“If a man has a debt lodged against him, and the storm-god Adad devastates his field or a flood sweeps away the crops, or there is no grain grown in the field due to insufficient water—in that year he will not repay grain to his creditor; he shall suspend performance of his contract and he will not give interest payments for that year.”

This law is part of the Code of Hammurabi, king of the Old Babylonian Empire, reigning from around 1792 to 1750 BC.

The gods chose him to rule over Babylon, “to prevent the strong from oppressing the weak.”

And he did. With one of the earliest forms of law to exist: a rudimentary yet meaningful insurance policy. A protective pact embedded within society, designed to shield the vulnerable from unforeseen events.

Fast-forward a few thousand years, and this guiding principle is as relevant today as it was in ancient Babylon, as the climate catastrophe devastates our fields and floods sweep away our crops.

The industry’s mandate has not changed. But our world has, and the industry is in a state of flux and struggles for profitability. At the same time, insurance is inaccessible to those who need it most.

This time-honored industry has to find agile solutions to fulfill its mandate and find its way back to success. And this is how.

8 Billion and the insurance industry

A community comes together, shares risk, and becomes more resilient. It could be that easy.

Sharing risk plays a vital role in our society. It drives economic growth, enables innovation and gives peace of mind.

In an ideal world, insurance serves us all. But for a crucial part of our global community, it is often out of reach.

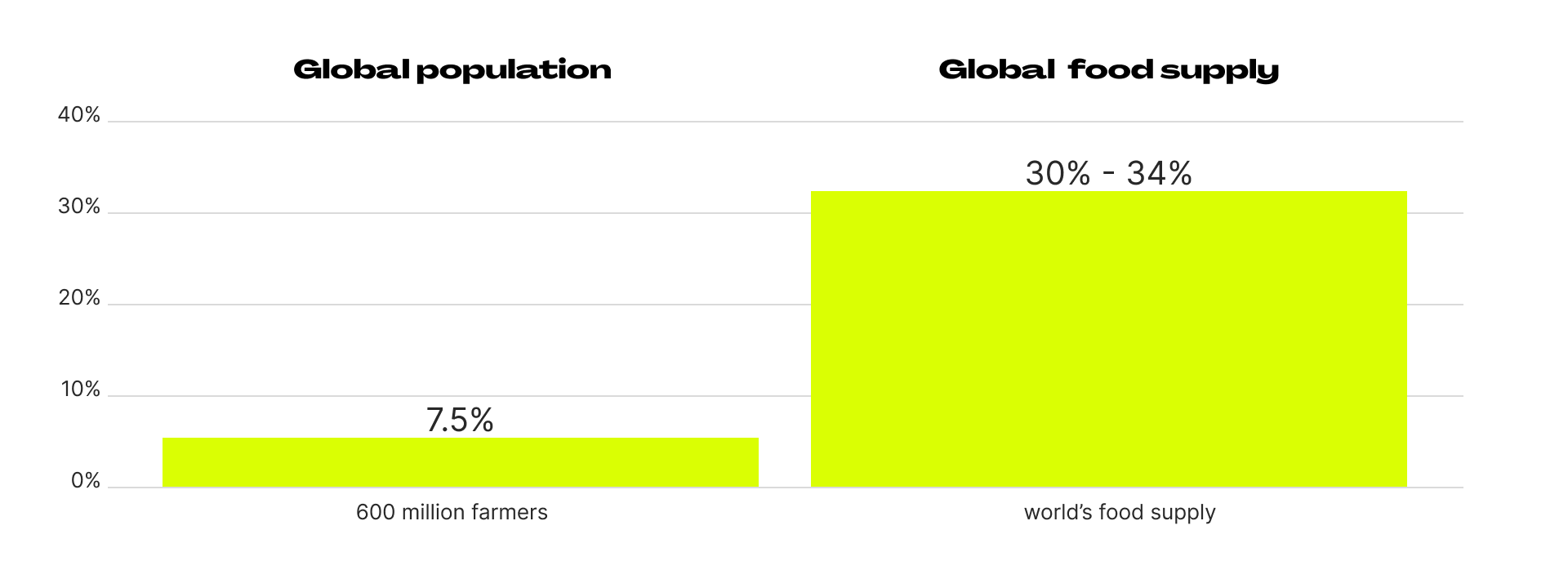

Consider this: our world is home to approximately 600 million smallholder farmers, representing 7.5% of the world’s population. These farmers contribute an estimated 30-34% of the world’s food supply.

