategy deep dive?

To dive deeper into the regulatory ravines, it’s time to read our comprehensive token launch report. We understand that it’s hard to find detailed case studies, metrics, and roadmaps for managing tokenization in business, so we did the research for you. Our report goes over token launch eras, token launch mechanics, and launch regulations — and then gives you the facts, survey-led insights, and Web3 information you need to take action. Hit the button below to move forward in the Track and start reading.