80% of those farmers in low- and middle-income countries are lacking access to formal agricultural insurance. In sub-Saharan Africa, the number is 97%. Only 3% are financially protected against crippling climate risks such as floods and droughts.

The irony is stark – our world’s population hinges on this minority. Yet, they lack our support when they need it. Without it, they will find it almost impossible to adapt to a changing climate.

This marks a clear mandate for the industry. The industry, however, is dealing with its own problems.

A closer look at the insurance industry

To illustrate those problems – we let the numbers speak for themselves.

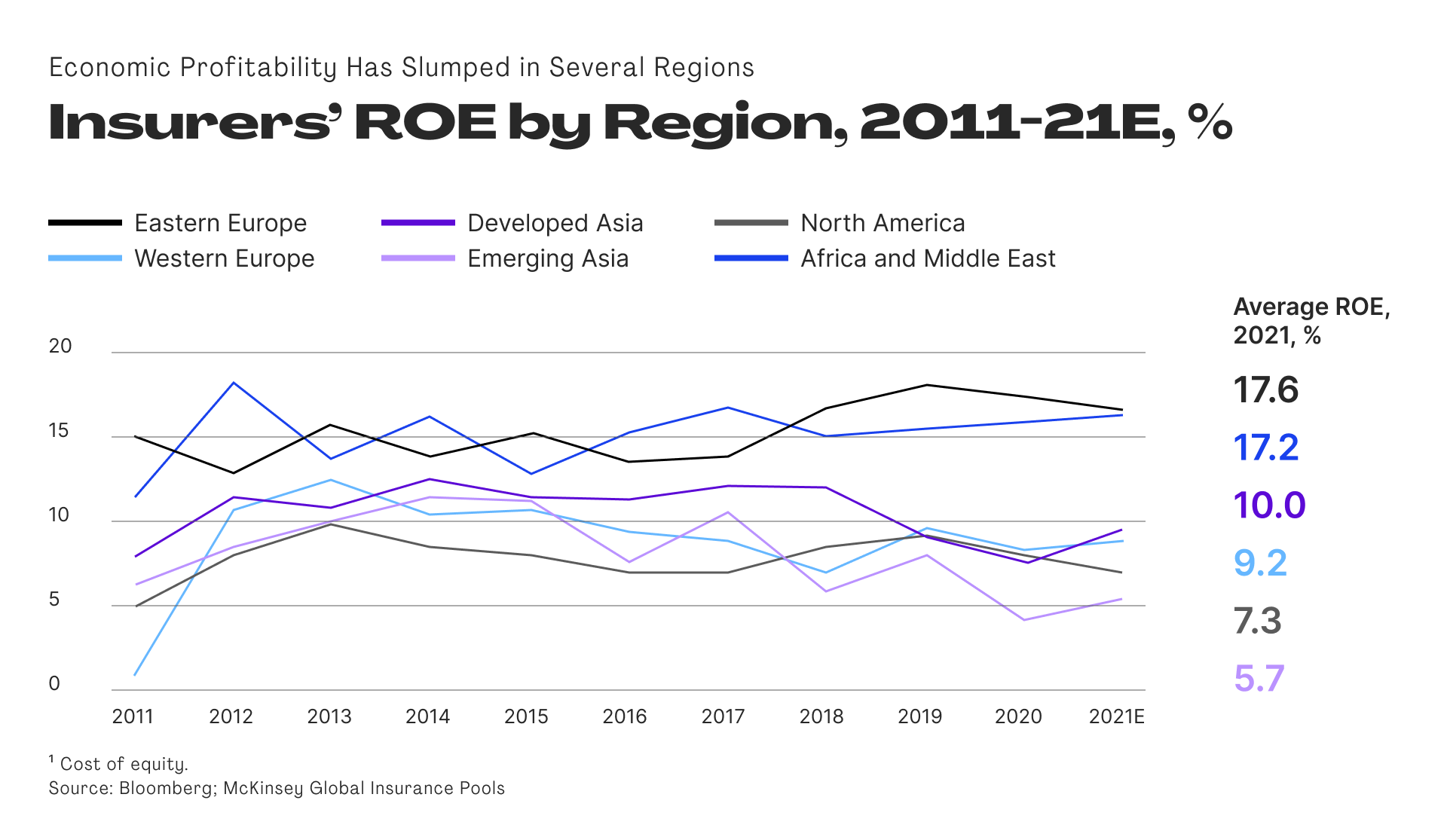

Except for Eastern Europe, Africa, and the Middle East, the average return on equity (ROE) of insurers has dropped over the past decade, according to the McKinsey & Company Global Insurance Report 2022.

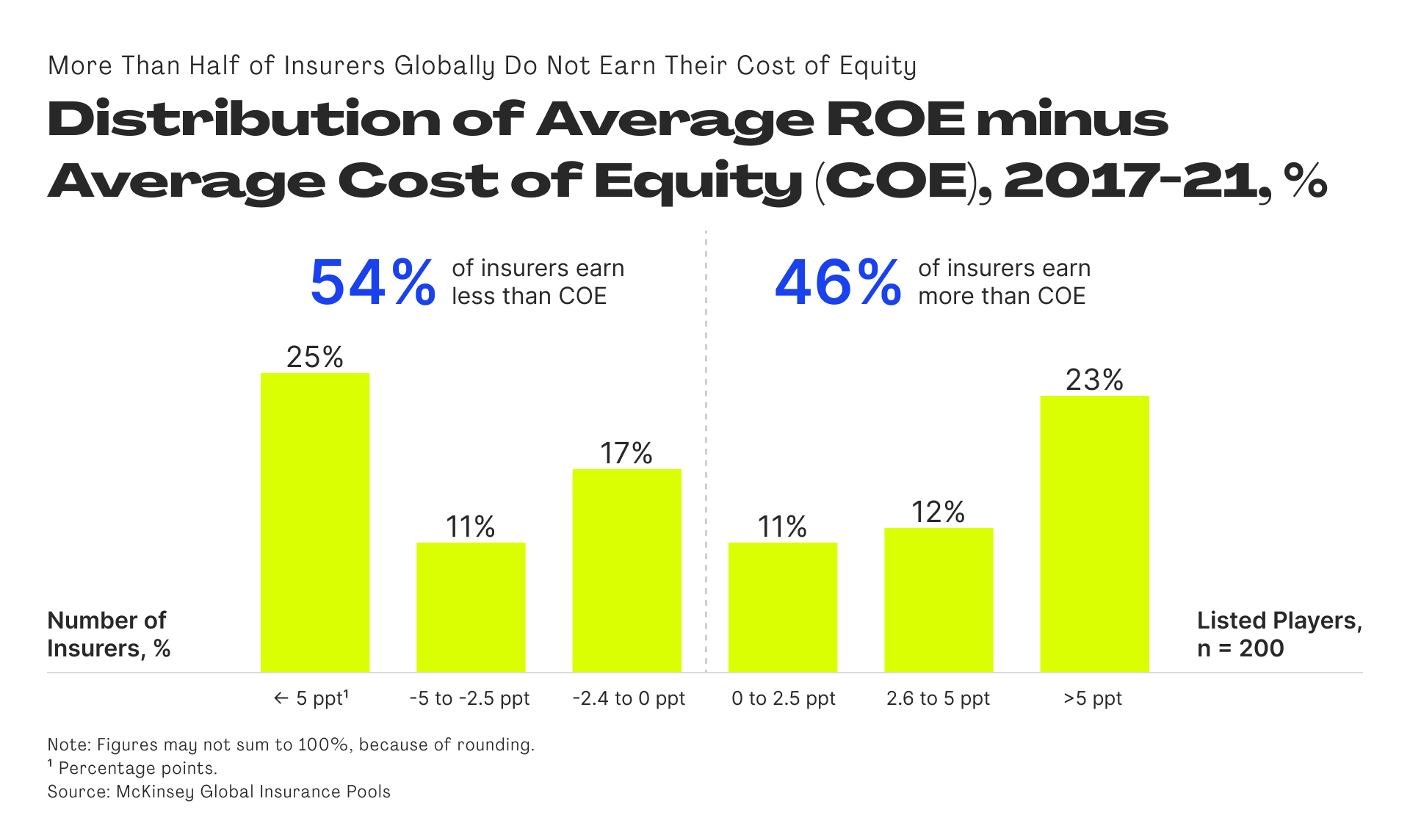

This isn’t a case of a few outliers; it’s a far-reaching issue. Over the past five years, more than half of the listed insurers have struggled to exceed their cost of equity (COE) with their ROE.

If a company’s ROE surpasses its COE, it means it’s generating more revenue than what’s required to fund the equity segment of its capital structure.

Below, on the right side of the graphic, we find these successful entities. Of these, the top 10 percent of companies generate 80 percent of the economic profit.

If there is one takeaway from these numbers, it is this: The business model of most players in the industry is not sustainable. The thousand-year-old industry needs to adapt to a new world.

The problem with traditional insurance

An insurance policy is a financial agreement between two parties. The insurer allows the policyholder to share risk in return for a profit.

Pretty straightforward, if there were no bad actors involved.

But this is not reality. And this is where things get complicated.

The cycle of distrust and misaligned incentives

A financial agreement. A win-lose dynamic. And a misaligned incentive.

Welcome to the cycle of distrust.

On one side, the policyholder. In the underwriting process, withholding negative data and exaggerating positive ones reduces premiums. Those who accurately present their risk are subject to higher premiums.

On the other end, insurers, who rely on this information to determine risk profiles and rates. Underwriters often receive inaccurate data. To counteract, insurers invest in robust but costly and time-consuming verification processes.

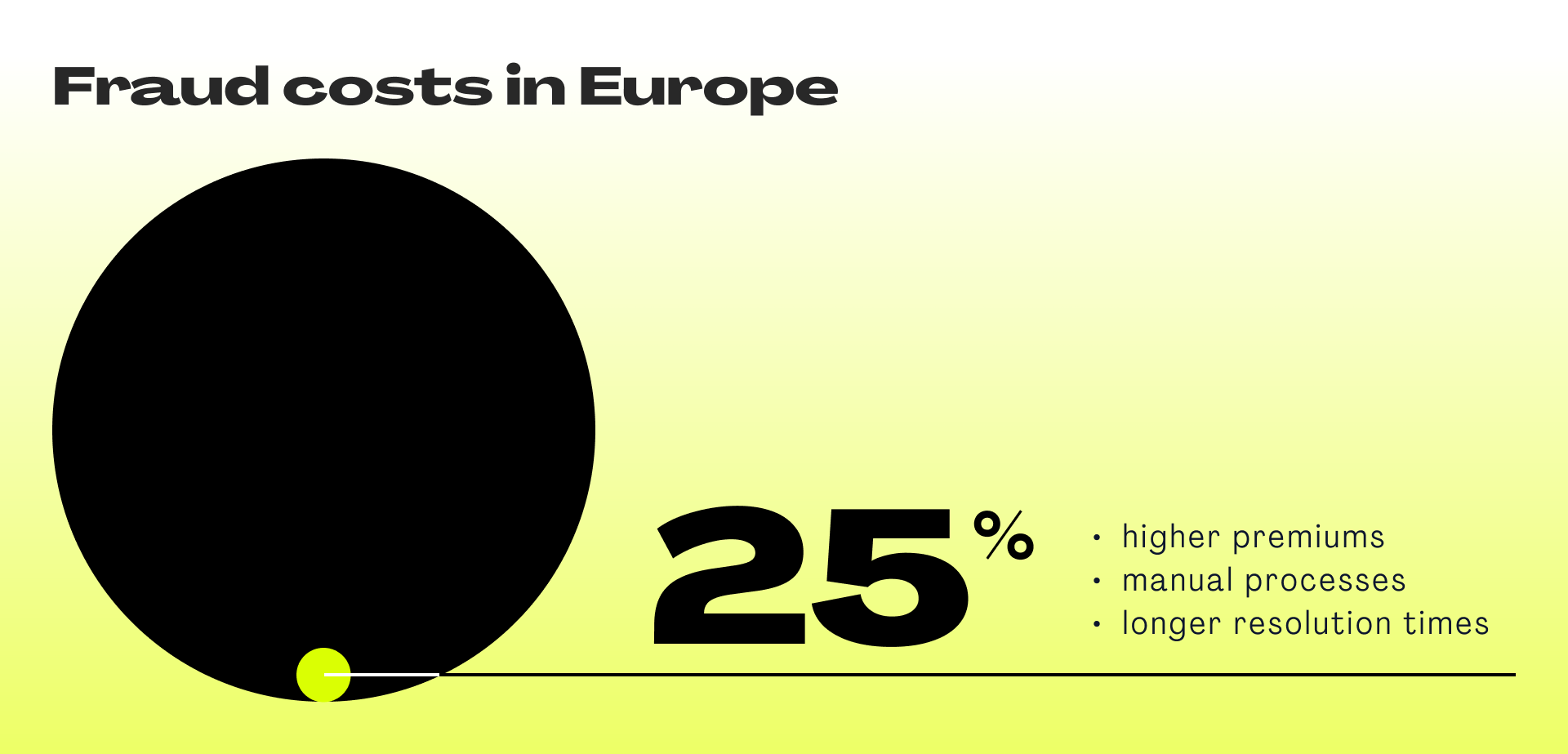

Fraudulent claims are part of the business. This results in considerable resources spent on fraud prevention. Estimates suggest that fraud costs in Europe constitute 10% of the total amount of claims. This leads to higher premiums, more manual processes, and longer resolution times.

A lose-lose situation. And an opaque situation.

Opaque processes

For policyholders, opaque processes are the norm. The factors behind premium pricing, claim processing, and policy parameters remain hidden from them. They are left in the dark about the rationale behind pricing and the reasons for claim denials. They are left at the mercy of insurance companies.

The lack of transparency (on both sides) distorts the pricing and value of insurance policies. In an attempt to reclaim fairness, this may incentivize some policyholders to game the system.

This is the full cycle of mistrust.

It all boils down to one basic principle: when it comes to insurance, transparency and trust are critical, as is a smooth customer experience.

Long-winded processes

Insurance equals paperwork, lengthy claims processes, and unclear and costly manual procedures.

This is frustrating to some and threatening to others. Sometimes, one cannot wait. For farmers trying to buy seeds for the next season after a flood, a late payment is equivalent to a lost harvest – or existence.

The industry needs to innovate its business model. For its own survival. And for those who rely on it.

Insurtechs drive innovation

The novelty and hope of the industry is insurtech.

Insurtech refers to the digital innovations that insurers and new entrants use to streamline operations and enhance customer experiences.

Artificial intelligence (AI) is its most important technology. Others are chatbots, the Internet of Things (IoT), and telematics. Blockchain, on the other hand, is still underutilized.

To find out why, we spoke with Martin Baier. Martin built a prototype for blockchain-based crop insurance for smallholder farmers in Africa for Zurich Insurance and is the lead-founder of InsureBlox.

“Blockchain is not a proven technology in the insurance industry. Capacity is tied up in core IT systems, improved user experience and data analytics, IoT and AI.

Blockchain is on the list too. At the very bottom. It’s just not a priority – yet.”

Lemonade is a good example of a successful insurtech company that prioritizes AI over blockchain. AI and chatbots are woven into the fabric of its business model. And it processes claims faster than traditional insurers. This technological advantage has fueled the company’s rapid growth. In 2022, revenue grew 100%.

However, AI isn’t the silver bullet for all challenges of the industry. Its decision-making process is typically a “black box” that lacks transparency, ironically reinforcing the issue at hand.

Furthermore, AI isn’t immune to data quality and bias problems. Biases concealed within the training data can propagate through the AI system.

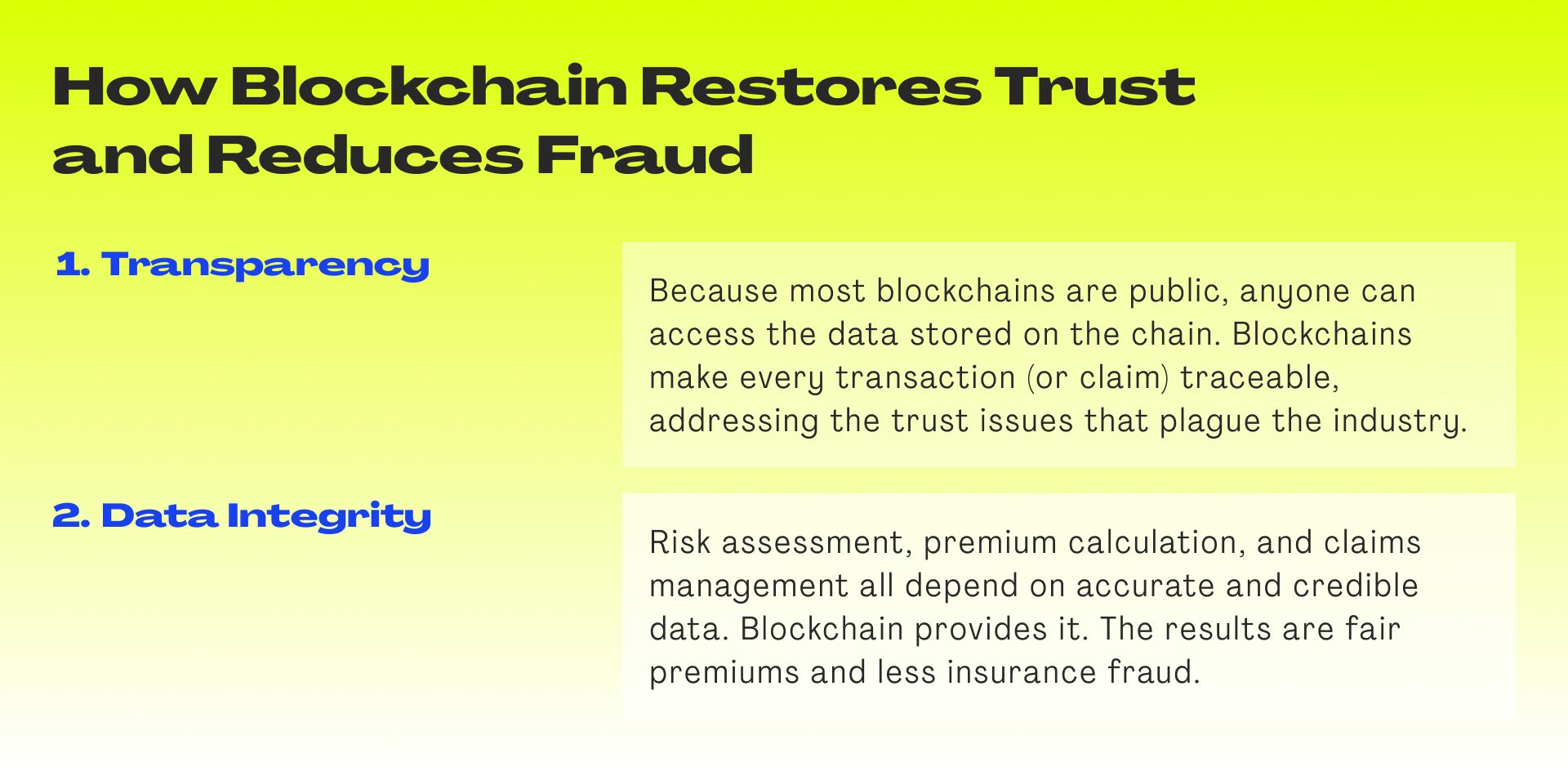

Blockchain is the missing piece that completes the insurtech puzzle. It can help the industry become transparent and build trust between stakeholders.

Blockchain and smart contracts – The unloved game changers

Blockchains are decentralized databases that help everything else fall into place.

Blockchains store incoming data in a new block, linked to its predecessor. In that process, a decentralized network of validators confirms the data’s integrity. Once added, the data is then immutably stored across multiple computers (or nodes).

This marks a barrier against manipulation, ensuring exceptional data integrity, security, and resilience.

Blockchain lays the foundation. Smart contracts bring utility.

A smart contract is a digitized contract that executes autonomously upon meeting predefined conditions. Once deployed on a blockchain, a smart contract inherits the transparency and immutability of the database.

In the insurance context, we can use smart contracts to create a digital, programmable, and self-executing insurance policies.

Some, including Lemonade, are starting to explore this potential.

Blockchain-enabled products and use cases

At-cost parametric agricultural insurance

Let’s revisit sub-Saharan Africa, where millions of smallholder farmers need agricultural insurance. To help these farmers, Lemonade formed the Crypto Climate Coalition.

The coalition is building automatic, parametric, at-cost agricultural insurance using blockchain and smart contracts.

The model builds around an “area yield index”, based on the crop yields of a few sampled farms within a certain area. If the crop yield for the sampled farms falls short of a certain target, all farms in that area receive an automatic insurance payout.

Even when crops fail, the next season’s planting is secure. There is no need for complicated and lengthy claim filing. This allows farmers to dare more, invest in their fields, and sleep soundly at night.

Despite an unpredictable climate and thanks to blockchain.

If insurance can be so elegant, why isn’t everyone working on blockchain-based solutions?

Regulation hinders adoption

“The answer lies in the regulatory environment” says Martin. “Germany, for example, is very different from Kenya. The Federal Financial Supervisory Authority, better known as BaFin, regulates the insurance industry. In the event of a lawsuit, the agency must be able to seize assets. When funds are deposited on a blockchain, the BaFin can’t seize them.

As you can see, traditional insurers can’t just offer a complete blockchain-based solution. In time, we will get there. But Africa and Asia will be first.

A DAO, on the other hand, could. As long as no one in the DAO structure receives any income from that structure.”

A new old way of sharing risk – New insurance structures

A community comes together, shares risk, and starts a DAO.

DAO stands for Decentralized Autonomous Organization. These organizations are the democratic communities of Web3. Communities without a central authority, where members set the rules of their organization. DAOs are also the organizational structure of native Web3 insurers such as Nexus Mutual.

Nexus Mutual is a community-driven insurance platform. Members own and manage Nexus Mutual. On a risk marketplace, members can buy insurance coverage or earn rewards for providing risk expertise or capital.

In stark contrast to traditional insurers, DAOs operate with full transparency. While insurance firms will have to go through a huge transformation to adapt to the modern world, Web3 native insurers have no legacy baggage to carry.

As we look to the future, the expansion of Web3 insurers into real-world insurance could pose a genuine challenge for legacy firms. Nexus Mutual is already planning to expand to the real world.

“One of the really important things for what we want to take Nexus to is impact on the real world – earthquake coverage in Peru, or whatever it is – but actually get outside the specific Web3 world and into the real world, because fundamentally this technology can really change things. Hugh Karp – Founder of Nexus Mutual

Blockchain is about really changing the status quo. And some pioneers are showing how to challenge it. They are the potential disruptors of today’s legacy firms. But they could also serve as their inspiration.

The tools they build on are available to everyone. And for the sake of humanity, we should use them.